How do you get a Liberty Mutual car insurance quote online?

Founded in 1912, Liberty Mutual has spent the last 106 years becoming a leading insurance provider in the United States. If you're looking to save money on auto coverage through bundling, the company is especially worth investigating as they offer auto insurance bundles with home, renters and condo insurance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Professor & Published Author

D. Gilson is a writer and author of essays, poetry, and scholarship that explore the relationship between popular culture, literature, sexuality, and memoir. His latest book is Jesus Freak, with Will Stockton, part of Bloomsbury’s 33 1/3 Series. His other books include I Will Say This Exactly One Time and Crush. His first chapbook, Catch & Release, won the 2012 Robin Becker Prize from S...

D. Gilson, PhD

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Jeffrey Manola

Updated March 2024

- Liberty Mutual has been insuring Americans for over 100 years

- Car insurance discounts and the RightTrack savings program can help you save money on auto insurance with Liberty Mutual

- Policy bundling with homeowners, rental and condo insurance policies are possible with Liberty Mutual

Founded in 1912, Liberty Mutual has spent the last 106 years becoming a leading insurance provider in the United States. They’re currently the fourth-largest property and casualty insurance company in America. From personal to business coverage, Liberty Mutual offers plenty of options for business and homeowners, renters, and drivers across the nation.

Whether you’ve seen one of the many catchy Liberty Mutual commercials or got a suggestion from someone you know, there’s lots to learn about Liberty Mutual.

If you’re looking to save money on auto coverage through bundling, the company is especially worth investigating as they offer auto insurance bundles with home, renters and condo insurance.

Before we jump into quotes, though, take some time to learn about Liberty Mutual. On the official site for the Liberty Mutual Group, you can learn about the company’s cultures and values, awards and recognition and read about how they’re striving to continuously innovate the insurance industry.

If you’re on social media, check out the official Liberty Mutual Twitter and YouTube channel. Here, you can see how the brand engages with its clients and promotes itself in a much more natural, conversational fashion.

If you like what you see, head over to LibertyMutual.com to start getting your free quote.

Smart shoppers compare prices; enter your zip code on our site to compare quotes from multiple insurers.

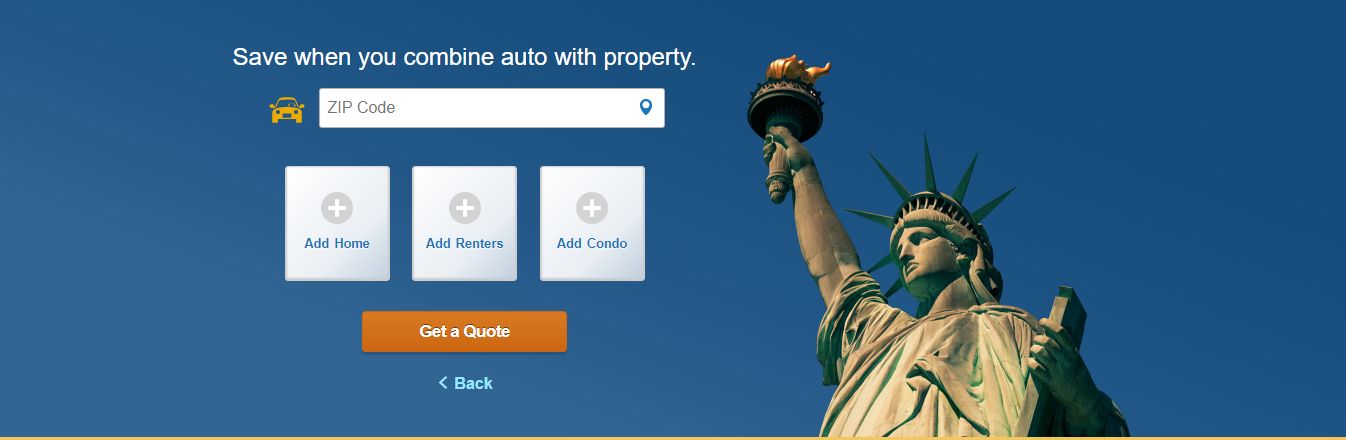

Step #1 — Start Off with Your Zip Code

From Liberty Mutual’s homepage, select “Auto” from the insurance categories and enter your zip code. You can also click on the location marker in the zip code box and hit “Allow” on the popup that appears and Liberty Mutual’s site will input the zip code of your current location.

If you want to get a quote for an auto insurance bundle policy, you can click one of the options to add home, renters or condo insurance to your request. This article will cover the process of requesting an auto insurance policy. When you’re ready to continue, click “Get a Quote”.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

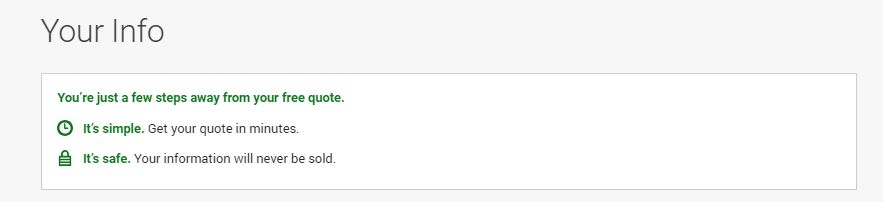

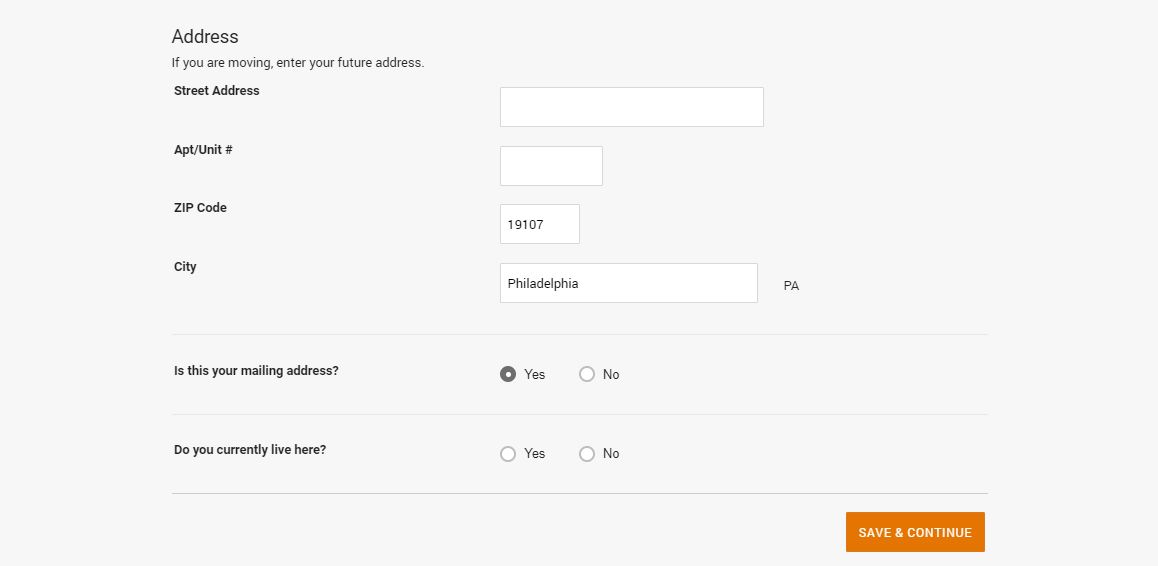

Step #2 — Enter Your Address

The first thing you’ll see when you begin the first true step of the quote request process at Liberty Mutual is this:

This simple introduction leads you to the first prompt of the process, which is a form for you to enter your address. If you’re moving, you can provide your future address.

Your location is a factor in how much you’ll pay for car insurance. Each state has its own auto insurance requirements and the average cost of auto insurance in the US varies from state to state and even sometimes county to country.

When you’re ready to proceed, hit “Save & Continue”.

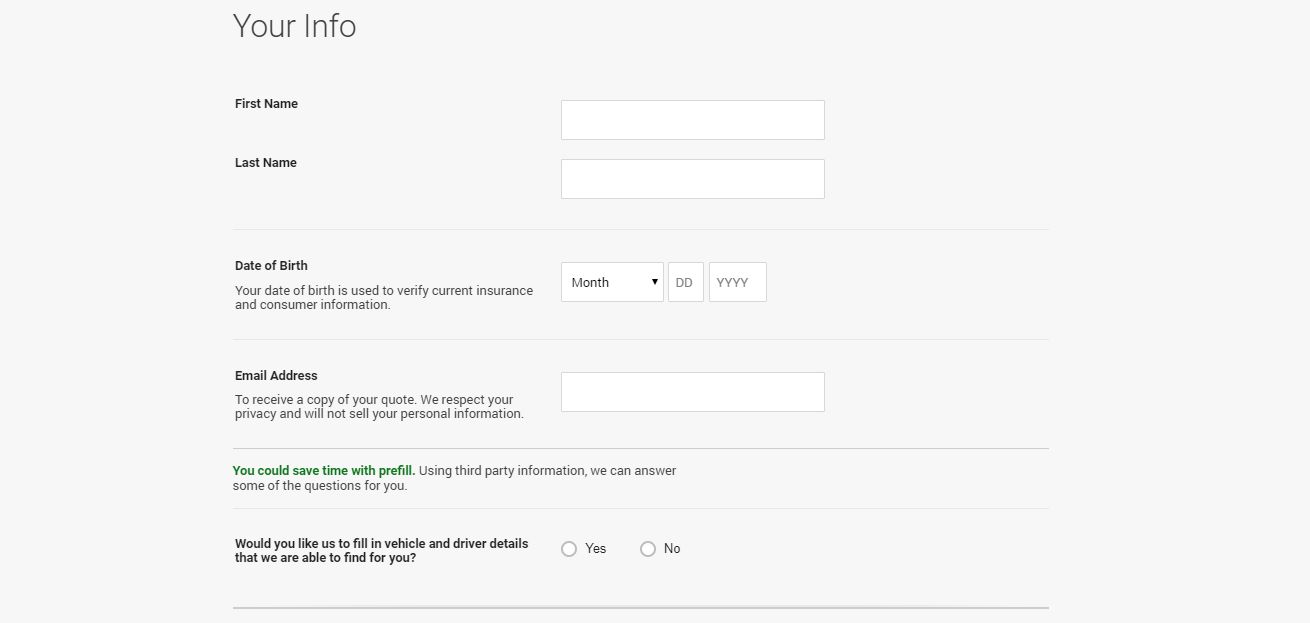

Step #3 — Enter Your Name, Email, and Explore Prefill Options

Now it’s time to start providing some more personal information that will assist the quotes process and help give you an accurate rate. Enter your legal first and last names followed by your date of birth.

Liberty Mutual explains on the page that your birthdate is used to confirm your identity and current insurance status, but your age is also another important factor when it comes to calculating car insurance costs.

If you’d like, Liberty Mutual can use the address, name, and birthdate provided to find any vehicles registered to you through a third-party. This information can then be automatically added to the system, saving you the time of having to input everything yourself.

If you aren’t comfortable with this idea, that’s okay. You can click “No” on the question prompt. If you’d like to learn more before you decide, check out the Information Disclosure agreement at the bottom of the screen and read the popup that appears.

You’ll also have to enter your email at this stage so Liberty Mutual can use it to send you your quote.

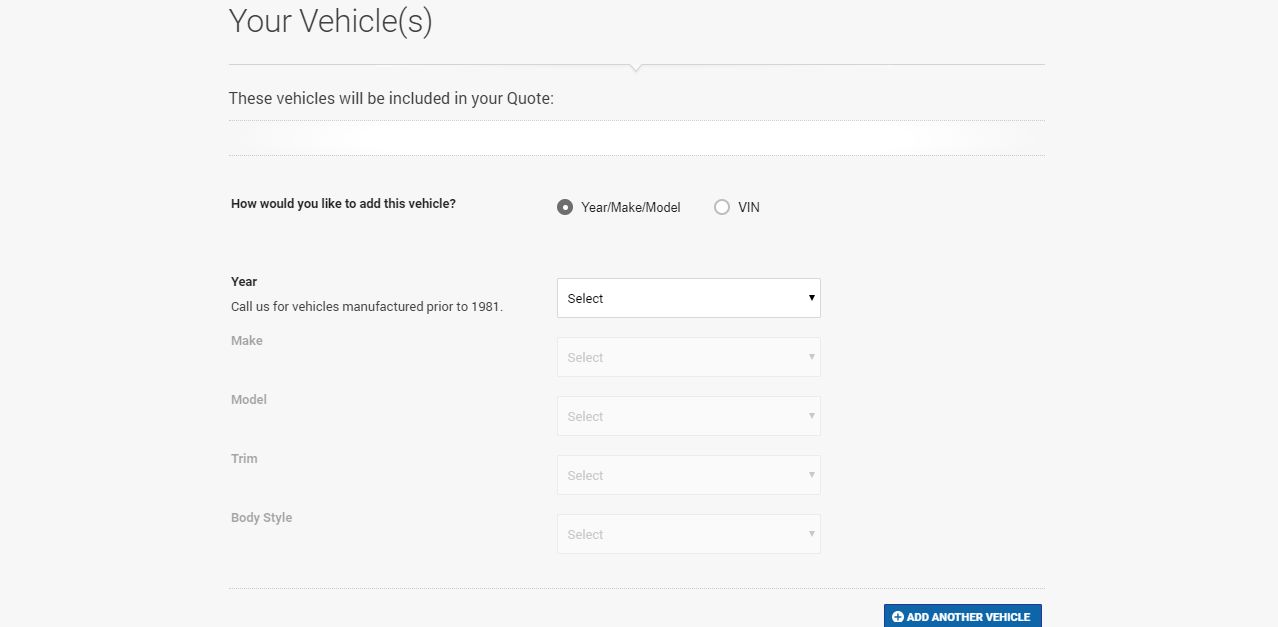

Step #4 — Enter Your Vehicle Information

The Vehicles section of the Liberty Mutual’s quote process is straightforward and easy to navigate. You won’t be bombarded with a ton of different boxes but instead only have to fill information out one step at a time.

You can, however, preview the type of details you’ll have to provide, so now is a good time to make sure you have all the necessary documents and information on your car(s) before proceeding.

You can choose to enter your vehicle’s make, model, trim, body type, and other specifics by hand or you can enter your Vehicle Identification Number (VIN). This ID is unique to every car and can tell an insurance provider everything they need to know quickly.

Find your VIN on the side of your driver’s side door frame or on the windshield where the glass meets your dashboard.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

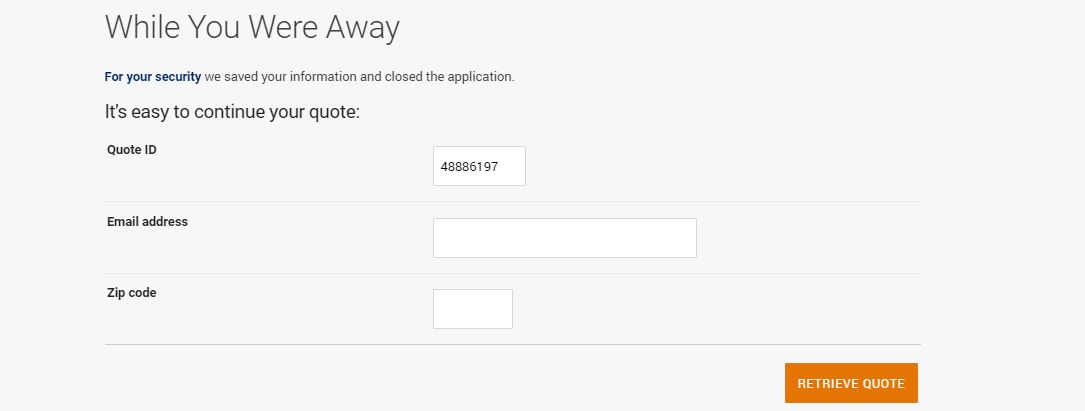

Step #5 — Don’t Be Afraid to Step Away

If you need to take a break and come back later, don’t worry. Your quote will be saved right where you left off. If you’re inactive for a certain period of time, the system will save your info with a unique quote ID. To resume your progress, just enter your email address and zip code.

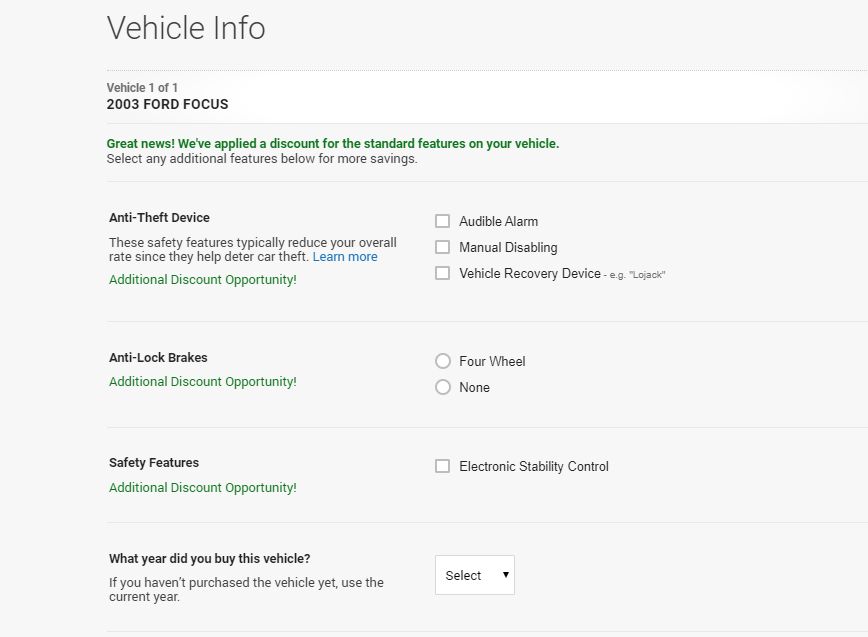

Step #6 — Learn About Discounts

In many cases, Liberty Mutual will automatically apply discounts that your vehicle qualifies for once you provide the necessary information.

There are tons of different ways to save money on car insurance, and selecting the safety features that the quotes wizard presents can help you save even more. Anti-lock brakes, anti-theft devices, and additional safety features can all save you money in premiums.

Check out our comprehensive guide to auto insurance discounts so you can bring them up to an agent when you sign up for a new policy.

Read more: Liberty Mutual Car Insurance Discounts

Step #7 — Round Up Your Driving Experience

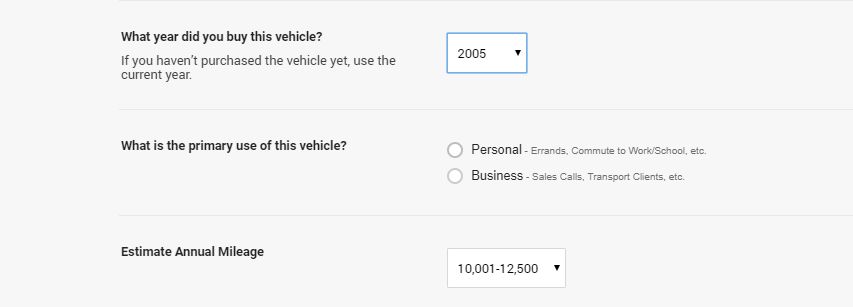

The final stage of the vehicle information collection process will require you to specify the year you got your current vehicle, answer whether it’s owned, financed, or leased, and the primary use. Most people will select personal, but if you use your car to operate a business or conduct work-related activities like sales calls, then you’ll select business.

You will also have to estimate your annual mileage; the Federal Highway Administration found that the average American drives 13,476 miles per year as of March 2018.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

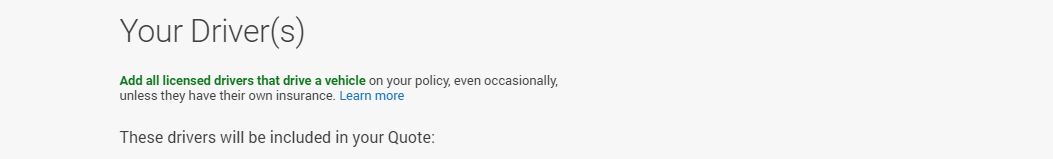

Step #8 – Add Drivers

Next, you’ll want to list every driver of the vehicle(s) you’re requesting quotes for even if they already have their own insurance. If you’re married, then make sure you include your spouse’s information. Your name and age will already be listed, so choose a gender and answer whether or not you’re in a civil union.

You will have to provide additional information for each new driver. As you proceed, you’ll have to input your homeownership status, when you were first licensed, and answer whether or not you’ve been involved in any accidents within the last 5 years.

You can also provide your SSN, but we recommend holding off on this until you’re buying a policy.

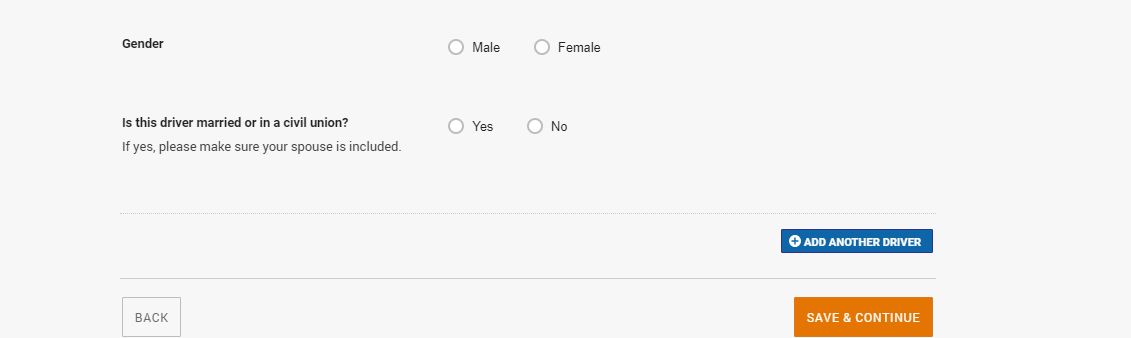

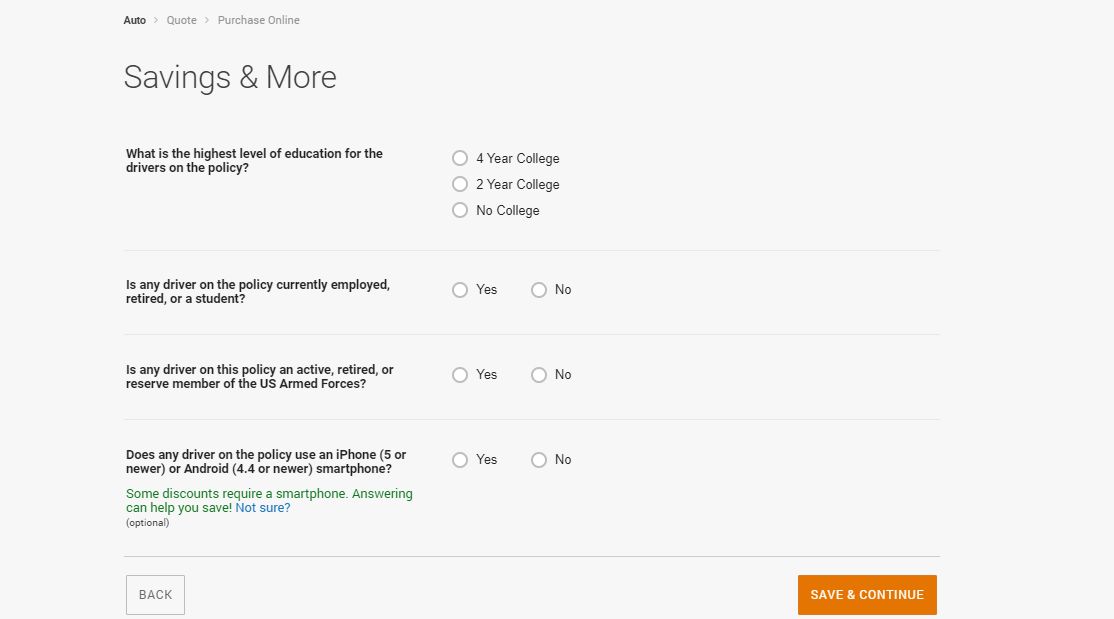

Step #9 — Find Out if You Qualify to Save More

You can provide additional information that can qualify you for greater discounts; being a college student or graduate, an active duty, reserve member or veteran, and even owning a smartphone can qualify you for discounts.

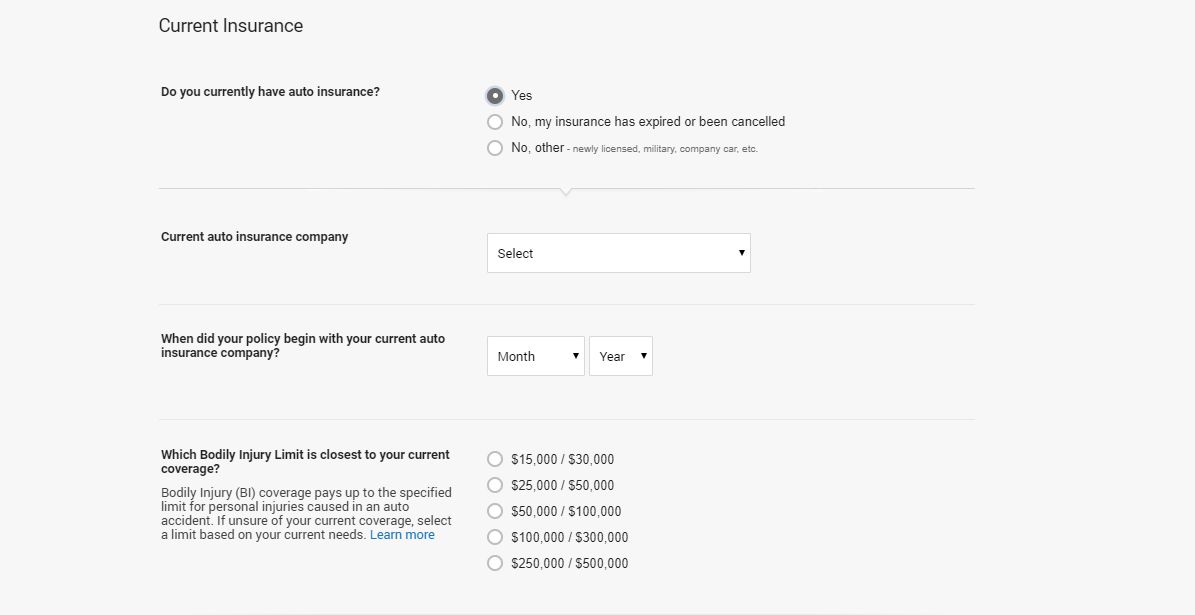

Step #10 — Provide Insurance Information

If you currently have car insurance and are looking to switch carriers, you’ll need to provide information about your current company and policy. Speak to an agent at your current company as well to make sure you’re able to transfer coverage or cancel your policy before buying a new one.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

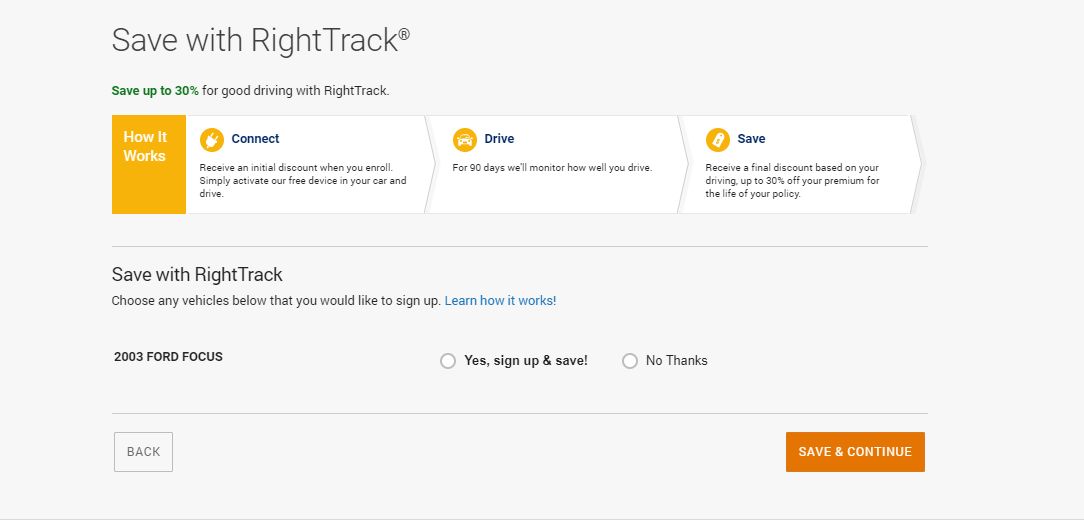

Step #11 — Decide if RightTrack is Right for You

Liberty Mutual’s RightTrack program rewards drivers with good records to help them qualify for additional discounts and savings on their auto insurance. Enrolling in the RightTrack program automatically gets you a discount.

You’ll have to install the RightTrack device in your car and drive for 90 days; your driving habits and mileage will be monitored and recorded by Liberty Mutual. At the end of the 90-day period, if you’ve driven responsibility, a discount of up to 30% will be applied to your policy.

https://www.youtube.com/watch?v=kEFtLm8pZZM

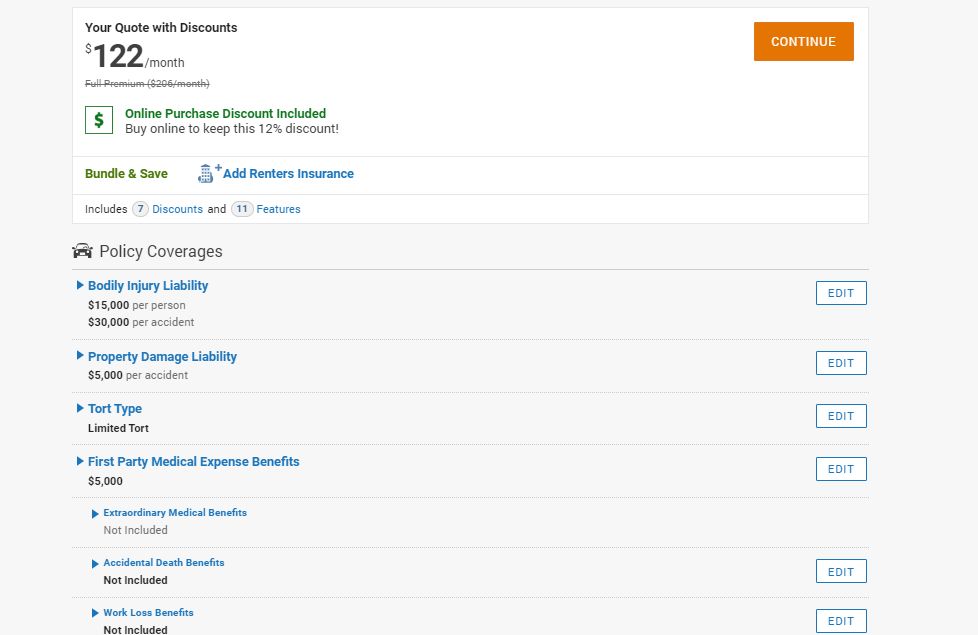

Step #12 — Review Your Quote

Your quote estimate will be presented on the next page and broken down in amounts. You’ll be able to edit coverages and change information you provided from this screen, as well as chat with a live agent if you have questions or want to move forward with purchasing a policy.

Our suggestion? Keep your quote and enter your zip code below to get several others for comparison. It pays to shop around, and since auto insurance varies from providers, it’s a good idea to compare at least three before making a final decision.

To sum it all up, Liberty Mutual is a great choice for anybody looking for customizable policy options, convenient online tools, and access to a full range of discounts. Auto quotes are based on the coverage limits.

Current and prospective Liberty Mutual customers can explore auto insurance quotes with ease by using their online tools.

Case Studies: Liberty Mutual Car Insurance Quote Online

Case Study 1: John’s Bundled Coverage With Liberty Mutual

John, a homeowner and car owner, was looking for ways to save money on his insurance coverage. He decided to explore Liberty Mutual’s auto insurance bundles with home insurance. By bundling his policies, John was able to get comprehensive coverage for his home and car while enjoying significant savings on his premiums.

Case Study 2: Sarah’s Personalized Coverage With Liberty Mutual

Sarah, a renter and frequent traveler, wanted insurance coverage that fit her unique needs. She turned to Liberty Mutual and discovered their customizable car insurance options. With Liberty Mutual, Sarah customized her coverage to include comprehensive protection, personal injury coverage, and features that aligned with her lifestyle. She felt secure.

Case Study 3: Mark’s Safe Driving Discounts With Liberty Mutual

Mark, a responsible driver, was interested in finding auto insurance that rewarded his good driving habits. He chose Liberty Mutual and enrolled in their RightTrack program. By installing the RightTrack device in his car and driving responsibly for 90 days, Mark earned a discount of up to 30% on his auto insurance policy. With Liberty Mutual, Mark was able to save money while continuing to drive safely.

Frequently Asked Questions

How can I obtain a car insurance quote from Liberty Mutual online?

Getting a car insurance quote from Liberty Mutual online is a simple process. Follow these steps:

- Visit the Liberty Mutual website.

- Locate the “Car Insurance” section and click on it.

- Look for the “Get a Quote” or “Start a Quote” button and click on it.

- Fill out the required information, including personal details, vehicle information, and coverage preferences.

- Review the information you provided, make any necessary adjustments, and click “Submit” or “Get Quote.”

- Liberty Mutual will then generate a car insurance quote based on the information you provided.

What information do I need to provide to get an accurate car insurance quote online?

To receive an accurate car insurance quote online from Liberty Mutual, you will typically need to provide the following information:

- Personal details: Name, address, date of birth, and contact information.

- Vehicle information: Year, make, model, mileage, and VIN (Vehicle Identification Number).

- Driving history: Details about your driving record, including any accidents or violations.

- Coverage preferences: The type and level of coverage you desire.

Can I customize my car insurance coverage when obtaining a quote online?

Yes, Liberty Mutual provides options for customizing your car insurance coverage when obtaining a quote online. You can choose from various coverage options such as liability, collision, comprehensive, personal injury protection, uninsured/underinsured motorist, and more. You can also adjust the coverage limits and deductibles to fit your needs and budget.

Will I receive my car insurance quote instantly?

In most cases, Liberty Mutual provides a car insurance quote instantly after you submit your information online. However, in some cases, additional underwriting may be required, and the quote may take longer. You can contact Liberty Mutual directly for further assistance or clarification.

Can I save my progress and return to complete the car insurance quote later?

Yes, Liberty Mutual’s online quoting system typically allows you to save your progress and return to complete the car insurance quote at a later time. You may need to create an account or provide your email address to save and access your quote. This feature enables you to gather any additional information you may need before finalizing your quote.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.