Compare Pennsylvania Car Insurance Rates [2025]

Pennsylvania drivers must carry 15/30/5 of liability insurance to drive legally but can compare Pennsylvania car insurance rates to find the best deal. A minimum liability policy in Pennsylvania costs an average of $33 per month, while a full coverage policy costs an average of $110 per month.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Joel Ohman

Certified Financial Planner

Joel Ohman is the CEO of a private equity backed digital media company. He is a CERTIFIED FINANCIAL PLANNER™, author, angel investor, and serial entrepreneur who loves creating new things, whether books or businesses. He has also previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He has an MBA from the University of South Florida. Joel...

UPDATED: Apr 23, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 23, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Pennsylvania Statistics Summary | Details |

|---|---|

| Annual Road Miles | Total in State: 120,039 Vehicle Miles Driven: 99.9 billion |

| Vehicles | Registered in State: 10.1 million Total Stolen: 13,040 |

| State Population | 12,807,060 |

| Most Popular Vehicle | Honda CR-V |

| Uninsured Motorists | 8% State Rank: 43rd |

| Total Driving Fatalities | 2008-2017 Speeding: 468 Drunk Driving: 314 |

| Annual Average Premiums | Liability: $499/yr Collision: $327/yr Comprehensive: $144/yr Average Full Coverage Rates: $970/yr |

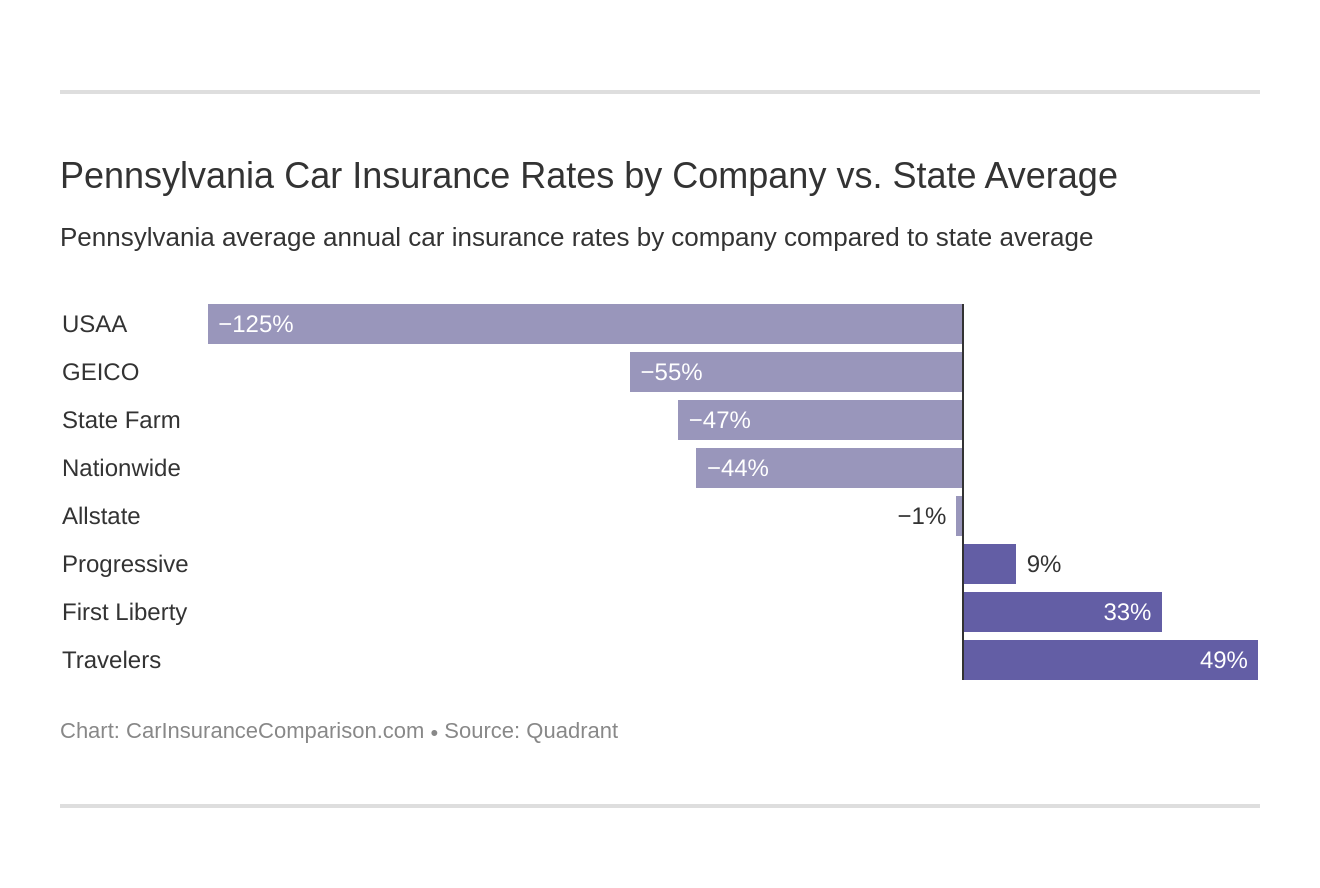

| Cheapest Provider | USAA |

- Pennsylvania drivers must carry 15/30/5 of liability car insurance

- Full coverage car insurance costs an average of $110/mo in Pennsylvania

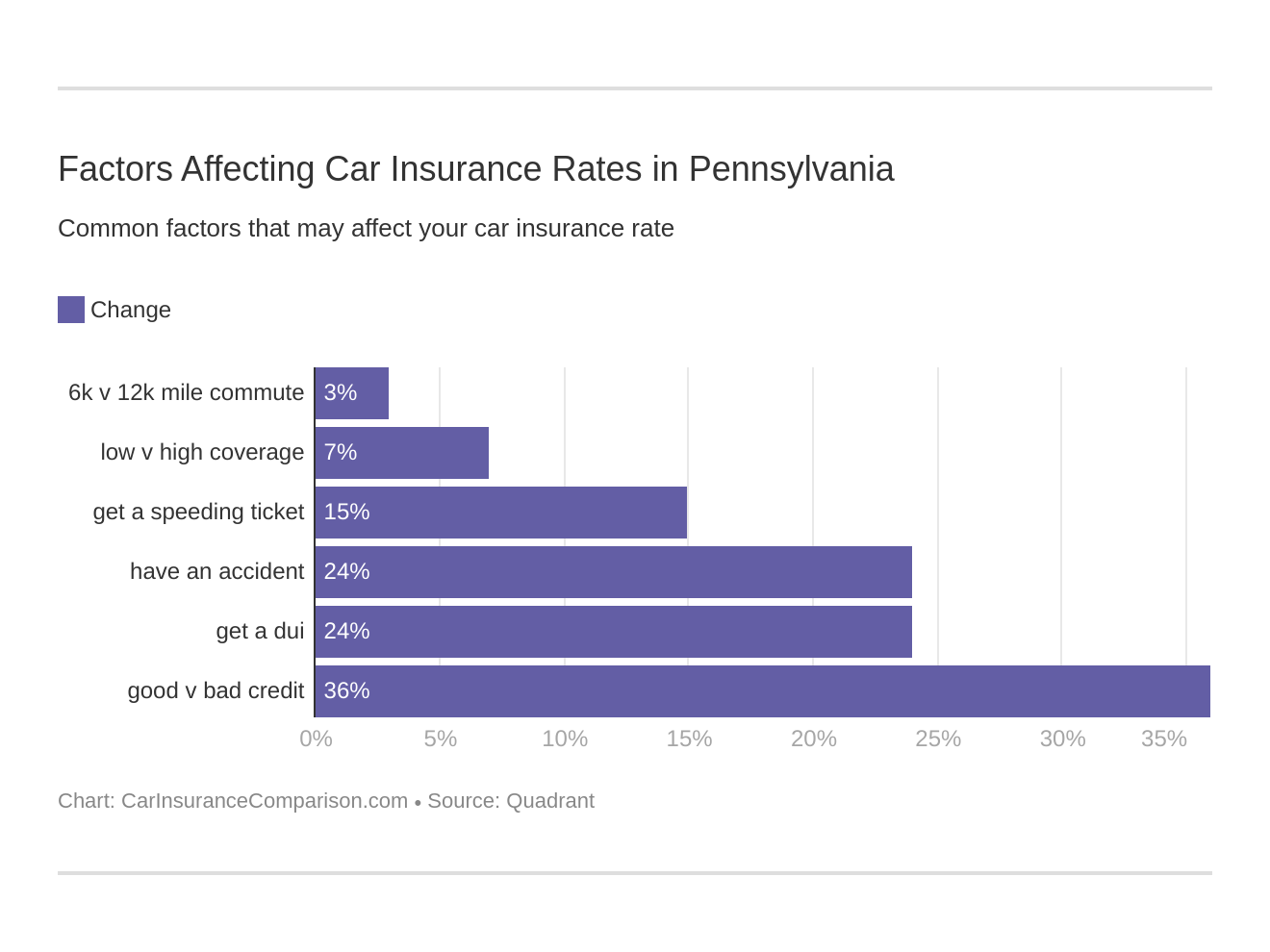

- Pennsylvania insurance rates will vary based on a driver’s driving record

If you want to compare Pennsylvania car insurance rates to get the best deal, the first step is to decide how much coverage you want to carry on your car. While Pennsylvania’s minimum coverage policies may seem like the best deal for cheap car insurance, they won’t cover you completely like full coverage policies.

We go over everything you need to know about finding cheap Pennsylvania car insurance, from the coverages you need to the different insurance laws. If you want to jump right into finding affordable Pennsylvania car insurance coverage, use our free comparison tool.

Pennsylvania Insurance Coverage and Rates

Pennsylvania requires all drivers to be insured, and looking through the many options available can make you feel overwhelmed. For the money that you must pay, you want to understand the coverage you get.

Our guide will help you get to know what you’re paying for; we’ll explain the major coverage types, insurers, average rates in Pennsylvania and other states, and much more.

So, buckle up and keep reading to learn more!

Pennsylvania Minimum Insurance Coverage

Most states require minimum coverage to ensure the financial responsibility of drivers on the road. Pennsylvania is no different, but minimum costs vary from state to state, as we can see below.

Pennsylvania is a no-fault insurance state, which means that you submit your claim to your insurance company. Your basic personal injury protection (PIP) or medical benefits coverage will pay for your medical bills and certain other out-of-pocket losses regardless of who caused the crash.

- Car Insurance Rates in Pennsylvania

- Compare York, PA Car Insurance Rates [2025]

- Compare Westmoreland City, PA Car Insurance Rates [2025]

- Compare Sharon Hill, PA Car Insurance Rates [2025]

- Compare Paupack, PA Car Insurance Rates [2025]

- Compare New Bethlehem, PA Car Insurance Rates [2025]

- Compare Mayport, PA Car Insurance Rates [2025]

- Compare Matamoras, PA Car Insurance Rates [2025]

- Compare Latrobe, PA Car Insurance Rates [2025]

- Compare Lancaster, PA Car Insurance Rates [2025]

- Compare Lake Ariel, PA Car Insurance Rates [2025]

- Compare Johnstown, PA Car Insurance Rates [2025]

- Compare Horsham, PA Car Insurance Rates [2025]

- Compare Hatboro, PA Car Insurance Rates [2025]

- Compare Hamburg, PA Car Insurance Rates [2025]

- Compare Gap, PA Car Insurance Rates [2025]

- Compare Easton, PA Car Insurance Rates [2025]

- Compare Canonsburg, PA Car Insurance Rates [2025]

- Compare Bristol, PA Car Insurance Rates [2025]

- Compare Bridgeport, PA Car Insurance Rates [2025]

- Compare Bala Cynwyd, PA Car Insurance Rates [2025]

- Compare Philadelphia, PA Car Insurance Rates [2025]

Unlike other “no-fault” states, Pennsylvania lets vehicle owners “opt out” of the no-fault system when they buy a car insurance policy. Insurance companies must inform customers of these coverage options: full tort or limited tort coverage.

Limited tort coverage: you can seek recovery for all medical and other out-of-pocket losses from an accident, and limited pain and suffering or other non-monetary losses unless your injuries qualify as “serious.” Recent Pennsylvania court decisions show that a “serious” injury often requires critical impairment of a bodily function or permanent and severe disfigurement.

Full tort coverage: it costs more, but gives you unlimited rights to sue for medical treatment, pain and suffering, and other out-of-pocket losses when another driver causes a car crash, even if the law doesn’t define your injuries as “serious.”

Read more: Compare Full Tort Car Insurance: Rates, Discounts, & Requirements

Note that Pennsylvania’s no-fault car insurance system doesn’t apply to vehicle damage claims. Someone injured in an accident can file a claim for vehicle damage against the at-fault driver without limits.

All Pennsylvania drivers must have car insurance. State minimum car insurance requirements are:

- $5,000 of Medical Benefits coverage (also known as First-Party Benefits), a form of personal injury protection, to cover medical expenses for yourself or others, regardless of fault

- $15,000 in liability insurance to cover medical costs for injuries to one person, capped at $30,000 per accident

- $5,000 to cover property damage if you’re at fault

- Limited or full tort coverage

Liability insurance pays everyone owed money for property damage and/or injuries from a car accident that you or anyone under your policy has caused – drivers, passengers, pedestrians, bicyclists, etc.

The Keystone State also recognizes certain all-purpose car insurance policies as long as there is a minimum of $35,000 in total coverage.

Remember that if you’re found at fault for a car accident and the injured drivers’ and/or passengers’ losses exceed the limits of your car insurance policy – even if you’ve met the state minimum coverage requirements – you could be responsible for the difference.

So, to protect yourself in case this happens, it makes sense to buy more than the minimum coverage required.

Forms of Financial Responsibility

Liability insurance or self-insurance, or other reliable monetary arrangements, deposits, resources, or commitments filed with PennDOT can provide proof of financial responsibility. If a law enforcement offer pulls you over, you’ll need to provide this proof.

According to PennDOT, drivers must provide proof of insurance in one of the following ways:

- An insurance identification card from an insurer or self-insurance.

- A copy of the insurance declaration page listing the claim holder and insured cars and drivers

- An insurance binder a licensed broker has signed

- A copy of an application for the Pennsylvania Assigned Risk Plan

- A signed letter from the insurance provider on company letterhead

Self-Insurance

According to the PennDOT, Pennsylvania drivers may apply to insure themselves, rather than go through an insurance company. To do this, the group or individual must get approval from the Department.

Requirements for a self-insurance proposal include:

- A self-insurance application

- Self-insurance security agreement

- An income statement and completed balance sheet that demonstrates the financial standing of the person or group as of the previous year

- A minimum of $50,000 collateral for one vehicle, and $10,000 for each additional vehicle in the form of U.S. currency, U.S. Treasury bills or notes, loans, escrow deposits, or bonds

Next, we’ll look at how much the average Pennsylvanian spends on car insurance to help you determine how much you can afford.

Premiums as a Percentage of Income

In 2014, the annual per capita disposable personal income (DPI) in Pennsylvania, after taxes were paid, was $42,414.

The average annual cost of car insurance in Pennsylvania is $950, which is two percent of the average DPI and about the same as nearby states; this number remained steady from 2012 to 2014.

The average Pennsylvanian has $3,535 each month to buy food, pay bills, etc. Car insurance will take about $79 out of that, and possibly more if your driving record isn’t entirely spotless.

Frequently Asked Questions

How are car insurance rates determined in Pennsylvania?

Car insurance rates in Pennsylvania are determined by various factors, including your driving record, age, gender, location, the type of vehicle you drive, coverage options chosen, and your credit history. Insurance companies use these factors to assess the level of risk you pose as a driver and calculate your premium accordingly.

Are car insurance rates higher in Pennsylvania compared to other states?

Car insurance rates in Pennsylvania can vary compared to other states. The rates are influenced by factors such as population density, traffic congestion, weather conditions, and state-specific insurance regulations. While rates may differ, it’s important to compare quotes from multiple insurance providers to find the best rate for your specific situation.

Are there any minimum car insurance requirements in Pennsylvania?

Yes, Pennsylvania requires all drivers to carry minimum liability coverage. The minimum requirements include $15,000 for bodily injury per person, $30,000 for bodily injury per accident, and $5,000 for property damage liability. These requirements ensure that drivers have a basic level of coverage to protect themselves and others in the event of an accident.

How can I find the best car insurance rates in Pennsylvania?

To find the best car insurance rates in Pennsylvania, consider the following steps:

- Shop around: Obtain quotes from multiple insurance companies to compare rates and coverage options.

- Evaluate coverage needs: Determine the level of coverage you require based on your vehicle, driving habits, and financial situation.

- Check for discounts: Inquire about available discounts for factors like safe driving records, bundling policies, or completing defensive driving courses.

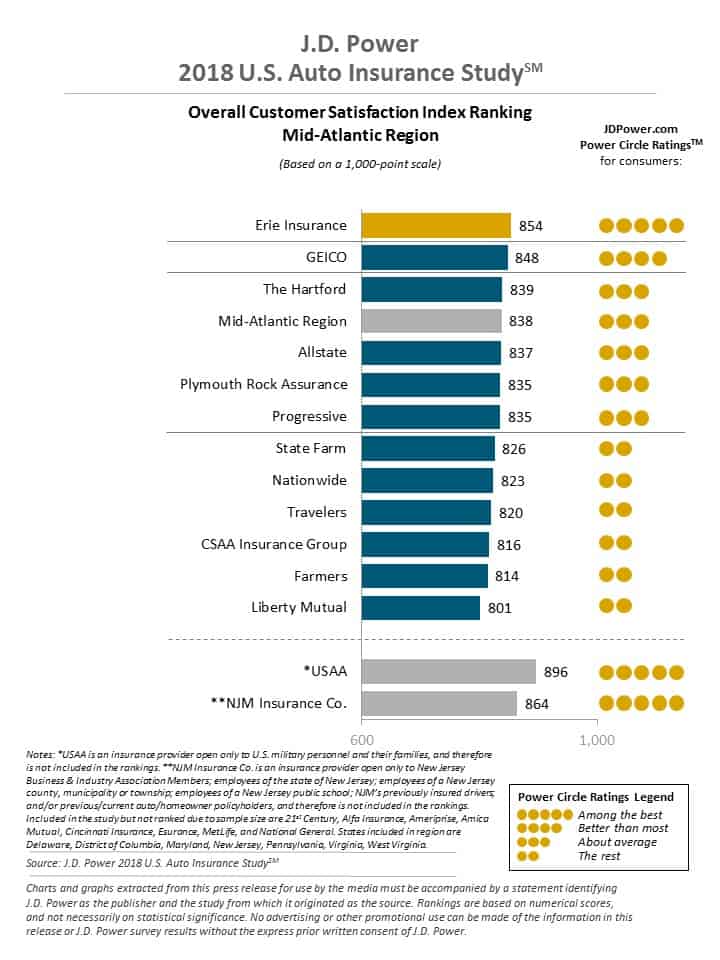

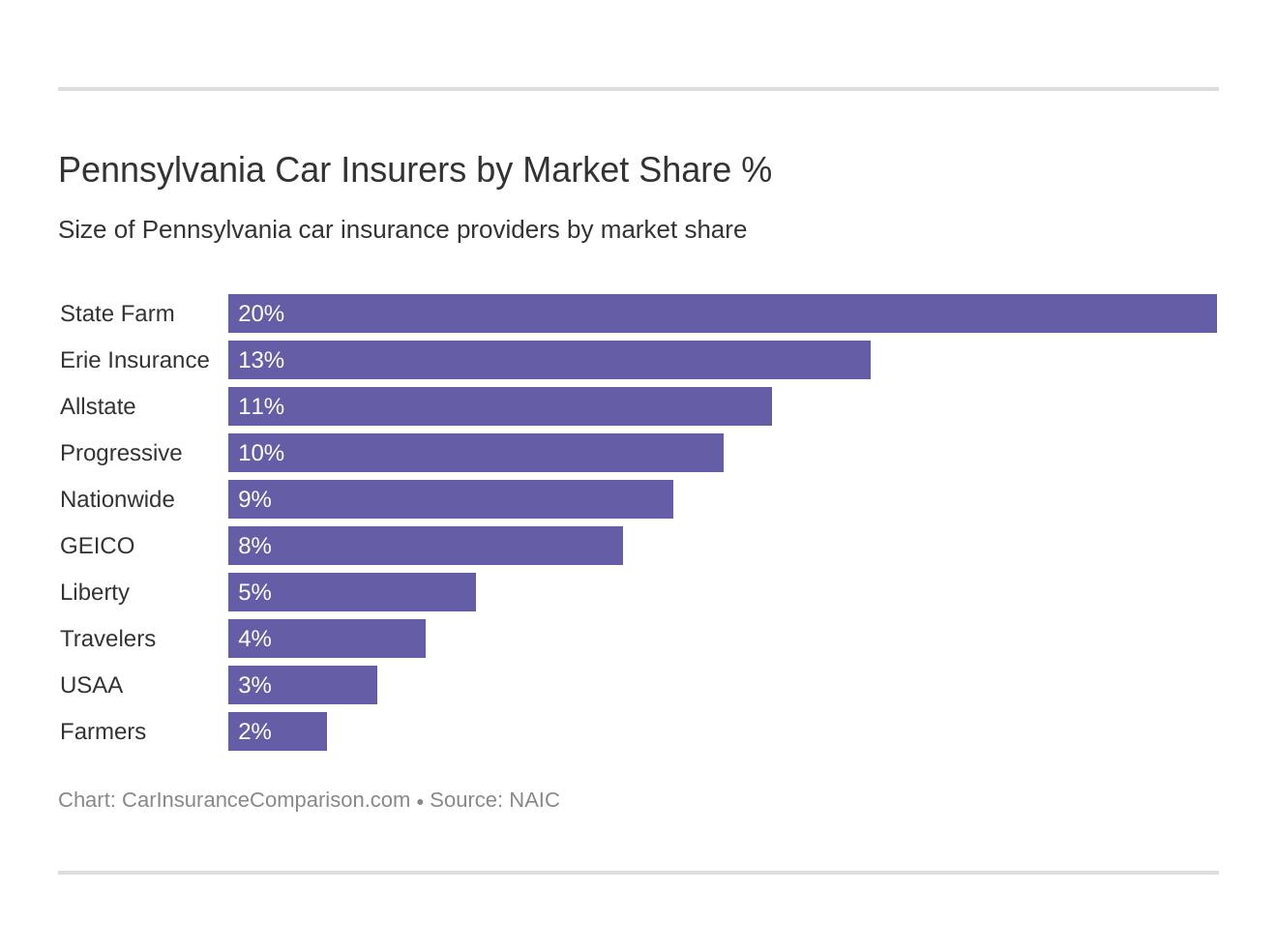

- Review customer reviews and ratings: Research the reputation and customer satisfaction levels of insurance companies you’re considering.

- Consider working with an insurance agent: An agent can help navigate the process, provide personalized advice, and find suitable options for you.

What are some pros of comparing car insurance rates in Pennsylvania?

- Cost savings: By comparing rates, you can find insurance providers offering more affordable premiums, potentially saving you money.

- Customization: You can tailor your coverage to meet your specific needs by comparing different coverage options from various insurers.

- Enhanced coverage: Comparing rates allows you to discover insurers that offer additional benefits or policy features not provided by others.

- Customer satisfaction: Researching and comparing rates can help you choose an insurance provider known for their excellent customer service and reliability.

What are some cons of comparing car insurance rates in Pennsylvania?

- Time-consuming: Comparing rates from different insurance providers can be time-consuming, especially if you want to thoroughly evaluate each option.

- Information overload: The abundance of insurance options and policies may lead to confusion and make it challenging to select the best one for your needs.

- Limited scope: Some insurance companies may not be included in the comparison process, potentially leaving out competitive options.

- Changing policies: Switching insurance providers frequently for the sake of lower rates may cause inconvenience or require adjustments to your coverage.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Joel Ohman

Certified Financial Planner

Joel Ohman is the CEO of a private equity backed digital media company. He is a CERTIFIED FINANCIAL PLANNER™, author, angel investor, and serial entrepreneur who loves creating new things, whether books or businesses. He has also previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He has an MBA from the University of South Florida. Joel...

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.