Best Car Insurance for Church Employees in 2026 (Top 10 Companies)

State Farm, USAA, and Progressive lead the pack as the best car insurance for church employees offering discounts up to 30%. Tailored coverage, faith-based discounts, and comprehensive plans set these companies apart, ensuring that church workers can navigate the road with confidence.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Sr. Director of Content

Sara Routhier, Managing Editor and Outreach Director, has professional experience as an educator, SEO specialist, and content marketer. She has over five years of experience in the insurance industry. As a researcher, data nerd, writer, and editor she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world o...

Sara Routhier

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Kalyn Johnson

Updated May 2024

Company Facts

Full Coverage for Church Worker

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Church Worker

A.M. Best Rating

Complaint Level

Company Facts

Full Coverage for Church Worker

A.M. Best Rating

Complaint Level

Having a job in the clergy, whether it is as a pastor, bishop, or priest, requires a lot of personal commitment and the desire to help people who are struggling.

Our Top 10 Best Companies: Best Car Insurance for Church Employees

| Company | Rank | Faith-Based Discount | Safe Driver Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | 30% | Multi-Policy Discounts | State Farm | |

| #2 | 15% | 25% | Customer Service | USAA | |

| #3 | 12% | 30% | Customizable Policies | Progressive | |

| #4 | 10% | 30% | Safe-Driving Discounts | Allstate | |

| #5 | 8% | 25% | 24/7 Support | Liberty Mutual |

| #6 | 10% | 20% | Customizable Coverage | Farmers | |

| #7 | 15% | 25% | Vanishing Deductible | Nationwide |

| #8 | 10% | 20% | Bundling Policies | Travelers | |

| #9 | 12% | 25% | Add-on Coverages | American Family | |

| #10 | 10% | 30% | Online Convenience | Esurance |

Those in the clergy spend a good deal of time driving to and from appointments and visiting people in their congregations. (Read more: Does driving less affect car insurance rates?)

To find the best deal on car insurance rates, you can compare rates for yourself by entering your ZIP code in the free quote tool above.

- State Farm, USAA, and Progressive offer faith-based discounts

- Erratic driving patterns and transporting passengers require specialized coverage

- Multi-policy discounts, and tax breaks for church-related mileage

#1 – State Farm: Top Overall Pick

Pros

- Competitive Rates: As mentioned in our State Farm car insurance review they offer competitive rates for church workers, with an average monthly rate of $156.00 for good drivers.

- Faith-Based Discount: Provides a faith-based discount of up to 10%, offering additional savings for clergy members.

- Safe Driver Incentives: Offers a safe driver discount of up to 30%, encouraging and rewarding safe driving habits.

Cons

- Limited Military Focus: Unlike USAA, State Farm may not cater specifically to military members, potentially missing out on that demographic.

- Limited Online Convenience: While they offer multi-policy discounts, their online convenience may not be as robust as some online-focused competitors like Esurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Customer Service

Pros

- Low Average Monthly Rate: USAA boasts a low average monthly rate of $62.75 for good drivers, providing affordable options for church workers.

- Faith-Based Discount: Offers a faith-based discount of up to 15%, recognizing and supporting the needs of clergy members.

- Excellent Customer Service: Known for exceptional customer service, USAA provides a high level of support and assistance to its members.

Cons

- Limited Membership Eligibility: Membership eligibility is limited to military members and their families, excluding the general public.

- Not Available to Everyone: USAA membership is not available to everyone, potentially leaving out individuals who do not meet the eligibility criteria. Read more about their availability in our USAA car insurance review.

#3 – Progressive: Best for Customizable Policies

Pros

- Balanced Coverage and Cost: Positioned as a balanced choice, Progressive offers competitive rates at $109.17 for good drivers.

- Faith-Based Discount: Provides a faith-based discount of up to 12%, catering to the unique needs of church workers.

- Customizable Policies: As mentioned in our Progressive car insurance review, they allow individuals to tailor coverage according to their specific requirements.

Cons

- Not the Cheapest Option: While competitive, Progressive may not always be the absolute cheapest option, depending on individual circumstances.

- Average Customer Satisfaction: While complaint levels are low, overall customer satisfaction may not be as high as some other providers.

#4 – Allstate: Best for Safe-Driving Discounts

Pros

- Comprehensive Coverage Options: Allstate provides a wide range of coverage options, allowing customers to tailor their policies to specific needs.

- Faith-Based Discount: Offers a faith-based discount of up to 10%, providing additional savings for clergy members.

- Safe-Driving Discounts: Best for those with a safe driving record, offering discounts of up to 30%. Learn more in our Allstate car insurance review.

Cons

- Higher Average Monthly Rate: Allstate’s average monthly rate for good drivers is higher at $160, which may be a consideration for budget-conscious individuals.

- Mixed Customer Service Reviews: Customer service reviews vary, with some customers reporting mixed experiences with Allstate representatives.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for 24/7 Support

Pros

- Faith-based discount: Offers a faith-based discount of up to 8%, recognizing the unique needs of clergy members.

- 24/7 support: Provides 24/7 customer support, ensuring assistance is available whenever needed. (Read more: Liberty Mutual Car Insurance Review)

- Safe driver discount: Offers discounts of up to 25% for safe driving habits, encouraging responsible behavior on the road.

Cons

- Average monthly rate: The average monthly rate for good drivers is higher at $174, which may be a consideration for those on a budget.

- Mixed reviews on claims process: Some customers report mixed experiences with the claims process, with delays or complications in settling claims.

#6 – Farmers: Best for Customizable Coverage

Pros

- Faith-Based Discount: Offers a faith-based discount of up to 10%, recognizing the unique needs of clergy members.

- Customizable Coverage: Best for those seeking customizable coverage options to match their specific needs. Learn more in our Farmers car insurance review.

- Safe Driver Discount: Provides discounts of up to 20% for safe driving, promoting responsible behavior on the road.

Cons

- Average Monthly Rate: While competitive, the average monthly rate for good drivers is higher at $139.

- Mixed Customer Reviews: Some customers report mixed experiences with customer service and claims processing.

#7 – Nationwide: Best for Vanishing Deductible

Pros

- Faith-Based Discount: Offers a faith-based discount of up to 15%, providing additional savings for clergy members. (Read more: Nationwide Car Insurance Discounts)

- Safe Driver Discount: Provides discounts of up to 25% for safe driving habits, encouraging responsible behavior on the road.

- Vanishing Deductible: Introduces vanishing deductible options, rewarding safe driving over time.

Cons

- Average Monthly Rate: The average monthly rate for good drivers is higher at $115, which may impact budget-conscious individuals.

- Mixed Reviews on Claims Handling: Some customers report mixed experiences with the claims handling process, with delays or disputes.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Bundling Policies

Pros

- Faith-Based Discount: Offers a faith-based discount of up to 10%, recognizing the unique needs of clergy members.

- Safe Driver Discount: Provides discounts of up to 20% for safe driving habits, promoting responsible behavior on the road.

- Bundling Policies: Best for customers interested in bundling policies to maximize savings. More information is available in our Travelers Car insurance review.

Cons

- Average Monthly Rate: While competitive, the average monthly rate for good drivers is higher at $99.

- Mixed Customer Reviews: Some customers report mixed experiences with customer service, with varying levels of satisfaction.

#9 – American Family: Best for Add-On Coverages

Pros

- Faith-Based Discount: Offers a faith-based discount of up to 12%, recognizing the unique needs of clergy members.

- Safe Driver Discount: American Family car insurance provides discounts of up to 25% for safe driving habits, encouraging responsible behavior on the road.

- Add-On Coverages: Best for customers looking for additional coverages, allowing them to enhance their policies.

Cons

- Average Monthly Rate: The average monthly rate for good drivers is higher at $117, which may be a consideration for budget-conscious individuals.

- Mixed Customer Reviews: Some customers report mixed experiences with customer service and claims processing.

#10 – Esurance: Best for Online Convenience

Pros

- Faith-Based Discount: Offers a faith-based discount of up to 10%, recognizing the unique needs of clergy members.

- Safe Driver Discount: Provides discounts of up to 30% for safe driving habits, promoting responsible behavior on the road.

- Online Convenience: Best for those seeking online convenience, with a user-friendly platform for policy management. (Read more: How do you get an Esurance car insurance quote?)

Cons

- Limited Physical Presence: Esurance lacks a physical presence, which may be a drawback for those who prefer in-person interactions.

- Mixed Customer Reviews: Some customers report mixed experiences with customer service and claims processing, indicating room for improvement.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Car Insurance Rates for Church Workers With the Industry Leaders

When it comes to securing car insurance for church workers, it’s essential to consider various factors, including faith-based discounts, safe driver incentives, and the overall coverage options provided by different insurance companies. Here, we’ll compare the best insurance companies tailored for church workers, examining their strengths and areas of specialization.

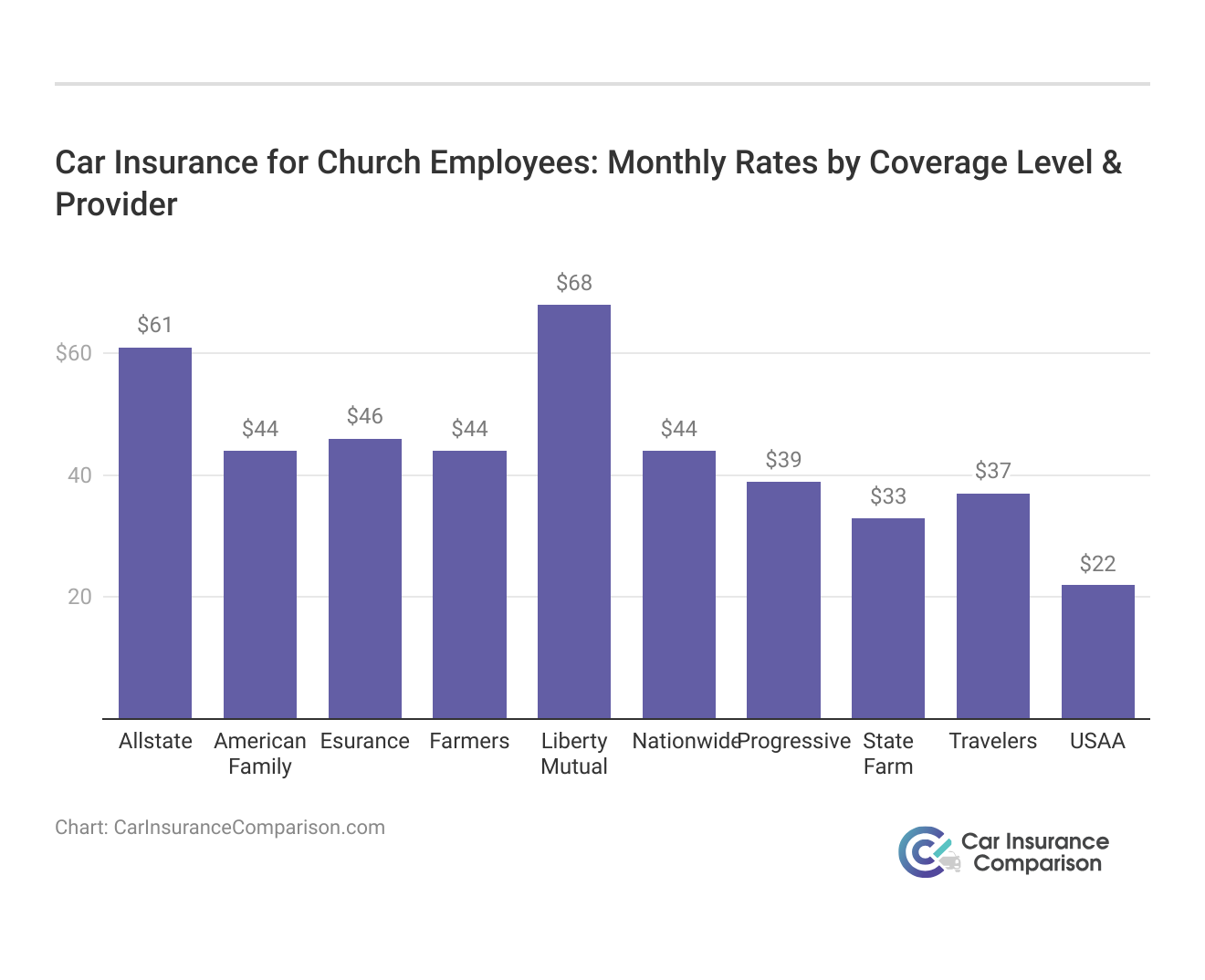

Car Insurance for Church Worker: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $61 | $160 |

| American Family | $44 | $117 |

| Esurance | $46 | $114 |

| Farmers | $44 | $139 |

| Liberty Mutual | $68 | $174 |

| Nationwide | $44 | $115 |

| Progressive | $39 | $105 |

| State Farm | $33 | $86 |

| Travelers | $37 | $99 |

| USAA | $22 | $59 |

State Farm stands out as a top choice, providing competitive rates of $86 for full coverage and $33 for minimum coverage. Following closely is USAA, offering budget-friendly options at $59 for full coverage and $22 for minimum coverage, tailored to the specific needs of military members.

State Farm stands out as the top choice, providing tailored coverage and advantageous plans for church workers, ensuring confident journeys on the road.

Melanie Musson Published Insurance Expert

Progressive, positioned as a balanced choice between coverage and cost, presents rates at $105 for full coverage and $39 for minimum coverage. Each of these industry leaders provides distinct advantages, allowing church workers to select the insurance coverage that aligns best with their priorities and requirements. To get more insights, read our article called “Understanding Your Car Insurance Policy“.

The Impact of Clergy Driving Habits on Car Insurance

As with any employee, car insurance rates are often set by industry studies of the driving habits of those employed in different occupations and through various organizations.

Though each individual has slightly different habits related to where they work, their personal life circumstances, and their own preferences, the insurance industry takes the data and paints a picture of the average person or employee in that occupation and then sets rates.

Clergy members tend to spend a lot of time driving.

This includes to and from their churches, hospital visits, appointments, counseling sessions, and additional emergencies. All of this driving means that clergy members will be on the road an average of 20 hours a week.

Due to emergencies and other situations that arise within the clergy profession, the hours that they drive are often erratic.

Having an unplanned routine and driving to unexpected places can result in more accidents and moving violations. It means that the type of protection the insurance provider can offer isn’t set in stone, because anything can happen. The driver isn’t necessarily high-risk, but they don’t want there to be any allowance for being undercut. Therefore, car insurance rates will be higher rather than lower.

Clergy members are often likely to be transporting people in their vehicles as well. This could be family members or members of the congregation that they oversee. Because of all of this, the insurance industry has set the annual average for clergy car insurance at the middle to high range. They want to ensure that they keep their family members safe, so it’s up to them to offer the type of coverage that would best come in handy.

Read more: Does car insurance cover driving a friend’s car?

Car Insurance Services as a Clergy Member: Tips and Tricks

As a clergy member, you have ways to save money on your insurance that other individuals may not have.

First of all, many churches provide car insurance coverage for their pastor, bishop, or priest. It is part of the overall benefits package offered to clergy members so there is no need to purchase a personal package. Take care to inform your provider so that they understand you’re eligible for this type of policy.

Other churches will provide a vehicle that is owned by the church to be driven by the clergy member. This could be a personal vehicle or a church van.

If it is a church-owned vehicle, there will likely be commercial car insurance coverage for the clergy member and other drivers on staff.

Clergy members have many different tax breaks than those in different occupations. Almost everything involved in the daily life of a clergy member can be written off for tax purposes. (Read more: Compare Commercial vs. Personal Car Insurance: Rates, Discounts, & Requirements)

Car insurance, a vehicle purchase, and mileage that you drive for church-related purposes are all things that can be written off at tax time. You have to keep an accurate and complete mileage record for your miles to count.

This includes recording the mileage when you leave for your destination and the mileage when you arrive at your destination.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Exploring Available Discounts for Clergy Members

Clergy members are allowed the same discounts as other drivers, as long as they qualify. They also qualify for safe driver car insurance discounts.

For example, a good driver discount is for anyone who has avoided accidents and moving violations in the last three years. Having an anti-theft device on your vehicle is worthy of a discount as well.

Other discounts based on age, student status, defensive driving courses, and multiple policies are available to clergy and to anyone else that qualifies.

Some insurance companies that insure churches for property damage and personal liability will extend a discount to clergy members if they purchase a policy as well.

Case Studies: Tailoring Car Insurance for Church Workers – Protecting, Serving, and Customizing

These three compelling case studies, each highlighting how different insurance providers cater to the specific requirements of church workers. From Reverend Johnson’s need for comprehensive coverage to Sergeant Anderson’s dual roles as a military member and church volunteer, and finally, Pastor Ramirez’s necessity for flexible policies.

- Case Study #1 – Protecting Multi-Policy Discounts for Reverend Johnson: Reverend Johnson, a dedicated pastor, frequently travels between the church, hospital visits, and community events. Seeking comprehensive coverage, he decides to bundle his car insurance with State Farm, taking advantage of their multi-policy discounts. This explores how State Farm caters to the diverse needs of church workers through customizable coverage options and cost-effective solutions.

- Case Study #2 – Serving Sergeant Anderson, a Devoted Church Volunteer: Sergeant Anderson, an active-duty military member, volunteers at his local church during his off-duty hours. USAA’s focus on military members and their families makes it an ideal choice for Sergeant Anderson. This delves into how USAA’s faith-based discount and exemplary customer service align with the unique lifestyle of a church worker who also serves in the military.

- Case Study #3 – Customizable Policies for Pastor Ramirez: Pastor Ramirez leads a congregation with diverse needs, often requiring a flexible insurance policy. Progressive’s emphasis on customizable policies allows Pastor Ramirez to tailor coverage to the unique requirements of his pastoral responsibilities. This explores how Progressive’s approach to offering a balance between coverage and cost benefits clergy members seeking flexibility in their insurance plans.

By prioritizing customization, cost-effectiveness, and specialized discounts, these providers not only ensure adequate coverage but also affirm their commitment to serving those who serve their communities with dedication and devotion. Read our article called “How Occupation Affects Car Insurance Rates” for more insights.

Discovering What Comes Next in Your Insurance Journey

The best way to reduce your car insurance rate is to shop around; your income is meant to provide for a number of things and not just your car insurance. To ensure that you’re not spending all of your salary on bills, there are a few things that you can do.

Compare the best car insurance companies is a great way to start, and will determine if you are still getting the best rate that is available to you no matter your occupation. Even after getting a policy, comparing rates every six months is important because you could be looking at a number of savings. Especially because there are various types of coverage offered by any of the multitudes of companies that exist. You’ll have no trouble finding the type of policy that’s right for you.

No matter what job you have, you can compare car insurance rates by entering your ZIP code in the free box now.

Frequently Asked Questions

Do the driving habits of the clergy matter when determining car insurance rates?

Yes, the driving habits of clergy members can impact car insurance rates. Due to the nature of their profession, clergy members often spend a significant amount of time on the road, traveling to and from appointments, hospitals, counseling sessions, and emergencies. Erratic driving patterns and unexpected travel can influence insurance rates, making them typically higher for clergy members.

How can church workers save money on car insurance services?

Church workers, including clergy members, can explore various avenues to save money on car insurance. Some churches provide insurance coverage as part of the benefits package, and others may offer church-owned vehicles with commercial car insurance. Additionally, clergy members may benefit from tax breaks, such as writing off car insurance, vehicle purchases, and mileage for church-related purposes.

Read more insights in our article called “Best Car Insurance by Occupation“.

Are there any specific discounts available for clergy members?

Clergy members are eligible for the same discounts as other drivers, provided they meet the criteria. Common discounts include good driver discounts, anti-theft device discounts, age-based discounts, student discounts, and discounts for completing defensive driving courses. Some insurance companies may also extend discounts if the clergy member purchases a policy from the same insurer that covers the church’s property damage and personal liability.

Affordable car insurance rates are just a click away. Enter your ZIP code into our free quote tool below to find the best policy for you.

How do multi-policy discounts benefit church workers?

Multi-policy discounts provide a valuable opportunity for church workers to save on insurance expenses. By consolidating different insurance policies, such as car and home insurance, with the same insurer, church workers can unlock discounts. This approach allows them to not only streamline their coverage but also enjoy cost savings through the insurer’s multi-policy discount, making comprehensive coverage more affordable.

Are there specialized insurance policies tailored specifically for clergy members?

Yes, some insurance companies offer specialized insurance policies designed to meet the unique needs of clergy members. These policies may include additional coverage options or discounts specifically tailored for those in religious professions.

What’s the best way to reduce car insurance rates for church workers?

To reduce car insurance rates, church workers, like any other individuals, should shop around and compare rates from different insurance companies. It’s essential to consider coverage options, faith-based discounts, and safe driver incentives. Regularly comparing rates, even after securing a policy, can help ensure that church workers are getting the best available rates.

Read more: Occupation Car Insurance Discounts

Do insurance companies consider church-owned vehicles differently for insurance coverage?

Yes, insurance companies often have specific policies for insuring church-owned vehicles, especially if they are used by clergy members. These policies may differ from standard personal auto insurance policies and may include coverage for multiple drivers or commercial use.

Are there insurance options available for clergy members who volunteer or travel for religious missions?

Yes, some insurance companies offer coverage options specifically designed for clergy members who volunteer or travel for religious missions. These policies may include coverage for international travel, medical emergencies, and other unique situations encountered during religious missions.

Take the first step toward cheaper car insurance rates. Enter your ZIP code below to see how much you could save.

How does the mileage driven by clergy members impact their car insurance rates?

The mileage driven by clergy members can impact their car insurance rates, as insurance companies often consider mileage when calculating premiums. Higher mileage generally increases the risk of accidents, so clergy members who drive more frequently may face higher insurance rates compared to those who drive less.

Read more: How much does mileage affect car insurance rates?

What steps can clergy members take to ensure they have adequate insurance coverage for their specific needs?

Clergy members can take several steps to ensure they have adequate insurance coverage for their specific needs. This may include reviewing their current coverage with an insurance agent to identify any gaps or deficiencies, exploring specialized insurance options for clergy members, and regularly reassessing their insurance needs to adjust coverage as necessary.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.