Compare Delaware Car Insurance Rates [2026]

At $171 per month, Delaware car insurance rates are usually higher than the national average. Despite higher prices, drivers can find the cheapest Delaware car insurance by comparing quotes. Prices vary, but some of the best Delaware car insurance companies are Nationwide, Progressive, and Geico.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson is the fourth generation in her family to work in the insurance industry. She grew up with insurance talk as part of her everyday conversation and has studied to gain an in-depth knowledge of state-specific insurance laws and dynamics as well as a broad understanding of how insurance fits into every person’s life, from budgets to coverage levels. Through her years working in th...

Melanie Musson

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Tracey L. Wells

Updated May 2024

- Average Delaware car insurance rates are $171 per month for full coverage, which is higher than the national average

- Prices can be high, but some of the cheapest Delaware car insurance companies include Nationwide, Geico, and Progressive

- Although rates are high, drivers can find affordable Delaware auto insurance quotes by comparing prices, finding discounts, and keeping your driving record clean

Delaware car insurance rates are $171 per month for full coverage and $ 84 for minimum insurance. The minimum amount of liability insurance coverage requirements for Delaware car insurance is a 25/50/10 plan.

Although Delaware car insurance requirements are fairly low, rates still tend to be higher than the national average. There are several reasons that car insurance in Delaware tends to be expensive, but the primary factors include more traffic, higher repair and health care costs, and a large number of uninsured drivers.

Delaware auto insurance rates might be higher than the national average, but there are plenty of ways to save. Read on to learn where to find the best Delaware car insurance for your needs. Then, compare Delaware car insurance rates to find the best policy.

Benefits of Price Comparison Shopping

For families and individuals who are on a restricted budget and are interested in obtaining the best car insurance for the most reasonable price, the cost of the coverage the most important consideration in the shopping process.

Car insurance companies are sensitive to this fact.

Most major auto insurance providers offer a free service that provides a rate quote to consumers who are shopping around for car insurance.

The benefits of a car insurance comparison include:

- Improved odds of paying a low premium for coverage

- Discovery of free or low-cost incentives offered by insurance companies

- Ability to use competing companies’ rate quotes as leverage during price negotiations

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Compare Delaware Car Insurance Quotes

The advent of the internet has made it possible for major auto insurance providers such as Nationwide, USAA, Geico, and Progressive Direct to provide an online quote in a matter of minutes.

When shopping for car insurance online, the process of rate quote comparison shopping typically requires consumers to select specific details that they desire to have as part of their total auto insurance package.

Generally, the types of coverage offered by auto insurance companies include:

- Comprehensive car insurance

- Liability car insurance coverage

- Collision car insurance

- Personal injury protection coverage

Depending upon the level of coverage that the consumer desires, a rate quote is generated using data that is provided by the car insurance company’s website.

According to the Delaware Insurance Department, a driver must carry the following minimum liability coverage before registering or operating any vehicle in the state:

- $10, 000 for property damage

- $15, 000 for personal injury or death for one person

- $30, 000 for personal injury or death for more than one person

Once the minimum state car insurance requirements and personal desires are calculated by the auto insurance quote software, a monthly rate quote is provided to the consumer.

Generally, the online quote is valid and will be honored within a specified period of time after the quote is generated.

Why get more than one Delaware car insurance quote?

Obtaining more than one rate quote allows the consumer to conduct a price comparison analysis between auto insurance companies.

Having several valid car insurance rate quotes gives the consumer leverage in price negotiations between Delaware car insurance providers.

Because the auto insurance industry is so fiercely competitive, many major car insurance companies provide extra features to attract customers that their competitors may not offer.

For example, an auto insurance company may offer free roadside assistance to customers who meet certain criteria or commit to a certain level of coverage.

Sometimes these added features are not advertised, and consumers may only learn of these special incentives when conducting price comparison shopping for car insurance.

Some other bonus features that may be offered by auto insurance companies may include:

- Reduced car insurance deductibles

- Accident forgiveness

- Cash rewards for good driving

Obtaining several auto insurance quotes through multiple car insurance providers allows the consumer to determine the cost-effectiveness of the rate quote in association with the level of coverage.

In addition to a negotiation tool, consumers can determine which car insurance companies fit their personal needs and budgetary restrictions.

Delaware Auto Insurance Companies

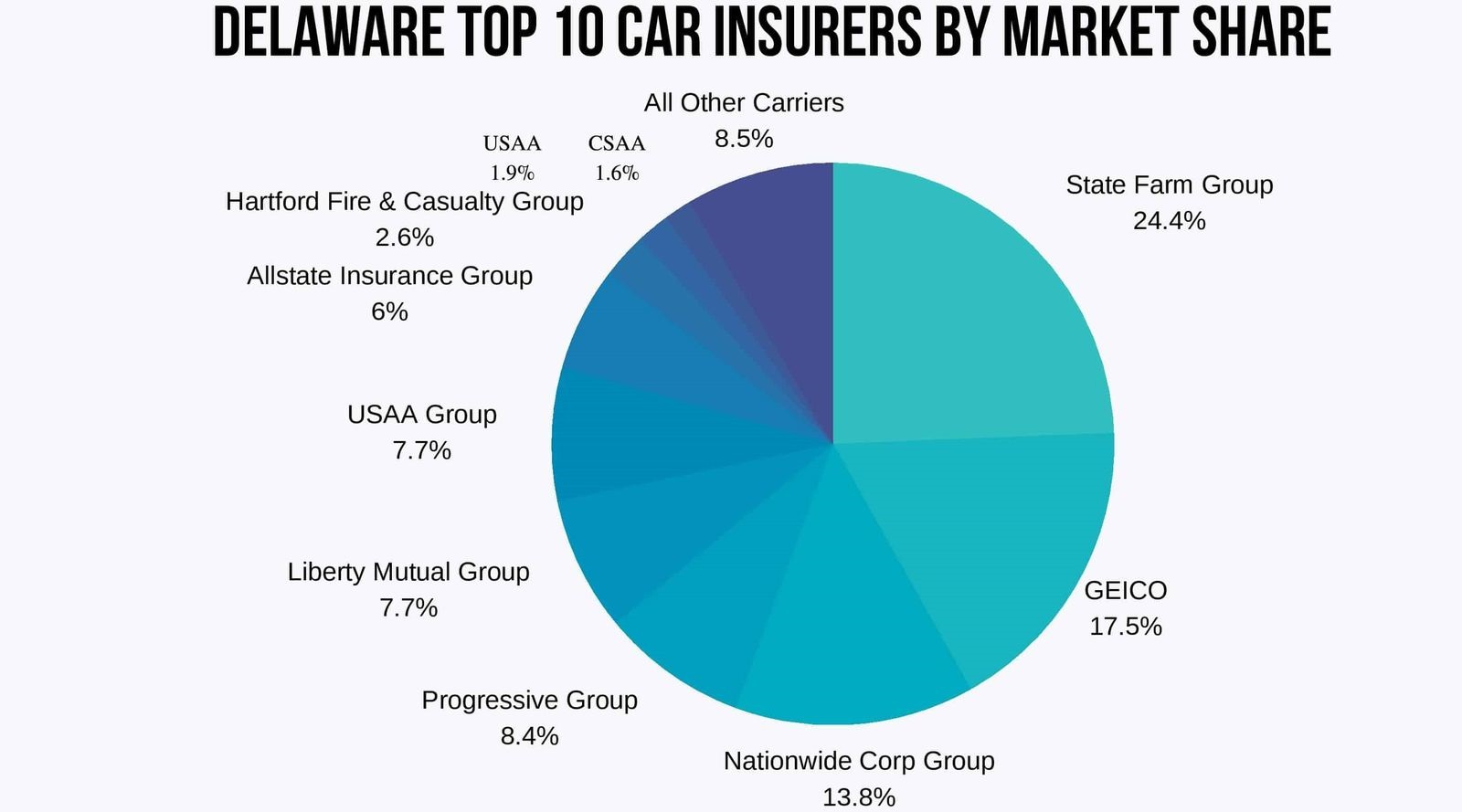

According to the Delaware Department of Insurance, car insurance companies that offer car insurance products and services in Delaware include:

- Nationwide Mutual: Nationwide is an insurance provider that offers various types of insurance products to Delaware residents. Drivers who insure vehicles with air bags, have multiple policies with the company, and insure students with good grades may qualify for discounts.

- Geico: Geico car insurance offers affordable coverage to residents of Delaware and offers car insurance discounts to qualified drivers who have a good driving record, insure more than one vehicle on the policy, and have completed driver education courses.

- USAA: USAA car insurance provides coverage to active military members, veterans, and their families. Among the discounts offered by USAA are discounts for air bags, low annual mileage, and multiple vehicles insured on the policy.

- Progressive: Known for its service of providing quote estimates of competing auto insurance companies, Progressive car insurance offers qualifying Delaware residents discounts for good claims history, good driving record, and multiple vehicle coverages with the company.

Consumers who desire to find the cheapest car insurance while maintaining the peace of mind that accompanies quality insurance coverage would be wise to conduct a thorough price comparison analysis when shopping for their auto insurance.

The utilization of rate quotes during the shopping process can ensure that the best possible price is obtained and the highest quality coverage is established.

Make sure you’re getting the best deal on quality coverage with our FREE ZIP code search below!

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Finding Cheap Car Insurance in Delaware

Delaware, due to being the first of the original 13 colonies to ratify the Constitution on December 7, 1787, is distinguished as “The First State” of our nation. Like former NBA great Shaquille O’Neal, however, one moniker just isn’t enough for Delaware.

Even though it’s the second smallest state in the union, it boasts many monikers such as “The Diamond State,” “Blue Hen State,” and “Small Wonder,” giving Delaware an impressive nickname-per-square mileage ratio.

Equally impressive is the longevity of Delaware’s longest-tenured senator Joe Biden. His 36 years in office puts the former Vice President of the United States in the top 20 all-time of longest-serving senators in the history of our country.

During his time in the Senate and as vice president, Biden has been an advocate of investing in America’s infrastructure.

We’ve got to rebuild the nation’s infrastructure. We need highways, we need transit, [and] we need lightning-fast broadband. It’s an absolute necessity.

Not only is concern about the conditions and viability of the roads on which we travel significant, but attention must also be given to the manner in which we travel. Having a proper understanding of the vehicles we drive and the best ways to insure them is important while traversing these ever-changing, ever-expanding roadways.

To get your free quote comparison, enter your ZIP code today!

Delaware Insurance Coverage and Rates

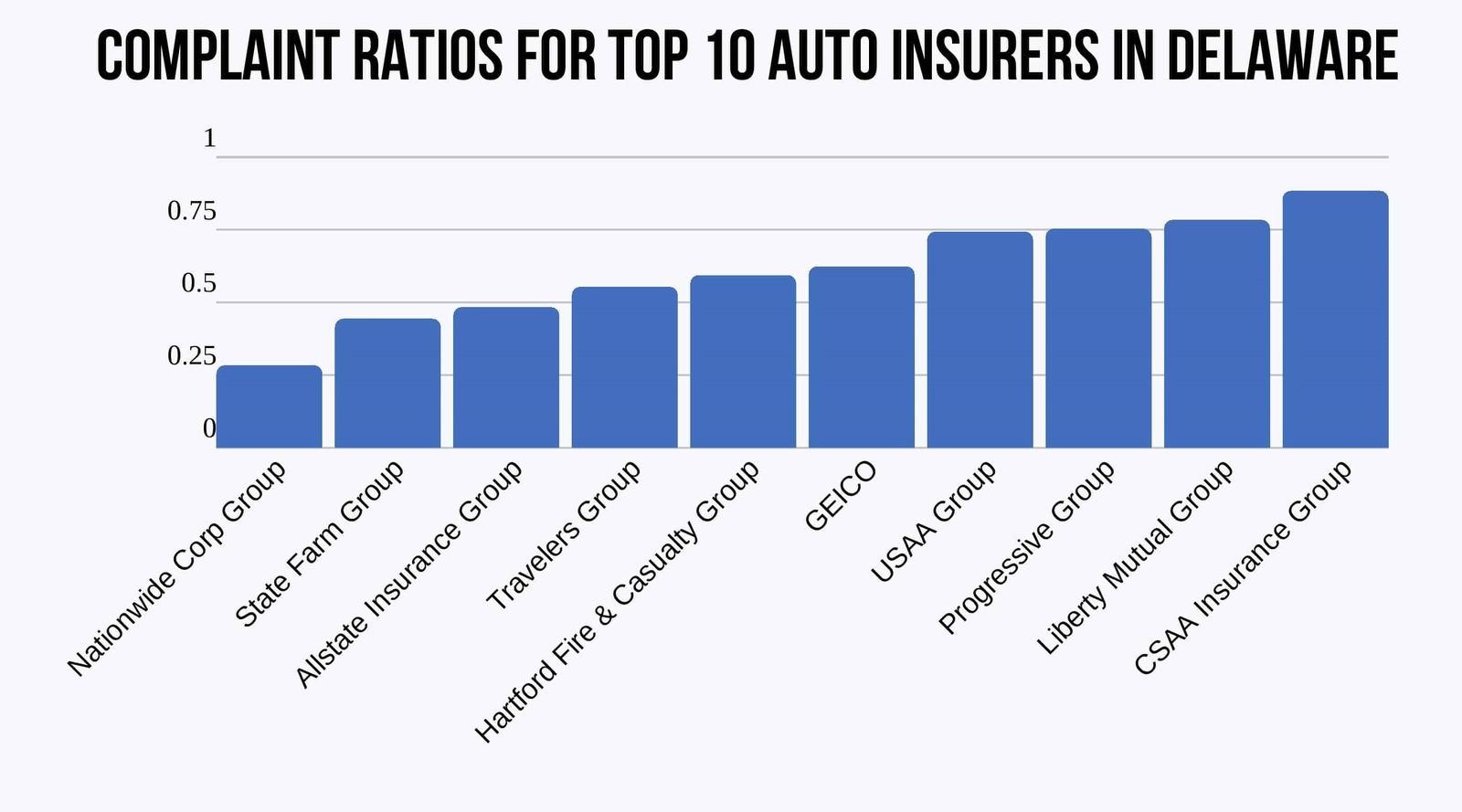

Why is car insurance so expensive in Delaware? Who has the cheapest car insurance in Delaware? Finding the time to research all there is to know about car insurance companies in Delaware and their rates and practices can seem like an impossible task.

The good news is we’ve paved the way for you to get the information you want and need to make an informed decision about your car insurance. We will help you discover the key indicators that insurance companies consider risks and how you can mitigate those risks.

We’ll help you to know what the state requires, what you may want or need, and where you can get it at the best price.

Delaware Minimum Auto Insurance Coverage

Is car insurance required in Delaware? Well, Delaware is one of only a few no-fault insurance states meaning, regardless of who is found to be at fault for an accident, all drivers must seek compensation for damages from their own insurance companies.

The Diamond State mandates that all drivers carry Personal Injury Protection coverage (PIP). The minimum amount of PIP coverage required by law is $15,000 per person and $30,000 per occurrence. In addition, $5,000 funeral services coverage is required.

The required minimum limits for basic coverage in Delaware is 25/50/10 for all motorists. This means that car owners must carry the following minimum levels of liability insurance:

$25,000 for bodily injury or death per person in an accident caused by the owner of the insured vehicle, $50,000 for total bodily injury or death per accident caused by the owner of the insured vehicle, and $10,000 for property damage per accident caused by the owner of the insured vehicle.

Delaware does not require you to carry Uninsured/Underinsured Motorist coverage, but it is a viable option and can protect you and your passengers if the at-fault driver has no insurance, or if you’re the victim of a hit-and-run.

How much risk are you assuming by only carrying the minimum amount of liability insurance? It depends on your monthly budget and on how exposed you want to be to potential litigation.

If you have assets or future assets that you wish to protect, you want to consider increasing your liability coverage.

The experts at the Wall Street Journal recommend liability limits of 100/300/50 and offer the following advice for choosing your coverage limits:

Make sure you’re covered for an amount equal to the total value of your assets (Add up the dollar values of your house, your car, savings, and investments.).

Please be aware that basic coverage only provides you with liability protection; It will not pay to repair or replace your car for an accident that you cause.

If you’re looking to repair or replace your car after an accident, then collision and comprehensive coverage are worth the investment. These policies come with a deductible and they pay based on the current value of your car, not necessarily the price you might have paid for it.

Self-insurance is available in Delaware to individuals and businesses with 15 or more cars registered in the state.

Next, we will take a look at how much motorists in Delaware pay on average for auto insurance. The amount you actually will pay may be slightly lower or higher than these figures, but this data will provide you with some context from which you can project your own situation with reasonable accuracy.

Premiums as a Percentage of Income

The late, great American cartoonist Bob Thaves once said, “I don’t know if I can live on my income or not, the government won’t let me try it.”

That funny quote illustrates the concept of one’s Disposable Personal Income (DPI), which is the money you’re allowed to keep after the government takes its cut in the form of taxes.

| Annual Full Coverage Average Premiums | Monthly Full Coverage Average Premiums | Annual Per Capita Disposable Personal Income | Monthly Per Capita Disposable Personal Income | Percentage of Income |

|---|---|---|---|---|

| $1,215.69 | $101.31 | $40,256.00 | $3,354.67 | 3.02% |

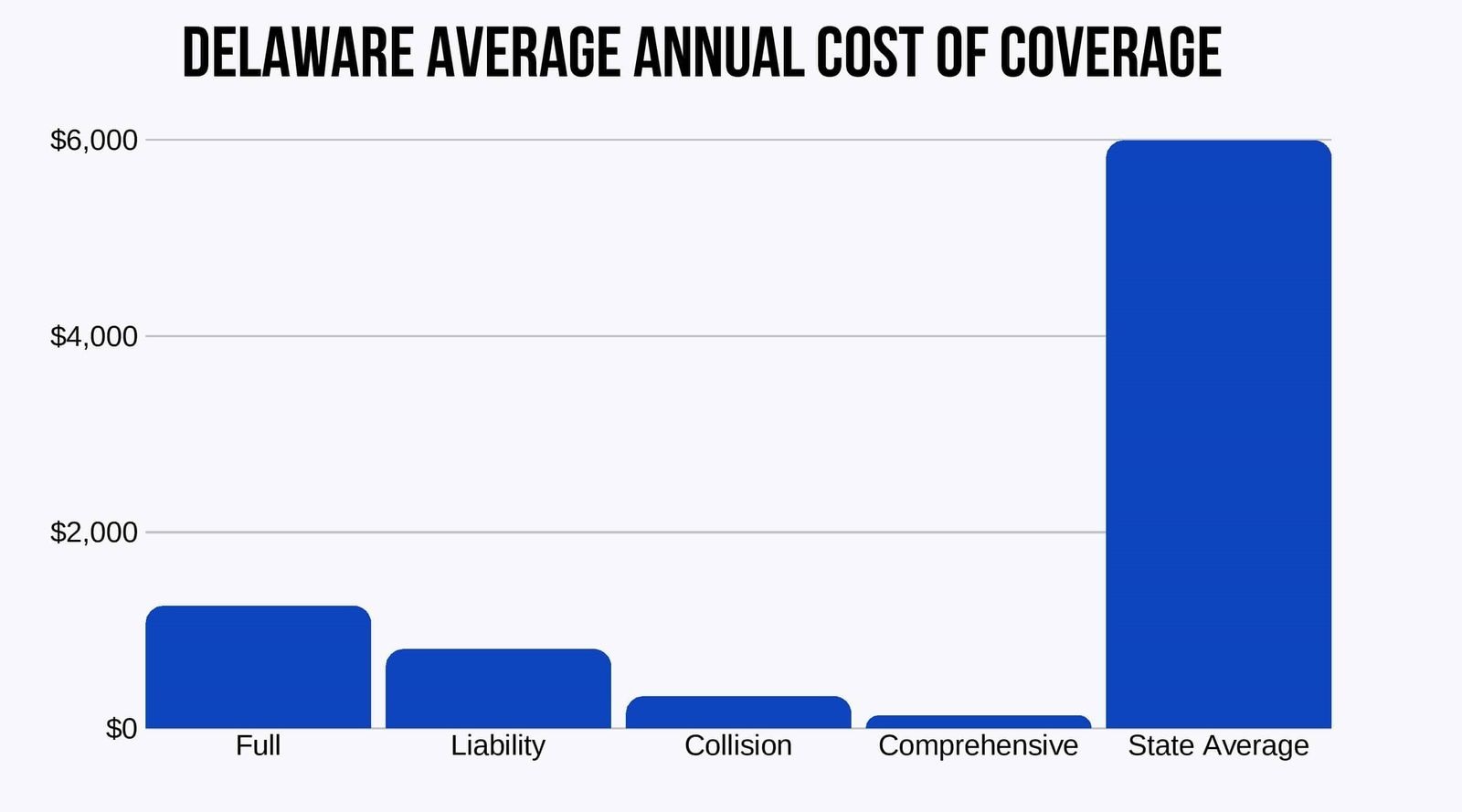

You are mandated by law to carry at least the basic coverage. A full coverage car insurance policy includes liability, comprehensive, and collision insurance. So, how much is car insurance in Delaware? Here’s a peek at the average cost of each package type:

Frequently Asked Questions

What factors can affect car insurance rates in Delaware?

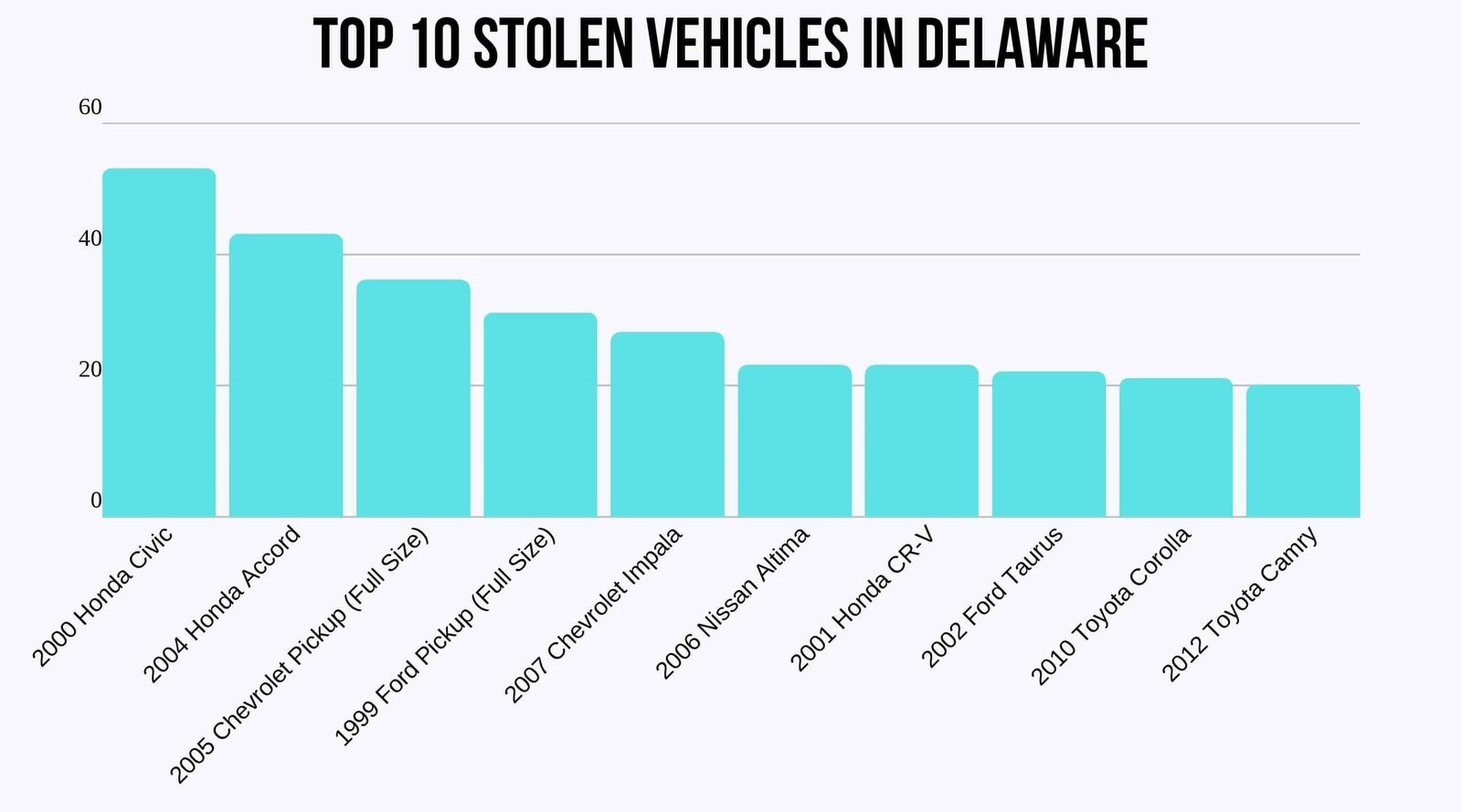

Car insurance rates in Delaware can be influenced by various factors. These include your driving record, age, gender, marital status, type of vehicle, coverage options, deductible amount, and credit history. Additionally, factors such as the location where you live in Delaware, the frequency of accidents and thefts in the area, and the average cost of repairs can also impact insurance rates.

What are the minimum car insurance requirements in Delaware?

In Delaware, the minimum car insurance requirements include liability coverage of at least $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $10,000 for property damage per accident. Additionally, drivers are required to carry personal injury protection (PIP) coverage of at least $15,000 per person and $30,000 per accident.

Are there any specific insurance considerations for Delaware?

Delaware is a unique state with its own specific insurance considerations. One factor to consider is the high population density in some areas, which can lead to more traffic congestion and potentially higher accident rates. Additionally, certain coastal areas may be prone to flooding and other weather-related risks. These factors can impact insurance rates and coverage options in Delaware.

How can I find affordable car insurance in Delaware?

To find affordable car insurance in Delaware, it’s recommended to shop around and compare quotes from different insurance providers. Additionally, maintaining a good driving record, bundling your car insurance with other policies, opting for higher deductibles, and taking advantage of available discounts, such as safe driver or multi-policy discounts, can help lower your insurance premiums.

What discounts are available for car insurance in Delaware?

Insurance providers in Delaware often offer various discounts for car insurance. Common discounts include safe driver discounts, multi-policy discounts, good student discounts, and discounts for vehicles equipped with safety features such as anti-lock brakes or airbags. It’s advisable to inquire with insurance providers about the specific discounts they offer.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.