Geico DriveEasy App Review: Compare Rates, Discounts, & Requirements [2026]

Does Geico DriveEasy track speed? Yes, along with hard braking, mileage, phone use, and time of day driving to determine your Geico usage-based insurance discount. Our Geico DriveEasy review details the DriveEasy app setup, savings (up to 25%), and availability (37 states), as well as Geico DriveEasy complaints.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Insurance & Finance Analyst

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Updated December 2025

- The Geico DriveEasy app tracks driving habits and tailors discounts based on behavior

- Drivers can save up to 25% on their car insurance with Geico DriveEasy

- The Geico DriveEasy program is now available in 37 states

Usage-based car insurance programs (UBI) are growing in popularity. With the Geico DriveEasy program, safe drivers can save up to 25% on Geico car insurance coverage.

What is Geico DriveEasy? Geico’s usage-based car insurance, monitored through the Geico DriveEasy mobile app, tracks certain driving behaviors and awards cheaper rates if drivers do well.

This Geico DriveEasy app review will overview some of the pros and cons of Geico DriveEasy, how to buy the best usage-based insurance (UBI), and whether the program can hurt your car insurance rates. Can unsafe drivers end up paying higher rates? We will answer this and show you further Geico DriveEasy benefits and availability by state.

Before diving into this Geico DriveEasy program review, type your ZIP code into our free and helpful tool above. With it, you will find the most affordable car insurance rates in your area.

Geico DriveEasy App Review and Comparison

Geico DriveEasy reviews are mostly mixed. Geico DriveEasy Pro has 3.4 out of 5 stars on the Apple App Store with 181 reviews and 3.3 out of 5 stars on the Google Play Store with 195 reviews. Several Geico DriveEasy complaints say the app is buggy, constantly runs in the background, and tracks drivers when it shouldn’t.

To find the most affordable UBI insurance policy in your area, it’s vital to compare car insurance discounts for safe driving from various companies.

Take a look at the table below for a list of usage-based insurance programs and potential discounts:

Usage-Based Car Insurance Availability & Savings for Best Usage-Based Car Insurance Companies

Insurance Company Program Name Earned Savings Areas Available

Allstate Drivewise® 40% Most states, excluding, CA, DC

American Family KnowYourDrive 20% Available in specific states: AZ, CO, GA, ID, IL, IN, IO, KS, MN, MO, NE, NV, ND, OH, OR, SD, UT, WA, WI

Farmers Signal® 30% Most states, excluding: AK, HI, LA, MA, MI, NJ, NY

Geico DriveEasy 25% Most states, excluding:

AK, CA, DC, DE, HI, KS, ME, MA, MO, MS, MT, ND, HD, NY, RI, SD, VT, WV, WY

Hartford TrueLane® 25% Most states, excluding: FL

Liberty Mutual RightTrack® 30% Most states, excluding: AK, CA, DC,

Nationwide SmartRide® 40% Most states, excluding: CA, HI, MA, MI, NY

Progressive Snapshot 30% Most states, excluding: DC

Safeco RightTrack® 30% Available in specific states, including:

FL, IL, MA, MO, RI, NJ, NV, NY

State Farm Drive Safe and Save™ 30% Most states, excluding: DC

Travelers IntelliDrive® 30% Most states, excluding: CA, HI, NY

USAA SafePilot 30% Available in specific states, including: AZ, OH, TX, OK

As you can see, while Geico doesn’t have the lowest amount of savings, Allstate and Nationwide offer the most significant savings for participating in their UBI program.

Read more:

- Allstate Drivewise Review: Compare Rates, Discounts, & Requirements

- American Family Insurance KnowYourDrive Review: Compares Rates, Discounts, & Requirements

- Farmers Signal Review: Compare Rates, Discounts, & Requirements

- Safeco RightTrack App Review: Compare Rates, Discounts, & Requirements

- State Farm Drive Safe and Save App Review: Compare Rates, Discounts, & Requirements

Keep reading our DriveEasy usage-based insurance review to compare the best car insurance companies for UBI.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Geico DriveEasy Program Explained

The Geico DriveEasy program uses an app to track the insured’s driving habits. All they need to do is download the Geico DriveEasy app and create their personalized Geico login information.

What does this usage-based program do for Geico’s insured? According to the Insurance Information Institute (III), these types of programs incentivize drivers to operate their vehicles safely and less frequently.

Provided the driver operates the vehicle safely, how much can be saved? Safe drivers can receive a discount upward of 25%.

Knowing this, let’s take a look at a table showing Geico’s standard car insurance rates by state:

Geico Monthly Rates by State

| State | Geico Monthly Rate |

|---|---|

| Alabama | $239 |

| Alaska | $240 |

| Arizona | $189 |

| Arkansas | $290 |

| California | $240 |

| Colorado | $258 |

| Connecticut | $256 |

| Delaware | $311 |

| Florida | $315 |

| Georgia | $248 |

| Hawaii | $280 |

| Idaho | $231 |

| Illinois | $232 |

| Indiana | $188 |

| Iowa | $191 |

| Kansas | $268 |

| Kentucky | $386 |

| Louisiana | $513 |

| Maine | $126 |

| Maryland | $319 |

| Massachusetts | $235 |

| Michigan | $536 |

| Minnesota | $292 |

| Mississippi | $341 |

| Missouri | $240 |

| Montana | $300 |

| Nebraska | $320 |

| Nevada | $305 |

| New Hampshire | $135 |

| New Jersey | $230 |

| New Mexico | $372 |

| New York | $202 |

| North Carolina | $245 |

| North Dakota | $222 |

| Ohio | $156 |

| Oklahoma | $286 |

| Oregon | $268 |

| Pennsylvania | $217 |

| Rhode Island | $467 |

| South Carolina | $265 |

| South Dakota | $245 |

| Tennessee | $274 |

| Texas | $272 |

| Utah | $247 |

| Vermont | $183 |

| Virginia | $172 |

| Washington | $214 |

| Washington, D.C. | $308 |

| West Virginia | $327 |

| Wisconsin | $177 |

| Wyoming | $291 |

So, what driving habits does the Geico DriveEasy program monitor?

What the Geico DriveEasy App Monitors

How does Geico DriveEasy work? Does Geico DriveEasy just monitor major events like accidents? Geico usage-based insurance monitors several driving behaviors to assess your DriveEasy discount, including:

- Speed: Your Geico DriveEasy app will ding you for excessive speeding. See our article, What is a safe speed to drive your car?

- Time of day driven: Insurers consider nighttime driving as risky. DriveEasy will take note if you make a 2 a.m. trip.

- Mileage: The Geico DriveEasy program tracks annual mileage. Learn more about how much mileage affects car insurance rates.

- Braking/cornering: Hard braking and cornering will affect your Geico DriveEasy discount.

- Distractions: Phone usage — including handheld phone calls, holding your phone, and tapping your phone — all count against your DriveEasy score.

You may be wondering what entails distracted driving behavior. First and foremost, distracted driving and car insurance rates go hand in hand.

Read more: Does a cell phone ticket affect car insurance rates?

Geico DriveEasy monitors handheld phone calls as well as active phone use when the driver is going 6 miles per hour or faster.

Geico considers active phone use to include using the GPS or even unlocking one's phone.

Daniel Walker Licensed Insurance Agent

In short, poor driving habits entitle Geico to raise your rates.

Furthermore, DriveEasy is a telematics program, so your phone’s data will be tracked. In recent years, digital identity theft has given individuals pause in terms of having their data tracked.

Safe driving is the best way to get a Geico Drive Easy discount. Keep reading to learn about other Geico car insurance discounts.

Geico DriveEasy Car Insurance Discounts and Benefits

Geico’s Drive Easy app is one of many ways to save money on car insurance with Geico. How much does Geico DriveEasy save? The usage-based program allows car insurance policyholders to earn a 25% Geico DriveEasy discount on their auto insurance if they practice safe driving skills.

You’ll see a significant Geico DriveEasy discount if you drive the speed limit and avoid distracted driving. However, bad drivers could see increased rates with the program.

There are several other benefits of Geico car insurance with DriveEasy besides its discount listed below, including:

- DriveEasy encourages drivers to improve their driving skills.

- Geico can use the DriveEasy program’s data after an accident for investigations.

Your trips automatically log in the Geico DriveEasy Pro mobile app when you drive. After each trip, the app displays feedback on how to improve driving habits.

Merriya Valleri Insurance and Finance Writer

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Other Geico Car Insurance Discounts for Safe Drivers

Check out the list below to see additional safe driver discounts you can earn with Geico insurance:

- Pay-per-mile car insurance

- Low-mileage car insurance discounts

- Safe driver car insurance discounts

- Defensive driver car insurance discounts

- Safety features car insurance discounts

There are different ways to lower car insurance rates. So, always compare discounts from the best usage-based car insurance companies to find the best deal for you.

Let’s move on to the states in which Geico offers DriveEasy.

Where to Get the Geico DriveEasy App

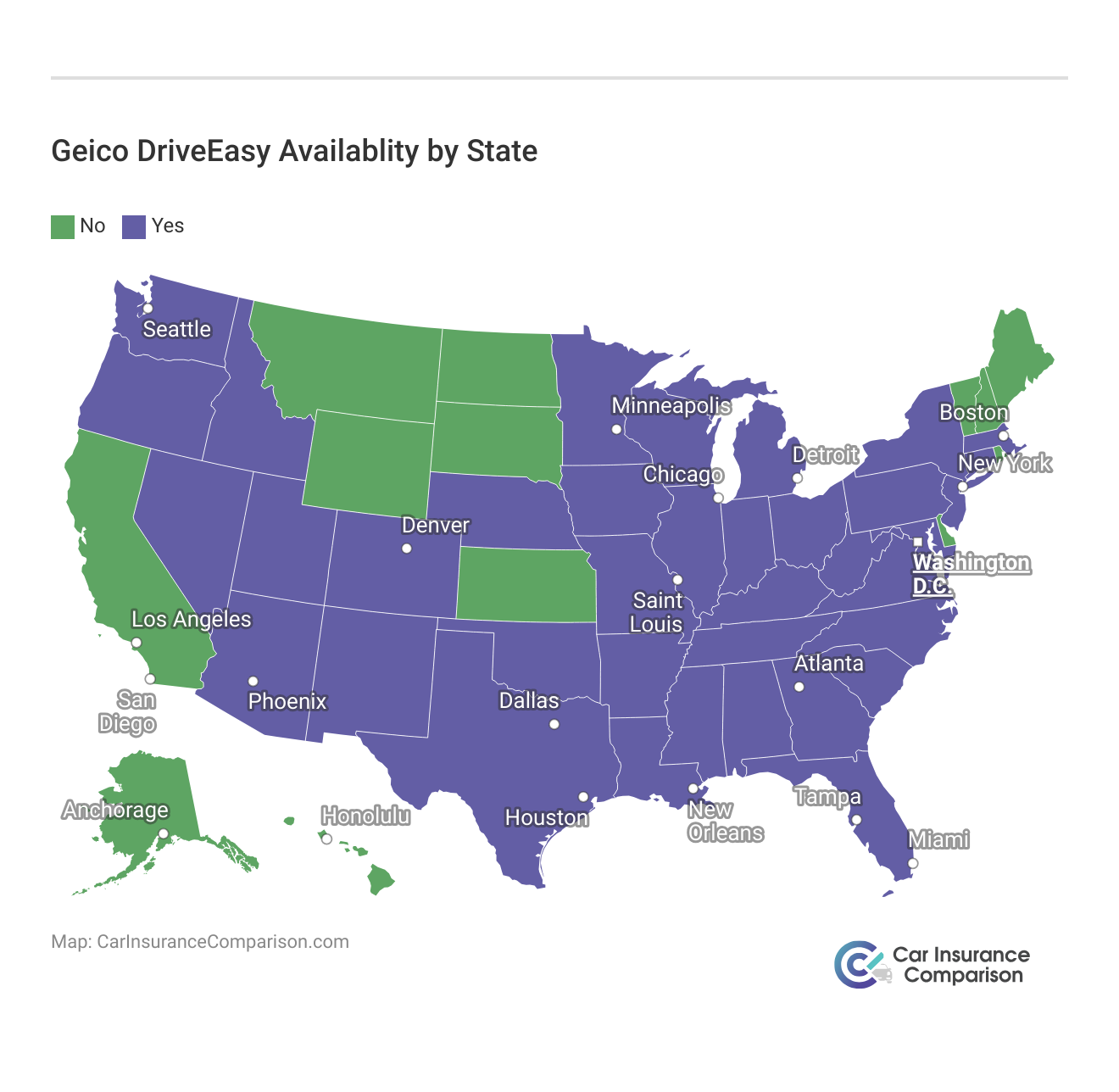

While all states sell Geico auto insurance, not all states have the Geico DriveEasy app.

The Geico DriveEasy app is available in these 37 states and the District of Columbia:

- Alabama

- Arizona

- Arkansas

- Colorado

- Connecticut

- Florida

- Georgia

- Idaho

- Illinois

- Indiana

- Iowa

- Kentucky

- Louisiana

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Nebraska

- Nevada

- New Jersey

- New Mexico

- New York

- North Carolina

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- South Carolina

- Tennessee

- Texas

- Utah

- Virginia

- Washington

- West Virginia

- Wisconsin

That means the app is not available in these 13 states:

- Alaska

- California

- Delaware

- Hawaii

- Kansas

- Maine

- Montana

- New Hampshire

- North Dakota

- Rhode Island

- South Dakota

- Vermont

- Wyoming

In reference to rates, check out the table below to see how much you could pay for regular full-coverage car insurance in your state:

Full Coverage Car Insurance Monthly Rates by State & Provider

States Allstate American Family Farmers Geico Liberty Mutual Nationwide Progressive State Farm Travelers USAA

Alabama $135 $105 $127 $76 $164 $108 $97 $65 $93 $60

Alaska $108 $105 $133 $89 $162 $96 $112 $108 $79 $56

Arizona $162 $137 $165 $91 $99 $128 $131 $80 $111 $55

Arkansas $180 $114 $135 $65 $178 $116 $84 $81 $104 $63

California $199 $138 $167 $101 $216 $142 $132 $108 $122 $74

Colorado $166 $118 $163 $94 $92 $107 $120 $94 $114 $78

Connecticut $196 $125 $151 $62 $201 $112 $133 $91 $83 $77

Delaware $241 $115 $139 $69 $180 $172 $115 $111 $102 $48

District of Columbia $207 $130 $157 $101 $494 $144 $90 $116 $82 $43

Florida $183 $188 $227 $89 $161 $103 $153 $99 $166 $47

Georgia $165 $124 $149 $61 $263 $152 $115 $107 $110 $71

Hawaii $118 $82 $99 $60 $128 $84 $78 $64 $72 $44

Idaho $126 $95 $82 $81 $116 $73 $75 $65 $92 $55

Illinois $128 $93 $92 $57 $79 $82 $91 $53 $57 $40

Indiana $176 $114 $117 $47 $76 $93 $89 $64 $87 $62

Iowa $140 $107 $79 $63 $183 $97 $69 $71 $69 $43

Kansas $160 $114 $144 $75 $174 $92 $127 $81 $87 $56

Kentucky $236 $164 $197 $80 $168 $184 $111 $98 $139 $72

Louisiana $206 $176 $212 $141 $274 $181 $161 $124 $156 $98

Maine $143 $99 $120 $72 $155 $103 $95 $78 $88 $53

Maryland $201 $116 $140 $135 $181 $106 $121 $107 $103 $80

Massachusetts $108 $84 $117 $37 $120 $87 $94 $59 $61 $37

Michigan $406 $204 $335 $99 $424 $257 $152 $209 $183 $107

Minnesota $160 $93 $108 $90 $375 $87 $101 $67 $94 $68

Mississippi $148 $106 $135 $90 $129 $66 $98 $85 $114 $50

Missouri $147 $120 $145 $72 $119 $96 $120 $82 $88 $54

Montana $154 $125 $164 $82 $59 $88 $171 $70 $111 $50

Nebraska $169 $82 $99 $69 $82 $111 $32 $77 $99 $44

Nevada $136 $145 $107 $61 $398 $77 $110 $76 $88 $44

New Hampshire $125 $112 $130 $92 $179 $77 $95 $69 $102 $56

New Jersey $128 $77 $93 $50 $198 $77 $63 $59 $69 $41

New Mexico $157 $115 $231 $74 $279 $119 $93 $113 $136 $61

New York $158 $103 $131 $90 $161 $96 $86 $69 $91 $65

North Carolina $165 $140 $155 $110 $111 $112 $82 $103 $91 $69

North Dakota $147 $137 $165 $78 $200 $164 $96 $137 $175 $85

Ohio $120 $62 $96 $59 $106 $114 $85 $70 $63 $41

Oklahoma $135 $118 $136 $109 $184 $122 $110 $91 $105 $68

Oregon $153 $106 $111 $93 $141 $111 $78 $75 $97 $58

Pennsylvania $148 $108 $131 $68 $219 $86 $148 $76 $75 $57

Rhode Island $189 $151 $183 $125 $235 $190 $116 $76 $103 $65

South Carolina $133 $118 $166 $79 $185 $118 $105 $88 $105 $69

South Dakota $136 $151 $113 $57 $230 $76 $105 $67 $97 $58

Tennessee $144 $102 $86 $78 $11 $118 $92 $72 $88 $58

Texas $201 $176 $137 $105 $178 $154 $121 $90 $101 $62

Utah $117 $105 $115 $73 $119 $93 $95 $103 $88 $50

Vermont $103 $83 $100 $69 $129 $86 $61 $63 $73 $43

Virginia $142 $85 $103 $38 $100 $77 $181 $87 $75 $42

Washington $114 $91 $102 $75 $92 $70 $60 $69 $81 $46

West Virginia $123 $63 $109 $62 $84 $226 $94 $58 $72 $47

Wisconsin $162 $115 $139 $83 $196 $104 $110 $79 $102 $67

Wyoming $155 $111 $130 $111 $75 $114 $106 $82 $98 $57

Always compare car insurance rates by state to ensure you get the cheapest deal in your area.

Geico DriveEasy App Review: The Bottom Line

Now that you’ve had an introduction to DriveEasy, you’re probably wondering, “Is Geico DriveEasy worth it?”

Using Geico DriveEasy could be worthwhile if you’re a safe driver because it could save you money on your car insurance policy.

If you live in a state where Geico offers DriveEasy, absolutely. Even if you already have coverage with Geico, it’s not too late. Furthermore, it’s easy to set up.

The program may not be a good fit if you’re an unsafe driver since it can increase your insurance premium for behaviors like speeding

If you decide it’s not for you and want to know how to cancel Geico DriveEasy, there’s good news. All you need to do is open the Google Play Store, find the app, and press “Cancel Subscription.”

Now that you’ve finished our Geico DriveEasy program review, type your ZIP code into our free and helpful tool below. With it, you’ll find the most affordable car insurance rates in your area.

Frequently Asked Questions

What is the Geico DriveEasy program?

The Geico DriveEasy program is a mobile app that tracks driving habits to reward safe drivers with up to a 25% discount on Geico insurance premiums.

How does the Geico DriveEasy app work with car insurance?

The DriveEasy Pro mobile app with Geico runs in the background and monitors driving behaviors, offering a discount of up to 25% if you perform well.

What is the highest Geico DriveEasy score you can earn to get the cheapest car insurance rates?

Generally, you’ll receive a good discount for Geico DriveEasy score of 80 or higher.

How can I enroll in DriveEasy Geico?

To enroll in DriveEasy, simply download the app and complete the registration form.

Is Geico DriveEasy available in all states?

No, DriveEasy is currently available only in 37 states and the District of Columbia.

How long do I have to use Geico DriveEasy before I get lower car insurance rates?

You must constantly run the Geico DriveEasy app to receive cheaper insurance premiums.

Can Geico DriveEasy hurt you — by raising your car insurance rate?

The Geico DriveEasy program may increase your rates for poor driving. You may end up needing to compare car insurance rates with a bad driving record.

How do you get around Geico DriveEasy?

The only way to bypass Geico’s usage-based DriveEasy program is to contact customer service at 800-841-3000 to unenroll.

What driving behaviors does Geico DriveEasy monitor?

The Geico safe driver app monitors various driving behaviors, including distracted driving, speeding, and hard braking. See our article on the best defensive driving tips.

Does Geico DriveEasy monitor speed?

Yes, most of the best companies for UBI, including Geico, monitor driving behaviors such as speed, hard braking, and phone usage.

Does Geico DriveEasy track phone usage?

Can Geico track your location?

Does Geico DriveEasy work in airplane mode?

Is Geico DriveEasy worth it?

Can I turn off Geico DriveEasy?

Can unsafe drivers end up paying higher rates with Geico DriveEasy?

Why is my DriveEasy score low?

How can I improve my Geico DriveEasy score?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.