Compare Idaho Car Insurance Rates [2025]

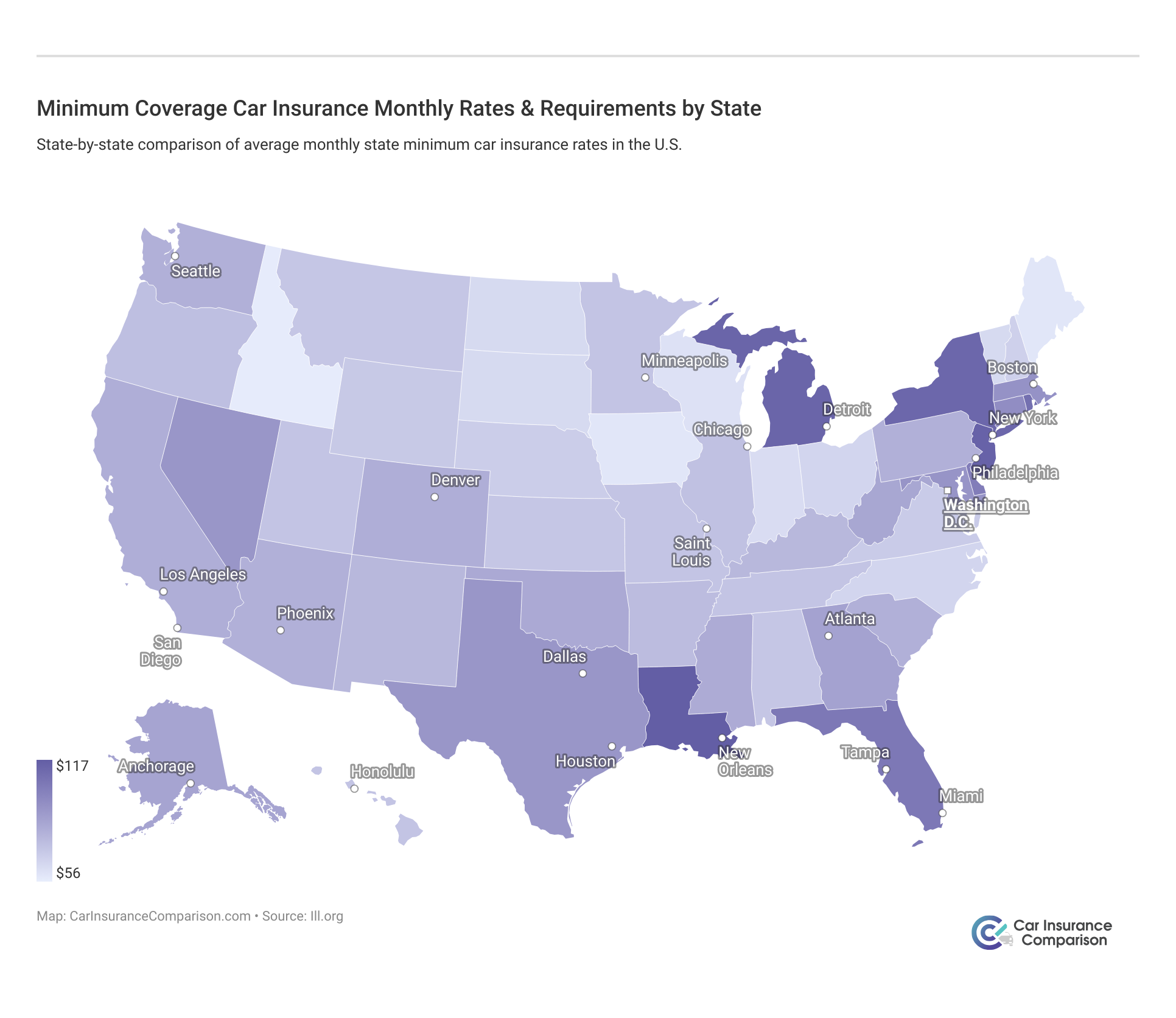

Idaho car insurance requires a minimum of 25/50/15 for bodily injury and property damage coverage. Finding affordable auto insurance in Idaho shouldn't be a headache. Idaho car insurance rates average $57 per month, but drivers can also compare cheap ID car insurance quotes to save even more.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

UPDATED: May 5, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: May 5, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

If you’re one of the over 1.68 million individuals residing in the state of Idaho, finding the right Idaho car insurance provider is essential to keep all the drivers in your family safe and secure while on the road.

A recent study found that approximately 8.2 percent of drivers in the state of Idaho are driving without insurance. If you get into an accident with one of these uninsured motorists while on the road, you need to ensure that you are protected and know exactly what your rights are under current Idaho laws.

If you’re on the fence as to why being insured really matters in the first place, this informative guide is also for you. Penalties for being caught driving uninsured range from moderate to heavy fines up to extreme consequences like license suspension and jail time for repeat offenders.

Long story short, if you live in the state of Idaho, you need auto insurance. But what are your options? What are your minimum coverage requirements? What providers offer the best Idaho car insurance rates? What driving laws govern Idaho motorists?

To start things off, compare rates in your area to save big on insurance providers and maximize your future savings. Alright, ready to learn everything you need to know about Idaho car insurance rates? Let’s dive right in.

Idaho Car Insurance Coverage and Rates

Also known as The Gem State for its rich supply of precious minerals, gold, lead, cobalt, zinc, and other natural resources, Idaho offers an endless array of beautiful views with its mixtures of farmland and mountainous regions. In terms of land mass, Idaho ranks number 11 out of all 50 states but 39th for the total population.

Outdoor recreational activities are a significant part of life for Idaho residents, with kayaking, whitewater rafting, skiing, and snowboarding being frequent seasonal pastimes. Idaho is also a hot spot for job seekers, with CNBC ranking the state number four among the top states to find a job in America.

Needless to say, business and life in Idaho are booming. So, whether you’re considering relocating to The Gem State or have lived there all your life, it’s time to get into Idaho car insurance rates so you can find the policy you need without breaking the bank. Ready? Let’s get into it!

Compare Car Insurance Rates in Idaho

Discover the varying car insurance rates across different cities in Idaho, including Boise, Coeur D’Alene, Malad City, and Pocatello. Compare and contrast to make informed decisions on securing the best coverage for your needs.

| Compare Car Insurance Rates in Your City |

|---|

| Boise, ID |

| Coeur D'Alene, ID |

| Malad City, ID |

| Pocatello, ID |

Idaho Minimum Car Insurance Coverage Requirements

| Insurance Required | Coverage |

|---|---|

| Bodily Injury Liability Coverage | $25,000 per person $50,000 per accident |

| Property Damage Liability Coverage | $15,000 per accident |

| Uninsured Motorist Coverage | Amount must equal selected bodily injury liability coverage amount |

The table above details the minimum coverage amounts required in the state of Idaho. Under Idaho Statutes section 49-1229, all vehicles registered with the state must be covered by adequate liability insurance.

The penalty for failing to carry the required coverages for first-time offenders is a $75 fine.

However, the penalty increases for a second or additional violation within the following five years, including fines up to $1,000 and/or as much as six months in jail.

In addition, under Idaho Statutes Section 41-2502, Idaho car insurance policies are required to also include uninsured motorist coverage equal to the insured’s selected bodily injury liability coverage amount. The exception would be if the policyholder waived the requirement in writing.

Drivers may opt to post an indemnity bond to meet Idaho’s financial responsibility requirements in lieu of taking out liability insurance. However, the risks of driving without auto insurance coverage for your vehicle make this an ill-advised maneuver in most scenarios.

Let’s look at your Idaho car insurance minimum liability coverage requirements closer:

- $25,000 — for bodily injury or death per person resulting from an accident you cause

- $50,000 — for total bodily injury or death liability resulting from an accident you cause

- $15,000 — to cover property damage per accident resulting from a collision you cause

These liability coverage amounts serve to take care of medical expenses, property damage costs, and other bills incurred by any drivers, pedestrians, or passengers in an accident you’re responsible for. Such expenses are covered up to and until your policy limits are exhausted.

It is wise to compare liability car insurance and find a policy above the required limits. In the event that you cause an auto accident and serious injuries ensue for the other parties involved, your personal assets could be on the line. The coverages discussed above do not cover any injuries or property damage you incur following an accident. This is where other coverage options apply, which we will discuss further down.

Remember! Idaho also requires all drivers to carry uninsured motorist coverage (unless waived in writing), equal to the insureds bodily injury liability coverage. Uninsured motorist coverage covers the cost of medical bills and property damage costs you incur when the at-fault driver in the accident does not have liability insurance.

If you’ve moved from out of the state, you may notice that your premiums for minimum coverage may have changed.

Idaho is a “fault” state, meaning the state’s car insurance laws hold the at-fault driver in an accident responsible for any losses incurred as a result of their negligent driving, such as physical injuries, property damage, lost wages, etc.

If you’re wondering if you have to report a car accident to your insurance company or police, it’s generally in your best interest to do so.

Mandatory Forms of Financial Responsibility in Idaho

Idaho drivers must always keep a valid form of financial responsibility or proof of insurance coverage in their car. Acceptable proof of insurance is the SR-22 (or certificate of insurance) document your insurance carrier issues to you when coverage commences.

If you are pulled over while out on the road or get into an accident, and you are unable to provide proof of insurance, you will be found guilty of committing an infraction for first-time offenses.

A first offense is accompanied by a one-year license suspension while another offense within the following five years is a misdemeanor incurring a three-year license suspension.

The moral of the story is — carry your proof of insurance card in your car or keep an electronic copy with you at all times, and you’ll be good to go!

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

What is the penalty for driving without insurance in Idaho?

Penalties for driving without Idaho car insurance include a fine of $75 for a 1st offense and license suspension until you show proof of financial responsibility. Subsequent convictions will result in jail time and fines up to $5,000.

- If you are driving without car insurance in the state of Idaho, you may be responsible for paying a fine

- Your license might be suspended until you can provide proof of financial responsibility

- You are required to show proof of financial responsibility following your conviction

- If you are caught driving without a license after your first offense, you will have to pay higher fines and possible imprisonment

If you are caught driving without insurance in Idaho, you may have to pay a fine and forfeit your license. The fine for a first offense is $75, but it is higher for any subsequent offenses. Your license will be suspended until you can show proof of financial responsibility.

You must maintain proof of financial responsibility for the one-year period following your conviction. If you are in a car accident while you are driving without car insurance, you may still be considered financially responsible for damage you caused.

Compare car insurance quotes today by entering your ZIP code into our free rate comparison tool above. Our tool will help you find the best car insurance in Idaho.

If you’re worried about having your car impounded for driving without insurance, in some states, that could happen.

What is the second offense penalty for driving without car insurance in Idaho?

If you are charged with driving without car insurance a second time, the penalties and fines can greatly increase. If you are convicted of a second violation within five years of the first one, you may have to pay a $5,000 fine.

Your license will be suspended until you can provide proof of financial responsibility.

You can also be punished with a six-month imprisonment sentence. You must also provide proof of insurance and financial responsibility for the next three years following your conviction. The fees for a third offense or any subsequent offenses are the same as the fees for the second offense.

Does Idaho have a mandatory car insurance requirement?

Idaho requires drivers to have insurance or another form of financial responsibility. Car insurance must protect against loss from bodily injury, physical damage, or death.

What is the minimum amount of liability insurance coverage required?

Your insurance must cover the following:

- $25,000 worth of bodily injury or death for an accident involving one person

- $50,000 worth of bodily injury or death for an accident involving two people

- $15,000 worth of physical damage and destruction

You do have the option of posting an indemnity bond with the director of the department of insurance if you do not want car insurance. The bond must ensure that any payments will be disbursed within 30 days of an accident. The indemnity bond must cover $50,000 for bodily injury and $15,000 for property damage.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

What do I do when my license is suspended?

What happens if you drive with a suspended license? If your license is suspended because you were driving without insurance, you will have to surrender it to the Department of Motor Vehicles. If you choose not to forfeit your license, the department can send an officer to collect the license and return it to the DMV.

After the suspension period is lifted, you can apply for a duplicate license if you meet all of the other requirements.

The penalty for driving without car insurance in Idaho is a fine and a suspended license. The fine for the first offense is $75, while the fine for subsequent offenses can be up to $5,000.

If you are convicted of driving without a license a second time, you may have to serve a prison sentence up to six months long.

Compare car insurance quotes today by entering your ZIP code into our free comparison tool below.

Premiums as a Percentage of Income in Idaho

As of 2017, the average per capita income for residents of Idaho was $41,826. Your personal income is the amount you keep to pay bills, spend, or save after taxes are taken out of your paycheck.

The average yearly cost of Idaho car insurance is about $700, which is just under 1.7 percent of the average per capita income for residents.

In more succinct terms, Idaho residents have approximately $3,500 a month to cover living expenses, save, etc. Your monthly car insurance bill will subtract somewhere around $58 from that amount. While that figure might seem small, it adds up over time.

By keeping at least the minimum coverage amounts on your policy required under Idaho car insurance laws and following defensive driving tips, you’ll keep your rates down and save big in the long run.

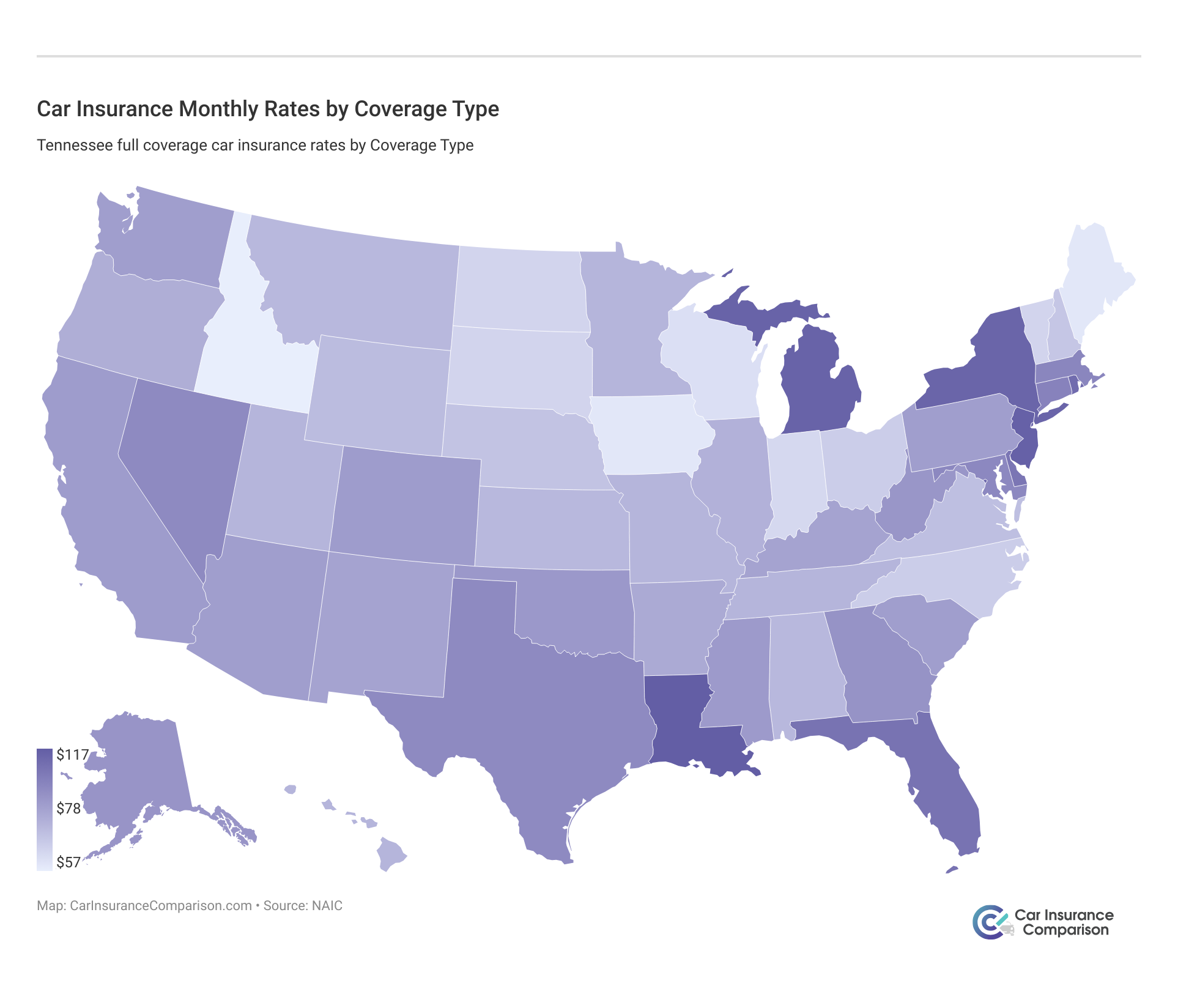

Average Monthly Car Insurance Rates in ID (Liability, Collision, Comprehensive)

| Coverage Type | Annual Cost as of 2015 |

|---|---|

| Liability | $344.29 |

| Collision | $219.05 |

| Comprehensive | $116.55 |

| Combined | $679.89 |

The table above displays data gathered from the most recent study conducted by the NAIC (National Association of Insurance Commissioners. You should expect Idaho car insurance rates to rise in the year 2019 and moving forward credits to car industry inflation.

Take a look at what people are paying on average for car insurance in Idaho, versus in the other 49 states!

Ready to jump into your additional liability coverage options? Let’s go!

Additional Liability Coverage in Idaho

| Loss Ratio | 2015 | 2014 | 2013 |

|---|---|---|---|

| Medical Payments (MedPay) | 79.94 | 73.00 | 69.52 |

| Uninsured/ Underinsured Motorist Coverage | 59.20 | 57.40 | 54.69 |

Take a look at the table above. It reveals the average loss ratio in the state of Idaho, pulled from the NAIC’s most recent data report. The loss ratio is the percentage of loss a car insurance company experiences in comparison to the premiums it earns.

So, if an Idaho car insurance company sustains a loss ratio over 100, this reveals that the carrier is actually paying out more claims than they are getting back in insured premiums. If an insurer continues to have an ongoing loss ratio that exceeds 100, that doesn’t bode well for them.

The table above reveals that Idaho car insurance companies’ average gains to losses are in a healthy range for MedPay coverage.

Remember when we talked about how uninsured motorist coverage is mandatory in Idaho (unless you waive it from your policy in writing)?

Well, the data above shows that car insurance companies might want to consider lowering their uninsured/underinsured motorist coverage premiums because only about 50 percent are being used to pay claims. Currently, Idaho ranks number 40 in the country for uninsured drivers.

The NAIC’s report did not identify personal injury protection (PIP) insurance loss ratios for Idaho car insurance companies from the last few years.

Check out their 2018 Auto Insurance Database Report for additional details. In the state of Idaho, coverage add-ons like PIP, MedPay, and collision coverage are optional. However, that does not mean they are any less critical or should be left off your policy.

Add-ons, Endorsements, and Riders

In addition to coverage options like MedPay and PIP, there are more add-ons you might want to consider including in your Idaho car insurance policy. Let’s take a look!

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-as-You-Go insurance

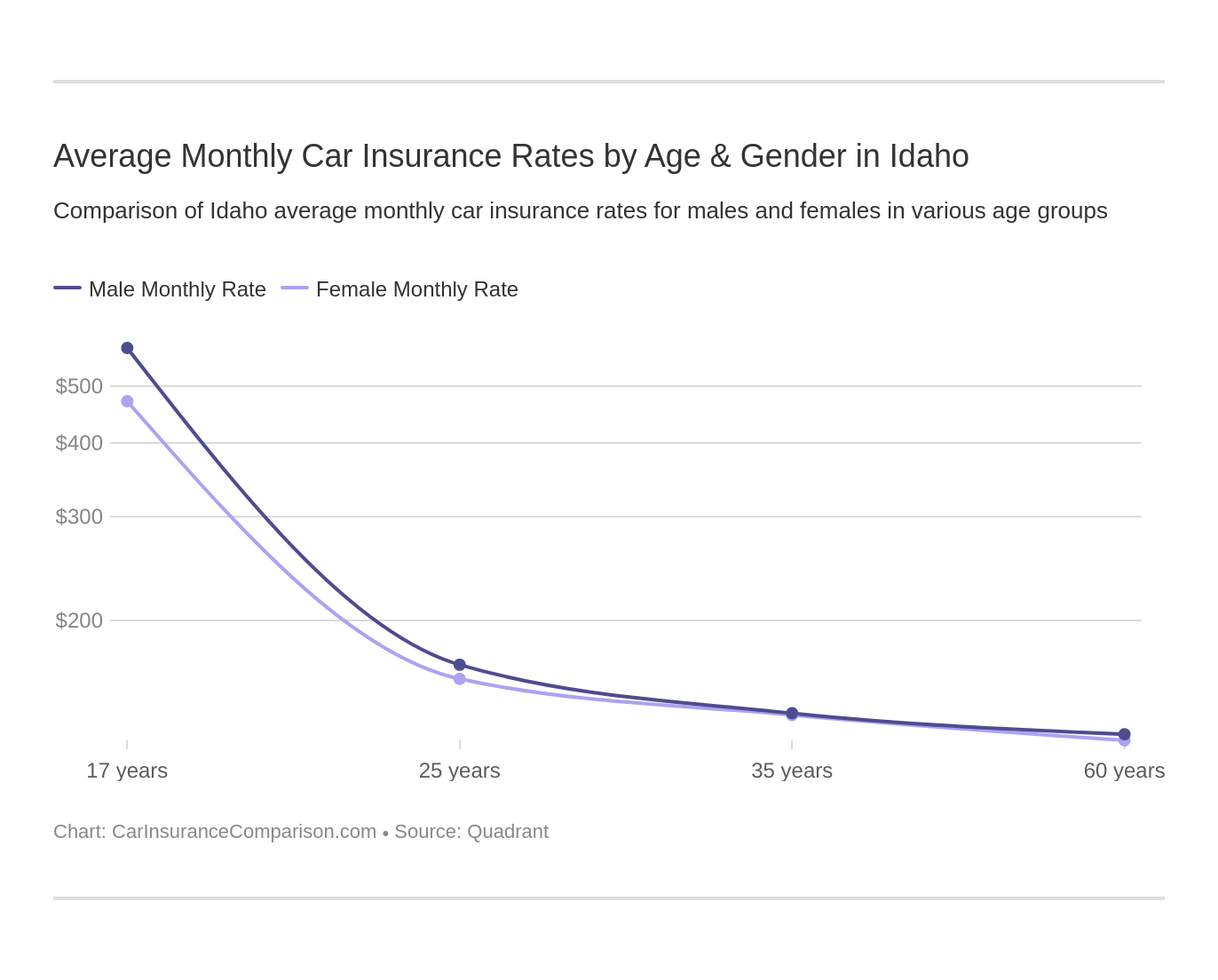

Average Monthly Idaho Car Insurance Rates by Age & Gender

The two tables below include data from top Idaho car insurance companies, revealing whether or not age and gender actually make a difference in the rates insureds are charged. As a rule of thumb, men are usually charged higher annual rates than women because they are seen as higher-risk drivers needing high-risk car insurance.

But, what did we discover about Idaho rates for men and women in the course of our research?

Let’s take a look!

Demographic and Insurance Carrier

| Company | Married 35-year old female Annual Rates | Married 35-year old male Annual Rates | Married 60-year old female Annual Rates | Married 60-year old male Annual Rates | Single 17-year old female Annual Rates | Single 17-year old male Annual Rates | Single 25-year old female Annual Rates | Single 25-year old male Annual Rates |

|---|---|---|---|---|---|---|---|---|

| Allstate F&C | $2,345.01 | $2,332.52 | $2,040.06 | $2,114.91 | $8,575.44 | $9,910.14 | $2,620.54 | $2,771.46 |

| American Family Mutual | $2,098.66 | $2,098.66 | $1,865.53 | $1,865.53 | $7,458.86 | $9,709.85 | $2,098.66 | $2,634.55 |

| Farmers Ins Co Of ID | $1,579.86 | $1,568.87 | $1,394.21 | $1,475.19 | $7,662.21 | $7,928.27 | $1,819.86 | $1,917.77 |

| Geico General | $2,003.54 | $1,977.85 | $1,905.97 | $1,851.21 | $4,285.41 | $5,332.81 | $2,715.75 | $2,092.87 |

| Safeco Ins Co of IL | $1,441.66 | $1,555.14 | $1,167.08 | $1,303.18 | $4,638.27 | $5,157.45 | $1,530.65 | $1,618.67 |

| Depositors Insurance | $1,856.77 | $1,901.41 | $1,674.47 | $1,778.32 | $4,550.02 | $5,610.65 | $2,171.95 | $2,339.94 |

| State Farm Mutual Auto | $1,150.90 | $1,150.90 | $1,037.46 | $1,037.46 | $3,436.89 | $4,333.19 | $1,298.56 | $1,498.32 |

| Travelers Home & Marine Ins Co | $1,355.74 | $1,376.87 | $1,363.72 | $1,357.36 | $6,688.71 | $10,577.29 | $1,440.61 | $1,650.04 |

| USAA | $1,099.98 | $1,098.36 | $1,073.73 | $1,059.32 | $3,611.65 | $4,046.57 | $1,458.58 | $1,572.68 |

As you can see from the table above, there are exceptions to the rule of thumb that insurance carriers charge men higher annual rates. Take a look at Allstate, for instance. Although the margin is small, they actually charge 35-year-old females about $13 more in annual premiums than 35-year-old males!

Along the same lines, while Allstate’s rates for 60-year-old males are slightly higher than for 60-year-old females, the price difference is only about $74. However, the disparity in annual rates between 17-year-old male and 17-year-old female drivers is over $1,300!

If you look at the teen driver annual rates for each company listed above, you will see that they are significantly higher for both male and female drivers than any other age group. Furthermore, car insurance is higher for teenage boys than teenage girls, usually.

It is also interesting to note, that both American Family and State Farm charge 35-year-old and 60-year-old drivers the exact same annual rates, regardless of whether the individual is male or female.Rank by Demographic and Insurance Carrier

| Company | Demographic | Average Annual Rate | Rank |

|---|---|---|---|

| Travelers Home & Marine Ins Co | Single 17-year old male | $10,577.29 | 1 |

| Allstate F&C | Single 17-year old male | $9,910.14 | 2 |

| American Family Mutual | Single 17-year old male | $9,709.85 | 3 |

| Allstate F&C | Single 17-year old female | $8,575.44 | 4 |

| Farmers Ins Co Of ID | Single 17-year old male | $7,928.27 | 5 |

| Farmers Ins Co Of ID | Single 17-year old female | $7,662.21 | 6 |

| American Family Mutual | Single 17-year old female | $7,458.86 | 7 |

| Travelers Home & Marine Ins Co | Single 17-year old female | $6,688.71 | 8 |

| Depositors Insurance | Single 17-year old male | $5,610.65 | 9 |

| Geico General | Single 17-year old male | $5,332.81 | 10 |

| Safeco Ins Co of IL | Single 17-year old male | $5,157.45 | 11 |

| Safeco Ins Co of IL | Single 17-year old female | $4,638.27 | 12 |

| Depositors Insurance | Single 17-year old female | $4,550.02 | 13 |

| State Farm Mutual Auto | Single 17-year old male | $4,333.19 | 14 |

| Geico General | Single 17-year old female | $4,285.41 | 15 |

| USAA | Single 17-year old male | $4,046.57 | 16 |

| USAA | Single 17-year old female | $3,611.65 | 17 |

| State Farm Mutual Auto | Single 17-year old female | $3,436.89 | 18 |

| Allstate F&C | Single 25-year old male | $2,771.46 | 19 |

| Geico General | Single 25-year old female | $2,715.75 | 20 |

| American Family Mutual | Single 25-year old male | $2,634.55 | 21 |

| Allstate F&C | Single 25-year old female | $2,620.54 | 22 |

Now, the table above lists out Idaho car insurance companies’ annual rates according to the age demographic by rank from most to least expensive.

As you can see, Travelers charges the highest annual rates across the board for teen male drivers. In fact, they charge 17-year-old male drivers approximately $6,500 more than the carrier with the least expensive male teen driver rates, USAA.

For more information, read our Travelers car insurance review.

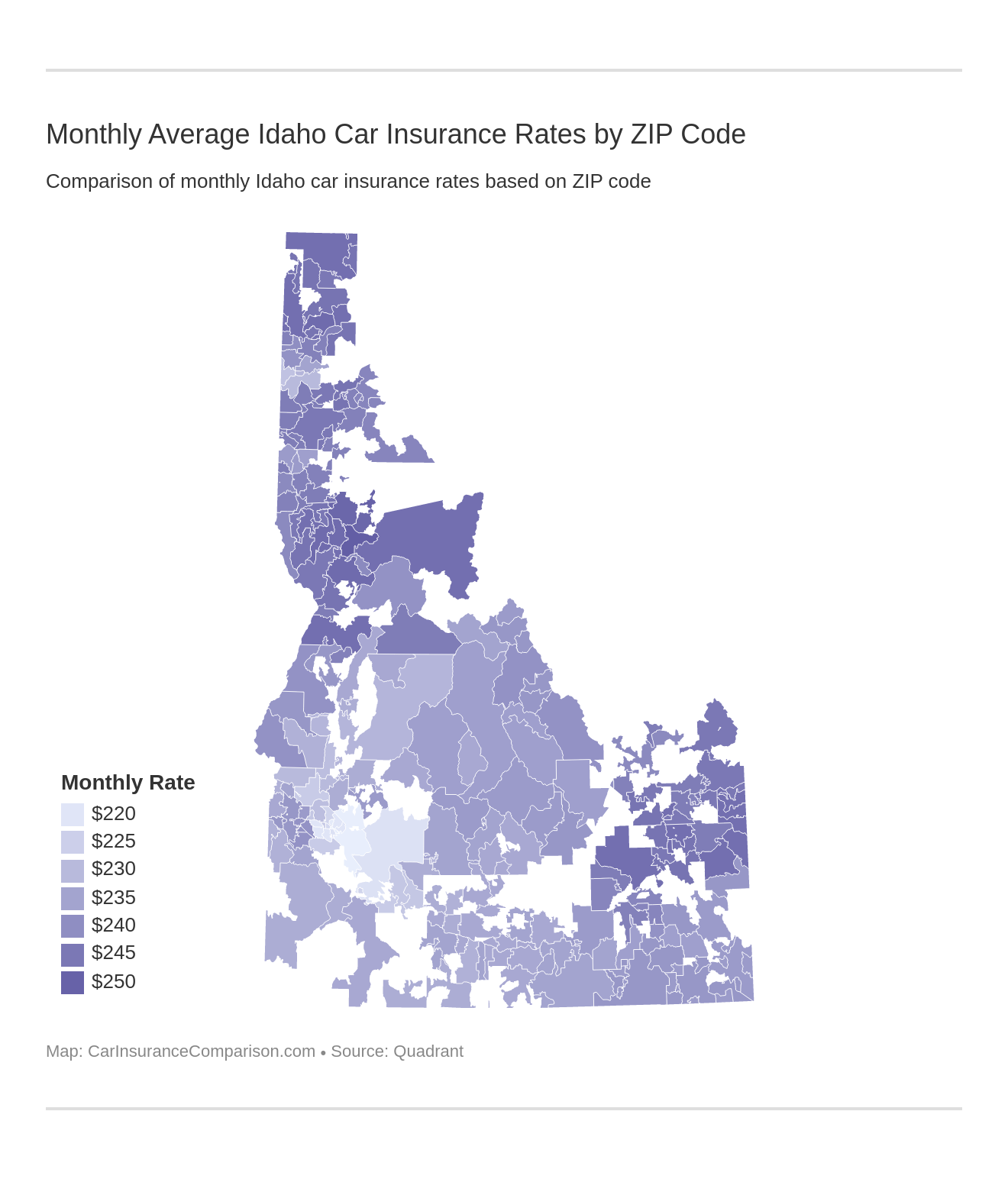

Highest and Lowest Rates in Idaho by ZIP Code

Did you know that where you live can directly impact your insurance rates? Take a look;

The table below lists the highest and lowest Idaho car insurance rates by ZIP code. Keep an eye on the average annual rates listed to see how they change based on your address. Use the search bar below to find your ZIP code!| Zipcode | Average Annual Rates | Allstate F&C Annual Rates | American Family Mutual Annual Rates | Farmers Ins Co Of ID Annual Rates | Geico General Annual Rates | Safeco Ins Co of ID Annual Rates | Depositors Insurance Annual Rates | State Farm Mutual Auto Annual Rates | Travelers Home & Marine Ins Co Annual Rates | USAA Annual Rates |

|---|---|---|---|---|---|---|---|---|---|---|

| 83536 | $3,008.28 | $4,691.81 | $3,695.28 | $3,306.96 | $2,777.53 | $2,466.87 | $2,804.12 | $1,989.82 | $3,344.06 | $1,998.09 |

| 83546 | $2,999.62 | $4,631.61 | $3,695.28 | $3,306.96 | $2,777.53 | $2,432.86 | $2,872.16 | $2,000.81 | $3,281.24 | $1,998.09 |

| 83531 | $2,994.12 | $4,600.50 | $3,695.28 | $3,306.96 | $2,777.53 | $2,338.96 | $2,872.16 | $1,921.71 | $3,435.94 | $1,998.09 |

| 83544 | $2,991.37 | $4,540.30 | $3,695.28 | $3,306.96 | $2,777.53 | $2,432.86 | $2,872.16 | $2,017.88 | $3,281.24 | $1,998.09 |

| 83520 | $2,988.00 | $4,691.81 | $3,695.28 | $3,306.96 | $2,777.53 | $2,466.87 | $2,872.16 | $1,921.71 | $3,161.57 | $1,998.09 |

| 83553 | $2,987.99 | $4,540.30 | $3,695.28 | $3,306.96 | $2,777.53 | $2,432.86 | $2,872.16 | $2,003.38 | $3,265.37 | $1,998.09 |

| 83523 | $2,980.70 | $4,691.81 | $3,695.28 | $3,306.96 | $2,777.53 | $2,466.87 | $2,804.12 | $1,924.06 | $3,161.57 | $1,998.09 |

| 83543 | $2,975.21 | $4,600.50 | $3,695.28 | $3,306.96 | $2,777.53 | $2,466.87 | $2,804.12 | $1,965.99 | $3,161.57 | $1,998.09 |

| 83860 | $2,974.33 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,427.69 | $2,776.38 | $1,949.95 | $3,566.74 | $2,028.83 |

| 83530 | $2,973.80 | $4,600.50 | $3,695.28 | $3,306.96 | $2,777.53 | $2,252.15 | $2,872.16 | $1,825.55 | $3,435.94 | $1,998.09 |

| 83526 | $2,973.54 | $4,691.81 | $3,695.28 | $3,306.96 | $2,777.53 | $2,252.15 | $2,872.16 | $1,921.71 | $3,246.18 | $1,998.09 |

| 83449 | $2,968.69 | $4,339.03 | $3,935.85 | $3,231.61 | $2,777.53 | $2,404.62 | $2,712.31 | $2,023.09 | $3,349.33 | $1,944.86 |

| 83434 | $2,968.23 | $4,265.28 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,926.80 | $1,916.45 | $3,457.46 | $1,944.86 |

| 83826 | $2,967.64 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,480.69 | $2,802.25 | $1,921.71 | $3,455.88 | $2,028.83 |

| 83853 | $2,967.64 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,480.69 | $2,802.25 | $1,921.71 | $3,455.88 | $2,028.83 |

| 83404 | $2,967.30 | $4,279.29 | $3,935.85 | $3,319.49 | $2,841.52 | $2,404.62 | $2,803.64 | $1,939.56 | $3,236.84 | $1,944.86 |

| 83524 | $2,965.83 | $4,691.81 | $3,552.57 | $3,306.96 | $2,777.53 | $2,466.87 | $2,804.12 | $1,863.47 | $3,374.98 | $1,854.19 |

| 83809 | $2,964.55 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,427.69 | $2,776.38 | $1,974.64 | $3,453.94 | $2,028.83 |

| 83548 | $2,964.45 | $4,691.81 | $3,695.28 | $3,306.96 | $2,777.53 | $2,466.87 | $2,804.12 | $1,921.71 | $3,161.57 | $1,854.19 |

| 83865 | $2,964.42 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,427.69 | $2,802.25 | $1,921.71 | $3,479.87 | $2,028.83 |

| 83805 | $2,964.11 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,480.69 | $2,802.25 | $1,889.90 | $3,455.88 | $2,028.83 |

| 83455 | $2,963.74 | $4,339.03 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,876.70 | $2,102.03 | $3,262.32 | $1,890.34 |

| 83428 | $2,963.46 | $4,339.03 | $3,935.85 | $3,231.61 | $2,777.53 | $2,404.62 | $2,712.31 | $2,016.77 | $3,382.90 | $1,870.51 |

| 83539 | $2,963.26 | $4,631.61 | $3,695.28 | $3,306.96 | $2,777.53 | $2,252.15 | $2,872.16 | $1,892.81 | $3,242.75 | $1,998.09 |

| 83856 | $2,961.57 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,427.69 | $2,802.25 | $1,953.39 | $3,422.54 | $2,028.83 |

| 83422 | $2,960.74 | $4,339.03 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,876.70 | $2,075.08 | $3,262.32 | $1,890.34 |

| 83836 | $2,960.60 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,480.69 | $2,802.25 | $1,948.96 | $3,365.22 | $2,028.83 |

| 83822 | $2,959.92 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,427.69 | $2,802.25 | $1,953.39 | $3,407.67 | $2,028.83 |

| 83549 | $2,959.83 | $4,540.30 | $3,695.28 | $3,306.96 | $2,777.53 | $2,252.15 | $2,872.16 | $1,959.63 | $3,236.40 | $1,998.09 |

| 83401 | $2,959.48 | $4,181.57 | $3,935.85 | $3,319.49 | $2,841.52 | $2,404.62 | $2,712.31 | $2,023.03 | $3,272.09 | $1,944.86 |

| 83452 | $2,959.41 | $4,339.03 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,876.70 | $2,063.11 | $3,262.32 | $1,890.34 |

| 83533 | $2,959.06 | $4,691.81 | $3,695.28 | $3,306.96 | $2,777.53 | $2,252.15 | $2,872.16 | $1,921.71 | $3,115.83 | $1,998.09 |

| 83221 | $2,958.18 | $4,201.19 | $3,935.85 | $3,231.61 | $2,841.52 | $2,452.43 | $2,762.33 | $2,105.49 | $3,148.31 | $1,944.86 |

| 83845 | $2,957.53 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,480.69 | $2,802.25 | $1,895.95 | $3,390.67 | $2,028.83 |

| 83554 | $2,956.33 | $4,540.30 | $3,695.28 | $3,306.96 | $2,777.53 | $2,252.15 | $2,872.16 | $1,921.71 | $3,242.78 | $1,998.09 |

| 83821 | $2,956.28 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,480.69 | $2,802.25 | $1,898.85 | $3,376.45 | $2,028.83 |

| 83444 | $2,955.14 | $4,153.76 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,926.80 | $1,962.74 | $3,404.85 | $1,944.86 |

| 83848 | $2,953.98 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,480.69 | $2,802.25 | $1,921.71 | $3,332.93 | $2,028.83 |

| 83811 | $2,953.78 | $4,076.47 | $3,668.25 | $3,306.96 | $2,985.98 | $2,480.69 | $2,776.38 | $1,959.78 | $3,300.64 | $2,028.83 |

| 83864 | $2,953.66 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,323.02 | $2,802.25 | $1,929.51 | $3,479.87 | $2,028.83 |

| 83218 | $2,953.40 | $4,224.74 | $3,935.85 | $3,231.61 | $2,841.52 | $2,452.43 | $2,762.33 | $2,016.77 | $3,248.63 | $1,866.71 |

| 83402 | $2,952.67 | $4,213.93 | $3,935.85 | $3,319.49 | $2,841.52 | $2,395.81 | $2,803.64 | $1,937.78 | $3,181.16 | $1,944.86 |

| 83450 | $2,951.80 | $4,185.79 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,926.80 | $1,937.02 | $3,368.48 | $1,944.86 |

| 83840 | $2,951.68 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,427.69 | $2,802.25 | $1,921.71 | $3,365.22 | $2,028.83 |

| 83841 | $2,951.68 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,427.69 | $2,802.25 | $1,921.71 | $3,365.22 | $2,028.83 |

| 83541 | $2,950.11 | $4,691.81 | $3,552.57 | $3,306.96 | $2,777.53 | $2,466.87 | $2,804.12 | $1,935.36 | $3,161.57 | $1,854.19 |

| 83555 | $2,949.99 | $4,691.81 | $3,695.28 | $3,306.96 | $2,777.53 | $2,225.41 | $2,804.12 | $1,900.98 | $3,149.76 | $1,998.09 |

| 83850 | $2,949.04 | $3,941.82 | $3,668.25 | $3,306.96 | $2,985.98 | $2,478.28 | $2,776.38 | $2,012.25 | $3,342.64 | $2,028.83 |

| 83813 | $2,948.73 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,427.69 | $2,776.38 | $1,983.50 | $3,302.74 | $2,028.83 |

| 83406 | $2,948.71 | $4,234.50 | $3,935.85 | $3,319.49 | $2,841.52 | $2,404.62 | $2,712.31 | $2,004.26 | $3,141.01 | $1,944.86 |

| 83852 | $2,947.82 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,427.69 | $2,802.25 | $1,919.29 | $3,332.93 | $2,028.83 |

| 83236 | $2,946.32 | $4,192.99 | $3,935.85 | $3,231.61 | $2,777.53 | $2,452.43 | $2,762.33 | $2,008.19 | $3,211.14 | $1,944.86 |

| 83839 | $2,946.09 | $3,941.82 | $3,668.25 | $3,306.96 | $2,985.98 | $2,478.28 | $2,776.38 | $1,985.71 | $3,342.64 | $2,028.83 |

| 83522 | $2,945.39 | $4,600.50 | $3,695.28 | $3,306.96 | $2,777.53 | $2,252.15 | $2,872.16 | $1,889.98 | $3,115.83 | $1,998.09 |

| 83427 | $2,945.31 | $4,279.29 | $3,935.85 | $3,231.61 | $2,841.52 | $2,404.62 | $2,712.31 | $2,016.77 | $3,141.01 | $1,944.86 |

| 83847 | $2,945.23 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,427.69 | $2,802.25 | $1,895.95 | $3,332.93 | $2,028.83 |

| 83425 | $2,944.13 | $4,305.88 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,926.80 | $1,900.69 | $3,215.70 | $1,944.86 |

| 83274 | $2,942.05 | $4,192.99 | $3,935.85 | $3,231.61 | $2,841.52 | $2,452.43 | $2,762.33 | $1,937.52 | $3,179.32 | $1,944.86 |

| 83424 | $2,941.37 | $4,339.03 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,876.70 | $1,900.69 | $3,262.32 | $1,890.34 |

| 83540 | $2,940.84 | $4,691.81 | $3,552.57 | $3,306.96 | $2,777.53 | $2,225.41 | $2,804.12 | $1,859.37 | $3,395.55 | $1,854.19 |

| 83861 | $2,940.69 | $3,941.82 | $3,668.25 | $3,306.96 | $2,985.98 | $2,432.86 | $2,776.38 | $1,965.80 | $3,359.32 | $2,028.83 |

| 83545 | $2,938.99 | $4,691.81 | $3,552.57 | $3,306.96 | $2,777.53 | $2,466.87 | $2,804.12 | $1,832.79 | $3,164.06 | $1,854.19 |

| 83431 | $2,938.11 | $4,270.46 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,926.80 | $1,947.35 | $3,150.27 | $1,944.86 |

| 83420 | $2,937.21 | $4,265.28 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,926.80 | $1,915.05 | $3,234.18 | $1,890.34 |

| 83866 | $2,937.09 | $3,941.82 | $3,668.25 | $3,306.96 | $2,985.98 | $2,432.86 | $2,776.38 | $1,933.37 | $3,359.32 | $2,028.83 |

| 83810 | $2,936.68 | $3,941.82 | $3,668.25 | $3,306.96 | $2,985.98 | $2,478.28 | $2,776.38 | $1,964.36 | $3,279.25 | $2,028.83 |

| 83429 | $2,936.38 | $4,265.28 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,926.80 | $1,932.41 | $3,209.35 | $1,890.34 |

| 83451 | $2,936.22 | $4,265.28 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,926.80 | $1,838.44 | $3,301.86 | $1,890.34 |

| 83442 | $2,935.59 | $4,270.46 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,926.80 | $1,956.08 | $3,118.91 | $1,944.86 |

| 83436 | $2,934.77 | $4,265.28 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,926.80 | $1,900.69 | $3,226.58 | $1,890.34 |

| 83542 | $2,933.61 | $4,540.30 | $3,695.28 | $3,306.96 | $2,777.53 | $2,252.15 | $2,872.16 | $1,921.71 | $3,038.34 | $1,998.09 |

| 83833 | $2,932.09 | $3,941.82 | $3,668.25 | $3,306.96 | $2,985.98 | $2,478.28 | $2,776.38 | $1,931.25 | $3,271.08 | $2,028.83 |

| 83842 | $2,931.94 | $3,941.82 | $3,668.25 | $3,306.96 | $2,985.98 | $2,478.28 | $2,776.38 | $1,921.71 | $3,279.25 | $2,028.83 |

| 83824 | $2,931.84 | $3,897.43 | $3,668.25 | $3,306.96 | $2,985.98 | $2,432.86 | $2,776.38 | $1,921.71 | $3,368.17 | $2,028.83 |

| 83262 | $2,931.35 | $4,050.30 | $3,935.85 | $3,231.61 | $2,777.53 | $2,452.43 | $2,762.33 | $2,098.97 | $3,128.26 | $1,944.86 |

| 83537 | $2,929.55 | $4,691.81 | $3,552.57 | $3,306.96 | $2,777.53 | $2,214.33 | $2,804.12 | $1,896.98 | $3,267.47 | $1,854.19 |

| 83445 | $2,929.41 | $4,265.28 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,926.80 | $1,832.34 | $3,246.69 | $1,890.34 |

| 83421 | $2,928.50 | $4,265.28 | $3,695.28 | $3,231.61 | $2,777.53 | $2,434.83 | $2,926.80 | $1,900.69 | $3,234.18 | $1,890.34 |

| 83215 | $2,928.21 | $4,201.19 | $3,935.85 | $3,028.45 | $2,841.52 | $2,452.43 | $2,762.33 | $2,016.77 | $3,248.63 | $1,866.71 |

| 83446 | $2,927.88 | $4,305.88 | $3,695.28 | $3,231.61 | $2,777.53 | $2,434.83 | $2,926.80 | $1,900.69 | $3,211.60 | $1,866.71 |

| 83851 | $2,927.88 | $3,941.82 | $3,668.25 | $3,306.96 | $2,985.98 | $2,432.86 | $2,776.38 | $1,938.71 | $3,271.08 | $2,028.83 |

| 83440 | $2,926.93 | $4,265.28 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,926.80 | $1,830.10 | $3,226.58 | $1,890.34 |

| 83671 | $2,926.88 | $4,540.30 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,872.16 | $1,921.71 | $3,242.78 | $1,998.09 |

| 83870 | $2,926.80 | $3,897.43 | $3,668.25 | $3,306.96 | $2,985.98 | $2,432.86 | $2,776.38 | $1,885.23 | $3,359.32 | $2,028.83 |

| 83433 | $2,925.74 | $4,265.28 | $3,695.28 | $3,231.61 | $2,777.53 | $2,434.83 | $2,926.80 | $1,900.69 | $3,209.35 | $1,890.34 |

| 83872 | $2,925.52 | $4,600.50 | $3,552.57 | $3,306.96 | $2,777.53 | $2,214.33 | $2,673.74 | $1,849.83 | $3,406.89 | $1,947.30 |

| 83876 | $2,923.27 | $3,941.82 | $3,668.25 | $3,306.96 | $2,892.45 | $2,478.28 | $2,776.38 | $1,945.43 | $3,271.08 | $2,028.83 |

| 83535 | $2,922.35 | $4,691.81 | $3,552.57 | $3,306.96 | $2,777.53 | $2,214.33 | $2,673.74 | $1,884.61 | $3,345.44 | $1,854.19 |

| 83443 | $2,922.33 | $4,270.46 | $3,695.28 | $3,231.61 | $2,777.53 | $2,434.83 | $2,926.80 | $1,900.69 | $3,118.91 | $1,944.86 |

| 83832 | $2,921.33 | $4,691.81 | $3,552.57 | $3,306.96 | $2,777.53 | $2,214.33 | $2,673.74 | $1,860.24 | $3,267.47 | $1,947.30 |

| 83812 | $2,919.68 | $3,988.75 | $3,668.25 | $3,306.96 | $2,985.98 | $2,432.86 | $2,776.38 | $1,921.71 | $3,167.40 | $2,028.83 |

| 83803 | $2,919.27 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,224.27 | $2,705.06 | $1,966.22 | $3,329.59 | $2,028.83 |

| 83871 | $2,918.98 | $4,600.50 | $3,552.57 | $3,306.96 | $2,777.53 | $2,214.33 | $2,673.74 | $1,842.99 | $3,354.93 | $1,947.30 |

| 83460 | $2,918.87 | $4,265.28 | $3,695.28 | $3,231.61 | $2,777.53 | $2,434.83 | $2,876.70 | $1,817.18 | $3,226.58 | $1,944.86 |

| 83448 | $2,918.32 | $4,265.28 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,876.70 | $1,802.78 | $3,226.58 | $1,890.34 |

| 83868 | $2,918.02 | $3,897.43 | $3,668.25 | $3,306.96 | $2,985.98 | $2,263.18 | $2,776.38 | $1,992.56 | $3,342.64 | $2,028.83 |

| 83806 | $2,917.85 | $4,600.50 | $3,552.57 | $3,306.96 | $2,777.53 | $2,214.33 | $2,673.74 | $1,832.79 | $3,354.93 | $1,947.30 |

| 83827 | $2,917.63 | $3,988.75 | $3,695.28 | $3,306.96 | $2,777.53 | $2,432.86 | $2,872.16 | $1,921.71 | $3,265.37 | $1,998.09 |

| 83830 | $2,917.14 | $4,033.13 | $3,668.25 | $3,306.96 | $2,985.98 | $2,263.18 | $2,776.38 | $1,921.71 | $3,269.84 | $2,028.83 |

| 83438 | $2,917.01 | $4,265.28 | $3,695.28 | $3,231.61 | $2,777.53 | $2,338.96 | $2,926.80 | $1,900.69 | $3,226.58 | $1,890.34 |

| 83837 | $2,916.87 | $3,897.43 | $3,668.25 | $3,306.96 | $2,985.98 | $2,263.18 | $2,776.38 | $1,973.04 | $3,351.76 | $2,028.83 |

| 83204 | $2,916.73 | $3,950.56 | $3,935.85 | $3,220.36 | $2,827.17 | $2,452.43 | $2,783.09 | $2,094.87 | $3,115.76 | $1,870.51 |

| 83547 | $2,916.57 | $4,540.30 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,872.16 | $1,921.71 | $3,150.00 | $1,998.09 |

| 83808 | $2,914.35 | $3,897.43 | $3,668.25 | $3,306.96 | $2,985.98 | $2,263.18 | $2,776.38 | $1,950.38 | $3,351.76 | $2,028.83 |

| 83801 | $2,911.64 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,224.27 | $2,776.38 | $1,971.85 | $3,184.02 | $2,028.83 |

| 83823 | $2,911.17 | $4,600.50 | $3,552.57 | $3,306.96 | $2,777.53 | $2,214.33 | $2,673.74 | $1,865.74 | $3,354.93 | $1,854.19 |

| 83804 | $2,911.12 | $3,923.58 | $3,668.25 | $3,306.96 | $2,985.98 | $2,427.69 | $2,802.25 | $1,954.48 | $3,102.03 | $2,028.83 |

| 83867 | $2,910.15 | $3,897.43 | $3,668.25 | $3,306.96 | $2,985.98 | $2,263.18 | $2,776.38 | $1,921.71 | $3,342.64 | $2,028.83 |

| 83435 | $2,910.08 | $3,999.42 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,926.80 | $1,900.69 | $3,215.70 | $1,944.86 |

| 83849 | $2,909.77 | $3,897.43 | $3,668.25 | $3,306.96 | $2,985.98 | $2,263.18 | $2,776.38 | $1,918.28 | $3,342.64 | $2,028.83 |

| 83844 | $2,909.41 | $4,600.50 | $3,552.57 | $3,306.96 | $2,777.53 | $2,214.33 | $2,673.74 | $1,832.79 | $3,278.99 | $1,947.30 |

| 83201 | $2,908.65 | $3,950.56 | $3,935.85 | $3,220.36 | $2,827.17 | $2,404.62 | $2,783.09 | $2,072.13 | $3,113.54 | $1,870.51 |

| 83802 | $2,907.88 | $3,897.43 | $3,668.25 | $3,306.96 | $2,985.98 | $2,263.18 | $2,776.38 | $1,921.71 | $3,322.24 | $2,028.83 |

| 83202 | $2,902.87 | $4,008.90 | $3,935.85 | $3,220.36 | $2,827.17 | $2,404.62 | $2,783.09 | $2,034.83 | $3,040.47 | $1,870.51 |

| 83873 | $2,902.47 | $3,897.43 | $3,668.25 | $3,306.96 | $2,985.98 | $2,263.18 | $2,776.38 | $1,854.26 | $3,340.98 | $2,028.83 |

| 83210 | $2,902.40 | $4,037.34 | $3,935.85 | $3,028.45 | $2,777.53 | $2,452.43 | $2,762.33 | $1,995.38 | $3,187.48 | $1,944.86 |

| 83846 | $2,901.21 | $3,897.43 | $3,668.25 | $3,306.96 | $2,985.98 | $2,263.18 | $2,776.38 | $1,861.68 | $3,322.24 | $2,028.83 |

| 83245 | $2,900.20 | $3,992.53 | $3,935.85 | $3,231.61 | $2,827.17 | $2,452.43 | $2,631.16 | $2,033.19 | $3,127.33 | $1,870.51 |

| 83209 | $2,897.71 | $3,950.56 | $3,935.85 | $3,220.36 | $2,827.17 | $2,452.43 | $2,631.16 | $2,075.63 | $3,115.76 | $1,870.51 |

| 83423 | $2,897.09 | $3,999.42 | $3,695.28 | $3,231.61 | $2,777.53 | $2,434.83 | $2,926.80 | $1,941.79 | $3,199.88 | $1,866.71 |

| 83277 | $2,895.19 | $4,037.34 | $3,935.85 | $3,028.45 | $2,777.53 | $2,452.43 | $2,762.33 | $2,016.77 | $3,179.32 | $1,866.71 |

| 83843 | $2,891.59 | $4,600.50 | $3,552.57 | $3,306.96 | $2,596.54 | $2,214.33 | $2,673.74 | $1,853.42 | $3,278.99 | $1,947.30 |

| 83501 | $2,890.80 | $4,691.81 | $3,552.57 | $3,208.69 | $2,596.54 | $2,225.41 | $2,804.12 | $1,846.78 | $3,237.05 | $1,854.19 |

| 83552 | $2,888.02 | $3,954.45 | $3,695.28 | $3,306.96 | $2,777.53 | $2,252.15 | $2,872.16 | $1,892.81 | $3,242.78 | $1,998.09 |

| 83869 | $2,875.40 | $3,923.58 | $3,668.25 | $3,306.96 | $2,985.98 | $2,224.27 | $2,705.06 | $1,933.66 | $3,102.03 | $2,028.83 |

| 83687 | $2,871.66 | $3,973.77 | $4,166.07 | $3,203.06 | $2,499.48 | $2,267.71 | $2,801.06 | $1,909.39 | $3,297.43 | $1,726.98 |

| 83626 | $2,871.31 | $4,004.21 | $4,166.07 | $3,041.94 | $2,515.57 | $2,338.96 | $2,805.89 | $1,859.31 | $3,382.91 | $1,726.98 |

| 83686 | $2,871.09 | $3,973.77 | $4,166.07 | $3,203.06 | $2,499.48 | $2,381.57 | $2,717.98 | $1,908.45 | $3,262.45 | $1,726.98 |

| 83858 | $2,869.16 | $3,819.53 | $3,668.25 | $3,306.96 | $2,985.98 | $2,224.27 | $2,705.06 | $1,926.26 | $3,157.25 | $2,028.83 |

| 83612 | $2,868.51 | $4,540.30 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,746.31 | $1,808.07 | $3,088.31 | $1,866.71 |

| 83525 | $2,867.22 | $3,863.12 | $3,695.28 | $3,306.96 | $2,777.53 | $2,252.15 | $2,872.16 | $1,894.73 | $3,144.95 | $1,998.09 |

| 83250 | $2,865.42 | $3,992.53 | $3,695.28 | $3,231.61 | $2,827.17 | $2,452.43 | $2,631.16 | $1,964.55 | $3,127.33 | $1,866.71 |

| 83651 | $2,864.29 | $3,973.77 | $4,166.07 | $3,185.49 | $2,499.48 | $2,269.58 | $2,801.06 | $1,991.41 | $3,164.82 | $1,726.98 |

| 83672 | $2,864.12 | $4,637.51 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,746.31 | $1,705.50 | $3,054.16 | $1,866.71 |

| 83464 | $2,863.70 | $4,202.95 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,814.70 | $1,961.37 | $3,160.69 | $1,866.71 |

| 83605 | $2,863.42 | $3,937.96 | $4,166.07 | $3,014.28 | $2,499.48 | $2,345.70 | $2,838.90 | $1,965.27 | $3,276.10 | $1,726.98 |

| 83467 | $2,862.84 | $4,202.95 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,814.70 | $1,940.19 | $3,174.07 | $1,866.71 |

| 83286 | $2,859.35 | $4,116.21 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,788.99 | $3,364.85 | $1,866.71 |

| 83610 | $2,859.27 | $4,540.30 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,746.31 | $1,814.28 | $2,998.91 | $1,866.71 |

| 83462 | $2,859.10 | $4,202.95 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,814.70 | $1,919.91 | $3,160.69 | $1,866.71 |

| 83468 | $2,858.98 | $4,202.95 | $3,695.28 | $3,041.94 | $2,777.53 | $2,338.96 | $2,814.70 | $1,900.69 | $3,092.11 | $1,866.71 |

| 83654 | $2,858.61 | $4,540.30 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,746.31 | $1,828.16 | $2,979.06 | $1,866.71 |

| 83233 | $2,858.15 | $4,071.41 | $3,695.28 | $3,231.61 | $2,777.53 | $2,338.96 | $2,631.16 | $1,745.81 | $3,364.85 | $1,866.71 |

| 83213 | $2,857.29 | $4,201.19 | $3,695.28 | $3,028.45 | $2,777.53 | $2,252.15 | $2,771.34 | $1,916.84 | $3,206.17 | $1,866.71 |

| 83465 | $2,856.96 | $4,202.95 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,814.70 | $1,900.69 | $3,160.69 | $1,866.71 |

| 83466 | $2,856.96 | $4,202.95 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,814.70 | $1,900.69 | $3,160.69 | $1,866.71 |

| 83607 | $2,856.56 | $4,054.78 | $4,166.07 | $3,041.94 | $2,515.57 | $2,375.37 | $2,805.89 | $1,921.26 | $3,101.23 | $1,726.98 |

| 83676 | $2,855.64 | $4,004.21 | $4,166.07 | $3,041.94 | $2,515.57 | $2,338.96 | $2,805.89 | $1,826.41 | $3,274.70 | $1,726.98 |

| 83263 | $2,854.56 | $4,116.21 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,745.87 | $3,364.85 | $1,866.71 |

| 83272 | $2,854.56 | $4,116.21 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,745.87 | $3,364.85 | $1,866.71 |

| 83223 | $2,854.55 | $4,116.21 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,745.81 | $3,364.85 | $1,866.71 |

| 83283 | $2,854.55 | $4,116.21 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,745.81 | $3,364.85 | $1,866.71 |

| 83252 | $2,854.44 | $4,116.21 | $3,695.28 | $3,231.61 | $2,777.53 | $2,452.43 | $2,631.16 | $1,780.84 | $3,138.23 | $1,866.71 |

| 83285 | $2,854.44 | $4,192.99 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,745.81 | $3,283.25 | $1,870.51 |

| 83234 | $2,853.72 | $4,116.21 | $3,695.28 | $3,231.61 | $2,777.53 | $2,452.43 | $2,631.16 | $1,776.88 | $3,135.65 | $1,866.71 |

| 83217 | $2,852.05 | $4,073.85 | $3,695.28 | $3,231.61 | $2,777.53 | $2,452.43 | $2,631.16 | $1,769.34 | $3,166.74 | $1,870.51 |

| 83214 | $2,851.19 | $4,034.89 | $3,695.28 | $3,231.61 | $2,777.53 | $2,452.43 | $2,631.16 | $1,803.19 | $3,167.89 | $1,866.71 |

| 83220 | $2,849.58 | $4,071.41 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,745.81 | $3,364.85 | $1,866.71 |

| 83238 | $2,849.58 | $4,071.41 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,745.81 | $3,364.85 | $1,866.71 |

| 83281 | $2,849.34 | $4,116.21 | $3,695.28 | $3,231.61 | $2,777.53 | $2,452.43 | $2,631.16 | $1,745.81 | $3,127.33 | $1,866.71 |

| 83463 | $2,849.34 | $4,202.95 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,814.70 | $1,900.69 | $3,092.11 | $1,866.71 |

| 83855 | $2,848.45 | $3,897.43 | $3,552.57 | $3,306.96 | $2,777.53 | $2,214.33 | $2,673.74 | $1,852.90 | $3,413.29 | $1,947.30 |

| 83243 | $2,847.29 | $4,116.21 | $3,695.28 | $3,231.61 | $2,827.17 | $2,452.43 | $2,631.16 | $1,745.81 | $3,059.27 | $1,866.71 |

| 83251 | $2,846.67 | $3,999.42 | $3,695.28 | $3,028.45 | $2,777.53 | $2,252.15 | $2,771.34 | $1,973.22 | $3,255.95 | $1,866.71 |

| 83340 | $2,846.21 | $4,037.34 | $3,695.28 | $3,028.45 | $2,777.53 | $2,222.00 | $2,706.72 | $1,932.28 | $3,392.53 | $1,823.77 |

| 83230 | $2,845.61 | $4,190.56 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,745.81 | $3,206.20 | $1,870.51 |

| 83228 | $2,845.31 | $4,116.21 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,776.88 | $3,250.62 | $1,866.71 |

| 83237 | $2,844.28 | $4,116.21 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,767.61 | $3,250.62 | $1,866.71 |

| 83254 | $2,844.20 | $4,071.41 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,697.43 | $3,364.85 | $1,866.71 |

| 83211 | $2,843.72 | $4,037.34 | $3,695.28 | $3,028.45 | $2,827.17 | $2,452.43 | $2,631.16 | $1,806.31 | $3,248.63 | $1,866.71 |

| 83239 | $2,843.53 | $4,071.41 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,691.38 | $3,364.85 | $1,866.71 |

| 83276 | $2,843.08 | $4,190.56 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,723.03 | $3,206.20 | $1,870.51 |

| 83255 | $2,842.92 | $4,034.33 | $3,695.28 | $3,028.45 | $2,777.53 | $2,252.15 | $2,771.34 | $1,921.71 | $3,238.75 | $1,866.71 |

| 83631 | $2,841.87 | $3,916.80 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,771.34 | $1,863.50 | $3,391.58 | $1,866.71 |

| 83232 | $2,841.86 | $4,116.21 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,745.81 | $3,250.62 | $1,866.71 |

| 83287 | $2,841.86 | $4,116.21 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,745.81 | $3,250.62 | $1,866.71 |

| 83644 | $2,839.20 | $3,892.56 | $4,166.07 | $3,041.94 | $2,543.13 | $2,230.07 | $2,805.89 | $1,928.74 | $3,217.41 | $1,726.98 |

| 83857 | $2,838.56 | $3,897.43 | $3,552.57 | $3,306.96 | $2,777.53 | $2,214.33 | $2,673.74 | $1,831.70 | $3,345.44 | $1,947.30 |

| 83244 | $2,834.89 | $4,034.33 | $3,695.28 | $3,028.45 | $2,777.53 | $2,252.15 | $2,771.34 | $1,900.69 | $3,187.51 | $1,866.71 |

| 83241 | $2,833.28 | $4,073.85 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,739.83 | $3,217.91 | $1,870.51 |

| 83246 | $2,831.92 | $3,992.53 | $3,695.28 | $3,231.61 | $2,777.53 | $2,452.43 | $2,631.16 | $1,751.93 | $3,088.06 | $1,866.71 |

| 83253 | $2,831.54 | $3,974.13 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,814.70 | $1,900.69 | $3,160.69 | $1,866.71 |

| 83212 | $2,829.43 | $3,992.53 | $3,695.28 | $3,231.61 | $2,777.53 | $2,452.43 | $2,631.16 | $1,745.81 | $3,071.82 | $1,866.71 |

| 83834 | $2,828.33 | $3,897.43 | $3,552.57 | $3,306.96 | $2,777.53 | $2,214.33 | $2,673.74 | $1,832.79 | $3,345.44 | $1,854.19 |

| 83278 | $2,826.86 | $4,012.05 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,771.34 | $1,971.75 | $3,053.03 | $1,866.71 |

| 83235 | $2,826.72 | $3,974.13 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,771.34 | $1,900.69 | $3,160.69 | $1,866.71 |

| 83226 | $2,826.16 | $3,974.13 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,771.34 | $1,895.71 | $3,160.69 | $1,866.71 |

| 83641 | $2,824.89 | $3,878.18 | $4,166.07 | $3,041.94 | $2,515.57 | $2,252.15 | $2,717.98 | $1,824.03 | $3,161.37 | $1,866.71 |

| 83271 | $2,824.30 | $4,037.34 | $3,695.28 | $3,028.45 | $2,827.17 | $2,452.43 | $2,631.16 | $1,820.94 | $3,059.27 | $1,866.71 |

| 83327 | $2,824.05 | $4,037.34 | $3,695.28 | $3,028.45 | $2,777.53 | $2,252.15 | $2,706.72 | $1,896.19 | $3,277.85 | $1,744.94 |

| 83229 | $2,823.92 | $3,974.13 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,814.70 | $1,900.69 | $3,092.11 | $1,866.71 |

| 83469 | $2,823.92 | $3,974.13 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,814.70 | $1,900.69 | $3,092.11 | $1,866.71 |

| 83347 | $2,823.71 | $4,034.80 | $3,989.27 | $3,028.45 | $2,777.53 | $2,078.91 | $2,722.48 | $1,719.58 | $3,317.43 | $1,744.94 |

| 83353 | $2,823.59 | $4,037.34 | $3,695.28 | $3,028.45 | $2,777.53 | $2,222.00 | $2,706.72 | $1,932.28 | $3,188.93 | $1,823.77 |

| 83341 | $2,823.22 | $3,981.55 | $3,989.27 | $3,028.45 | $2,777.53 | $2,243.36 | $2,517.12 | $1,814.30 | $3,312.51 | $1,744.94 |

| 83342 | $2,821.81 | $4,034.89 | $3,989.27 | $3,028.45 | $2,777.53 | $2,078.91 | $2,722.48 | $1,787.86 | $3,231.96 | $1,744.94 |

| 83655 | $2,820.93 | $4,004.21 | $3,695.28 | $3,041.94 | $2,543.13 | $2,338.96 | $2,746.31 | $1,765.46 | $3,386.32 | $1,866.71 |

| 83311 | $2,820.70 | $4,034.89 | $3,989.27 | $3,028.45 | $2,777.53 | $2,078.91 | $2,722.48 | $1,777.86 | $3,231.96 | $1,744.94 |

| 83312 | $2,820.50 | $4,034.89 | $3,989.27 | $3,028.45 | $2,777.53 | $2,078.91 | $2,722.48 | $1,776.05 | $3,231.96 | $1,744.94 |

| 83666 | $2,820.16 | $3,990.50 | $3,695.28 | $3,028.45 | $2,777.53 | $2,252.15 | $2,771.34 | $1,740.19 | $3,259.27 | $1,866.71 |

| 83333 | $2,819.20 | $4,037.34 | $3,695.28 | $3,028.45 | $2,777.53 | $2,157.63 | $2,706.72 | $1,903.09 | $3,243.00 | $1,823.77 |

| 83635 | $2,816.93 | $3,863.12 | $3,695.28 | $3,041.94 | $2,777.53 | $2,338.96 | $2,746.31 | $1,740.19 | $3,282.34 | $1,866.71 |

| 83323 | $2,816.45 | $4,004.47 | $3,989.27 | $3,028.45 | $2,777.53 | $2,078.91 | $2,722.48 | $1,770.01 | $3,231.96 | $1,744.94 |

| 83316 | $2,816.20 | $3,981.55 | $3,989.27 | $3,028.45 | $2,777.53 | $2,243.36 | $2,517.12 | $1,703.17 | $3,360.47 | $1,744.94 |

| 83321 | $2,816.17 | $3,981.55 | $3,989.27 | $3,028.45 | $2,777.53 | $2,243.36 | $2,517.12 | $1,702.88 | $3,360.47 | $1,744.94 |

| 83835 | $2,814.62 | $3,378.15 | $3,668.25 | $3,306.96 | $2,892.45 | $2,224.25 | $2,705.06 | $1,913.57 | $3,214.11 | $2,028.83 |

| 83350 | $2,812.32 | $3,923.80 | $3,989.27 | $3,028.45 | $2,777.53 | $2,078.91 | $2,722.48 | $1,733.43 | $3,312.05 | $1,744.94 |

| 83325 | $2,811.29 | $3,893.47 | $3,989.27 | $3,028.45 | $2,777.53 | $2,243.36 | $2,501.20 | $1,810.88 | $3,312.51 | $1,744.94 |

| 83336 | $2,810.54 | $3,923.80 | $3,989.27 | $3,028.45 | $2,777.53 | $2,078.91 | $2,722.48 | $1,712.02 | $3,317.43 | $1,744.94 |

| 83318 | $2,809.93 | $3,923.80 | $3,989.27 | $3,028.45 | $2,777.53 | $2,078.91 | $2,722.48 | $1,712.02 | $3,311.97 | $1,744.94 |

| 83328 | $2,809.58 | $3,981.55 | $3,989.27 | $3,028.45 | $2,777.53 | $2,243.36 | $2,517.12 | $1,761.33 | $3,242.70 | $1,744.94 |

| 83344 | $2,809.18 | $3,893.47 | $3,989.27 | $3,028.45 | $2,777.53 | $2,243.36 | $2,517.12 | $1,812.35 | $3,276.17 | $1,744.94 |

| 83335 | $2,807.89 | $3,893.47 | $3,989.27 | $3,028.45 | $2,777.53 | $2,243.36 | $2,501.20 | $1,816.63 | $3,276.17 | $1,744.94 |

| 83324 | $2,807.80 | $4,122.97 | $3,989.27 | $3,028.45 | $2,777.53 | $2,078.91 | $2,501.20 | $1,837.80 | $3,189.15 | $1,744.94 |

| 83320 | $2,807.71 | $4,037.34 | $3,695.28 | $3,028.45 | $2,777.53 | $2,078.91 | $2,706.72 | $1,932.41 | $3,188.93 | $1,823.77 |

| 83677 | $2,807.29 | $3,863.12 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,746.31 | $1,740.19 | $3,282.34 | $1,866.71 |

| 83338 | $2,807.01 | $3,981.55 | $3,989.27 | $3,028.45 | $2,777.53 | $2,243.36 | $2,501.20 | $1,807.70 | $3,189.15 | $1,744.94 |

| 83638 | $2,806.24 | $3,812.10 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,746.31 | $1,781.75 | $3,282.34 | $1,866.71 |

| 83227 | $2,806.14 | $3,974.13 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,771.34 | $1,900.69 | $2,975.52 | $1,866.71 |

| 83334 | $2,805.37 | $3,951.78 | $3,989.27 | $3,028.45 | $2,777.53 | $2,243.36 | $2,517.12 | $1,806.74 | $3,189.15 | $1,744.94 |

| 83346 | $2,805.21 | $3,923.89 | $3,989.27 | $3,028.45 | $2,640.14 | $2,078.91 | $2,722.48 | $1,806.80 | $3,312.05 | $1,744.94 |

| 83352 | $2,804.68 | $4,122.97 | $3,989.27 | $3,028.45 | $2,777.53 | $2,078.91 | $2,501.20 | $1,809.70 | $3,189.15 | $1,744.94 |

| 83313 | $2,804.18 | $4,037.34 | $3,695.28 | $3,028.45 | $2,777.53 | $2,078.91 | $2,706.72 | $1,900.71 | $3,188.93 | $1,823.77 |

| 83348 | $2,804.18 | $4,037.34 | $3,695.28 | $3,028.45 | $2,777.53 | $2,078.91 | $2,706.72 | $1,900.69 | $3,188.93 | $1,823.77 |

| 83604 | $2,803.70 | $3,957.83 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,771.34 | $1,716.71 | $3,153.84 | $1,866.71 |

| 83660 | $2,803.64 | $4,004.21 | $3,695.28 | $3,041.94 | $2,515.57 | $2,338.96 | $2,746.31 | $1,784.72 | $3,378.79 | $1,726.98 |

| 83332 | $2,803.35 | $3,895.92 | $3,989.27 | $3,028.45 | $2,777.53 | $2,243.36 | $2,501.20 | $1,745.80 | $3,303.66 | $1,744.94 |

| 83349 | $2,802.61 | $4,065.22 | $3,989.27 | $3,028.45 | $2,777.53 | $2,078.91 | $2,501.20 | $1,848.81 | $3,189.15 | $1,744.94 |

| 83637 | $2,802.41 | $4,035.84 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,771.34 | $1,740.19 | $3,040.72 | $1,866.71 |

| 83302 | $2,801.88 | $3,957.83 | $3,989.27 | $3,028.45 | $2,777.53 | $2,243.36 | $2,517.12 | $1,776.05 | $3,182.42 | $1,744.94 |

| 83622 | $2,801.87 | $3,851.12 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,771.34 | $1,961.84 | $2,998.91 | $1,866.71 |

| 83650 | $2,801.63 | $3,920.66 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,771.34 | $1,740.19 | $3,148.92 | $1,866.71 |

| 83615 | $2,801.62 | $3,812.10 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,746.31 | $1,740.19 | $3,282.34 | $1,866.71 |

| 83355 | $2,801.00 | $3,981.55 | $3,989.27 | $3,028.45 | $2,777.53 | $2,243.36 | $2,501.20 | $1,737.29 | $3,205.41 | $1,744.94 |

| 83629 | $2,800.10 | $3,893.01 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,771.34 | $1,850.06 | $3,052.86 | $1,866.71 |

| 83314 | $2,793.41 | $3,895.92 | $3,989.27 | $3,028.45 | $2,777.53 | $2,252.15 | $2,501.20 | $1,745.80 | $3,205.41 | $1,744.94 |

| 83337 | $2,791.00 | $3,895.92 | $3,695.28 | $3,028.45 | $2,777.53 | $2,252.15 | $2,706.72 | $1,740.19 | $3,277.85 | $1,744.94 |

| 83624 | $2,790.70 | $3,920.66 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,771.34 | $1,695.73 | $3,094.98 | $1,866.71 |

| 83330 | $2,789.58 | $3,895.92 | $3,989.27 | $3,028.45 | $2,777.53 | $2,078.91 | $2,501.20 | $1,786.32 | $3,303.66 | $1,744.94 |

| 83645 | $2,786.61 | $3,928.48 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,746.31 | $1,767.19 | $3,003.84 | $1,866.71 |

| 83639 | $2,785.64 | $3,920.66 | $3,695.28 | $3,041.94 | $2,515.57 | $2,252.15 | $2,771.34 | $1,828.33 | $3,178.81 | $1,866.71 |

| 83619 | $2,784.05 | $4,004.21 | $3,695.28 | $3,041.94 | $2,543.13 | $2,338.96 | $2,746.31 | $1,721.94 | $3,097.92 | $1,866.71 |

| 83301 | $2,782.56 | $3,767.16 | $3,989.27 | $3,136.73 | $2,640.14 | $2,243.36 | $2,517.12 | $1,821.89 | $3,182.42 | $1,744.94 |

| 83628 | $2,780.47 | $3,920.66 | $3,695.28 | $3,041.94 | $2,515.57 | $2,252.15 | $2,771.34 | $1,781.81 | $3,178.81 | $1,866.71 |

| 83611 | $2,777.71 | $3,850.00 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,746.31 | $1,770.53 | $2,998.91 | $1,866.71 |

| 83643 | $2,776.34 | $3,863.12 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,746.31 | $1,740.19 | $3,003.84 | $1,866.71 |

| 83602 | $2,775.91 | $3,776.31 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,771.34 | $1,740.19 | $3,061.71 | $1,866.71 |

| 83632 | $2,771.35 | $3,818.17 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,746.31 | $1,740.19 | $3,003.84 | $1,866.71 |

| 83322 | $2,770.68 | $3,895.92 | $3,695.28 | $3,028.45 | $2,777.53 | $2,252.15 | $2,706.72 | $1,740.19 | $3,094.98 | $1,744.94 |

| 83815 | $2,769.93 | $3,287.39 | $3,668.25 | $3,069.45 | $2,892.45 | $2,188.37 | $2,616.57 | $1,925.45 | $3,252.68 | $2,028.83 |

| 83661 | $2,763.83 | $3,917.84 | $3,695.28 | $3,041.94 | $2,543.13 | $2,252.15 | $2,746.31 | $1,721.94 | $3,089.14 | $1,866.71 |

| 83814 | $2,761.06 | $3,287.39 | $3,668.25 | $3,106.56 | $2,892.45 | $2,137.80 | $2,616.57 | $1,925.45 | $3,186.27 | $2,028.83 |

| 83670 | $2,756.15 | $3,893.01 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,550.15 | $1,836.16 | $3,051.43 | $1,707.67 |

| 83657 | $2,747.13 | $3,960.33 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,550.15 | $1,740.19 | $2,998.91 | $1,707.67 |

| 83616 | $2,743.03 | $3,798.47 | $3,533.88 | $3,203.06 | $2,515.57 | $2,156.72 | $2,622.63 | $2,000.78 | $3,167.23 | $1,688.94 |

| 83854 | $2,732.36 | $3,359.90 | $3,668.25 | $2,736.09 | $2,892.45 | $2,152.23 | $2,681.54 | $1,908.48 | $3,163.44 | $2,028.83 |

| 83633 | $2,728.15 | $3,895.92 | $3,695.28 | $3,028.45 | $2,097.93 | $2,252.15 | $2,771.34 | $1,740.19 | $3,205.41 | $1,866.71 |

| 83623 | $2,725.76 | $3,895.92 | $3,695.28 | $3,028.45 | $2,097.93 | $2,252.15 | $2,771.34 | $1,718.69 | $3,205.41 | $1,866.71 |

| 83669 | $2,725.33 | $3,970.99 | $3,438.58 | $3,203.06 | $2,499.48 | $2,158.46 | $2,550.15 | $1,790.11 | $3,228.23 | $1,688.94 |

| 83713 | $2,719.52 | $3,912.68 | $3,533.88 | $3,107.12 | $2,451.67 | $2,258.52 | $2,626.54 | $1,871.30 | $3,077.54 | $1,636.40 |

| 83627 | $2,717.41 | $4,004.78 | $3,695.28 | $3,028.45 | $2,097.93 | $2,252.15 | $2,771.34 | $1,740.19 | $2,999.83 | $1,866.71 |

| 83634 | $2,711.21 | $3,786.71 | $3,438.58 | $3,203.06 | $2,470.64 | $2,146.48 | $2,580.24 | $1,846.56 | $3,239.70 | $1,688.94 |

| 83617 | $2,706.75 | $3,882.38 | $3,695.28 | $3,041.94 | $2,543.13 | $2,080.69 | $2,550.15 | $1,806.66 | $3,052.86 | $1,707.67 |

| 83648 | $2,692.24 | $3,920.66 | $3,695.28 | $3,041.94 | $2,470.64 | $2,252.15 | $2,771.34 | $1,599.08 | $3,072.20 | $1,406.90 |

| 83636 | $2,691.56 | $3,951.90 | $3,695.28 | $3,041.94 | $2,403.40 | $2,080.69 | $2,550.15 | $1,740.19 | $3,052.86 | $1,707.67 |

| 83714 | $2,691.46 | $3,892.84 | $3,533.88 | $3,041.94 | $2,403.40 | $2,140.68 | $2,622.63 | $1,874.85 | $3,076.52 | $1,636.40 |

| 83704 | $2,671.21 | $3,645.33 | $3,533.88 | $3,107.12 | $2,451.67 | $2,177.55 | $2,590.59 | $1,805.21 | $3,093.17 | $1,636.40 |

| 83708 | $2,652.60 | $3,892.48 | $3,438.58 | $3,012.15 | $2,403.40 | $2,030.14 | $2,473.21 | $1,827.67 | $3,068.76 | $1,726.98 |

| 83647 | $2,647.03 | $3,810.09 | $3,695.28 | $3,041.94 | $2,097.93 | $2,252.15 | $2,771.34 | $1,836.28 | $2,911.33 | $1,406.90 |

| 83705 | $2,646.43 | $3,652.78 | $3,533.88 | $3,012.15 | $2,451.67 | $2,158.80 | $2,586.68 | $1,732.81 | $3,052.70 | $1,636.40 |

| 83712 | $2,644.60 | $3,724.95 | $3,438.58 | $3,039.47 | $2,470.64 | $2,153.26 | $2,473.21 | $1,741.39 | $3,123.46 | $1,636.40 |

| 83702 | $2,643.34 | $3,724.95 | $3,438.58 | $3,039.47 | $2,470.64 | $2,011.10 | $2,473.21 | $1,850.82 | $3,144.94 | $1,636.40 |

| 83642 | $2,642.29 | $3,677.17 | $3,438.58 | $2,785.84 | $2,408.93 | $2,216.06 | $2,580.24 | $1,841.47 | $3,143.40 | $1,688.94 |

| 83709 | $2,641.37 | $3,547.57 | $3,438.58 | $3,270.65 | $2,451.67 | $2,030.14 | $2,581.95 | $1,821.11 | $2,994.27 | $1,636.40 |

| 83646 | $2,636.84 | $3,708.80 | $3,438.58 | $2,763.07 | $2,408.93 | $2,146.48 | $2,622.63 | $1,772.67 | $3,143.40 | $1,726.98 |

| 83703 | $2,630.15 | $3,724.95 | $3,438.58 | $3,012.15 | $2,403.40 | $2,094.92 | $2,630.93 | $1,809.91 | $2,920.16 | $1,636.40 |

| 83725 | $2,625.99 | $3,680.86 | $3,438.58 | $2,945.06 | $2,403.40 | $2,116.06 | $2,511.51 | $1,827.67 | $3,074.37 | $1,636.40 |

| 83706 | $2,615.06 | $3,602.20 | $3,438.58 | $3,012.15 | $2,403.40 | $2,008.23 | $2,511.51 | $1,711.24 | $3,211.80 | $1,636.40 |

| 83716 | $2,612.88 | $3,669.45 | $3,438.58 | $2,975.76 | $2,470.64 | $2,036.00 | $2,473.21 | $1,741.54 | $3,074.37 | $1,636.40 |

Most Expensive/Least Expensive Carrier Rates by City

Search the table below to see how expensive car insurance carrier rates are for your city! It is interesting to note, that smaller cities like Kamiah actually have higher carrier rates than larger ones like Boise.

| City | Average Annual Rate |

|---|---|

| MERIDIAN | $2,639.57 |

| BOISE | $2,645.74 |

| MOUNTAIN HOME | $2,647.03 |

| GARDEN CITY | $2,691.46 |

| LETHA | $2,691.57 |

| MOUNTAIN HOME A F B | $2,692.24 |

| EMMETT | $2,706.75 |

| KUNA | $2,711.21 |

| HAMMETT | $2,717.41 |

| STAR | $2,725.33 |

| GLENNS FERRY | $2,725.77 |

| KING HILL | $2,728.15 |

| POST FALLS | $2,732.36 |

| EAGLE | $2,743.03 |

| OLA | $2,747.13 |

| SWEET | $2,756.15 |

| PAYETTE | $2,763.83 |

| COEUR D ALENE | $2,765.50 |

| CORRAL | $2,770.68 |

| INDIAN VALLEY | $2,771.35 |

| BANKS | $2,775.91 |

| MESA | $2,776.34 |

| CASCADE | $2,777.71 |

| HOMEDALE | $2,780.47 |

| TWIN FALLS | $2,782.56 |

| FRUITLAND | $2,784.04 |

| MARSING | $2,785.64 |

| MIDVALE | $2,786.60 |

| GOODING | $2,789.58 |

| GRAND VIEW | $2,790.70 |

| HILL CITY | $2,791.00 |

| BLISS | $2,793.41 |

| HORSESHOE BEND | $2,800.10 |

| WENDELL | $2,801.00 |

| DONNELLY | $2,801.62 |

| MURPHY | $2,801.63 |

| GARDEN VALLEY | $2,801.87 |

| ROGERSON | $2,801.88 |

| LOWMAN | $2,802.41 |

| RICHFIELD | $2,802.61 |

| HAGERMAN | $2,803.35 |

| PARMA | $2,803.64 |

| BRUNEAU | $2,803.70 |

| BELLEVUE | $2,804.18 |

| PICABO | $2,804.18 |

| SHOSHONE | $2,804.68 |

| OAKLEY | $2,805.21 |

| HANSEN | $2,805.37 |

| CLAYTON | $2,806.14 |

| MCCALL | $2,806.23 |

| JEROME | $2,807.02 |

| YELLOW PINE | $2,807.29 |

| CAREY | $2,807.71 |

| DIETRICH | $2,807.80 |

| HAZELTON | $2,807.89 |

| MURTAUGH | $2,809.18 |

| FILER | $2,809.58 |

| BURLEY | $2,809.93 |

| HEYBURN | $2,810.54 |

| EDEN | $2,811.29 |

| RUPERT | $2,812.32 |

| HAYDEN | $2,814.63 |

| CASTLEFORD | $2,816.17 |

| BUHL | $2,816.20 |

| DECLO | $2,816.44 |

| LAKE FORK | $2,816.93 |

| HAILEY | $2,819.20 |

| PLACERVILLE | $2,820.16 |

| ALMO | $2,820.50 |

| ALBION | $2,820.70 |

| NEW PLYMOUTH | $2,820.93 |

| MALTA | $2,821.81 |

| KIMBERLY | $2,823.22 |

| SUN VALLEY | $2,823.59 |

| PAUL | $2,823.71 |

| COBALT | $2,823.92 |

| SHOUP | $2,823.92 |

| FAIRFIELD | $2,824.05 |

| ROCKLAND | $2,824.31 |

| MELBA | $2,824.89 |

| CHALLIS | $2,826.16 |

| ELLIS | $2,826.72 |

| STANLEY | $2,826.86 |

| HARVARD | $2,828.33 |

| ARBON | $2,829.43 |

| MAY | $2,831.54 |

| LAVA HOT SPRINGS | $2,831.92 |

| GRACE | $2,833.28 |

| HOWE | $2,834.89 |

| PRINCETON | $2,838.55 |

| MIDDLETON | $2,839.20 |

| DAYTON | $2,841.86 |

| FISH HAVEN | $2,841.86 |

| IDAHO CITY | $2,841.87 |

| MOORE | $2,842.92 |

| SODA SPRINGS | $2,843.08 |

| GEORGETOWN | $2,843.53 |

| AMERICAN FALLS | $2,843.72 |

| MONTPELIER | $2,844.20 |

| FRANKLIN | $2,844.28 |

| CLIFTON | $2,845.31 |

| CONDA | $2,845.61 |

| KETCHUM | $2,846.21 |

| MACKAY | $2,846.67 |

| HOLBROOK | $2,847.29 |

| POTLATCH | $2,848.45 |

| GIBBONSVILLE | $2,849.34 |

| SWANLAKE | $2,849.34 |

| BERN | $2,849.58 |

| GENEVA | $2,849.58 |

| ARIMO | $2,851.19 |

| BANCROFT | $2,852.05 |

| DOWNEY | $2,853.72 |

| MALAD CITY | $2,854.44 |

| WAYAN | $2,854.44 |

| BLOOMINGTON | $2,854.55 |

| THATCHER | $2,854.55 |

| PRESTON | $2,854.56 |

| SAINT CHARLES | $2,854.56 |

| WILDER | $2,855.64 |

| LEMHI | $2,856.96 |

| NORTH FORK | $2,856.96 |

| ARCO | $2,857.30 |

| DINGLE | $2,858.15 |

| NEW MEADOWS | $2,858.60 |

| TENDOY | $2,858.99 |

| CARMEN | $2,859.10 |

| CAMBRIDGE | $2,859.27 |

| WESTON | $2,859.35 |

| CALDWELL | $2,859.99 |

| SALMON | $2,862.84 |

| LEADORE | $2,863.70 |

| WEISER | $2,864.12 |

| MCCAMMON | $2,865.42 |

| ELK CITY | $2,867.22 |

| COUNCIL | $2,868.51 |

| NAMPA | $2,869.02 |

| RATHDRUM | $2,869.15 |

| GREENLEAF | $2,871.31 |

| SPIRIT LAKE | $2,875.40 |

| STITES | $2,888.02 |

| LEWISTON | $2,890.80 |

| SPRINGFIELD | $2,895.19 |

| DUBOIS | $2,897.10 |

| INKOM | $2,900.20 |

| MOSCOW | $2,900.50 |

| MULLAN | $2,901.21 |

| ABERDEEN | $2,902.40 |

| WALLACE | $2,902.47 |

| POCATELLO | $2,906.49 |

| AVERY | $2,907.88 |

| OSBURN | $2,909.77 |

| MONTEVIEW | $2,910.08 |

| SILVERTON | $2,910.15 |

| BLANCHARD | $2,911.12 |

| DEARY | $2,911.17 |

| ATHOL | $2,911.64 |

| CALDER | $2,914.35 |

| POLLOCK | $2,916.57 |

| KELLOGG | $2,916.87 |

| PARKER | $2,917.01 |

| FERNWOOD | $2,917.14 |

| ELK RIVER | $2,917.63 |

| BOVILL | $2,917.85 |

| SMELTERVILLE | $2,918.02 |

| SUGAR CITY | $2,918.32 |

| TROY | $2,918.98 |

| BAYVIEW | $2,919.27 |

| CLARKIA | $2,919.68 |

| GENESEE | $2,921.33 |

| RIRIE | $2,922.33 |

| JULIAETTA | $2,922.35 |

| REXBURG | $2,922.90 |

| WORLEY | $2,923.28 |

| VIOLA | $2,925.52 |

| MACKS INN | $2,925.75 |

| TENSED | $2,926.80 |

| WARREN | $2,926.88 |

| PLUMMER | $2,927.88 |

| SPENCER | $2,927.88 |

| ATOMIC CITY | $2,928.21 |

| CHESTER | $2,928.51 |

| SAINT ANTHONY | $2,929.41 |

| KENDRICK | $2,929.55 |

| PINGREE | $2,931.35 |

| DESMET | $2,931.84 |

| MEDIMONT | $2,931.94 |

| HARRISON | $2,932.09 |

| LUCILE | $2,933.61 |

| NEWDALE | $2,934.77 |

| RIGBY | $2,935.59 |

| TETON | $2,936.22 |

| ISLAND PARK | $2,936.38 |

| CATALDO | $2,936.68 |

| SANTA | $2,937.09 |

| ASHTON | $2,937.21 |

| LEWISVILLE | $2,938.11 |

| PECK | $2,938.99 |

| SAINT MARIES | $2,940.69 |

| LAPWAI | $2,940.83 |

| FELT | $2,941.37 |

| SHELLEY | $2,942.05 |

| HAMER | $2,944.13 |

| NAPLES | $2,945.23 |

| IONA | $2,945.31 |

| COTTONWOOD | $2,945.39 |

| KINGSTON | $2,946.09 |

| FIRTH | $2,946.32 |

| PONDERAY | $2,947.82 |

| COCOLALLA | $2,948.73 |

| PINEHURST | $2,949.04 |

| WINCHESTER | $2,949.99 |

| LENORE | $2,950.11 |

| KOOTENAI | $2,951.68 |

| LACLEDE | $2,951.68 |

| TERRETON | $2,951.80 |

| BASALT | $2,953.40 |

| SANDPOINT | $2,953.66 |

| CLARK FORK | $2,953.78 |

| NORDMAN | $2,953.98 |

| ROBERTS | $2,955.14 |

| COOLIN | $2,956.28 |

| WHITE BIRD | $2,956.33 |

| IDAHO FALLS | $2,957.04 |

| MOYIE SPRINGS | $2,957.53 |

| BLACKFOOT | $2,958.18 |

| GREENCREEK | $2,959.06 |

| TETONIA | $2,959.41 |

| RIGGINS | $2,959.83 |

| OLDTOWN | $2,959.92 |

| HOPE | $2,960.60 |

| DRIGGS | $2,960.74 |

| PRIEST RIVER | $2,961.57 |

| KOOSKIA | $2,963.26 |

| IRWIN | $2,963.46 |

| VICTOR | $2,963.74 |

| BONNERS FERRY | $2,964.11 |

| COLBURN | $2,964.42 |

| REUBENS | $2,964.45 |

| CAREYWOOD | $2,964.55 |

| CULDESAC | $2,965.83 |

| EASTPORT | $2,967.64 |

| PORTHILL | $2,967.64 |

| MENAN | $2,968.23 |

| SWAN VALLEY | $2,968.69 |

| FERDINAND | $2,973.54 |

| GRANGEVILLE | $2,973.79 |

| SAGLE | $2,974.33 |

| NEZPERCE | $2,975.21 |

| CRAIGMONT | $2,980.70 |

| WEIPPE | $2,987.99 |

| AHSAHKA | $2,988.00 |

| OROFINO | $2,991.37 |

| FENN | $2,994.12 |

| PIERCE | $2,999.61 |

| KAMIAH | $3,008.28 |

Best Idaho Car Insurance Companies

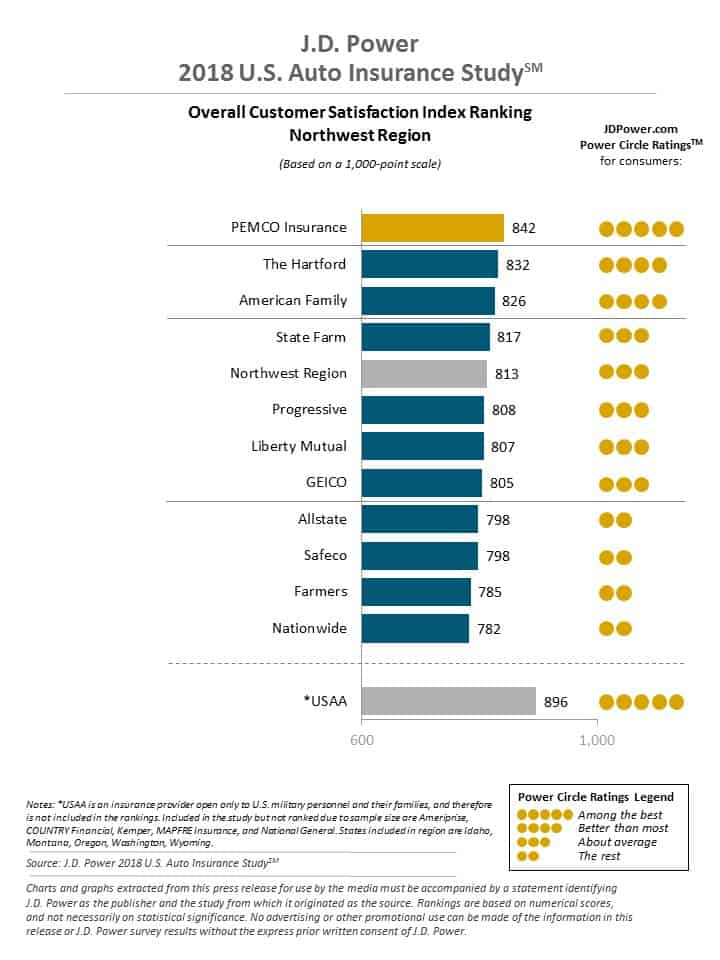

According to J.D. Power, the best car insurance companies in Idaho are PEMCO, The Hartford, and American Family. Financial stability and excellent customer service make these the best car insurance companies in ID. You’ll find that many of the best in Idaho are also the best car insurance companies in the U.S.

Alright, now that you have a better understanding of how factors like age, gender, ZIP code, and city affect your Idaho car insurance rates, let’s take a look at which companies are the best option for consumers and rank highest (or lowest) with insureds.

You won’t want to miss this. Let’s go!

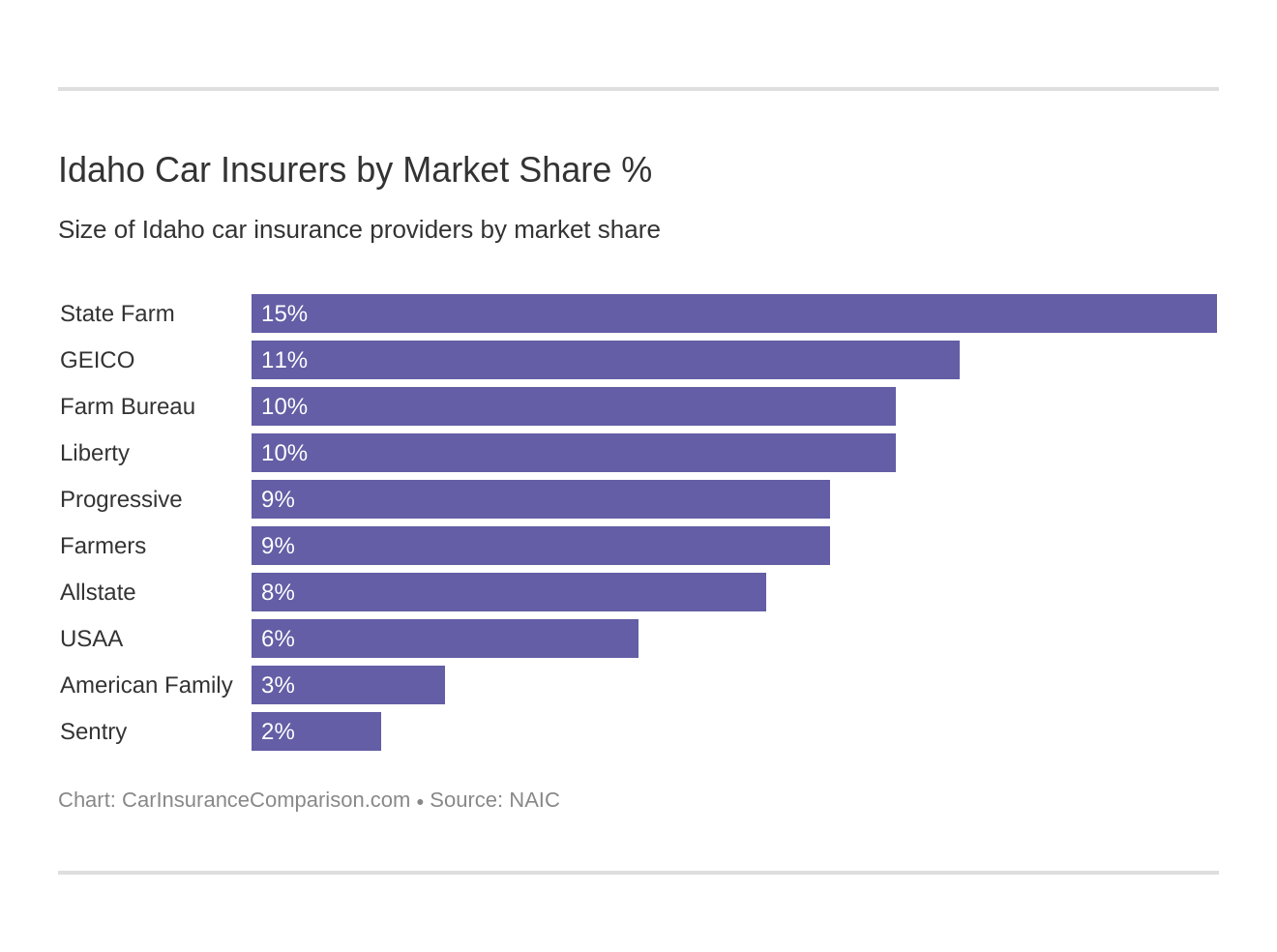

The 10 Largest Idaho Car Insurance Companies’ Financial Ratings

| Providers (Listed by Size, Largest to Smallest) | A.M. Best Rating |

|---|---|

| State Farm Group | A++ |

| Geico | A++ |

| Farm Bureau Group | A |

| Liberty Mutual Group | A |

| Progressive Group | A+ |

| Farmers Insurance Group | A |

| Allstate Insurance Group | A+ |

| USAA Group | A++ |

| American Family Insurance Group | A |

| Sentry Insurance Group | A+ |

- Idaho is home to many well-known insurance companies such as Allstate, Nationwide, and Easy Auto Tag Insurance

- Remember that when searching for auto insurance, your needs will always be different from the next person. Just because your best friend or brother has gotten insurance from one company, it does not mean that that is the best one for you

- Online comparison shopping is one of the best ways to compare multiple Idaho insurance quotes at one time

There are plenty of options for car insurance in Idaho and each one may work out to be the best for different people. When deciding on an insurance carrier, take the time to make a list of must-haves and wants.

Where do I start?

There are different companies for each county within the state, which is something that you will need to take into account. Some companies will cover statewide, while others will only cover the county that you are in.

Some of the more well-known insurance companies include Nationwide Insurance, which covers the majority of the state. There is also Allstate Insurance Company and Easy Auto Tag and Insurance. Take your time to search online to get free car insurance quotes for your own needs.

Get started with an Allstate vs. Nationwide car insurance comparison.

Remember that when searching for auto insurance, your needs will always be different from the next person. Just because your best friend or brother has gotten insurance from one company, it does not mean that that is the best one for you.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Finding the Cheapest Idaho Car Insurance

The first thing that you want is to find car insurance that is affordable and cheap. Every time it comes to renewing your car insurance, you should check to make sure that you are getting the cheapest deal on your auto cover.

Your renewal costs with your current company are not guaranteed to be cheaper than any of the others out there.

You can find the cheapest car insurance options by checking on our price comparison tool. This is a great way to look at each of the companies and just fill out one form, so it takes much less time and effort. The prices of car insurance will fluctuate.

You also need to remember that you cannot make the cover completely tailored to you. There are chances that by going directly to the companies and telephoning them, you can receive a discount.

Finding the Best Deals

However, just because you have found the cheapest car insurance in Idaho, it does not mean that it is the best one for you. Take some time to find out what the next ones about any extras and deals that the companies are able to offer for your money. If you pay a little extra, will you get breakdown cover as well?

You may find that paying 100 dollars more for a different provider will lead to more cover in case you are in an accident.

Of course, you may want to compare short-term car insurance to see if it’s a good fit. You may find that you get 10 months of coverage but still get your year’s no-claim bonus to give you the discount the year afterward.

The Type of Insurance

While looking at the prices, you also need to look at the type of car insurance that you are buying. While you want to be protected, you only need third-party insurance as a minimum.

This will cover the costs of anybody that you hit. However, this will not cover the costs of your car and will not cover the costs if anybody hits you. Third-party coverage is enough for some people and may be enough for you, but you will need to sit down and really think about it before you agree to anything.

You can compare full coverage car insurance to find a policy that will cover first-part damages

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Research the Company

You need to know more about the company that you are thinking about taking insurance out with. Have you ever heard of the company before today? If they do not show up in search results, there are chances that the company is not legitimate.

You also need to look into whether the insurance company is one that can be trusted to pay out when you ask for it. Research into what will happen if you are hit by a driver who is uninsured since the costs may come out of your own pocket!

Idaho Car Insurance Companies with the BEST Customer Ratings

Now, it’s time to find out which Idaho car insurance companies have the most consumer complaints. Let’s dive right in!

Idaho Car Insurance Companies with the MOST Customer Complaints

| Company Name | # of Complaints | Index | Market Share | Premium |

|---|---|---|---|---|

| State Farm | 3 | 2.24 | 13.38 % | $126,962,470 |

| Liberty Mutual | 2 | 9.99 | 2.00 % | $19,000,251 |

| Safeco | 1 | 1.32 | 7.58 % | $71,952,626 |

| Geico | 1 | 4.06 | 2.46 % | $23,355,526 |

The table above reveals the most recent data collected from the Idaho Department of Insurance’s consumer complaint section for auto insurance carriers. It not only shows the companies with the most consumer complaints but details their index, market share percentage, and premiums written.

Bear in mind, customer complaints indicate overall customer satisfaction, so use this as one of the multiple factors when deciding which Idaho car insurance company to go with. You should avoid the car insurance companies with the worst customer satisfaction.

Idaho’s Car Insurance Rates by Provider

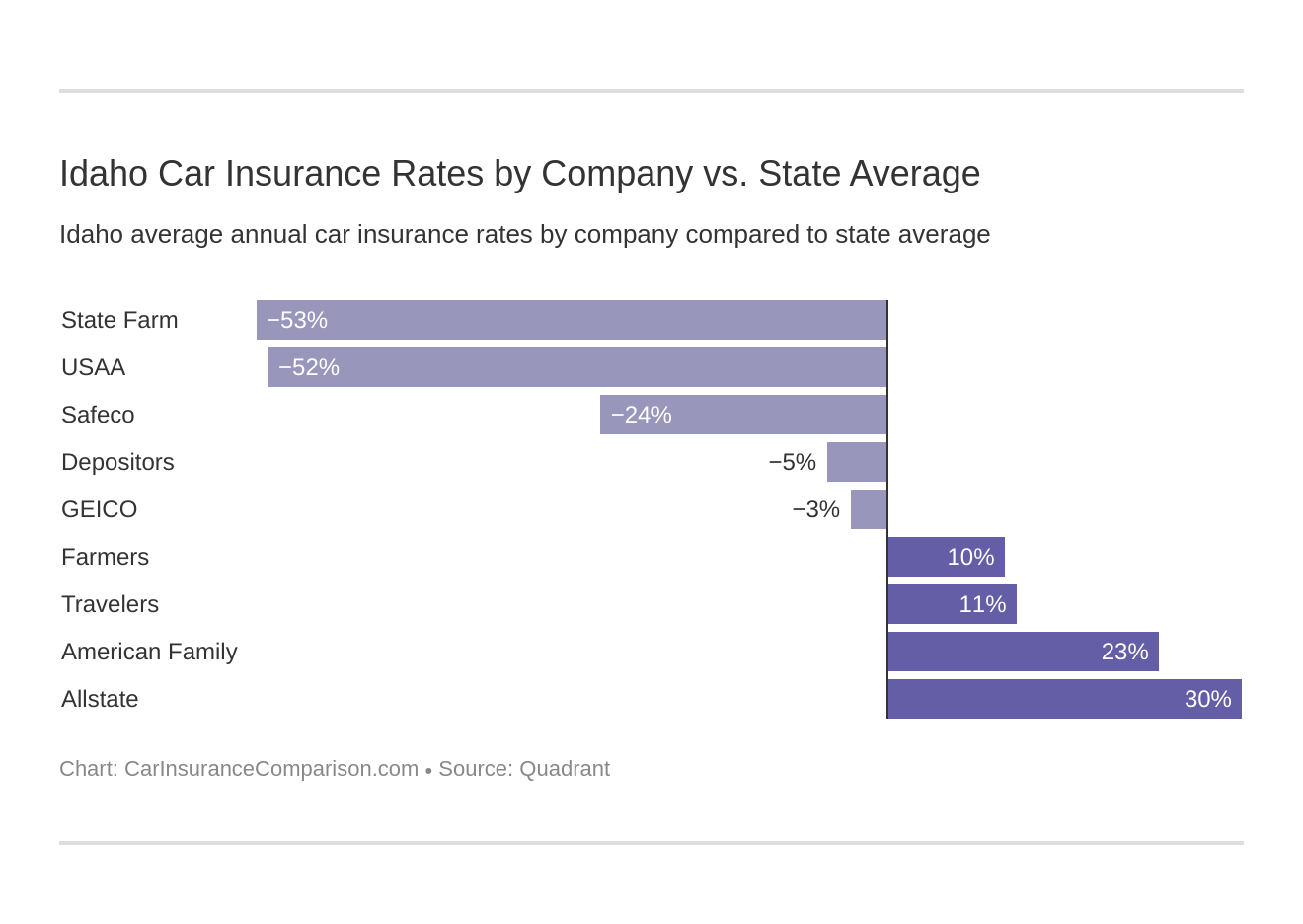

Of course, rates are going to be one of your most important decision-making tools when selecting an insurance carrier. Check out the chart below, listing the top Idaho car insurance carriers and their average rates as opposed to the state average.

As you can see Allstate charges the highest average annual premiums, which are over $2,000 higher than USAA’s!

For more information, read our in-depth USAA car insurance review.

Commute Rates

| Group | Commute & Annual Mileage | Annual Average |

|---|---|---|

| Allstate | 10 miles commute. 6000 annual mileage. | $4,088.76 |

| Allstate | 25 miles commute. 12000 annual mileage. | $4,088.76 |

| American Family | 10 miles commute. 6000 annual mileage. | $3,651.77 |

| American Family | 25 miles commute. 12000 annual mileage. | $3,805.81 |

| Travelers | 10 miles commute. 6000 annual mileage. | $3,226.29 |

| Travelers | 25 miles commute. 12000 annual mileage. | $3,226.29 |

| Farmers | 10 miles commute. 6000 annual mileage. | $3,168.28 |

| Farmers | 25 miles commute. 12000 annual mileage. | $3,168.28 |

| Geico | 10 miles commute. 6000 annual mileage. | $2,723.05 |

| Geico | 25 miles commute. 12000 annual mileage. | $2,818.30 |

| Nationwide | 10 miles commute. 6000 annual mileage. | $2,735.44 |

| Nationwide | 25 miles commute. 12000 annual mileage. | $2,735.44 |

| Liberty Mutual | 10 miles commute. 6000 annual mileage. | $2,301.51 |

| Liberty Mutual | 25 miles commute. 12000 annual mileage. | $2,301.51 |

| State Farm | 10 miles commute. 6000 annual mileage. | $1,823.01 |

| State Farm | 25 miles commute. 12000 annual mileage. | $1,912.91 |

| USAA | 10 miles commute. 6000 annual mileage. | $1,855.16 |

| USAA | 25 miles commute. 12000 annual mileage. | $1,900.06 |

The table here juxtaposes the Idaho car insurance rates of top insurers with consumers’ average commute mileage. You’ll notice that Allstate charges the highest premiums to commute rates than any other carrier listed. That said, their premiums are the same for both 10-mile and 25-mile commutes as are those for Liberty Mutual, Nationwide, Farmers, and Travelers.

However, car insurance carriers like American Family have an approximate $150 annual rate difference between 10 vs. 25-mile commutes.

For more information, read our in-depth company reviews:

- Allstate car insurance review

- American Family car insurance review

- State Farm car insurance review

- Liberty Mutual car insurance review

- Farmers car insurance review

Coverage Level Rates

| Group | Coverage Type | Annual Average |

|---|---|---|

| Allstate | High | $4,249.86 |

| Allstate | Medium | $4,080.92 |

| Allstate | Low | $3,935.49 |

| American Family | High | $3,542.83 |

| American Family | Medium | $3,914.07 |

| American Family | Low | $3,729.46 |

| Travelers | High | $3,232.47 |

| Travelers | Medium | $3,273.82 |

| Travelers | Low | $3,172.59 |

| Farmers | High | $3,359.73 |

| Farmers | Medium | $3,132.36 |

| Farmers | Low | $3,012.76 |

| Geico | High | $2,918.37 |