Progressive Car Insurance Review [2026]

How much is Progressive car insurance? Rates average $311/month for low coverage and $363/month for high coverage. Our Progressive car insurance review will compare rates by coverage level, state, demographics, and other factors. We'll list Progressive insurance pros and cons as well as a Progressive Snapshot review.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Dorothea Hudson has been professionally writing in many spheres since 2013. She has written on entertainment, insurance, finance, travel, technology, AI, renewable energy, crypto, fundraising, and real estate for many websites. Her work has been published for British retailer Marks and Spencer, Kroger Magazine, the Vision Group, and more. Her passions include writing, music, running, travel, te...

Dorothea Hudson

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Tracey L. Wells

Updated May 2024

- Progressive insurance rating with A.M. Best is Superior (A+)

- Progressive provides easy access online, comparable rates, and policy bundles

- Progressive offers several opportunities to take advantage of discounts

Does car insurance seem like a foreign language to you?

Flo has been translating insurance into plain English for Progressive for over 10 years. Have you paid attention to Flo and Jamie? Have you considered Progressive because of its funny commercials? Are you fluent in insurance speak yet?

Sound familiar? Progressive is another of the large insurance companies that use humor to sell insurance. What started as a single commercial advertising a giant superstore filled with “boxes of car insurance” has turned into a juggernaut of name-brand recognition for the third-largest insurer in the country. The message is simple: bundle and save.

Car insurance is something most of us need, and we want to make sure that you’re not spending too much. Saving money is a language we all want to know more about. Our Progressive car insurance review will show you everything you need to know about Progressive, including ratings, company history, coverage options, and more.

Would you like to start comparison shopping today? Take advantage of our free online tool to start comparing rates in your area.

Let’s get started.

Progressive Car Insurance Rates

We partnered with Quadrant Data to bring you this information. Here are two things to keep in mind.

- Many variables can affect what you pay. Your rate will differ from what is listed below

- Progressive car insurance discounts may help offset the cost

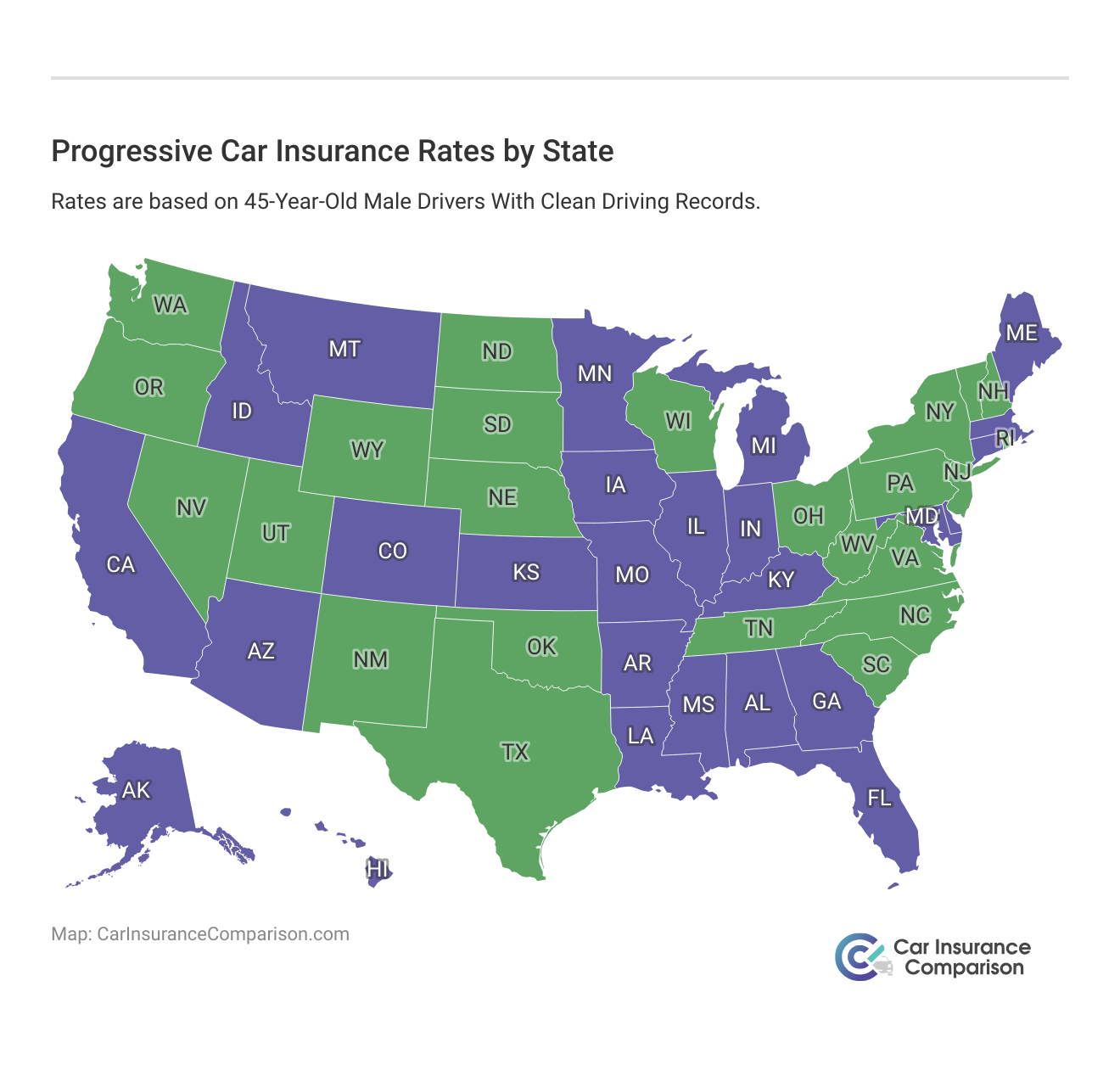

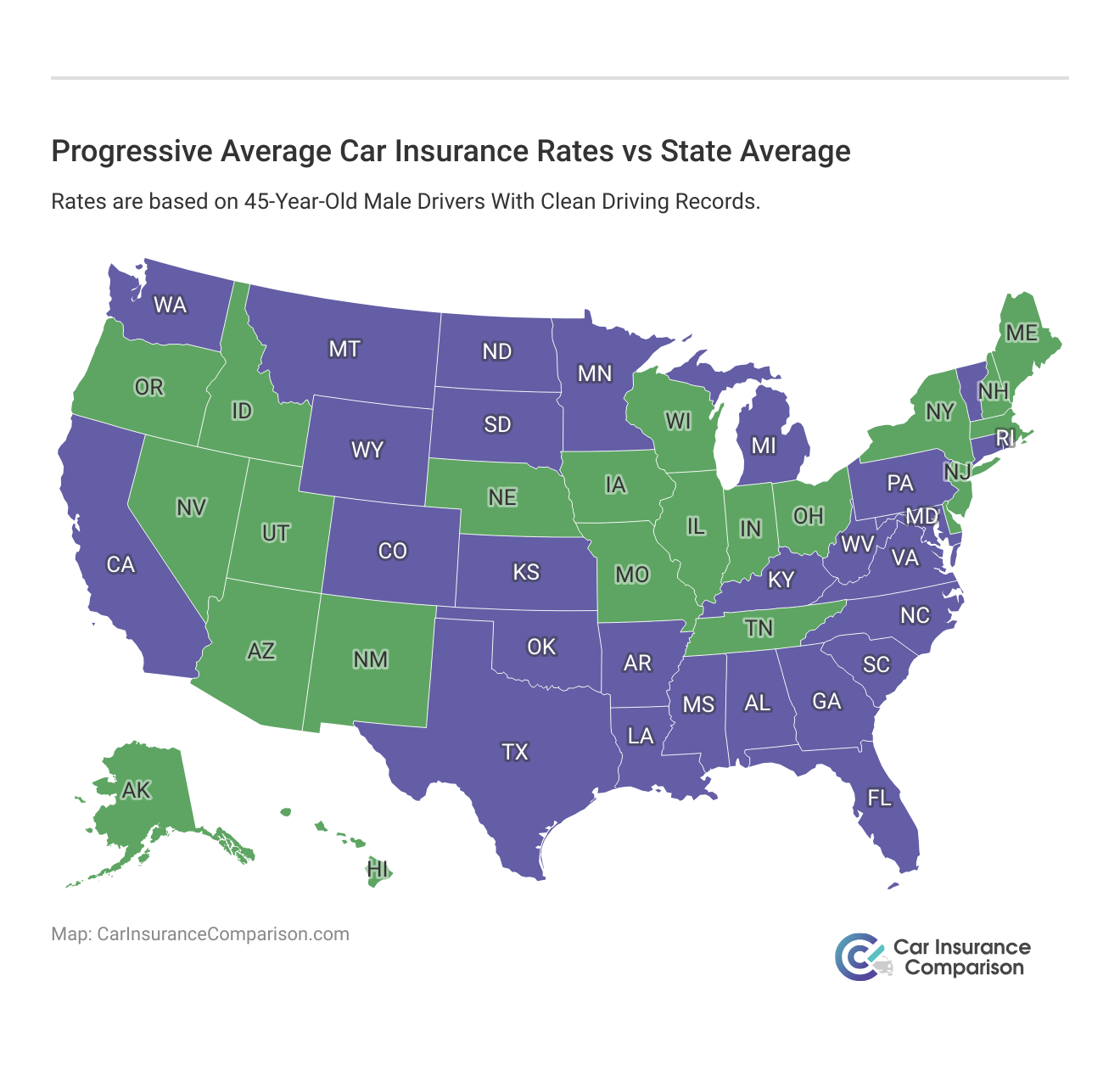

Progressive Rates By State

Progressive is available in almost every state. Their rates vary, sometimes below and sometimes above average, and can be further affected by factors like driving record and credit history.

Progressive Rates Compared to State Average: Monthly Average Rate

| State | Progressive Average | U.S. Average |

|---|---|---|

| Alabama | $112 | $105 |

| Alaska | $97 | $103 |

| Arizona | $84 | $112 |

| Arkansas | $131 | $116 |

| California | $132 | $140 |

| Colorado | $120 | $115 |

| Connecticut | $133 | $123 |

| Delaware | $90 | $156 |

| Florida | $153 | $142 |

| Georgia | $115 | $132 |

| Hawaii | $78 | $83 |

| Idaho | $91 | $77 |

| Illinois | $89 | $92 |

| Indiana | $69 | $92 |

| Iowa | $75 | $86 |

| Kansas | $127 | $111 |

| Kentucky | $111 | $145 |

| Louisiana | $161 | $173 |

| Maine | $94 | $80 |

| Maryland | $121 | $129 |

| Massachusetts | $95 | $101 |

| Michigan | $152 | $238 |

| Minnesota | $101 | $124 |

| Mississippi | $120 | $105 |

| Missouri | $98 | $102 |

| Montana | $171 | $107 |

| Nebraska | $95 | $104 |

| Nevada | $82 | $114 |

| New Hampshire | $63 | $86 |

| New Jersey | $93 | $138 |

| New Mexico | $86 | $105 |

| New York | $96 | $138 |

| North Carolina | $32 | $86 |

| North Dakota | $110 | $124 |

| Ohio | $85 | $82 |

| Oklahoma | $110 | $118 |

| Oregon | $78 | $102 |

| Pennsylvania | $148 | $112 |

| Rhode Island | $116 | $143 |

| South Carolina | $105 | $117 |

| South Dakota | $105 | $109 |

| Tennessee | $92 | $102 |

| Texas | $121 | $133 |

| Utah | $95 | $96 |

| Vermont | $181 | $93 |

| Virginia | $61 | $81 |

| Washington | $60 | $80 |

| Washington D.C. | $115 | $129 |

| West Virginia | $110 | $116 |

| Wisconsin | $94 | $94 |

| Wyoming | $106 | $104 |

The most expensive state to carry Progressive as your insurance provider is Michigan, followed by New Jersey, where rates are thousands above average.

Progressive Rates Compared to Other Companies

Here’s a look at Progressive compared to nine other top companies on a state-by-state basis. Progressive has the third-highest rates behind Allstate and Liberty Mutual.

Carrier Average Rates by State: Monthly Average Rate

| State | Average Rate by State | Allstate Rate | American Family Rate | Farmers Rate | Geico Rate | Liberty Mutual Rate | Nationwide Rate | Progressive Rate | State Farm Rate |

|---|---|---|---|---|---|---|---|---|---|

| Alaska | $285 | $262 | $346 | NA in State | $240 | $441 | NA in State | $255 | $186 |

| Alabama | $297 | $276 | NA in State | $349 | $239 | $334 | $222 | $371 | $400 |

| Arkansas | $344 | $429 | NA in State | $355 | $290 | NA in State | $322 | $443 | $232 |

| Arizona | $314 | $409 | NA in State | $417 | $189 | NA in State | $291 | $298 | $396 |

| California | $307 | $378 | NA in State | $417 | $240 | $253 | $388 | $237 | $350 |

| Colorado | $323 | $461 | $311 | $441 | $258 | $233 | $312 | $353 | $273 |

| Connecticut | $385 | $486 | NA in State | NA in State | $256 | $607 | $306 | $410 | $248 |

| District of Columbia | $370 | $539 | NA in State | NA in State | $308 | NA in State | $404 | $414 | $340 |

| Delaware | $499 | $526 | NA in State | NA in State | $311 | $1,530 | $361 | $348 | $372 |

| Florida | $390 | $620 | NA in State | NA in State | $315 | $447 | $362 | $465 | $283 |

| Georgia | $414 | $351 | NA in State | NA in State | $248 | $838 | $540 | $375 | $282 |

| Hawaii | $213 | $181 | NA in State | $397 | $280 | $266 | $213 | $181 | $87 |

| Iowa | $248 | $247 | $252 | $203 | $191 | $368 | $228 | $200 | $185 |

| Idaho | $248 | $341 | $311 | $264 | $231 | $192 | $253 | $285 | $156 |

| Illinois | $275 | $434 | $318 | $384 | $232 | $190 | $226 | $295 | $195 |

| Indiana | $285 | $332 | $307 | $286 | $188 | $482 | NA in State | $325 | $201 |

| Kansas | $273 | $334 | $179 | $309 | $268 | $399 | $206 | $345 | $227 |

| Kentucky | $433 | $595 | NA in State | NA in State | $386 | $494 | $459 | $462 | $280 |

| Louisiana | $476 | $500 | NA in State | NA in State | $513 | NA in State | NA in State | $623 | $382 |

| Maine | $246 | $306 | NA in State | $231 | $235 | $361 | NA in State | $304 | $183 |

| Maryland | $382 | $436 | NA in State | NA in State | $319 | $775 | $243 | $341 | $330 |

| Massachusetts | $223 | $226 | NA in State | NA in State | $126 | $362 | NA in State | $320 | $113 |

| Michigan | $875 | $1,909 | NA in State | $709 | $536 | $1,667 | $527 | $447 | $1,047 |

| Minnesota | $367 | $378 | $293 | $261 | $292 | $1,130 | $244 | $365 | $172 |

| Missouri | $277 | $341 | $274 | $359 | $240 | $377 | $189 | $285 | $224 |

| Mississippi | $305 | $412 | NA in State | NA in State | $341 | $371 | $230 | $359 | $248 |

| Montana | $268 | $389 | NA in State | $326 | $300 | $111 | $290 | $361 | $201 |

| North Carolina | $283 | $599 | NA in State | NA in State | $245 | $182 | $237 | $199 | $257 |

| North Dakota | $347 | $389 | $318 | $258 | $222 | $1,071 | $213 | $302 | $213 |

| Nebraska | $274 | $267 | $185 | $333 | $320 | $520 | $217 | $313 | $203 |

| New Hampshire | $263 | $227 | NA in State | NA in State | $135 | $704 | $208 | $225 | $182 |

| New Jersey | $460 | $476 | NA in State | $635 | $230 | $564 | NA in State | $331 | $627 |

| New Mexico | $289 | $350 | NA in State | $360 | $372 | NA in State | $293 | $260 | $195 |

| Nevada | $405 | $448 | $453 | $466 | $305 | $517 | $290 | $339 | $483 |

| New York | $357 | $395 | NA in State | NA in State | $202 | $545 | $334 | $314 | $374 |

| Ohio | $226 | $266 | $126 | $285 | $156 | $369 | $275 | $286 | $209 |

| Oklahoma | $345 | $310 | NA in State | $345 | $286 | $573 | NA in State | $403 | $235 |

| Oregon | $289 | $397 | $294 | $313 | $268 | $361 | $265 | $302 | $228 |

| Pennsylvania | $336 | $332 | NA in State | NA in State | $217 | $505 | $233 | $371 | $229 |

| Rhode Island | $417 | $413 | NA in State | NA in State | $467 | $515 | $367 | $436 | $201 |

| South Carolina | $315 | $325 | NA in State | $391 | $265 | NA in State | $302 | $381 | $256 |

| South Dakota | $332 | $394 | $337 | $314 | $245 | $626 | $228 | $313 | $192 |

| Tennessee | $305 | $402 | NA in State | $286 | $274 | $517 | $285 | $305 | $220 |

| Texas | $337 | $457 | $404 | NA in State | $272 | NA in State | $322 | $389 | $240 |

| Utah | $301 | $297 | $308 | $326 | $247 | $361 | $249 | $319 | $387 |

| Virginia | $196 | $282 | NA in State | NA in State | $172 | NA in State | $173 | $208 | $189 |

| Vermont | $270 | $266 | NA in State | NA in State | $183 | $302 | $177 | $435 | $365 |

| Washington | $255 | $295 | $309 | $247 | $214 | $333 | $177 | $267 | $208 |

| West Virginia | $216 | $318 | NA in State | NA in State | $177 | $244 | NA in State | $295 | $177 |

| Wisconsin | $301 | $405 | $126 | $315 | $327 | $563 | $435 | $261 | $199 |

| Wyoming | $267 | $364 | NA in State | $256 | $291 | $166 | $266 | $367 | $192 |

| Median | $305 | $378 | $308 | $326 | $256 | $441 | $266 | $328 | $228 |

As we’ve mentioned previously, your rates will vary based on your situation.

Progressive Male vs. Female Car Insurance Rates

Here’s how Progressive’s annual rates based on demographics compare to other top insurance carriers in the country. These averages are national, so where you live could affect your rates.

Male vs Female Monthly Average Rates: An Analysis of Insurance Companies

| Companies | 35-year old Female Rate | 35-year old Male Rate | 60-year old Female Rate | 60-year old Male Rate | 17-year old Female Rate | 17-year old Male Rate | 25-year old Female Rate | 25-year old Male Rate |

|---|---|---|---|---|---|---|---|---|

| Allstate | $263 | $260 | $243 | $249 | $774 | $887 | $285 | $298 |

| American Family | $184 | $185 | $166 | $168 | $500 | $678 | $191 | $225 |

| Farmers | $213 | $213 | $195 | $204 | $710 | $762 | $246 | $253 |

| Geico | $192 | $193 | $187 | $190 | $471 | $523 | $198 | $189 |

| Liberty Mutual | $317 | $321 | $287 | $307 | $968 | $1,143 | $330 | $375 |

| Nationwide | $197 | $199 | $178 | $185 | $480 | $598 | $224 | $241 |

| Progressive | $191 | $181 | $166 | $171 | $724 | $802 | $225 | $230 |

| State Farm | $173 | $173 | $156 | $156 | $496 | $610 | $195 | $213 |

| Travelers | $182 | $183 | $171 | $173 | $776 | $1,071 | $194 | $208 |

| USAA | $129 | $128 | $121 | $121 | $401 | $449 | $166 | $177 |

As with most other insurance companies, single, male teens pay more for car insurance than any other group.

Progressive Rates by Make and Model

What vehicle you drive can also have an impact on your car insurance. Below, we show you what you can expect to pay for five specific models from Progressive and its competitors.

Make & Model Car Insurance Rates: Monthly Average

| Make and Model | Allstate | American Family | Farmers | Geico | Liberty Mutual | Nationwide | Progressive | State Farm | Travelers |

|---|---|---|---|---|---|---|---|---|---|

| 2015 Ford F-150 Lariat SuperCab with 2WD 6.5 foot bed and 2.7L V6 | $369 | $287 | $341 | $258 | $486 | $298 | $326 | $267 | $335 |

| 2015 Honda Civic Sedan LX with 2.0L 4cyl and CVT | $396 | $265 | $367 | $258 | $489 | $296 | $369 | $252 | $368 |

| 2015 Toyota RAV4 XLE | $360 | $277 | $311 | $258 | $485 | $293 | $304 | $269 | $365 |

| 2018 Ford F-150 Lariat SuperCab with 2WD 6.5 foot bed and 2.7L V6 | $458 | $291 | $366 | $278 | $499 | $281 | $330 | $291 | $368 |

| 2018 Honda Civic Sedan LX with 2.0L 4cyl and CVT | $448 | $310 | $398 | $278 | $557 | $280 | $377 | $266 | $388 |

| 2018 Toyota RAV4 XLE | $412 | $291 | $314 | $278 | $520 | $277 | $311 | $285 | $392 |

The good news is if you drive a 2015 Toyota RAV4 XLE, because of the vehicles listed, it has the cheapest rates.

Progressive Rates by Commute

If you drive more than 12,000 miles a year, you may also see your car insurance rates start to rise.

Progressive Rates by Commute by State: Monthly Average Mileage

| State | 10 mi Commute/ 6000 Mileage Rate | 25 mi Commute/ 12000 Mileage Rate |

|---|---|---|

| AK | $255 | $255 |

| AL | $371 | $371 |

| AR | $443 | $443 |

| AZ | $298 | $298 |

| CA | $215 | $259 |

| CO | $353 | $353 |

| CT | $410 | $410 |

| DC | $414 | $414 |

| DE | $348 | $348 |

| FL | $465 | $465 |

| GA | $375 | $375 |

| HI | $181 | $181 |

| IA | $200 | $200 |

| ID | N/A | N/A |

| IL | $295 | $295 |

| IN | $325 | $325 |

| KS | $345 | $345 |

| KY | $462 | $462 |

| LA | $623 | $623 |

| MA | $320 | $320 |

| MD | $341 | $341 |

| ME | $304 | $304 |

| MI | $447 | $447 |

| MN | N/A | N/A |

| MO | $285 | $285 |

| MS | $359 | $359 |

| MT | $361 | $361 |

| NC | $199 | $199 |

| ND | $302 | $302 |

| NE | $313 | $313 |

| NH | $225 | $225 |

| NJ | $331 | $331 |

| NM | $260 | $260 |

| NV | $339 | $339 |

| NY | $314 | $314 |

| OH | $286 | $286 |

| OK | $403 | $403 |

| OR | $302 | $302 |

| PA | $371 | $371 |

| RI | $436 | $436 |

| SC | $381 | $381 |

| SD | $313 | $313 |

| TN | $305 | $305 |

| TX | $389 | $389 |

| UT | $319 | $319 |

| VA | $208 | $208 |

| VT | $435 | $435 |

| WA | $267 | $267 |

| WI | $261 | $261 |

| WV | $367 | $367 |

| WY | N/A | N/A |

Progressive customers can expect to pay the sixth-highest rates when it comes to their commute. Other factors such as living in a rural or urban area could also contribute to the cost of your insurance.

Progressive Coverage Level Rates

You might think that having the minimum car insurance requirements by state is the best way to ensure you and your family are protected. But that’s not necessarily the case, because sometimes the difference in low to high coverage is less than you think.

Check out the table below to see the differences in coverage in your state.

Car Insurance Companies Coverage Rate: Monthly Average

| Companies | Average Monthly Rate with Low Coverage | Average Monthly Rate with Medium Coverage | Average Monthly Rate with High Coverage |

|---|---|---|---|

| Allstate | $386 | $408 | $428 |

| American Family | $281 | $295 | $285 |

| Farmers | $327 | $347 | $375 |

| Geico | $250 | $268 | $286 |

| Liberty Mutual | $484 | $505 | $530 |

| Nationwide | $283 | $288 | $292 |

| Progressive | $311 | $335 | $363 |

| State Farm | $255 | $273 | $288 |

| Travelers | $352 | $372 | $385 |

| USAA | $200 | $212 | $222 |

Progressive Credit History Rates

Besides not being able to secure a car loan or a mortgage, poor credit can also have an impact on how much you pay for car insurance. The table below reflects what you’ll pay for car insurance if you have good, fair, or poor credit. Of course, these are estimates, and your rates may be different based on your situation.

Car Insurance Companies Credit Amount: Monthly Average Rate

| Companies | Average Rate with Good Credit | Average Rate with Fair Credit | Average Rate with Poor Credit |

|---|---|---|---|

| Allstate | $322 | $382 | $541 |

| American Family | $224 | $264 | $372 |

| Farmers | $306 | $325 | $405 |

| Geico | $203 | $249 | $355 |

| Liberty Mutual | $366 | $467 | $734 |

| Nationwide | $244 | $271 | $340 |

| Progressive | $302 | $330 | $395 |

| State Farm | $181 | $238 | $413 |

| Travelers | $338 | $362 | $430 |

| USAA | $152 | $185 | $308 |

The average credit score in the U.S. is 675. If your credit score is lower than this, you may face increased rates on car insurance. In some states, poor credit can raise your rates by thousands of dollars. On average, with Progressive, poor credit can raise your rates by $1,100.

Progressive Driving Record Rates

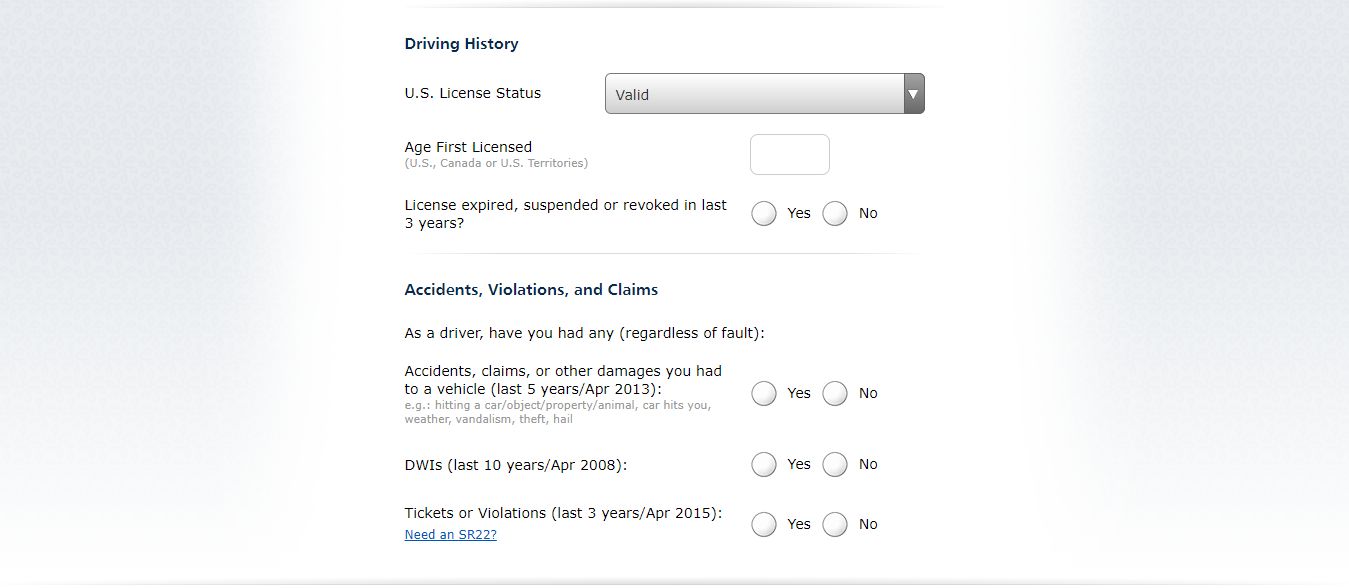

If you get a speeding ticket, have an accident, or get a DUI, your rates with Progressive will increase in most states.

The table below shows rates for these three violations compared to the rate for a clean record.

Car Insurance Companies Driving History Costs: Monthly Average Rates

| Companies | Clean record | With 1 speeding violation | With 1 accident | With 1 DUI |

|---|---|---|---|---|

| Allstate | $318 | $374 | $416 | $522 |

| American Family | $224 | $252 | $310 | $361 |

| Farmers | $288 | $340 | $377 | $393 |

| Geico | $179 | $220 | $266 | $406 |

| Liberty Mutual | $398 | $475 | $517 | $634 |

| Nationwide | $229 | $259 | $283 | $379 |

| Progressive | $283 | $334 | $398 | $331 |

| State Farm | $235 | $266 | $283 | $303 |

| Travelers | $287 | $355 | $357 | $478 |

| USAA | $161 | $183 | $210 | $292 |

One speeding violation with Progressive can raise your rates over $600.

Progressive offers the same coverage as all of the other companies do and in some cases, at a competitive rate. Let’s take a look at standard insurance terms and go into detail about what they mean.

Progressive talks a lot about bundling:

https://www.youtube.com/watch?v=Ix5_5KGnksk

Gary may be excited about bundling with Progressive, while some companies advertise coverage under every scenario imaginable, but what is that actual coverage called?

We know, it can be confusing, so that’s why we’ve compiled a list of common coverages with a brief explanation. Different coverage types fall into four basic categories:

When You Are at Fault

Liability coverage covers the physical damages you inflict upon another vehicle and the bodily injuries sustained by all individuals in the other vehicle.

When You Are Not at Fault

Uninsured and Underinsured Motorist Coverage covers your expenses if the at-fault driver has little or no liability coverage.

Vehicle Protection

- Collision Car Insurance – covers your vehicle repairs or replacement after an accident

- Comprehensive Car Insurance – includes what most would consider “out of our control” such as storm damage, hitting an animal, and more

- Emergency Road Service – covers standard roadside services like tire changes, jump starts, and lockout services

- Rental Reimbursement Coverage – includes a rental car while yours is getting repaired

- Mechanical Breakdown Coverage – covers parts and systems failure of your vehicle that is not caused by normal wear and tear or improper maintenance

Personal Protection

- Medical Payments Coverage – covers medical expenses of those in your vehicle

- Personal Injury Protection – covers costs incurred from injuries to yourself or others in the vehicle, lost wages, and funeral expenses no matter who is at fault

- Umbrella Policy – extends your liability coverage to a much higher limit which blankets over multiple policies such as home and auto as well as others

Progressive’s extensive list of auto insurance coverages means you can tailor a car insurance plan to meet your needs.

Additional Car Insurance Options from Progressive

Depending on where you live, some of the above may be optional coverages. Progressive also has a good selection of additional coverage, including the most popular options

- Towing and Roadside Assistance (See our article, Does car insurance cover towing?)

- New Car Replacement

- Classic and collector car coverage (See our article, Classic vs. Standard Car Insurance.)

To add onto these standard options, Progressive goes a step further and offers a couple of specialty options:

- Rideshare Coverage: coverage for anyone working for a ridesharing service (such as Lyft or Uber)

- Loan/Lease Payoff Coverage: coverage that helps you pay off the loan/lease of your vehicle if it were to be totaled during a wreck

Progressive’s Area of Operation

Progressive is available in all states in the United States.

Progressive’s Discounts Offered

Is Progressive good insurance? It certainly is when it comes to discounts. Progressive has many discounts and affordability options available to its consumers. Depending on the discount, you could save up to 40%.

Progressive Average Discount Amount

| Discount Name | Average Discount | Details |

|---|---|---|

| Multi-Policy | 5% | If you have two or more policies with Progressive (for example: if you were to have an auto and home-owners policy with Progressive) |

| Snapshot Program | $130 | Their Snapshot program that personalizes your rate based on your driving. |

| Safe Driver | 31% | If you have no accidents/traffic violations in the past three years |

| Multi-Car | 10% | If you have more than one vehicle listed on your policy |

| Homeowner | nearly 10% | If you own a home (even if it is not insured through Progressive's network) |

| Sign Online | nearly 8% | If you sign your documents online |

| Online Quote | 7% | If you got your policy quote online (or if you start your quote online and a licensed Progressive representative finishes it for you over the phone |

| Paperless | Varies | If you opt to receive your documents via email (dependent on signing your documents online and is an addition to the sign online discount) |

| Continuous Insurance | Varies | If you switch to Progressive from another insurer, you won't lose any longevity benefits (discount value will depend on how long you've been consistently insured with no gaps or cancellations) |

| Teen Driver | Varies | If you're adding a teen driver to your policy |

| Good Student | Varies | If you have a student who maintains a "B" average or better (discount also applies to college students, students more than 100 miles from your residence, or is 22 years or younger) |

| Pay in Full | Varies | If you pay for your six month policy up front |

| Automatic Payment | Varies | If you set up automatic payments from a checking account to pay (you cannot combine the automatic payment and pay in full discounts) |

These discounts aren’t available everywhere, so be sure to ask your agent about what options you qualify for based on your situation.

Progressive Snapshot

The Snapshot® program allows customers to have their driving habits monitored for 30 days and, based on the results, earn a discount of up to 30%. You use a telematics device installed into your vehicle or through the Snapshot mobile app itself.

The device/app then monitors the time you spend driving as well as any habits you may be prone to, such as speeding, sudden braking, and more. It then calculates the rate based on the data it receives. Who has the most to gain from this program?

Anyone confident in their driving abilities! If you think you are a particularly safe driver, you may see a lot of savings using this program.

Possible Savings of Snapshot

The possible savings for people who use this device to monitor their driving is up to 30% off your current policy total.

This discount does not apply to your policy until it is time to renew your policy with Progressive, and Progressive wants you to use the device for at least 30 days before a discount is calculated.

The benefit of Snapshot is that if you’re a great driver but you seem to have hit a stalemate on getting discounts on your car insurance, you may have the opportunity to actually lower your car insurance rate.

Brad Larson Licensed Insurance Agent

If you turn out to be a terrible driver, Progressive does not increase your rates and will not increase your rates when it comes time to renew your policy with the company.

According to the company, it is not their intention to punish drivers who have poor driving records.

Possible Downsides of Snapshot

Progressive Snapshot reviews found that a major downside to using this device is if you turn out to be someone who the company considers to be an unsafe driver. As mentioned above, the company isn’t going to increase your rates when you renew your policy.

However, if you want to add another car to your policy, that’s a different scenario altogether.

In addition, if you switch from Progressive and then decide to come back to the company, the data it collected while you were using Snapshot is used to determine your rates.

Perhaps you were getting great rates before, but if your Snapshot shows you to be a high-risk driver, your new rates are going to reflect that.

Another possible downside is simple technology failure.

Many people who use Snapshot claim that it recorded hard braking during times they weren’t driving. Someone else plugged in the device and their vehicle stopped working.

It turned out that the device triggered a failure in their computer.

Some people complained that they didn’t receive the discount offered in their Snapshot, although they may not have realized that the discount does not apply until after they renewed their policy.

Availability of Snapshot

Because Snapshot is available in so many states, it would be much easier to list the states in which Snapshot is not available.

There are currently 17:

- Alabama

- Alaska

- Arkansas

- California

- Connecticut

- Delaware

- Georgia

- Hawaii

- Maine

- Massachusetts

- Nevada

- New Hampshire

- New Jersey

- New York

- Rhode Island

- Virginia

- Washington

Progressive’s Deductible Savings Bank

The deductible savings bank essentially helps you pay your deductible.

Once you add this feature to your policy, you will automatically be subtracted $50 from your collision and comprehensive deductible for every claim-free policy period. So if you go your policy period (six months for example) without making a claim, you get deducted $50 from what you paid for your collision/comprehensive deductible.

So for example, let’s say you were to choose a $500 deductible for your comprehensive and collision on your policy. You then go six months (on your policy period) without making a claim.

At the end of that period, your deductible will then drop to $450. Let’s say you keep going and the next policy period comes to an end, and you have yet again made no claims, you would then go down an extra $50 to a $400 deductible.

This savings bank allows you to try to get all the way down to $0.

The Progressive Deductible Savings Bank cost is zero. How to enroll in Progressive Deductible Savings Bank?

Call Progressive or go to the Progressive site. Decide which collision and comprehensive deductible makes the most sense for you. Then add the program before you buy. You will have the option to add the program to your policy once you view your rate.

What Stands Out and What’s Missing

Is Progressive insurance good? Let’s review what we’ve learned so far by looking at what stands out about Progressive’s offerings and what’s missing.

- What Stands Out — Progressive has a higher-than-average number of discounts. It also has a great variety of add-on coverages and programs that go beyond the basics.

- What’s Missing — Progressive doesn’t have a military discount, which is generally a typical discount at other insurance providers.

For the most part, Progressive has more to offer than what’s missing (though it also has higher prices).

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Canceling Your Policy with Progressive

Over time, there may be occasions when you may need to cancel or adjust your insurance policy with Progressive. Here are four examples that may apply to you:

- Selling a car and not replacing it

- Storing a classic or antique vehicle

- A teen is heading to college and will no longer be driving the vehicle

- A vehicle has been paid off and no longer requires comprehensive cover

But what if you want to cancel your policy for other reasons such as customer dissatisfaction, rates that are too high, or you’re moving geographic locations? Keep reading to learn how to cancel your policy.

How to Cancel Progressive

You’ll need to pick up the phone and call 1-800-776-4737 or your local agent if you want to cancel your policy. Progressive’s website does allow you to modify or change some policies but doesn’t allow for canceling a policy.

Cancellation Fee

Progressive does charge a cancellation fee if you cancel your policy early (such as before the next renewal cycle).

This fee is generally around $50.

If you cancel at the end of a renewal cycle, you shouldn’t be charged a cancellation fee.

When You Can Cancel

Don’t cancel your policy until you’ve secured representation with another company. Even a one-day lapse in coverage can cause unwanted headaches and possible fines in some states. The cancellation will go into effect at midnight the following day after your policy expires or whatever day you have chosen to end the policy.

Read more: How To Cancel Progressive Car Insurance

How to Make a Claim With Progressive

Uh, oh. You’ve been in an accident and need to file a car insurance claim. How does that work?

Ease of Making a Claim with Progressive

It’s easy with Progressive, follow these simple steps:

- Online — You can file a claim online at Progressive’s website. You will need to have your policy number, contact information, and accident/incident information.

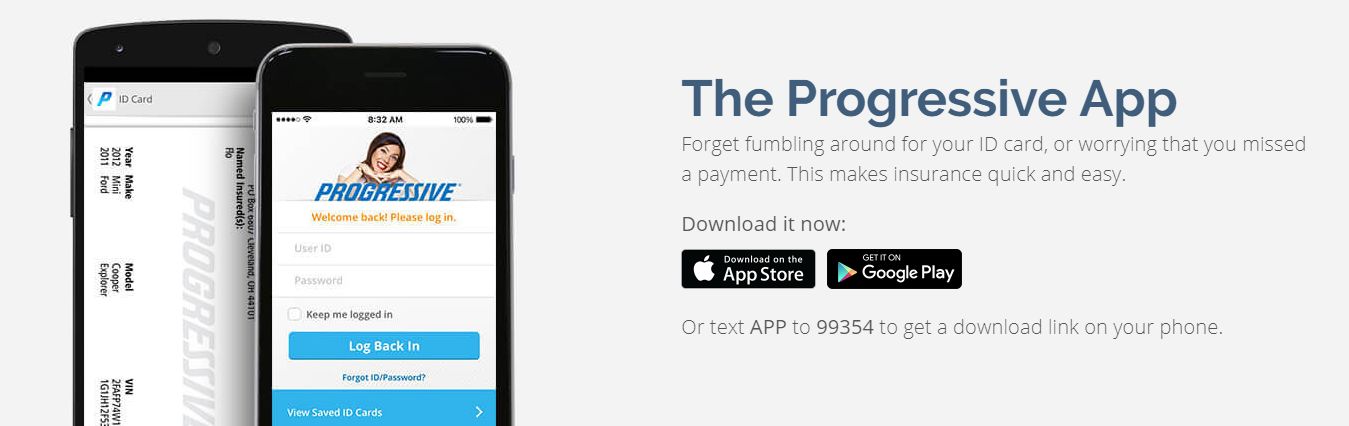

- Mobile App — If you have Progressive’s mobile app, you can use it to file a claim.

- Agent — You can also contact your agent directly to file a claim.

- Phone — You can call the Progressive insurance phone number 1-800-776-4737 at any time (it is available 24/7, seven days a week).

Now, that we’ve shown you how to file a claim, let’s look at how Progressive pays out claims to its customers. Loss ratios can give us some insight into the answer to that question.

Progressive’s Premiums Written and Loss Ratio

The information below comes from NAIC and shows the premiums written by Progressive compared to its loss ratio over four years. The company has shown consistent growth over the lookback period, which means it’s attracting more customers. The loss ratio decreased slightly, which could mean clients are reporting fewer claims or Progressive isn’t paying out as much.

Progressive Loss Ratios

| Private Passenger Auto | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|

| Premiums written | $21.3 billion | $23.9 billion | $27.8 billion | $29.8 billion |

| Loss Ratio | 61.39% | 67.82% | 64.49% | 63% |

What exactly is a loss ratio?

However, the good news is that Progressive is a stable company and should have no problem paying claims to its customers.

How to Get a Quote Online With Progressive

How do you get Progressive car insurance quotes online? Progressive has a state-of-the-art website that allows you to shop for insurance online and purchase a policy if you choose.

Progressive’s website caters to customers that are completely new to auto insurance.

Individuals who already have car insurance and are looking to switch companies can also get a quote to compare their current rates.

Saving money is not the only reason to switch car insurance companies, and Progressive recognizes that.

It is vital to make sure your coverage levels are suitable for your lifestyle and your deductible is affordable in case you need to make a claim.

Step #1 – Learn About Progressive

Progressive has a lot to offer from car to life insurance, so before you even request a quote, take some time to explore their site and get a feel for who they are as a company.

Here’s a pathway we suggest: Start off on their About page. Learn about their core values like integrity and respect, then check out their News Releases page to see what they’re doing in the world.

One thing many people don’t consider when researching a car insurance company is their role in the industry at large; do they only care about you for your money, or are they passionate about car insurance and what that really means — driver safety, affordability, accessibility, and accident prevention?

Once you’ve learned about Progressive as a brand, check out their Auto Insurance page and read about their coverage options. If you like what you see, it’s time to get quotes.

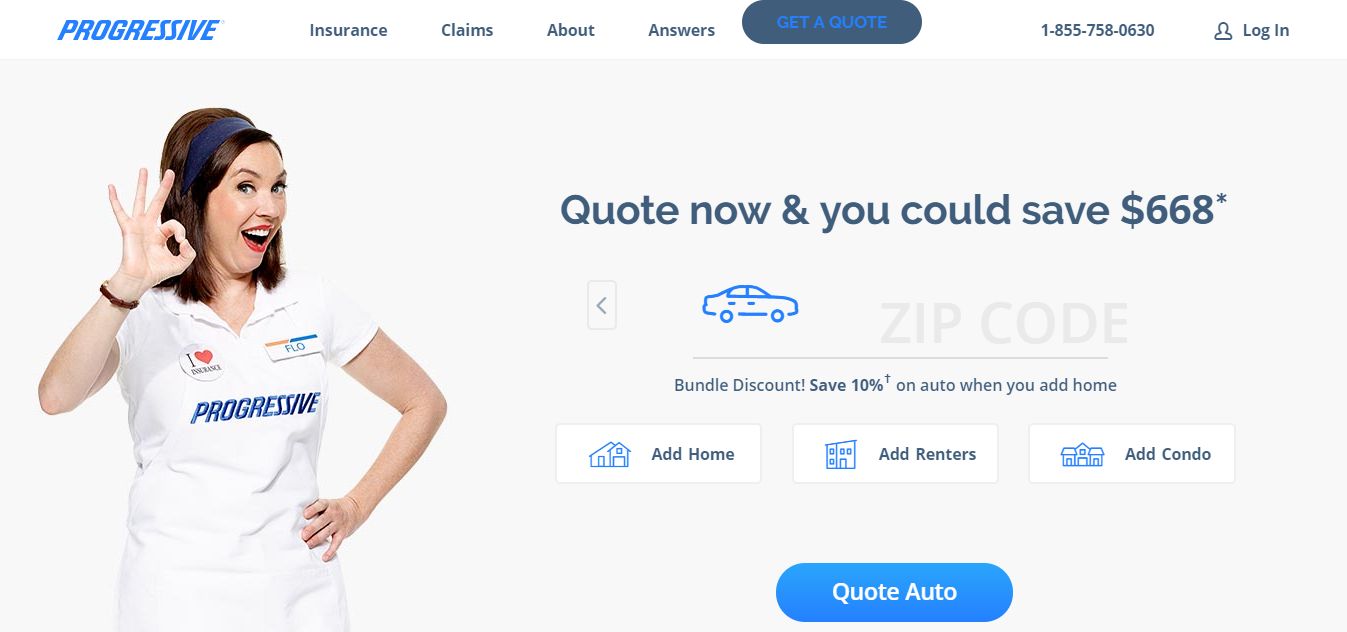

Step #2 – Enter Your ZIP Code

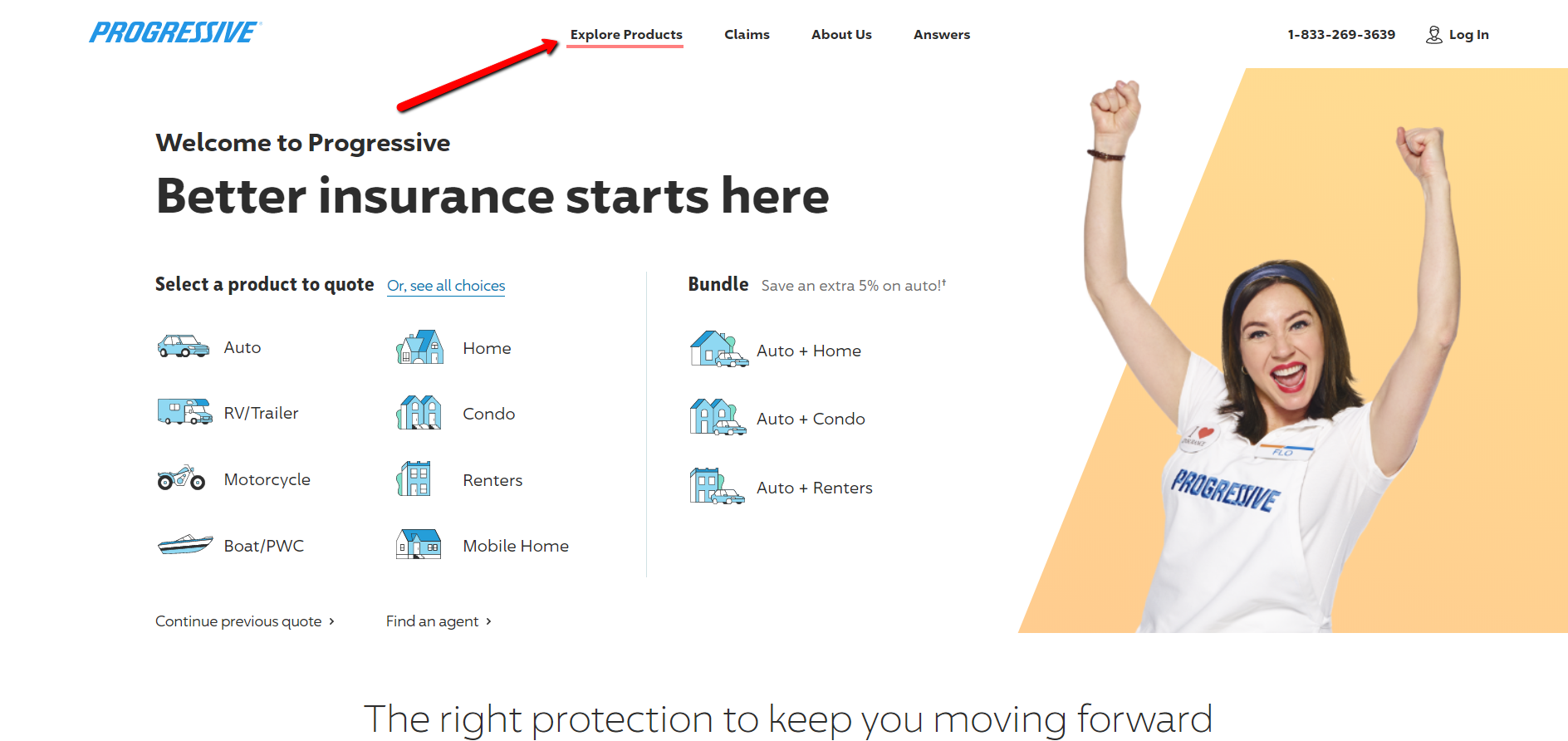

On Progressive’s home page, you can select the type of insurance you’d like quotes for (see image above).

Then, you’ll be prompted to enter your ZIP code (see image above). Click “Quote Auto” and you’ll be redirected to the next page. The search has officially started!

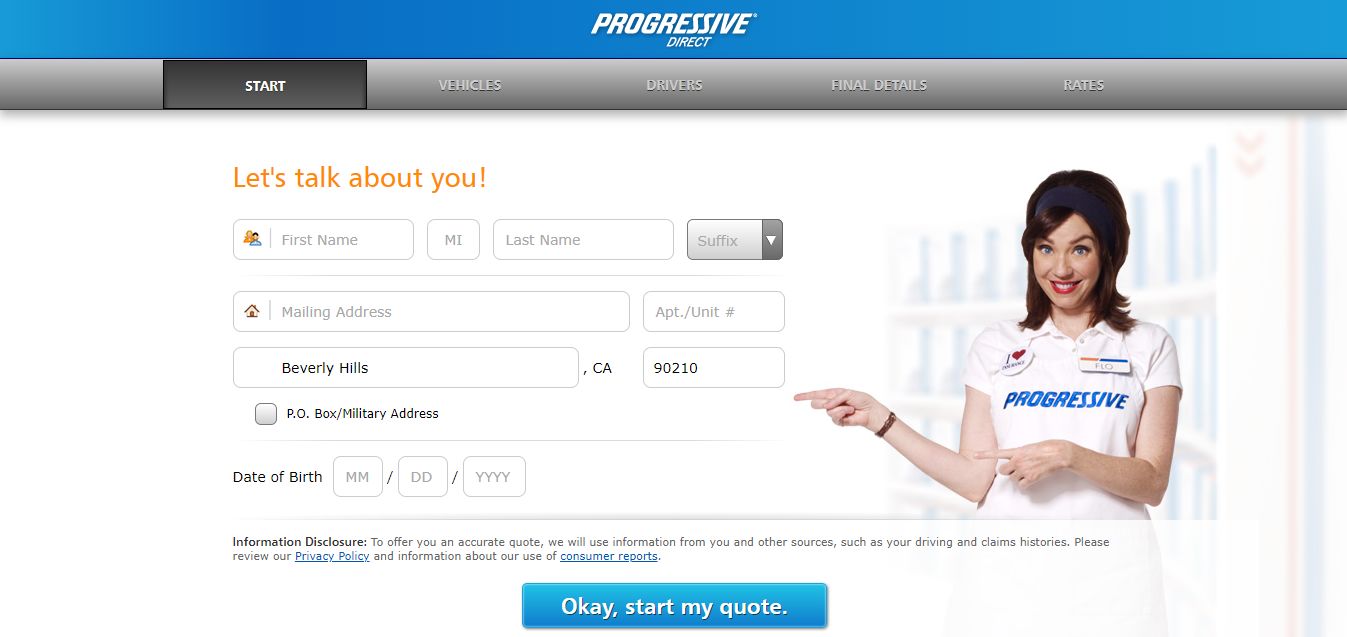

Step #3 – Provide Your Information

Car insurance rates vary from state to state and person to person. Your age, driving record, and even your gender affects how much you’ll pay, so this baseline level of information lays the framework for the quotes Progressive will give you.

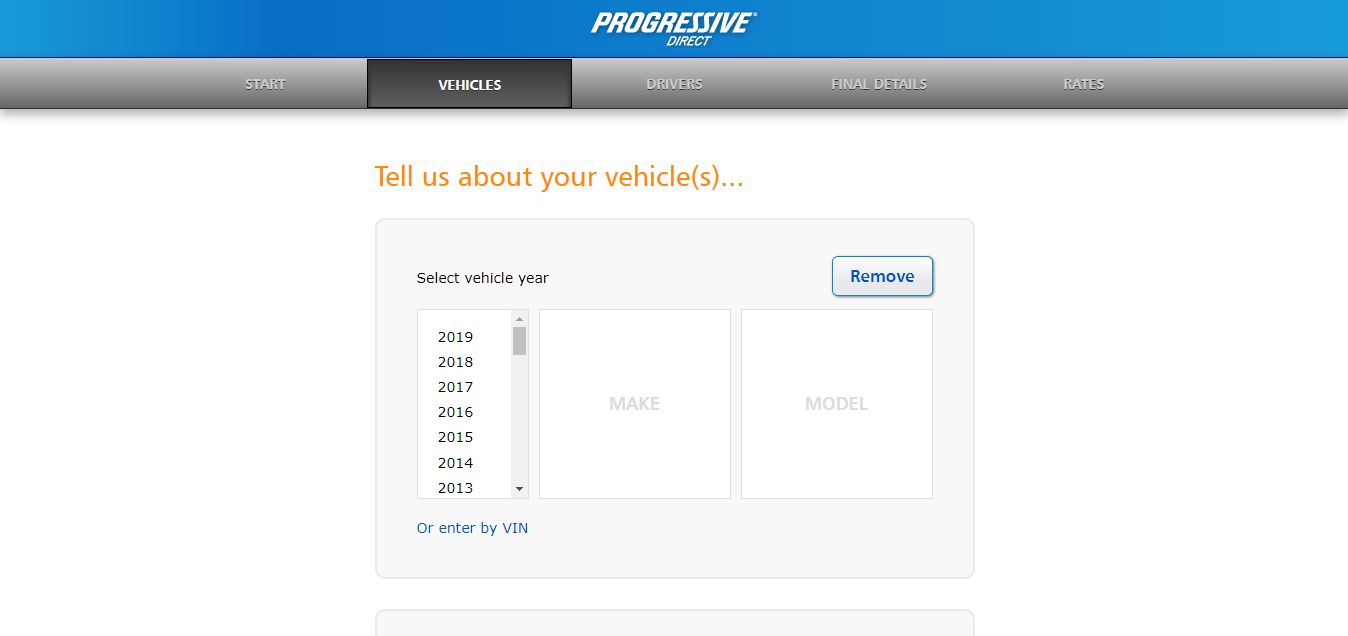

Step #4 – Add Vehicles

Now, you’ll enter information for every vehicle you want to insure. You’ll be prompted to input the year, make, and model of each car. You can also enter your car’s VIN and have the information generated for you.

If you don’t know how to find your car’s VIN (Vehicle Identification Number), read our article on understanding your car insurance policy to learn all about VINs and how to interpret and find your own.

You’ll also have to specify how you use each vehicle you enter.

There is a difference in cost and coverage for vehicles that are used strictly for recreation, commuting (errands, to and from school, etc.), and business. Select the option from the choices provided that most accurately summarizes how you use your vehicle on a routine basis.

You can always adjust coverage levels and make changes to your policy make changes to your policy once you speak with an agent, but being honest and accurate during the quote process is important in getting the most accurate rates.

Read more: How much insurance do you need for a new car?

Step #5 – Get to Know Your Vehicle

There are a lot of important details you have to know in order to properly fill out the information form. Firstly, you’ll need to know exactly what make and model your car is. Just “Toyota” won’t work.

So how can you find this info if you aren’t sure? Check out this YouTube video (below) that will walk you through the simple process of finding the make and model of your car.

Your Vehicle Identification Number (VIN) is handy because you can input this directly into Progressive’s system and it will input all of the information for you.

Step #6 – Understand How You Use Your Vehicle

Once you’ve entered your car’s basic details, you’ll be asked to specify its primary use. Many of us think that our car is just our car and is meant for everything unless you’re a farmer or business person using your car only for specific tasks. Progressive gives you four options to choose from:

- Personal – This is the option most everyday drivers will choose; select this if you drive your car to work or school, use it to run errands, drive around town, etc. In other words, if this car is your typical mode of transportation, this is the right option for you. (Progressive may ask if you commute to a specific state nearby depending on the ZIP code you enter. For example, if you live in Philadelphia, you would be asked if you primarily use your car to commute to New Jersey or New York for work or school.)

- Business – Select this option if you mostly use your vehicle to make sales calls, run business errands, drive customers around, or perform other work-related activities.

- Commercial – Pizza delivers, snow plowers, taxis, and similar workers will select the commercial car insurance option. You can also check whether or not you use your car in a rideshare program (like Uber or Lyft).

- Farming – If your vehicle is used in agriculture and ranching, then select this option.

Choosing the right option and understanding how you use your car is vital to getting proper coverage. Your insurance needs and state requirements will differ depending on how your car is used, so make sure you’re honest and that the information you provide is as accurate as possible.

Have a multi-purpose vehicle? Choose the option that most closely reflects how you use your car 75% of the time. You can go over details with an agent and have your quotes readjusted later if you like the initial rates you’re presented with.

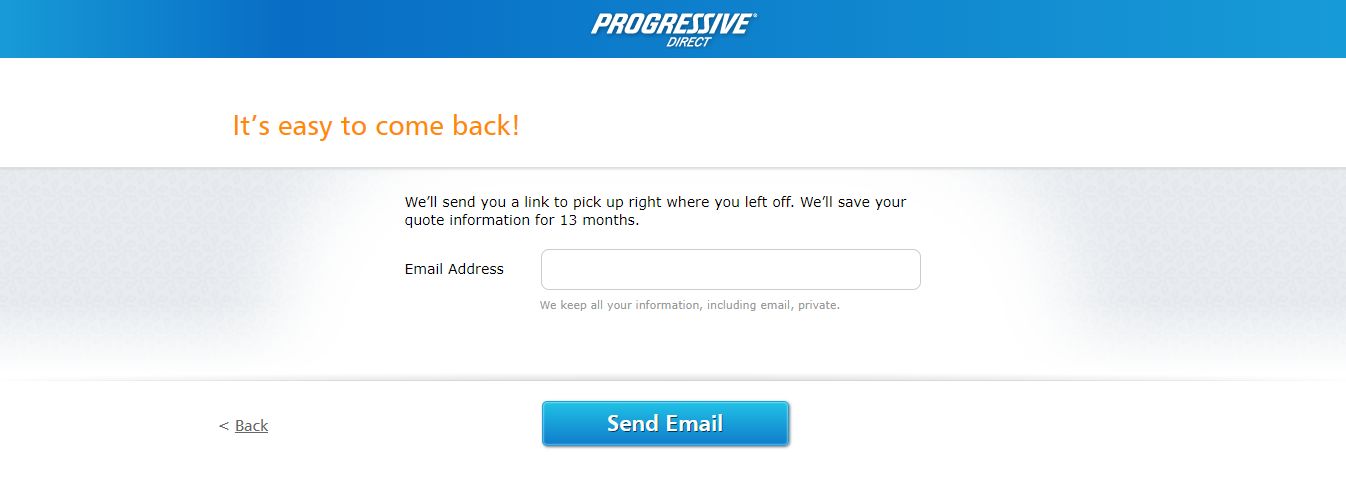

Step #7 – Save Your Progress

Doing so might require you to get some information you don’t have on hand, so click “Save and Return” at the bottom of the screen and enter your email address.

You’ll be able to pick up right where you left off anywhere in the process after this for up to 13 months.

Step #8 – Get Fast Answers to Questions

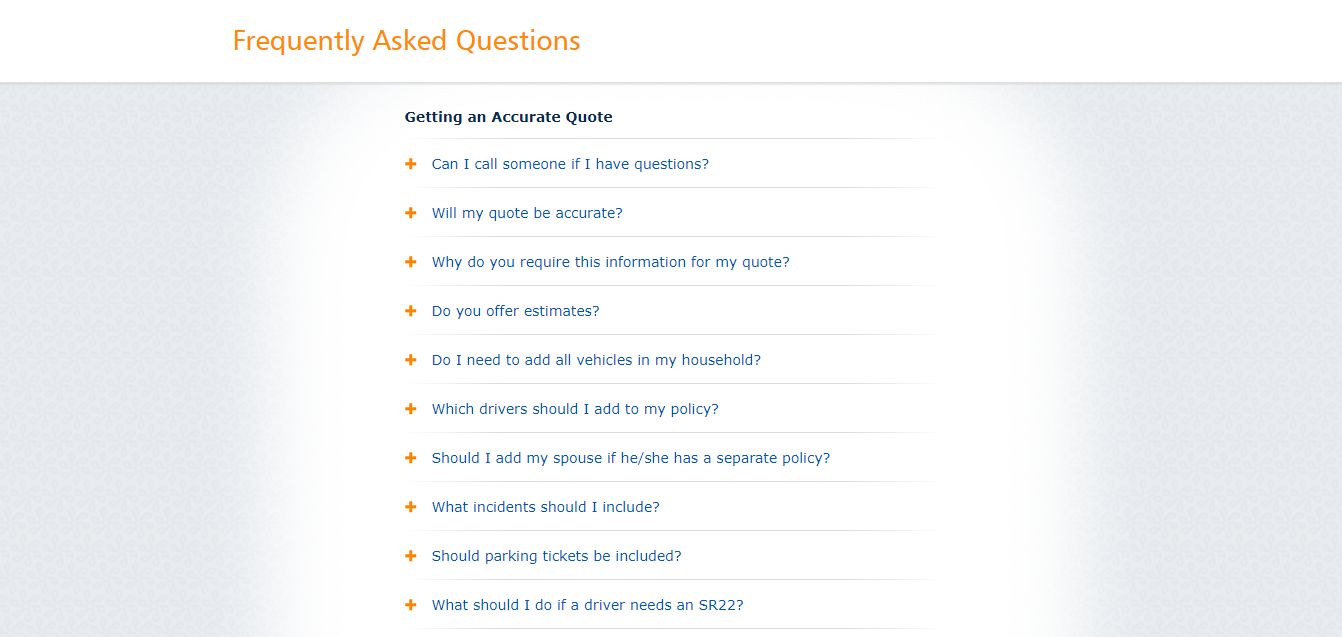

The FAQs section is divided into helpful categories — Getting an Accurate Quote, How and Why to Buy Progressive, Snapshot, Comparison Rates, and Security and Privacy.

Whether you want to know how Progressive calculates a rate or how they securely handle the personal information you provide, this is the place to get answers.

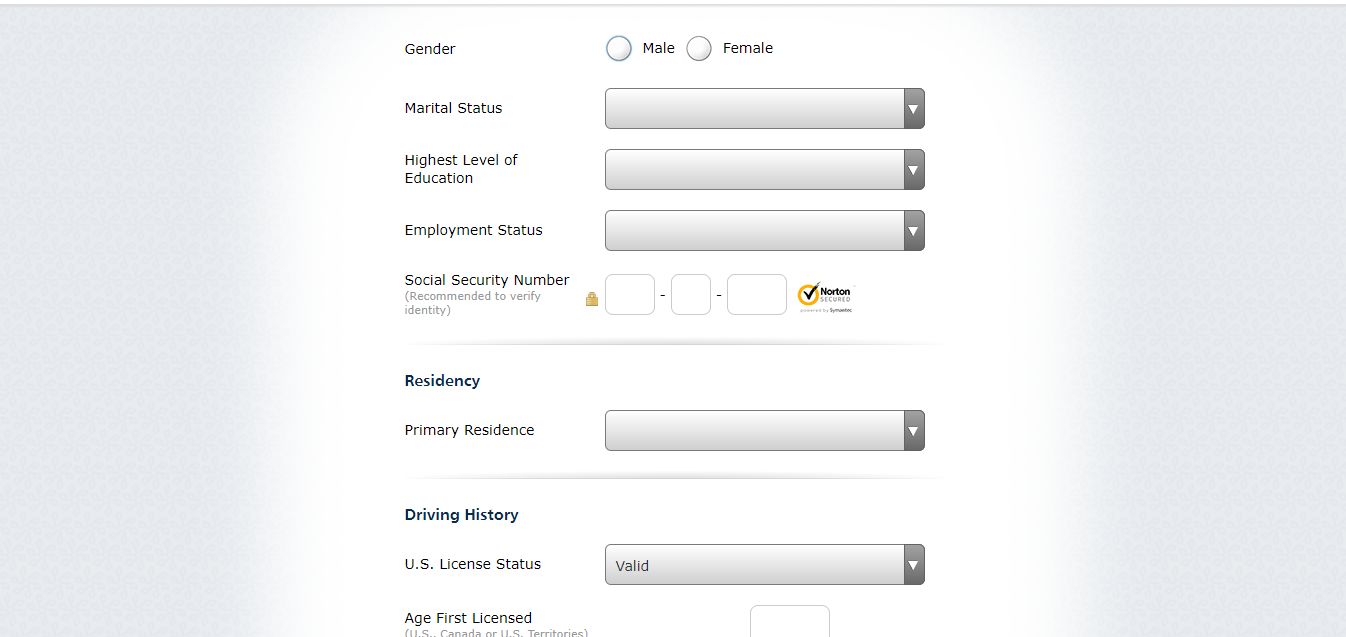

Step #9 – Enter Driver Info

Understanding how car insurance rates are calculated and the multiple factors providers take into consideration can also help you understand which discounts your lifestyle may qualify you for.

Step #10 – Call for Help if You Need It

Before you go through the final step, you want to make sure that you’re 100% clear on everything you’ve been asked and have responded with the most accurate information possible.

If you have questions about how to locate certain information or if a particular question or part of the quotes wizard confuses you, you can scroll down and request a call from a live customer service representative or call Progressive yourself at 1-877-776-4266.

Step #11 – Get Your Quotes

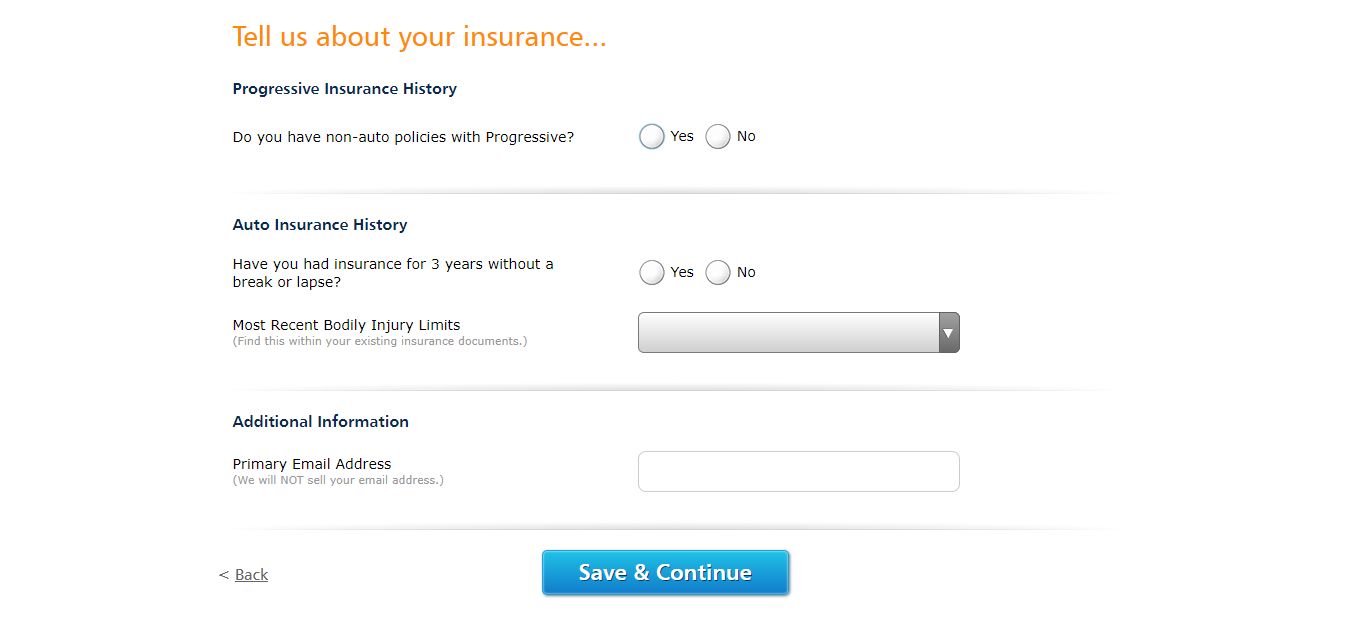

Shortly after entering your email, you’ll receive your personal car insurance quotes from Progressive, but wait! There’s still some more work to be done before you buy coverage.

Step #12 – Go Mobile

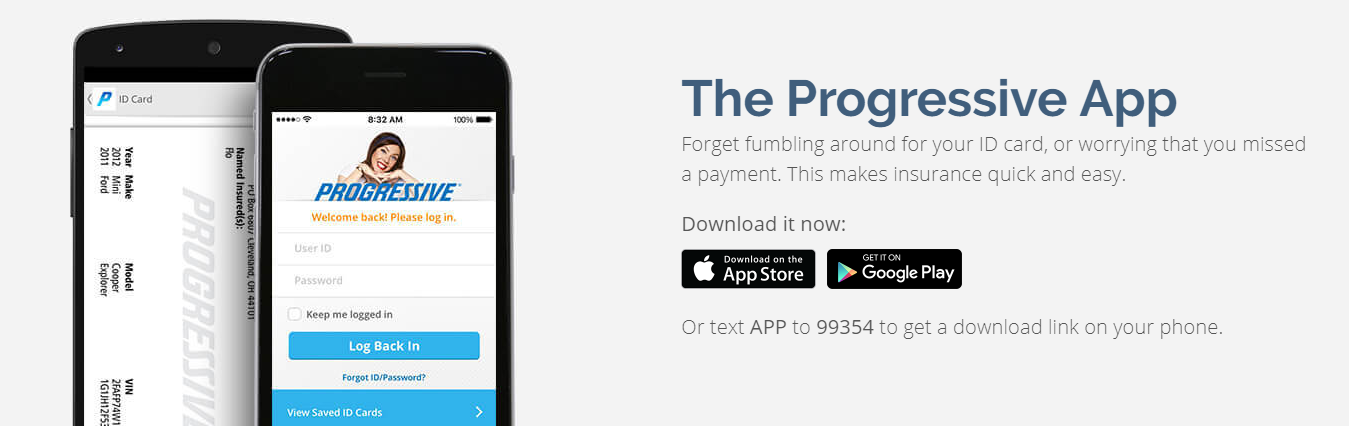

Most of the features here are for members who want to manage their coverage effectively; you can view policy details, pay your premiums, report a claim, talk to an agent, get roadside assistance, and find a Service Center.

You will then be given additional information after your quote, as well as the option to purchase a policy from Progressive. As a reminder, here is what you’ll need to apply.

Progressive Requirements for Insurance Quote

| Information | Required? |

|---|---|

| Social Security Number | Yes (used to check credit scores) |

| Driver's License | No |

| Vehicle Identification Number | No |

| Contact Information (email, address, etc.) | Yes |

| Driver's History | Yes |

| Vehicle Information | Yes |

To get as accurate a quote as possible, be sure to fill out all required information about your vehicle and driving record.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Seeing Other Car Insurance Rates When Shopping on the Progressive Website

Comparing car insurance rates is very important when looking for coverage, as there are many different factors that you should consider, especially for a Tesla driver.

However, going to many different websites or calling different companies can be both tedious and confusing.

Progressive simplifies the car insurance shopping process by helping you see different quotes from various companies right on the same website, and in a very short amount of time.

After you complete an online Progressive car insurance quote, you can choose to compare car insurance rates.

Read more: How do you compare multiple car insurance quotes online?

Once you answer some additional questions, you will see the rates from other main insurance companies in a couple of minutes.

Progressive’s Name Your Price Tool

The Name Your Price® program allows you to name the amount you want to pay for insurance, and Progressive creates an insurance policy based on that amount.

To utilize this, you go through three steps:

- Get a Quote – You’ll give them some necessary information about yourself and your vehicle to determine the lowest and highest possible prices you could get

- Use the Name Your Price Tool – After you’ve gotten all of your information in on your quote, you’ll see a Name Your Price option on the page for you to select

- See your coverage options and purchase – You’ll then see all of your coverage options, you can even adjust your coverages to get the policy you desire.

Read more: Progressive Name Your Price Tool Review: Compare Rates, Discounts, & Requirements

How the MyRate Tool Works

The way Progressive works is that you must first apply for coverage. Upon applying for coverage, you will receive a quote.

If you decide to purchase insurance from Progressive, you are then given the option of signing up for the “MyRate” tool. If you sign up for the tool, Progressive will give you a 10% discount on your first-term premium. Then, you are charged $30 for every term to cover the measuring device that is placed in your vehicle.

The device will provide a reading of how, how much, and when you drive.

According to Progressive, the measuring device can save you up to 25% on your policy or cost you up to 9% more depending on driving habits and patterns.

If you do some research, you’ll find proof on the Internet that MyRate from Progressive is saving people money on their auto insurance.

MyRate Program Availability

The MyRate program is only available in certain states, according to Progressive. Every state’s insurance requirements and minimum rates vary. Insurance companies can only discount certain amounts and still meet insurance regulations.

Insurance companies are required to charge a certain minimum rate for insurance.

Insurance companies must keep enough reserves on hand in case of catastrophic payouts. If they charge too little, the reserves will not grow or will become depleted. In certain states, there is less leverage to adjust rates.

Another factor to why the tool is only available in certain states is that insurance discounts must first be approved by the state’s insurance department before the company can market it to potential policyholders.

Progressive is currently working on receiving approval from other states’ insurance departments so that they can market the MyRate tool in these additional markets.

If MyRate Program Differs From Other Discounts

The MyRate program is not any different than any other discount offered by an insurance company. For instance, most insurance companies will give you a discount if you drive less than the national average.

Most insurance companies will also give you a discount on how you drive. You can get a lower premium for being a good driver with almost any insurance company.

Lastly, many insurance companies will give you a lower premium if you drive at off times. If you do not drive in rush hour every day for miles to the office, there is a pretty good chance your insurance will be lower than someone who does.

Naming Your Own Price Without the MyRate Device

According to Consumer Reports, you can also name your price without the MyRate tool. Progressive allows you to name your own price by entering an amount in a toolbox after the quote has been generated.

However, the website will not allow you to go below a certain level due to industry regulations.

Also, as your amount is adjusted, so is your coverage. Your price will get lower as the insurance coverage decreases or as your car insurance deductible increases.

Naming Your Own Price With Another Company

You can name your own price with any insurance company but with certain restrictions. Again, insurance companies are regulated by how much or how little they can charge.

You can lower your premiums by adjusting your coverage. A few adjustments to coverage can save you hundreds of dollars.

You should also ask for or research possible discounts for car safety features, driver’s education courses, good student discounts, marital status, or bundling of coverage.

Essentially, when you make these adjustments, you are naming your own price in the insurance industry. After all, you are determining the minimum required coverage for the lowest amount of money.

Remember you should always receive at least three quotes when shopping for car insurance. You should always compare the cost of coverage and be sure you purchase insurance from a reputable company.

Ready to start saving on your car insurance?

Just enter your ZIP code below to get the best rates in your area using our free online tool.

Progressive’s Financial Ratings

How good is Progressive insurance? All companies advertise how much better they are than the competition. But let’s see what multiple independent agencies say about Progressive and if it’s the right company for your insurance needs. Comparing the pros and cons is an important factor in determining which auto insurance company is best for you.

Progressive Financial Ratings

| Agency | Rating |

|---|---|

| AM Best | A+ (Superior) |

| Better Business Bureau | A (Very Good) |

| Moody's | A2 (Good) |

| S&P | AA (Very Strong) |

Progressive AM Best

An AM Best rating measures the financial stability of a company, with A++ being the highest rating possible. Since Progressive has an A+ rating, it means the company has a stable financial future.

Progressive Moody’s

Moody’s rating looks at how well a company can pay off its debts (its creditworthiness). Progressive’s A2 rating falls into the P-2 category, meaning the company has a “strong ability to repay debts and has a predictable, stable future.”

Progressive Standard and Poor’s (S&P)

S&P’s rating of Progressive is good, though the best grade is AAA. This AA rating means that Progressive has a strong capacity to meet financial commitments. It differs from the highest-rated companies by only a small degree.

Progressive Better Business Bureau

This rating looks at multiple aspects of a business, although the most critical element is the company’s complaint history. A complaint history shows how satisfied customers are with the service they receive.

Since A+ is the highest rating the BBB gives, the Better Business Bureau views Progresive A as better than most but needs improvement.

Progressive J.D. Power

Another essential rating to look at when searching for an insurance company is customer satisfaction levels. J.D. Power rates companies solely on customer satisfaction levels. Progressive received a score of 815 in providing a satisfying purchase experience, ranking it ninth among auto insurers.

Progressive Consumer Reports

| Claims Handling | Score |

|---|---|

| Total | 87 |

| Ease of Reaching an Agent | Very Good |

| Simplicity of the Process | Very Good |

| Promptness of Response - Very Good | Very Good |

| Damage Amount | Very Good |

| Agent Courtesy | Very Good |

| Timely Payment | Excellent |

| Freedom to Select Repair Shop | Very Good |

| Being Kept Informed of Claim Status | Very Good |

Progressive scores extremely well in many of the above categories.

Progressive Consumer Affairs

As for the Consumer Affairs’ rating of Progressive, the company has received 4/5 stars on 2,700+ reviews. While this is an exceptional overall score, there is room for improvement in multiple categories such as “simplicity of the process” and “agent courtesy.”

Progressive NAIC Complaint Index

Progressive Complaint Index

| Private Passenger Policies | 2021 | 2022 | 2023 |

|---|---|---|---|

| Total Complaints | 32 | 35 | 34 |

| Complaint Index (Better or Worse than National Index) | 0.0011 (better) | 0.0000 (better) | 0.0012 (better) |

| National Complaint Index | 1.47 | 1.53 | 1.51 |

The National Association of Insurance Commissioners (NAIC) measures the number of complaints a company receives. The company’s complaint ratio is 0.75 and below the national average of 1.16. One thing to consider is that your experience may be better or worse than these ratings based on your insurance needs.

Progressive’s Company History

Since its founding in Cleveland in 1937, Progressive has taken an innovative approach to auto insurance.

Progressive was the first company to:

- Create the first claims office that allowed customers to drive in

- Enable customers to pay in installments instead of annually

- Offer reduced rates to safe drivers

- Allowed individuals to compare Progressive rates with other car insurance companies online

The company has grown substantially over the last 75 years and has entrenched itself as the third-largest insurer in the U.S. In the 1990s, the company became the first auto insurer to establish a website.

According to Progressive’s Web site:

Between 1996 and 2005, Progressive grew an average of 17% per year, from $3.4 billion to $14 billion.

But many factors make up a company, including how it treats its customers, how it works within the community, and whether it is financially viable enough to weather volatile economic situations.

Why should you care about the history of Progressive? Because looking at a company’s history gives you essential data about how successful the company is and what its future is like.

Up next, we are going to dig into everything from Progressive market share to its awards and accolades.

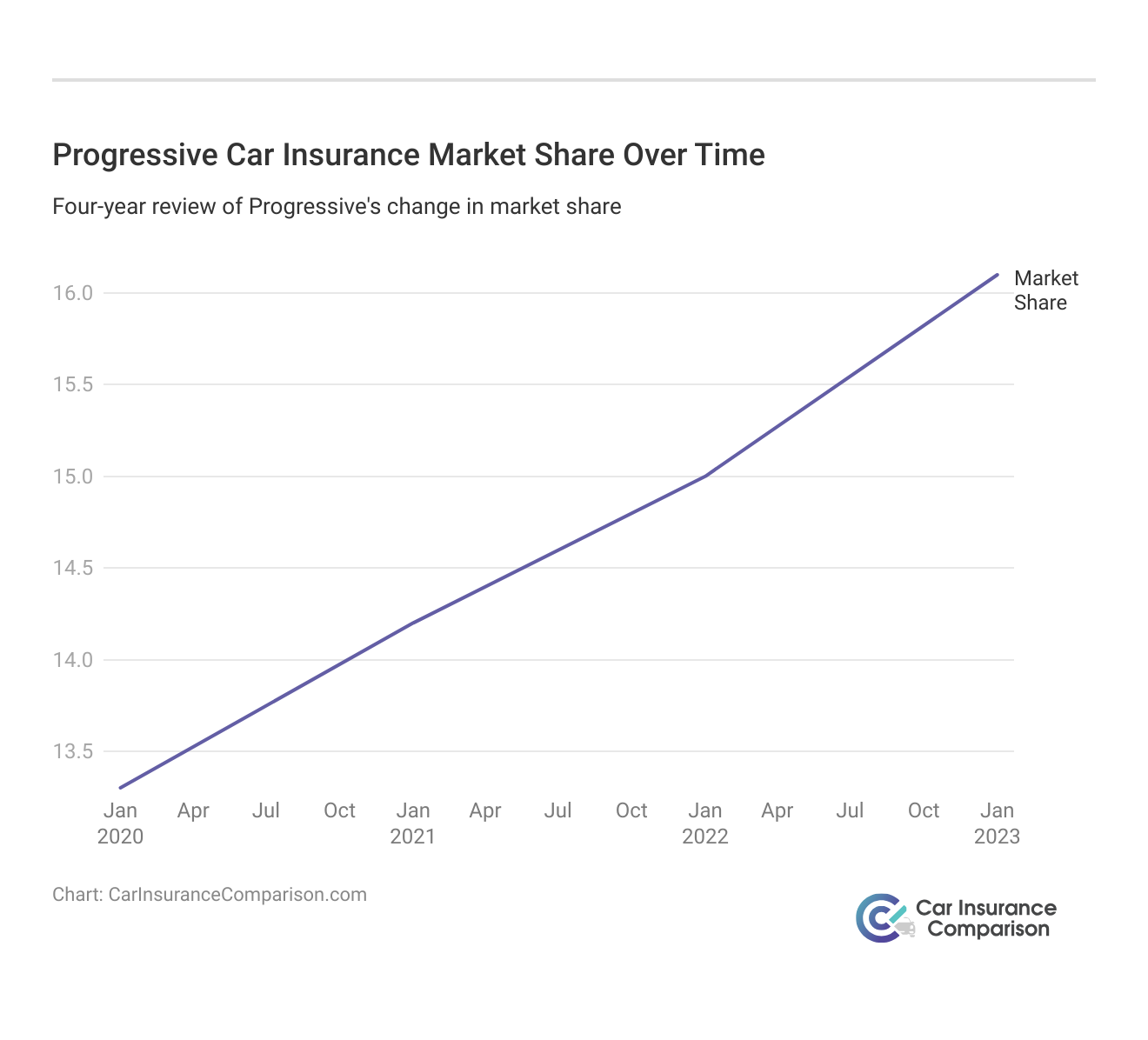

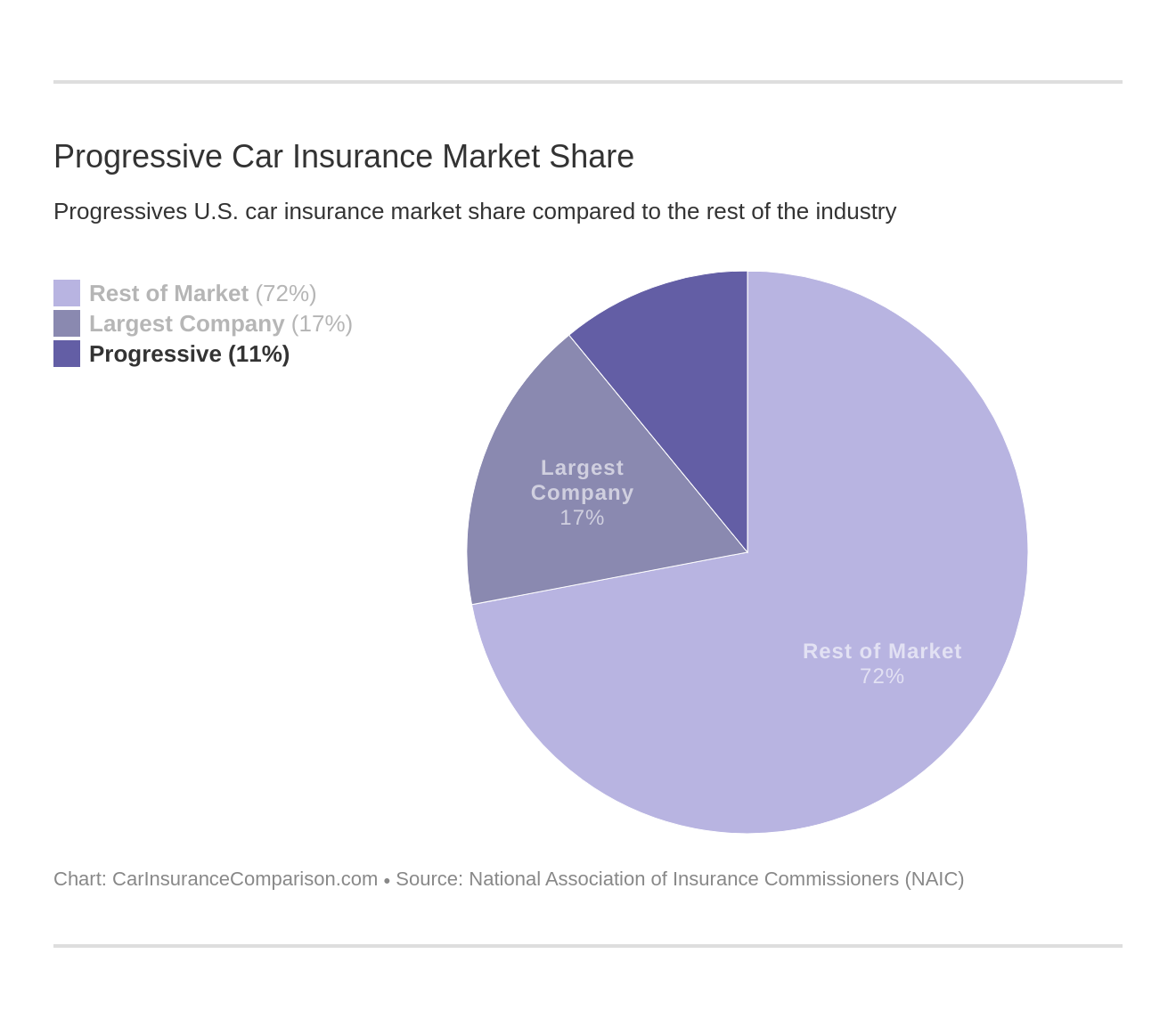

Progressive’s Market Share

Below, you will see NAIC’s data on Progressive’s market share for the last four years.

Progressive Market Share

| Year | Premiums Written | Market Share % | Loss Ratio |

|---|---|---|---|

| 2020 | $17,518,721 | 9% | 64% |

| 2021 | $19,611,981 | 99% | 66% |

| 2022 | $22,776,349 | 10% | 63% |

| 2023 | $27,058,768 | 11% | 62% |

Below you can see a chart of Progressive’s overall market share today.

Accessibility

Progressive has several options if you want to access information or get in touch with someone about your car insurance policy.

- Online — You can find quotes and more online at the Progressive website.

- Agents — You can talk to agents by texting, calling, or emailing.

- Apps — Progressive offers a mobile app, through which you can access your policy information and contact agents.

Commercials

Car insurance companies do whatever it takes to grab your attention through humor, what-if scenarios, and emotional bonding. Progressive is no exception.

Who doesn’t love Flo and Jaime? Flo has been the featured spokesperson for Progressive since 2008.

“Flo” in the Progressive Car Insurance commercials

Who is Flo from the progressive commercials? Lots of different companies have spokespersons that help deliver a message, but not all of them become memorable.

Flo, the Progressive car insurance girl, has become one of the most memorable characters captivating people nationwide. Flo, the often loved but sometimes hated Progressive Superstore cashier, is portrayed by Stephanie Courtney.

Courtney has been an actress for well over 20 years; but, it is only more recently that she began her career as the perky Progressive car insurance girl. Flo has become the Progressive spokesperson and has done an amazing job!

Stephanie Courtney, the Actress

So now we can answer the question, “Who is Flo?” Stephanie Courtney is an actress who was born on February 8, 1970, in Stony Point, New York. She began her acting career in the first grade and fell in love with it immediately.

Her sister, Jennifer Courtney, is also an actress. On November 25, 2008, Stephanie Courtney married Scott Kolanach, who is the lighting director for The Groundlings.

The Groundlings is a Los Angeles improv theater where Courtney is the main company member. Courtney still performs improv at The Groundlings, but she originally started doing stand-up up in New York.

After graduating from the Neighborhood Playhouse in New York City and doing mostly free theater, Courtney moved to Los Angeles where there were more acting opportunities.

It only took six months of stand-up comedy before she was discovered by her current manager.

Her first movie role was that of Kate in Sweet Bird of You in 1988. In that same year, she appeared in the television show Mr. Show with Bob and David. In 2000, Courtney’s television career started to gain momentum and by 2003 she was making more feature films.

In 2007 she played Gayla in The Heartbreak Kid along with Ben Stiller. You may have seen her in big television hits such as Angel, Everybody Loves Raymond, ER, and Without a Trace.

Her latest movie was in 2009, where she played Karen Balsac in Coco Lipshitz: Behind the Laughter. Most recently, Courtney appeared on Jay Leno.

In total, she has had more than 60 movie and television appearances, which does not include all of her commercials or live shows.

Courtney was awarded the Copper Wing Award in 2003 for Best Ensemble Acting. She shared the award with her co-stars of Melvin Goes to Dinner.

Flo, the Progressive Car Insurance Spokesperson

The character of Flo the Progressive girl was born sometime in 2007 and is played by Stephanie Courtney in a series of television commercials for Progressive car insurance.

Flo’s role is that of a cashier selling Progressive car insurance in a bright, white insurance retail store. Capturing the attention of viewers everywhere, Progressive was happy to sign another contract for 12 commercials with Courtney back in 2008 and then again in 2009.

After two hours of getting her hair teased and her makeup applied, Courtney is transformed into her character of Flo.

Merriya Valleri Insurance and Finance Writer

Although the Progressive car insurance girl is a scripted character, Courtney is allowed to add some improvisation to the role, letting the silly side of the actress spill onscreen a bit.

It seems the big debate about Flo is why she is so appealing. She has been described as cute, perky, comical, and sexy in a naughty schoolgirl way. She has also been blasted as dumb and annoying.

However, statistically, the latter group is in very low numbers and most people are quite fascinated with her.

The debate is mostly about what makes Flo so attractive and likable. Some attribute it to her appearance, with the retro look and stark contrasts. Others think her bubbly personality is charming enough to be appealing.

Perhaps the combination of the two is what makes her a growing sensation in the media. Whatever the reason is, the majority of people are mesmerized and want to see more of her. Is Flo from Progressive hot? Of course! Saving money on car insurance is always hot, right?

Progressive has done all that it can to capitalize on the sudden fame of its spokesperson. They even have a “Dress Like Flo” section of their website, which, honestly is a little ridiculous, but, hey, whatever teases your big hair.

But, there is no doubt that Flo from Progressive has become very, very popular — she even has over 5 million likes on her (Progressive official) Facebook page!

One essential ingredient missing in Progressive’s advertising is that Progressive relies solely on Flo to advertise its products. There is no catchy jingle or tagline (such as Farmers’ “we’ve seen it and covered it”).

While the lack of a catchphrase may make Progressive stick less in people’s minds, Progressive has done an impressive job of promoting its brand by developing a mascot that people can relate to when searching for car insurance.

Investment in the Community

Progressive is proud to give back to the community. The video below shows how the company is doing just that.

Community service shows a company cares, and Progressive has involved itself in several programs to give back to the community.

- The Progressive Insurance Foundation — Progressive matches employees’ donations to eligible charities.

- Volunteer Website — Progressive has an internal website where Progressive employees can search and find volunteer opportunities.

- STEM Progress Program — Progressive has a program where employees visit schools and help teach skills using insurance concepts.

Progressive also makes an effort to be socially responsible in maintaining a sustainable environment, helping others, and ensuring a better future for generations to come.

Progressive’s Positioning for the Future

Here’s an interview with CEO Tricia Griffith who explains what’s ahead for the company.

Working at Progressive

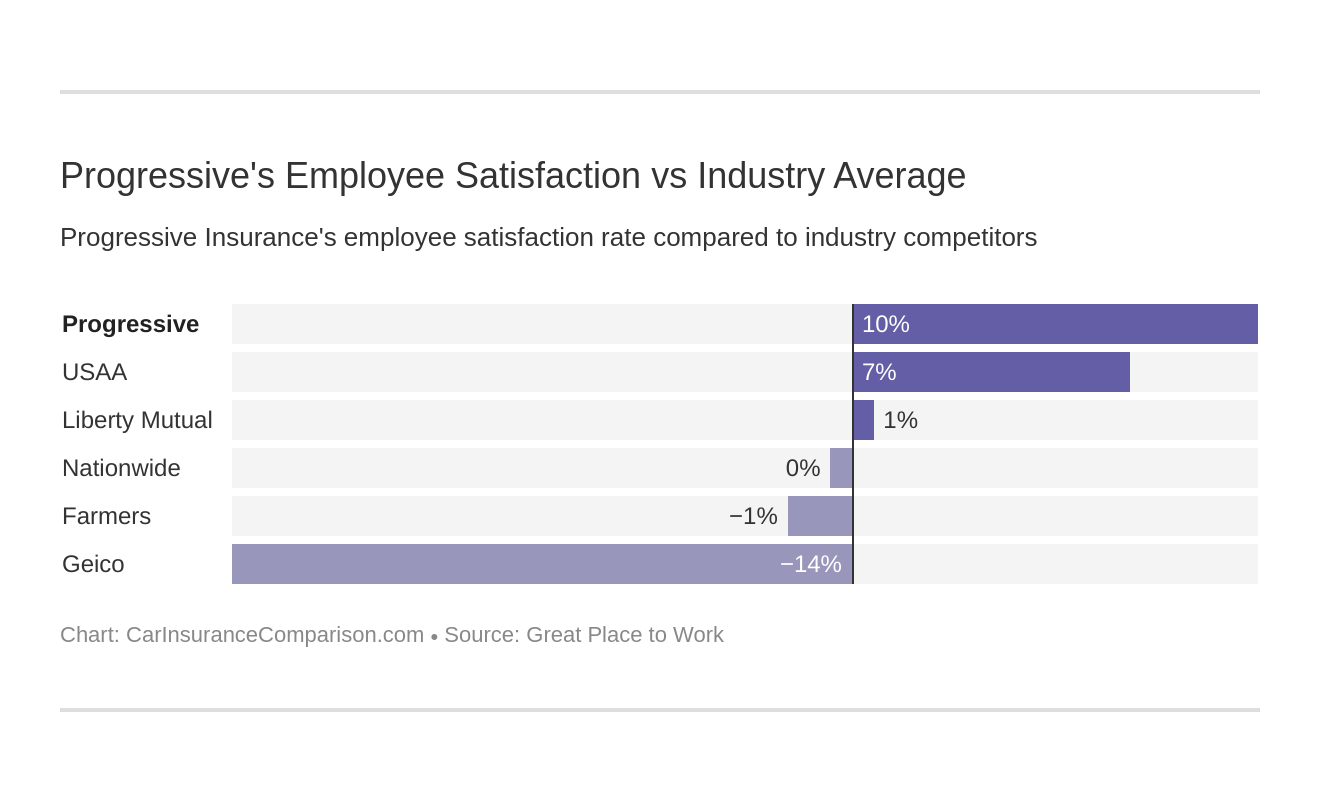

Let’s take a look at what employees think of Progressive. This will give us insight into the company’s values and employee satisfaction levels.

Let’s start by looking at employees’ experience ratings according to A Great Place to Work.

Progressive Employee Percentage by Statements

| Statement | Employee Percentage in Agreement |

|---|---|

| When you join the company, you are made to feel welcome. | 97% |

| Management is honest and ethical in business practices. | 93% |

| I am given the resources and equipment to do my job. | 93% |

| I am proud to tell others I work here. | 93% |

| People here are given a lot of responsibility. | 92% |

Numbers don’t lie. At Progressive, 91% of the company’s employees say that it’s a great place to work.

Here are Glassdoor’s ratings.

- Progressive received 3.7 stars out of five (from over 2,000 reviews)

- 70% of employees would recommend Progressive to a friend

- 91% of employees approve of Progressive’s CEO

Positive reviews about Progressive mention a great work environment, great people, and excellent benefits. Dissatisfied reviews say factors such as long hours, little work/life balance, and the difficulty of working in Progressive’s call center.

Awards and Accolades

Let’s take a look at the most recent awards and accolades Progressive has earned.

- Glassdoor’s Top CEOs Award in 2018, 2017, and 2014

- Multiple awards for advertising and website/app innovation

Progressive has also earned several awards from Great Places to Work.

Progressive Awards and Accolades

| Year of Award | Award |

|---|---|

| 2023 | #3 in Best Workplaces in Financial Services & Insurance |

| 2023 | #28 in Best Workplaces in Texas |

| 2023 | #64 in Fortune 100 Best Companies to Work For |

| 2022 | #5 in Best Workplaces in Financial Services & Insurance |

| 2022 | #21 in Best Workplaces in Texas |

| 2022 | #55 in Fortune 100 Best Companies to Work For |

| 2021 | #7 in Best Workplaces in Financial Services & Insurance |

| 2021 | #18 in Best Workplaces in Texas |

| 2021 | #68 in Fortune 100 Best Companies to Work For |

| 2020 | #8 in Best Workplaces in Financial Services & Insurance |

| 2020 | #19 in Best Workplaces in Texas |

| 2020 | #70 in Fortune 100 Best Companies to Work For |

The company has a long history of valuing diversity and inclusion and continues to operate on those principles.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Design of Website/App

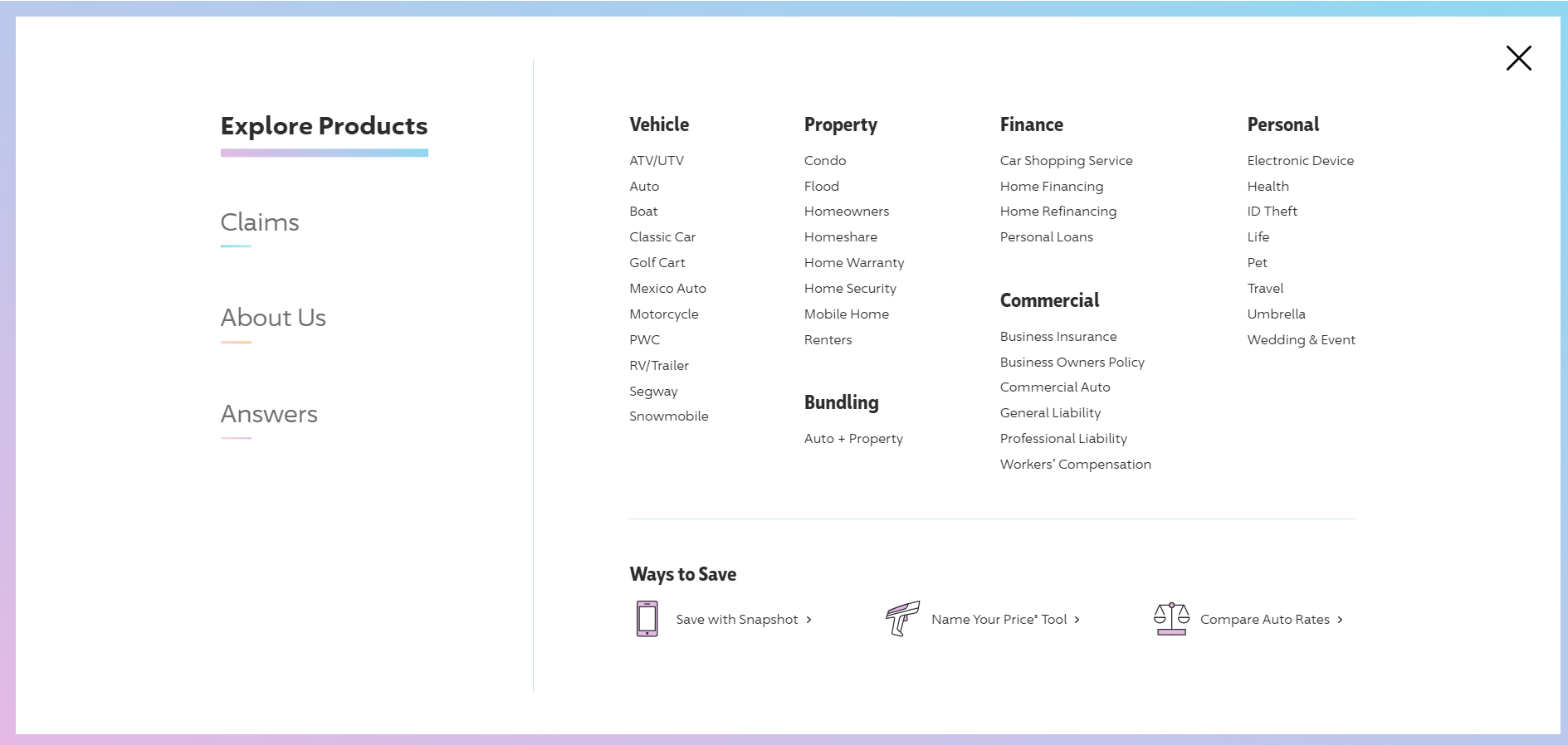

While other insurance company websites and apps may be difficult to navigate, Progressive’s is relatively simple and easy to use. On the website, it is easy to find whatever information you’re searching for. Just click from any of the categories on the drop-down menu and go.

At the top of the page, you will see tabs that drop down into menus with more choices. The Explore Products tab will give you a full breakdown of what Progressive offers and lead you to more information.

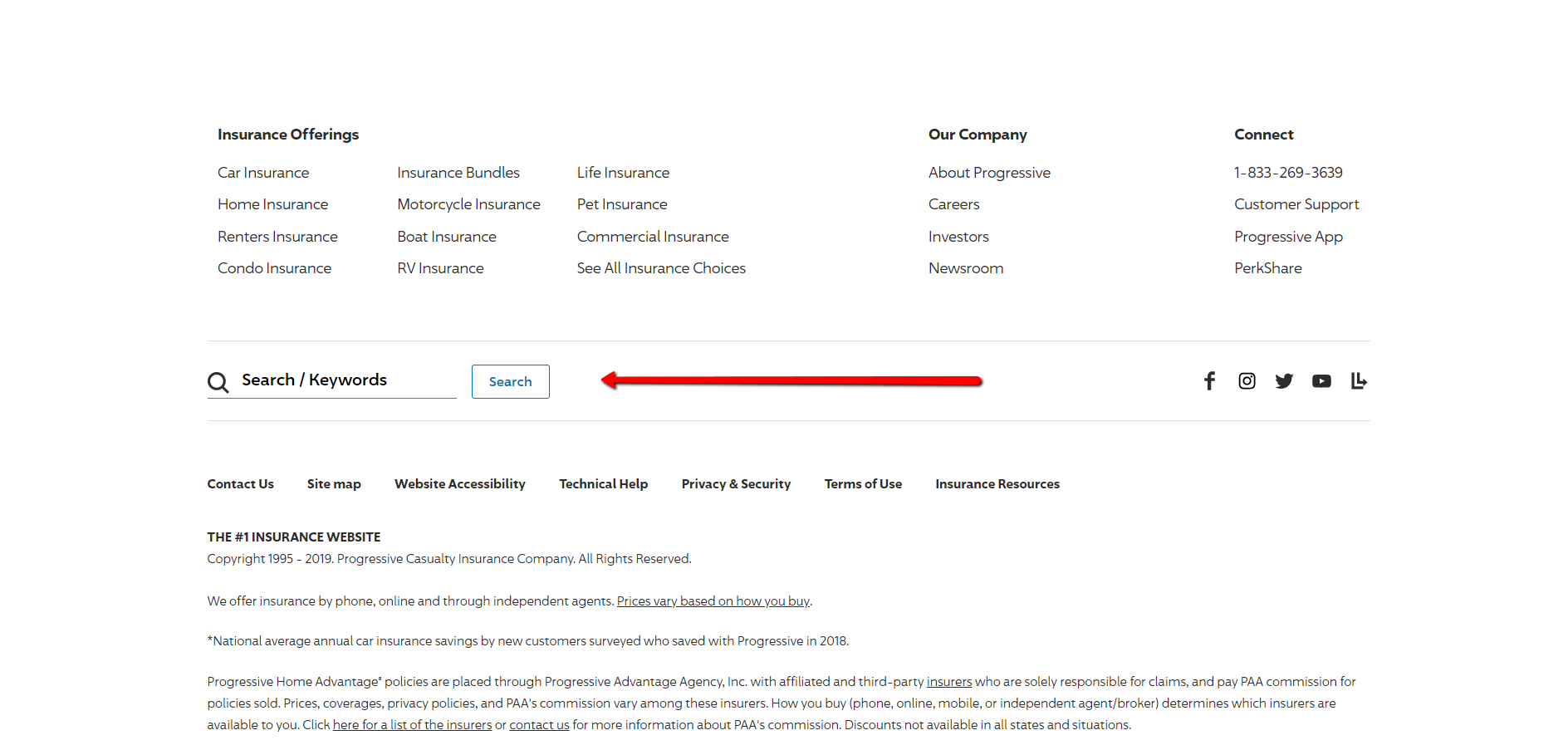

If you can’t easily find your answer in the drop-down options, scrolling down to the bottom of Progressive’s webpage will show you a search bar.

Let’s move on and look at Progressive’s main app.

The app received 3.4 stars out of five (based on 1.3k ratings). Complaints about the app include the following.

- Can’t use debit cards for autopay

- Trouble signing in with passwords

Other App Features

- View your coverages, discounts, ID cards, documents, and policy details

- Report a claim and add pictures

- Pay bills and view billing history

- See Snapshot progress

- Get a quote or make a policy change

- Request roadside assistance

- Contact your agent

One key component missing from the app is the inability to check the status of your claim. For the most part, though, you can check a variety of things on the app.

Pros and Cons

Now that we have covered everything you need to know about Progressive let’s check out the biggest takeaways in terms of pros and cons.

Progressive Pros and Cons

| Pros | Cons |

|---|---|

| 24/7/365 Support | High rates for poor driving history |

| Numerous discounts to help drivers offset cost of insurance | High rates for poor credit history |

| Comparable rates despite commute distance in most states | Accident forgiveness program is a separate cost |

| Customer Satisfaction ratings higher than other insurers | Rates higher than state average in several states |

| Loss ratio is stable | Mobile app ratings spotty based on customer experience |

| One of the only insurers who offers pet protection | Financial strength ratings not as high as other insurers |

| "Name Your Price" option to cater your budget to the policy you can actually afford | Not as many discounts as other competitors |

| Snapshot program to personalize your rate your YOUR driving | Supplemental Coverage options harder to find |

| Reputation of helping high-risk drivers | Teen driver rates higher than other insurers |

As we can see, there are plenty of benefits to choosing Progressive’s car insurance with a handful of reasons being their friendly and reliable customer support, and a plethora of ways to customize your savings.

Read more:

- Progressive vs. AAA Car Insurance Comparison

- Progressive vs. Farmers Car Insurance Comparison

- State Farm vs. Progressive Car Insurance Comparison

- Progressive vs. Travelers Car Insurance Comparison

Other Insurance Products From Progressive

Progressive offers many different insurance products, including coverage for your home, motorcycle, and RV, as well as commercial and renters insurance.

In most cases, Progressive will offer a multi-policy discount if you have more than one item or property insured through the company.

These multi-policy discounts can be as much as 10% off the total cost of your insurance premiums.

In addition, having all of your insurance policies with one company can make managing your costs easier.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Bottom Line: Progressive Car Insurance Review

Is Progressive good car insurance? Our Progressive auto insurance review has shown you everything you need to know about Progressive, so you can decide for yourself whether they are right for you. With Progressive, Flo and Jamie have urged us to bundle and save in every way imaginable.

But don’t focus too much on that bundle that you end up paying too much for your car insurance. One thing to consider is that everyone’s needs are different, and rates can vary significantly based on individual factors.

As thorough as this guide is, we still strongly suggest that you shop around with your personal details and specific vehicle information before you choose an auto insurance provider.

Now that you have read our Progressive insurance review, get quotes today to find out how much you could save on car insurance. Get started by simply entering your ZIP code in our free comparison tool.

Frequently Asked Questions

What is Progressive car insurance?

Progressive auto insurance provides coverage for vehicles, offering various types of auto insurance policies to meet different needs.

Is Progressive a reputable car insurance company?

Progressive auto insurance reviews found the answer is yes. Progressive has received the highest financial strength rating from the A.M. Best Company and an A rating from the Better Business Bureau since 1995.

How reliable is Progressive insurance?

Is Progressive insurance reliable? Yes, according to Progressive insurance reviews. Progressive earned a 1.97 score, which is .97 above the national average, on the NAIC Insurance Claims Complaints index. And they scored 870 out of 1,000, just below the industry average, for J.D. Power’s 2023 Insurance Claims Satisfaction.

Are people happy with Progressive?

The provider’s customers are generally satisfied: For example, in one Progressive auto insurance rating, Progressive came in third (behind Amica and Geico), in J.D. Power’s 2023 survey of digital customer experience. See our article Amica vs. Progressive Car Insurance Comparison.

Who is better, Geico or Progressive?

While Geico edges out Progressive when it comes to lower rates and customer satisfaction, Progressive is better for high-risk drivers and those interested in usage-based insurance. See more in our article, Esurance vs. Geico vs. Progressive Car Insurance Comparison.

Where is Progressive car insurance available?

Progressive car insurance is available in all 50 states of the United States, including Washington, D.C.

What types of coverage does Progressive car insurance offer?

Progressive car insurance offers a range of coverage options, including liability coverage, comprehensive coverage, collision coverage, uninsured/underinsured motorist coverage, and more.

What are the benefits of Progressive car insurance?

Progressive car insurance offers benefits such as an A+ financial rating, savings programs, and multi-policy discounts of up to 10%.

Can I get a quote and purchase a Progressive car insurance policy online?

Yes, Progressive has a user-friendly website that allows you to get a quote and purchase a car insurance policy online.

You can compare that quote to other top-rated insurance companies with our free online comparison tool. Just enter your ZIP code to get started.

What are the most recent programs for Progressive auto to help save money?

Progressive has introduced the Snapshot® program, which offers up to a 30% discount based on monitored driving habits, and the Name Your Price® program, which creates a policy based on the amount you want to pay for insurance.

Does Progressive offer discounts on car insurance?

How can I file a claim with Progressive car insurance?

Can I get other insurance products from Progressive?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.