Best Acura Car Insurance Rates in 2026 (Check Out the Top 10 Companies)

Geico, State Farm, and Progressive have the best Acura car insurance rates. Geico's minimum rates for Acuras average $62/mo. Some Acura models will cost more to insure, with the Acura TL being one of the most expensive models. However, the best Acura companies offer discounts and affordable rates.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Luke Williams is a finance, insurance, real estate, and home improvement expert based in Philadelphia, Pennsylvania, specializing in writing and researching for consumers. He studied finance, economics, and communications at Pennsylvania State University and graduated with a degree in Corporate Communications. His insurance and finance writing has been featured on Spoxor, The Good Men Project...

Luke Williams

Published Insurance Expert

Melanie Musson is the fourth generation in her family to work in the insurance industry. She grew up with insurance talk as part of her everyday conversation and has studied to gain an in-depth knowledge of state-specific insurance laws and dynamics as well as a broad understanding of how insurance fits into every person’s life, from budgets to coverage levels. Through her years working in th...

Melanie Musson

Updated May 2024

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Acura

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Acura

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Acura

A.M. Best Rating

Complaint Level

13,283 reviews

13,283 reviewsGeico, State Farm, and Progressive have the best Acura car insurance rates.

Acuras are a premium car brand that varies in cost to insure depending on what model you own. Acura car insurance rates also change based on driver factors and your choice of insurance company. To find the best deal, you’ll need to compare Acura car insurance rates among the best car insurance companies.

Our Top 10 Company Picks: Best Acura Car Insurance Rates

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 15% | A++ | Good Drivers | Geico | |

| #2 | 10% | A++ | Customizable Policies | State Farm | |

| #3 | 5% | A+ | Budget Shopping | Progressive | |

| #4 | 20% | A+ | Pay-Per-Mile Rates | Allstate | |

| #5 | 10% | A | Add-on Coverages | Farmers | |

| #6 | 10% | A+ | Deductible Options | Nationwide |

| #7 | 12% | A++ | Military Families | USAA | |

| #8 | 8% | A | Accident Forgiveness | Liberty Mutual |

| #9 | 10% | A++ | Bundling Policies | Travelers | |

| #10 | 15% | A | Loyalty Rewards | American Family |

Continue reading to learn about how to find the best car insurance for Acuras, from what car insurance coverages to carry to tips on saving. Or, compare rates now with our free tool to find the cheapest Acura auto insurance rates.

- Geico has the best car insurance rates for Acuras

- Acura car insurance costs depend on several factors, including which model you drive

- Drivers can find affordable Acura car insurance with discounts and quotes

#1 – Geico: Top Pick Overall

Pros

- Good Drivers: Geico has some of the most affordable Acura car insurance rates for good drivers, reducing the cost of a Geico Acura policy.

- Online Tools: Geico focuses on digital policy management. Learn more in our Geico review.

- Financial Rating: Geico has the highest rating possible for its financial reliability and management.

Cons

- Customer reviews: Geico has some negative customer reviews.

- Add-On Coverages: Geico’s coverage lineup is missing some extras, like gap coverage.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Customizable Policies

Pros

- Customizable Policies: Local agents can help Acura owners customize their policies. See what the company offers in our State Farm review.

- Financial Rating: Acura owners can rest easy knowing the company has the highest possible rating for financial management.

- Drive Safe & Save: Acura owners could save up to 30% by enrolling in State Farm’s UBI program.

Cons

- Online Tools: State Farm’s online tools are more limited due to the availability of local agents.

- Bad Credit Rates: Acura owners with poor credit scores will have higher rates.

#3 – Progressive: Best for Budget Shopping

Pros

- Budget Shopping: Acura owners on a budget can use Progressive’s free Name Your Price tool.

- Snapshot: Progressive’s UBI program offers Acura owners savings of up to 30%.

- Coverage Options: Progressive has great coverage for Acuras, such as loan or lease payoff coverage. Learn more in our Progressive review.

Cons

- Snapshot Rate Increases: Poor driving in the program will raise rates.

- Customer Reviews: Progressive has negative reviews from customers complaining about claim processing.

#4 – Allstate: Best for Pay-Per-Mile Rates

Pros

- Pay-Per-Mile Rates: Pay for your Acura insurance by the mile with Milewise. Find out more in our Allstate Milewise review.

- Add-On Coverages: Acura owners can purchase extras like rental reimbursement coverage or roadside coverage. Learn more in our Allstate review.

- Discount Variety: Acura owners can reduce rates by applying for Allstate discounts.

Cons

- Customer Reviews: Customer complaints are higher at Allstate than at other companies.

- High-Risk Rates: Clean driving records will go a long way to keeping Acura auto insurance affordable at Allstate.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Farmers: Best for Add-On Coverages

Pros

- Add-On Coverages: Acura owners can add on options like breakdown assistance. Read more in our Farmers review.

- Various Discounts: Acura owners have numerous ways to save on their Acura insurance.

- Availability: Acura auto insurance is sold in every state.

Cons

- Online Tools: You’ll need to contact a Farmers’ representative for assistance with some actions.

- Customer Satisfaction: Some customers left poor reviews about Farmers’ customer service.

#6 – Nationwide: Best for Deductible Options

Pros

- Deductible Options: Choose from several deductible amounts for your Acura insurance policy at Nationwide.

- Pay-Per-Mile Rates: Pay for your Acura auto insurance by the mile with SmartMiles by Nationwide.

- Bundling Discounts: Purchase home or renters insurance from Nationwide, too, to save on Acura insurance. Find out more by reading about Nationwide car insurance discounts.

Cons

- High-Risk Rates: Drivers with a DUI will see higher Acura insurance rates.

- Limited Local Agents: Nationwide does lack local agents in some areas.

#7 – USAA: Best for Military Families

Pros

- Military Families: USAA has the most affordable Acura rates for military and veteran families.

- SafePilot: Acura owners participating in USAA’s UBI program could save up to 30%.

- Customer Service: USAA’s customer service is positively rated by a number of customers.

Cons

- Add-On Coverages: USAA offers fewer add-on options for Acura owners. Learn more in our USAA review.

- Eligibility: Acura owners who are service members or veterans are the only drivers allowed to purchase USAA insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Acura drivers with clean records may be forgiven an accident.

- RightTrack: Acura drivers participating in Liberty Mutual’s UBI program RightTrack could save on their policy.

- Customizable Policies: Acura drivers can adjust their policies as needed at Liberty Mutual. Read more in our Liberty Mutual review.

Cons

- Claims Satisfaction: Claims services have been rated poorly by a few customers.

- Telematics Tracking: Acura owners should be aware that RightTrack tracks driving data.

#9 – Travelers: Best for Bundling Policies

Pros

- Bundling Policies: Acura owners will get discounted auto insurance rates if they also purchase home or renters insurance.

- Availability: Acura owners can get Acura auto insurance in every state. Read more in our Travelers review.

- IntelliDrive Program: Participants could save up on their Acura insurance.

Cons

- Limited Local Agents: Acura customers should know that local agents are limited.

- IntelliDrive Rates: Poor driving in the Intellidrive program could increase Acura rates.

#10 – American Family: Best for Loyalty Rewards

Pros

- Loyalty rewards: Acura owners can get loyalty rewards for sticking with the company.

- Coverage Options: Acura owners have plenty of choices to add to their Acura policy, which you can learn about in our American Family review.

- Discount Variety: American Family has discounts for every type of Acura driver.

Cons

- Availability: Not as widely available in the U.S. as its competition.

- High-Risk Rates: Acura owners will get the best rates at American Family if they have clean driving records.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding Coverages for Acuras

Your car insurance rates are based partly on how much coverage you carry on your Acura. You will usually have the choice between full or minimum coverage.

While it can be tempting to carry the bare minimum to get cheaper rates, comprehensive and collision car insurance is usually advisable to pay for your Acura’s repairs after an accident. If you have a lease or loan on your Acura, you will be required to carry them.

Dani Best Licensed Insurance Producer

Both these coverages will protect you from various collision types and damages. Comprehensive car insurance covers a variety of situations, from animal collisions to weather damages, whereas collision coverage covers collisions with other vehicles and objects. So, if you carry both coverages, your Acura’s repairs will be covered in a number of different accident types. Below, you can see the difference in coverage rates at the best companies for Acura insurance.

Car Insurance Monthly Rates for Acura by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $67 | $148 |

| American Family | $71 | $140 |

| Farmers | $76 | $145 |

| Geico | $62 | $154 |

| Liberty Mutual | $68 | $138 |

| Nationwide | $73 | $152 |

| Progressive | $79 | $157 |

| State Farm | $64 | $135 |

| Travelers | $75 | $142 |

| USAA | $80 | $151 |

Besides collision and comprehensive coverage, the types of car insurance that most drivers will have to carry due to state regulations include liability insurance, medical insurance, and uninsured/underinsured insurance.

- Liability insurance helps pay others’ accident bills if you cause a wreck that injures others or damages their property.

- Medical payments insurance helps pay for your medical bills if you are injured in a car accident.

- Personal injury protection helps pay for your medical bills, lost wages, child care, and more if you are injured in a car accident.

- Underinsured motorist insurance helps pay your accident bills if the driver who hit your Acura doesn’t have enough insurance coverage.

- Uninsured motorist insurance helps pay your accident bills if the driver who hit your Acura doesn’t have car insurance.

You won’t have to carry all of the above coverages, but most states require at least a few. Make sure to check your state’s requirements to see what car insurance you absolutely have to carry on your Acura, and then you can make a decision on what other car insurance coverages you are willing to purchase.

Average Acura Car Insurance Rates

So how much will standard car insurance coverages cost for an Acura? The table below displays average rates for full coverage policies for Acura models.

Acura Car Insurance Average Rates by Model

| Model | Rates |

|---|---|

| Acura TLX | $156 |

| Acura RLX | $171 |

| Acura RDX | $129 |

| Acura NSX | $239 |

| Acura MDX | $147 |

| Acura ILX | $143 |

Part of what rates are based on is the model of Acura you own. If you own an Acura NSX sports car, you will have more expensive car insurance rates than if you own a different Acura model.

View this post on Instagram

For example, if you have an Acura RDX, your Acura RDX insurance cost will be half that of Acura NSX owners. Insurance companies will also base your car insurance rates on your age and driving record. The reason younger drivers are charged more is that they don’t have as much driving experience as older drivers.

Read more: Compare Young Driver Car Insurance Rates

Drivers with at-fault accidents, DUIs, or traffic tickets are more likely to file another claim in the future. Therefore, car insurance companies charge these drivers more.

How to Save on Acura Car Insurance Rates

If you own a more expensive Acura model or simply want to reduce your rates, there are a few things to consider trying. First, if you are happy with your insurance policy, see if you can reduce your rates at your current company. One of the ways you can do this is by raising your deductible.

This is a quick and easy way to reduce your rates as you agree to take on more financial responsibility for repairs in a claim.

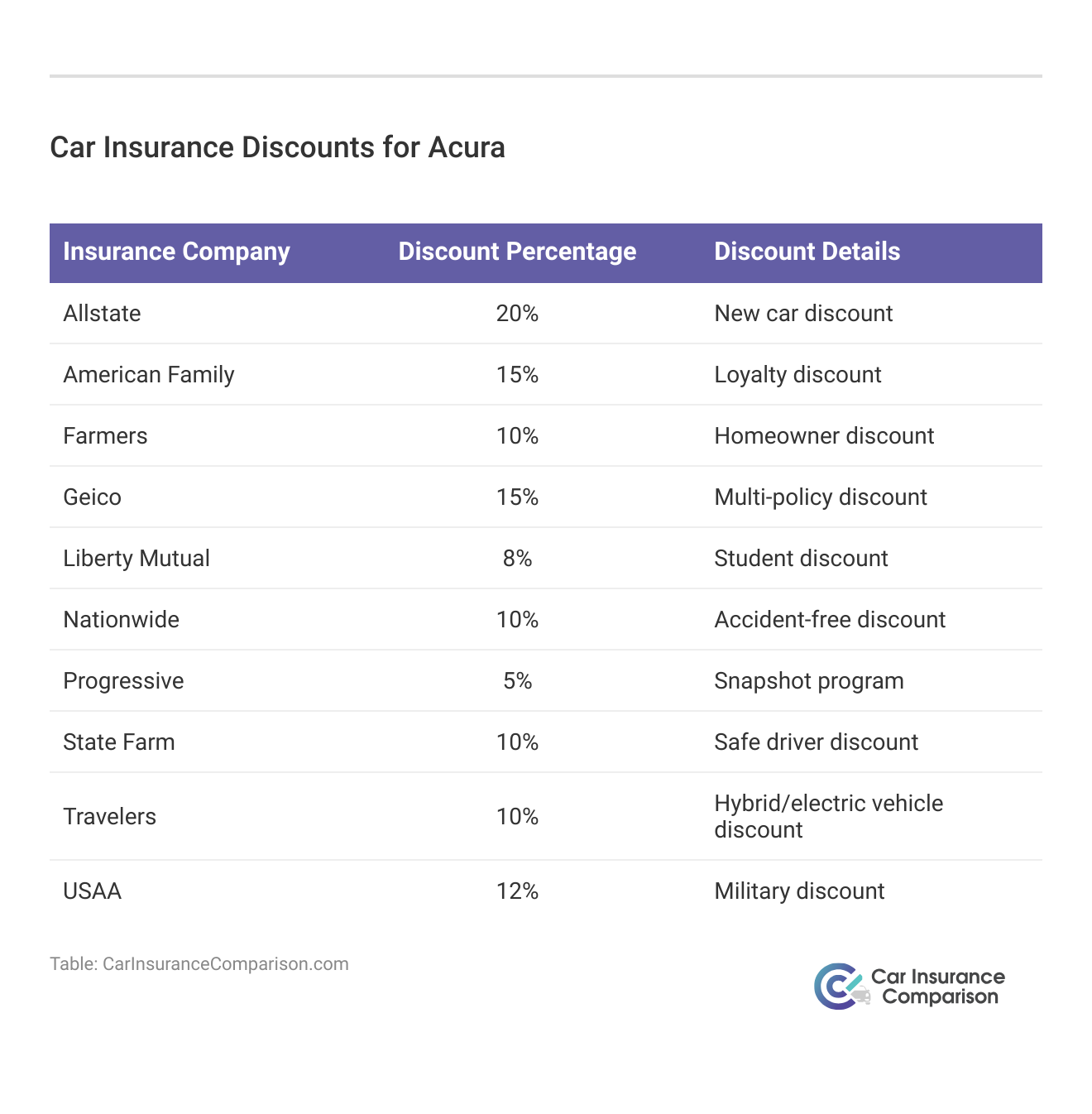

However, if you already have an extremely high deductible, you probably shouldn’t raise it anymore and might want to look at our guide about how to lower your car insurance deductible. Instead, you should look into car discounts to see if you missed any discounts that could be applied to your policy and reduce your rates.

There may be discounts you weren’t aware of because insurance companies don’t automatically apply all discounts unless you provide proof that you qualify. For example, you would have to provide a certificate of completion for a defensive driving course in order to qualify for a defensive driving discount.

If you are unable to reduce your car insurance rates at your current company, then the best option is to see if a different company offers a cheaper rate. Just make sure that you consider a company’s reputation and coverage options in addition to their rates before you sign up with a new company. You can get quotes directly from companies like Geico.

Saving money on car insurance is always great, but if the new company is known for being difficult in paying out claims or has frustrating customer service, it may not be worth the extra hundred dollars saved a year.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Final Word on the Best Acura Car Insurance Rates

Some Acuras will be more expensive to insure, especially if you own a sports model Acura. Most drivers should be able to find savings on their Acura car insurance by looking for car insurance discounts, increasing deductibles, or getting quotes from the best car insurance companies for Acuras.

Drivers who want to jump right into comparing rates to find the best deal for their Acura can use our free quote comparison tool. It helps drivers find the best car insurance rates in their area so they can start saving immediately.

Frequently Asked Questions

Are Acuras expensive to insure?

Most Acura models have normal average insurance rates, neither extremely high nor extremely low. However, a few more expensive models, such as the Acura NSX, will cost more to insure on average than the Acura cheapest cars. If you have a more expensive model, make sure you are looking for car insurance discounts and frequently evaluating car insurance rates.

Is buying a used Acura worth it?

Buying Acura used cars can be cheaper than buying new Acuras, making it a cost-effective way to buy an Acura. If you want to shop for the cheapest Acura car insurance today, enter your ZIP into our free tool to compare Acura quotes from companies in your area.

Is it cheap to maintain Acuras?

Most Acura models are not that expensive to maintain. However, the most expensive Acura cars like the Acura NSX will cost more on average to maintain. This is because if replacement parts are needed for maintenance, the parts will be more expensive to purchase than for cheaper models (learn more: Does car insurance cover non-accident repairs?).

Why is Acura car insurance so expensive?

Although many factors affect Acura car insurance rates, one of the main reasons for higher prices is that it’s a luxury brand. Luxury vehicles cost more to repair and replace, which leads to higher rates.

Should you buy gap insurance for an Acura?

You should buy gap coverage for an Acura if you’re taking a loan out on your car. Gap insurance pays the difference between what you owe on your loan and your vehicle’s value. It can save you from paying for a car you no longer own if you total your Acura.

Do you need full coverage for an Acura?

If you have a loan or lease on your car, you’ll probably need full coverage Acura car insurance. Even if you own it outright, however, it’s often advisable to buy more than the minimum insurance required in your state. Acuras are luxury, valuable cars, and many drivers choose to protect them with the best full coverage car insurance.

What are the best car insurance companies for Acuras?

While rates vary from person to person, Geico, State Farm, and Progressive are often the best car insurance companies for Acuras.

Is Acura a luxury car?

Yes, Acura is considered a luxury brand.

Do you need luxury car insurance for Acuras?

Although Acuras are luxury cars, you can buy regular car insurance to cover them. Some car brands, like Lamborghini and Ferrari, often need specialty car insurance for luxury cars, but Acuras do not (read more: Best Insurance for Luxury Cars).

Is Acura Japanese?

Acura is owned by a Japanese company, but most Acuras are produced in the U.S.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.