Compare Colorado Car Insurance Rates [2026]

Colorado car insurance rates cost an average of $168 per month, which is a little higher than the national average. Factors like uninsured drivers and high vehicle thefts lead to higher Colorado car insurance quotes, but you can compare Colorado car insurance rates to find an affordable plan.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Feature Writer

Chris Tepedino is a feature writer that has written extensively about car insurance for numerous websites. He has a college degree in communication from the University of Tennessee and has experience reporting, researching investigative pieces, and crafting detailed, data-driven features. His works have been featured on CB Blog Nation, Healing Law, WIBW Kansas, and Cinncinati.com. He has been a...

Chris Tepedino

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Updated May 2024

| Colorado Statistics Summary | Details |

|---|---|

| Road Miles | Total in State: 88,740 Vehicle Miles Driven: 4.9 billion |

| Vehicles | Registered: 4.6 million Total Stolen: 15,891 |

| State Population | 5,607,154 |

| Most Popular Vehicle | Subaru Outback |

| Uninsured Motorists | 13.3% State Rank: 19th |

| Total Driving Fatalities | 2008-2017 Speeding: 1,867 Drunk Driving: 1,537 |

| Annual Premiums by Coverage Type | Collision: $287 Comprehensive: $174.61 Liability: $520.04 |

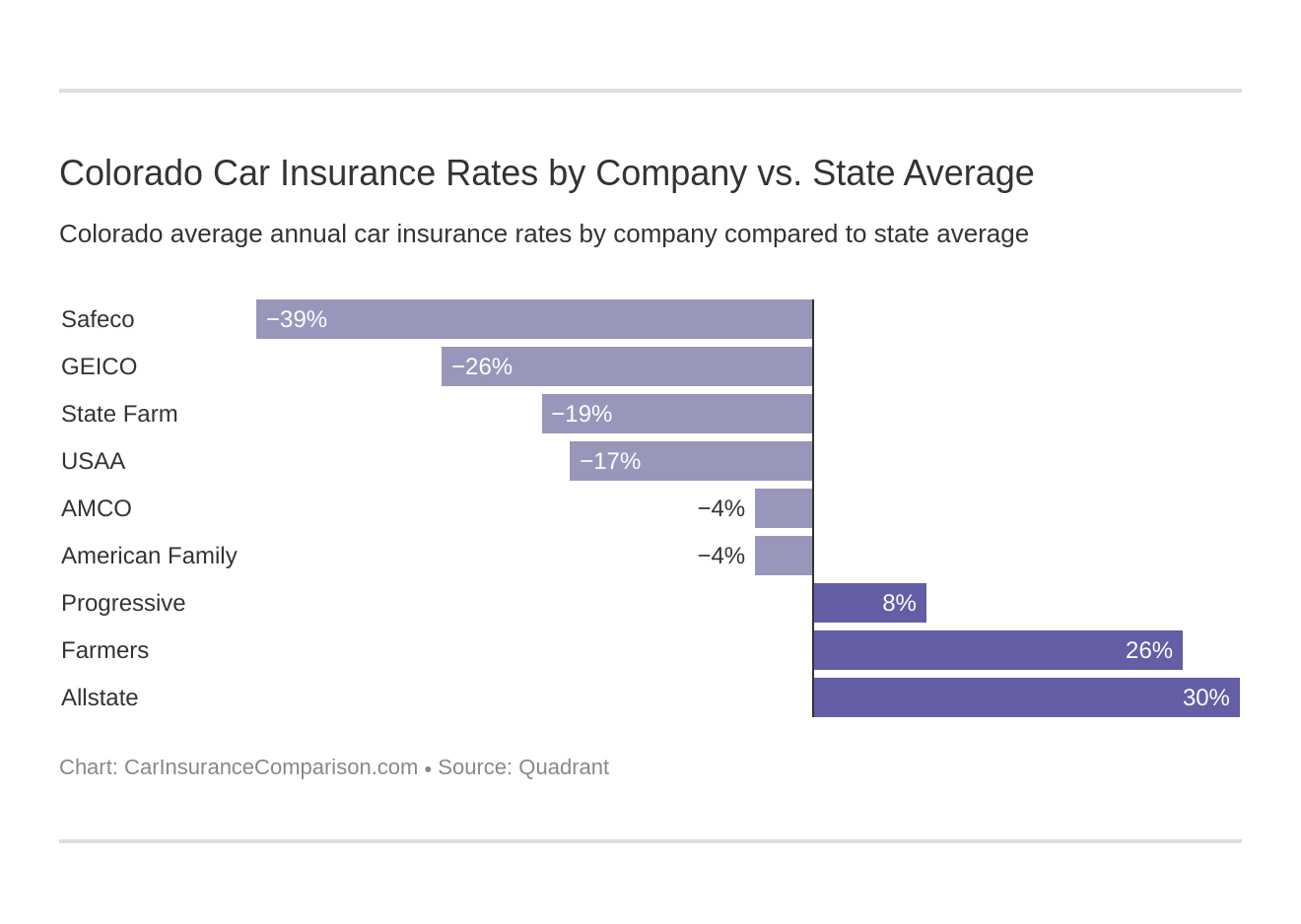

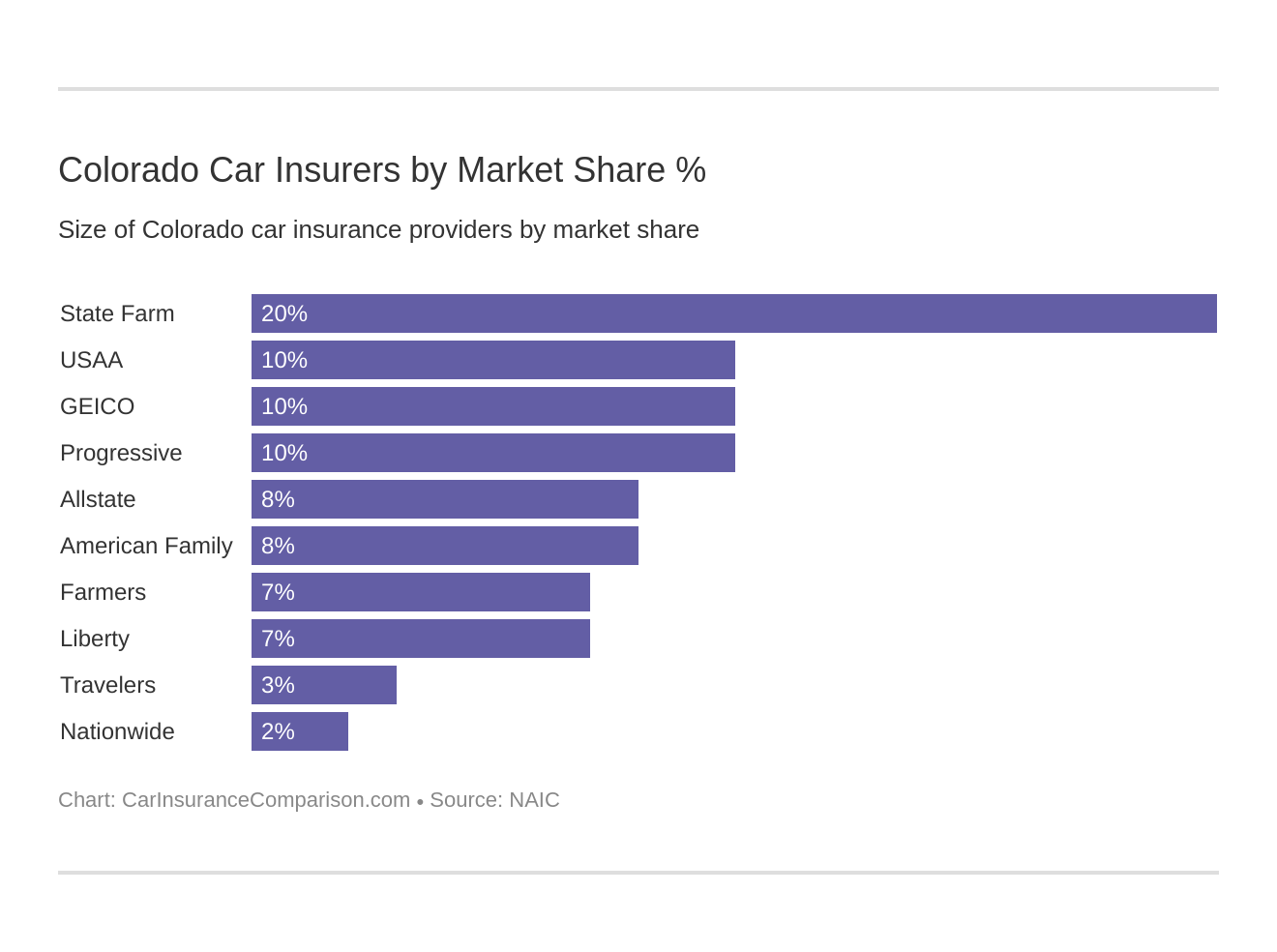

| Cheapest Providers | Safeco and Geico |

- Colorado car insurance costs an average of $168 per month, which is higher than the national average

- Colorado car insurance requirements include a 25/50/15 liability plan, though most experts recommend more coverage

- To find the cheapest car insurance in Colorado, you should find discounts, choose the right coverage for your vehicle, and compare as many quotes as possible

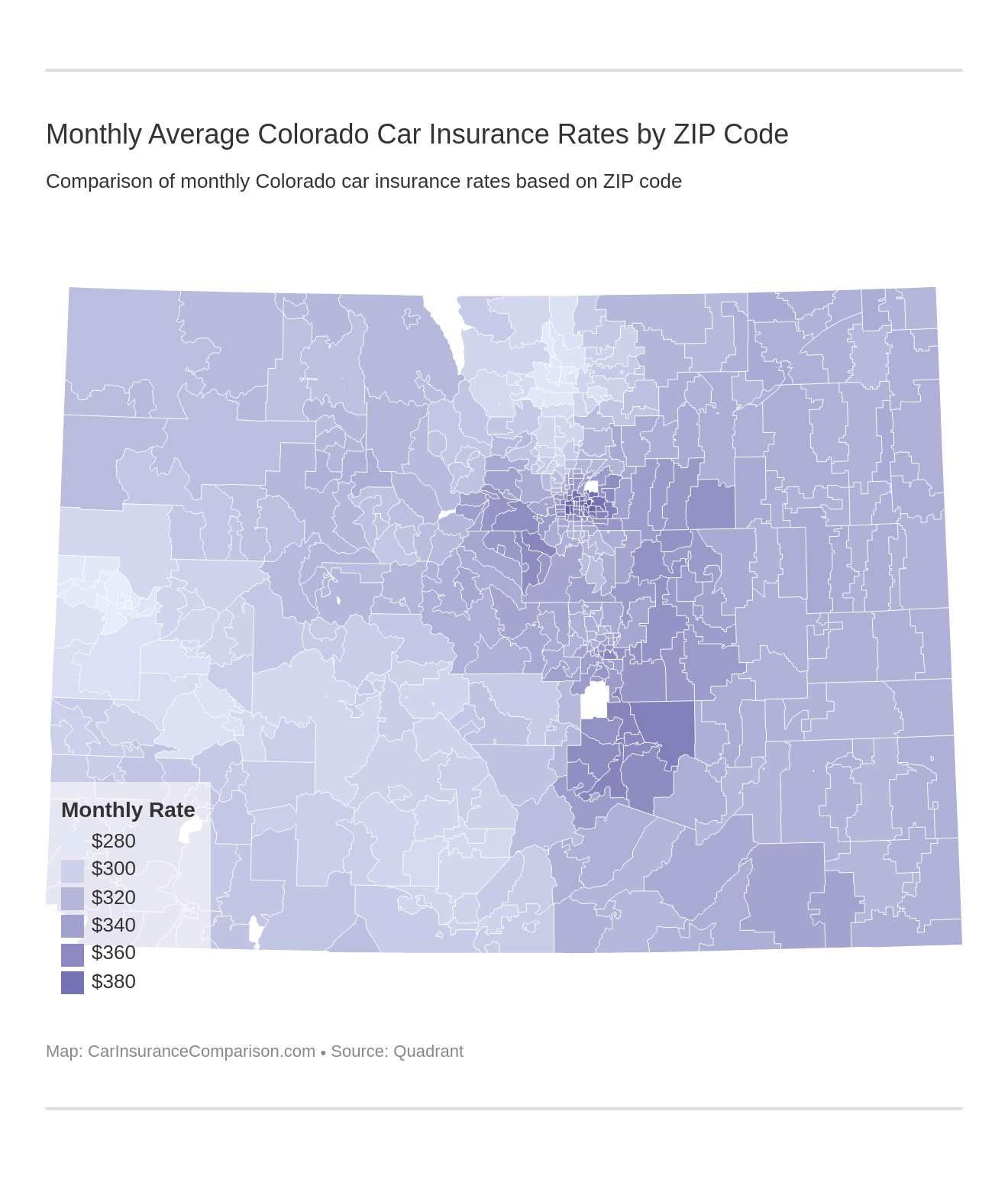

Car insurance in Colorado is a little higher than the national average, with the typical driver paying $168 per month. There are several reasons for increasing Colorado car insurance rates, but primary factors include vehicle theft rates, more drivers on the road, and an above-average number of uninsured drivers.

Although Colorado car insurance quotes are a little higher than the national average, there are ways to save. To find the best Colorado car insurance, you’ll need to find discounts, pick the right coverage, and research your options.

Read on to learn who the cheapest car insurance companies in Colorado are and how to pick the best policy for your vehicle. Then, compare Colorado car insurance rates to find the most affordable plan.

Compare Colorado Car Insurance Rates and Coverage Options

The median household income in Colorado in 2017 was over $69.117, and drivers, on average paid over $982 for car insurance. That’s way too high for us! However you feel about it, we think consumers in the Centennial State are spending way too much money on car insurance.

There has to be a better way. Below, we have provided information and helpful advice so you can get the best coverage options for your needs.

| Colorado Minimum Coverage Requirements | *May be waived if rejected. UUM must be rejected in writing. MedPay may be rejected in writing or in the same way you buy insurance. |

|---|---|

| Bodily Injury Liability | $25,000 per person $50,000 per accident |

| Property Damage Liability | $15,000 per accident |

| Uninsured/Underinsured Motorist Coverage* | $25,000 per person $50,000 per accident |

| Medical Payments (MedPay)* | $5000 |

- Car Insurance Rates in Colorado

- Compare Stratton, CO Car Insurance Rates [2026]

- Compare Peyton, CO Car Insurance Rates [2026]

- Compare Pagosa Springs, CO Car Insurance Rates [2026]

- Compare Longmont, CO Car Insurance Rates [2026]

- Compare Limon, CO Car Insurance Rates [2026]

- Compare Lakewood, CO Car Insurance Rates [2026]

- Compare Greeley, CO Car Insurance Rates [2026]

- Compare Granby, CO Car Insurance Rates [2026]

- Compare Fountain, CO Car Insurance Rates [2026]

- Compare Byers, CO Car Insurance Rates [2026]

- Compare Broomfield, CO Car Insurance Rates [2026]

- Compare Boone, CO Car Insurance Rates [2026]

- Compare Aspen, CO Car Insurance Rates [2026]

- Compare Fort Collins, CO Car Insurance Rates [2026]

- Compare Male vs. Female Car Insurance Rates in Colorado [2026]

- Compare Colorado Springs, CO Car Insurance Rates [2026]

Okay, you’ve read the numbers, but what do they mean? What is 25/50/15? If you cause an accident, you’ll want to know what liability insurance means. The basic coverage requirements in Colorado which all motorists must have for liability car insurance coverage are:

- $25,000 to cover death or injury per person

- $50,000 to cover total death or injury per accident

- $15,000 to cover property damage per accident

Liability insurance pays all individuals and drivers, passengers, pedestrians, etc. who are owed compensation for property damage and/or injuries resulting from a car accident that you or anyone under your policy causes. If you cause a wreck, liability insurance pays everyone affected by the accident.

Proof of Insurance in Colorado

What is financial responsibility? Basically, financial responsibility is proof that you have Colorado’s minimum liability coverage. State law requires every driver and owner of a vehicle to have proof of financial security at all times.

Here are a few acceptable forms of proof of financial security in Colorado:

- Valid Insurance ID Card

- Electronic proof on a smartphone

- A letter from an insurance agent or insurer on company letterhead.

Compare Colorado Car Insurance Rates as a Percentage of Income

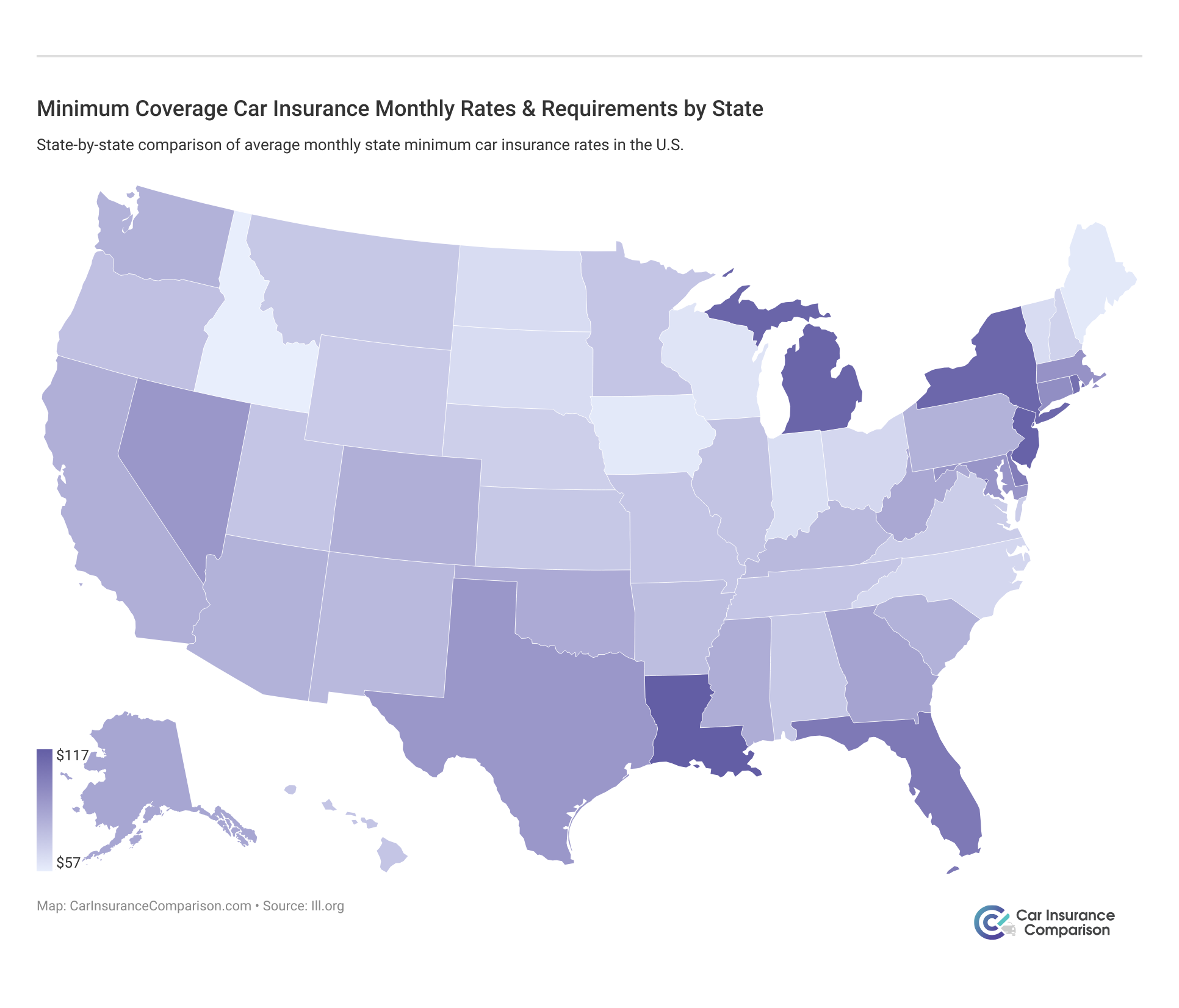

The per capita disposable income in Colorado is $36,345. On average, residents spend $982 a year on car insurance. To put this amount in perspective, the countrywide annual average for car insurance is $981.

This means people in Colorado are comparable with the countrywide average but pay more than neighboring states. New Mexico car insurance and Wyoming car insurance costs yearly amounts of $938 and $844, respectively.

Frequently Asked Questions

What factors affect car insurance rates in Colorado?

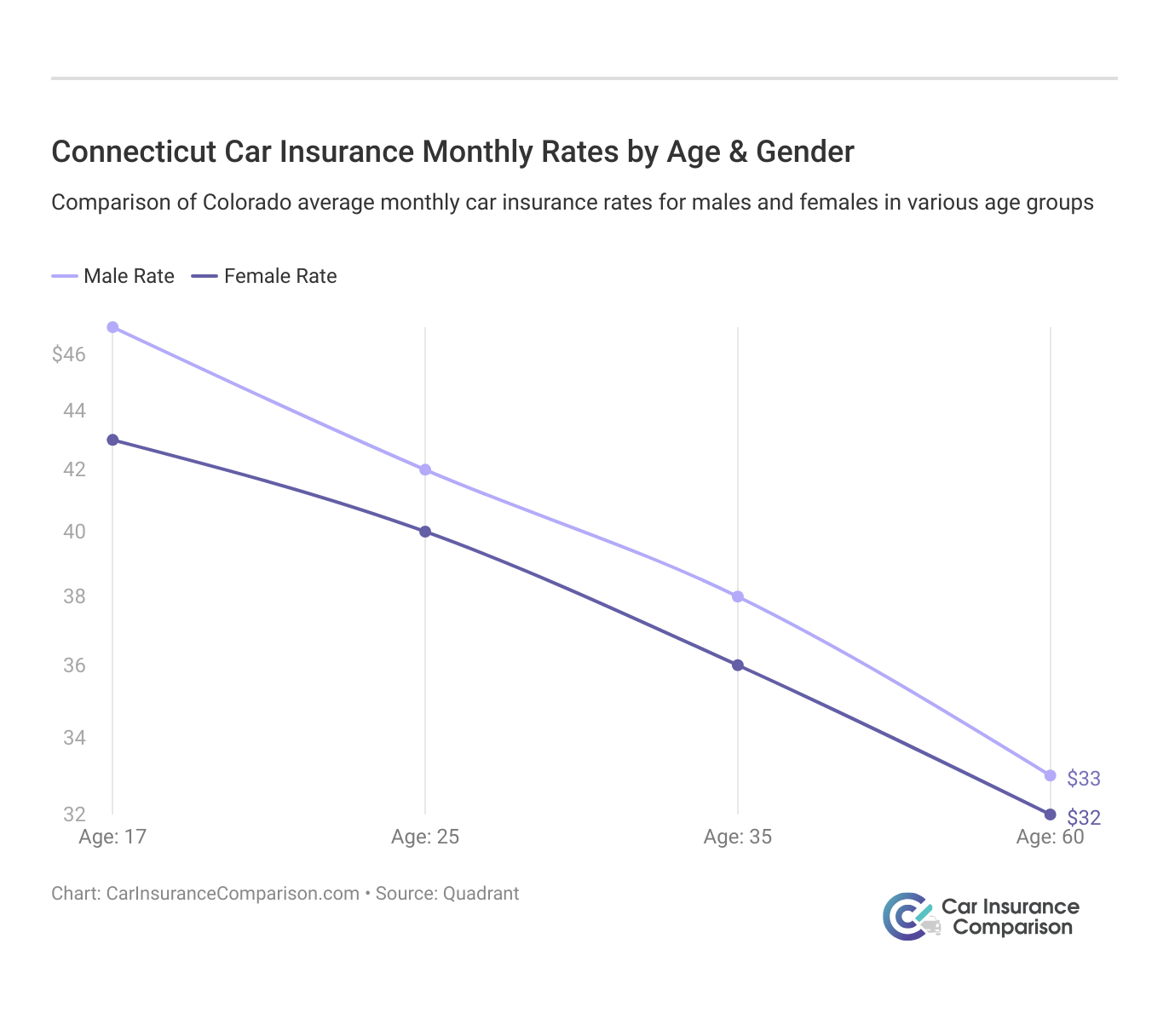

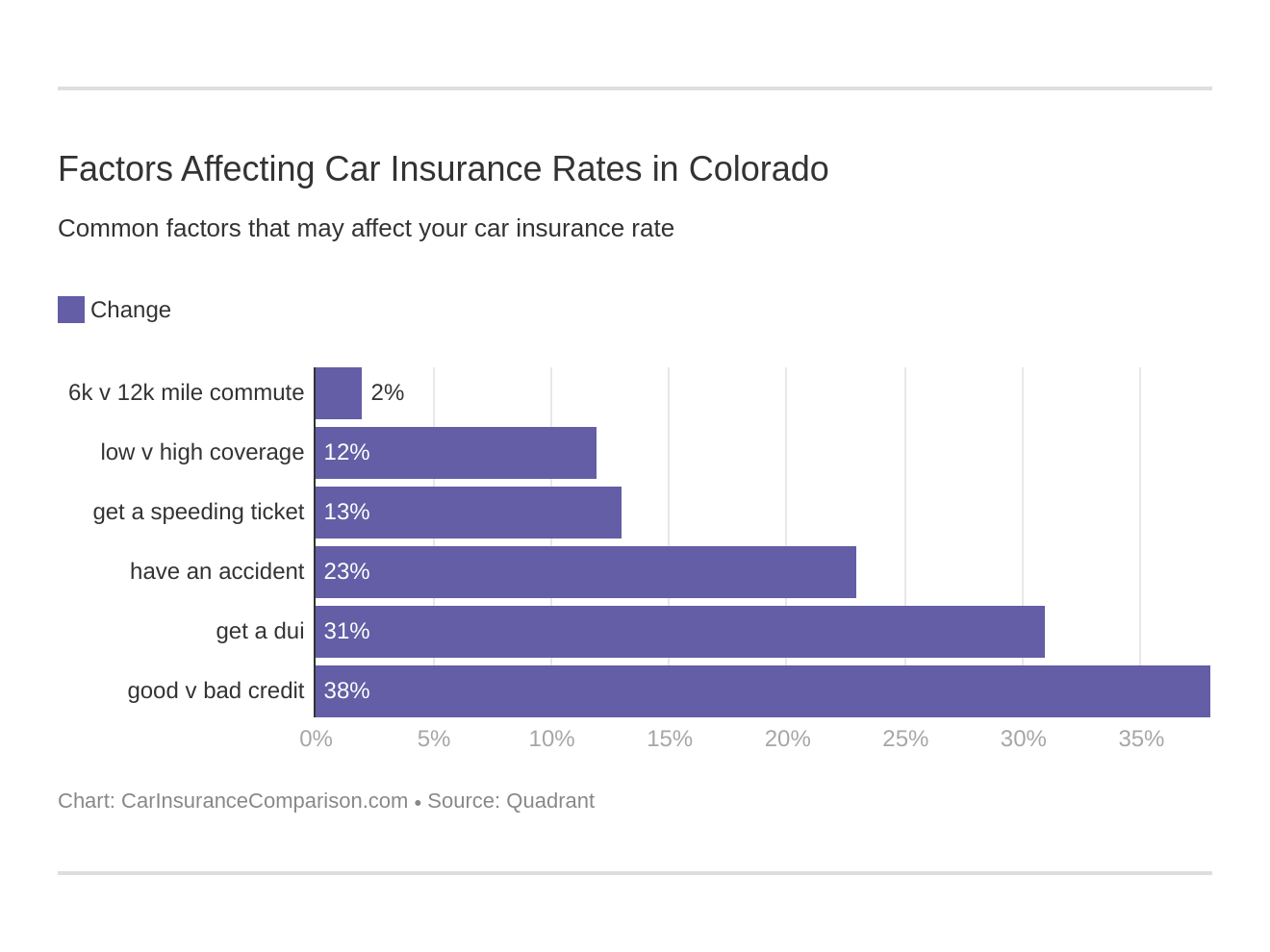

Several factors can affect car insurance rates in Colorado. These factors include your age, driving record, the make and model of your car, your credit history, the coverage options you choose, and the deductible amount. Additionally, factors such as the local crime rate, population density, and traffic conditions in your specific area of Colorado may also influence insurance rates.

What are the minimum car insurance requirements in Colorado?

In Colorado, the minimum car insurance requirements include liability coverage. The state law mandates a minimum coverage of $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $15,000 for property damage per accident. It’s important to note that these are the minimum requirements, and it’s often recommended to consider higher coverage limits for better protection.

Are there any specific insurance considerations for Colorado?

Colorado is known for its diverse climate and topography, which can present unique challenges for drivers. For example, areas with higher elevation may experience harsh winter conditions, such as snow and ice. Therefore, it is advisable for drivers in Colorado to consider comprehensive coverage, which can help protect against damage caused by weather events, as well as collision coverage for accidents.

How can I find affordable car insurance in Colorado?

To find affordable car insurance in Colorado, it’s important to shop around and compare quotes from different insurance providers. Consider factors such as coverage options, deductibles, and discounts offered. Maintaining a good driving record, bundling your car insurance with other policies, and taking advantage of available discounts, such as safe driver or multi-vehicle discounts, can also help lower your insurance premiums.

Are there any specific discounts available for car insurance in Colorado?

Insurance providers in Colorado may offer various discounts for car insurance. Common discounts include safe driver discounts, multi-policy discounts, good student discounts, and discounts for vehicles equipped with safety features such as anti-lock brakes or airbags. It’s advisable to check with insurance providers to see which discounts may apply to you.

How much does car insurance in Colorado cost?

While rates vary from person to person, the average driver pays $168 per month for Colorado car insurance. This is a little higher than the national average, but you might be able to find lower rates.

Is Colorado a no-fault state?

Colorado is an at-fault state, which means the person who causes an accident is financially responsible for property damage and injuries they cause.

What are the cheapest car insurance companies in Colorado?

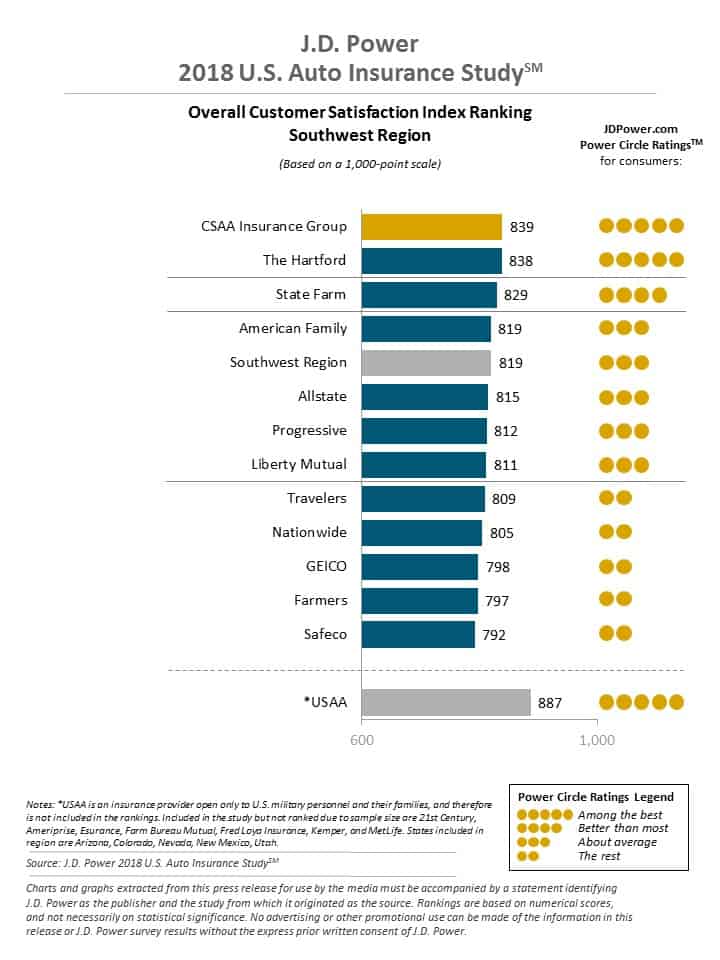

State Farm, Geico, and Auto-Owners tend to be the cheapest car insurance companies in Colorado, though you might find more affordable rates elsewhere.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.