Compare Florida Car Insurance Rates [2025]

Car insurance in Florida is affected by many factors, including traffic density and weather risks. Average Florida car insurance rates cost $238 per month for full coverage, much higher than the national average. Compare Florida car insurance rates with multiple companies to find the best policy.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Apr 23, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 23, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Florida Statistics Summary | Details |

|---|---|

| Miles of Roadway | 122,391 |

| Vehicle Miles Driven Annually | 201 billion |

| Vehicles | Registered in State: 14.9 million Total Stolen: 42,579 |

| State Population | 20.9 million |

| Most Popular Vehicle | Toyota Corolla |

| Uninsured Motorists | 26.7% State Rank: 1st |

| Driving Fatalities | 2017 Speeding: 299 Drunk Driving: 839 |

| Annual Insurance Costs | Liability: $857.64 Collision: $282.96 Comprehensive: $116.53 Combined: $1257.13 |

| Cheapest Provider | USAA |

Florida car insurance rates are some of the highest in the country, with the average driver paying over $200 per month for full coverage insurance. There are many reasons Florida car insurance quotes run high, but it’s primarily due to Florida car insurance regulations, a large percentage of uninsured drivers, and more high-risk drivers.

Although coverage can be expensive, there are ways to find affordable Florida car insurance. To find cheap car insurance in Florida, make sure to look for discounts, keep your driving record clean, and choose the right amount of coverage.

One of the most important steps in finding the cheapest Florida car insurance is comparing quotes. Read on to learn more about coverage in the Sunshine State, then compare Florida car insurance rates with as many companies as possible.

Compare Florida Car Insurance Rates

When you think of Florida, perhaps Disney, South Beach, The Miami Heat, or its warm, comfortable climate with bright sunshine springs to mind.

- Car Insurance Rates in Florida

- Compare Wesley Chapel, FL Car Insurance Rates [2025]

- Compare Waldo, FL Car Insurance Rates [2025]

- Compare Vero Beach, FL Car Insurance Rates [2025]

- Compare Venice, FL Car Insurance Rates [2025]

- Compare The Villages, FL Car Insurance Rates [2025]

- Compare Tavares, FL Car Insurance Rates [2025]Q: What should I do if I can’t afford car insurance in Tavares, FL? A: If you’re struggling to afford car insurance in Tavares, FL, there are a few options you can explore. First, consider adjusting your coverage limits or deductibles to lower your premium. You can also shop around and compare quotes from multiple insurers to find more affordable options. Additionally, some states offer low-cost or subsidized insurance programs for individuals with limited incomes. Contact your state’s insurance department or a local insurance agent to inquire about such programs.Compare Tavares, FL Car Insurance Rates [2025]

- Compare Tallahassee, FL Car Insurance Rates [2025]

- Compare Summerfield, FL Car Insurance Rates [2025]

- Compare Spring Hill, FL Car Insurance Rates [2025]

- Compare Sarasota, FL Car Insurance Rates [2025]

- Compare Santa Rosa Beach, FL Car Insurance Rates [2025]

- Compare Pompano Beach, FL Car Insurance Rates [2025]

- Compare Perry, FL Car Insurance Rates [2025]

- Compare Panama City Beach, FL Car Insurance Rates [2025]

- Compare Palm Beach Gardens, FL Car Insurance Rates [2025]

- Compare Ocoee, FL Car Insurance Rates [2025]

- Compare Ocala, FL Car Insurance Rates [2025]

- Compare North Fort Myers, FL Car Insurance Rates [2025]

- Compare Myakka City, FL Car Insurance Rates [2025]

- Compare Mount Dora, FL Car Insurance Rates [2025]

- Compare Milton, FL Car Insurance Rates [2025]

- Compare Melbourne, FL Car Insurance Rates [2025]

- Compare Lutz, FL Car Insurance Rates [2025]

- Compare Lynn Haven, FL Car Insurance Rates [2025]

- Compare Longwood, FL Car Insurance Rates [2025]

- Compare Lake Helen, FL Car Insurance Rates [2025]

- Compare Lady Lake, FL Car Insurance Rates [2025]

- Compare Kissimmee, FL Car Insurance Rates [2025]

- Compare Key Biscayne, FL Car Insurance Rates [2025]

- Compare Hollywood, FL Car Insurance Rates [2025]

- Compare Gulf Breeze, FL Car Insurance Rates [2025]

- Compare Fort Mc Coy, FL Car Insurance Rates [2025]

- Compare Englewood, FL Car Insurance Rates [2025]

- Compare Eglin Afb, FL Car Insurance Rates [2025]

- Compare Dunedin, FL Car Insurance Rates [2025]

- Compare Destin, FL Car Insurance Rates [2025]

- Compare Daytona Beach, FL Car Insurance Rates [2025]

- Compare Citra, FL Car Insurance Rates [2025]

- Compare Callaway, FL Car Insurance Rates [2025]

- Compare Callahan, FL Car Insurance Rates [2025]

- Compare Bushnell, FL Car Insurance Rates [2025]

- Compare Port St. Lucie, FL Car Insurance Rates [2025]

- Compare Cape Coral, FL Car Insurance Rates [2025]

- Compare Hialeah, FL Car Insurance Rates [2025]

- Compare Male vs. Female Car Insurance Rates in Florida [2025]

- Compare St. Petersburg, FL Car Insurance Rates [2025]

U.S. News & World Report ranked a series of Florida cities within the top 50 of its “125 Best Places to Live in the USA.” While there are many advantages of living in Florida, knowing what types of car insurance policies are available to you is one of the most important aspects for peace of mind.

Minimum Florida Car Insurance Requirements

| Florida Insurance Required | Minimum Limits |

|---|---|

| Personal Injury Coverage | $10,000 Personal Injury Protection (PIP) |

| Property Damage Liability Coverage | $10,000 Property Damage Liability (PDL) |

While Florida insurance laws state that you must maintain the Personal Injury Protection (PIP) insurance and Property Damage Liability (PDL) coverage throughout the licensing and registration of your vehicle, you’ll be happy to know that the coverage is broad.

For instance, in the event of an automobile crash, not only will PIP cover you and your vehicle, but also covers:

- Your child

- Members of your household

- Passengers who don’t have PIP Insurance (only if they don’t own a vehicle)

- If you are injured in someone else’s vehicle

- If, as a pedestrian or bicyclist, you’re struck by a vehicle

- If your child is injured on a school bus

Florida is a “no-fault” insurance state, which means that drivers are required to carry coverage that will pay for their own medical bills regardless of who was at fault in the accident.

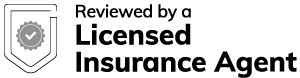

You can see below how the minimum rates compare across the country.

The minimum coverage includes:

- $10,000 to cover personal injury protection (PIP)

- $10,000 to cover property damage liability (PDL)

Bodily Injury Liability (BI) coverage is not required to drive in the state of Florida. In fact, they are the only state without that requirement. Many insurance companies will not sell a liability car insurance policy without minimum bodily injury limits, though.

Read more: Compare School Bus Insurance Rates

What Forms are Required with Florida Car Insurance

You must have the minimum insurance coverage in Florida; it’s the law. So, when it comes to actually proving that you have auto insurance and financial responsibility in Florida, you must present one of the following documents every time you operate your vehicle :

- The insurance ID card provided by your insurance company

- Your insurance policy

- Certificate of self-insurance

- Form E, Uniform Motor Carrier Bodily Injury and Property Damage Liability

- Insurance policy binder

- A surety bond or combination of surety bond and insurance policy

Some of the most common times when you proof of insurance and financial responsibility are:

- You are asked by a police officer (such as when you are pulled over)

- You register your vehicle

- You are getting or reinstating your license

- You didn’t abide by or failed to maintain financial responsibility penalties

In the event that you don’t show proof of your Florida car insurance regulations when requested, the penalties can be stiff for driving without insurance.

For instance, the law states that your driving privileges, registration, and license plate could be suspended for up to three years or until proof of insurance is shown; or you can be given a license reinstatement fine of between $150 to $500.

Compare Florida Car Insurance Rates as Percentage of Income

The annual per capita disposable personal income (DPI) in Florida was $38,350.00, which represents the total amount of money available for individuals to spend (or save) after taxes have been paid.

The average cost for full coverage car insurance premiums is $238 per month, representing 3.15% of the average resident’s DPI. That percentage puts Florida as the fourth most expensive state for insurance when compared to income.

Average Yearly Car Insurance Rates in FL (Liability, Collision, Comprehensive)

| Florida Coverage Type | Annual Costs in 2015 |

|---|---|

| Liability | $857.64 |

| Collision | $282.96 |

| Comprehensive | $116.53 |

| Combined | $1257.13 |

The above table illustrates the most recent data provided by the leading source on the matter, the National Association of Insurance Commissioners.

Don’t forget: Florida has minimum requirements for liability coverage, but experts suggest drivers purchase more than what state law requires.

You also may not think about how your average car insurance rates compare to neighboring states.

Let’s dig into some of the most popular coverage options to add to a basic auto insurance policy.

Additional Liability Coverage in Florida

| Florida Loss Ratio | 2012 | 2013 | 2014 |

|---|---|---|---|

| Medical Payments (MedPay) | 74.31% | 72.51% | 81.29% |

| Personal Injury Protection | 74.95% | 62.03% | 75.76% |

| Uninsured/Underinsured Motorist | 73.12% | 79.83% | 85.87% |

Are you wondering what the relevance of a loss ratio is? Maybe you’re wondering what a loss ratio is? Here’s your answer:

A loss ratio demonstrates the amount paid in claims to the amount earned in premiums. A loss ratio of 75% indicates that insurance companies paid $75 on claims for every $100 earned.

A loss ratio matters because it shows the financial health of that insurance product and indicates whether the rates will need to raise, lower, or stay the same for the insurance companies to maintain financial stability.

The loss ratios listed above are in a healthy range but demonstrate a rising trend which means rates are likely to increase.

Uninsured/Underinsured Motorist coverage is optional in Florida, but they’re still important to have. Why?

In 2015, 13% of motorists (or approximately one in eight drivers) in the US were uninsured, and a whopping 26.7% of motorists were uninsured in Florida – the highest in the U.S.

Add-ons, Endorsements, and Riders in Florida

We understand that getting the complete coverage you need for an affordable price is your goal while at the same time finding all the required coverage you need. The good news is that there are a plethora of powerful but reasonable extras you can add to your policy in Florida.

After all, an unfortunate accident is an experience everyone wants to avoid, but when it does happen, the additional coverage can make for an easier (and sometimes less expensive) outcome.

Here’s a list of useful coverage available to you in Florida:

- Collision insurance

- Comprehensive insurance

- GAP insurance

- Personal Umbrella Policy (PUP)

- Rental Car Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-as-You-Go Insurance

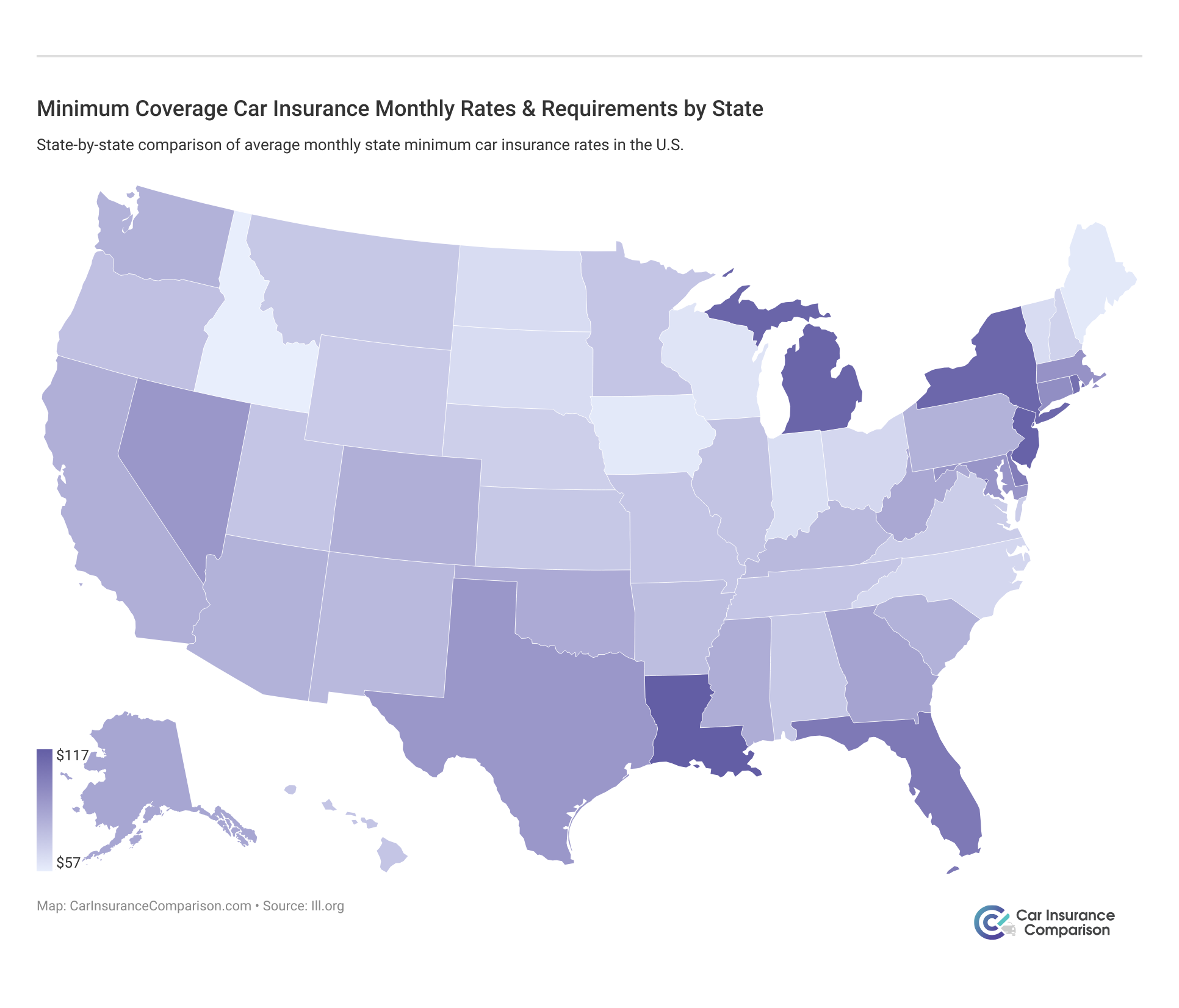

Compare Florida Car Insurance Rates by Age and Gender

Read more: Compare Male vs. Female Car Insurance Rates in Florida

Florida Demographic and Insurance Carrier Rates

| Florida Company | Married 35-year old female Annual Rate | Married 35-year old male Annual Rate | Married 60-year old female Annual Rate | Married 60-year old male Annual Rate | Single 17-year old female Annual Rate | Single 17-year old male Annual Rate | Single 25-year old female Annual Rate | Single 25-year old male Annual Rate |

|---|---|---|---|---|---|---|---|---|

| Allstate F&C | $4,653.38 | $4,423.29 | $4040.00 | $4,089.70 | $15,905.72 | $17,179.33 | $4,592.92 | $4,639.32 |

| Geico General | $2,986.89 | $3,001.17 | $2,793.99 | $2,793.99 | $5,342.74 | $6,713.47 | $3,292.51 | $3,344.27 |

| Liberty Mutual Ins. Co. | $3,711.14 | $3,711.14 | $3,398.94 | $3,398.94 | $7,859.88 | $12,116.72 | $3,711.14 | $5,037.27 |

| Allied P&C | $3,039.80 | $3,000.81 | $2,710.48 | $2,806.30 | $7,314.60 | $9,013.69 | $3,347.30 | $3,483.83 |

| Progressive Select | $3,736.10 | $3,523,35 | $3,200.74 | $3,428.17 | $10,512.83 | $11,453.56 | $4,508.82 | $4,302.83 |

| State Farm Mutual Auto | $2,158.99 | $2,158.99 | $1,954.51 | $1,954.51 | $6,166.09 | $7,832.79 | $2,399.41 | $2,556.07 |

| USAA | $1,646.31 | $1,619.23 | $1,536.18 | $1,525.12 | $5,638.10 | $6,551.72 | $2,060.09 | $2,226.40 |

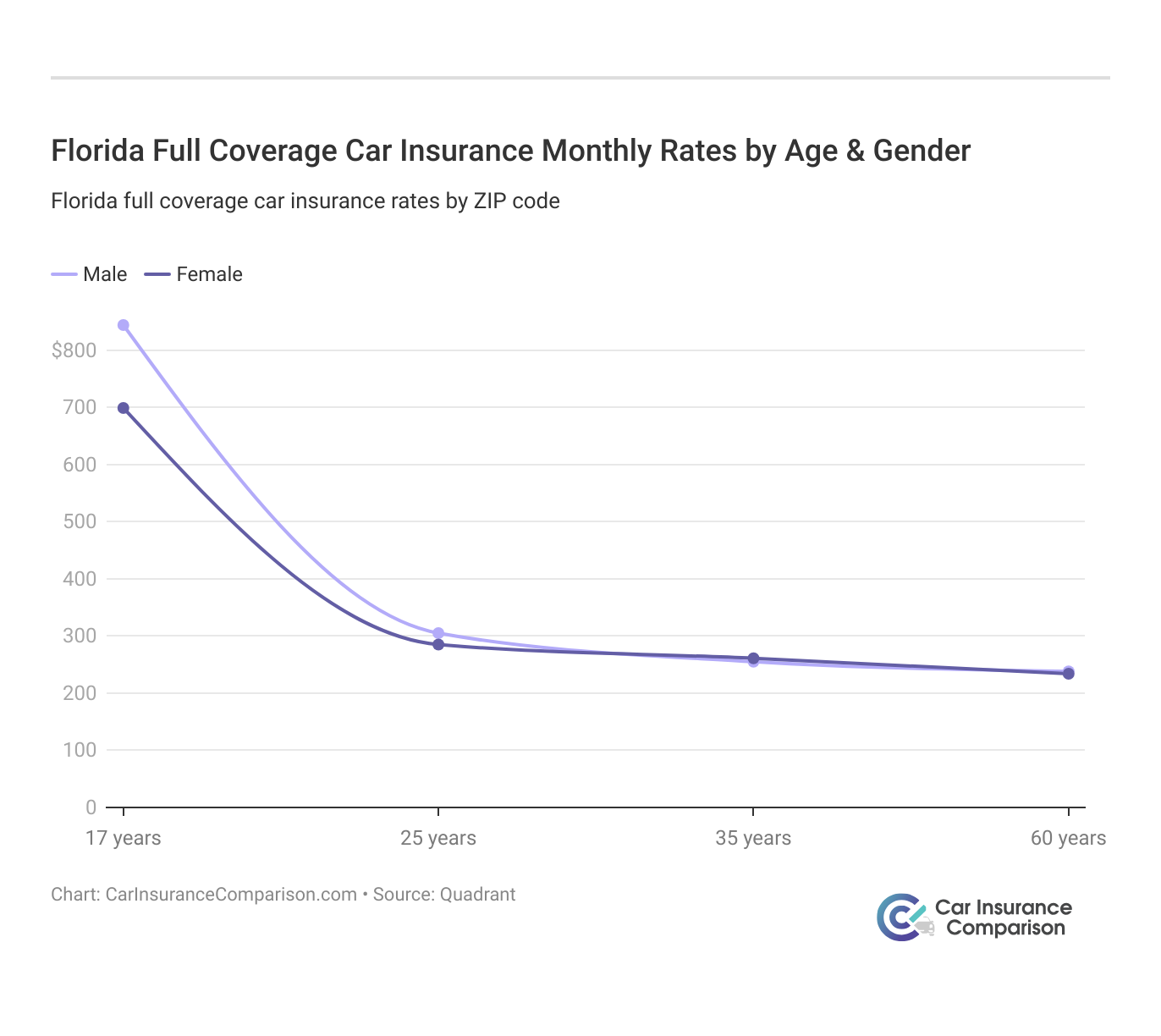

Highest and Lowest Rates in Florida by Zip Code

Below are the highest and lowest insurance carrier rates in Florida based on zip code. Take a close look at the averages to see how they fluctuate based on your address.

| 25 Most Expensive Zip Codes in Florida | City | Annual Average by Zip Code | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 33142 | MIAMI | $7,631.16 | Allstate | $12,185.02 | Liberty Mutual | $9,457.09 | USAA | $4,036.96 | Geico | $4,603.44 |

| 33147 | MIAMI | $7,626.18 | Allstate | $12,185.02 | Liberty Mutual | $9,457.09 | USAA | $4,202.34 | Geico | $4,603.44 |

| 33125 | MIAMI | $7,606.64 | Allstate | $12,185.02 | Liberty Mutual | $9,457.09 | USAA | $4,036.96 | Geico | $4,603.44 |

| 33135 | MIAMI | $7,606.64 | Allstate | $12,185.02 | Liberty Mutual | $9,457.09 | USAA | $4,036.96 | Geico | $4,603.44 |

| 33130 | MIAMI | $7,592.83 | Allstate | $12,185.02 | Liberty Mutual | $9,457.09 | USAA | $4,036.96 | Geico | $4,603.44 |

| 33136 | MIAMI | $7,592.83 | Allstate | $12,185.02 | Liberty Mutual | $9,457.09 | USAA | $4,036.96 | Geico | $4,603.44 |

| 33127 | MIAMI | $7,517.24 | Allstate | $12,185.02 | Liberty Mutual | $9,457.09 | USAA | $4,036.96 | Geico | $4,603.44 |

| 33010 | HIALEAH | $7,448.04 | Allstate | $12,185.02 | Progressive | $8,805.26 | USAA | $4,036.96 | Geico | $4,603.44 |

| 33150 | MIAMI | $7,428.69 | Allstate | $12,124.19 | Liberty Mutual | $9,457.09 | USAA | $4,202.34 | Geico | $4,603.44 |

| 33128 | MIAMI | $7,404.00 | Allstate | $12,185.02 | Progressive | $8,497.04 | USAA | $4,036.96 | Geico | $4,603.44 |

| 33012 | HIALEAH | $7,304.68 | Allstate | $11,716.92 | Progressive | $8,805.26 | USAA | $4,202.34 | Geico | $4,603.44 |

| 33126 | MIAMI | $7,297.22 | Allstate | $12,367.26 | Liberty Mutual | $8,135.30 | USAA | $4,036.96 | Geico | $4,603.44 |

| 33013 | HIALEAH | $7,275.81 | Allstate | $11,715.10 | Progressive | $8,604.99 | USAA | $4,202.34 | Geico | $4,603.44 |

| 33168 | MIAMI | $7,240.81 | Allstate | $11,827.36 | Progressive | $8,466.37 | USAA | $4,505.83 | Geico | $4,603.44 |

| 33167 | MIAMI | $7,216.08 | Allstate | $11,654.27 | Progressive | $8,466.37 | USAA | $4,505.83 | Geico | $4,603.44 |

| 33145 | MIAMI | $7,199.47 | Allstate | $10,732.87 | Liberty Mutual | $9,457.09 | USAA | $4,036.96 | Geico | $4,603.44 |

| 33144 | MIAMI | $7,197.53 | Allstate | $12,367.26 | Liberty Mutual | $8,135.30 | USAA | $4,036.96 | Geico | $4,603.44 |

| 33174 | MIAMI | $7,178.70 | Allstate | $12,367.26 | Liberty Mutual | $8,247.08 | USAA | $4,038.46 | Geico | $4,603.44 |

| 33199 | MIAMI | $7,178.70 | Allstate | $12,367.26 | Liberty Mutual | $8,247.08 | USAA | $4,038.46 | Geico | $4,603.44 |

| 33122 | MIAMI | $7,163.83 | Allstate | $11,836.51 | Liberty Mutual | $8,135.30 | USAA | $4,036.96 | Geico | $4,603.44 |

| 33054 | OPA LOCKA | $7,162.08 | Allstate | $11,656.10 | Progressive | $8,533.79 | USAA | $4,505.83 | Geico | $4,603.44 |

| 33184 | MIAMI | $7,153.94 | Allstate | $12,193.91 | Liberty Mutual | $8,247.08 | USAA | $4,038.46 | Geico | $4,603.44 |

| 33016 | HIALEAH | $7,146.88 | Allstate | $11,656.10 | Progressive | $8,805.26 | USAA | $4,505.83 | Geico | $4,603.44 |

| 33175 | MIAMI | $7,127.61 | Allstate | $12,009.61 | Liberty Mutual | $8,247.08 | USAA | $4,038.46 | Geico | $4,603.44 |

| 33162 | MIAMI | $7,110.30 | Allstate | $11,684.61 | Liberty Mutual | $8,135.30 | USAA | $4,505.83 | Geico | $4,603.44 |

| 25 Least Expensive Zip Codes in Florida | City | Annual Average by Zip Codes | Most Expensive Company | Most Expensive Yearly Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 32694 | WALDO | $3,481.35 | Allstate | $5,638.78 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32643 | HIGH SPRINGS | $3,486.23 | Allstate | $5,672.94 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32618 | ARCHER | $3,486.59 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32667 | MICANOPY | $3,486.59 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32669 | NEWBERRY | $3,486.59 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32601 | GAINESVILLE | $3,489.42 | Allstate | $5,638.78 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32609 | GAINESVILLE | $3,489.42 | Allstate | $5,638.78 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32641 | GAINESVILLE | $3,489.42 | Allstate | $5,638.78 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32615 | ALACHUA | $3,490.52 | Allstate | $5,703.00 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32658 | LA CROSSE | $3,490.52 | Allstate | $5,703.00 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32612 | GAINESVILLE | $3,492.52 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32603 | GAINESVILLE | $3,494.66 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32605 | GAINESVILLE | $3,494.66 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32606 | GAINESVILLE | $3,494.66 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32607 | GAINESVILLE | $3,494.66 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32608 | GAINESVILLE | $3,494.66 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32611 | GAINESVILLE | $3,494.66 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32653 | GAINESVILLE | $3,494.66 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32610 | GAINESVILLE | $3,504.58 | Allstate | $5,675.46 | Progressive | $3,951.64 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32631 | EARLETON | $3,523.03 | Allstate | $5,930.57 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32550 | MIRAMAR BEACH | $3,597.34 | Allstate | $5,996.61 | Progressive | $4,267.71 | USAA | $1,983.74 | State Farm | $2,555.76 |

| 32664 | MC INTOSH | $3,610.75 | Allstate | $5,675.46 | Liberty Mutual | $3,954.28 | USAA | $2,456.82 | State Farm | $2,656.82 |

| 32681 | ORANGE LAKE | $3,610.75 | Allstate | $5,675.46 | Liberty Mutual | $3,954.28 | USAA | $2,456.82 | State Farm | $2,656.82 |

| 32633 | EVINSTON | $3,646.11 | Allstate | $5,638.78 | Progressive | $5,035.52 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32640 | HAWTHORNE | $3,646.11 | Allstate | $5,638.78 | Progressive | $5,035.52 | USAA | $2,129.02 | State Farm | $2,685.17 |

Compare Florida Car Insurance Rates by City and County

How can you find the cheapest auto insurance in Florida? In the tables below, you’ll notice how insurance rates compare greatly geographically.

| 10 Most Expensive Cities in Florida | Annual Average by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Brownsville | $7,631.16 | Allstate | $12,185.02 | Liberty Mutual | $9,457.09 | USAA | $4,036.96 | Geico | $4,603.44 |

| Gladeview | $7,527.43 | Allstate | $12,154.60 | Liberty Mutual | $9,457.09 | USAA | $4,202.34 | Geico | $4,603.44 |

| Fountainebleau | $7,237.96 | Allstate | $12,367.26 | Liberty Mutual | $8,191.19 | USAA | $4,037.71 | Geico | $4,603.44 |

| Hialeah | $7,178.98 | Allstate | $11,504.33 | Progressive | $8,630.10 | USAA | $4,248.38 | Geico | $4,603.44 |

| Golden Glades | $7,161.53 | Allstate | $11,695.48 | Liberty Mutual | $8,135.30 | USAA | $4,505.83 | Geico | $4,603.44 |

| Coral Terrace | $7,081.53 | Allstate | $12,367.26 | Liberty Mutual | $8,191.19 | USAA | $4,045.62 | Geico | $4,603.44 |

| Olympia Heights | $7,078.68 | Allstate | $12,367.26 | Liberty Mutual | $8,247.08 | USAA | $4,038.46 | Geico | $4,603.44 |

| Miami | $7,078.48 | Allstate | $11,539.59 | Liberty Mutual | $8,684.52 | USAA | $4,077.32 | Geico | $4,603.44 |

| Biscayne Park | $6,983.18 | Allstate | $11,896.30 | Progressive | $8,392.79 | USAA | $4,505.83 | Geico | $4,603.44 |

| Miami Gardens | $6,972.48 | Allstate | $10,667.38 | Liberty Mutual | $8,209.82 | USAA | $4,505.83 | Geico | $4,603.44 |

The table above lists the 10 most expensive cities, while the table below lists the 10 least expensive.

| 10 Least Expensive Cities in Florida | Annual Average by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Waldo | $3,481.35 | Allstate | $5,638.78 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| High Springs | $3,486.23 | Allstate | $5,672.94 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| Archer | $3,486.59 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| Micanopy | $3,486.59 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| Newberry | $3,486.59 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| Alachua | $3,490.52 | Allstate | $5,703.00 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| La Crosse | $3,490.52 | Allstate | $5,703.00 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| Gainesville | $3,494.00 | Allstate | $5,666.29 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| Earleton | $3,523.03 | Allstate | $5,930.57 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| Miramar Beach | $3,597.34 | Allstate | $5,996.61 | Progressive | $4,267.71 | USAA | $1,983.74 | State Farm | $2,555.76 |

Busier centers such as Hollywood and Miami in the south differ greatly from the state capital of Tallahassee in the north or even the smaller communities such as Edgewater or Waldo, FL.

Secure Your Ride With the Best Rates in Florida: Compare Car Insurance in Your City

Easily compare car insurance rates across various cities in Florida. Start now to find the best rates for your needs!

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Florida Car Insurance Companies

Getting an auto insurance policy only to realize your friend or relative found a better deal with a more economical provider can be frustrating, to say the least.

Don’t despair. If you’re currently browsing or in the market for a new provider, we provide the right insight you need to know to make the right decision. We’ll help you find the best provider in Florida to meet your needs.

The 10 Largest Florida Car Insurance Companies Financial Ratings

You don’t have to be an analyst on Wall Street to determine the financial ratings for an auto insurance provider in your state.

The ratings are commonly touted on the company’s website and are ranked annually by such top agencies as A.M. Best, Fitch, Kroll Bond Rating Agency (KBRA), Moody’s, and Standard & Poor’s.

Checking out a provider’s rating is a great starting point, as they are graded by such criteria as customer satisfaction ratings, financial strength ratings, and more. Here are ten of the financial ratings of the top car insurance companies in Florida.

| Florida Providers (Listed by Size, Largest to Smallest): | A.M. Best Rating: |

|---|---|

| Geico | A++ |

| State Farm | A++ |

| USAA | A++ |

| Allstate | A+ |

| Progressive | A+ |

| Farmers | A |

| Liberty Mutual | A |

| Travelers Group | A |

| AmTrust NGH Group | A- |

| J. Whited Group (Windhaven) | A- |

Customer Satisfaction

In 2018, MetLife hit the top of the charts earning the highest Overall Customer Satisfaction Index Rating for Florida besides USAA, which is only available to military and their families.

According to J.D. Power, the 2018 U.S. Auto Insurance Study examines customer satisfaction in five factors (in order of importance), including interaction, policy offerings, price, billing process, policy information, and claims.

The study is based on responses from 44,622 auto insurance customers and was fielded from February-April 2018.

Florida Car Insurance Companies Customer Complaints

No large corporation is 100% perfect, and it’s practically impossible for them to be all things to all people in any given industry, the auto insurance market included. Here are the complaint ratios for the top 10 insurance companies in Florida.

| Insurance Company/Group | Number of Autos Insured | Number of Complaints Received | Ratio of Complaints Per 1,000 Autos |

|---|---|---|---|

| Allstate Ins. Co. | 83,479 | 5 | 0.060 |

| DTRIC Ins. Co., Ltd. | 26,234 | 5 | 0.191 |

| Farmers Ins. Hawaii, Inc. | 67,473 | 43 | 0.637 |

| First Ins. Co. | 59,085 | 8 | 0.135 |

| Geico Ins. Co. | 232,142 | 79 | 0.340 |

| Hartford Underwriters Ins. Co. | 17,979 | 3 | 0.167 |

| Island Ins. Co. | 26,450 | 3 | 0.113 |

| Liberty Mutual Ins. Co. | 36,017 | 5 | 0.139 |

| Progressive Ins. Co. | 40,623 | 12 | 0.295 |

| State Farm Ins. Co. | 176,321 | 12 | 0.068 |

| USAA Ins. Co. | 104,745 | 15 | 0.143 |

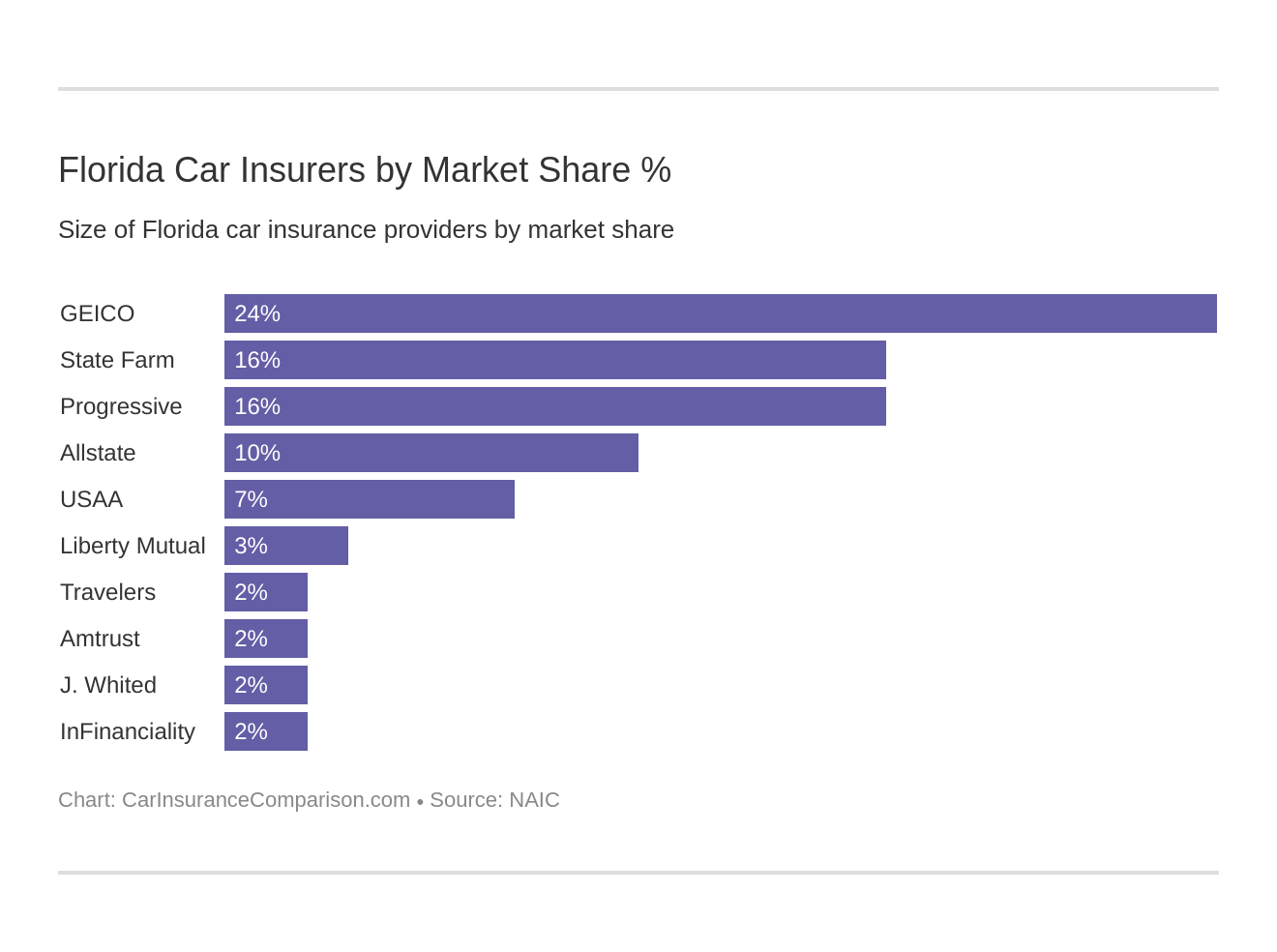

The 10 Largest Car Insurance Companies in Florida

| Florida Providers | Premiums Written | Market Share |

|---|---|---|

| Geico | $4,678,326 | 24.44% |

| State Farm | $3,042,871 | 15.89% |

| Progressive Group | $3,031,444 | 15.84% |

| Allstate Insurance Group | $1,842,800 | 9.63% |

| USAA Group | $1,357,367 | 7.09% |

| Liberty Mutual Group | $617,089 | 3.22% |

| Travelers Group | $444,623 | 2.32% |

| Amtrust NGH Group | $413,351 | 2.16% |

| J. Whited Group (Windhaven) | $385,885 | 2.02% |

| InFinanciality Prop & Casualty Insurance Group | $357,011 | 1.86% |

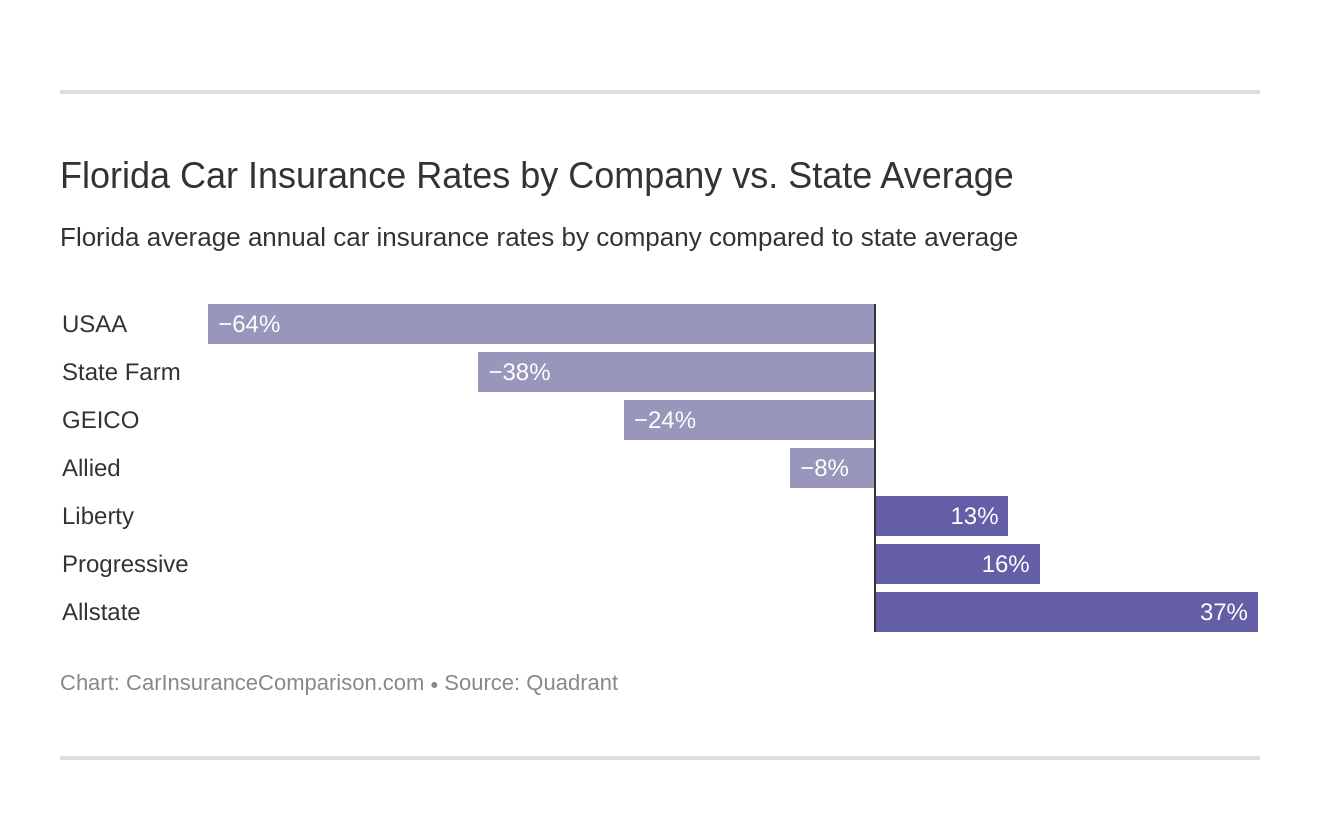

Florida Car Insurance Rates by Company

Read more: Allied Car Insurance Discounts

| Provider | Average Annual Rate |

|---|---|

| USAA | $2,850.41 |

| State Farm | $3,397.67 |

| Geico General | $3,783.63 |

| Allied P&C | $4,339.60 |

| Liberty Mutual Ins Co | $5,368.15 |

| Progressive Select | $5,583.30 |

| Allstate F&C | $7,440.46 |

Florida Annual Rates by Commute

| Company | 10 miles commute/6000 annual mileage. | 25 miles commute/12000 annual mileage. |

|---|---|---|

| Allstate | $7,227.85 | $7,653.06 |

| Progressive | $5,583.30 | $5,583.30 |

| Liberty Mutual | $5,193.97 | $5,542.32 |

| Nationwide | $4,339.60 | $4,339.60 |

| Geico | $3,765.00 | $3,802.25 |

| State Farm | $3,278.22 | $3,517.12 |

| USAA | $2,818.01 | $2,882.80 |

As you can see, Progressive car insurance and Nationwide car insurance don’t change the price based on the annual mileage. Allstate is already the most expensive option of the big providers in the state, and they’ll charge over $400 annually more for the longer commute.

Annual Rates by Coverage Level in Florida

| Company | Low Coverage Annual Rate | Medium Coverage Annual Rate | High Coverage Annual Rate |

|---|---|---|---|

| Allstate | $5,762.84 | $7,820.73 | $8,737.79 |

| Progressive | $4,681.36 | $5,712.27 | $6,356.27 |

| Liberty Mutual | $4,921.70 | $5,456.65 | $5,726.09 |

| Nationwide | $3,427.69 | $4,511.14 | $5,079.97 |

| Geico | $3,105.08 | $3,915.19 | $4,330.61 |

| State Farm | $2,915.85 | $3,477.29 | $3,799.88 |

| USAA | $2,450.79 | $2,954.56 | $3,145.87 |

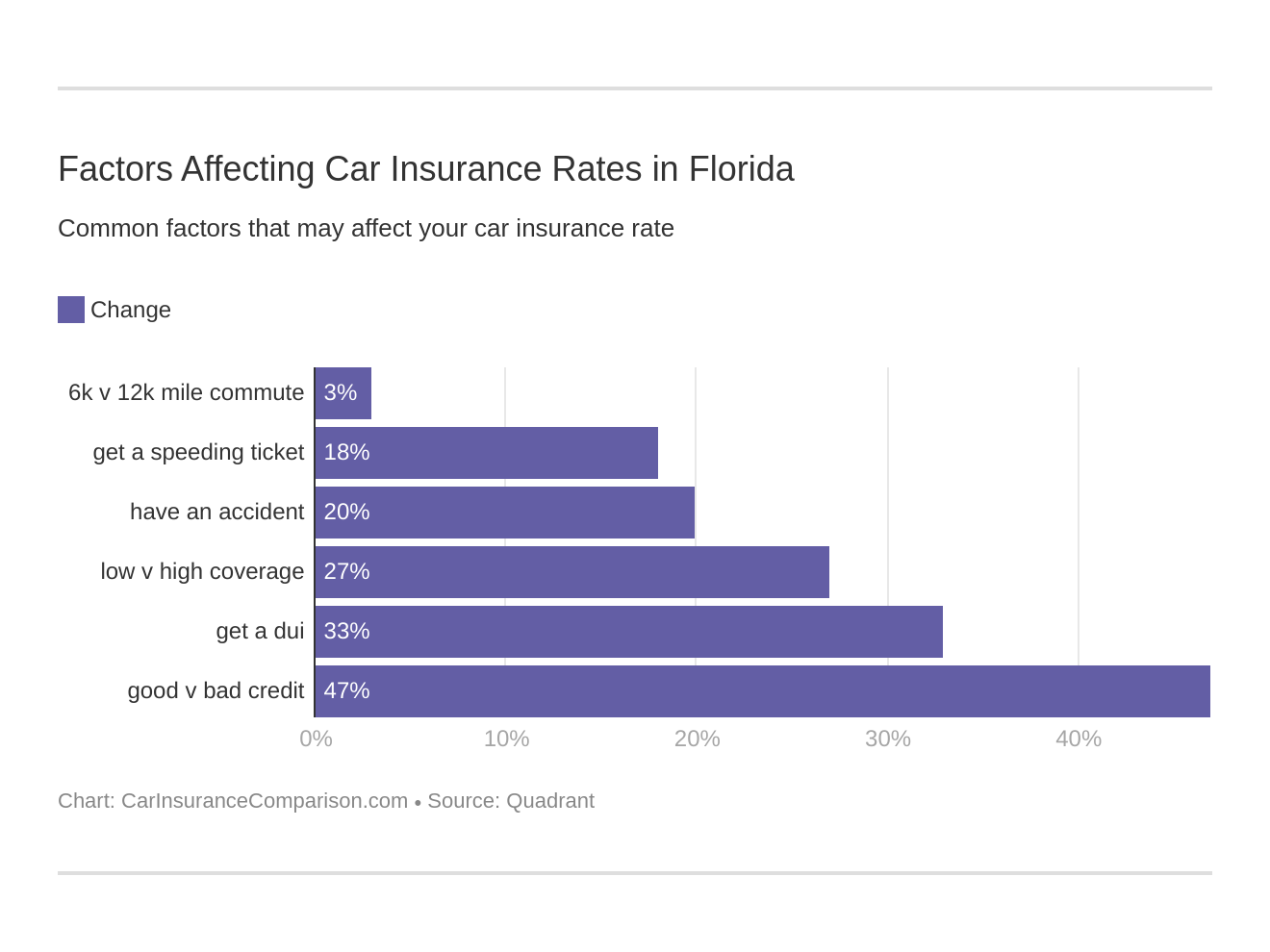

Annual Rates by Credit History in Florida

| Company | Annual Rate with Poor Credit | Annual Rate with Fair Credit | Annual Rate with Good Credit |

|---|---|---|---|

| Allstate | $10,432.38 | $6,574.17 | $5,314.82 |

| Progressive | $7,278.07 | $5,169.65 | $4,302.18 |

| Liberty Mutual | $6,921.08 | $5,073.66 | $4,109.70 |

| Geico | $5,509.78 | $3,335.60 | $2,505.51 |

| Nationwide | $5,441.06 | $3,981.62 | $3,596.12 |

| State Farm | $4,651.82 | $3,045.80 | $2,495.39 |

| USAA | $4,639.45 | $2,266.46 | $1,645.31 |

Credit rating makes a huge impact on rates. Of the large companies in our research, State Farm car insurance is the lowest-priced insurance in Florida available to the general public, and Geico car insurance rates are competitive with State Farms for individuals with good credit.

Those with fair or poor credit may do better to consider State Farm over Geico. You’ll only know which company offers you the best rate by comparing quotes for your unique situation.

Annual Rates by Driving History in Florida

| Company | Annual Rate with Clean Record | Annual Rate with One Speeding Violation | Annual Rate with One Accident | Annual Rate with One DUI |

|---|---|---|---|---|

| Allstate | $6,417.39 | $7,119.64 | $7,700.66 | $8,524.13 |

| Liberty Mutual | $3,869.33 | $5,285.32 | $5,026.31 | $7,291.64 |

| Progressive | $4,407.95 | $5,915.72 | $6,519.19 | $5,490.35 |

| Nationwide | $3,705.32 | $4,114.99 | $4,065.71 | $5,472.37 |

| Geico | $2,636.72 | $4,116.12 | $3,368.94 | $5,012.72 |

| USAA | $2,233.94 | $2,341.64 | $2,755.24 | $4,070.81 |

| State Farm | $3,105.11 | $3,397.66 | $3,690.25 | $3,397.66 |

This table reveals some interesting and surprising information. I’ll highlight a few things:

- State Farm is the most forgiving of bad history and charges less than $300 more annually for a DUI on record than for a clean record

- Most people assume a DUI will make rates rise more than any other infraction, however, Progressive increases rates more for a speeding violation than for a DUI conviction, and State Farm increases rates equally for a speeding violation and a DUI conviction

- Liberty Mutual, Nationwide, and Geico increase rates more for a speeding violation than for an accident.

Number of Car Insurance Companies in Florida

| Florida Property & Casualty Insurance | Number |

|---|---|

| Domestic | 114 |

| Foreign | 953 |

| Total | 1,067 |

Laws and Florida Car Insurance

Laws regarding auto insurance differ from state to state. Florida insurance laws are detailed and you must realize and understand the common auto insurance laws to avoid unexpected fines.

The old saying, “ignorance of the law is no excuse” rings true and certainly applies in the state of Florida.

So keep reading to learn all about Florida’s specific laws.

Florida’s Car Insurance Laws

There are many Florida car insurance laws that apply to you, whether you’re a senior citizen, young adult, or a late teen who just passed the driver education course and examinations.

High-Risk Insurance in Florida

We said before that Florida is the only state that doesn’t require bodily injury liability coverage. If, however, you have caused an accident that caused bodily injury to another party, you will be required to carry full liability car insurance coverage.

People that have a DUI on their record and let their insurance lapse will be required to file an FR-44 insurance form. This form filing requires that the driver carry increased limits on their policy:

- $100,000 – Bodily Injury Liability per person

- $300,000 – Total bodily Injury Liability per accident

- $50,000 – Property Damage Liability per accident

Read more: Compare FR-44 Insurance: Rates, Discounts, & Requirements

If you’ve committed offenses that require an SR-22 car insurance certification, you will have to purchase bodily injury liability (BIL) car insurance on top of the state’s basic car insurance requirements.

You have to carry the SR-22 for three years if:

- You have been in a car accident that causes injuries or property damage.

- Your driver’s license has been suspended due to excessive traffic violation points.

- Your driver’s license has been habitually revoked.

Should you be found guilty of driving without car insurance, you may have to carry a six-month SR-22 for up to two years. which cannot be canceled. This also means that have to pay your whole premium each time before you renew your policy.

The list of Florida Insurance laws is an extensive one and it’s always best to know the regulations to make sure you’re always on the right side of the insurance laws.

Florida’s Windshield and Glass Repair Laws

Whether you’re an urban dweller who commonly commutes on the interstate or you travel to and from the country on the back roads, sooner or later you may get a crack windshield.

Gravel, dirt, or other debris kick-up and hit windshields all the time, and when you hit a big one that causes some real damage you should know how you stand with your insurance company when it comes to broken windshields car insurance.

The good news is that if you have comprehensive insurance, there is no deductible per Florida Statute 627.7288. Insurance companies don’t have to use OEM parts, but replacement parts need to be the same fit, quality, and performance.

The Statute of Limitations in Florida

Video provided by Brian R Toung, Attorney at Law

Understanding the statute of limitations is really not that difficult to comprehend and you certainly don’t require three years of law school to determine its premise. Basically, the statute of limitations is a state law that sets a limit on the amount of time to file a lawsuit.

The statute of limitations for personal injury is four years.

| Florida Statute of Limitations | Penalty |

|---|---|

| Personal Injury | Injury: 4 years Wrongful death: 2 years |

| Property Damage | 4 Years |

Automobile Insurance Fraud in Florida

False and fraudulent insurance claims are a crime in the State of Florida and are punishable as provided in subsection (11) if that person has the intent to injure, defraud, or deceive any insure.

| Florida and Insurance Fraud | Yes/No |

|---|---|

| Insurance Fraud Classified as a Crime | Yes |

| Immunity Statues | Yes |

| Fraud Bureau | Yes |

| Mandatory Insurer Fraud Plan | Yes |

| Mandatory Auto Photo Inspection | No |

Florida’s Vehicle Licensing Laws

To drive a car, you have to have a license. Keep reading to find out what Florida’s mandatory licensing laws are. It’s also pertinent to remember Florida’s license renewal procedures.

Under Florida law, residents 80 years old and older are required to renew their licenses every six years while the general population must renew every eight years. Here are some additional specifics for new drivers, the general population, and seniors.

Penalties for Driving Without Insurance

You must carry proof of insurance whenever you are driving anywhere in the U.S.. Suffice to say, driving without insurance in Florida can have severe penalties.

| Penalties for Driving without Insurance | Penalty |

|---|---|

| First Offense | Suspension of license and registration until reinstatement fee is paid and non-cancelable coverage is secured; $150 fee for first reinstatement |

| Second Offense | Suspension of license and registration until reinstatement fee is paid and non-cancelable coverage is secured; $250 fee for second reinstatement |

Teen Driver Laws in Florida

Not all teen driving regulations are the same from state to state. Here’s what new drivers need to know in Florida:

| Young Driver Licensing System | Requirements |

|---|---|

| To get a learners license you must: | Be a minimum age of 15 |

| Before getting a license or restricted license you must: | Be a minimum age of 16 Have a minimum supervised driving time of 50 hours (10 of which must be at night) Have a mandatory holding period of 12 months |

| Restrictions during intermediate or restricted license stage: | 11 p.m.-6 a.m. for 16 year-olds; 1 a.m.-5 a.m. for 17 year-olds Passenger restrictions: None |

| Minimum age at which restrictions may be lifted: | 18 years-old |

License Renewal Procedures for Older Drivers in Florida

It’s not uncommon to see license renewal procedures with different requirements for older residents than for the general population. Here are some tables to help you easily see what is required.

| License Renewal Cycle in Georgia | Period |

|---|---|

| General Population | 8 years |

| Older Population | 6 years for people 80 and older |

| Proof of Adequate Vision Required for License Renewal | Requirement |

|---|---|

| General population | When renewing in person |

| Older population | 80-years-old and older, every renewal |

| Mail or online renewal permitted | Requirement |

|---|---|

| General population | Both, every other renewal |

| Older population | Both, every other renewal |

New Residents or People Visiting Florida

If you have a valid out-of-state license, you will likely be able to apply for and receive a Florida driver license without taking a driving or written test.

To register a vehicle, the Vehicle identification number (VIN) must be physically inspected and verified by one of the following:

- A law enforcement officer from any state.

- A licensed Florida or out of state motor vehicle dealer.

- A Florida DMV Compliance Examiner/Inspector, DMV or tax collector employee.

- A notary public commissioned by the state of Florida.

- Provost Marshal or a commissioned officer in active military service, with a rank of 2nd Lieutenant or higher or an LNC, “Legalman, Chief Petty Officer, E-7”

A vehicle must be registered within 30 days of the owner doing any of the following:

- Becoming employed

- Placing children in public school

- Establishing residency

Snowbirds

Maybe you’re one of the million snowbirds who escape the cold weather up north to winter in Florida. There are some things you need to know:

- If you intend to use your vehicle for 90 days or more (consecutive or not) in Florida you must register your car in Florida.

- If your car is registered in Florida, you will have to get insurance from Florida that meets minimum requirements.

- You do not need to get a Florida driver’s license unless you spend seven or more months of the year in Florida.

Florida Rules of the Road

Whether you’re a resident or just passing through, it’s important to know the rules of the road. Take a peek at this basic rundown to make sure you are following the law.

Fault vs. No-Fault

Florida is a no-fault state, which means your own PIP coverage will pay for your injuries regardless of who caused the accident. Whoever causes the crash will still be liable for property damage.

Impaired-Driving Laws in Florida

There can’t be enough enforcement or education when it comes to the dangerous, reckless practice of drinking and driving. Like many states, Florida DUI laws are very strict if found guilty.

| Florida DUI Laws | Penalty |

|---|---|

| BAC Limit | 0.08% |

| High BAC Limit | 0.15% |

| Criminal Status by Offense | First and Second: misdemeanors; Third and subsequent within 10 years: Third degree felony |

| Formal Name for Offense | Driving Under the Influence (DUI) |

| Look Back Period/Washout Period | 10 year for first - third offenses; Unlimited/lifetime for fourth and subsequent offenses |

| 1st Offense - ALS or Revocation | 180 days minimum up to one year |

| 1st Offense - Imprisonment | Eight hours minimum, but not more than six months; With high BAC or a minor in car: not more than nine months; For a first conviction, total period of probation and incarceration may not exceed one year |

| 1st Offense - Fine | $500-$1000; High BAC or minor in car: $1000-$2000 |

| 1st Offense - Other | Car impounded for 10 days unless family has no other transportation; Mandatory 50 hours community service or additional fine of $10 for each hour of community service required |

| 2nd Offense - DL Revocation | Second within five years: minimum five year revocation; Second in six or more years: minimum 180 days up to one year revocation |

| 2nd Offense - Imprisonment | Not more than nine months; With high BAC or a minor in car: not more than 12 months; If second in five years: mandatory imprisonment at least 10 days with 48 hours consecutive |

| 2nd Offense - Fine | $1000-$2000; High BAC or a minor in car: $2000-$4000 |

| 2nd Offense - Other | Second in five years: car impounded for 30 days unless family has no other transportation |

| 3rd Offense - DL Revocation | Third in 10 years of second conviction: minimum 10 year revocation, may be eligible for hardship reinstatement after two years |

| 3rd Offense - Imprisonment | Within 10 years: mandatory 30 days with 48 consecutive hours; If over 10 years: imprisonment for not more than 12 months |

| 3rd Offense - Fine | Within 10 years from 2nd conviction: $2000-$5000; High BAC or minor in car, $4000 min |

| 3rd Offense - Other | Within 10 years: car impounded for 90 days unless family has no other transportation |

| 4th Offense - DL Revocation | Mandatory permanent revocation with no hardship reinstatement allowed |

| 4th Offense - Imprisonment | Not more than five years |

| 4th Offense - Fine | $2000 minimum |

| Mandatory Interlock | Repeat offenders |

Speed Limits in Florida

Knowing the speed limit in Florida (for new residents or if you are just passing through) is something you need to be aware of before its too late and you see two red lights flashing in your rearview mirror. Here is a simple breakdown of the speed limits in Florida.

| Road Type | Speed Limit |

|---|---|

| Rural Interstates | 70 mph |

| Urban Interstates | 65 mph |

| Other limited access roads | 70 mph |

| Other roads | 65 mph |

Child Safety Seat Laws in Florida

Child safety laws are some of the most important laws to adhere to and regulations are in strict force in Florida to ensure the utmost safety.

- Children from birth to age three must be secured in a federally approved child safety seat

- Children ages four and five may be secured in a federally approved child safety seat or a booster seat

If you fail to abide by this law you can face a fine of $60 for a first offense.

Another thing to consider regarding children in Florida: The Sunshine State tragically sees more child fatalities from heat strokes in cars than almost any other state in the nation.

Move Over and Keep Right Laws

Florida has what is called a Move Over law that requires you to move over for law enforcement, emergency, utility service, towing and even wrecker vehicles.

If it’s difficult or you can’t move over slow to a speed of 20 mph less than the posted speed limit. In the event of a posted speed limit of 20 mph slow to a speed a five mph.

Florida’s keep right laws require slower traffic to keep right and drivers to yield to faster vehicles.

For example: If you’re on a four-lane highway driving in the left lane and a vehicle moving faster than you is behind you, you must move over to the right lane and let them pass.

Distracted Driving

One of the common issues that have become more prominent since the dawn of smartphones is distracted driving while talking or texting while at the wheel.

Florida, like most states, has enacted laws limiting the use of handheld devices when driving.

Effective October 1st, 2019, the Florida Department of Highway Safety and Motor Vehicles (FLHSMV) says cellphones can “only be used in a hands-free manner when driving in a designated school crossing, school zone, or active work zone area.”

| Ban Type | Status |

|---|---|

| Hand-held ban | Yes |

| Young drivers all cellphone ban | No |

| Texting ban | Yes - all drivers |

| Enforcement | Primary |

Enforcement for texting while driving is also now a primary offense (effective since July 1st, 2019).

The FLHSMV says that if drivers text while driving, they face the following penalties.

- 1st violation: non-moving offense (no points added to driver’s record).

- 2nd violation: moving violation (three points added to driver’s record).

So put the phone down in the car, as Florida is strengthening its laws on distracted driving.

Ridesharing in Florida

Ridesharing services in Florida are one of the most common forms of transportation. Lyft and Uber are the most popular. Uber and Lyft drivers who have the app on must be carrying the following rideshare insurance limits.

- $50,000 of bodily injury coverage per person

- $100,000 of bodily injury coverage per accident,

- $25,000 of property damage liability coverage per accident.

Once you have a passenger, you need to be covered by the company’s third-party liability insurance policy, with at least one million dollars coverage for bodily injury and property damage.

Automation on the Roads in Florida

Florida allows autonomous vehicles in the state, but the laws specify the person who activated the autonomous technology shall be considered the “operator” regardless of whether that person is in the vehicle or not.

Owners (typically this would be a corporate entity) must provide proof of five million dollars proof on insurance or surety bond to the Florida Department of Highway Safety and Motor Vehicles when testing an autonomous vehicle.

These Facts Might Raise Your Eyebrow

To protect yourself, passengers, and your vehicle it’s best to be informed.

Vehicle Theft in Florida

Here are the top-10 stolen cars in the state of Florida:

| Make/Model | Year | # of Thefts |

|---|---|---|

| Ford Pickup (Full Size) | 2006 | 2,070 |

| Honda Civic | 2000 | 1,127 |

| Nissan Altima | 2015 | 1,098 |

| Toyota Camry | 2014 | 1,089 |

| Honda Accord | 1997 | 1,025 |

| Toyota Corolla | 2014 | 914 |

| Chevrolet Pickup (Full Size) | 2015 | 786 |

| Chevrolet Impala | 2015 | 542 |

| Dodge Pickup (Full Size) | 2005 | 534 |

| Nissan Maxima | 2014 | 479 |

Road Danger in Florida

The best way to stay out of danger on the road is to drive defensively and be aware of common issues in your state.

Traffic Fatalities from 2017

Here are statistics on traffic fatalities in Florida from 2017:

Fatalities by Person Type

| Person Type | Number of Fatalities |

|---|---|

| Traffic Fatalities | 3,112 |

| Passenger Vehicle Occupant Fatalities (All Seat Positions) | 1,009 |

| Motorcyclist Fatalities | 590 |

| Pedestrian Fatalities | 654 |

| Bicyclist and Other Cyclist Fatalities | 123 |

Fatalities by Crash Type

| Crash Type | Number |

|---|---|

| Single Vehicle | 1,622 |

| Involving a Large Truck | 292 |

| Involving Speeding | 299 |

| Involving a Rollover | 538 |

| Involving a Roadway Departure | 1,122 |

| Involving an Intersection (or Intersection Related) | 1,134 |

Fatalities Rates in the Largest Cities

| City | 2016 Total Killed | 2016 Pedestrians Killed | 2016 Population | Total Fatality Rate per 100,000 Population | Pedestrian Fatality Rate per 100,000 Population |

|---|---|---|---|---|---|

| Jacksonville | 149 | 35 | 880,619 | 16.92 | 3.97 |

| Miami | 46 | 19 | 453,579 | 10.14 | 4.19 |

| Tampa | 52 | 18 | 377,165 | 13.79 | 4.77 |

| Orlando | 35 | 15 | 277,173 | 12.63 | 5.41 |

| St. Petersburg | 34 | 12 | 260,999 | 13.03 | 4.60 |

| Hialeah | 17 | 2 | 236,387 | 7.19 | 0.85 |

| Tallahassee | 17 | 3 | 190,894 | 8.91 | 1.57 |

| Port St. Lucie | 13 | 6 | 185,132 | 7.02 | 3.24 |

| Cape Coral | 10 | 0 | 179,804 | 5.56 | 0.00 |

| Fort Lauderdale | 31 | 12 | 178,752 | 17.34 | 6.71 |

| Pembroke Pines | 8 | 3 | 168,587 | 4.75 | 1.78 |

| Hollywood | 24 | 5 | 151,998 | 15.79 | 3.29 |

Traffic Fatalities: Rural vs. Urban

| Roadway Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Rural | 969 | 634 | 859 | 870 | 674 |

| Urban | 1,434 | 1,860 | 1,972 | 2,275 | 1,731 |

| Unknown | 0 | 0 | 107 | 31 | 707 |

Fatalities Involving a DUI by County

| County | Number of DUI-Related Fatalities (2016) | DUI-Related Fatalities per 100,000 Population (2016) |

|---|---|---|

| Alachua County | 9 | 3.4 |

| Baker County | 5 | 17.91 |

| Bay County | 15 | 8.2 |

| Bradford County | 2 | 7.48 |

| Brevard County | 25 | 4.33 |

| Broward County | 66 | 3.44 |

| Calhoun County | 0 | 0 |

| Charlotte County | 10 | 5.61 |

| Citrus County | 7 | 4.9 |

| Clay County | 9 | 4.34 |

| Collier County | 6 | 1.64 |

| Columbia County | 4 | 5.77 |

| Desoto County | 3 | 8.35 |

| Dixie County | 1 | 6.07 |

| Duval County | 53 | 5.72 |

| Escambia County | 12 | 3.85 |

| Flagler County | 6 | 5.57 |

| Franklin County | 1 | 8.48 |

| Gadsden County | 5 | 10.83 |

| Gilchrist County | 0 | 0 |

| Glades County | 0 | 0 |

| Gulf County | 0 | 0 |

| Hamilton County | 3 | 20.94 |

| Hardee County | 1 | 3.65 |

| Hendry County | 5 | 12.61 |

| Hernando County | 6 | 3.29 |

| Highlands County | 7 | 6.89 |

| Hillsborough County | 70 | 5.07 |

| Holmes County | 1 | 5.15 |

| Indian River County | 7 | 4.62 |

| Jackson County | 5 | 10.35 |

| Jefferson County | 3 | 21.53 |

| Lafayette County | 1 | 11.56 |

| Lake County | 16 | 4.77 |

| Lee County | 33 | 4.57 |

| Leon County | 14 | 4.88 |

| Levy County | 1 | 2.51 |

| Liberty County | 1 | 12.02 |

| Madison County | 3 | 16.39 |

| Manatee County | 20 | 5.33 |

| Marion County | 19 | 5.46 |

| Martin County | 10 | 6.31 |

| Miami-Dade County | 73 | 2.67 |

| Monroe County | 9 | 11.64 |

| Nassau County | 6 | 7.51 |

| Okaloosa County | 4 | 2 |

| Okeechobee County | 1 | 2.46 |

| Orange County | 60 | 4.53 |

| Osceola County | 12 | 3.55 |

| Palm Beach County | 54 | 3.71 |

| Pasco County | 20 | 3.92 |

| Pinellas County | 43 | 4.47 |

| Polk County | 33 | 4.95 |

| Putnam County | 13 | 17.95 |

| Santa Rosa County | 2 | 1.18 |

| Sarasota County | 21 | 5.09 |

| Seminole County | 12 | 2.63 |

| St. Johns County | 9 | 3.83 |

| St. Lucie County | 9 | 2.94 |

| Sumter County | 4 | 3.28 |

| Suwannee County | 4 | 9.13 |

| Taylor County | 1 | 4.52 |

| Union County | 1 | 6.55 |

| Volusia County | 40 | 7.56 |

| Wakulla County | 3 | 9.41 |

| Walton County | 5 | 7.64 |

| Washington County | 1 | 4.09 |

Fatalities Involving Speeding by County

| County | Fatalities Involving Speeding (2016) | Fatalities Involving Speeding per 100,000 Population (2016) |

|---|---|---|

| Alachua County | 6 | 2.27 |

| Baker County | 1 | 3.58 |

| Bay County | 7 | 3.83 |

| Bradford County | 1 | 3.74 |

| Brevard County | 9 | 1.56 |

| Broward County | 28 | 1.46 |

| Calhoun County | 0 | 0 |

| Charlotte County | 5 | 2.81 |

| Citrus County | 2 | 1.4 |

| Clay County | 3 | 1.45 |

| Collier County | 1 | 0.27 |

| Columbia County | 2 | 2.89 |

| Desoto County | 3 | 8.35 |

| Dixie County | 0 | 0 |

| Duval County | 9 | 0.97 |

| Escambia County | 3 | 0.96 |

| Flagler County | 1 | 0.93 |

| Franklin County | 0 | 0 |

| Gadsden County | 6 | 13 |

| Gilchrist County | 0 | 0 |

| Glades County | 0 | 0 |

| Gulf County | 0 | 0 |

| Hamilton County | 1 | 6.98 |

| Hardee County | 0 | 0 |

| Hendry County | 3 | 7.57 |

| Hernando County | 1 | 0.55 |

| Highlands County | 0 | 0 |

| Hillsborough County | 27 | 1.95 |

| Holmes County | 0 | 0 |

| Indian River County | 3 | 1.98 |

| Jackson County | 4 | 8.28 |

| Jefferson County | 0 | 0 |

| Lafayette County | 0 | 0 |

| Lake County | 3 | 0.89 |

| Lee County | 12 | 1.66 |

| Leon County | 3 | 1.05 |

| Levy County | 2 | 5.02 |

| Liberty County | 1 | 12.02 |

| Madison County | 0 | 0 |

| Manatee County | 5 | 1.33 |

| Marion County | 7 | 2.01 |

| Martin County | 8 | 5.05 |

| Miami-Dade County | 30 | 1.1 |

| Monroe County | 1 | 1.29 |

| Nassau County | 1 | 1.25 |

| Okaloosa County | 3 | 1.5 |

| Okeechobee County | 0 | 0 |

| Orange County | 10 | 0.76 |

| Osceola County | 0 | 0 |

| Palm Beach County | 31 | 2.13 |

| Pasco County | 6 | 1.18 |

| Pinellas County | 13 | 1.35 |

| Polk County | 11 | 1.65 |

| Putnam County | 0 | 0 |

| Santa Rosa County | 0 | 0 |

| Sarasota County | 11 | 2.66 |

| Seminole County | 5 | 1.1 |

| St. Johns County | 1 | 0.43 |

| St. Lucie County | 3 | 0.98 |

| Sumter County | 0 | 0 |

| Suwannee County | 2 | 4.56 |

| Taylor County | 1 | 4.52 |

| Union County | 0 | 0 |

| Volusia County | 12 | 2.27 |

| Wakulla County | 0 | 0 |

| Walton County | 2 | 3.06 |

| Washington County | 0 | 0 |

Five-year Fatality Trends in the Top-10 Counties (2017)

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Miami-Dade County | 225 | 280 | 339 | 294 | 285 |

| Broward County | 180 | 173 | 224 | 245 | 225 |

| Hillsborough County | 171 | 158 | 190 | 228 | 190 |

| Orange County | 124 | 143 | 142 | 171 | 189 |

| Palm Beach County | 137 | 130 | 187 | 181 | 162 |

| Duval County | 133 | 120 | 133 | 156 | 151 |

| Volusia County | 90 | 86 | 87 | 122 | 130 |

| Pinellas County | 83 | 116 | 103 | 128 | 118 |

| Lee County | 92 | 81 | 95 | 105 | 113 |

| Polk County | 94 | 113 | 112 | 137 | 111 |

| Total for Top Ten Counties | 1,329 | 1,400 | 1,612 | 1,767 | 1,674 |

| Total for All other Counties | 1,074 | 1,094 | 1,326 | 1,409 | 1,438 |

| Total for All Counties | 2,403 | 2,494 | 2,938 | 3,176 | 3,112 |

Teens and Drunk Driving

Teen drunk driving is a serious problem in a lot of states, and one that each parent must take seriously.

| Teens and Drunk Driving | Stats |

|---|---|

| Alcohol-Impaired Driving Fatalities Per one million people | 1.6 |

| Higher/Lower Than National Average (1.2) | Higher |

| DUI Arrests (Under 18 years old) | 109 |

| DUI Arrests (Under 18 years old) Total Per Million People | 26.29 |

Commute Rates by Company in FL

You wouldn’t think that a commute would impact insurance rates at all. That isn’t the case, though, as you can see in the chart below.

Top Four Cities for Traffic Congestion

| City | Hours Spent in Congestion Annually | Cost of Congestion Per Driver Per Year |

|---|---|---|

| Miami | 105 hours | $1,470 |

| Tampa | 87 hours | $1,216 |

| Orlando | 74 hours | $1,037 |

| Jacksonville | 60 hours | $840 |

Don’t waste another minute. Start comparison shopping car insurance rates today!

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

How do car insurance rates vary by age and gender in Florida?

Car insurance rates can vary based on age and gender. It is recommended to compare quotes to find the best rates.

What add-ons, endorsements, and riders are available in Florida?

- Collision insurance

- Comprehensive insurance

- GAP insurance

- Personal Umbrella Policy (PUP)

- Rental Car Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-as-You-Go Insurance

Can additional liability coverage be added in Florida?

Yes, additional liability coverage can be added to your car insurance policy.

What are the average yearly car insurance rates in Florida?

- Liability: $857.64

- Collision: $282.96

- Comprehensive: $116.53

- Combined: $1,257.13

Are there any discounts available for Florida car insurance?

Yes, many insurance companies offer discounts for various factors, such as safe driving, multiple policies, anti-theft devices, good grades for students, and completion of defensive driving courses. Check with your insurance provider to see which discounts you may be eligible for.

Does my credit score affect my car insurance rates in Florida?

Yes, your credit score can impact your car insurance rates in Florida. Insurance companies often consider credit history when determining premiums, as they believe there is a correlation between creditworthiness and the likelihood of filing claims.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.