Best Land Rover Car Insurance Rates in 2026 (We Suggest These 10 Providers)

Liberty Mutual, Farmers, and Travelers have the best Land Rover car insurance rates. While Land Rovers are considered luxury cars, their rates are lower than those of many other luxury brands, such as Mercedes. Liberty Mutual has the cheapest minimum Land Rover insurance at an average of $74/mo.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Scott W. Johnson

Updated May 2024

3,792 reviews

3,792 reviewsCompany Facts

Full Coverage for Land Rover

A.M. Best Rating

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviews 3,072 reviews

3,072 reviewsCompany Facts

Full Coverage for Land Rover

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviews 1,733 reviews

1,733 reviewsCompany Facts

Full Coverage for Land Rover

A.M. Best Rating

Complaint Level

1,733 reviews

1,733 reviewsLiberty Mutual, Farmers, and Travelers have the best Land Rover car insurance rates.

As one of the most iconic British brands, Land Rover is a popular choice for drivers looking to mix luxury with off-road capabilities. Luxury car insurance always costs more than standard coverage, but Land Rover drivers typically see slightly more affordable rates.

Our Top 10 Company Picks: Best Land Rover Car Insurance Rates

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | A | Customizable Polices | Liberty Mutual |

| #2 | 15% | A | Local Agents | Farmers | |

| #3 | 10% | A+ | Usage Discount | Travelers | |

| #4 | 15% | A++ | Accident Forgiveness | Nationwide |

| #5 | 15% | A++ | Many Discounts | State Farm | |

| #6 | 18% | A++ | Military Savings | USAA | |

| #7 | 20% | A+ | Online Convenience | Progressive | |

| #8 | 19% | A+ | Add-on Coverages | Allstate | |

| #9 | 20% | A | Student Savings | American Family | |

| #10 | 15% | A++ | Good Drivers | Geico |

The primary reason Land Rover car insurance rates are cheaper is that most models usually have high safety ratings. On the other end of the scale, luxury car insurance costs more because the vehicles cost more to repair and replace. With some models costing over $100,000, Land Rovers are expensive to repair or replace.

Read on to learn more about Land Rover car insurance, including how to find the cheapest rates. Then, use our free tool to compare Land Rover car insurance quotes from multiple companies to find the best policy for your vehicle.

- Liberty Mutual is the best Land Rover insurance company

- British-based Land Rover is known for its reliability and off-road capabilities

- As a luxury brand, Land Rover car insurance rates are higher

- Land-Rover Car Insurance

#1 – Liberty Mutual: Top Pick Overall

Pros

- Customizable Policies: Customize your Land Rover car insurance policy with add-on coverages and adjustable deductibles. Learn more in our Liberty Mutual review.

- Accident Forgiveness: Land Rover drivers who haven’t filed a claim in years can qualify for accident forgiveness.

- Discount Options: Liberty Mutual offers plenty of discounts to Land Rover Owners.

Cons

- Claims Satisfaction: Reviews for claims satisfaction aren’t always positive.

- DUI Rates: Land Rover owners with DUIs will find rates less affordable.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Farmers: Best for Local Agents

Pros

- Local Agents: Land Rover owners can get help with their policies from local agents.

- Adjustable Deductibles: Drivers can adjust deductibles to lower their Land Rover car insurance rates.

- Discount Options: Land Rover owners can choose from several discounts.

Cons

- Customer Reviews: Not all customers are satisfied with the level of service they receive.

- DUI Rates: DUI drivers will have more expensive Land Rover rates. Read more about costs in our Farmers review.

#3 – Travelers: Best for Usage Discount

Pros

- Usage Discount: Drivers can participate in the IntelliDrive program to save up to 30% on their Land Rover auto insurance.

- Coverage Options: You can buy less common options like rideshare insurance for your Land Rover. For a full list, read our Travelers review.

- Multi-Policy Discount: Buy home or renters insurance along with your Land Rover car insurance for a discount.

Cons

- IntelliDrive Rate Increases: Bad drivers should skip the IntelliDrive program, which can increase rates.

- Customer Satisfaction: Land Rover owners should know that it’s not always rated highly.

#4 – Nationwide: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Land Rover claims-free drivers may qualify for accident forgiveness and other Nationwide car insurance discounts.

- Pay-Per-Mile Insurance: Great if you drive your Land Rover less than 10,000 miles per year.

- Simple Claims: Nationwide offers online claims filing.

Cons

- Telematics Tracking: Mileage-based insurance does track driving data.

- Availability: Land Rover drivers may not have auto insurance in their state.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – State Farm: Best for Many Discounts

Pros

- Many Discounts: Taking advantage of the many State Farm discounts will help drivers get affordable Land Rover car insurance rates.

- Local Support: Local agents can help Land Rover owners with their policies. Learn more in our State Farm insurance review.

- Coverage Options: Add practical coverages like roadside assistance for your Land Rover.

Cons

- Online Tools: Local agents provide most services, so online functions may be more limited.

- Credit Score Rates: Land Rover owners may see rate increases if they have poor credit scores.

#6 – USAA: Best for Military Savings

Pros

- Military Savings: USAA has some of the cheapest Land Rover car insurance rates for service members and veterans.

- Customer Service: Land Rover owners will receive highly rated customer service. Read more in our USAA review.

- Discount Options: Get additional savings on your Land Rover policy with discounts.

Cons

- Physical Locations: Services are mostly virtual due to a lack of physical branches with agents.

- Eligibility: Non-military or non-veteran drivers with Land Rovers can’t buy USAA coverage.

#7 – Progressive: Best for Online Convenience

Pros

- Online Convenience: Make changes to your Land Rover policy online or file a claim. Learn more in our Progressive review.

- Snapshot Program: Land Rover drivers could save up to 30% with the Snapshot discount.

- Budget Shopping: Land Rover owners on a budget can use Progressive’s Name Your Price tool.

Cons

- Snapshot Rate Increases: Land Rover drivers who are poor drivers may see increases in their rates.

- Customer Claim Reviews: Not all Progressive customers have left positive reviews after filing claims.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Allstate: Best for Add-On Coverages

Pros

- Add-On Coverages: Allstate offers several coverages that can be added to Land Rover policies.

- Pay-Per-Mile Insurance: Milewise insurance is great for low-mileage Land Rover drivers. Learn more about this insurance in our Allstate Milewise review.

- Adjustable Deductibles: Get cheaper Land Rover car insurance by raising your deductibles.

Cons

- Customer Complaints: Allstate isn’t as highly rated as its competition for customer service.

- DUI Rates: Rates are pricier for Land Rover owners with DUIs.

#9 – American Family: Best for Student Savings

Pros

- Student Savings: Young drivers can get a good student discount if they have higher than a 3.0 average.

- Coverage Options: Land Rover policies can be rounded out with coverages like roadside assistance.

- Accident Forgiveness: A great perk for claim-free Land Rover drivers. Learn what else the company offers in our American Family review.

Cons

- Availability: Land Rover drivers may not have American Family in their state.

- DUI Rates: American Family will be pricier for Land Rover drivers with more than one DUI.

#10 – Geico: Best for Good Drivers

Pros

- Good Drivers: Geico offers very affordable rates for Land Rover drivers who have clean driving records.

- Affiliation Discounts: Geico has a discount for military or government employees.

- Coverage Options: There are plenty of add-ons for Land Rover policies. Learn more in our Geico review.

Cons

- Lack of Local Agents: Most support is offered over the phone or through virtual chats.

- DUI Rates: Geico will not be as cheap for high-risk drivers with a DUI.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Determine Your Land Rover Car Insurance Rates

The average Land Rover driver pays about $172 a month for car insurance, which is about $30 more than the national average. Compared with other luxury brands, Land Rover insurance is a bit more on the affordable side, especially if you shop at the the companies with the best Land Rover insurance rates.

Car Insurance Monthly Rates for Land Rover by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $80 | $176 |

| American Family | $89 | $169 |

| Farmers | $95 | $187 |

| Geico | $96 | $181 |

| Liberty Mutual | $74 | $183 |

| Nationwide | $86 | $180 |

| Progressive | $76 | $161 |

| State Farm | $91 | $173 |

| Travelers | $81 | $165 |

| USAA | $84 | $168 |

Several factors affect your Land Rover car insurance rates, which companies use to determine how much you’ll pay for coverage. The factors that affect car insurance rates include:

- Age and gender

- Credit score

- Location

- Driving record

- Your vehicle

- Marital status

The amount of coverage you want for your Land Rover also affects your rates.

The minimum amount of coverage required in your state is your cheapest option for coverage. It doesn't protect your vehicle, but it'll keep your costs low. Full coverage gives your Land Rover more protection, but it costs more.

Dani Best Licensed Insurance Producer

Finally, the model you buy will affect your rates, with some models costing less than others. Check below to see how much you might pay for insurance based on the model you buy.

Land Rover Average Monthly Car insurance by Model and Coverage Type

| Vehicle Model | Comprehensive | Collision | Liability | Full Coverage |

|---|---|---|---|---|

| 2023 Land Rover Range Rover Evoque | $36 | $64 | $42 | $157 |

| 2023 Land Rover Discovery Sport | $37 | $67 | $42 | $161 |

| 2023 Land Rover Range Rover Sport | $43 | $81 | $42 | $182 |

| 2023 Land Rover Range Rover | $45 | $87 | $42 | $190 |

As you can see, the Range Rover is the most expensive Land Rover model to insure with an average rate of nearly $200 a month. However, the model you buy isn’t the only factor companies look at when crafting your rates.

Compare Land Rover Car Insurance Rates by Model

Quickly compare car insurance rates for the Land Rover LR4 model. Start now to find the best rates for your Land Rover.

| Compare Land Rover Car Insurance Rates by Model |

|---|

| Land Rover LR4 |

Choosing a cheaper Land Rover model will result in lower auto insurance rates.

Land Rover Car Insurance Policy Types

When you buy a Land Rover, you have two main options for a car insurance policy. The first option is minimum insurance, which is the least amount of coverage required in your state. Minimum insurance is an excellent option for older, less valuable cars since it’s your cheapest option for coverage. However, many Land Rover drivers want more coverage, even if their vehicle is older.

Your second option is full coverage. Full coverage costs more but offers much better protection for your Land Rover. When you buy a full coverage policy, you’ll get the following types of car insurance:

- Liability: Liability car insurance pays for damage and injuries you cause to other people and their cars. It never pays for damage to your own vehicle.

- Collision: If you want help with your car repairs, you need collision car insurance. Collision insurance also covers you if you hit an object, like a parked car.

- Comprehensive: Comprehensive car insurance covers life’s unexpected events, including fire, floods, extreme weather, animals, vandalism, and theft.

- Uninsured/Underinsured Motorist: Although most states require insurance, not everyone has it. Uninsured motorist coverage protects you from drivers without enough coverage.

- Personal Injury Protection/Medical Payments: Medical payments and personal injury protection insurance pay your health care expenses after an accident. It usually covers your passengers as well.

Since Land Rovers are expensive vehicles, most owners choose to add additional coverage to their policy even when their car is older. Popular add-ons for Land Rover owners include rental car reimbursement, gap insurance, and roadside assistance.

View this post on Instagram

While adding coverage to your policy means your car will be better protected, you should only buy what you need. Purchasing additional coverage can drastically increase your rates. If you’re unsure how much coverage you need, an insurance representative can help.

Tips to Save on Your Land Rover Car Insurance

As a luxury brand, Land Rover car insurance is always higher than standard coverage. However, most models have insurance rates that are a little more affordable than similar luxury brands.

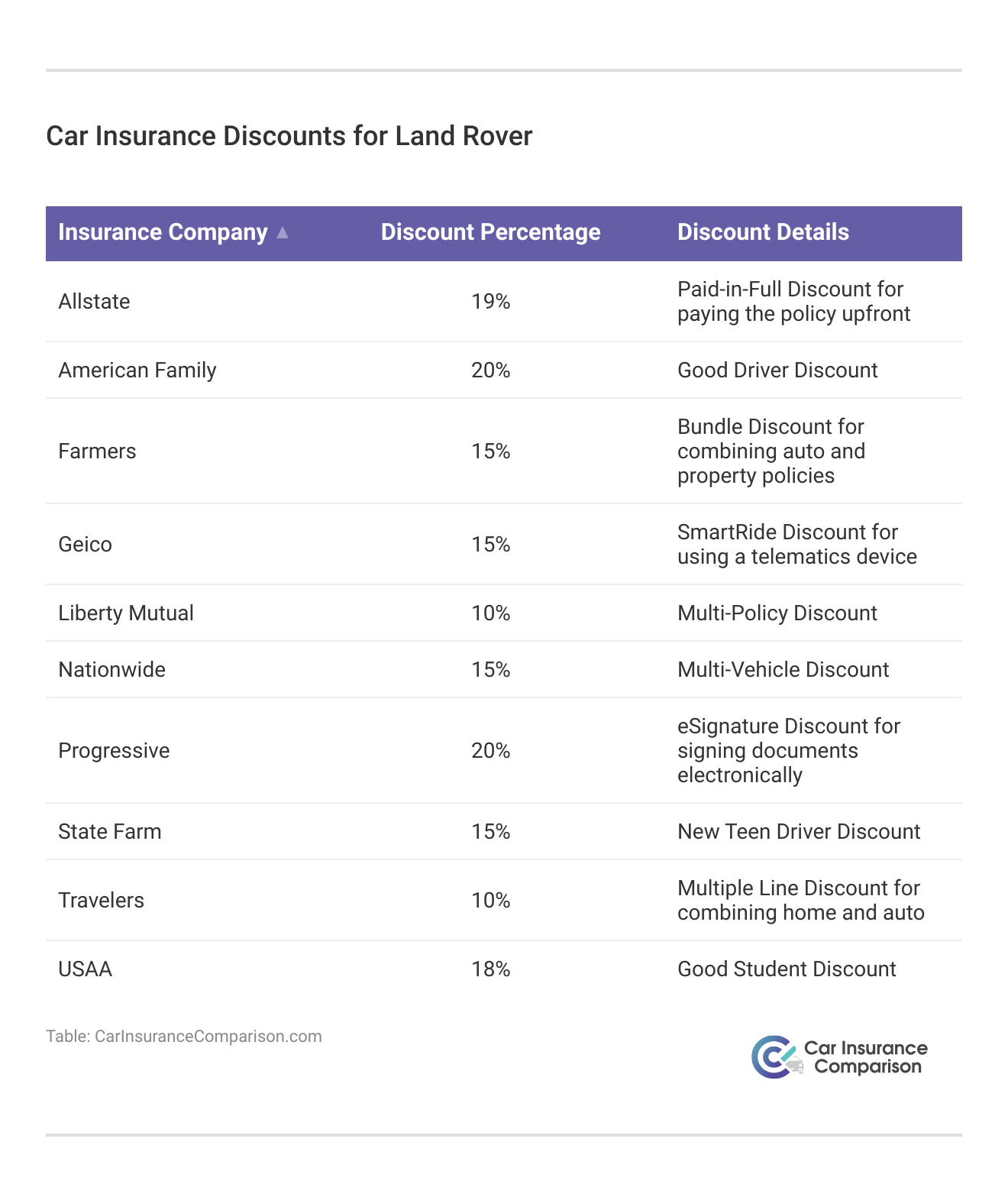

Despite the overall affordability of Land Rover car insurance, there are always ways to save more. One tip is to search for commonly offered car insurance discounts for Land Rover drivers, including bundling multiple policies, remaining claims-free, and having multiple cars on the same policy.

If you’re looking for the cheapest car insurance for your Land Rover, you should also try the following techniques:

- Raise Deductibles: Your deductible is the portion you pay before your insurance kicks in. You can save on your monthly rates by choosing a higher deductible, but you’ll have to pay more. Here’s how to find your car insurance deductible.

- Keep Records Clean: Car insurance companies check driving records, so drivers with traffic incidents like speeding tickets and at-fault accidents pay more for insurance. You can keep your rates low simply by avoiding citations.

- Enroll in Telematics: Usage-based car insurance programs track your driving habits, including speeding, hard braking, and mileage. If you regularly drive safely, a telematics program might be right for you.

- Keep Cars Safe: Most insurance companies offer lower rates if your Land Rover has safety features like anti-lock brakes, GPS tracking, and audible alarms. You can also keep rates low by parking in a safe location when you’re not using your car.

The tips listed above are great ways to find affordable Land Rover car insurance. However, the most important step to take is to compare car insurance quotes with as many companies as possible, starting with the best companies like Liberty Mutual.

If you don’t compare personalized quotes, you’ll likely overpay for your insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Start Comparing the Best Land Rover Car Insurance Rates

Luxury car insurance is always more expensive than standard coverage, primarily because it costs more to repair or replace expensive vehicles. Despite being a luxury brand, Land Rovers generally come with lower car insurance rates. While rates are usually affordable, there are plenty of ways to find even more savings, such as with safety features car insurance discounts.

Finding lower car insurance rates for a Land Rover is a simple task if you find discounts, try telematics, and keep your driving record clean. However, the most important step to take is comparing quotes with as many companies as possible. Enter your ZIP into our free to find cheap Land Rover insurance quotes today.

Frequently Asked Questions

Is Land Rover considered a luxury car?

Land Rover is considered a luxury vehicle for its high-tech amenities and bespoke finishes, including leather interior, cabin air purification and climate control, and heated seats.

Is Land Rover expensive to insure?

Land Rovers are luxury vehicles and have higher-than-average car insurance rates.

How expensive are Land Rover car insurance rates?

The cost of car insurance for a Land Rover is around $170 monthly but can vary depending on several factors, including the model, your location, and the coverage options you choose. To get an accurate estimate, it’s best to request quotes from different insurance providers and compare their rates (learn more: How do you get competitive quotes for car insurance?).

What factors affect the cost of Land Rover car insurance?

Several factors can influence the cost of Land Rover car insurance, including:

- Vehicle Model: The specific model of your Land Rover will impact insurance rates. More expensive models or those with higher repair costs may result in higher premiums.

- Location: The area where you live can affect insurance rates. Factors such as crime rates, traffic congestion, and the number of accidents in the area are considered.

- Driving Record: Your driving history and any previous accidents or traffic violations can impact your insurance rates. A clean driving record usually results in lower premiums.

- Age and Experience: Younger drivers and those with less driving experience often face higher insurance rates.

- Coverage and Deductibles: The level of coverage you choose and the deductibles you select can affect your premiums. Higher coverage limits and lower deductibles may result in higher premiums.

Compare rates with our free tool to get cheap Land Rover car insurance today.

What is the cheapest Land Rover to insure?

The model with the most affordable Land Rover car insurance rates is the Land Rover Range Rover Evoque with monthly quotes averaging $157.

How can I reduce my Range Rover insurance rates?

There are often discounts available for Range Rover and Land Rover car insurance, including:

- Multi-Policy Discount: Bundling your Land Rover insurance with other policies, such as home or renters insurance, can lead to discounted rates.

- Good Driver Discount: Maintaining a clean driving record without accidents or traffic violations may make you eligible for lower premiums.

- Safety Feature Discount: Land Rovers often come equipped with safety features. Having features such as anti-lock brakes, airbags, and anti-theft systems can help lower insurance rates.

- Good Student Discount: If you’re a student with good grades, you may qualify for a discount on your Land Rover insurance.

- Membership Discounts: Some insurance companies offer discounts to members of certain organizations or professional associations.

Applying for car insurance discounts will help most drivers save on their Rover insurance policy.

Is insurance more expensive on a Range Rover?

Land Rover Range Rovers have some of the highest rates at $190 per month.

How much is Range Rover insurance for a 21-year-old?

Ranger Rover insurance rates for a 21-year-old will be around $431 per month.

What is the best car insurance for Land Rovers?

Full coverage is the best insurance on a Land Rover (read more: Best Full Coverage Car Insurance). However, the cheapest Land Rover insurance will be minimum coverage.

Who has the Land Rover insurance reviews?

USAA has some of the best customer service reviews, and so does Geico.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.