Compare West Virginia Car Insurance Rates [2026]

You can expect to pay $86 a month on average to meet West Virginia car insurance requirements, which mandate a minimum of 25/50/20 for bodily injury and property damage. Learn about other WV driving laws, and how to obtain car insurance quotes to help you easily compare West Virginia car insurance rates.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Updated April 2024

| West Virginia Summary Statistics | Details |

|---|---|

| Annual Road Miles | Total in State: 38,760 Vehicle Miles Driven: 19.1 billion |

| Vehicles | Registered: 1.5 million Total Stolen: 938 |

| State Population | 1,848,514 |

| Most Popular Vehicle | Chevy Silverado 1500 |

| Uninsured Drivers | 10.1 percent State Rank: 32nd |

| Traffic Fatalities | Total: 303 Speeding: 84 Drunk Driving: 101 |

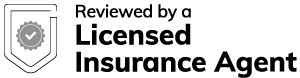

| Average Annual Premium | Combined $1,103.05 Liability $491.83 Collision $330 Comprehensive $204.28 |

| Cheapest Providers | State Farm and USAA |

West Virginia, the Mountain State, is known fondly for its mining towns, its Appalachian music, and its love of high school and college football.

Whether you’re traveling through the Blue Ridge Mountains or along the Shenandoah River, you will want to make sure you have the best West Virginia car insurance coverage while driving on those country roads.

We know that finding coverage isn’t always easy and there are so many questions to answer. Is car insurance cheaper in West Virginia? Who has the cheapest car insurance? What are the WV car insurance laws?

The best way to assure yourself that you’re getting the proper coverage for your situation at the best possible rates is to compare rates from the best car insurance companies in West Virginia.

Enter your ZIP code below to get your FREE quotes today!

What do coverage options and auto insurance rates look like in West Virginia?

Whether you are of the Hatfield bloodline or are a sprouting branch of the McCoy tree, chances are you do a fair amount of driving if you’re a resident of West Virginia. West Virginians drive about 14,283 miles each year, which is a smidge below the national average of 14,485.

Due to having a shorter-than-average commute time, Mountain State residents are on the road less than most of their fellow drivers on the East Coast.

- Car Insurance Rates in West Virginia

Every mile that you drive is a mile of potential risk in the eyes of the auto insurers. You need the proper amount of car insurance to mitigate that risk.

But wading through all the minutiae of the various regulations, requirements, and rates can be burdensome.

No need to worry. We’ll help you learn what is required, what you might want, and where you can find it for the best price.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

West Virginia Minimum Coverage

West Virginis is a “fault” state meaning that it follows a traditional fault-based system when it comes to financial responsibility for property damage and injuries resulting from a crash.

Basic coverage in West Virginia increased in 2016 to a required minimum car of 25/50/20 for all motorists. This mandates that all car owners carry the following minimum levels of liability car insurance coverage:

- $25,000 for bodily injury or death per person in an accident caused by the owner of the insured vehicle

- $50,000 for total bodily injury or death per accident caused by the owner of the insured vehicle

- $20,000 for property damage per accident caused by the owner of the insured vehicle.

West Virginia does not require you to carry Uninsured/Underinsured Motorist coverage, but legislators do mandate all auto insurance companies in the state to offer consumers the optional maximum coverage of 100/300/50.

Declining to carry any form of uninsured/underinsured coverage means that you’re foregoing insurance that can protect you and your passengers if the at-fault driver has no insurance, or if you’re the victim of a hit-and-run.

| Type of Coverage | Prior to January 1, 2016 | As of January 1, 2016 | Increase |

|---|---|---|---|

| Bodily Injury Liability | $20,000 per person $40,000 per accident | $25,000 per person $50,000 per accident | $5,000 per person $10,000 per accident |

| Property Damage Liability | $10,000 per accident | $20,000 per accident | $10,000 per accident |

| Uninsured/Underinsured Motorist Coverage | Optional | Optional | Cannot be be determined |

Is it wise for any West Virginian to choose the bare minimum coverage? Maybe. Maybe not.

If you have assets or future assets that you wish to protect, you may wish to reconsider settling for only basic liability coverage or the cheapest option. Everyone has individual financial situations which will influence what insurance services they can afford, and what insurance carriers are available to them.

You should increase your liability limits to the maximum optional offering of 100/300/50, and make sure you’re covered for an amount equal to the total value of your assets (Add up the dollar values of your house, your car, savings, and investments).

Please be aware that basic coverage only provides you with liability protection; It will not pay to repair or replace your car for an accident that you cause.

If you’re looking to repair or replace your car after an accident, then collision car insurance and comprehensive car insurance coverage are worth the investment. These policies come with a deductible and they pay out based on the current value of your car, not necessarily the price you might have paid for it.

Next, we will take a look at the what average motorist in West Virginia pays for car insurance. The actual amount you will pay will vary from these amounts; however, the upcoming figures will give you a strong foundation from which you can build.

Premiums as a Percentage of Income

When asked about his success, longevity, and wealth in the music and entertainment industry, Hip hop superproducer and entrepreneurial mogul Dr. Dre stated that “Money is easy to make, but harder to keep.”

The entertainer, born Andre Young, also claimed that “The only two things that scare me are God and the IRS.”

Both of these quotes illustrate the concept and importance of your Disposable Personal Income (DPI), which is the money you retain after taxes and other expenditures.

| Type | Insurance Versus Income |

|---|---|

| Annual Full Coverage Average Premiums | $1,032.45 |

| Monthly Full Coverage Average Premiums | $86.04 |

| Annual Per Capita Disposable Personal Income | $32,277.00 |

| Monthly Per Capita Disposable Personal Income | $2,689.75 |

| Percentage of Income | 3.20 percent |

You are mandated by law to carry at least the basic coverage. A full coverage car insurance policy includes liability, comprehensive, and collision insurance. Here’s a peek at the average cost of each:

Let’s take a look at some important statistics about the car insurance companies themselves since we are now caught up on some important data for the individual customer.

Up first is loss ratio.

Loss Ratio

What is loss ratio? And how exactly does it impact your rate quotes?

The insurance loss ratio is the loss to the insurance company for claims that were paid out, divided by the premiums collected. A high loss ratio means that an insurance company has too many customers filing claims, which will subsequently lead to a rise in future premiums for all consumers.

Loss ratios are measurements used by insurers to assess the profitability of their businesses or policies. A loss ratio is a single number that can be used to identify performance — the lower the number, the better the performance.

Example: Suppose the owner of a small car dealership pays $50,000 in annual premiums to insure his or her inventory. Then, a polar vortex causes $75,000 in damages, for which the business owner submits a claim. The insurer’s one-year loss ratio becomes $75,000 / $50,000, or 150 percent.

Add-ons, Endorsements, Riders

According to the Insurance Information Institute, just over 10 percent of drivers in West Virginia don’t have insurance, which is the 32nd highest total in the United States. This stat alone should make you reconsider declining the optional (but recommended) Uninsured Motorist Coverage.

Medical Payments Coverage is optional in West Virginia. Med Pay insurance applies regardless of whether the insured or another driver was at fault. This kind of coverage can protect motorists from damage and injuries caused by the increasing collisions involving the deer population in West Virginia.

Pay-per-mile car insurance plans offered by companies like Metromile are gaining in popularity daily; however, they are currently unavailable in West Virginia.

Other usage-based car insurance programs (UBI) are active and available to residents of West Virginia. Programs like Drivewise from Allstate or Snapshot from Progressive offer discounts to drivers based on how well and how often they drive.

Additionally, there are a handful of alternative enhancements that you can research to decide if any of them makes sense in your circumstance:

- GAP insurance

- Personal Umbrella Policy (PUP)

- Rental Car Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

Male Versus Female Rates in West Virginia

On September 20, 1973, Billie Jean King soundly defeated Bobby Riggs in an epic, intergender tennis match dubbed the “Battle of the Sexes” in straight sets.

That triumph on the tennis court by King sounded a forceful blow for women’s rights and equality that reverberated beyond the world of athletic competition.

Unfortunately, that movement toward equality hasn’t quite reached the auto insurance industry. On average, male drivers are afforded better premium quotes than their female counterparts.

We compared rates for 25-year-old drivers with identical backgrounds, location, and driving history, using gender as the only independent variable. Here is what we found:

Comparison of Insurance Quotes: 25-Year-Old Male vs. Female in West Virginia

| Age and Gender | Geico | Progressive |

|---|---|---|

| 25-Year-Old Male | $93 | $146 |

| 25-Year-Old Female | $97 | $141 |

When we extended our research by comparing rates for 55-year-old men and women with identical driving records and demographic information, the battle for equality did not fare any better:

Insurance Quote Comparison: Male vs. Female for 55-Years-Old in West Virginia

| Age and Gender | Geico | Progressive |

|---|---|---|

| 55-Year-Old Male | $76 | $100 |

| 55-Year-Old Female | $76 | $106 |

Maybe if Serena Williams and Naomi Osaka team up to defeat the McEnroe Brothers (John and Patrick) in a doubles match, then we’ll inch closer to equal premium rate quotes for men and women drivers. The results from this research are counterintuitive, as we think of the insurance industry often giving cheaper car insurance rates to women. Auto insurance costs truly do vary state by state.

Cheapest West Virginia Insurance Rates by Location

Most Affordable Coverage in West Virginia Based on Location

| City | Monthly Cost for Liability Coverage |

|---|---|

| Beckley | $90 |

| Bluefield | $86 |

| Charleston | $89 |

| Clarksburg | $78 |

| Huntington | $88 |

| Martinsburg | $74 |

| Morgantown | $78 |

| Parkersburg | $86 |

| Wheeling | $81 |

| Williamson | $108 |

Did you know that Wheeling was once the capital of West Virginia? Having your vehicle registered in the former capital as opposed to the current capital of Charleston will save you nearly $100 annually in premiums.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What car insurance companies are the best in West Virginia?

Sifting through all of the information available for each car insurance company in order to select the most suitable one for your circumstance can be an arduous endeavor.

Where do you go to get the best rates? Who has the most competent customer service representatives? Will you qualify for any car insurance discounts or upgrades? Unlike the familiar country roads of the place you belong, finding the answers to these questions can be difficult to navigate.

We will help you to choose the company that will best suit your specific needs, whether you need additional coverage or you’re seeking a safe driver discount.

When selecting the car insurance company that you’ll ultimately give your business to, you should look for the company (or companies) that you know you can lean on.

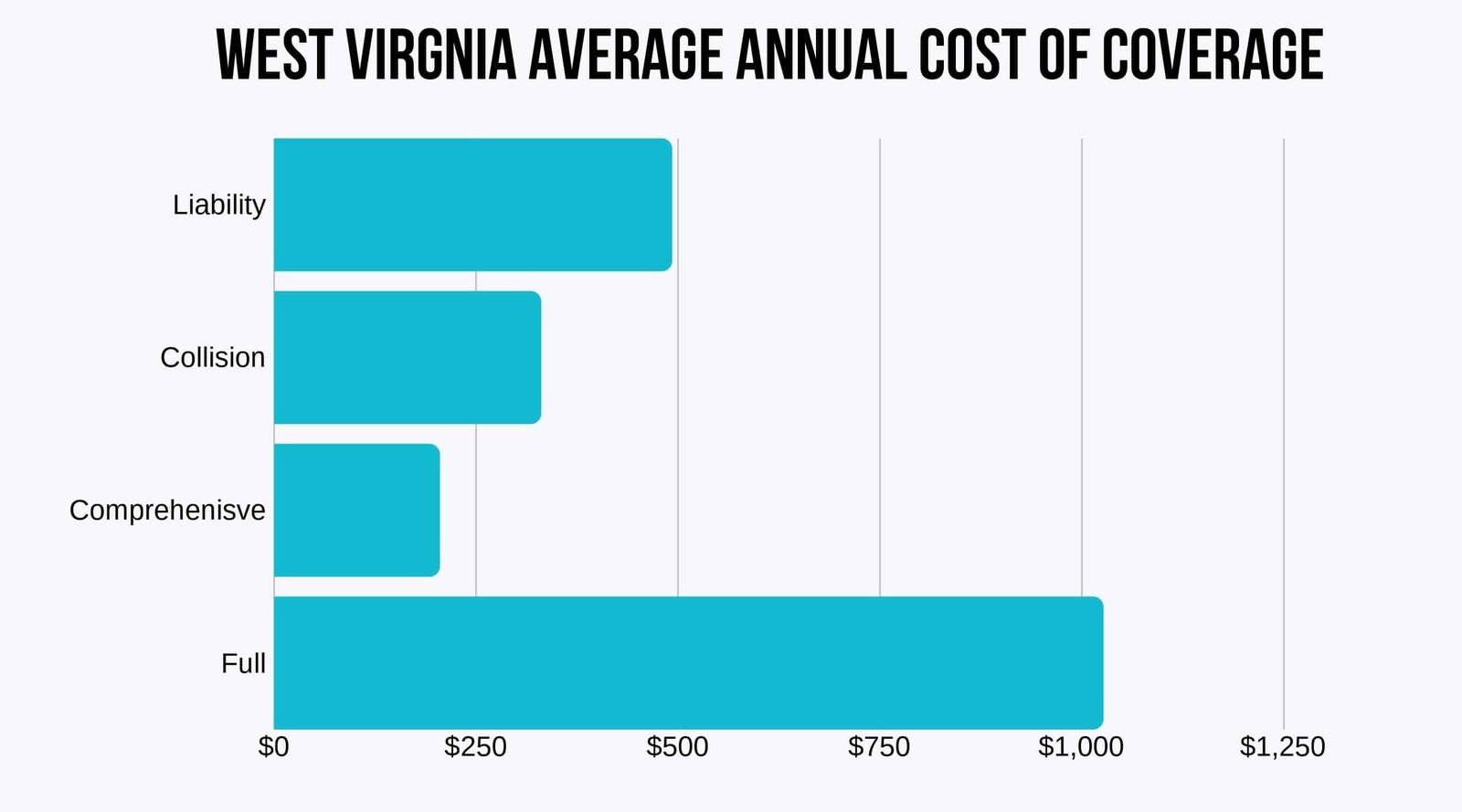

The public’s perception of a company can sometimes be an indicator of the quality of rates it offers to its customers. We’ll show how the largest companies rate in the areas of financial stability and customer satisfaction for comparative purposes.

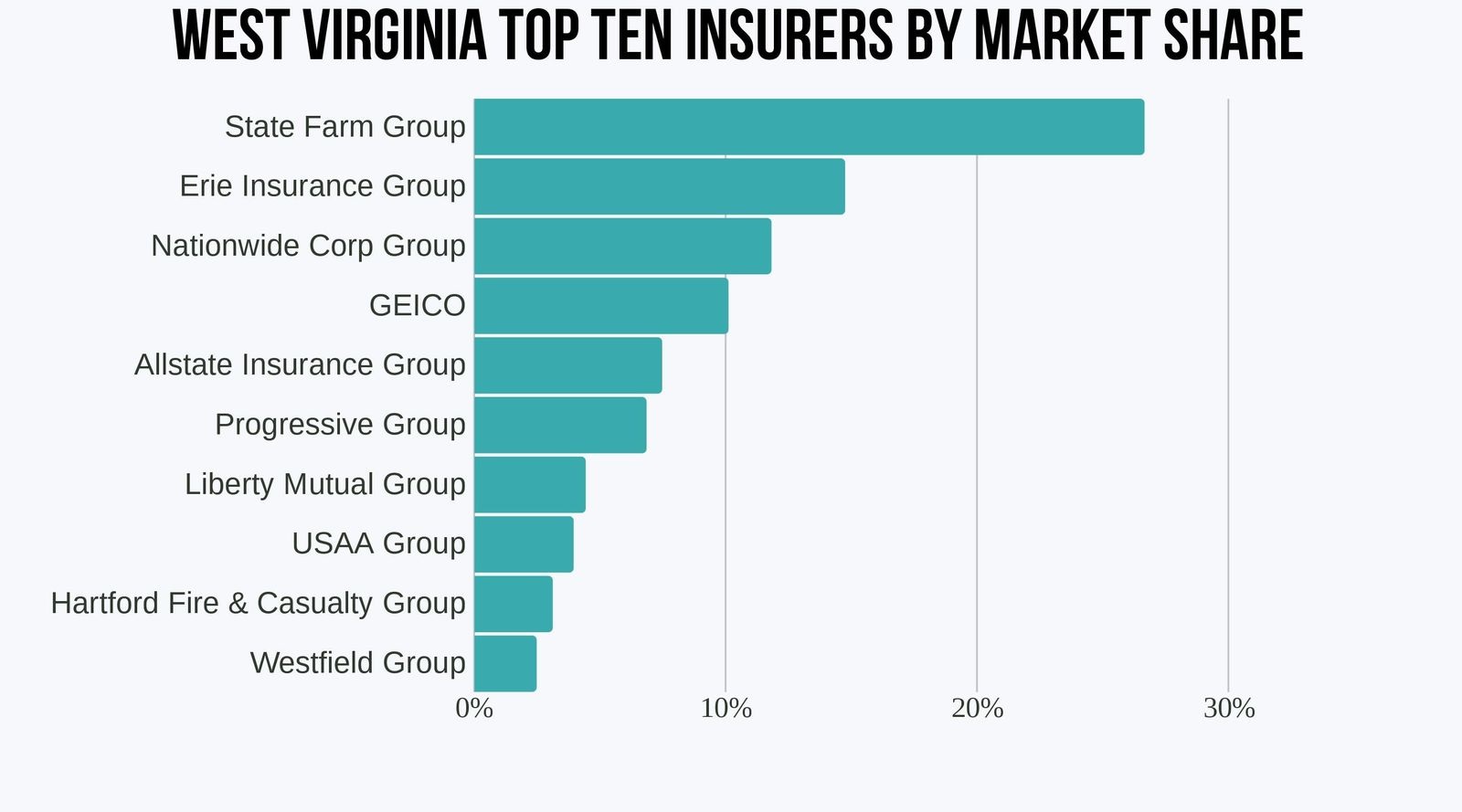

Financial Ratings

AM Best is a credit rating agency. It evaluates insurance companies and grades them based on their financial stability. The table below shows the ten largest insurance companies in West Virginia as measured by direct premiums written with their AM Best rating.

| Company | Direct Premiums Written | AM Best Rating |

|---|---|---|

| Allstate Insurance Group | $92,007 | A+ |

| Erie Insurance Group | $182,120 | A+ |

| Geico | $124,709 | A++ |

| Hartford Fire & Casualty Group | $38,099 | A+ |

| Liberty Mutual Group | $54,356 | A |

| Nationwide Corp Group | $145,858 | A+ |

| Progressive Group | $84,332 | A+ |

| State Farm Group | $329,651 | A++ |

| USAA Group | $48,434 | A |

| Westfield Group | $30,163 | A |

Customer Satisfaction Ratings

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

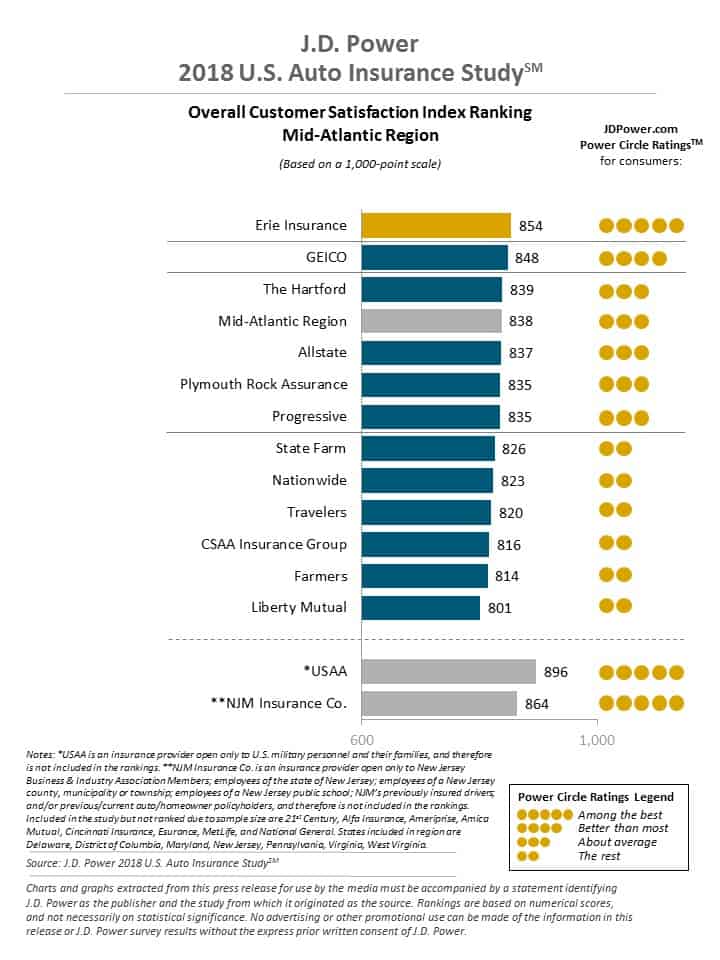

Companies in West Virginia With the Least and Most Complaints

Trust is essential in any long-lasting relationship. Mutual satisfaction has to be a priority for both parties.

One hundred percent satisfaction is a lofty and elusive goal. When a customer has a negative experience with an insurance company, he or she can file a complaint. Those complaints, warranted or not, are factored into a company’s complaint ratios.

West Virginia permits customers to file a complaint both electronically or by paper application.

The complaint ratio is how many complaints a company receives per one million dollars of business.

Due to the sheer volume of business they conduct, a large insurance company will have more complaints than a smaller company; thus, what matters more than the number of complaints is the complaint ratio.

These are the companies that had the best complaint ratios in the state.

| Name of Insurer | Complaint Ratio (Best) | Name of Insurer | Complaint Ratio (Worst) |

|---|---|---|---|

| AmTrust | 0 | QBE Insurance | 32.86 |

| Farmers Insurance Group | 0 | J. Whited Group | 7.43 |

| Southern Farm Bureau | 0 | Sentry Insurance | 6.53 |

| Georgia Farm Bureau | 0 | Mapfre Insurance | 6.25 |

| Island Insurance Company | 0 | Liberty Mutual | 5.95 |

| MS & AD Insurance Group | 0 | Hartford Fire & Casualty | 4.68 |

| Indiana Farm Bureau | 0 | CSAA Insurance | 3.97 |

| Safety Group | 0 | IMT Mutual Holding | 3.45 |

| North Dakota Mutual | 0 | The Hanover Insurance Group | 2.43 |

| Center Mutual | 0 | Infinity Property & Casualty | 2.03 |

| De Smet Farm Insurance | 0 | GoAuto Insurance | 1.93 |

| Bear River Mutual | 0 | State Auto Mutual | 1.74 |

| Co-Operative Insurance | 0 | Safeway Insurance | 1.6 |

| Kentucky Farm Bureau | 0.02 | Mountain West Farm | 1.47 |

| New Jersey Manufacturers Group | 0.03 | Arbella Insurance | 1.33 |

| Grinnell Mutual | 0.07 | Metropolitan | 1.3 |

| Travelers | 0.09 | Plymouth Rock Insurance | 1.16 |

| Consumers County Mutual | 0.1 | Horace Mann | 0.79 |

| Pemco Mutual | 0.14 | American Family Insurance | 0.79 |

| Alfa Insurance | 0.16 | Automobil Club of Michigan | 0.78 |

| Texas Farm Bureau Mutual | 0.16 | Iowa Farm Bureau | 0.77 |

| Oklahoma Farm Bureau | 0.21 | Progressive | 0.75 |

| Michigan Farm Bureau | 0.26 | Westfield | 0.75 |

| Vermont Mutual | 0.26 | USAA | 0.74 |

| Frankenmuth | 0.27 | Tokio Marine Holdings | 0.71 |

Read more:

Complaint Ratios for West Virginia’s 10 Largest Auto Insurers

This chart gives a visual representation of how the top car insurance companies in West Virginia compare with one another in terms of complaint ratios.

For more information on this topic, take a look at the most recently released annual report from the state insurance commissioner.

West Virginia Car Insurance Rates by Company

Below is a list of the most expensive and cheapest car insurance companies in West Virginia by their average premiums.

Top 10 Most Affordable and Most Expensive Car Insurance Companies in West Virginia

| Cheapest Companies | Monthly Rate | Most Expensive Companies | Monthly Rate |

|---|---|---|---|

| American National Property & Casualty | $49 | Allstate | $125 |

| Encompass | $53 | Esurance | $128 |

| Erie Insurance | $36 | First Liberty | $108 |

| Garrison Property & Casualty | $41 | Liberty | $228 |

| Hartford Of The Midwest | $49 | Liberty Mutual | $171 |

| Metropolitan | $34 | Motorists Mutual | $103 |

| Property & Casualty Insurance Company Of Hartford | $43 | Peak Propery & Casualty | $175 |

| Trumbull | $47 | Progressive | $127 |

| Twin City Fire Insurance | $51 | Westfield Insurance Company | $100 |

| USAA | $22 | West Virginia Nationall Auto | $133 |

Read more: Encompass Car Insurance Discounts

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Largest Car Insurance Companies in West Virginia

Whether you go with a locally based company or an out-of-state option, the best way to guarantee you’re getting the most suitable coverage at the most competitive prices is to shop around.

You should make a habit of comparing West Virginia car insurance quotes every six months to a year.

Will Smith informs us that “the more you know, the further you’ll go.

You can only miss potential opportunities in cutting the cost of your auto insurance if you decide to forego comparison shopping. There is more to gain than there is to lose when you look around.

This PSA from the Fresh Prince is a reminder that knowledge is power. In fact, knowledge of your state’s regulations for the road (and applying that knowledge) is powerful enough to help save you money on your car insurance premiums.

Let’s take a look at the laws of the land to keep you knowledgeable and to ensure your dollar will go further when purchasing insurance.

How Much Auto Insurance Costs in West Virginia

Delve into the specifics of car insurance costs in West Virginia cities like Durbin, Kingwood, Liberty, Romney, Weirton, and Williamson. This citywise analysis provides valuable insights into the factors shaping car insurance rates, helping you make informed decisions about coverage tailored to your specific location in the Mountain State.

| Compare Car Insurance Rates in Your City | |

|---|---|

| Durbin, WV | Romney, WV |

| Kingwood, WV | Weirton, WV |

| Liberty, WV | Williamson, WV |

Are there any West Virginia laws that drivers should be aware of?

No need to list every traffic law in West Virginia. We’ll go over some of the most important ones that all West Virginians should know.

Car Insurance Laws

Car insurance companies in West Virginia have a lot of latitude to set the premium rates they will offer to consumers.

Yet even with this much authority, these companies must adhere to the regulations and expectations set by the National Association of Insurance Commissioners (NAIC), which acts as a self-regulatory governing body.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Car Insurance Rate-Setting Regulations

“Open competition” is the capitalistic process in which rates are formed; however, if the insurance commissioner decides that rates are excessive or could be harmful to the company’s solvency, he or she will step in and adjust those figures.

High-Risk Insurance

West Virginia State Code states that an individual may be considered a substandard risk if:

- They have a record of traffic accidents;

- Have a record of traffic law violations;

- Have undesirable occupational circumstances; or

- Have any other valid underwriting consideration.

In many other states in the US, an SR-22 car insurance form is mandatory for motorists deemed substandard or high-risk after having committed serious moving violations, insurance violations, or after the suspension of a license in order to be reinstated.

However, there is no such requirement in West Virginia to obtain an SR-22 form.

While an SR-22 form isn’t a requirement in West Virginia in order to reinstate driving privileges, you will still need to meet other requirements. The requirements will vary based on the nature of the offense.

Depending on the severity of the crime and conviction, you may be required to serve a period of incarceration and have your license revoked temporarily before you can reapply for a new license. Plus, you may be responsible for both court fines and reinstatement fees.

You can track and monitor what type of offenses will earn you points on your license by checking the DMV’s Point System.

In West Virginia the following violations may lead to your license being revoked or suspended:

- Point accumulation according to the DMV Point System.

- Falsely obtaining a license.

- Driving with a suspended or revoked license.

- Failure to drive according to the restrictions on your license.

- Failing to pay any type of court fees or court-ordered payment (such as child support).

- Driving without insurance.

- Failure to provide proof of insurance.

- DUI offenses, such as driving with a blood alcohol content (BAC) over the legal limit, or refusing to test for BAC.

- Leaving an accident scene that resulted in personal injury or death.

- Failing to satisfy any civil judgment made against you due to your involvement in an accident.

- Negligent homicide or manslaughter involving a motor vehicle.

Note: This list is representative and by no means exhaustive.

Windshield Coverage

West Virginia mandates that for all cars less than three years old insurers must use original equipment manufacturers (OEM) replacement parts for broken windshield car insurance unless the consumer agrees in writing.

Read more: Does car insurance cover broken car windows?

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Automobile Insurance Fraud in West Virginia

Did you know that fraud accounts for roughly 10 percent of operating costs for the insurance industry as a whole? Why does that matter to you as a consumer?

That 10 percent that insurance companies use to investigate, combat, and pay to fraudulent claims is essentially 10 percent of your premiums that are wasted.

And if those fraud numbers continue to escalate, it is more likely that the insurance will pass on some of that cost to you as the consumer in the form of increased premiums.

If companies didn’t have to waste your premium dollars on false claims, you could see a reduction in the rates you pay.

There are two classifications of fraud: hard and soft.

- Hard Fraud: A purposefully fabricated claim or accident

- Soft Fraud: A misrepresentation of information to the insurance company

Soft fraud is more common than hard fraud. Twenty to 40 percent of consumers admitted to lying to their insurer about one of the following:

- Number of annual miles driven

- Number of drivers in the household

- How the vehicle would be used

Insurance fraud is a crime no matter how you slice it. Even the “little, white lie” you tell to get a lower rate can lead to harmful consequences. That kind of willful misrepresentation of facts is called known as “rate evasion” and is $16 billion annual expense to auto insurers.

If you suspect insurance fraud, you can report it through the Office of the Inspector General (OIG) Fraud Unit.

Statute of Limitations

The statute of limitations for filing a claim in West Virginia is as follows:

| Coverage | Years |

|---|---|

| Property Damage | Two years |

| Personal Injury | Two years |

Vehicle Licensing Laws

When rumbling through the multitude of country roads, make sure your vehicle is registered and that you can brandish proof of insurance. Otherwise, you might suffer some costly consequences.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Penalties for Driving Without Insurance

The penalties for driving without insurance in West Virginia are as follows:

| Penalty | First Offense | Second Offense |

|---|---|---|

| Fine | $200 to $5,000 – $200 penalty reinstatement fee if no proof of insurance | $200 to $5,000 fine and/or 15 days to one year in jail if second offense occurs within five years |

| License Suspension | 30 days with reinstatement fees, unless there's proof of insurance | 90 days and registration revoked until proof of insurance |

West Virginia Automobile Insurance Plan

Car insurance companies in West Virginia can refuse high-risk car insurance or coverage to substandard drivers like motorists with poor driving records.

If you are having a difficult time finding car insurance on the open market, you may apply for insurance through the West Virginia Automobile Insurance Plan (WVAIP), which helps guarantee that all licensed drivers have access to car insurance.

Teen Driver Laws

West Virginia utilizes a Graduate Driver’s Licensing (GDL) program. These laws were implemented to reduce fatalities, and lower injuries, and have been proven to result in safer highways and roadways.

New drivers who participate in the GDL system must reach various milestones before they are allowed to graduate to a less restrictive license level, and eventually, receive a full unrestricted license.

Teen drivers must also provide a valid Driver’s Eligibility Certificate, which is issued by the local school board and proves the teen driver’s attendance.

All teenage applicants for a driver’s permit must have parental consent when submitting their applications, unless they are married, in which case, parental consent is waived.

There are three levels of driving permissions available for teens in West Virginia. They are Instruction Permit (Level 1), Intermediate License (Level 2), and Class E License (Level 3).

- Instruction Permit: An instruction permit is valid until the young driver reaches the age of 18. After the person turns 18, they have 30 days to complete the road skills examination, which is required to qualify for the Intermediate License.The Level 1 permit can’t be renewed. If the permit expires, the teen driver must reapply for a permit and hold it in good standing without a traffic conviction for at least 180 days before applying for an Intermediate License.

- Intermediate License: Teen drivers between the ages of 16 – 18 who have completed all the Instruction Permit requirements are eligible for an Intermediate License. To apply for a Level 2 License, the teen driver must complete either a driver’s education course approved by the State Department of Education or 50 hours of behind-the-wheel experience (including at least ten hours of night driving) certified by a parent, legal guardian, or another responsible adult who is older than 21. Applicants must provide valid identification and proof of residency and have at least 180 days of consecutive driving without a traffic conviction immediately prior to submitting their application for a Level 2 License. Drivers with an Intermediate License may drive alone only between the hours of 5 a.m. and 10 p.m.Outside of those hours, the teen driver must be accompanied by a licensed driver at least 21 years of age, unless one of the exceptions applies. The exceptions include driving to and from a place of employment, driving to and from school and religious activities, and driving during emergency situations to prevent bodily injury or death of another.

- Class E License: Teens in West Virginia are eligible to apply for a Level 3 License once they’ve turned 17, have completed a driver’s improvement program, have earned a valid Driver’s Eligibility Certificate or proof of having completed school, have a clean driving record for the one year prior to submitting their applications, and have submitted the applications with all necessary licensing fees.A driver who turns 18 years old while holding an Intermediate License needs only complete the application and pay the fees to get a Class E license. A Level 3 License is valid until 30 days after the licensee turns 21 years old. The driver and all passengers must wear seat belts at all times.

| Restrictions | Level 1 | Level 2 | Level 3 |

|---|---|---|---|

| Age | 15 | 15 1/2 – must have held an Instruction Permit for a minimum of six months prior | 16 – must have held an Intermediate License for a minimum of six months prior |

| Passengers | No more than two passengers and must be supervised by a licensed adult | First six months or until age 18 – no passengers younger than 20 Second six months – no more than one passenger younger than 20 | All restrictions lifted when 17 AND have license for 12 months or 18 (whichever comes first) |

| Hours | Under age 18 – no driving between 10 p.m. and 5 a.m. | All restrictions lifted when 17 AND have license for 12 months or 18 (whichever comes first) | All restrictions lifted when 17 AND have license for 12 months or 18 (whichever comes first) |

| Cell Phone Use | Handheld ban Texting prohibited for all drivers | Handheld ban Texting prohibited for all drivers | Handheld ban Texting prohibited for all drivers |

| Pre-requisites | If under 18, must provide a valid Driver's Eligibility Certificate, which is issued by the local school board and proves attendance record | 50 total hours supervised driving, 10 must be at night | Must have Driver's Eligibility Certificate and clean driving record for up to a year prior |

Once a teenager has completed the requirements for getting a driver’s license, the next step is finding teen driver car insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Older Driver License Renewal

When it comes to its driving laws, West Virginia can never be accused of ageism. Older drivers in the Mountain State must renew their licenses every eight years, just like the rest of the general population.

Older motorists must also show proof of adequate vision at every renewal and are eligible to renew online every other renewal, just like every other motorist.

New Resident Licensing

New residents of West Virginia may have lots of questions about how and when to apply for a new license. According to the DMV:

A new resident who does not have possession of the out-of-state license or if it has expired, must obtain a certified driving record, dated no more than 30 days from the date of the application, from the state in which they were previously licensed.

If your out-of-state license is suspended or revoked, you cannot be licensed in West Virginia, until you receive clearance in the Problem Driver Points System (PDPS).

It is illegal to drive in West Virginia with a suspended or revoked license. All applicants must be verified with the PDPS. It is important to confirm that you are not under suspension in any other jurisdiction before attempting to obtain a license in West Virginia.

License Renewal

All motorists in West Virginia must renew their licenses every eight years, regardless of age. All must show proof of adequate vision at the time of renewal. And all are eligible for online renewal, every other renewal period.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Rules of the Road

West Virginia is a fault state, meaning that the driver at fault in an accident is responsible to pay for damages done to the other party. This is also commonly referred to as a tort state.

Keep Right and Move Over Laws

West Virginia law requires that you keep to the right, to the right if driving slower than the average speed of traffic around you. Driving in the left lane is only permissible when passing or when turning left.

Move Over laws mean exactly what they say: a motorist should move his/her vehicle over whenever approaching a stopped emergency vehicle with its lights on.

“If possible with regard to safety and traffic conditions, slow down and change lanes whenever possible for all law enforcement, emergency vehicles, first responders and tow trucks when they are flashing their lights.”

Speed Limits

| Type of Roadway | Speed Limit |

|---|---|

| Rural Interstates | 70 mph |

| Urban Interstates | 55 mph |

| Other Limited Access Roads | 65 mph |

| Other Roads | 55 mph |

Seat Belt Laws

Seat belt laws in West Virginia require front-seat passengers eight years old and older to wear a seat belt. All other passengers between the ages of eight and 17 must also wear a seat belt. A violation is not a primary offense.

Not wearing a seat belt by itself cannot be a cause for your getting pulled over but should you be stopped for some other traffic violation, you can be ticketed for failure to wear a seat belt. The minimum fine is $25.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Car Seat Laws

All children seven years old or younger and less than four feet, nine inches tall are required to be seated in a child safety seat. West Virginia law states no preference for rear-facing car seats.

Ridesharing

As of now, State Farm, Progressive, USAA, and Geico are the only auto insurers in West Virginia offering rideshare car insurance specifically for ride sharing

Automation on the Road

Currently, West Virginia has no laws or testing or deployment of any automation on the road.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Safety Laws

The Governor’s Highway Safety Program (GHSP) exists is to encourage, promote, and support highway safety throughout West Virginia. The Traffic Safety Resource Prosecutor is another valuable resource that provides safety training, education, and technical support to West Virginians.

DUI Laws

According to West Virginia DUI insurance laws, The Blood-Alcohol Content (BAC) limit is 0.08 percent; the High BAC limit is 0.15 percent. The first two offenses are misdemeanors and every subsequent offense will be a felony. After a second offense, an Ignition Interlock Device (IID) will be required.

| Penalty Type | First Driving Under the Influence (DUI) | Second DUI | Third and Subsequent DUIs |

|---|---|---|---|

| Revoked License | 15 days | One year | One year |

| Imprisonment | No minimum, but up to six months | Six to 12 months of jail | One to three years |

| Fine | $100–$500 | $1000–$3000 | $3000 –$5000 |

| Other | IID possible | IID required | IID required |

Drug-impaired Driving Laws

West Virginia has a marijuana-impaired limit of THC per se (3 nanograms).

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

West Virginia Can’t-Miss Facts

Here are some interesting tidbits for motorists in the state of West Virginia.

Vehicle Theft in West Virginia

Auto theft is a major problem for consumers. The one whose property is pilfered isn’t the only victim; customers all over a given municipality are penalized with higher premiums when the frequency of auto theft increases.

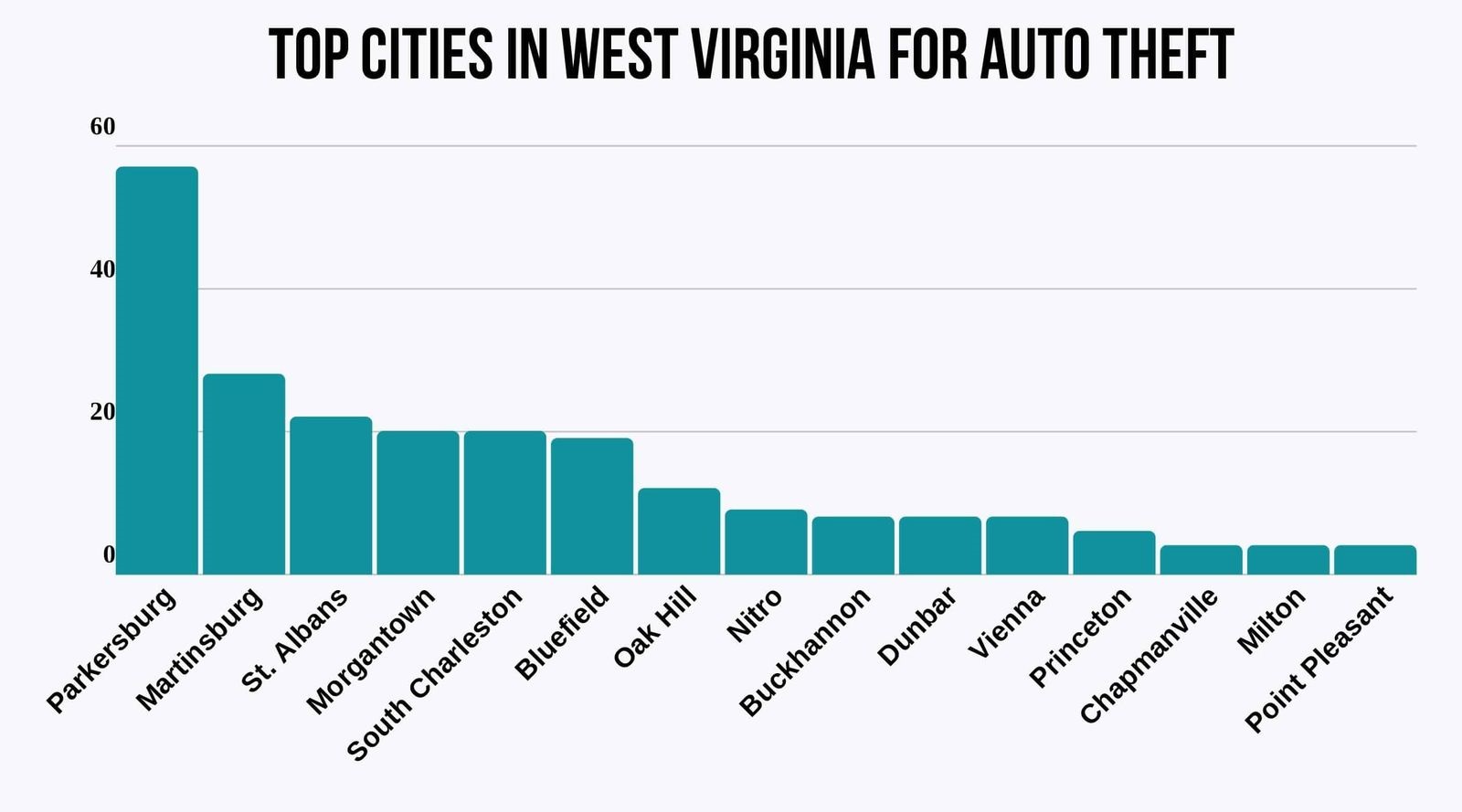

Top Cities for Stolen Vehicles in West Virginia

The chart below shows the top cities for auto theft within the state.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Top 10 Stolen Vehicles in West Virginia

Have you ever wondered if the vehicle you’re currently driving makes you more attractive to car thieves? Check out the table below to find out.

| Model | Number of Thefts |

|---|---|

| 2003 Ford Pickup (Full Size) | 87 |

| 2000 Chevrolet Pickup (Full Size) | 76 |

| 1996 Jeep Cherokee/Grand Cherokee | 36 |

| 2003 Dodge Pickup (Full Size) | 29 |

| 1999 Chevrolet Pickup (Small Size) | 29 |

| 2006 Chevrolet Impala | 24 |

| 2014 Toyota Camry | 20 |

| 1995 Ford Taurus | 19 |

| 2011 GMC Pickup (Full Size) | 18 |

| 2002 Chevrolet Cavalier | 17 |

Risky and Harmful Behavior

For your information, we’ve compiled a list of all driving-related fatalities in West Virginia.

Fatalities Involving Speeding by County

| County | 2015 | 2016 | 2017 |

|---|---|---|---|

| Barbour | 0 | 0 | 1 |

| Berkeley | 4 | 4 | 3 |

| Boone | 0 | 0 | 0 |

| Braxton | 2 | 1 | 0 |

| Brooke | 0 | 0 | 0 |

| Cabell | 6 | 1 | 1 |

| Calhoun | 0 | 0 | 1 |

| Clay | 1 | 2 | 0 |

| Doddridge | 0 | 0 | 2 |

| Fayette | 2 | 1 | 2 |

| Gilmer | 0 | 2 | 3 |

| Grant | 2 | 2 | 1 |

| Greenbrier | 0 | 1 | 1 |

| Hampshire | 1 | 1 | 1 |

| Hancock | 1 | 1 | 2 |

| Hardy | 0 | 0 | 1 |

| Harrison | 3 | 1 | 4 |

| Jackson | 2 | 1 | 2 |

| Jefferson | 2 | 3 | 2 |

| Kanawha | 8 | 4 | 13 |

| Lewis | 3 | 4 | 0 |

| Lincoln | 1 | 0 | 0 |

| Logan | 2 | 1 | 3 |

| Marion | 3 | 5 | 1 |

| Marshall | 2 | 0 | 2 |

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Fatalities by DUI by County

| County | 2015 | 2016 | 2017 |

|---|---|---|---|

| Barbour | 0 | 2 | 1 |

| Berkeley | 2 | 3 | 2 |

| Boone | 0 | 0 | 0 |

| Braxton | 3 | 0 | 0 |

| Brooke | 0 | 0 | 1 |

| Cabell | 3 | 3 | 7 |

| Calhoun | 0 | 0 | 0 |

| Clay | 1 | 0 | 0 |

| Doddridge | 0 | 0 | 0 |

| Fayette | 3 | 0 | 0 |

| Gilmer | 0 | 2 | 0 |

| Grant | 0 | 0 | 1 |

| Greenbrier | 2 | 1 | 1 |

| Hampshire | 1 | 3 | 1 |

| Hancock | 0 | 1 | 0 |

| Hardy | 2 | 0 | 0 |

| Harrison | 5 | 2 | 6 |

| Jackson | 2 | 1 | 1 |

| Jefferson | 4 | 3 | 1 |

| Kanawha | 7 | 7 | 6 |

| Lewis | 2 | 1 | 1 |

| Lincoln | 0 | 0 | 2 |

| Logan | 2 | 1 | 3 |

| Marion | 0 | 3 | 1 |

| Marshall | 1 | 1 | 2 |

Fatality Rates Rural Versus Urban

| Roadway Type | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Rural | 217 | 223 | 206 | 218 | 235 | 215 | 183 | 195 | 169 | 91 |

| Urban | 200 | 137 | 153 | 137 | 184 | 184 | 200 | 214 | 222 | 60 |

Fatalities by Person Type

| Person Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Passenger Vehicle Occupant | 247 | 202 | 192 | 186 | 218 |

| Motorcyclist | 24 | 26 | 32 | 29 | 26 |

| Pedestrian | 28 | 19 | 19 | 24 | 26 |

| Bicyclist and Other Cyclist | 0 | 2 | 1 | 1 | 3 |

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

EMS Response Time

| Location | Time of Crash to EMS Notification | Notification to Arrival | Arrival at Scene to Hospital Arrival | Time of Crash to Time of Hospital Arrival |

|---|---|---|---|---|

| Rural | 8.98 | 16.16 | 39.61 | 55.00 |

| Urban | 5.36 | 10.22 | 29.23 | 42.48 |

Transportation

Where does West Virginia rank in commute time? How does rush-hour traffic compare to the rest of the nation? What methods do they use to get to work? We’ll answer those questions and more.

Car Ownership

In West Virginia, 41.7 percent of households own two cars. That is a little higher than the national average of 40.3 percent.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Commute Time

Workers in West Virginia have a shorter average commute time than the normal US worker (25.3 minutes). Additionally, 3.3 percent of the workforce in West Virginia have “super commutes” in excess of 90 minutes.

Commuter Transportation

A majority of West Virginians drive to work alone — 83.3 percent. Only 8.57 percent of workers carpooled during their daily commute.

You now have comprehensive knowledge of what you need for insurance, what you can expect your rates to be, and how to safely obey the traffic laws governing your great state of West Virginia.

Enter your ZIP code below to compare West Virginia car insurance rates online to ensure the vehicle that takes you home to the place where you belong has the proper coverage at rates that are almost heaven.

Frequently Asked Questions

How much is car insurance in West Virginia?

The cost of car insurance in West Virginia can vary depending on several factors, including your age, driving record, location, and the type of coverage you choose. It’s best to get quotes from different insurance companies to find the most accurate price for your specific situation.

Who has the cheapest car insurance in West Virginia?

The cheapest car insurance provider in West Virginia can vary depending on individual circumstances. It’s recommended to compare quotes from multiple insurance companies to find the best rates for your specific needs.

What are the car insurance laws in West Virginia?

In West Virginia, car insurance is mandatory. The minimum liability coverage required by law is 25/50/20, which means you must have at least:

- $25,000 for bodily injury or death per person

- $50,000 for total bodily injury or death per accident

- $20,000 for property damage per accident

Do I need uninsured/underinsured motorist coverage in West Virginia?

Uninsured/underinsured motorist coverage is not required by law in West Virginia, but it is highly recommended. This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages.

Should I choose the bare minimum coverage?

The decision to choose the minimum coverage or additional coverage depends on your personal financial situation and the value of your assets. If you have assets to protect, it’s generally advisable to increase your liability limits and consider additional coverage options.

What is loss ratio and how does it impact my rates?

The loss ratio is a measure used by insurance companies to assess their profitability. It is calculated by dividing the amount paid out in claims by the premiums collected. A high loss ratio indicates that the insurance company has had a high number of claims, which may result in higher premiums for policyholders in the future.

What are some optional add-ons or endorsements for car insurance in West Virginia?

Some optional add-ons or endorsements for car insurance in West Virginia include:

- GAP insurance

- Personal Umbrella Policy (PUP)

- Rental Car Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

Are there differences in car insurance rates between male and female drivers in West Virginia?

On average, male drivers may receive better premium quotes than female drivers in West Virginia. However, individual circumstances such as age, driving record, and location can also affect insurance rates.

What factors can affect car insurance rates in West Virginia?

Several factors can affect car insurance rates in West Virginia, including:

- Age

- Driving record

- Location

- Type of vehicle

- Coverage options

- Deductibles

- Credit history

- Annual mileage

Which companies have the best car insurance in West Virginia?

The best car insurance company for you will depend on your specific needs and preferences. It’s recommended to research and compare the financial stability and customer satisfaction ratings of different insurance companies to find the one that suits you best.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.