Best Car Insurance for Natural Disasters in 2026 (Your Guide to the Top 10 Companies)

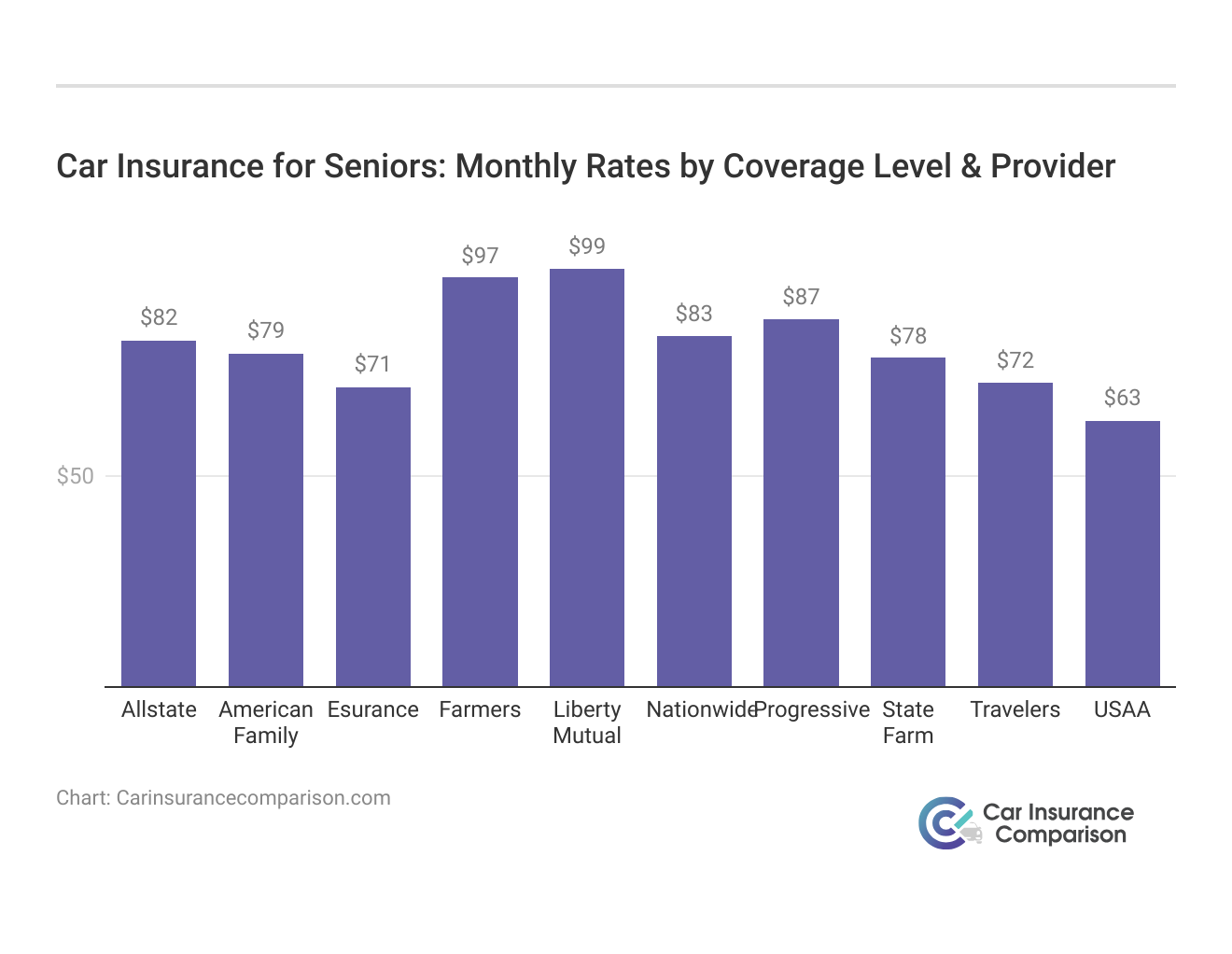

State Farm, USAA, and Progressive are the top providers of the best car insurance for natural disasters, starting at just $63 monthly. They excel due to their comprehensive coverage options, exceptional customer service, and proven reliability in handling claims related to natural disasters.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Expert

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Insurance & Finance Analyst

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Updated May 2024

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Natural Disasters

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Natural Disasters

A.M. Best Rating

Complaint Level

6,589 reviews

6,589 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Natural Disasters

A.M. Best Rating

Complaint Level

13,283 reviews

13,283 reviewsThe top picks for the best car insurance for natural disasters are State Farm, USAA, and Progressive, known for their affordability and robust coverage.

Natural hazards and disasters can impact car insurance by damaging vehicles directly or affecting the insurance market.

Our Top 10 Company Picks: Best Car Insurance for Natural Disasters

| Company | Rank | Multi-Policy Discount | Low-Mileage Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | 30% | Many Discounts | State Farm | |

| #2 | 10% | 20% | Military Savings | USAA | |

| #3 | 10% | 30% | Online Convenience | Progressive | |

| #4 | 10% | 30% | Add-on Coverages | Allstate | |

| #5 | 10% | 5% | Local Agents | Farmers | |

| #6 | 12% | 30% | Customizable Polices | Liberty Mutual |

| #7 | 20% | 20% | Usage Discount | Nationwide |

| #8 | 13% | 10% | Accident Forgiveness | Travelers | |

| #9 | 29% | 10% | Student Savings | American Family | |

| #10 | 10% | 10% | Policy Options | Esurance |

Avoid driving during extreme weather, but even parked cars can be damaged in storms. Learn more on how to assess car damage for insurance purposes.

Moreover, if a storm causes widespread damage, insurance rates may rise for all policyholders to cover large payouts. Use the car insurance rates comparison tool in the box above now by just typing in your ZIP code.

How a Natural Disaster Can Affect the Car Insurance Market

Most people understand how an individual’s car insurance premium can increase when they have to file a claim for a car that has been damaged in a storm or other natural hazard.

People might not be completely aware of how a major natural disaster can affect the rates of a person who was in no way involved or affected by the natural disaster.

If a natural disaster causes an insurance company to have to pay out millions in claims to keep the insurance company from failing, they might have to increase the insurance rates of all of their policyholders.

During the period directly following a natural disaster it might even be in the insurance company’s best interest to not offer new coverage for a short time.

If a certain area experiences multiple natural disasters in a short window of time or if a certain area is more prone to things like tornadoes, hurricanes, and earthquakes, the cost of certain types of car insurance coverage can be increased permanently.

An example of this might be how flood insurance coverage often costs more in areas that are more prone to flooding because they have more annual rainfall or are more prone to hurricanes. So naturally, flood insurance coverage would cost more in Florida than it would in Kansas. A person would pay more for wildfire coverage if they lived in southern California than they would if they lived in Oregon.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How the Green Movement Is Affecting Car Insurance

The Green Movement focuses on reducing energy demands and carbon emissions. There is increasing evidence that high carbon emissions and high energy demands hurt the weather throughout the world.

One of the ways this happens is that certain weather events become more severe.

More severe natural hazards equals more damage and a more adverse affect on the insurance market.

Since the insurance industry recognizes how “going green” can benefit their bottom line in the long run, they have started to invest in the Green Movement. Some of the ways the insurance industry is investing in the Green Movement are by offering discounts for more earth-friendly cars and by donating money every year to “green” charities and organizations.

Many leading national car insurance companies offer a five-percent to ten-percent discount to policyholders who drive a more earth-friendly car. Some of these cars include hybrids like the Toyota Prius and cars that have been modified to use biofuel instead of fossil fuels or to produce less carbon emissions. More earth-friendly cars not only offer the policyholder the chance of a discount on their car insurance but also tend to be much safer.

Cars that do not rely on fossil fuels are less likely to catch on fire if they are in an accident. The majority of these earth-friendly cars have been manufactured in the past six to seven years, which means they have been manufactured under much stricter government safety regulations.

State Farm leads the pack in car insurance for natural disasters, combining comprehensive coverage with exceptional value.

Brad Larson Licensed Insurance Agent

Earth-friendly cars also tend to be made out of more impact-resistant materials, have brighter lights, and have airbags not only in the dashboard and steering wheel but also at the sides of the car. To learn more, explore our comprehensive resource on “Minimum Car Insurance Requirements by State.”

Case Studies: Car Insurance for Natural Disasters

In areas where natural disasters are a frequent threat, finding the right car insurance that feels like a reliable safeguard can be daunting. Through these case studies, we delve into personal stories of individuals who have found bespoke insurance solutions to protect themselves and their properties in the face of nature’s unpredictability.

- Case Study #1 – Tailored Coverage in Earthquake-Prone Regions: Sarah, a homeowner in an earthquake-prone zone, found the perfect insurance solution with State Farm. Their wide agent network and customized policies ensured comprehensive coverage. Local agents provided invaluable support, guiding her through claims seamlessly.

- Case Study #2 – Military Precision in Hurricane-Affected Regions: John, a serviceman in a hurricane-prone coastal area, chose USAA for its tailored military services. When a fierce hurricane hit, USAA’s insurance provided reliable protection for his property and car amidst extensive damage.

- Case Study #3 – Innovative Solutions for Tornado-Risk Areas: Mark, a cautious driver in a tornado-prone region, prioritizes insurance coverage that adapts to his driving habits and offers protection against natural disasters. Choosing Progressive for its innovative coverage solutions and usage-based savings, Mark experienced the challenge of a severe tornado damaging his car.

These case studies emphasize the significance of choosing an insurance provider that not only offers coverage tailored to specific regional risks but also delivers substantial support during crises. The personal accounts of Sarah, John, and Mark illustrate how dedicated customer service and tailored insurance solutions are vital in easing the financial strains caused by natural disasters.

Read more: Can I purchase additional car insurance during a storm?

What to Do When a Car Is Damaged in a Natural Disaster

Does car insurance cover natural disasters? When a person’s car is damaged in a natural disaster or by the effects of a natural disaster, they should contact their car insurance provider as soon as possible to file a claim (For more information, read our “How much car insurance coverage do I need for a new car?”).

Choose State Farm for exceptional customer service and robust coverage in the face of unpredictable natural events.

Tracey L. Wells Licensed Insurance Agent & Agency Owner

They should take photographs of the damage and provide their car insurance company with any relocation or contact change information. With some natural disasters, there could be a time limit to file a claim.

The free rate tool below will help you compare car insurance rates for your area. Type in your ZIP code now.

Frequently Asked Questions

Does car insurance cover damage from natural disasters?

It depends on the type of coverage you have. Comprehensive car insurance typically covers damage from natural disasters, including hurricanes, floods, earthquakes, hailstorms, and wildfires. However, standard liability or collision coverage alone may not cover such damages. It’s important to review your insurance policy or consult with your insurance provider to confirm the extent of coverage for natural disasters.

Learn more in our “Compare Comprehensive Car Insurance: Rates, Discounts, & Requirements.”

What does comprehensive car insurance cover in relation to natural disasters?

Comprehensive car insurance provides coverage for damage to your vehicle caused by events other than collisions with another vehicle. This can include damage from natural disasters, such as:

- Floods: Water damage to your car from flooding caused by heavy rains, storms, or overflowing rivers.

- Hailstorms: Dents, cracks, or shattered windows caused by hailstones.

- Hurricanes and windstorms: Damage from high winds, falling trees, or flying debris during a hurricane or windstorm.

- Earthquakes: Damage to your vehicle resulting from seismic activity.

- Wildfires: Damage from fire or smoke due to a wildfire.

How can I compare car insurance coverage for natural disasters?

When comparing car insurance coverage for natural disasters, consider the following factors:

- Comprehensive coverage: Ensure the policy includes comprehensive coverage, which protects against damage from natural disasters.

- Deductibles: Review the deductible amount for comprehensive coverage. A higher deductible may lower your premium but means you’ll pay more out of pocket in the event of a claim.

- Coverage limits: Check the coverage limits for comprehensive coverage. Make sure they are sufficient to cover potential damages caused by natural disasters.

- Additional coverage: Some insurance providers may offer optional add-ons or endorsements specifically for natural disaster coverage. Inquire about any additional coverage options available.

Is car insurance required by law to cover natural disasters?

Car insurance requirements vary by state and country. While liability insurance is typically required by law, coverage for natural disasters may not be mandatory. However, it’s highly recommended to have comprehensive coverage, especially if you live in an area prone to natural disasters.

What should I do if my car is damaged in a natural disaster?

If your car is damaged in a natural disaster, follow these steps:

- Ensure your safety. Prioritize your safety and the safety of others. Follow any evacuation or emergency procedures if necessary.

- Document the damage. Take photos or videos of the damage to your car from different angles. This documentation will be helpful when filing an insurance claim.

- Contact your insurance provider. Report the damage to your insurance provider as soon as possible. They will guide you through the claims process and provide instructions on how to proceed.

- Follow claim procedures. Provide the necessary information, including photos, a description of the damage, and any supporting documents requested by your insurance provider.

- Arrange for repairs. Once your claim is approved, work with the insurance company’s approved repair shops or follow their guidelines to get your car repaired.

See more details on our “Car Insurance Claim Investigation.”

What is act of nature car insurance?

Act of nature car insurance refers to coverage that protects against damage to your car caused by natural events such as earthquakes, floods, or storms.

Are hurricanes covered by insurance?

Yes, hurricanes are typically covered under comprehensive car insurance policies, which protect against damage not caused by a collision.

Can we claim car insurance for natural disasters?

Yes, you can claim car insurance for natural disasters if you have comprehensive coverage, which includes events like floods, tornadoes, and other natural incidents.

What does car insurance for natural calamity cover?

Car insurance for natural calamities covers damage to your vehicle caused by natural events such as earthquakes, floods, hurricanes, and wildfires, provided you have comprehensive coverage.

Access comprehensive insights into our “Types of Car Insurance Coverage.”

Does car insurance cover hurricane damage?

Yes, car insurance covers hurricane damage if you have a comprehensive policy that includes coverage for natural disasters and weather-related events.

What does car insurance natural disaster coverage typically include?

How does car insurance natural disaster differ from regular coverage?

Why is it important to have car insurance natural disasters coverage?

What damage can a category 3 hurricane cause to a vehicle?

Are vehicles covered for damage from a category 4 hurricane under standard car insurance policies?

What is the meaning of a category 4 hurricane?

What does category 4 storm mean?

What is a disaster car price?

Do car insurance cover natural disasters?

Does auto insurance cover natural disasters?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.