Best Rolls-Royce Car Insurance Rates in 2026 (Check Out the Top 10 Companies)

Allstate, USAA, and Hagerty have the best Rolls-Royce car insurance rates. At Allstate, minimum coverage for a Rolls-Royce is an average of $250/mo. Rolls-Royce car insurance is more expensive, so consider collector car insurance if you don't drive your Rolls-Royce often and look for safe driving discounts.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Certified Financial Planner

Joel Ohman is the CEO of a private equity backed digital media company. He is a CERTIFIED FINANCIAL PLANNER™, author, angel investor, and serial entrepreneur who loves creating new things, whether books or businesses. He has also previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He has an MBA from the University of South Florida. Joel...

Joel Ohman

Updated May 2024

11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Rolls-Royce

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Rolls-Royce

A.M. Best Rating

Complaint Level

6,589 reviews

6,589 reviews 16 reviews

16 reviewsCompany Facts

Full Coverage for Rolls-Royce

A.M. Best Rating

Complaint Level

16 reviews

16 reviewsAllstate, USAA, and Hagerty have the best Rolls-Royce car insurance rates.

If you have a Rolls-Royce, start comparing luxury car insurance rates in your area to get the most affordable Rolls-Royce insurance quotes. The costs of insuring a vehicle can vary significantly depending on your circumstances, so it’s important to shop around and compare multiple companies to find low rates.

Our Top 10 Company Picks: Best Rolls-Royce Car Insurance Rates

| Company | Rank | Good Driver Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 15% | A+ | International Reach | Allstate | |

| #2 | 20% | A++ | Military Families | USAA | |

| #3 | 25% | A- | Classic Cars | Hagerty | |

| #4 | 15% | A+ | Vintage Expertise | American Modern | |

| #5 | 20% | A++ | Nationwide Coverage | State Farm | |

| #6 | 15% | A+ | Customizable Plans | Progressive | |

| #7 | 15% | A | Wealth Management | AIG | |

| #8 | 15% | A++ | High Value | Chubb | |

| #9 | 15% | A++ | Flexible Policies | Travelers | |

| #10 | 20% | A | Policy Bundling | Liberty Mutual |

This guide will provide an overview of what you need to know about buying Rolls-Royce car insurance and explain how to compare different insurers for the best rates.

By taking time to research and compare car insurance policies, you can save money on Rolls-Royce insurance while maintaining adequate coverage for your needs. Enter your ZIP in our free tool to find cheap Rolls-Royce car insurance quotes today.

- Factors like driver’s age, vehicle type, and driving history affect car insurance premiums

- When buying insurance for a Rolls Royce, it is especially important to compare rates since this luxury car has higher premiums than other vehicles

- Most states require minimum amounts of liability coverage, so make sure you meet these requirements when purchasing a policy

#1 – Allstate: Top Pick Overall

Pros

- Pay-Per-Mile Rates: Allstate’s pay-per-mile coverage is perfect for low-mileage drivers. Learn more in our Allstate Milewise review.

- New Car Replacement: An add-on coverage perfect for new Rolls-Royce vehicles.

- Drivewise Savings: A usage-based program that helps good drivers reduce their Rolls-Royce rates.

Cons

- Customer Reviews: Allstate customer complaints are more than expected.

- Telematics Tracking: Milewise and Drivewise track the driving data of customers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Families

Pros

- Military Families: USAA has some of the cheapest Rolls-Royce insurance rates for military families. Learn more in our USAA review.

- SafePilot Program: Policyholders who participate in this program can save up to 30% on their Rolls-Royce insurance.

- Bundling Discount: Rolls-Royce owners can also buy their home insurance from USAA for a discount.

Cons

- Add-On Coverages: USAA’s add-on coverages aren’t as numerous as at other companies.

- Eligibility: Only service members or veterans can buy Rolls-Royce insurance from USAA.

#3 – Hagerty: Best for Classic Cars

Pros

- Classic Cars: Hagerty specializes in collector cars, which is great for classic Rolls-Royce models.

- Guaranteed Value: Hagerty will pay you the agreed-upon value if your Rolls-Royce is totaled.

- Lower Rates: Hagerty’s rates are lower because classic cars are driven less. Learn more in our Hagerty car insurance review.

Cons

- Only Insures Classics: If your Rolls-Royce isn’t considered a classic, you won’t be able to get insurance.

- Customer Satisfaction: Hagerty does have some negative ratings and reviews.

#4 – American Modern: Best for Vintage Expertise

Pros

- Vintage Expertise: American Modern specializes in insuring vintage vehicles, making it one of the top providers of the best car insurance for specialty vehicles.

- Anti-Theft Discount: American Modern has a 15% anti-theft discount for Rolls-Royces with anti-theft devices.

- Financial Rating: American Modern is rated well for financial stability and reliability.

Cons

- Only Insures Specialized Vehicles: American Modern will only insure vintage Rolls-Royces.

- Coverage Options: There aren’t as many add-on coverage options for your Rolls-Royce.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – State Farm: Best for Nationwide Coverage

Pros

- Nationwide Coverage: Auto insurance policies are available in every state.

- Customer Service: State Farm has high ratings due to its local agent availability. Read our State Farm review to find out more about its customer service.

- Discount Variety: Good student discounts, accident forgiveness, and more are offered at the company.

Cons

- Online Tools: With the focus on in-person service, State Farm may not have as many online functions.

- Bad Credit Rates: The company does increase rates for bad credit scores, like most companies.

#6 – Progressive: Best for Customizable Plans

Pros

- Customizable Plans: Progressive customers can customize their Rolls-Royce plans with add-ons and adjustable deductibles. Read our Progressive review to learn more.

- Snapshot Program: Rolls-Royce owners can save on their policy by participating in the Snapshot discount program.

- Young Driver Discounts: Families can save if teens qualify for Progressive’s good student or student away discount.

Cons

- Snapshot Rate Increases: Snapshot does raise rates for poor driving performances in some states.

- Customer Loyalty: Progressive has some dissatisfied reviews from customers who left.

#7 – AIG: Best for Wealth Management

Pros

- Wealth Management: AIG is a good choice if you want a company experienced in wealth management.

- Coverage Options: AIG has a good selection of different types of auto insurance for Rolls-Royce owners (read more: Compare Car Insurance by Coverage Type).

- Nationwide Coverage: AIG insures vehicles across the U.S.

Cons

- Local Agents: Local agents are lacking in most areas.

- Policies Complex: AIG’s insurance options aren’t as straightforward as other companies, as it specialises in wealthy customers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Chubb: Best for High Value

Pros

- High Value: Chubb is experienced in insuring high-value vehicles and has some of the best insurance for luxury cars.

- Anti-Theft Discount: Chubb offers a large discount to Rolls-Royce with anti-theft devices.

- Availability: Chubb insurance is available in all U.S. states.

Cons

- Affordability: Chubb isn’t the cheapest on the market for Rolls-Royce owners.

- Coverage Options: Can be more limited than at other companies in some areas.

#9 – Travelers: Best for Flexible Policies

Pros

- Flexible Policies: Rolls-Royce drivers can adjust their policies as needed. Learn more in our Travelers review.

- Availability: Travelers is available in every state.

- IntelliDrive Program: IntelliDrive participants could save up to 30% on Rolls-Royce insurance.

Cons

- Local Agents: Travelers doesn’t have as vast a network of local agents as other companies.

- IntelliDrive Rates: Participating in the Intellidrive program could increase bad drivers’ rates.

#10 – Liberty Mutual: Best for Policy Bundling

Pros

- Policy Bundling: Liberty Mutual discounts rates if customers bundle auto and home insurance.

- RightTrack: Rolls-Royce drivers who participate in RightTrack could save up to 30%.

- Young Driver Discounts: Families can save with teen discounts at Liberty Mutual.

Cons

- Claims Satisfaction: Some customers have negative feedback about claims services. Learn more in our Liberty Mutual review.

- Telematics Tracking: RightTrack tracks driving data for its discount.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Rolls-Royce Car Insurance Rates

Car insurance can be expensive for Rolls-Royce due to several factors. Generally, the cost of insuring a luxury vehicle is higher than that of an everyday model because it is more valuable, costs more to repair, and is more desirable by thieves, thus posing increased risks for insurers.

The cost of insurance for a Rolls Royce will vary depending on the model, as well as your age, driving record, and other factors. Generally, you can expect to pay anywhere from $100 to $400 or more per month for coverage.

Rolls-Royce car insurance rates are higher because your company will pay out more than for a standard make and model when you file a car insurance claim. Furthermore, Rolls-Royce cars tend to attract attention on the roads, which may lead to a greater risk of them being involved in an incident or collision.

Rates will also be higher if you have a history of making claims or have any driving convictions on your record. Insurers take these details into account when calculating rates to determine how likely you are to make a claim, and many companies will quote different prices for similar levels of coverage. This is why it’s so important to get quotes from the best companies like Allstate when shopping for insurance for Rolls-Royces.

Compare car insurance quotes in our guide to the best car insurance companies to ensure that you get the best Rolls-Royce insurance rates possible while still getting adequate coverage for your needs.

Which Factors Influence Rolls-Royce Car Insurance Rates

The factors affecting your car insurance rates are largely determined by the risk profile associated with you and your vehicle. Generally, the higher risk an individual or a car is deemed to be, the higher their premiums will be.

Some of the primary factors that can affect the cost of insuring a Rolls-Royce are:

- Age: Younger drivers are seen as more likely to have an accident on the roads, so they typically pay more for car insurance than older drivers. You can compare car insurance rates by age and gender here.

- Driving History: Car insurance companies check your driving record, so they see you as a greater risk and increase rates if you have any convictions or points on your license, such as speeding fines or drunk-driving offenses.

- Credit Score: Insurers may consider your credit history when calculating premiums, as a good credit rating indicates responsible financial management.

- Car Value: Cars with a higher value are seen as more desirable to thieves and present greater risks of damage or loss for insurers, so Rolls-Royce car insurance generally costs more.

- Vehicle Safety Features: Certain safety features, such as airbags or anti-theft systems, can lower car insurance rates, as they reduce the likelihood of serious damage and injury. Find safety features car insurance discounts here.

- Location: Living in an area prone to theft or vandalism could result in higher premiums.

By comparing different insurers, you can ensure that you get the best Rolls-Royce car insurance rates.

Compare Types of Rolls-Royce Car Insurance Policies

When it comes to insuring a Rolls-Royce, there are many different types of car insurance. Each type of policy serves a particular purpose and provides varying levels of protection. Understanding the different options can help you make an informed decision when selecting your car insurance plan.

- Liability Car Insurance: Covers any damage you cause to another person or property while operating your vehicle. This includes medical expenses and legal fees if you are taken to court over an incident involving your vehicle.

- Collision Car Insurance: Pays for repairs if your vehicle is damaged in an accident. It is important to note that this type of insurance only applies to collisions and does not cover damages caused by weather, animals, or vandalism.

- Comprehensive Car Insurance: Provides protection for a variety of circumstances, including theft and damage from flooding and fire. It also covers any repairs needed due to natural disasters such as earthquakes or tornadoes.

- Uninsured/Underinsured Motorist Insurance: Pays if you are injured in an accident with another driver who either has no insurance or inadequate coverage levels.

- Gap Insurance: Covers the difference between what your car is worth and the amount still owed on your loan in the event that it is totaled in an accident

The first step in comparing car insurance policies is to determine what type of coverage you need. Are you looking for just liability, or do you want full coverage? Learn the difference between liability and full coverage car insurance to ensure that you are fully protected in the event of an accident or other unexpected circumstance.

Car Insurance Monthly Rates for Rolls-Royce by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AIG | $270 | $670 |

| Allstate | $250 | $630 |

| American Modern | $230 | $600 |

| Chubb | $250 | $600 |

| Hagerty | $220 | $580 |

| Liberty Mutual | $255 | $640 |

| Progressive | $260 | $650 |

| State Farm | $240 | $620 |

| Travelers | $240 | $620 |

| USAA | $200 | $550 |

You may also want to consider uninsured/underinsured motorist protection or gap insurance if you’re driving a new Rolls-Royce. What if you drive an older model? Read our guide to compare classic car insurance and find the lowest rates for your vintage Rolls-Royce.

By understanding the different types of coverage available for Rolls-Royce, you can select the best policy for your needs and budget. Once you know the types of coverage that are right for your situation, you can start comparing Rolls-Royce car insurance companies.

How to Get Affordable Rolls-Royce Car Insurance Rates

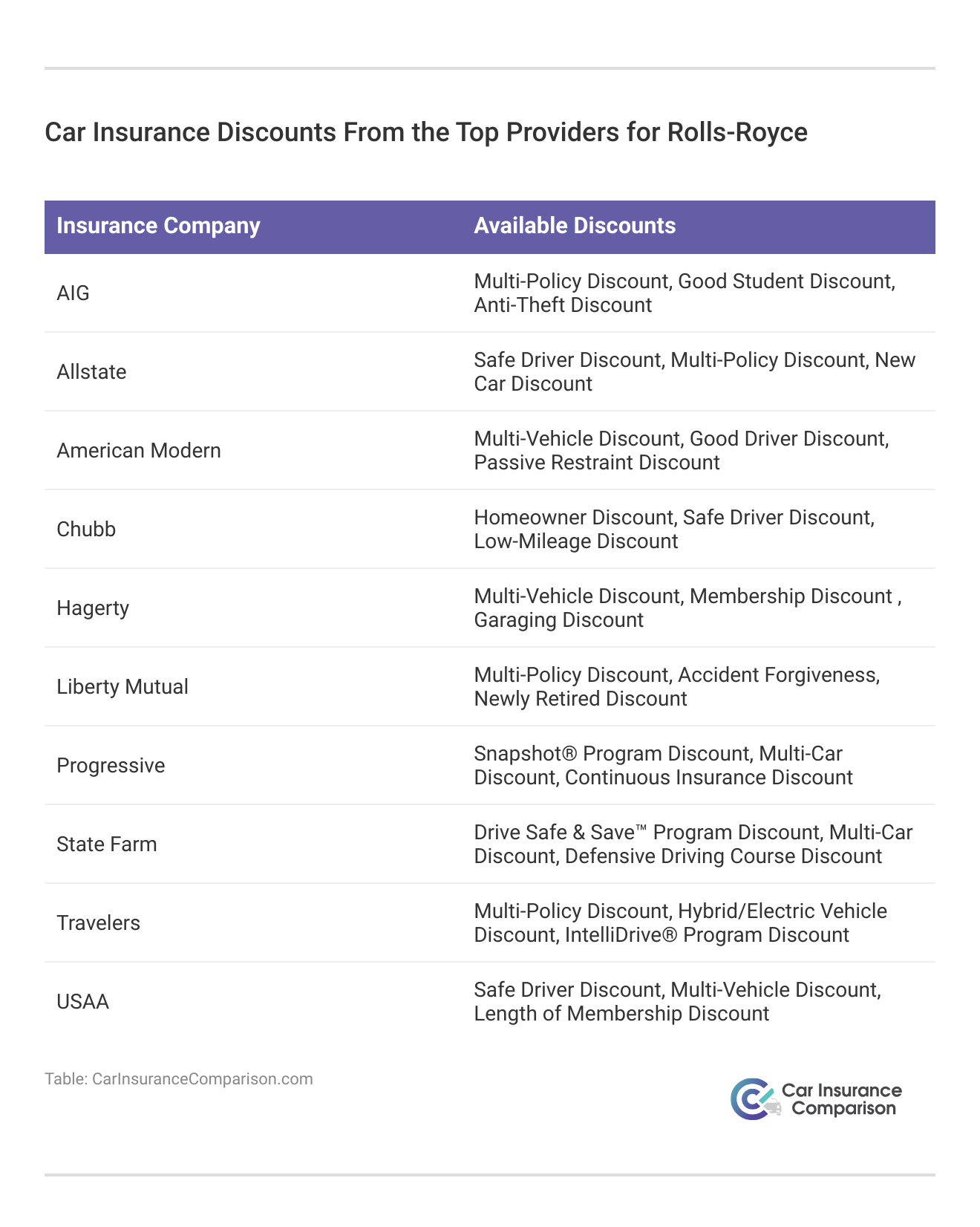

When looking for affordable Rolls-Royce car insurance, it is important to compare rates and coverage options between multiple companies. Doing this can help you find the best policy that meets your needs while also keeping costs as low as possible. you should also shop for car insurance discounts.

Look for insurers that offer competitive car insurance discounts based on factors such as your age, driving record, and vehicle type. You may also want to consider the coverage limits that each company offers, as this can make a big difference in what you will pay.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Why You Need Car Insurance for a Rolls-Royce

Car insurance is an important protection to have in the event of a car accident, theft, or damage. It provides financial protection against any costs that arise as a result of these unfortunate events and can help to cover repairs, medical bills, and any other expenses.

Driving without car insurance is illegal. Those caught doing so could face fines and points being added to their license.

Without proper insurance on a Rolls-Royce, you may be liable for the full cost of an accident or loss. This includes medical bills, repair costs, and legal fees if you injure another person or damage property in the incident.

Dani Best Licensed Insurance Producer

It’s important to note that even if you are a very safe driver, accidents can happen anytime and often involve more than one person. Many policies include legal cover, which can be invaluable if you are ever taken to court over an incident involving your vehicle.

View this post on Instagram

Having car insurance can also provide peace of mind in the event of an emergency or unexpected costs associated with your vehicle. For instance, you could face costly claims from other drivers, even if you were not at fault, but the right policy can protect you.

Overall, car insurance is vital for any driver wishing to remain protected against potential risks while on the road. However, different insurers will offer varying levels of coverage for different prices, so shop around and do your research to find the right coverage for your Rolls-Royce.

Buying the Right Rolls-Royce Car Insurance

Finding the right car insurance policy for your Rolls-Royce can be daunting. However, by understanding car insurance by coverage type and comparing rates between multiple providers, you can ensure that you get an affordable Rolls-Royce insurance price.

Take the time to do your research and find a policy that meets your needs. Doing so will provide peace of mind if an accident or other incident should occur. With the right Rolls-Royce car insurance policy, you’ll have the financial protection needed to get back on the road quickly without any major financial losses. Compare rates now with our free tool to find the Rolls-Royce auto insurance rates from companies near you.

Frequently Asked Questions

How much does it cost to insure a Rolls-Royce?

The cost of insurance for a Rolls Royce will vary depending on the model, as well as your age, driving record, and other factors. Generally, you can expect to pay anywhere from $1,000 to $3,000 or more for coverage.

How much is car insurance on a Rolls Royce Phantom?

Rolls-Royce Phantom insurance costs will vary depending on your age, driving record, and more. Most drivers pay anywhere from $2,000 to $5,000. Enter your ZIP code in our free tool to save on Rolls-Royce insurance costs.

Are luxury cars expensive to insure?

Yes, luxury car insurance is typically more expensive than coverage for a standard vehicle because repair costs tend to be higher, and there is an increased risk of theft and vandalism.

How much is insurance on a Rolls-Royce Wraith?

Rolls-Royce Wraith insurance costs average around $1,000 monthly.

What factors influence Rolls-Royce car insurance rates?

The factors that can affect the cost of insuring a Rolls-Royce include the model of the car, your age, driving record, location, and other risk factors. For example, used Roll-Royce cars will have different insurance rates than newer models, especially if you purchase classic Rolls-Royce insurance.

Do I need to buy Rolls-Royce car insurance?

Yes, car insurance is necessary for driving legally and protecting yourself financially. It provides coverage for accidents, theft, and damages. Without insurance, you may face legal consequences and be liable for significant costs in case of an incident.

How much is insurance on a Bugatti?

Bugattis are considered supercars and have higher insurance rates than Rolls-Royce, usually around $5,000-$6,000 per month (read more: Cheap Car Insurance for Supercars).

How much does it cost to maintain a Rolls-Royce annually?

Between high insurance rates and expensive service costs, you can expect to pay around $10,000 per year to maintain a Rolls-Royce.

How reliable is a Rolls-Royce?

Rolls-Royce has decent reliability ratings.

Who owns Rolls-Royce?

BMW owns Rolls-Royce. If you have a BMW, make sure to check out our guide on the best BMW car insurance rates.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.