Compare Hawaii Car Insurance Rates [2026]

When you compare Hawaii car insurance rates, a minimum liability insurance policy costs only an average of $31/mo, compared to an average of $94/mo for a full coverage insurance policy. Hawaii car insurance laws require Hawaii drivers to carry a minimum of 20/40/10 liability insurance coverage.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Brandon Frady

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Tracey L. Wells

Updated April 2024

- All Hawaii drivers must carry a minimum of 20/40/10 liability insurance coverage

- Full coverage car insurance in Hawaii costs an average of $94/mo

- Comparing Hawaii car insurance rates will help drivers find the best rate

If you want to compare Hawaii car insurance rates, it helps to first know what coverages you need to carry in Hawaii. Once you know how much you have to pay for minimum Hawaii insurance, you can decide how much your budget allows for extra car insurance coverage.

To make your life easier, we put together the following guide covering everything you need to know about finding the cheapest car insurance in Hawaii, including coverage and rates, car insurance providers, state laws, and so much more.

If you want to get started right away on finding cheap car insurance in Hawaii, use our free quote comparison tool.

Hawaii Car Insurance Coverage and Rates

Whether you’re a long-time resident of the Aloha state or considering a move, you need to know Hawaii car insurance rates so you can make an informed decision for your family.

Did you know that car insurance rates can fluctuate depending on your state? Even what city you live in? Sounds like something you might be interested in, right? Let’s dive right in.

Hawaii Minimum Car Insurance Coverage Requirements

| Insurance Type | Insurance Required |

|---|---|

| Bodily Injury Liability Coverage | $20,000 per person $40,000 per accident |

| Property Damage Liability Coverage | $10,000 minimum |

| PIP/"No-fault" Coverage | $10,000 minimum |

Hawaii’s Compulsory Liability Insurance Law requires that all drivers purchase minimum liability auto insurance coverage to get out on the open road. Failure to maintain basic liability coverage is dangerous and could cause you to incur strict penalties for driving without insurance in Hawaii.

- Car Insurance Rates in Hawaii

Learn more: What is the penalty for driving without car insurance in Hawaii?

In fact, if you are cited for driving without insurance more than twice in five years, you could be slapped with jail time. As such, it’s better to be safe than sorry and always protect yourself and your loved ones by staying insured.

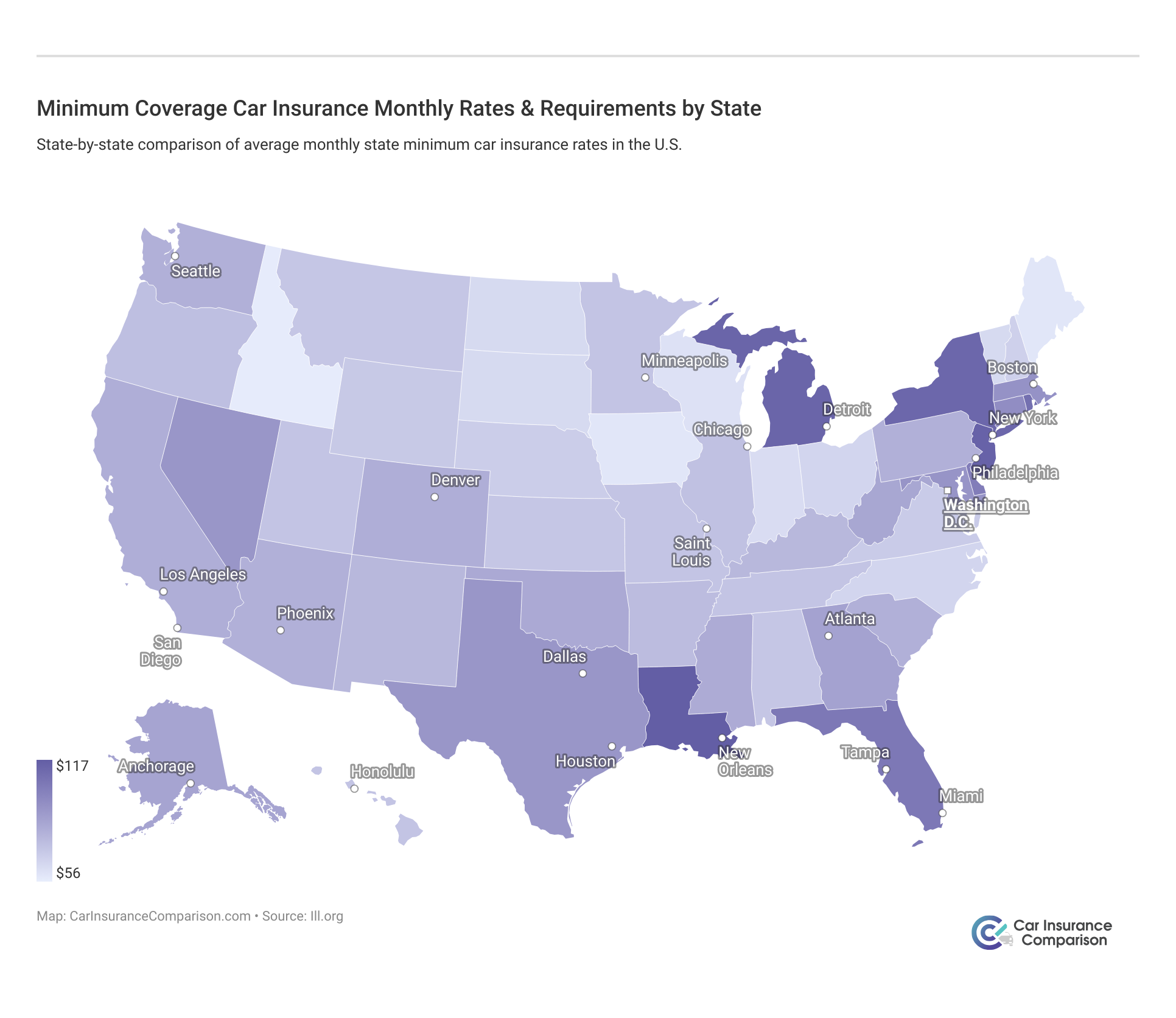

You can see how minimum coverage costs vary from state to state!

You do not have to carry comprehensive car insurance coverage unless you purchase your car via a lender who mandates such. The limits you must maintain for the duration of your car’s registration period are as follows:

- $20,000 liability coverage per person/$40,000 per accident to cover the expense of injuries to other drivers for an accident you cause

- $10,000 liability coverage to cover property damage expenses to the other driver’s vehicle for an accident you cause, not including your own car

- $10,000 PIP/no-fault coverage to cover your medical bills and expenses in the event of an accident

Hawaii is one of the few “no-fault” car insurance states. If you were to get into an auto accident, your policy’s personal injury protection (PIP) benefits would come into play.

This PIP coverage would take care of your medical bills and other related expenses up to the policy limits, no matter who caused the accident in the first place.

This also means that even when someone else is responsible for the accident, you must exhaust your PIP limits to cover medical bills, lost wages, and other expenses first and are only eligible to file a claim against the other driver in specific instances.

If an accident occurs, your no-fault benefits apply to injuries only and do not cover property damage matters pertaining to your vehicle. If the other driver was at fault, they would be obligated to cover the costs associated with your vehicle’s damage.

Bear in mind, these are the minimum coverages you are required to have by state law. You may wish to consider additional coverage options, which we will delve into further down.

Mandatory Forms of Financial Responsibility in Hawaii

Hawaii car insurance laws require you to not only keep your vehicle insured for the duration of your car’s registration period but to have proof of financial responsibility (or proof of minimum insurance coverage) in your vehicle at all times.

You must always keep a current Hawaii motor vehicle insurance identification card in your vehicle or on your electronic device in the event you are required to offer proof of financial responsibility.

Failure to keep a valid Hawaii motor vehicle insurance identification card on hand could result in tickets and fines of anywhere from $500 for first-time offenders to $5,000 for multiple offenses. You could also have your license suspended anywhere from three months for first-time offenders to one year for multiple offenses.

Premiums as a Percentage of Income in Hawaii

As of 2017, Hawaii’s average per capita personal income was $52,787. Your personal income equals the net amount you can save or spend after your taxes are taken out.

The average annual cost of Hawaii car insurance is approximately $860, comprising just over 1.6% of the average per capita personal income.

This means that the average Hawaiian has around $4,399 monthly to pay all expenses, including their mortgage/rent, food, bills, etc.

Your monthly car insurance bill will subtract about $72 from that. If you keep your insurance policy current and maintain a clean driving record, you’ll keep your auto insurance rates down and have one less thing to worry about.

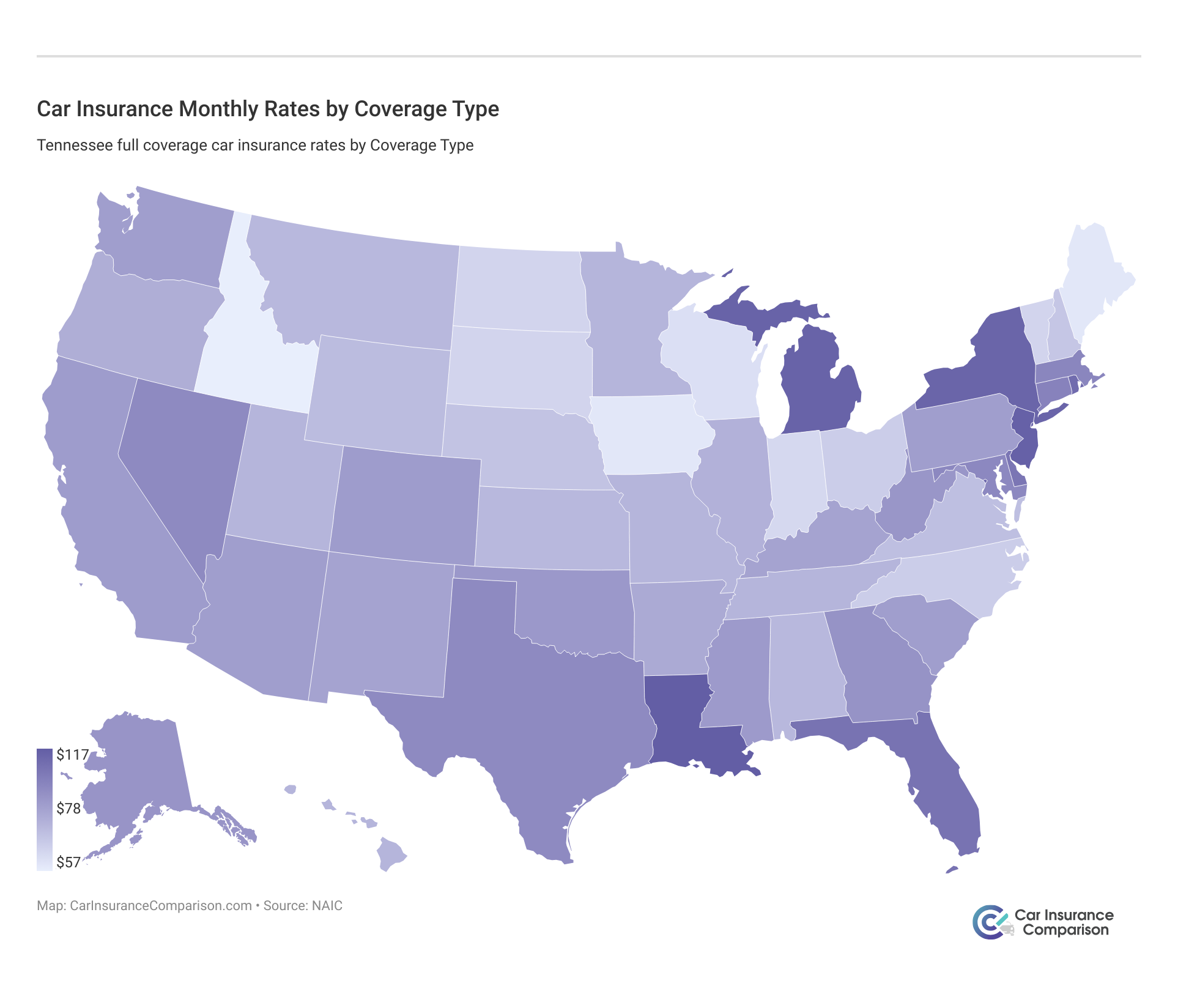

Average Monthly Car Insurance Rates in HI (Liability, Collision, Comprehensive)

| Coverage Type | Annual Costs in 2015: |

|---|---|

| Liability | $458.54 |

| Collision | $313.17 |

| Comprehensive | $101.56 |

| Combined | $873.28 |

| National Average | $1,311 |

We quantified the data in the above table from up-to-date studies conducted by the National Association of Insurance Commissioners. Be prepared for Hawaii insurance rates to increase notably in 2019 and moving forward.

Remember! Hawaii has minimum requirements for liability and PIP/No-Fault Insurance coverage, but research indicates that drivers should purchase above the state minimum to be safe.

Time to jump into the top coverage options you will want to consider adding on to your minimum insurance policy.

Additional Liability Coverage in Hawaii

| Loss Ratio | 2015 | 2014 | 2013 |

|---|---|---|---|

| Uninsured/Underinsured Motorist | 43% | 43% | 40% |

| PIP (Personal Injury Protection) | 63% | 62% | 61% |

| Medical Payments (Med Pay) | 126% | 232% | 79% |

The table above indicates the average loss ratio in the State of Hawaii, pulled from the most recent data compiled by the National Association of Insurance Commissioners. The loss ratio comprises the percentage of losses insurance companies have sustained compared to earned premiums.

A loss ratio over 100 shows that the insurance company is paying more in claims than they’re earning in premiums. It’s pretty obvious what happens to a company that keeps a record like that for an extended period of time, and it’s not good.

The ratios listed in the table above indicate that the average gains to losses in Hawaii are healthy for PIP coverage. Premiums for uninsured/underinsured motorist coverage should be reduced as companies only use roughly 40% of premiums to pay claims.

And unfortunately, MedPay coverage is paying way more than they’re taking in, so premiums will have to increase to reach a sustainable ratio.

In the state of Hawaii, coverages like comprehensive, collision, uninsured, and underinsured motorist insurance are all optional.

Death benefits, funeral benefits, alternative care, and wage loss coverages are also optional. According to the Insurance Information Institute, 10.6% of drivers in Hawaii were uninsured in 2015.

In fact, Hawaii ranked 30th in the nation for uninsured or underinsured drivers. While taking on these additional coverage options might boost your premiums in the short term, in the long run, they protect you in the case of an emergency or unexpected accident.

Add-ons, Endorsements, and Riders

If you’re searching for Hawaii car insurance, we know the first concern is getting the coverage you need for the price you want. Here are add-on coverage options you should consider for your policy, along with a quick overview of each so you can decide what’s best for you.

- Guaranteed Auto Protection (GAP) – GAP insurance makes up the disparity between the value of your car and the amount you currently owe on it. It gives you a cushion to fall back on, so you don’t have to keep making payments if your vehicle is totaled but you owe more than it’s worth.

- Personal Umbrella Policy (PUP) – A PUP policy offers additional coverage for several types of insurance, including home and auto. Relating to auto insurance, it may pay personal injury claims and lost wages resulting from an auto accident. It sometimes covers the costs of instances like false arrest, slander, libel, and incurred legal fees.

- Emergency Roadside Assistance – Roadside assistance coverage is there to cover those unexpected emergencies on the road. Things like battery assistance, emergency towing, lockout assistance, running out of gas, or changing a flat tire are covered.

- Mechanical Breakdown Insurance – Your standard minimum coverages do not apply to faulty engines. Mechanical breakdown insurance covers unexpected engine troubles and breakdowns. Similar to an extended warranty, it’s only available in specific situations.

- Rental Reimbursement – If your car is damaged so that you can’t drive it or it has to be in the shop for a while, you may be stranded without a rental car. Rental car reimbursement will cover the costs of renting a car while yours is out of commission following an accident or other covered damage.

- Modified Car Insurance Coverage – This type of coverage offers additional protection for any changes or modifications you make to your vehicle.

- Classic Car Insurance – If you own a classic car that has a high value, protect yourself by purchasing insurance specifically designed for classic makes and models. Classic car insurance coverage is usually much less than standard insurance because most owners do not drive their classic car as often as their primary vehicle.

- Non-Owner Car Insurance – If you are frequently behind the wheel of a car you don’t own, consider opting for non-owner car insurance. This is especially important if you operate a vehicle registered in someone else’s name over 10 times per month.

- Pay-As-You-Drive or Usage-Based Insurance – Usage-based auto insurance programs allows you to pay only for the number of miles you drive. If you do not drive very often, you could save up to 25 to 50% off a standard one-year auto insurance policy.

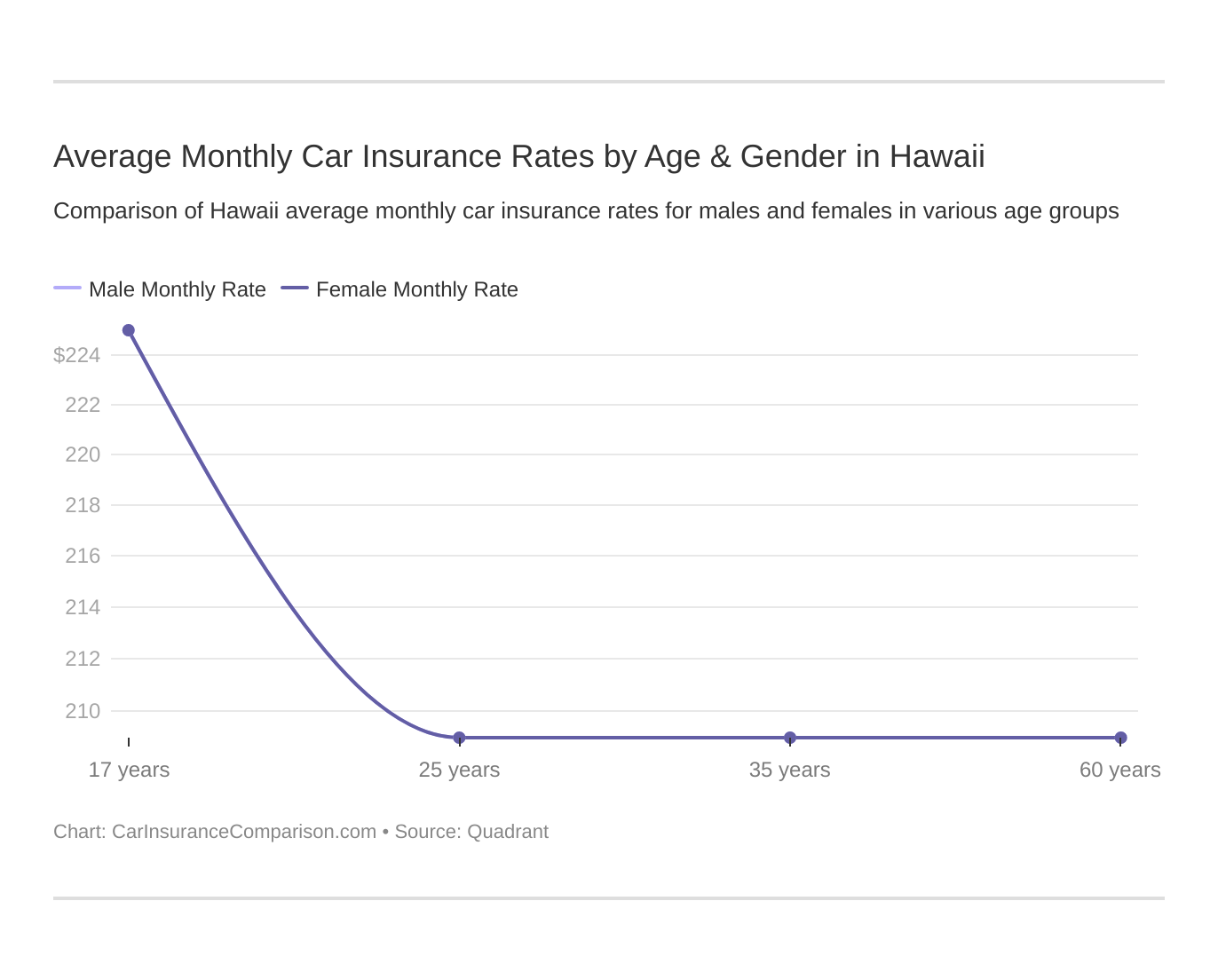

Male Vs. Female Annual Car Insurance Rates in Hawaii

Male vs. Female Car Insurance Rates? Who’s gonna win? Well, it’s complicated.

Most people are under the impression that men pay higher car insurance rates than women. However, as you can see from the data below, this is not necessarily the case. In the state of Hawaii, men and women actually pay the exact same premiums.

This is because Hawaii, among a handful of other states, has passed legislation banning insurance companies from gender discrimination when setting auto insurance rates.

Our researchers came to a surprising conclusion. They learned that age and the actual insurance carrier seem to be the most significant contributing factors in cost variance in the state of Hawaii.

Case in point, our Farmers car insurance review found the company charges 17-year-old male and female drivers approximately $5,077.15 annually, which is several hundred dollars higher when compared to their estimated $4,659.38 yearly premiums for insureds over 18.

Also, Farmers charges minor drivers between $2000-$4000 more in premiums than any other listed insurance company. Insurers like USAA and Liberty Mutual do charge a slightly higher annual rate for minor drivers, but the difference is typically less than $100 annually.

Learn more:

Furthermore, we discovered in our State Farm car insurance review and Geico car insurance review that the companies charge the exact same amount across the board, regardless of age or gender. Let’s dig deeper!

Demographic and Insurance Carrier

| Company | Married 35-year-old female Annual Rates | Married 35-year-old male Annual Rates | Married 60-year-old female Annual Rates | Married 60-year-old male Annual Rates | Single 17-year-old female Annual Rates | Single 17-year-old male Annual Rates | Single 25-year-old female Annual Rates | Single 25-year-old male Annual Rates |

|---|---|---|---|---|---|---|---|---|

| Allstate Insurance | $2,173.49 | $2,173.49 | $2,173.49 | $2,173.49 | $2,173.49 | $2,173.49 | $2,173.49 | $2,173.49 |

| Farmers Ins HI Standard | $4,659.38 | $4,659.38 | $4,659.38 | $4,659.38 | $5,077.15 | $5,077.15 | $4,659.38 | $4,659.38 |

| Geico Govt Employees | $3,358.86 | $3,358.86 | $3,358.86 | $3,358.86 | $3,358.86 | $3,358.86 | $3,358.86 | $3,358.86 |

| Liberty Mutual Fire | $3,179.89 | $3,179.89 | $3,179.89 | $3,179.89 | $3,218.54 | $3,218.54 | $3,179.89 | $3,179.89 |

| Progressive Direct | $1,976.86 | $1,976.86 | $1,976.86 | $1,976.86 | $2,781.14 | $2,781.14 | $1,976.86 | $1,976.86 |

| State Farm Mutual Auto | $1,040.28 | $1,040.28 | $1,040.28 | $1,040.28 | $1,040.28 | $1,040.28 | $1,040.28 | $1,040.28 |

| USAA | $1,176.35 | $1,176.35 | $1,176.35 | $1,176.35 | $1,228.38 | $1,228.38 | $1,176.35 | $1,176.35 |

Highest and Lowest Rates in Hawaii by Zip Code

Below are the highest and lowest insurance carrier rates in Hawaii based on zip code. Take a close look at the averages to see how they change based on your address. The overall statewide average is approximately $2,556.19.

| Zip Code | Average Annual Rates | Allstate Insurance Annual Rates | Farmers Ins HI Standard Annual Rates | Geico Govt Employees Annual Rates | Liberty Mutual Fire Annual Rates | Progressive Direct Annual Rates | State Farm Mutual Auto Annual Rates | USAA Annual Rates |

|---|---|---|---|---|---|---|---|---|

| 96701 | $2,508.57 | $2,130.17 | $4,664.22 | $3,200.79 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96703 | $2,198.62 | $1,778.53 | $4,071.56 | $3,065.08 | $2,624.75 | $1,960.81 | $894.17 | $995.42 |

| 96704 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96705 | $2,198.62 | $1,778.53 | $4,071.56 | $3,065.08 | $2,624.75 | $1,960.81 | $894.17 | $995.42 |

| 96706 | $2,520.31 | $2,212.33 | $4,664.22 | $3,200.79 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96707 | $2,508.57 | $2,130.17 | $4,664.22 | $3,200.79 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96708 | $2,459.60 | $2,116.77 | $4,338.04 | $3,347.67 | $3,139.39 | $2,104.66 | $1,075.14 | $1,095.52 |

| 96710 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96712 | $2,508.57 | $2,130.17 | $4,664.22 | $3,200.79 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96713 | $2,459.60 | $2,116.77 | $4,338.04 | $3,347.67 | $3,139.39 | $2,104.66 | $1,075.14 | $1,095.52 |

| 96714 | $2,198.62 | $1,778.53 | $4,071.56 | $3,065.08 | $2,624.75 | $1,960.81 | $894.17 | $995.42 |

| 96716 | $2,198.62 | $1,778.53 | $4,071.56 | $3,065.08 | $2,624.75 | $1,960.81 | $894.17 | $995.42 |

| 96717 | $2,508.57 | $2,130.17 | $4,664.22 | $3,200.79 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96718 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96719 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96720 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96722 | $2,198.62 | $1,778.53 | $4,071.56 | $3,065.08 | $2,624.75 | $1,960.81 | $894.17 | $995.42 |

| 96725 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96726 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96727 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96728 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96729 | $2,397.78 | $2,116.77 | $4,338.04 | $3,347.67 | $3,139.39 | $1,671.97 | $1,075.14 | $1,095.52 |

| 96730 | $2,508.57 | $2,130.17 | $4,664.22 | $3,200.79 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96731 | $2,508.57 | $2,130.17 | $4,664.22 | $3,200.79 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96732 | $2,459.60 | $2,116.77 | $4,338.04 | $3,347.67 | $3,139.39 | $2,104.66 | $1,075.14 | $1,095.52 |

| 96734 | $2,508.57 | $2,130.17 | $4,664.22 | $3,200.79 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96737 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96738 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96739 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96740 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96741 | $2,198.62 | $1,778.53 | $4,071.56 | $3,065.08 | $2,624.75 | $1,960.81 | $894.17 | $995.42 |

| 96742 | $2,397.78 | $2,116.77 | $4,338.04 | $3,347.67 | $3,139.39 | $1,671.97 | $1,075.14 | $1,095.52 |

| 96743 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96744 | $2,508.57 | $2,130.17 | $4,664.22 | $3,200.79 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96746 | $2,198.62 | $1,778.53 | $4,071.56 | $3,065.08 | $2,624.75 | $1,960.81 | $894.17 | $995.42 |

| 96747 | $2,198.62 | $1,778.53 | $4,071.56 | $3,065.08 | $2,624.75 | $1,960.81 | $894.17 | $995.42 |

| 96748 | $2,397.78 | $2,116.77 | $4,338.04 | $3,347.67 | $3,139.39 | $1,671.97 | $1,075.14 | $1,095.52 |

| 96749 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96750 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96751 | $2,198.62 | $1,778.53 | $4,071.56 | $3,065.08 | $2,624.75 | $1,960.81 | $894.17 | $995.42 |

| 96752 | $2,198.62 | $1,778.53 | $4,071.56 | $3,065.08 | $2,624.75 | $1,960.81 | $894.17 | $995.42 |

| 96753 | $2,459.60 | $2,116.77 | $4,338.04 | $3,347.67 | $3,139.39 | $2,104.66 | $1,075.14 | $1,095.52 |

| 96754 | $2,198.62 | $1,778.53 | $4,071.56 | $3,065.08 | $2,624.75 | $1,960.81 | $894.17 | $995.42 |

| 96755 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96756 | $2,198.62 | $1,778.53 | $4,071.56 | $3,065.08 | $2,624.75 | $1,960.81 | $894.17 | $995.42 |

| 96759 | $2,508.57 | $2,130.17 | $4,664.22 | $3,200.79 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96760 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96761 | $2,459.60 | $2,116.77 | $4,338.04 | $3,347.67 | $3,139.39 | $2,104.66 | $1,075.14 | $1,095.52 |

| 96762 | $2,508.57 | $2,130.17 | $4,664.22 | $3,200.79 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96763 | $2,263.39 | $2,116.77 | $3,397.27 | $3,347.67 | $3,139.39 | $1,671.97 | $1,075.14 | $1,095.52 |

| 96764 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96766 | $2,198.62 | $1,778.53 | $4,071.56 | $3,065.08 | $2,624.75 | $1,960.81 | $894.17 | $995.42 |

| 96768 | $2,459.60 | $2,116.77 | $4,338.04 | $3,347.67 | $3,139.39 | $2,104.66 | $1,075.14 | $1,095.52 |

| 96769 | $2,198.62 | $1,778.53 | $4,071.56 | $3,065.08 | $2,624.75 | $1,960.81 | $894.17 | $995.42 |

| 96770 | $2,397.78 | $2,116.77 | $4,338.04 | $3,347.67 | $3,139.39 | $1,671.97 | $1,075.14 | $1,095.52 |

| 96771 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96772 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96773 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96774 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96776 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96777 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96778 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96779 | $2,459.60 | $2,116.77 | $4,338.04 | $3,347.67 | $3,139.39 | $2,104.66 | $1,075.14 | $1,095.52 |

| 96780 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96781 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96782 | $2,508.57 | $2,130.17 | $4,664.22 | $3,200.79 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96783 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96784 | $2,459.60 | $2,116.77 | $4,338.04 | $3,347.67 | $3,139.39 | $2,104.66 | $1,075.14 | $1,095.52 |

| 96785 | $2,814.68 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,104.66 | $1,083.14 | $1,222.56 |

| 96786 | $2,508.57 | $2,130.17 | $4,664.22 | $3,200.79 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96789 | $2,508.57 | $2,130.17 | $4,664.22 | $3,200.79 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96790 | $2,459.60 | $2,116.77 | $4,338.04 | $3,347.67 | $3,139.39 | $2,104.66 | $1,075.14 | $1,095.52 |

| 96791 | $2,508.57 | $2,130.17 | $4,664.22 | $3,200.79 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96792 | $2,508.57 | $2,130.17 | $4,664.22 | $3,200.79 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96793 | $2,459.60 | $2,116.77 | $4,338.04 | $3,347.67 | $3,139.39 | $2,104.66 | $1,075.14 | $1,095.52 |

| 96795 | $2,544.50 | $2,130.17 | $4,664.22 | $3,200.79 | $3,078.47 | $2,415.64 | $1,049.86 | $1,272.36 |

| 96796 | $2,198.62 | $1,778.53 | $4,071.56 | $3,065.08 | $2,624.75 | $1,960.81 | $894.17 | $995.42 |

| 96797 | $2,520.31 | $2,212.33 | $4,664.22 | $3,200.79 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96813 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96814 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96815 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96816 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96817 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96818 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96819 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96821 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96822 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96825 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96826 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96844 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96850 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96853 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96854 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96857 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96858 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96859 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96860 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96861 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96863 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96898 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

Most Expensive/Least Expensive Hawaii Carrier Rates by City

| Most Expensive Cities | Average Annual Rates | Least Expensive Cities | Average Annual Rates |

|---|---|---|---|

| Hawi | $2,859.11 | Anahola | $2,198.62 |

| Hilo | $2,859.11 | Kapaa | $2,198.62 |

| Holualoa | $2,859.11 | Kaumakani | $2,198.62 |

| Honaunau | $2,859.11 | Kealia | $2,198.62 |

| Honokaa | $2,859.11 | Kekaha | $2,198.62 |

| Honomu | $2,859.11 | Kilauea | $2,198.62 |

| Kailua Kona | $2,859.11 | Koloa | $2,198.62 |

| Kamuela | $2,859.11 | Lihue | $2,198.62 |

| Kapaau | $2,859.11 | Makaweli | $2,198.62 |

| Keaau | $2,859.11 | Princeville | $2,198.62 |

| Kealakekua | $2,859.11 | Waimea | $2,198.62 |

| Keauhou | $2,859.11 | Lanai City | $2,263.39 |

| Kurtistown | $2,859.11 | Hoolehua | $2,397.78 |

| Laupahoehoe | $2,859.11 | Kalaupapa | $2,397.78 |

| Mountain View | $2,859.11 | Kaunakakai | $2,397.78 |

| Naalehu | $2,859.11 | Maunaloa | $2,397.78 |

| Ninole | $2,859.11 | Haiku | $2,459.60 |

| Ocean View | $2,859.11 | Hana | $2,459.60 |

| Ookala | $2,859.11 | Kahului | $2,459.60 |

| Paauilo | $2,859.11 | Kihei | $2,459.60 |

| Pahala | $2,859.11 | Kula | $2,459.60 |

| Pahoa | $2,859.11 | Lahaina | $2,459.60 |

| Papaaloa | $2,859.11 | Makawao | $2,459.60 |

| Papaikou | $2,859.11 | Paia | $2,459.60 |

| Waikoloa | $2,859.11 | Puunene | $2,459.60 |

Take a look at the table above, listing the most/least expensive carrier rates according to the city.

Interestingly, smaller cities like Anahola and Princeville typically have more affordable rates than more densely populated areas like Ocean View. As you can see, your location is a significant factor in the rates you can expect to pay.

Compare Car Insurance Rates in Hawaii

Navigate through the table to assess various car insurance rates tailored to Hilo, HI residents. Make an informed decision by comparing rates and selecting the most suitable coverage for your vehicle.

| Compare Car Insurance Rates in Your City |

|---|

| Hilo, HI |

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best Hawaii Car Insurance Companies

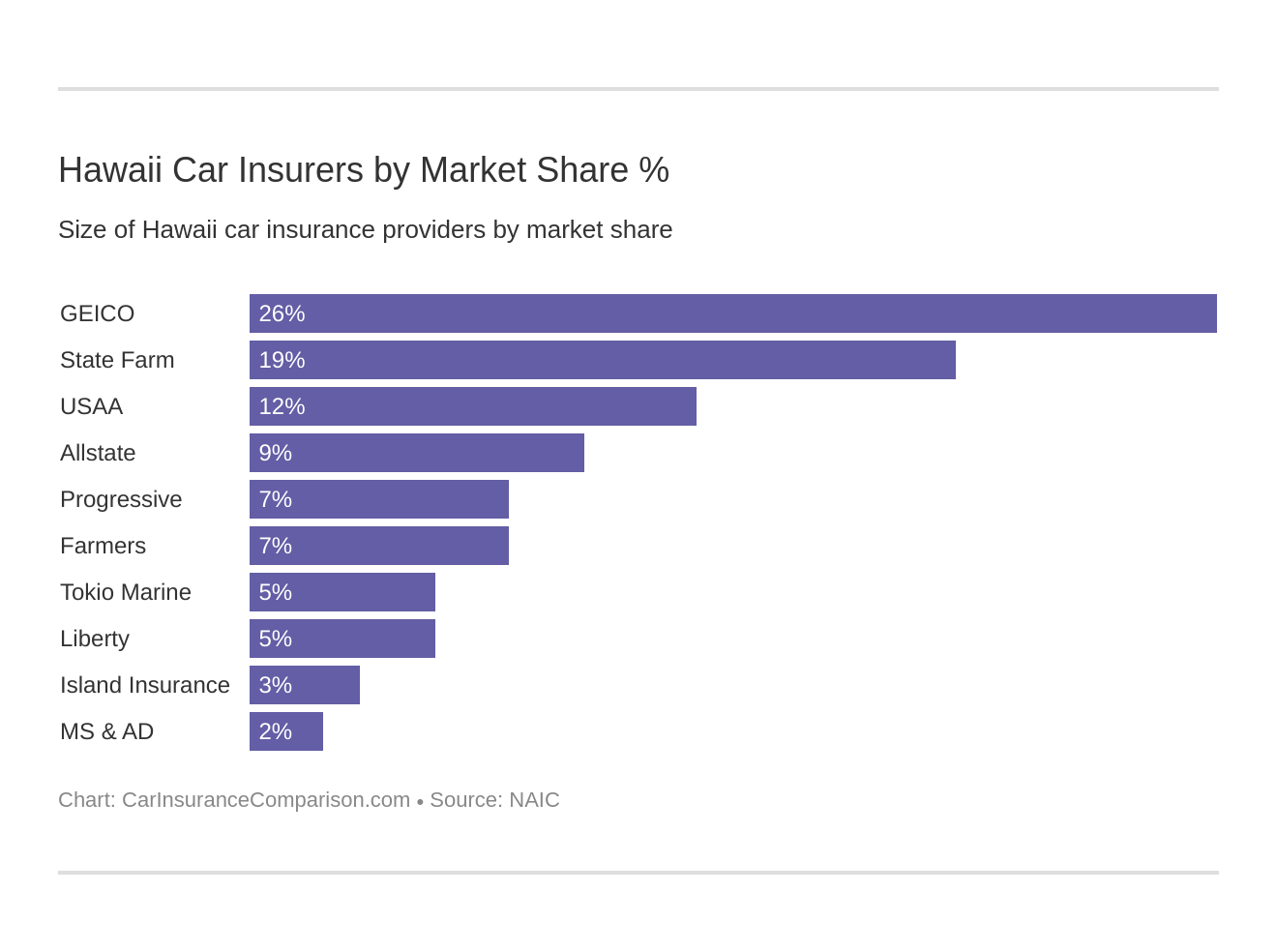

There are so many car insurance carriers vying for your business these days it’s hard to know which ones are the best in Hawaii. No need to worry; we’ve got you covered! Keep scrolling to find out who the 10 top car insurance companies are across the state. Ready to go? Let’s get this show on the road…

Hawaii Car Insurance Companies with the MOST Customer Complaints

These are the top 10 insurance companies in Hawaii responsible for writing over 95% of auto insurance in the state.

| Insurance Company/Group | Number of Autos Insured | Number of Complaints Received | Ratio of Complaints Per 1,000 Autos |

|---|---|---|---|

| Allstate Ins. Co. | 83,479 | 5 | 0.060 |

| DTRIC Ins. Co., Ltd. | 26,234 | 5 | 0.191 |

| Farmers Ins. Hawaii, Inc. | 67,473 | 43 | 0.637 |

| First Ins. Co. | 59,085 | 8 | 0.135 |

| Geico Ins. Co. | 232,142 | 79 | 0.340 |

| Hartford Underwriters Ins. Co. | 17,979 | 3 | 0.167 |

| Island Ins. Co. | 26,450 | 3 | 0.113 |

| Liberty Mutual Ins. Co. | 36,017 | 5 | 0.139 |

| Progressive Ins. Co. | 40,623 | 12 | 0.295 |

| State Farm Ins. Co. | 176,321 | 12 | 0.068 |

| USAA Ins. Co. | 104,745 | 15 | 0.143 |

Bear in mind, some complaints are based on general customer satisfaction, so factor that into your final decision.

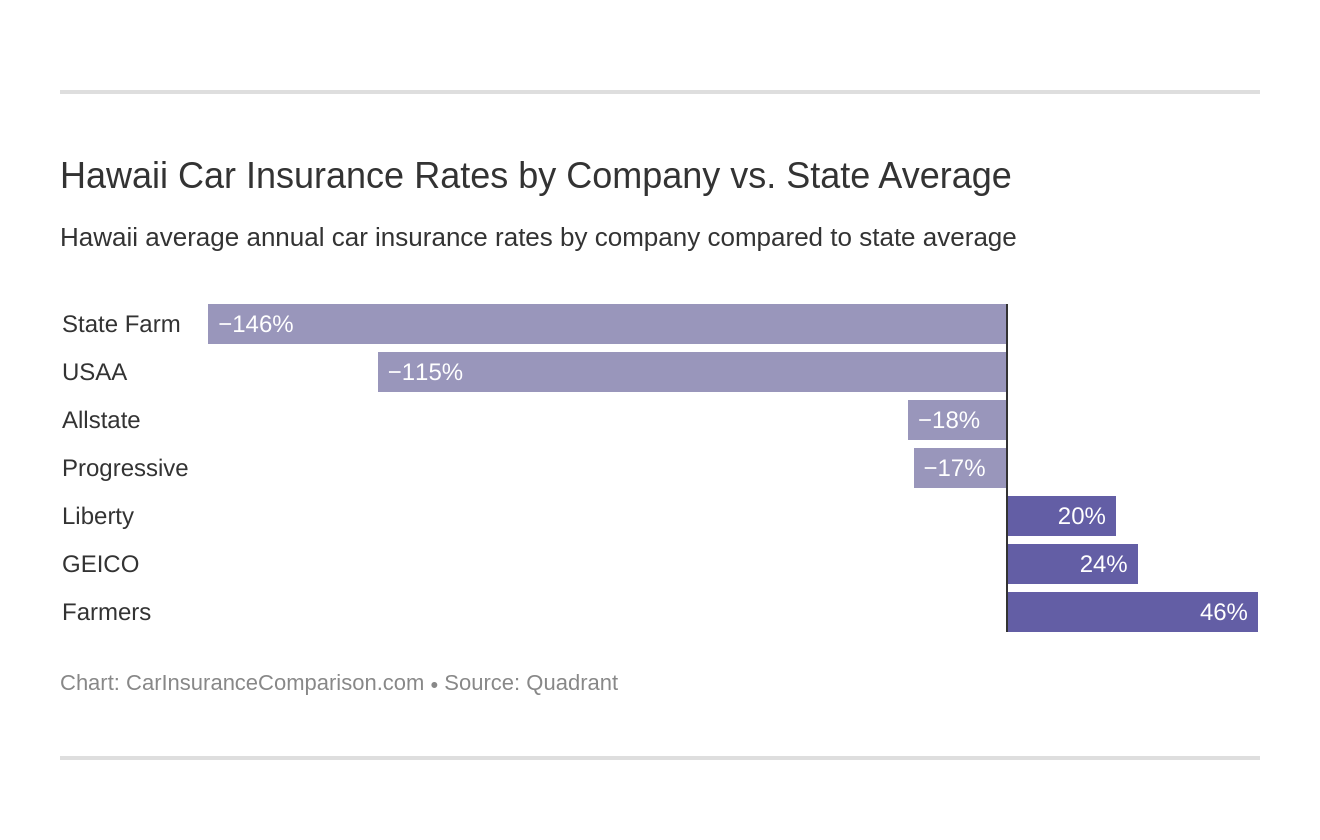

Hawaii’s Car Insurance Rates by Provider

| Company | Annual Rate Average | Compared to State Average (-/+) | Compared to State Average (-/+ %) |

|---|---|---|---|

| Allstate Insurance | $2,173.49 | -$382.70 | -17.61% |

| Farmers Ins HI Standard | $4,763.82 | $2,207.64 | 46.34% |

| Geico Govt Employees | $3,358.86 | $802.68 | 23.90% |

| Liberty Mutual Fire | $3,189.55 | $633.37 | 19.86% |

| Progressive Direct | $2,177.93 | -$378.25 | -17.37% |

| State Farm Mutual Auto | $1,040.28 | -$1,515.90 | -145.72% |

| USAA | $1,189.35 | -$1,366.83 | -114.92% |

We understand that rates are one of the biggest, if not the biggest factor when you pick Hawaii car insurance. The above chart shows seven of the top carriers in the state, along with their average rates compared to the overarching state average.

Our researchers discovered that Farmers charges the most in average premiums, with Geico coming in second place for the highest annual rates. Meanwhile, State Farm is number one for the most affordable average rates.

Commute Rates

| Group | Commute and Annual Mileage | Annual Average |

|---|---|---|

| Allstate | 10 miles commute. 6000 annual mileage. | $2,035.52 |

| Allstate | 25 miles commute. 12000 annual mileage. | $2,311.46 |

| Farmers | 10 miles commute. 6000 annual mileage. | $4,763.82 |

| Farmers | 25 miles commute. 12000 annual mileage. | $4,763.82 |

| Geico | 10 miles commute. 6000 annual mileage. | $3,358.86 |

| Geico | 25 miles commute. 12000 annual mileage. | $3,358.86 |

| Liberty Mutual | 10 miles commute. 6000 annual mileage. | $3,189.55 |

| Liberty Mutual | 25 miles commute. 12000 annual mileage. | $3,189.55 |

| Progressive | 10 miles commute. 6000 annual mileage. | $2,177.93 |

| Progressive | 25 miles commute. 12000 annual mileage. | $2,177.93 |

| State Farm | 10 miles commute. 6000 annual mileage. | $1,040.28 |

| State Farm | 25 miles commute. 12000 annual mileage. | $1,040.28 |

| USAA | 10 miles commute. 6000 annual mileage. | $1,189.35 |

| USAA | 25 miles commute. 12000 annual mileage. | $1,189.35 |

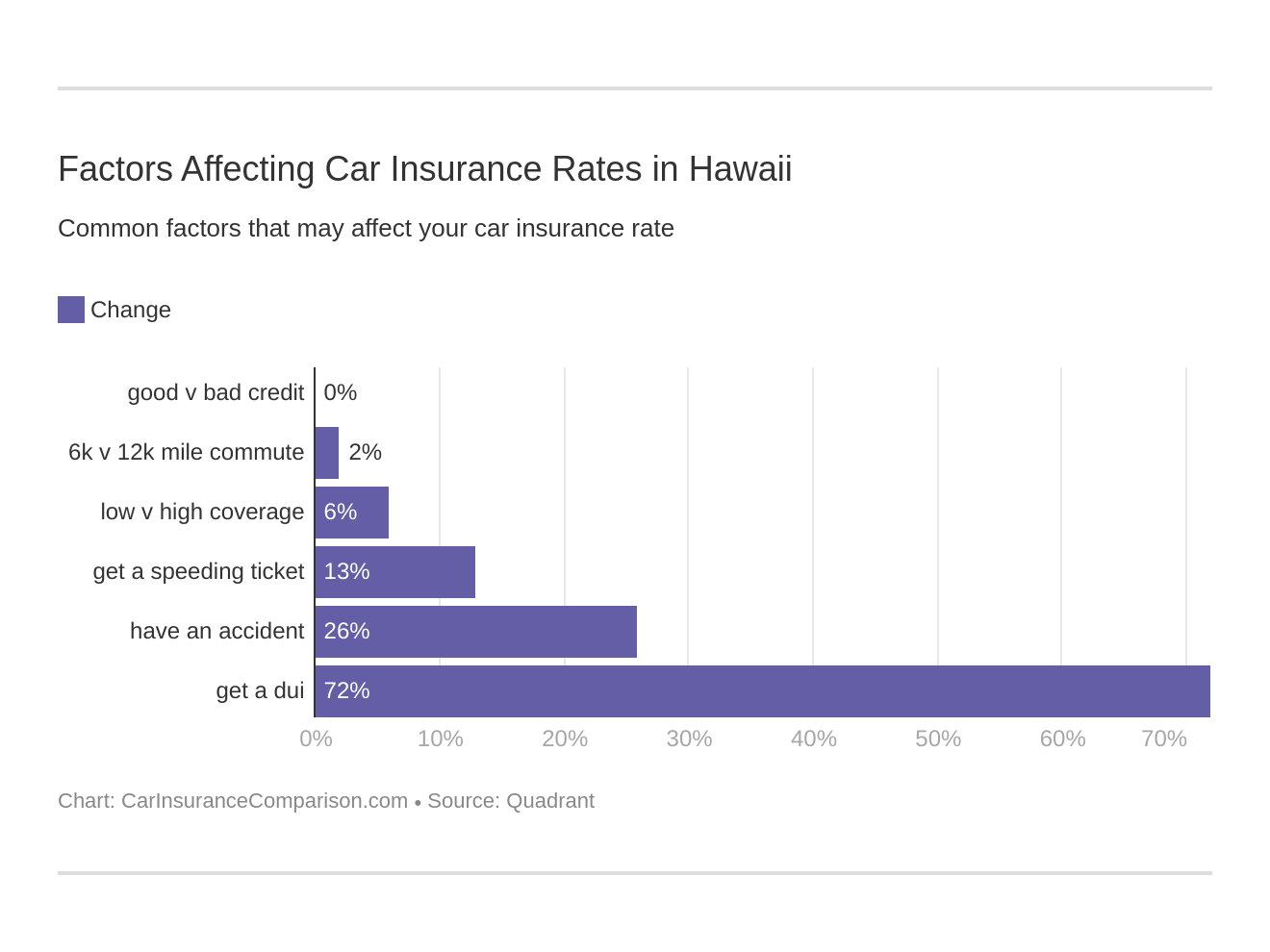

The table above compares the rates of top carriers in the state against average commute times. Interestingly enough, Farmers come in again with the highest premium ratio to annual mileage.

It is also interesting to note that Allstate is the only insurance carrier listed that charges insureds a different rate based on the length of their commute. That’s an approximately $276 rate change for a 15-mile commute difference!

Coverage Level Rates

| Group | Coverage Type | Annual Average |

|---|---|---|

| Allstate | High | $2,320.93 |

| Allstate | Medium | $2,178.85 |

| Allstate | Low | $2,020.68 |

| Farmers | High | $4,918.73 |

| Farmers | Medium | $4,799.09 |

| Farmers | Low | $4,573.64 |

| Geico | High | $3,493.66 |

| Geico | Medium | $3,383.08 |

| Geico | Low | $3,199.86 |

| Liberty Mutual | High | $3,365.61 |

| Liberty Mutual | Medium | $3,193.05 |

| Liberty Mutual | Low | $3,009.99 |

| Progressive | High | $2,369.14 |

| Progressive | Medium | $2,176.37 |

| Progressive | Low | $1,988.28 |

| State Farm | High | $1,108.19 |

| State Farm | Medium | $1,042.97 |

| State Farm | Low | $969.68 |

| USAA | High | $1,255.96 |

| USAA | Medium | $1,188.96 |

| USAA | Low | $1,123.14 |

Credit History Rates

According to a study conducted by Experian, the average resident of Hawaii has a credit card VantageScore of 693 and around 3.25 credit cards in their name. The average Hawaiian consumer has a credit card balance of $6,981.

If you think that your credit card debt and car insurance rates have no correlation, think again. In just about every state, a bad credit report will result in higher car insurance premiums.

But, for Hawaii residents with poor credit, we have some good news for you! Insurers in the state of Hawaii are banned from considering credit scores in premiums. Good credit or bad, it won’t impact your insurance rates in Hawaii.

Driving Record Rates

| Company | Clean Record | One Speeding Violation | One Accident | One DUI |

|---|---|---|---|---|

| Allstate | $1,293.11 | $1,774.29 | $1,904.18 | $3,722.37 |

| Farmers | $2,290.51 | $2,290.51 | $3,419.86 | $11,054.40 |

| Geico | $1,414.01 | $1,414.01 | $1,834.57 | $8,772.86 |

| Liberty Mutual | $1,697.57 | $2,124.22 | $2,124.22 | $6,812.19 |

| Progressive | $1,649.25 | $2,137.29 | $2,322.92 | $2,602.26 |

| State Farm | $950.44 | $1,040.29 | $1,130.10 | $1,040.29 |

| USAA | $901.19 | $942.77 | $1,109.67 | $1,803.79 |

As you’ll note in the table above, your driving history has a direct effect on the premiums you can expect to pay.

If you look at the rates listed for Geico, you’ll notice that the rate difference for one accident vs. one DUI is almost a $7,000 premium jump! Wow. Those are some high rates partially because Hawaii DUI insurance laws are strict.

The 10 Largest Car Insurance Companies in Hawaii

| Company Name | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|

| Allstate Insurance Group | $67,866 | 51.00% | 9.02% |

| Farmers Insurance Group | $51,498 | 52.22% | 6.84% |

| Geico | $198,986 | 69.37% | 26.45% |

| Island Insurance Co Group | $24,127 | 64.89% | 3.21% |

| Liberty Mutual Group | $34,387 | 60.68% | 4.57% |

| MS & AD Insurance Group | $17,932 | 53.46% | 2.38% |

| Progressive Group | $53,397 | 50.11% | 7.10% |

| State Farm Group | $139,679 | 56.60% | 18.56% |

| Tokio Marine Holdings Inc Group | $38,833 | 64.55% | 5.16% |

| USAA Group | $90,542 | 64.08% | 12.03% |

Number of Car Insurance Providers in Hawaii

| Property and Casualty Insurance | Amount |

|---|---|

| Domestic | 17 |

| Foreign | 608 |

| Total | 625 |

Laws in Hawaii

If you want to get the best carrier rates for your driver needs, you need to understand the relevant laws and statutes that govern the roads in Hawaii. Keep scrolling to learn all the must-have specifics before getting behind the wheel.

Hawaii Car Insurance Laws

Car insurance laws vary from state to state, and Hawaii is no different. Hawaii has important laws worth noting. One such law is Hawaii’s cell phone ban for all drivers under the age of 18. Another noteworthy restriction bans drivers of any age from the use of all hand-held devices while driving.

High-Risk Insurance

For drivers with a history of accidents or traffic violations, they may be unable to purchase coverage from an auto insurance carrier. This is where a type of insurance known as high-risk car insurance comes into play.

Known as the Hawaii Joint Underwriting Plan, all motor-vehicle insurers in the state must participate in this pooling agreement. The three authorized service insurers are:

- First Insurance Company of Hawaii

- Island Insurance

- State Farm

Low-Cost Insurance

Residents of Hawaii receiving disability benefits through the state’s Assistance to the Aged, Blind, and Disabled (AADB) Program may be eligible for free car insurance. To participate, you must meet one of the following requirements:

- 65 or older

- Legally blind

- Permanently disabled

- Caring for and living with individuals receiving AABD financial aid

In addition to these stipulations, you must also earn an annual salary under 34% of the Federal Poverty Level. In this scenario, auto insurance is offered completely free.

Windshield Coverage

While some states mandate a waived deductible for windshield repairs, and others specify the use of only manufacturer replacement parts, Hawaii has no laws specific to broken windshield car insurance coverage.

If windshield coverage is something you desire, you will need to have comprehensive car insurance coverage, and you will have to carefully examine how the different insurance providers handle windshield claims.

Automobile Insurance Fraud in Hawaii

Insurance fraud is a criminal offense in the state of Hawaii, occurring when an individual attempts to deceive an insurer to receive benefits or payouts they are not qualified to obtain. There are three ways in which insurance fraud is committed:

- Knowingly misreporting or hiding facts to get benefits, coverage, or compensation

- Aiding someone in misreporting or altering the facts to receive benefits

- Knowingly making false claims or statements on someone else’s behalf at an official proceeding

Insurance fraud is considered a:

- Class B felony if the value in question is over $20,000, punishable by as much as 10 years imprisonment and/or $25,000 fine

- Class C felony if the value in question is over $300, punishable by as much as five years imprisonment and/or $10,000 fine

- A misdemeanor if the value in question is $300 or under, punishable by as much as one year’s imprisonment and/or $2,000 fine

Simply put, don’t commit insurance fraud, and you’re good to go.

Statute of Limitations

A statute of limitations is the limit on the amount of time you have to bring a lawsuit to court. Different states have different statutes of limitations for personal injury and property damage matters.

If you are ever in an auto accident involving extensive injuries and damages, you need to know your rights in the matter in the state of Hawaii.

Modified Comparative Negligence

Since Hawaii is one of only a few no-fault insurance states in the country, your insurance covers any claims resulting from a car accident up to your PIP policy limits, regardless of who is at fault.

Hawaii’s Vehicle Licensing Laws

Now, we all know that you can’t drive a car without a license. Let’s find out what Hawaii’s mandatory vehicle licensing laws are.

Penalties for Driving Without Insurance

We’ve got you covered.

- First Offense – $500 fine or community service if approved by a judge and a three-month license suspension or purchase of a six-month, non-refundable insurance policy

- Second Offense – Minimum fine of $1500 if occurring within five years of the first offense and one-year license suspension or purchase of a six-month, non-refundable insurance policy

Proof of insurance for registration is accepted in the form of a hard copy card or electronically on your mobile device.

Teen Driver Laws

| Young Driver Licensing Laws | Age Restrictions | Passenger Restrictions | Time Restrictions |

|---|---|---|---|

| Learner's Permit | 15 years, six months | Passenger must be licensed driver aged 21 or older supervising in front seat. | Between 11 p.m. and 5 a.m., young driver must be accompanied by a parent or guardian. Teens must have 50 hours of driving practice, including 10 hours at night, with a parent or legal guardian, before obtaining provisional license. |

| Provisional License | Must be 16 years old and have held learner's permit for at least six months. | Can drive alone but transport no more than one person under age 18 who is not a household member. | May not drive between 11 p.m. and 5 a.m. unless accompanied by a licensed parent or guardian or driving to/from employment or to/from a school-authorized activity at the driver’s school. Between 11 p.m. and 5 a.m., they may not transport more than one person under 18 unless accompanied by a parent or guardian. |

| Full License | Must be 17 years old and have held provisional license for at least six months. | None. | None. |

Once a teenager has completed the requirements for getting a driver’s license, the next step is finding teen car insurance.

Older Driver and General Population License Renewal Procedure

| License Renewal Procedures | General Population | Older Population |

|---|---|---|

| License renewal cycle | Eight years | Two years for people 72 and older |

| Mail or online renewal permitted | By mail, limited to two consecutive renewals, but must appear in person at least every 16 years | By mail, limited to two consecutive renewals, but must appear in person at least every 16 years |

| Proof of adequate vision required at renewal | Every renewal | Every renewal |

New Residents

If you are about to make the move to Hawaii or even just planning on visiting, here’s what you need to know:

- The Hawaii Department of Transportation handles all matters related to vehicle licensing, offering a comprehensive Hawaii Driver’s Manual detailing traffic rules, safe driving tips, and licensing laws

- Maximum posted speed limits are 60 mph on rural interstates, 60 mph on urban interstates, 55 mph on other limited access roads, and 45 mph on other roads

- Hawaii imposes a ban on texting and all handheld devices on drivers while operating a motor vehicle

For new residents looking to obtain their first Hawaii driver’s license, you will need to provide proof of name and date of birth, proof of social security number, proof of legal presence, and proof of residence. Acceptable proofs of name and date of birth are:

- Valid unexpired out-of-state license

- Certified copy of a birth certificate filed with a State Office of Vital Statistics or equivalent agency in the state you were born in

- Certified marriage certificate filed with a State Office of Vital Statistics or equivalent agency in the state you were married in

- Certified decree of name change filed with the Lt. Governor’s office or equivalent agency in the State of the name change

- State or military identification card

- Immigration documents (alien/refugee registration identification

Hawaii’s vehicle registration and licensing division do not accept laminated documents or photocopies. Acceptable forms of proof of social security number are:

- Social security card

- Valid driver’s license

- Valid unexpired state identification card

- Military identification card that displays a social security number.

No photocopied or laminated copies will be accepted.

Comparative Negligence

Hawaii’s negligence laws err on the side of 51% comparative negligence. What does this mean? If another driver hits you and you become injured as a result of the accident, your PIP benefits must first be exhausted under the no-fault Hawaii car insurance laws.

However, if you wish to pursue a case against the driver for additional damages, you must prove negligence on behalf of the other party as direct causation to your injuries. However, the injured individual must be less than 51% at fault to claim damages.

If it is discovered that you were 51% or more at fault, you cannot proceed with a claim against the other driver. Furthermore, if you bear less than 51% of fault in the accident, the percentage of fault you carry will be subtracted from any damages you do recover.

Hawaii’s Rules of the Road

Now, before you get out on the open road in the Aloha State, you need to know the rules to stay safe and keep your rates down. Ready?

Fault vs. No-Fault

Remember, Hawaii is a no-fault insurance state. Your PIP coverage covers medical bills, lost wages, and other accident-related expenses due to an accident, no matter who was at fault.

You are only permitted to file a claim against the at-fault driver if your bills reach a certain point/or your injury is sufficiently serious and you are less than 51% at fault for the accident.

Keep Right and Move Over Laws

Hawaii Revised Statute 291C-41 states that you should keep right if driving slower than the average speed of surrounding traffic. Hawaii’s Move Over Bill was signed into law in 2012.

The law demands that drivers who approach emergency vehicles must move out of the adjacent lane to the emergency vehicle when safe to do so or slow down to a safe and prudent speed. Failure to comply could result in a $1000 fine.

Speed Limits

The maximum speed limit on rural and urban interstates is 60 mph. It is 55 mph on other limited access roads and 45 mph on other roads.

Seat Belt and Car Seat Laws

All children three years and younger must be restrained in a child safety seat. Children between four and seven years of age must be fastened in a booster seat or child restraint.

Children between four and seven years old who are over 4′ 9″ tall or weigh at least forty pounds may wear an adult safety belt if seated in the backseat. They are permitted to be restrained by a lap belt if no lap/shoulder belts are available.

Violation of Hawaii’s child seat law may not only put the child in danger, but could result in a base fine of $100 plus additional fees.

Children eight years of age and up are allowed to sit in all seats. In addition to seat belt and child safety laws, Hawaii also imposes restrictions on who can ride in pickup truck cargo areas.

Individuals aged 13 and up are permitted to ride in cargo areas if there are no other available seats and the tailgate and side racks are secured. Passengers must remain on the floor and not try to unfasten the cargo.

Ridesharing

Rideshare services like Uber and Lyft mandate that all drivers carry personal car insurance policies that align with or exceed the minimum coverages dictated by state law. Drivers rarely carry their own commercial car insurance coverage.

Automation on the Road

According to the Insurance Institute for Highway Safety (IIHS),

“Automation is the use of a machine or technology to perform a task or function that was previously carried out by a human. In driving, automation involves using radar, camera and other sensors to gather information about a vehicle’s surroundings, which is then used by computer programs to perform parts or all of the driving task on a sustained basis.”

Currently, Hawaii has only authorized testing of autonomous vehicles rather than complete deployment.

Hawaii’s Safety Laws

But wait, there’s more! Let’s dig deeper into Hawaii’s safety laws to protect you on the open road.

DUI Laws

| DUI Laws | DUI Limits |

|---|---|

| BAC Limit | 0.08 |

| HIGH BAC Limit | N/A |

| Criminal Status by Offense | First through Third petty are misdemeanors. Four or more are considered class C felony. |

| Formal Name for Offense | Driving Under the Influence (DUI) / Operating a Vehicle Under the Influence of an Intoxicant (OVUII). |

| Look Back Period/Washout Period | Five years |

| First Offense – ALS or Revocation | One year |

| First Offense Imprisonment | 48 hours to five days. |

| First Offense – Fine | $150–$1000 + $25 to neurotrauma special fund + $25 to trauma system special fund if the court ordered. |

| First Offense – Other | 14-hour minimum rehab program. May require 72 hours of community service. IID for one year |

| Second Offense – DL Revocation | 18 months to two years if second offense in five years. |

| Second Offense – Imprisonment | Minimum 240 community service hours OR five to 30 days with 48 consecutive hours. |

| Second Offense – Fine | $500–$1500 + $25 to neurotrauma special fund + $50 to trauma system fund if the court ordered. Additional $500 if there was a child in vehicle. |

| Second Offense – Other | Abuse and education program required. IID during the revocation period. |

| Third Offense – DL Revocation | Two-year revocation if received two convictions within the past five years. |

| Third Offense – Imprisonment | 10–30 days. 48 hours must be served consecutively. |

| Third Offense – Fine | $500–$2500 + $25 to neurotrauma special fund + $50 to trauma system fund if the court ordered. Additional $500 if child there was a child in the vehicle. |

| Third Offense – Other | 240 minimum hours of community service. Abuse and education program required. IID required during the revocation period |

| Mandatory Interlock | All offenders. |

Read more: What are the DUI insurance laws in Hawaii?

Marijuana-Impaired Driving Laws

Hawaii does not currently have any marijuana-specific impaired driving laws.

Distracted Driving Laws

The state of Hawaii enforces a strict ban on texting and hand-held devices for all drivers, along with a cellphone ban for all young drivers under the age of 18.

Hawaii Fascinating Facts You Need to Know

Do you want to know how safe it really is for drivers in Hawaii? Well, the data our researchers found might surprise you. Let’s take a look…

Vehicle Theft in Hawaii

In 2016 alone, there were just over 4,000 motor vehicle thefts in the state of Hawaii. Here are the top 10 stolen cars in Hawaii:

| Make/Model | Year | Number of Thefts |

|---|---|---|

| Honda Civic | 2000 | 250 |

| Honda Accord | 1994 | 180 |

| Ford Pickup (Full Size) | 2006 | 154 |

| Toyota Tacoma | 2003 | 86 |

| Toyota Corolla | 2004 | 64 |

| Toyota Camry | 2000 | 55 |

| Toyota 4Runner | 1997 | 45 |

| Nissan Frontier | 2004 | 44 |

| Nissan Altima | 2004 | 42 |

| Dodge Pickup (Full Size) | 2001 | 37 |

Risky/Harmful Driving Behavior

The best way to stay safe while driving is to always keep your eyes on the road and stay aware of common risky driving issues in your state. Let’s delve into this a bit further…

2017 Traffic Fatalities

| Type | Number of Fatalities |

|---|---|

| Drivers Involved in Fatal Crashes | 144 |

| Traffic Fatalities | 107 |

| Passenger Vehicle Occupant Fatalities (All Seat Positions) | 59 |

| Motorcyclist Fatalities | 25 |

| Pedestrian Fatalities | 14 |

| Bicyclist and other Cyclist Fatalities | 6 |

Fatalities by Person Type

| Person Type | Number |

|---|---|

| Occupants (Enclosed Vehicles) | 61 |

| Motorcyclists | 25 |

| Nonoccupants | 21 |

Fatalities by Crash Type

| Crash Type | Number |

|---|---|

| Involving a Roadway Departure | 60 |

| Single Vehicle | 59 |

| Involving Speeding | 50 |

| Involving an Intersection (or Intersection Related) | 30 |

| Involving a Rollover | 26 |

| Involving a Large Truck | 9 |

Five Year Trend for the Top 10 Counties

| County | Total Fatalities 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Hawaii | 26 | 13 | 21 | 32 | 35 |

| Honolulu | 53 | 53 | 48 | 59 | 49 |

| Kalawao | 0 | 0 | 0 | 0 | 0 |

| Kauai | 7 | 8 | 3 | 8 | 6 |

| Maui | 16 | 21 | 21 | 21 | 17 |

| Total | 102 | 95 | 93 | 120 | 107 |

Fatalities Involving Speeding by County

| County Name | Fatalities 2013 | 2014 | 2015 | 2016 | 2017 | Fatalities Per 100K Population 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Hawaii | 11 | 4 | 9 | 12 | 19 | 5.74 | 2.06 | 4.57 | 6.04 | 9.48 |

| Honolulu | 27 | 19 | 21 | 30 | 25 | 2.74 | 1.92 | 2.11 | 3.02 | 2.53 |

| Kalawao | 0 | 0 | 0 | 0 | 0 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Kauai | 2 | 3 | 4 | 4 | 1 | 2.87 | 4.25 | 1.40 | 5.57 | 1.39 |

| Maui | 5 | 10 | 8 | 8 | 5 | 3.11 | 6.12 | 6.08 | 4.84 | 3.01 |

Fatalities in Crashes Involving an Alcohol-Impaired Driver by County

| County Name | Total Fatalities 2015 | 2016 | 2017 | Fatalities Per 100K Population 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|

| Hawaii | 7 | 8 | 11 | 3.56 | 4.03 | 5.49 |

| Honolulu | 17 | 19 | 17 | 1.71 | 1.91 | 1.72 |

| Kalawao | 0 | 0 | 0 | 0 | 0 | 0 |

| Kauai | 1 | 3 | 1 | 1.4 | 4.18 | 1.39 |

| Maui | 12 | 7 | 13 | 7.3 | 4.23 | 7.82 |

Teen Drinking and Driving

| Teen DUI Laws | Limits |

|---|---|

| Alcohol-impaired Driving Fatalities Per 100K Population | 1.4 |

| Higher/Lower Than National Average (1.2) | Higher |

| DUI Arrest (Under 18 years old) | 23 |

| DUI Arrests (Under 18 years old) Total Per Million People | 74.67 |

EMS Response Time

| Type of Crash | Time of Crash to EMS Notification | EMS Notification to EMS Arrival | EMS Arrival at Scene to Hospital Arrival | Time of Crash to Hospital Arrival |

|---|---|---|---|---|

| Rural Fatal Crashes | 3 | 14.45 | 34.86 | 48.79 |

| Urban Fatal Crashes | 3.13 | 7.51 | 27.54 | 36.38 |

Transportation

Did you know that, on average, most drivers in Hawaii spend 26 minutes each way in commute time? In fact, 2.57% of working professionals have commutes well beyond 90 minutes! Let’s take a look…

Top Two Cities for Traffic Congestion

While Hawaii is not as densely populated as other U.S. states, this doesn’t mean residents don’t experience their fair share of traffic. See for yourself…

| City | Hours in Congestion | Commute in Traffic – Peak | Commute in Traffic – Daytime | Commute in Traffic – Overall |

|---|---|---|---|---|

| Honolulu, HI | 37 | 17% | 10% | 11% |

| Kaneohe, HI | 28 | 16% | 10% | 11% |

With its lush scenery and incredible weather, you’ll find no end to things to see and do in the Aloha State.

The time to find the right car insurance provider and compare Hawaii car insurance rates is now. Comparison shop today for the best Hawaii car insurance with our FREE online tool. Enter your zip code below to get started!

Frequently Asked Questions

What are the minimum car insurance requirements in Hawaii?

Hawaii requires 20/40/10 liability coverage and $10,000 in PIP coverage.

How much is the average car insurance rate in Hawaii?

The average monthly car insurance rate in Hawaii is $73.

Do I need comprehensive insurance in Hawaii?

Comprehensive insurance is not mandatory unless required by your car lender.

What is “no-fault” car insurance in Hawaii?

Hawaii is a “no-fault” car insurance state, meaning your PIP coverage pays for your medical expenses regardless of who caused the accident.

What are the penalties for driving without insurance in Hawaii?

Driving without insurance in Hawaii can result in fines, jail time, and license suspension.

Is car insurance more expensive in Hawaii?

No, Hawaii car insurance is actually cheaper than the national average. A full coverage insurance policy in Hawaii only costs an average of $94/mo.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.