Allstate Car Insurance Review [2026]

The average Allstate car insurance cost ranges from $103/mo in Virginia to $406/mo in Michigan. Our Allstate car insurance review reveals that while many customers can expect to pay some of the highest rates in the U.S., price isn’t the only thing that matters. We detail the factors that customers appreciate.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Jeffrey Manola

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Updated May 2024

- Allstate Insurance has been in business for nearly a century

- Allstate is accredited by the Better Business Bureau and has earned an “A+” rating from the BBB

- Allstate car insurance starts from $103/mo in VA and $406/mo in MI

Got insurance?

If you’re like us, you probably know that insurance is something you have to have to keep you and your family protected if the unforeseen happens. But if you’re lucky, you may never have to use it.

In this Allstate car insurance review, we’re going to take our gloves off and see if you are really in good hands. We’re going to provide you with everything you need to know about Allstate car insurance, including company history, ratings, coverage options, and more.

Want to start comparison shopping today? You can take advantage of our free online tool to start comparing rates in your area.

Let’s get started.

Allstate’s Financial Strength Ratings

Now that we have taken off our gloves, let’s see what multiple independent agencies have to say about Allstate and whether it’s the right company for your situation. Comparing the pros and cons is an important factor in determining which auto insurance company is best for you.

| Ratings Agency | Rating |

|---|---|

| AM Best | A+ (Superior) |

| Moody's | A3 |

| S&P | AA- |

| Better Business Bureau | A+ |

| JD Power | Overall Satisfaction: 3/5 Estimation Process: 3/5 Claims Servicing: 3/5 Settlement: 3/5 |

| Consumer Reports | 88 |

| Consumer Affairs | 4/5 |

| NAIC Compliant Ratio | 1.28 |

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

AM Best

AM Best rating measures the financial stability of a company, with A++ being the highest rating possible. Since Allstate has an A+ rating, it means Allstate has a stable financial future.

Read More: How do you get Allstate car insurance quotes online?

Moody’s

Moody’s rating looks at how well a company can pay off its debts (its creditworthiness). Moody’s A3 rating falls into the P-2 category, meaning the company has “a strong ability to repay short-term debt obligations.

Standard and Poor’s (S&P)

S&P’s rating of Allstate is very good, though the best rating is AAA. An AA- rating means that Allstate has a robust ability to pay back debts, though not as strong as an AA or AA+ company.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Better Business Bureau

This rating looks at multiple aspects of a business, though the most important aspect is the company’s complaint history. A complaint history shows how satisfied customers are with the service they receive.

J.D. Power

JD Power rates companies solely on customer satisfaction levels. Allstate’s JD Power ratings are okay averaging 3/5; in most areas, there is room for improvement.

Consumer Reports

Consumer Reports is another great company that measures customer satisfaction. The company based the overall score of 88 on the following category scores.

| Allstate Service | Consumer Report Score |

|---|---|

| Ease of Reaching an Agent | Excellent |

| Simplicity of the Process | Very Good |

| Promptness of the Response | Very Good |

| Damage Amount | Very Good |

| Agent Courtesy | Excellent |

| Timely Payment | Excellent |

| Freedom to Select Repair Shop | Very Good |

| Being Kept Informed of Claim Status | Very Good |

Allstate scores well in many of the above categories.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Consumer Affairs

As for the Consumer Affairs’ rating of Allstate, the overall rating of 4/5 is great. Allstate currently has over 400 negative reviews (three or fewer stars) on Consumer Affairs, though over a thousand reviews are four or more stars.

NAIC Complaint Index

The National Association of Insurance Commissioners (NAIC) measures the number of complaints a company receives. Allstate’s complaint ratio is fairly normal, as it is just a little over 1%. One thing to consider is that your experience may be better or worse than these ratings based on your insurance needs.

Allstate’s Insurance History

Allstate was founded in 1931 by Sears Roebuck and is only a few, short years from celebrating its centennial. Since its creation, Allstate has moved on to become one of the largest insurance providers, ranking as number 79 on the Fortune 500 in 2017.

As a series of natural disasters, from the California wildfires to Hurricane Michael, resulted in significant losses. Profits were down more than 29%, with the western wildfires alone resulting in $679 million in pre-tax losses. Exposure to losses like these has led the company to become an advocate for addressing climate change.

Why should you care about Allstate’s history? Essentially, looking at a company’s history gives you essential data about how successful the company is and what its future is like.

Up next, we are going to dig into everything from Allstate’s market share to its awards and accolades.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Allstate’s Market Share

Below, you will see NAIC’s data on Allstate’s market shares over three years.

Allstate Market Share

| Year | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|

| Market Share | 8.90% | 8.80% | 9.20% | 10.69% |

Allstate’s market share has increased steadily over the last three years. While State Farm has the largest market share in the car insurance market, Allstate stands out in part by giving a personalized experience with local insurance agents. The company also has great brand recognition.

How to Access Allstate

Allstate has several options if you want to access information or get in touch with someone about your car insurance policy.

- Online: You can find quotes and more online at Allstate’s website.

- Agents: You can talk to agents by texting, calling, or emailing.

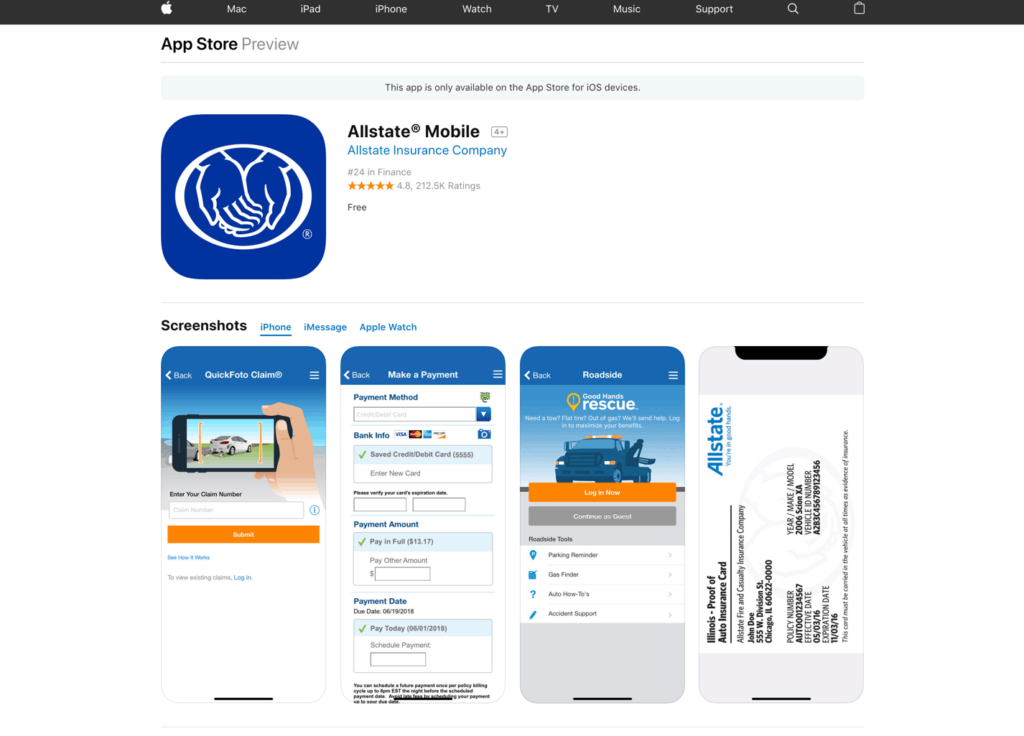

- Apps: Allstate offers a mobile app, through which you can access your policy information and contact agents.

Allstate’s Advertising

Whether it’s mayhem or good hands, car insurance companies do whatever it takes to grab your attention.

Consumers have been told:

We all want the good things in life, including good insurance, but are the good things really affordable?

Another smart advertising campaign that has swept us up into its chaos is the Allstate Mayhem commercials:

Another smart advertising campaign that has swept us up into its chaos is the Allstate Mayhem commercials Unlike other insurance companies, Allstate doesn’t base its advertising on how much you can save by switching or spending 15 minutes to save 15%, instead, the company markets itself as being there when and if it’s needed.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Allstate’s Community Investment

Allstate is proud to give back to the community. Watch the video below to show how one employee is doing just that.

Another way Allstate works hard to give back to the community is through the Allstate Foundation. The Allstate Foundation focuses on the following:

- Good Starts Young — focuses on empowering youth through in-school and after-school programs

- Purple Purse — focuses on helping end domestic violence by assisting victims to reach financial independence

- Nonprofit Leadership Center — provides a leadership development program

- Helping Hands — supports Allstate’s employees in volunteering

Allstate’s Position for the Future

Currently, Allstate’s customer satisfaction ratings are acceptable, but they could be improved. Being known for fantastic customer service would help solidify Allstate’s position as a top insurance company in the future.

What Working at Allstate Is Like

Out of all the reviews, 60% of the employees would recommend Allstate to a friend, and 72% approved of the CEO.

Why do we care what employees think of Allstate? An employee who enjoys working at Allstate and believes in the company’s purpose will do a better job of serving customers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Allstate Awards and Accolades

Allstate has received numerous awards and accolades, and we have included a few of the most recent below.

- 2024 BIG Innovation Award (from Business Intelligent Group) for Allstate Protection Plans

- 2023 Gold Winner for Customer Service in Insurance from TITAN Business Awards for Allstate Protection Plans

- 2023 Campus Forward Award for Demonstrated Investment in Early Career Hiring, and Overarching Commitment to Diversity and Inclusion

Allstate has also received dozens of other awards for the company’s inclusion of diversity, from awards for a military-friendly employer to awards for being a top company for women.

How to Get Cheap Car Insurance Rates

- Many variables can affect what you pay. Your rate will differ from what is listed below

- Allstate has discounts and options that may help offset the cost

Here’s how Allstate’s monthly rates based on demographics compare to other top insurance carriers in the country. These averages are national, so where you live could affect your rates.

Average Monthly Car Insurance Rate by Demographic

| Insurance Company | Single 17-Year-Old Female | Single 17-Year-Old Male | Single 25-Year-Old Female | Single 25-Year-Old Male | Married 35-Year-Old Female | Married 35-Year-Old Male | Married 60-Year-Old Female | Married 60-Year-Old Male |

|---|---|---|---|---|---|---|---|---|

| Allstate | $774 | $887 | $181 | $190 | $263 | $260 | $243 | $249 |

| American Family | $500 | $678 | $124 | $147 | $184 | $185 | $166 | $168 |

| Farmers | $710 | $762 | $172 | $180 | $213 | $213 | $195 | $204 |

| Geico | $471 | $523 | $97 | $93 | $192 | $193 | $187 | $190 |

| Liberty Mutual | $968 | $1,143 | $187 | $215 | $317 | $321 | $287 | $307 |

| Nationwide | $480 | $598 | $136 | $150 | $197 | $199 | $178 | $185 |

| Progressive | $724 | $802 | $136 | $146 | $191 | $181 | $166 | $171 |

| State Farm | $496 | $610 | $101 | $111 | $173 | $173 | $156 | $156 |

| Travelers | $776 | $1,071 | $107 | $116 | $182 | $183 | $171 | $173 |

| USAA | $401 | $449 | $80 | $85 | $129 | $128 | $121 | $121 |

Is Allstate expensive? Allstate car insurance price ranks consistently in the top three companies when it comes to certain demographic rates. For example, if you have a teenage son, you can expect to pay over $10,000 a year for his car insurance. Of course, you can offset some of these rates based on certain discounts available to you and your current insurance needs.

Rates Compared to the Top 10 Companies by Market Share

In the table below, you’ll see how Allstate’s average annual premium for each state compares to that of other companies.

Allstate Car Insurance Monthly Rates vs. Top Competitors

| State | Allstate | American Family | Farmers | Geico | Liberty Mutual | Nationwide | Progressive | State Farm | Travelers | USAA |

|---|---|---|---|---|---|---|---|---|---|---|

| Alabama | $108 | $105 | $133 | $89 | $162 | $96 | $112 | $108 | $79 | $56 |

| Alaska | $135 | $105 | $127 | $76 | $164 | $108 | $97 | $65 | $93 | $60 |

| Arizona | $180 | $114 | $135 | $65 | $178 | $116 | $84 | $81 | $104 | $63 |

| Arkansas | $162 | $137 | $165 | $91 | $99 | $128 | $131 | $80 | $111 | $55 |

| California | $199 | $138 | $167 | $101 | $216 | $142 | $132 | $108 | $122 | $74 |

| Colorado | $166 | $118 | $163 | $94 | $92 | $107 | $120 | $94 | $114 | $78 |

| Connecticut | $196 | $125 | $151 | $62 | $201 | $112 | $133 | $91 | $83 | $77 |

| Delaware | $207 | $130 | $157 | $101 | $494 | $144 | $90 | $116 | $82 | $43 |

| D.C. | $241 | $115 | $139 | $69 | $180 | $172 | $115 | $111 | $102 | $48 |

| Florida | $183 | $188 | $227 | $89 | $161 | $103 | $153 | $99 | $166 | $47 |

| Georgia | $165 | $124 | $149 | $61 | $263 | $152 | $115 | $107 | $110 | $71 |

| Hawaii | $118 | $82 | $99 | $60 | $128 | $84 | $78 | $64 | $72 | $44 |

| Idaho | $128 | $93 | $92 | $57 | $79 | $82 | $91 | $53 | $57 | $40 |

| Illinois | $176 | $114 | $117 | $47 | $76 | $93 | $89 | $64 | $87 | $62 |

| Indiana | $140 | $107 | $79 | $63 | $183 | $97 | $69 | $71 | $69 | $43 |

| Iowa | $126 | $95 | $82 | $81 | $116 | $73 | $75 | $65 | $92 | $55 |

| Kansas | $160 | $114 | $144 | $75 | $174 | $92 | $127 | $81 | $87 | $56 |

| Kentucky | $236 | $164 | $197 | $80 | $168 | $184 | $111 | $98 | $139 | $72 |

| Louisiana | $206 | $176 | $212 | $141 | $274 | $181 | $161 | $124 | $156 | $98 |

| Maine | $143 | $99 | $120 | $72 | $155 | $103 | $95 | $78 | $88 | $53 |

| Maryland | $201 | $116 | $140 | $135 | $181 | $106 | $121 | $107 | $103 | $80 |

| Massachusetts | $108 | $84 | $117 | $37 | $120 | $87 | $94 | $59 | $61 | $37 |

| Michigan | $406 | $204 | $335 | $99 | $424 | $257 | $152 | $209 | $183 | $107 |

| Minnesota | $160 | $93 | $108 | $90 | $375 | $87 | $101 | $67 | $94 | $68 |

| Mississippi | $147 | $120 | $145 | $72 | $119 | $96 | $120 | $82 | $88 | $54 |

| Missouri | $148 | $106 | $135 | $90 | $129 | $66 | $98 | $85 | $114 | $50 |

| Montana | $154 | $125 | $164 | $82 | $59 | $88 | $171 | $70 | $111 | $50 |

| Nebraska | $125 | $112 | $130 | $92 | $179 | $77 | $95 | $69 | $102 | $56 |

| Nevada | $165 | $140 | $155 | $110 | $111 | $112 | $82 | $103 | $91 | $69 |

| New Hampshire | $128 | $77 | $93 | $50 | $198 | $77 | $63 | $59 | $69 | $41 |

| New Jersey | $157 | $115 | $231 | $74 | $279 | $119 | $93 | $113 | $136 | $61 |

| New Mexico | $158 | $103 | $131 | $90 | $161 | $96 | $86 | $69 | $91 | $65 |

| New York | $147 | $137 | $165 | $78 | $200 | $164 | $96 | $137 | $175 | $85 |

| North Carolina | $169 | $82 | $99 | $69 | $82 | $111 | $32 | $77 | $99 | $44 |

| North Dakota | $136 | $145 | $107 | $61 | $398 | $77 | $110 | $76 | $88 | $44 |

| Nebraska | $125 | $112 | $130 | $92 | $179 | $77 | $95 | $69 | $102 | $56 |

| New Hampshire | $128 | $77 | $93 | $50 | $198 | $77 | $63 | $59 | $69 | $41 |

| New Jersey | $157 | $115 | $231 | $74 | $279 | $119 | $93 | $113 | $136 | $61 |

| New Mexico | $158 | $103 | $131 | $90 | $161 | $96 | $86 | $69 | $91 | $65 |

| Nevada | $165 | $140 | $155 | $110 | $111 | $112 | $82 | $103 | $91 | $69 |

| New York | $147 | $137 | $165 | $78 | $200 | $164 | $96 | $137 | $175 | $85 |

| Ohio | $120 | $62 | $96 | $59 | $106 | $114 | $85 | $70 | $63 | $41 |

| Oklahoma | $135 | $118 | $136 | $109 | $184 | $122 | $110 | $91 | $105 | $68 |

| Oregon | $153 | $106 | $111 | $93 | $141 | $111 | $78 | $75 | $97 | $58 |

| Pennsylvania | $148 | $108 | $131 | $68 | $219 | $86 | $148 | $76 | $75 | $57 |

| Rhode Island | $189 | $151 | $183 | $125 | $235 | $190 | $116 | $76 | $103 | $65 |

| South Carolina | $133 | $118 | $166 | $79 | $185 | $118 | $105 | $88 | $105 | $69 |

| South Dakota | $136 | $151 | $113 | $57 | $230 | $76 | $105 | $67 | $97 | $58 |

| Tennessee | $144 | $102 | $86 | $78 | $11 | $118 | $92 | $72 | $88 | $58 |

| Texas | $201 | $176 | $137 | $105 | $178 | $154 | $121 | $90 | $101 | $62 |

| Utah | $117 | $105 | $115 | $73 | $119 | $93 | $95 | $103 | $88 | $50 |

| Virginia | $103 | $83 | $100 | $69 | $129 | $86 | $61 | $63 | $73 | $43 |

| Vermont | $142 | $85 | $103 | $38 | $100 | $77 | $181 | $87 | $75 | $42 |

| Washington | $114 | $91 | $102 | $75 | $92 | $70 | $60 | $69 | $81 | $46 |

| West Virginia | $123 | $63 | $109 | $62 | $84 | $226 | $94 | $58 | $72 | $47 |

| Wisconsin | $162 | $115 | $139 | $83 | $196 | $104 | $110 | $79 | $102 | $67 |

| Wyoming | $155 | $111 | $130 | $111 | $75 | $114 | $106 | $82 | $98 | $57 |

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Rates Compared to State Average

If you’re considering purchasing Allstate car insurance, here’s how their rates stack up against the average rates in your state.

Use the table below to find out how Allstate does in your state.

Allstate Car Insurance vs. State Average

| State | Allstate Monthly Premium | Higher/Lower Than State Average | Percent Higher/Lower Than State Average |

|---|---|---|---|

| Alaska | $262 | -$23 | -8.07% |

| Alabama | $276 | -$21 | -7.16% |

| Arkansas | $429 | $85 | 24.85% |

| Arizona | $409 | $94 | 30.05% |

| California | $378 | $70 | 22.88% |

| Colorado | $461 | $138 | 42.84% |

| Connecticut | $486 | $101 | 26.25% |

| District of Columbia | $539 | $169 | 45.72% |

| Delaware | $526 | $27 | 5.51% |

| Florida | $620 | $230 | 58.97% |

| Georgia | $351 | -$63 | -15.22% |

| Hawaii | $181 | -$32 | -14.95% |

| Iowa | $247 | -$1 | -0.52% |

| Idaho | $341 | $92 | 37.25% |

| Illinois | $434 | $158 | 57.45% |

| Indiana | $332 | $47 | 16.51% |

| Kansas | $334 | $61 | 22.28% |

| Kentucky | $595 | $162 | 37.50% |

| Louisiana | $500 | $24 | 5.03% |

| Maine | $306 | $60 | 24.46% |

| Maryland | $436 | $54 | 14.19% |

| Massachusetts | $226 | $2 | 1.11% |

| Michigan | $1,909 | $1,034 | 118.15% |

| Minnesota | $378 | $11 | 2.92% |

| Missouri | $341 | $64 | 23.05% |

| Mississippi | $412 | $106 | 34.86% |

| Montana | $389 | $121 | 45.06% |

| North Carolina | $599 | $316 | 111.91% |

| North Dakota | $389 | $42 | 12.09% |

| Nebraska | $267 | -$7 | -2.58% |

| New Hampshire | $227 | -$36 | -13.54% |

| New Jersey | $476 | $17 | 3.60% |

| New Mexico | $350 | $61 | 21.28% |

| Nevada | $448 | $42 | 10.49% |

| New York | $395 | $38 | 10.51% |

| Ohio | $266 | $41 | 17.99% |

| Oklahoma | $310 | -$35 | -10.23% |

| Oregon | $397 | $108 | 37.44% |

| Pennsylvania | $332 | -$4 | -1.25% |

| Rhode Island | $413 | -$4 | -0.88% |

| South Carolina | $325 | $10 | 3.23% |

| South Dakota | $394 | $62 | 18.62% |

| Tennessee | $402 | $97 | 31.90% |

| Texas | $457 | $120 | 35.67% |

| Utah | $297 | -$4 | -1.26% |

| Virginia | $282 | $86 | 43.64% |

| Vermont | $266 | -$4 | -1.35% |

| Washington | $295 | $40 | 15.73% |

| West Virginia | $318 | $102 | 47.21% |

| Wisconsin | $405 | $104 | 34.62% |

| Wyoming | $364 | $98 | 36.68% |

Allstate is lower than average in 12 states, which essentially means you may pay more depending on your geographic location.

Rates by Make and Model

What vehicle you drive can also have an impact on your car insurance. Below, we show you what you can expect to pay for five specific models from Allstate and its competitors.

Allstate Car Insurance Monthly Rates vs. Top Companies by Make and Model

| Make And Model | Allstate | USAA | Geico | State Farm | American Family | Nationwide | Progressive | Farmers | Travelers |

|---|---|---|---|---|---|---|---|---|---|

| 2015 Ford F-150 Lariat SuperCab with 2WD 6.5 foot bed and 2.7L V6 | $369 | $213 | $258 | $267 | $287 | $298 | $326 | $341 | $335 |

| 2015 Honda Civic Sedan LX with 2.0L 4cyl and CVT | $396 | $201 | $258 | $252 | $265 | $296 | $369 | $367 | $368 |

| 2015 Toyota RAV4 XLE | $360 | $205 | $258 | $269 | $277 | $293 | $304 | $311 | $365 |

| 2018 Ford F-150 Lariat SuperCab with 2WD 6.5 foot bed and 2.7L V6 | $458 | $238 | $278 | $291 | $291 | $281 | $330 | $366 | $368 |

| 2018 Honda Civic Sedan LX with 2.0L 4cyl and CVT | $448 | $202 | $278 | $266 | $310 | $280 | $377 | $398 | $388 |

| 2018 Toyota RAV4 XLE | $412 | $211 | $278 | $285 | $291 | $277 | $311 | $314 | $392 |

Average Annual Premiums by Commute

If you drive more than 12,000 miles a year, you may also see your car insurance rates start to rise.

| Group | 10 miles commute / 6,000 annual mileage | 25 miles commute / 12,000 annual mileage |

|---|---|---|

| Allstate | $4,841.71 | $4,934.20 |

| American Family | $3,401.30 | $3,484.88 |

| Farmers | $4,179.32 | $4,209.22 |

| Geico | $3,162.64 | $3,267.37 |

| Liberty Mutual | $5,995.27 | $6,151.63 |

| Nationwide | $3,437.33 | $3,462.67 |

| Progressive | $4,030.02 | $4,041.01 |

| State Farm | $3,175.98 | $3,344.01 |

| Travelers | $4,399.85 | $4,469.96 |

| USAA | $2,482.69 | $2,591.91 |

Allstate customers can expect to pay the second-highest rates when it comes to their commute. Other factors such as living in a rural or urban area could also contribute to the cost of your insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Coverage Level Rates

You might think that having the lowest minimum coverage in your state is the best way to ensure you and your family are protected. But that’s not necessarily the case, because sometimes the difference in low to high coverage is less than you think.

Check out the table below to see the differences in coverage in your state.

Allstate Car Insurance Rates vs. Competitors by Coverage Level

| Company | High Coverage | Medium Coverage | Low Coverage |

|---|---|---|---|

| Allstate | $428 | $408 | $386 |

| American Family | $285 | $295 | $281 |

| Farmers | $375 | $347 | $327 |

| Geico | $286 | $268 | $250 |

| Liberty Mutual | $530 | $505 | $484 |

| Nationwide | $292 | $287 | $283 |

| Progressive | $363 | $335 | $311 |

| State Farm | $288 | $272 | $255 |

| Travelers | $385 | $372 | $352 |

| USAA | $222 | $212 | $200 |

Up next, we discuss how your credit score could affect what you pay for car insurance with Allstate.

Credit History Rates

Besides not being able to secure a car loan or a mortgage, poor credit can also have an impact on how much you pay for car insurance. The table below reflects what you’ll pay for car insurance if you have good, fair, or poor credit. Of course, these are estimates, and your rates may be different based on your situation.

Allstate Car Insurance Rates vs. Competitors by Credit History

| Insurance Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| Allstate | $110 | $130 | $150 |

| American Family | $105 | $125 | $145 |

| Farmers | $115 | $135 | $155 |

| Geico | $95 | $115 | $135 |

| Liberty Mutual | $100 | $120 | $140 |

| MetLife | $108 | $128 | $148 |

| Nationwide | $102 | $122 | $142 |

| Progressive | $98 | $118 | $138 |

| State Farm | $90 | $110 | $130 |

| Travelers | $112 | $132 | $152 |

| USAA | $85 | $105 | $125 |

The average credit score in the U.S. is 675. If your credit score is lower than this, you may face increased rates on car insurance. In some states, poor credit can raise your rates by thousands of dollars.

If you have poor credit and you live in California, Hawaii, Massachusetts, or Michigan, you’re in luck: Those states have banned insurance companies from using credit as a factor.

Justin Wright Licensed Insurance Agent

Driving Record Rates

If you get a speeding ticket, have an accident, or get a DUI, your rates with Allstate will increase in most states.

The table below shows rates for these three violations compared to the rate for a clean record.

Allstate Car Insurance Rates vs. Competitors by Driving Record

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Allstate | $160 | $225 | $270 | $188 |

| American Family | $117 | $176 | $194 | $136 |

| Farmers | $139 | $198 | $193 | $173 |

| Geico | $80 | $132 | $216 | $106 |

| Liberty Mutual | $174 | $234 | $313 | $212 |

| Nationwide | $115 | $161 | $237 | $137 |

| Progressive | $105 | $186 | $140 | $140 |

| State Farm | $86 | $102 | $112 | $96 |

| Travelers | $99 | $139 | $206 | $134 |

| USAA | $59 | $78 | $108 | $67 |

Type of Coverage Offered by Allstate

Allstate offers the same coverage as all of the other companies do, and in most cases, at a higher rate. Let’s take a look at standard insurance terms and go into detail about what they mean.

We know it can be confusing, so that’s why we’ve compiled a list of common coverages with a brief explanation. Different coverage types fall into four basic categories:

When You Are at Fault

Liability car insurance covers the physical damages you inflict upon another vehicle and the bodily injuries sustained by all individuals in the other vehicle

When You Are Not at Fault

Uninsured and Underinsured Motorist Coverage covers your expenses if the at-fault driver has little or no liability coverage.

Vehicle Protection

- Collision Car Insurance – Allstate collision coverage covers your vehicle repairs or replacement after an accident

- Comprehensive Car Insurance – includes what most would consider “out of our control” such as storm damage, hitting an animal, and more. (Allstate full coverage would include liability, collision, and comprehensive.)

- Emergency Road Service – covers standard roadside services like tire changes, jump starts, and lockout services

- Rental Reimbursement Coverage – includes a rental car while yours is getting repaired for a covered loss

- Mechanical Breakdown Coverage – covers parts and systems failure of your vehicle that is not caused by normal wear and tear or improper maintenance

Personal Protection

- Medical Payments Coverage – covers medical expenses of those in your vehicle

- Personal Injury Protection – covers costs incurred from injuries to yourself or others in the vehicle, lost wages and funeral expenses no matter who is at fault

- Umbrella Policy – extends your liability coverage to a much higher limit which blankets over multiple policies such as home and auto as well as others

Allstate’s extensive list of auto insurance coverages means you can tailor a car insurance plan to meet your needs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Additional Car Insurance Options

In addition to the numerous car insurance options we’ve already covered, Allstate offers the following add-on insurance options.

- Classic Car Insurance — Custom-tailored insurance for your classic car.

- Rideshare Car Insurance — If you want to be a rideshare driver, then you’ll need ridesharing insurance.

- Mexico Tourist Auto Insurance — Planning a trip to Mexico? Allstate offers a car insurance policy that helps cover drivers in Mexico (the policy matches the length of stay for up to a year).

- Roadside Assistance — Pays for the cost of most common roadside services (such as tire changes).

- Property Protection — This covers the cost of damages that you accidentally caused to someone else’s property.

- Sound System Coverage — Can’t live without music in your car? This coverage covers the cost of replacing stolen/damaged sound systems in your vehicle.

- Drivewise — Allstate has a usage-based program that runs on an app (Drivewise®) and creates a policy discount.

- Milewise — Usage-based program that charges premiums based on the actual miles driven each month.

These additional coverages and options are perfect if you want a little extra coverage on your policy. For example, classic car insurance is essential because even if your classic car never leaves your garage, you’ll need coverage on it.

The good news is that classic car insurance is generally cheaper than regular car insurance because classic cars aren’t driven as much.

The other add-on policies on the list are similar to classic car insurance they give you needed protection at a reasonable cost.

Allstate’s Availability

Allstate is available in all 50 states, so, no matter where you live, you’re in good hands. However, keep in mind that you must notify Allstate when you change geographic locations so that they can adjust your rates accordingly.

Allstate Auto Insurance Discounts

We’ve already learned that Allstate’s basic rate is more expensive than other insurance companies, which is why we want to look at Allstate’s discounts.

Discounts can help bring costs down, making car insurance more affordable. Below is a list of Allstate car insurance discounts.

Allstate Car Insurance Discounts

| Discount | Savings Earned |

|---|---|

| Anti-lock Brakes | 10% |

| Anti-Theft | 10% |

| Claim Free | 35% |

| Daytime Lights | 2% |

| Defensive Driver | 10% |

| Distant Student | 35% |

| Driver's Ed | 10% |

| Driving Device | 20% |

| Early Signing | 10% |

| Stability Control | 2% |

| Farm Vehicle | 10% |

| Full Payment | 10% |

| Good Student | 20% |

| Green Vehicle | 10% |

| Multiple Policies | 10% |

| Newer Vehicle | 30% |

| On-Time Payments | 5% |

| Paperless Documents | 10% |

| Paperless Auto Billing | 5% |

| Passive Restraint | 30% |

| Safe Driver | 45% |

| Senior Driver | 10% |

| Utility Vehicle | 15% |

| Vehicle Recovery | 10% |

While Allstate is more expensive than other providers, it also offers a lot of discounts. If you’re a safe driver, getting Allstate’s driving app that monitors driving habits could save you money on your premiums each month.

When considering Allstate, be sure to discuss all of these discount options with your agent to see if any of them apply to you.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Stands Out at Allstate

So what makes Allstate stand out from other insurance companies? Allstate’s rates are higher than its competitors, but its plethora of discounts available to its customers could reduce rates to a more manageable level.

Allstate also has programs that can save you money, such as Allstate’s driving apps. Allstate also has an accident forgiveness policy.

Accident Forgiveness Program at Allstate

The accident forgiveness program is a special offer from Allstate that protects customers’ rates from increasing after an accident.

Most often, car insurance rates will rise following an accident.

This will happen whether or not the accident is your fault because once there is an accident, you become a higher risk to the insurance company.

Drivers who are considered higher risk will pay more money to have their vehicles insured.

Read more: Learning About High-Risk Car Insurance

Allstate’s accident forgiveness program offers just that — forgiveness in the case of an accident. After your first accident while an Allstate insurance customer, your rates will not automatically increase just because of the accident.

Allstate will work to keep your rates the same, so you can get your car repaired and not worry about having a higher insurance premium cost.

The Safe Driving Bonus at Allstate

Is it easy to qualify for the Safe Driving Bonus at Allstate? If you are a safe driver, it is fairly easy to qualify for Allstate’s safe driving bonus check.

For every six months of safe driving with an Allstate car insurance policy, you will receive a check in the mail from Allstate for up to 5% of your total premium cost.

Safe driving is classified as having no accidents (fault or no fault), no moving violations, and no claims over six months.

Since safe drivers are less expensive to insure because the risk of an accident is lower, Allstate is able to pass its savings onto its customers in the form of a bonus check.

You can continue to receive a safe driving bonus check for every six months you carry your Allstate policy without an incident.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Deductible Rewards From Allstate

How can you qualify for deductible rewards from Allstate? You can earn the Allstate deductible rewards program just by signing up with Allstate car insurance. For example, if your policy deductible is $500, once you sign up for deductible rewards it will immediately be reduced by $100.

Read more: Car Insurance Deductible: Explained Simply

Every year that you are considered a safe driver — someone who does not get into an accident, get a traffic ticket, or file a claim — your deductible will be reduced by another $100.

If you maintain your driving record for another year, another $100 will be taken off your deductible.

In 48 states, the deductible can be reduced to zero. In New York and Pennsylvania, the deductible will not go below $100.

Laura Berry Former Licensed Insurance Producer

New Car Replacement Program

Does the new car replacement program apply to someone with a used car?

The new car replacement program applies to cars that are within three years of the current model year. Any older car is still protected under Allstate’s coverage but does not qualify for the new car replacement program.

If you have a new car that gets totaled within the first three model years of owning it, you will receive the cash amount equivalent to your car in the current model year, not a pro-rated amount.

So for example, if your 2020 Toyota Camry gets totaled in 2022, you can get a check for a new 2022 Toyota Camry.

If your car is outside of the three-year window of the current model year and it is totaled, you will still receive coverage from Allstate. But instead of being for the current model year, the check will just be for the actual value of your car that was totaled.

What’s Missing at Allstate

We know that Allstate offers a lot of discounts, but the company is notably missing a significant discount that most other providers give.

Allstate doesn’t have a discount for military personnel, an option that is available at most providers.

If you are a current or former member of the military or part of a military family, USAA generally offers the best affordable rates and discounts. (See our USAA Car Insurance Review.) This doesn’t mean you still can’t get a good deal at Allstate. If you utilize multiple discounts and programs, you can reduce Allstate premiums significantly.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Cancel Your Auto Insurance Policy

Over time, there may be occasions when you may need to cancel or adjust your insurance policy with Allstate. Here are four examples that may apply to you:

- Selling a car and not replacing it

- Storing a classic or antique car

- A teen is heading to college and will no longer be driving the car

- A car has been paid off and no longer requires comprehensive cover

But what if you want to cancel your policy for other reasons such as customer dissatisfaction, rates that are too high, or you’re moving geographic locations?

Here’s what you need to know:

How to Cancel

You’ll need to pick up the phone and call your local agent if you want to cancel your policy. Allstate’s website does allow you to modify or change some policies but doesn’t allow for canceling a policy.

Cancellation Fee

Allstate doesn’t generally charge a cancellation fee, but could if state law allows it. The company will also prorate any unused portion of your paid premium and refund you the difference.

When to Cancel

Don’t cancel your policy until you’ve secured representation with another company. Even a one-day lapse in coverage can cause unwanted headaches and possible fines in some states. The cancellation will go into effect at midnight the following day after your policy expires or whatever day you have chosen to end the policy.

How to Make a Claim

Uh, oh. You’ve been in an accident and need to file a claim. How does that work?

Here’s a how-to on the QuickFoto Claim in the Allstate mobile app:

Ease of Making a Claim

Well, Allstate makes it easy with these simple steps:

- Online through the Allstate website

- Via the Allstate mobile app

- Calling the 24/7 claims phone number at 1-800-ALLSTATE

- Find an agent locally to get help with your claim.

Allstate also offers a Claim Satisfaction Guarantee., which makes sure the claim process is to your satisfaction.

Is Allstate good about paying claims? Allstate scored 882 out of 1,000 in a J.D. Power claims satisfaction survey. That is slightly higher than the national average.

If you feel a claim wasn’t handled properly, you can send a letter with your complaint within 180 days of the accident. If your complaint meets the Claim Satisfaction Guarantee, Allstate will refund you six months of your policy premium. This guarantee isn’t available in all states.

Now, that we’ve shown you how to file a claim, let’s look at how Allstate pays out claims to its customers. Loss ratios can give us some insight into the answer to that question.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Allstate’s Written Premiums and Loss Ratio

The information below comes from NAIC and shows the premiums written by Allstate compared to its loss ratio over four years.

Allstate Written Premiums and Loss Ratio

| Private Passenger Auto | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|

| Premiums written | $144.12 billion | $148.42 billion | $154.94 billion | $276.04 billion |

| Loss Ratio | 94.80% | 100.40% | 112.60% | 107% |

The company has shown consistent growth over the lookback period, which means it’s attracting more customers. The loss ratio, though, has risen slightly.

What exactly is a loss ratio?

The increase in Allstate’s loss ratio could mean that the company is paying out more claims, or it could mean that in those years Allstate’s customers were in more accidents.

Nevertheless, Allstate is a financially stable company, meaning that if you have a valid claim, the company will be able to pay it.

How to Get a Quote Online

Maybe you don’t want to let your fingers do the walking and speak with an agent by phone. No problem. Up next, we’re going to show you how to get an Allstate quote for auto insurance online in simple, easy-to-follow steps.

Step #1 – Find the Quote Box and Enter Your ZIP code

The first thing you’ll need to do is go to Allstate’s website and click on the auto insurance quote option.

Next, you will see a page that requests your zip code and offers an option to add bundled policies to your quote. Remember, bundling policies can help you earn a discount.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Step #2 – Enter Your Basic Info

From there, you will proceed to pages that request basic personal information, such as your name, birth date, address, and email address.

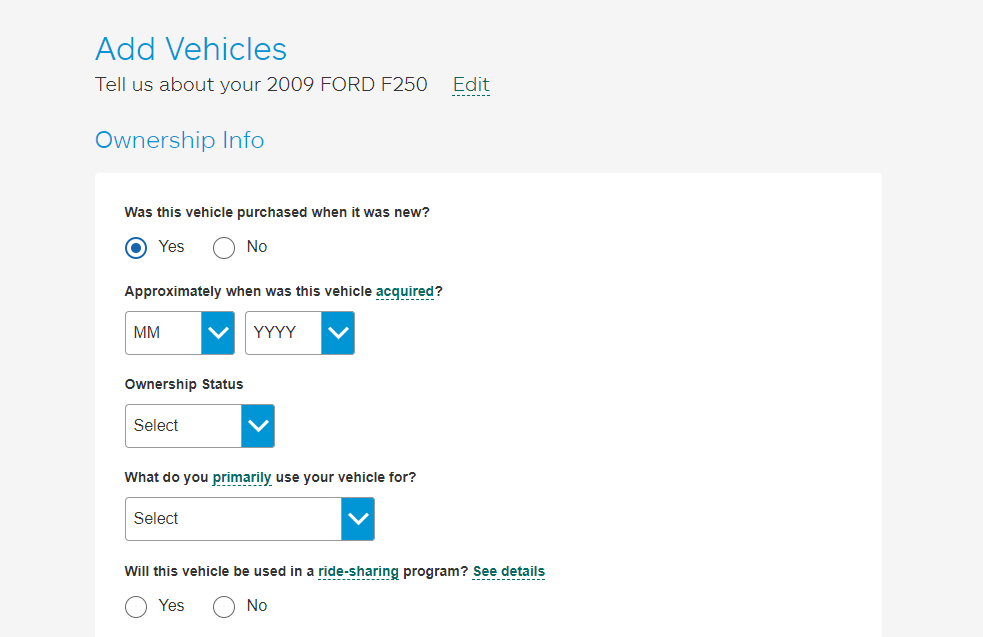

Step #3 – Enter Additional Info

Other information you will have to provide includes the following:

- Vehicle Information (how it’s used, how old it is, safety devices, etc.)

- Job Information (occupation, length of time at that career)

- Driving History (accidents and violations)

- Coverage Level (choose what level of coverage you want)

Step #4 – Add Vehicles

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Step #5 – Enter Your Phone Number

The final step is entering your phone number and permitting an agent to call you. If you don’t, you can’t continue with the Allstate car insurance quote process.

This process allows you to speak directly to an agent, who can answer any questions or concerns you have about your quote and whether you missed anything when filling in your information.

Step #6 – Your Quote Is Saved

Your Allstate auto insurance quote is also saved in Allstate’s database so that you can access it at any time.

As a reminder, below is the personal information Allstate requires for a quote.

| Information | Required |

|---|---|

| Basic Information: Birth-date, Address, etc. | Yes |

| Driver's License | No |

| Email Address | Yes |

| Phone Number | Yes |

| Social Security Number | No |

| Vehicle Identification Number | No |

To get as accurate a quote as possible, be sure to fill out all required information about your vehicle and driving record.

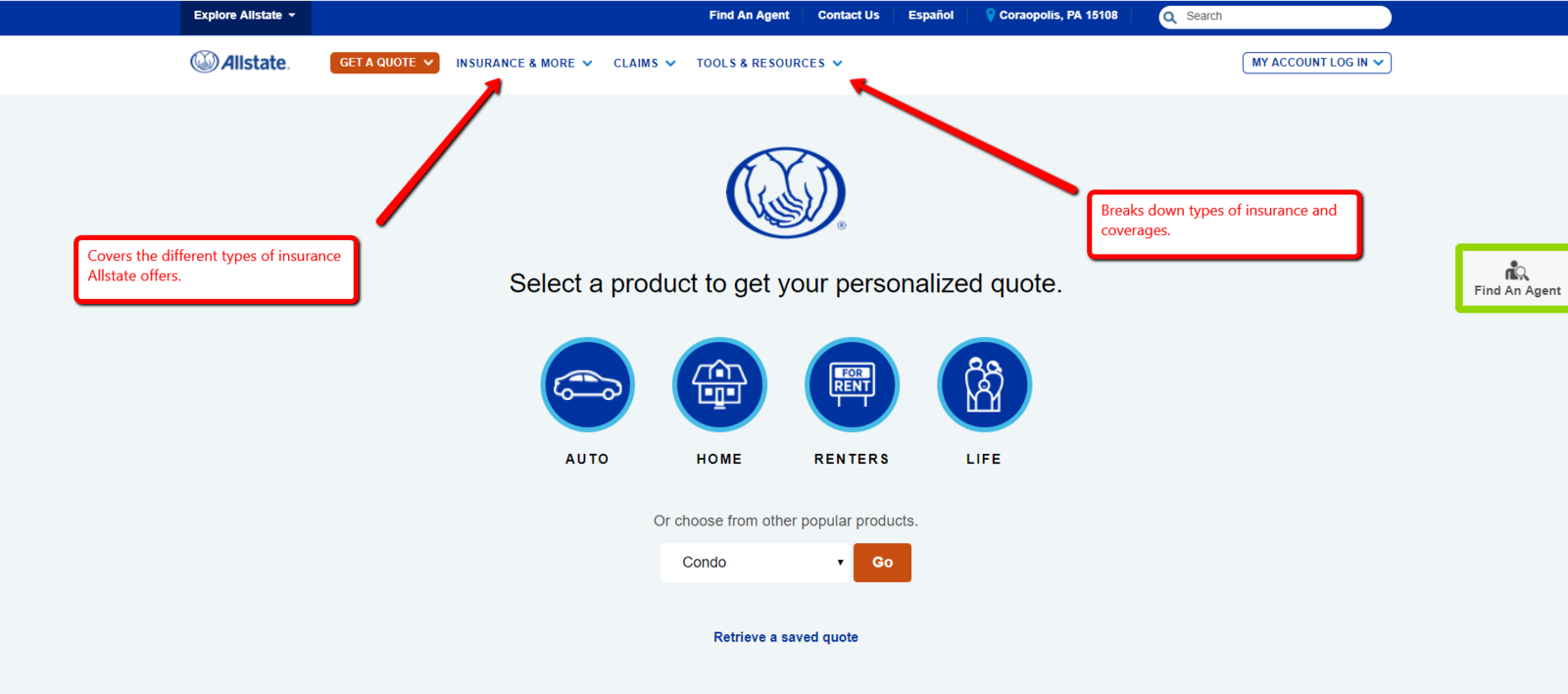

Allstate’s Website/App Design

While other insurance company websites and apps may be difficult to navigate, Allstate’s is relatively simple and easy to use. On the website, it is easy to find whatever information you’re searching for. Just click and go.

You will see four different dropdown options at the top of the page.

- Get a Quote — Allows you to select the type of insurance you want a quote for, from condo insurance to auto insurance.

- Insurance and More — Shows what types of insurance Allstate offers.

- Claims — Provides everything from an overview of claims to claims tracking.

- Tools and Resources — Articles explaining insurance coverages and basic insurance questions.

The format of the website is similar on tablets and phones, though it will be different on Allstate’s app. If you can’t find an answer to your question on the website, Allstate also has a YouTube channel that offers solutions to common questions.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Allstate® Mobile App

Allstate’s mobile app has 4.8 out of five stars in the app store from over 256,000 reviews. For people who are always on their phones and other devices, the Allstate app makes it easier to access their policy information wherever their location.

Some of the common complaints in the review section were about bugs with the Drivewise® section of the app, such as the app deactivating the program when closed.

Other App Features

Have you been in an accident? Allstate has an option called QuikFoto Claim where you can snap a picture of the damage and start the claims process.

According to Allstate’s website, here are other convenient options available on the app:

- Instant Agent Access

Instantly contact your agent through the app. Plus, store agent and auto policy information to Passbook for quick and easy access - Digital ID Cards

Access proof of insurance without having to reach for the glove box or sift through papers. - Policy Documents

View your policy documents and agent information on the spot, and even email it directly from the app, whenever you need it. - Manage Claims

Start a claim and track any changes or updates. Plus, you can use the Accident Toolkit to follow the step-by-step checklist immediately following a collision. - Roadside Assistance

Have a flat? Car breakdown? Every minute counts when you’re stranded on the road. Know who’s coming and when with our 24/7 Roadside Network. Our On-Demand service is accessible to any driver, any car, at any time. - Escape Route

Use augmented reality to create paths to safety in the event of a fire. - Preference Management

Easily manage your contact information and communication preferences. Choose from email and push notifications for billing/payment, policy communications, and more. - Helpful Extras

Additional features like Allstate’s Car Buying Service, Parking Reminder, and Gas Finder make navigating each day a little easier.

Allstate’s Pros and Cons

Now that our Allstate insurance reviews have covered everything you need to know about Allstate, let’s check out the biggest takeaways in terms of pros and cons.

| Pros | Cons |

|---|---|

| Strong financial stability | More expensive than other providers |

| Offers multiple discounts/programs to save money | Doesn't have a military discount |

| First accident forgiveness | Quotes not completely online (have to call to receive quote) |

| Multiple coverage options | Customer satisfaction ratings could be higher |

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Allstate Car Insurance Review: The Bottom Line

Is Allstate insurance good? Our Allstate auto insurance review has shown you virtually everything you need to know about Allstate, so you can decide for yourself whether Allstate is right for you. With Allstate auto insurance, you may be in good hands, but you certainly don’t want to pay too much by being so.

One thing to consider is that everyone’s needs are different, and rates can vary significantly based on individual factors.

As thorough as this guide is, we still strongly suggest that you shop around with your personal details and specific vehicle information before you choose an auto insurance provider.

Get quotes today to find out how much you could save on car insurance. Get started by simply entering your zip code in our free comparison tool.

Are you searching for car insurance rates? Enter your ZIP code below and get started today.

Frequently Asked Questions

Is Allstate car insurance a reputable company?

Yes, our Allstate review found that Allstate is a reputable insurance company. It is accredited by the Better Business Bureau (BBB) with an A+ rating, and it has also received an A+ (Superior) rating from the A.M. Best Company for financial strength, which is the highest rating an insurance company can receive.

Allstate is the largest publicly held insurance company in the United States and has more than $130 billion in assets. It offers a wide range of insurance products, including auto, home, life, and commercial insurance. See our article, 10 Best Companies for Bundling Home and Car Insurance.

What types of insurance does Allstate auto offer?

Allstate automobile insurance offers a range of options, including liability coverage, collision coverage, comprehensive coverage, personal injury protection, uninsured/underinsured motorist coverage, and more.

Allstate full coverage insurance would encompass liability, collision, and comprehensive.

Does Allstate offer additional coverage options?

Yes, Allstate provides various additional coverage options. These can include roadside assistance, rental reimbursement (covering the cost of a rental car while yours is being repaired), sound system coverage, and more. Availability may vary by location and policy.

What is the accident forgiveness program at Allstate?

Allstate’s accident forgiveness program is designed to protect customers’ insurance rates from increasing after an accident.

Typically, car insurance rates go up after an accident, regardless of fault, because the insured driver becomes a higher risk. However, with Allstate’s accident forgiveness program, your rates will not automatically increase after your first accident as an Allstate insurance customer.

Allstate will work to keep your rates the same, providing you peace of mind and financial stability.

Is it easy to qualify for the Safe Driving Bonus at Allstate?

Yes, it is fairly easy to qualify for Allstate’s Safe Driving Bonus. For every six months of safe driving with an Allstate car insurance policy, you will receive a check in the mail from Allstate for up to 5% of your total premium cost.

Safe driving means having no accidents (fault or no-fault), no moving violations, and no claims over six months. By maintaining a safe driving record, you can continue to receive the Safe Driving Bonus check every six months. Learn about the best defensive driving tips.

How can I qualify for deductible rewards from Allstate?

You can qualify for Allstate’s deductible rewards program simply by signing up for Allstate car insurance. When you sign up, your policy deductible will immediately be reduced by $100. Each year you maintain a safe driving record without any accidents, traffic tickets, or claims, your deductible will be reduced by an additional $100.

In 48 states, the deductible can be reduced to zero. In New York and Pennsylvania, the deductible will not go below $100.

Why is Allstate car insurance so expensive?

Unfortunately, Allstate is expensive because car insurance in general has become more expensive due to rising costs for insurers. However the average Allstate car insurance policy is actually cheaper than other competitors, and Allstate offers a large amount of discounts that can help greatly reduce your premium.

Comparison shopping at least three providers is a great way to save on car insurance. You can enter your ZIP code into our online quote tool to get started on your comparisons.

Will using Allstate Drivewise® increase my auto insurance rates?

Since Drivewise® monitors your driving habits, some people think that bad driving habits will add to their policy’s costs.

The good news is that Drivewise® only lowers your costs Allstate doesn’t add more costs for bad driving habits. While you may not receive a discount for that month you slammed on the brakes one too many times, costs won’t be added on.

What is Allstate Milewise®, and does it work?

Milewise® is a usage-based program. It is perfect for people who don’t drive that much (such as people who work from home).

You’ll have to download the Milewise® app or get a Milewise® device. You’ll then pay a daily rate and then a per-mile rate, which is lower than the usual premiums.

Does Allstate cover damages from fires or floods?

Allstate doesn’t cover car damages from natural disasters unless you have comprehensive coverage. Comprehensive coverage will cover losses from natural disasters, animal collisions, and theft/vandalism.

Can I switch Allstate insurance agents?

Does Allstate insurance cover rental cars?

Does the new car replacement program apply to someone with a used car?

Is Allstate better than Geico?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.