Compare Louisiana Car Insurance Rates [2025]

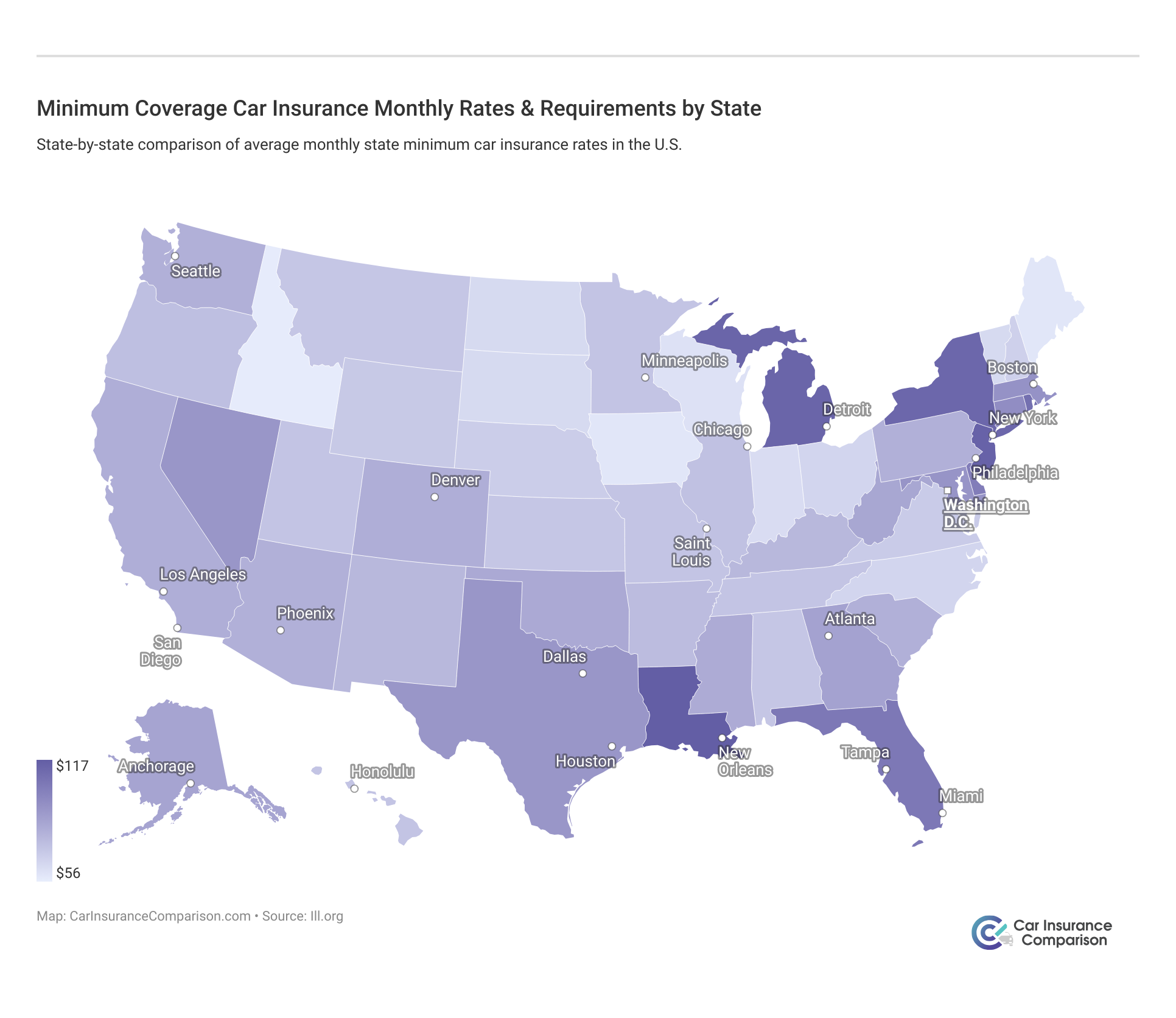

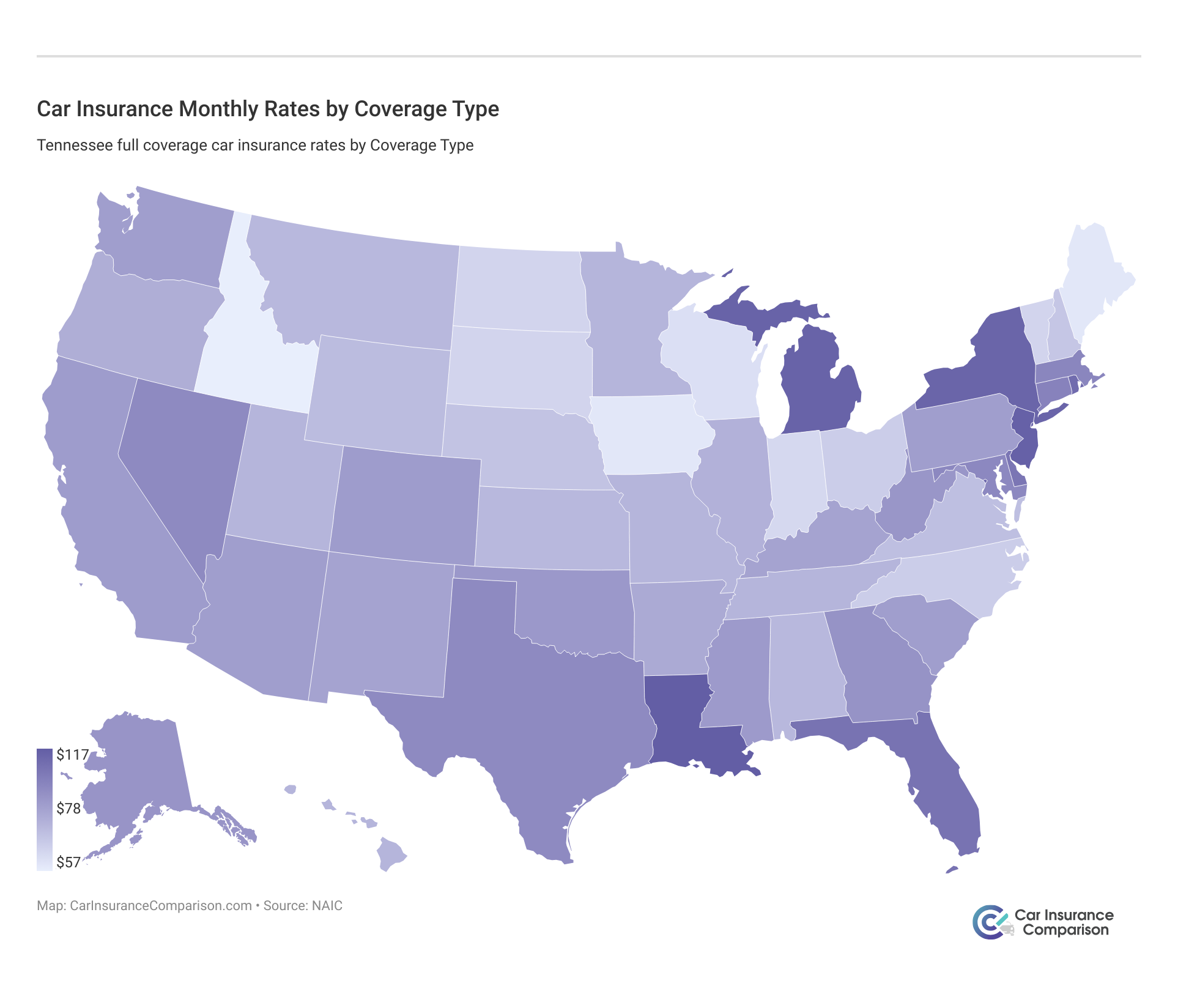

Compare Louisiana car insurance rates with an average of $117/month. Louisiana's minimum liability requirements are 15/30/25 for bodily injury and property coverage. When stopped by the police, proof of insurance is essential, including an insurance card, policy copy, declaration page, $30,000 securities, or bond.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: May 13, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: May 13, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Louisiana Statistics Summary | Details |

|---|---|

| Road Miles in State | 61,419 |

| Number of Vehicles Registered | 3,772,692 |

| Population | 4,659,978 |

| Most popular vehicle | Ford F-150 |

| Uninsured % | 13% |

| Total Driving Related Deaths | Speeding: 177 DUI: 225 |

| Average Annual Premiums | Liability: $775.83 Collision: $414.36 Comprehensive: $215.17 |

| Cheapest Providers | USAA State Farm |

Driving in Louisiana may drive you crazy, but it doesn’t mean that searching for car insurance should drive you crazy along with it!

Relax, and let the good times roll because we have put together a guide that has all the car insurance information that you’d ever want to know about Louisiana: coverage and rates, car insurance providers, state laws, and lots of other stuff.

Comparing rates is a great way to put money back into your pocket with big, big savings. Start today with just your ZIP code.

Louisiana Car Insurance Coverage and Rates

Laissez rouler les bons temps…let the good times roll. And in Louisiana, there is no shortage of places to go, things to do, and cool jazz to listen to.

Before you get too much into these cool beats, take a moment to sit down and go over the requirements of car insurance in Louisiana.

Minimum Car Insurance Requirements in Louisiana

| Insurance Required | Limits |

|---|---|

| Bodily Injury Coverage | $15,000 per person $30,000 per accident |

| Property Damage Coverage | $25,000 |

Liability car insurance pays anyone owed compensation when there is an accident you caused.

Louisiana follows the typical “fault” model. This means if an accident was your fault, you’re responsible for all the damages.

Louisiana requires that you carry, at the minimum, the following amounts:

- Car Insurance Rates in Louisiana

- Compare Winnsboro, LA Car Insurance Rates [2025]

- Compare Shreveport, LA Car Insurance Rates [2025]

- Compare Ruston, LA Car Insurance Rates [2025]

- Compare New Orleans, LA Car Insurance Rates [2025]

- Compare Leesville, LA Car Insurance Rates [2025]

- Compare Lena, LA Car Insurance Rates [2025]

- Compare Kenner, LA Car Insurance Rates [2025]

- Compare Hammond, LA Car Insurance Rates [2025]

- Compare Covington, LA Car Insurance Rates [2025]

- Compare Crowley, LA Car Insurance Rates [2025]

- Compare Bourg, LA Car Insurance Rates [2025]

- Compare Bentley, LA Car Insurance Rates [2025]

- Compare Baton Rouge, LA Car Insurance Rates [2025]

- Compare Bossier City, LA Car Insurance Rates [2025]

- Compare Lafayette, LA Car Insurance Rates [2025]

- $15,000 – covers injury/death per person.

- $30,000 – covers injuries or death per accident.

- $25,000 – covers property damage per accident.

Remember, these are the minimum requirements and do not cover injury, death, or damage to yourself or your own passengers!

Liability kicks in, however, no matter who is driving your car.

If you’re from out of state, your minimum car insurance requirements and rates could change! Take a look.

Required Forms of Financial Responsibility in Louisiana

By law in Louisiana, you are required to have valid liability insurance to be able to register your car or renew your registration. If you have renewed your registration online or bought a car from a dealer and registered it, the Louisiana Office of Motor Vehicles (OMV), can verify your car insurance electronically. If you are stopped by law enforcement, you are required, by law, to show proof of insurance.

Louisiana accepts the following as proof of insurance or financial responsibility:

- Insurance card.

- Copy of your insurance policy.

- A copy of your policy declaration page.

- Cash/unencumbered negotiable securities worth $30,000.

- Surety bond worth $30,000.

OR a statement from your insurer that must:

- Be on your car insurance company’s letterhead.

- Be signed by your insurance agent or a representative of the company.

- Have a complete description of your vehicle.

- Have your vehicle identification number (VIN).

Being caught without proof of insurance in Louisiana can give a police officer the authority to give you a Temporary Vehicle Use Authorization, or impound your vehicle.

Premiums as Percentage of Income in Louisiana

So, how much will you have to spend in Louisiana after all the necessities are taken care of?

In 2014, the annual per capita disposable personal income in Louisiana was $37,787.

Disposable personal income (DPI) is the total amount of money available for an individual to spend (or save) after their taxes have been paid.

The average annual cost of car insurance in Louisiana is $1,364, which is almost 4 percent of the average disposable personal income.

The average Louisiana resident has $3,148 each month to buy food, pay bills etc. The car insurance bill alone deducts about $113 out of that — much more if you have a less-than-perfect driving record.

Why is getting the best deal on car insurance so important?

American Consumer Credit Counseling suggests saving 20 percent of every paycheck. With Louisiana’s DPI, that’s a whopping $630 each month! How much are you setting aside for savings?

Average Monthly Car Insurance Rates in LA (Liability, Collision, Comprehensive)

| Coverage Types | Annual Costs in 2015 |

|---|---|

| Liability | $775.83 |

| Collision | $414.36 |

| Comprehensive | $215.17 |

| Combined | $1,405.36 |

The above table illustrates the most recent data provided by the leading source on the matter, the National Association of Insurance Commissioners. Expect car insurance rates in Louisiana to be significantly higher for 2019 and on.

Louisiana has seen several car insurance increases, as recently as last year.

Don’t forget: Louisiana has minimum requirements for liability coverage, but experts suggest drivers purchase more than what state law requires, especially when the state is an “at-fault” state like Louisiana.

You may be wondering: Why get more coverage than required? Louisiana has no snow, and no slippery roads to make for dangerous driving conditions (though it does have poor road conditions, ranked at the 40th worst roads in the United States). It is also a state that is highly rural, as opposed to urbanized.

Well, Louisiana tends to have more friendly judges willing to pay out more for bodily injury claims. According to USA Today, Louisiana has a large number of bad drivers making big claims and suing each other in front of friendly judges. This leads to high insurance payouts, which in turn leads to higher rates.

With this mind, in case you end up in court, you may want comprehensive coverage.

We can also easily how average car insurance rates in Louisiana compare with other states.

Let’s make a case and talk about the most popular coverage options to add to a basic car insurance policy.

Additional Liability Coverage in Louisiana

A loss ratio shows how much a company spends on claims to how much money they take in on premiums. A loss ratio of 60 percent indicates the company spent $60 on claims out of every $100 earned in premiums.

| Loss Ratio | 2012 | 2013 | 2014 |

|---|---|---|---|

| Medical Payments (Med Pay) | 82.21 | 85.21 | 80.68 |

| Uninsured/Underinsured Motorist | 84.40 | 90.07 | 91.66 |

It is assumed that drivers in Louisiana will have uninsured or underinsured motorist coverage:

“Louisiana’s uninsured motorist coverage differs from other states’ laws. Louisiana assumes that motorists have uninsured motorist coverage unless it is specifically rejected. It’s a subtle difference that becomes very important when filing a lawsuit”

Louisiana ranked 20th in the nation in 2015 for uninsured or underinsured drivers.

If you notice, loss ratios in Louisiana are high. If they go past 100 percent, it means that the insurance company is losing money, and these assumptions of having coverage might be the reasoning behind the high loss ratios for insurance companies in Louisiana. And it CAN be proven in court that you may not have rejected coverage, as Louisiana lawyer Tim Young told FreeAdvice.com:

“…we have absolutely handled cases where we’re able to show that the individual purchasing the policy never rejected such coverage. Courts will hold that they are entitled to UM or underinsured coverage unless they have specifically signed off on the rejection form.”

Long story short: if you don’t want the coverage, sign the rejection form.

Add-ons, Endorsements, and Riders

We know getting the complete coverage you need for an affordable price is your goal.

Good news: there are lots of powerful but cheap extras you can add to your policy.

Do you know what’s crazy? Louisiana has hot summers, with temperatures reaching upward of almost and over 90 degrees.

As the weather can be wildly unpredictable, it’s best to be prepared for whatever Mother Nature throws at you.

Don’t get blown away by high car insurance premiums! Start comparison shopping today using our FREE online tool. Enter your ZIP code above to get started!

Here’s a list of other useful coverage available to you in Louisiana:

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-as-You-Drive or Usage-Based Insurance

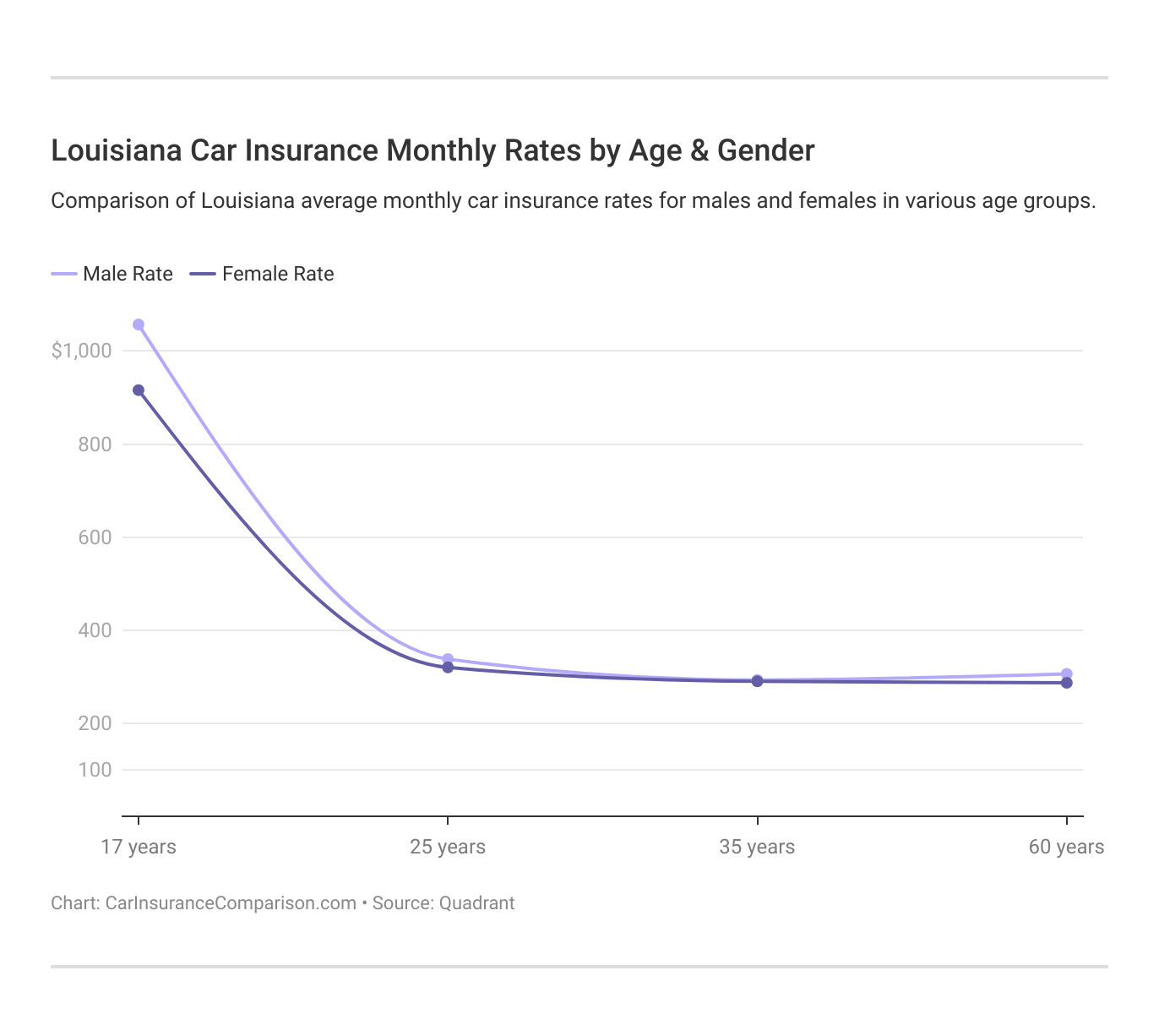

Average Monthly Car Insurance Rates by Age & Gender in LA

A popular myth: men pay more for car insurance. However, this myth mainly seems to hold true if you are a 17-year-old male in Louisiana. All other ages, it varies.

| Company | Married 35-year old female Annual Rate | Married 35-year old male Annual Rate | Married 60-year old female Annual Rate | Married 60-year old male Annual Rate | Single 17-year old female Annual Rate | Single 17-year old male Annual Rate | Single 25-year old female Annual Rate | Single 25-year old male Annual Rate |

|---|---|---|---|---|---|---|---|---|

| Allstate P&C | $4,254.40 | $4,254.40 | $4,394.91 | $4,394.91 | $9,256.33 | $11,657.16 | $4,694.46 | $5,083.73 |

| Geico Cas | $3,430.68 | $3,952.72 | $4,103.66 | $5,009.51 | $12,767.36 | $13,458.88 | $3,309.53 | $3,204.45 |

| Progressive Security Ins. | $4,158.02 | $3,880.90 | $3,483.46 | $3,762.32 | $16,529.91 | $18,373.77 | $4,746.19 | $4,834.20 |

| State Farm Mutual Auto | $2,851.05 | $2,851.05 | $2,619.17 | $2,619.17 | $8,404.12 | $10,538.72 | $3,180.57 | $3,569.11 |

| USAA | $2,678.38 | $2,634.64 | $2,612.63 | $2,591.11 | $8,021.04 | $9,403.41 | $3,286.33 | $3,597.39 |

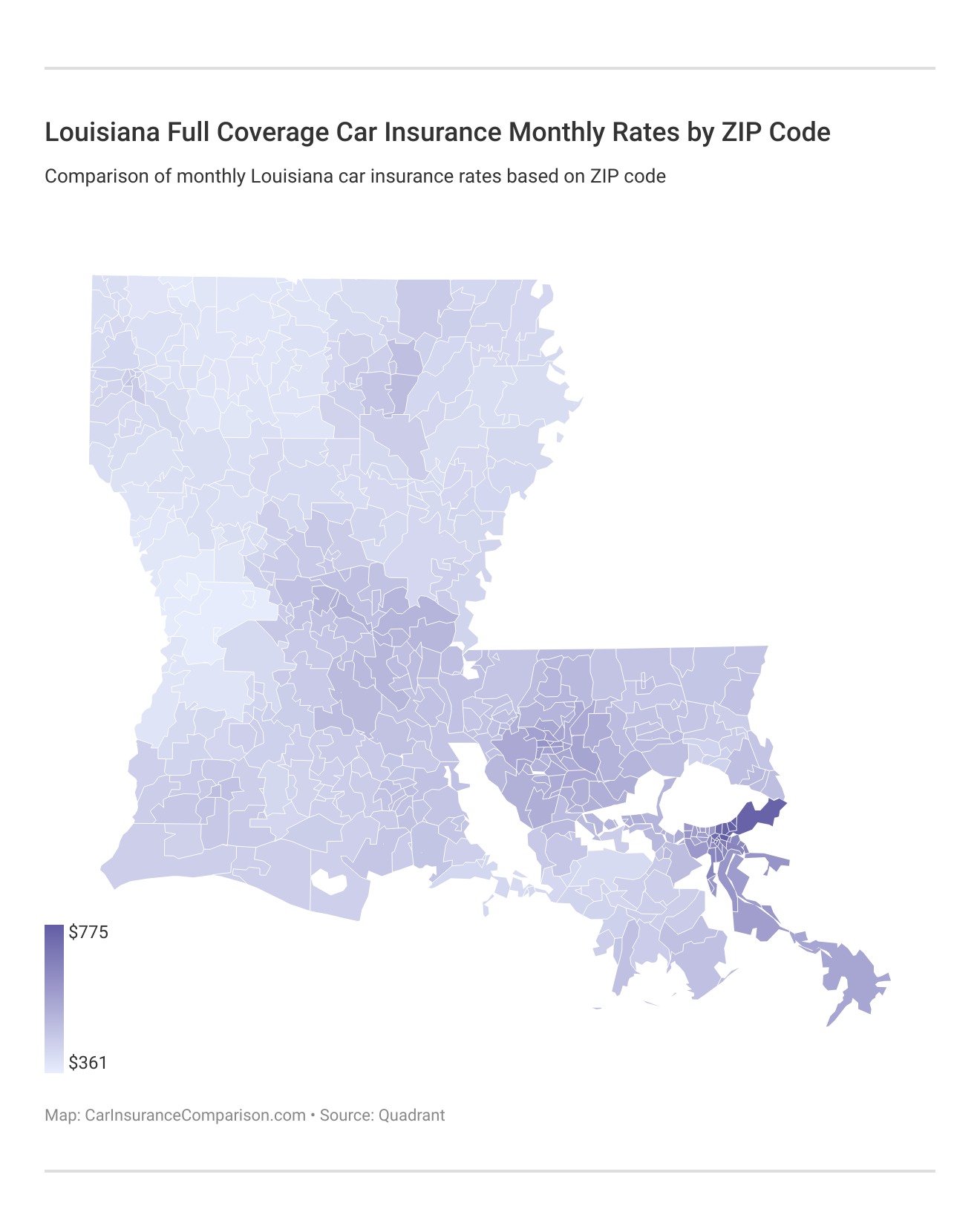

Cheapest Louisiana Car Insurance Rates by ZIP Code

Where you live influences how much you pay for car insurance.

| Cheapest ZIP Codes in Louisiana | City | Average Annual Rate by ZIP Codes | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 71439 | HORNBECK | $4,332.48 | Allstate | $5,413.73 | Progressive | $5,142.31 | USAA | $3,187.12 | State Farm | $3,544.31 |

| 71443 | KURTHWOOD | $4,355.93 | Allstate | $5,413.73 | Progressive | $5,152.75 | USAA | $2,981.19 | State Farm | $3,857.06 |

| 71459 | FORT POLK | $4,397.96 | Allstate | $5,579.18 | Progressive | $5,152.75 | USAA | $2,981.19 | State Farm | $3,926.59 |

| 71446 | LEESVILLE | $4,408.37 | Allstate | $5,579.18 | Progressive | $5,152.75 | USAA | $2,981.19 | State Farm | $3,978.60 |

| 71403 | ANACOCO | $4,430.85 | Allstate | $5,413.73 | Progressive | $5,142.31 | USAA | $3,418.09 | State Farm | $3,805.20 |

| 71474 | SIMPSON | $4,435.33 | Allstate | $5,579.18 | Progressive | $5,152.75 | USAA | $3,173.59 | State Farm | $3,921.03 |

| 71461 | NEWLLANO | $4,440.21 | Allstate | $5,579.18 | Progressive | $5,152.75 | USAA | $3,172.35 | State Farm | $3,946.65 |

| 71475 | SLAGLE | $4,471.44 | Allstate | $5,579.18 | Progressive | $5,152.75 | USAA | $3,418.09 | State Farm | $3,857.06 |

| 71075 | SPRINGHILL | $4,474.44 | Allstate | $5,413.73 | Geico | $5,046.39 | State Farm | $3,419.17 | USAA | $3,645.13 |

| 71429 | FLORIEN | $4,476.94 | Allstate | $5,413.73 | Progressive | $5,177.85 | State Farm | $3,406.01 | USAA | $3,555.97 |

| 71071 | SAREPTA | $4,477.36 | Allstate | $5,413.73 | Geico | $5,046.39 | State Farm | $3,433.73 | USAA | $3,645.13 |

| 71449 | MANY | $4,546.33 | Allstate | $5,413.73 | Progressive | $5,387.48 | State Farm | $3,543.35 | USAA | $3,555.97 |

| 71426 | FISHER | $4,568.59 | Allstate | $5,413.73 | Progressive | $5,177.85 | USAA | $3,555.97 | State Farm | $3,864.26 |

| 71486 | ZWOLLE | $4,580.26 | Progressive | $5,600.85 | Allstate | $5,413.73 | State Farm | $3,499.60 | USAA | $3,555.97 |

| 71462 | NOBLE | $4,587.34 | Progressive | $5,600.85 | Allstate | $5,413.73 | State Farm | $3,534.99 | USAA | $3,555.97 |

| 71468 | PROVENCAL | $4,591.96 | Allstate | $5,413.73 | Progressive | $5,170.17 | USAA | $3,580.55 | State Farm | $3,785.75 |

| 71016 | CASTOR | $4,592.82 | Allstate | $5,413.73 | Progressive | $5,270.63 | State Farm | $3,553.73 | USAA | $3,843.04 |

| 71072 | SHONGALOO | $4,595.44 | Progressive | $5,439.25 | Allstate | $5,413.73 | State Farm | $3,403.32 | USAA | $3,645.13 |

| 71048 | LISBON | $4,601.27 | Allstate | $5,413.73 | Progressive | $5,298.84 | State Farm | $3,624.07 | USAA | $3,645.13 |

| 71001 | ARCADIA | $4,604.07 | Allstate | $5,413.73 | Progressive | $5,206.83 | State Farm | $3,594.95 | USAA | $3,758.45 |

| 71045 | JAMESTOWN | $4,608.94 | Allstate | $5,413.73 | Progressive | $5,270.63 | State Farm | $3,634.33 | USAA | $3,843.04 |

| 71460 | NEGREET | $4,610.52 | Allstate | $5,413.73 | Progressive | $5,387.48 | USAA | $3,555.97 | State Farm | $3,864.26 |

| 71406 | BELMONT | $4,610.84 | Progressive | $5,614.41 | Allstate | $5,413.73 | USAA | $3,555.97 | State Farm | $3,577.97 |

| 71068 | RINGGOLD | $4,613.19 | Allstate | $5,413.73 | Progressive | $5,216.23 | State Farm | $3,709.97 | USAA | $3,843.04 |

| 71038 | HAYNESVILLE | $4,630.28 | Progressive | $5,439.25 | Allstate | $5,413.73 | State Farm | $3,577.56 | USAA | $3,645.13 |

Hornbeck residents, depending on the ZIP code, have the cheapest annual rates when it comes to car insurance! However, there are some areas where you will pay much more for car insurance than Hornbeck residents.

| Most Expensive ZIP Codes in Louisiana | City | Average Annual Rate by ZIP Code | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 70117 | NEW ORLEANS | $9,303.50 | Progressive | $11,349.19 | Geico | $10,722.66 | USAA | $6,335.87 | State Farm | $7,915.53 |

| 70127 | NEW ORLEANS | $9,249.24 | Progressive | $11,400.32 | Geico | $10,518.81 | USAA | $6,555.17 | State Farm | $7,577.65 |

| 70128 | NEW ORLEANS | $9,203.05 | Progressive | $11,483.77 | Geico | $10,518.81 | USAA | $6,562.78 | State Farm | $7,255.65 |

| 70126 | NEW ORLEANS | $9,155.49 | Progressive | $11,193.79 | Geico | $10,418.61 | USAA | $6,628.66 | State Farm | $7,342.14 |

| 70129 | NEW ORLEANS | $9,123.75 | Progressive | $11,277.24 | Geico | $10,565.56 | USAA | $6,562.78 | State Farm | $7,018.93 |

| 70113 | NEW ORLEANS | $9,085.51 | Progressive | $11,349.19 | Geico | $10,470.09 | USAA | $6,205.63 | State Farm | $7,208.41 |

| 70145 | NEW ORLEANS | $9,034.55 | Progressive | $11,349.19 | Geico | $10,722.66 | USAA | $5,708.44 | State Farm | $7,198.23 |

| 70146 | NEW ORLEANS | $9,034.55 | Progressive | $11,349.19 | Geico | $10,722.66 | USAA | $5,708.44 | State Farm | $7,198.23 |

| 70116 | NEW ORLEANS | $9,013.80 | Progressive | $11,286.61 | Allstate | $10,194.23 | USAA | $6,225.89 | State Farm | $7,667.52 |

| 70122 | NEW ORLEANS | $8,940.09 | Progressive | $11,349.19 | Geico | $10,626.87 | USAA | $5,798.83 | State Farm | $6,731.32 |

| 70148 | NEW ORLEANS | $8,877.47 | Progressive | $11,349.19 | Geico | $10,626.87 | USAA | $5,708.44 | State Farm | $6,508.60 |

| 70119 | NEW ORLEANS | $8,860.81 | Progressive | $11,297.04 | Allstate | $10,194.23 | USAA | $6,016.67 | State Farm | $7,081.33 |

| 70139 | NEW ORLEANS | $8,675.04 | Progressive | $11,286.61 | Allstate | $10,194.23 | USAA | $5,708.44 | State Farm | $7,198.23 |

| 70163 | NEW ORLEANS | $8,547.15 | Progressive | $11,349.19 | Allstate | $10,194.23 | USAA | $5,708.44 | State Farm | $7,198.23 |

| 70130 | NEW ORLEANS | $8,542.14 | Progressive | $11,286.61 | Allstate | $10,194.23 | USAA | $5,708.44 | State Farm | $7,235.76 |

| 70112 | NEW ORLEANS | $8,540.11 | Progressive | $11,286.61 | Allstate | $10,194.23 | USAA | $5,708.44 | State Farm | $7,428.67 |

| 70170 | NEW ORLEANS | $8,521.57 | Progressive | $11,286.61 | Allstate | $10,194.23 | USAA | $5,708.44 | State Farm | $7,198.23 |

| 70125 | NEW ORLEANS | $8,459.50 | Progressive | $11,116.86 | Allstate | $10,194.23 | USAA | $6,004.41 | State Farm | $6,878.72 |

| 70114 | NEW ORLEANS | $8,180.81 | Progressive | $11,286.61 | Geico | $9,623.03 | USAA | $5,846.50 | State Farm | $6,330.33 |

| 70032 | ARABI | $8,001.83 | Progressive | $11,220.15 | Geico | $8,646.01 | USAA | $5,601.65 | State Farm | $7,180.78 |

| 70058 | HARVEY | $7,919.05 | Progressive | $11,116.86 | Geico | $9,080.79 | USAA | $5,410.50 | State Farm | $6,169.49 |

| 70131 | NEW ORLEANS | $7,899.82 | Progressive | $11,411.76 | Geico | $8,621.16 | USAA | $5,502.31 | State Farm | $6,146.30 |

| 70053 | GRETNA | $7,895.98 | Progressive | $11,054.29 | Geico | $9,043.51 | USAA | $5,455.88 | State Farm | $6,108.63 |

| 70072 | MARRERO | $7,857.95 | Progressive | $10,759.92 | Geico | $8,816.72 | USAA | $5,929.56 | State Farm | $5,965.95 |

| 70043 | CHALMETTE | $7,852.33 | Progressive | $11,251.46 | Geico | $8,284.43 | USAA | $5,601.65 | State Farm | $6,763.55 |

New Orleans has a majority of the most expensive ZIP codes.

Louisiana Car Insurance Rates by City

The table below shows which cities have the cheapest car insurance rates. Unsurprisingly, Hornbeck is the cheapest city.

| Cheapest Cities in Louisiana | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Hornbeck | $4,332.48 | Allstate | $5,413.73 | Progressive | $5,142.31 | USAA | $3,187.12 | State Farm | $3,544.31 |

| Kurthwood | $4,355.93 | Allstate | $5,413.73 | Progressive | $5,152.75 | USAA | $2,981.19 | State Farm | $3,857.06 |

| Fort Polk | $4,397.96 | Allstate | $5,579.18 | Progressive | $5,152.75 | USAA | $2,981.19 | State Farm | $3,926.59 |

| Leesville | $4,408.37 | Allstate | $5,579.18 | Progressive | $5,152.75 | USAA | $2,981.19 | State Farm | $3,978.60 |

| Anacoco | $4,430.85 | Allstate | $5,413.73 | Progressive | $5,142.31 | USAA | $3,418.09 | State Farm | $3,805.20 |

| Simpson | $4,435.33 | Allstate | $5,579.18 | Progressive | $5,152.75 | USAA | $3,173.59 | State Farm | $3,921.03 |

| New Llano | $4,440.21 | Allstate | $5,579.18 | Progressive | $5,152.75 | USAA | $3,172.35 | State Farm | $3,946.65 |

| Slagle | $4,471.44 | Allstate | $5,579.18 | Progressive | $5,152.75 | USAA | $3,418.09 | State Farm | $3,857.06 |

| Cullen | $4,474.44 | Allstate | $5,413.73 | Geico | $5,046.39 | State Farm | $3,419.17 | USAA | $3,645.13 |

| Florien | $4,476.94 | Allstate | $5,413.73 | Progressive | $5,177.85 | State Farm | $3,406.01 | USAA | $3,555.97 |

| Sarepta | $4,477.35 | Allstate | $5,413.73 | Geico | $5,046.39 | State Farm | $3,433.73 | USAA | $3,645.13 |

| Many | $4,546.33 | Allstate | $5,413.73 | Progressive | $5,387.48 | State Farm | $3,543.35 | USAA | $3,555.97 |

| Fisher | $4,568.59 | Allstate | $5,413.73 | Progressive | $5,177.85 | USAA | $3,555.97 | State Farm | $3,864.26 |

| Zwolle | $4,580.26 | Progressive | $5,600.85 | Allstate | $5,413.73 | State Farm | $3,499.60 | USAA | $3,555.97 |

| Noble | $4,587.34 | Progressive | $5,600.85 | Allstate | $5,413.73 | State Farm | $3,534.99 | USAA | $3,555.97 |

| Provencal | $4,591.96 | Allstate | $5,413.73 | Progressive | $5,170.17 | USAA | $3,580.55 | State Farm | $3,785.75 |

| Castor | $4,592.82 | Allstate | $5,413.73 | Progressive | $5,270.63 | State Farm | $3,553.73 | USAA | $3,843.04 |

| Shongaloo | $4,595.44 | Progressive | $5,439.25 | Allstate | $5,413.73 | State Farm | $3,403.32 | USAA | $3,645.13 |

| Lisbon | $4,601.27 | Allstate | $5,413.73 | Progressive | $5,298.84 | State Farm | $3,624.07 | USAA | $3,645.13 |

| Arcadia | $4,604.07 | Allstate | $5,413.73 | Progressive | $5,206.83 | State Farm | $3,594.95 | USAA | $3,758.45 |

| Jamestown | $4,608.94 | Allstate | $5,413.73 | Progressive | $5,270.63 | State Farm | $3,634.33 | USAA | $3,843.04 |

| Negreet | $4,610.51 | Allstate | $5,413.73 | Progressive | $5,387.48 | USAA | $3,555.97 | State Farm | $3,864.26 |

| Belmont | $4,610.84 | Progressive | $5,614.41 | Allstate | $5,413.73 | USAA | $3,555.97 | State Farm | $3,577.97 |

| Ringgold | $4,613.19 | Allstate | $5,413.73 | Progressive | $5,216.23 | State Farm | $3,709.97 | USAA | $3,843.04 |

| Haynesville | $4,630.28 | Progressive | $5,439.25 | Allstate | $5,413.73 | State Farm | $3,577.56 | USAA | $3,645.13 |

If you live in New Orleans, you don’t really luck out when it comes to prices on car insurance. You are paying some of the most expensive rates, with prices ranging from $7,000 – $9,000!

| Most Expensive Cities in Louisiana | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| New Orleans | $8,649.31 | Progressive | $11,225.41 | Allstate | $9,603.97 | USAA | $5,944.69 | State Farm | $6,997.47 |

| Arabi | $8,001.83 | Progressive | $11,220.15 | Geico | $8,646.01 | USAA | $5,601.65 | State Farm | $7,180.78 |

| Harvey | $7,919.05 | Progressive | $11,116.86 | Geico | $9,080.79 | USAA | $5,410.50 | State Farm | $6,169.49 |

| Gretna | $7,860.34 | Progressive | $10,956.51 | Geico | $8,939.46 | USAA | $5,455.88 | State Farm | $6,132.24 |

| Estelle | $7,857.95 | Progressive | $10,759.92 | Geico | $8,816.72 | USAA | $5,929.56 | State Farm | $5,965.95 |

| Chalmette | $7,852.33 | Progressive | $11,251.46 | Geico | $8,284.43 | USAA | $5,601.65 | State Farm | $6,763.55 |

| Meraux | $7,789.28 | Progressive | $11,282.73 | Geico | $8,452.79 | USAA | $5,601.65 | State Farm | $6,248.68 |

| Poydras | $7,346.93 | Progressive | $11,312.43 | Allstate | $7,360.57 | USAA | $4,869.75 | State Farm | $6,208.18 |

| Lafitte | $7,282.71 | Progressive | $11,379.45 | Allstate | $7,817.59 | State Farm | $4,851.62 | USAA | $5,264.66 |

| Barataria | $7,257.44 | Progressive | $11,379.45 | Allstate | $7,817.59 | State Farm | $4,725.25 | USAA | $5,264.66 |

| Pointe A La Hache | $7,254.34 | Progressive | $11,312.43 | Allstate | $8,110.10 | USAA | $4,869.75 | State Farm | $4,879.19 |

| Kenner | $7,250.98 | Progressive | $10,866.48 | Geico | $7,913.35 | USAA | $5,527.33 | State Farm | $5,756.15 |

| Avondale | $7,150.36 | Progressive | $10,423.27 | Geico | $8,215.55 | Allstate | $5,175.46 | USAA | $5,929.56 |

| Belle Chasse | $7,147.88 | Progressive | $9,986.77 | Allstate | $8,110.10 | USAA | $4,869.75 | State Farm | $5,430.25 |

| Braithwaite | $7,070.65 | Progressive | $11,312.43 | Allstate | $7,360.57 | State Farm | $4,710.25 | USAA | $4,869.75 |

| Metairie | $7,028.30 | Progressive | $10,954.16 | Geico | $7,457.85 | USAA | $5,202.82 | State Farm | $5,401.80 |

| Uncle Sam | $7,025.29 | Progressive | $11,546.32 | Geico | $6,829.86 | USAA | $4,890.31 | State Farm | $5,056.99 |

| Burnside | $7,011.06 | Progressive | $11,546.32 | Geico | $6,829.86 | USAA | $4,819.16 | State Farm | $5,056.99 |

| Port Sulphur | $6,988.27 | Progressive | $9,986.77 | Allstate | $8,110.10 | USAA | $4,869.75 | State Farm | $4,874.50 |

| Elmwood | $6,943.52 | Progressive | $10,878.87 | Geico | $7,590.53 | USAA | $5,006.83 | State Farm | $5,116.54 |

| Baton Rouge | $6,786.59 | Progressive | $9,301.30 | Geico | $7,607.46 | USAA | $4,869.88 | State Farm | $5,317.05 |

| Pilottown | $6,775.22 | Progressive | $8,916.82 | Allstate | $8,110.10 | USAA | $4,869.75 | State Farm | $4,879.19 |

| Boothville | $6,756.68 | Progressive | $8,916.82 | Allstate | $8,110.10 | State Farm | $4,786.49 | USAA | $4,869.75 |

| Venice | $6,749.62 | Progressive | $8,916.82 | Allstate | $8,110.10 | State Farm | $4,751.19 | USAA | $4,869.75 |

| Baker | $6,694.24 | Progressive | $9,061.48 | Geico | $7,592.92 | USAA | $4,737.73 | State Farm | $5,276.11 |

Compare Car Insurance Rates in Your City

Discover and compare car insurance rates in your city. Whether you reside in Baton Rouge, Crowley, Lena, Bentley, Hammond, New Orleans, Bossier City, Kenner, Ruston, Bourg, Lafayette, Shreveport, Covington, Leesville, or Winnsboro, explore the varying insurance rates to make an informed decision tailored to your location.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Louisiana Car Insurance Companies

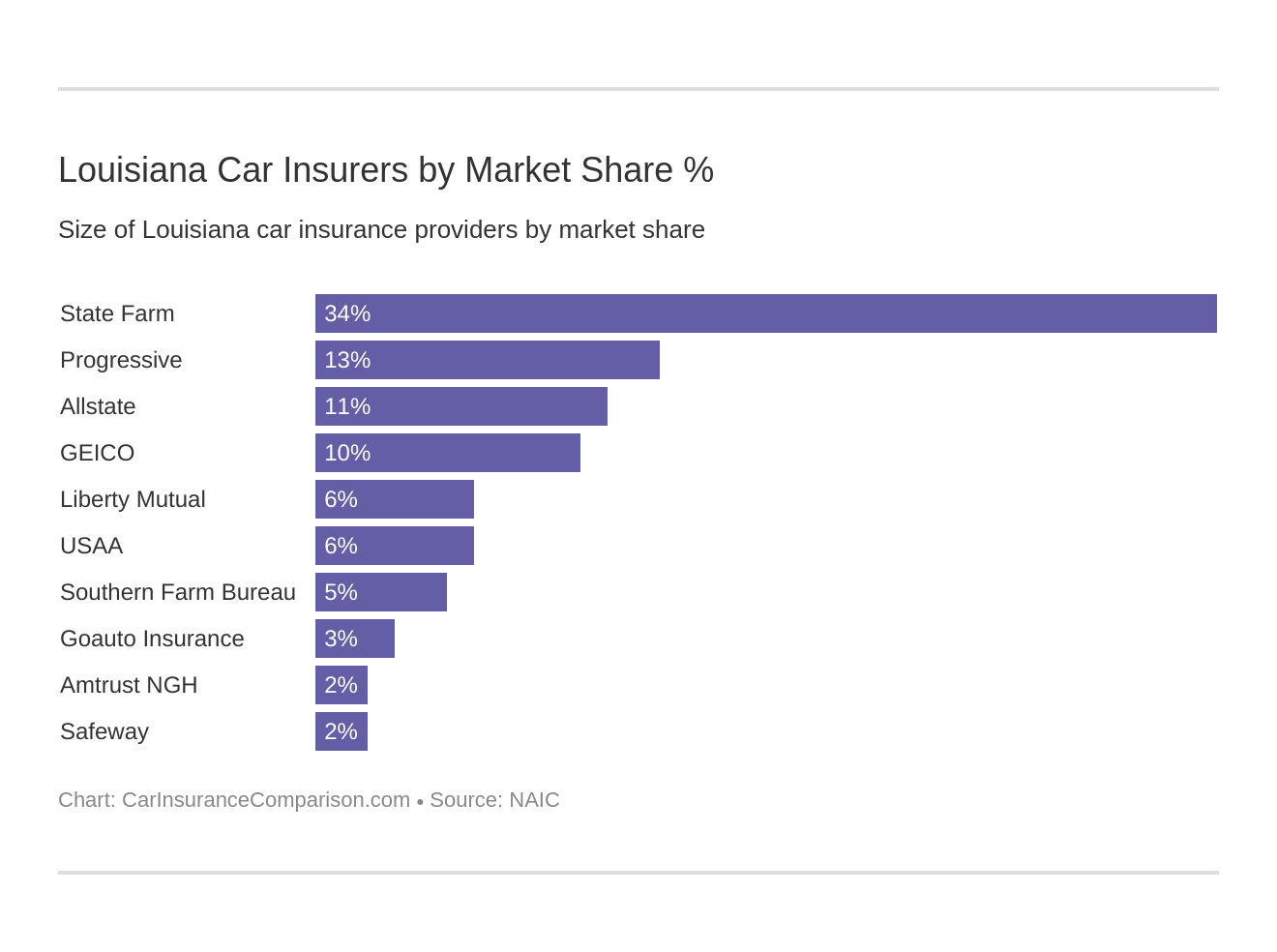

So many car insurance carriers compete for your business these days, that it can be hard to know which ones are the most reliable.

No need to worry, we’ve got you covered! Keep scrolling to find out who the 10 largest providers are across Louisiana.

Ready? Then allons-y!

The 10 Largest Louisiana Car Insurance Companies’ Financial Rating

AM Best gives insurance companies financial ratings. A good score means they are highly likely to stay solvent and have the ability to pay customer claims.

| Company | Financial Rating |

|---|---|

| State Farm Group | A++ |

| Progressive Group | A+ |

| Allstate Insurance Group | A+ |

| Geico | A++ |

| Liberty Mutual Group | A |

| USAA Group | A++ |

| Southern Farm Bureau Casualty Group | A+ |

| Goauto Insurance Co | Not Rated (NR) |

| Amtrust NGH Group | Not Rated (NR) |

| Safeway Insurance Group | A |

There are a lot of factors that go into picking the best Louisiana car insurance company. Customer praise and complaints should be two of those factors.

Car Insurance Companies with the Best Ratings

The company that receives the most praise, located in the state of Louisiana (on this list), is Geico.

Companies with Most Complaints in Louisiana

It is interesting to note that, according to this Gallup poll, Millenials are the “least likely” to be fully engaged with their auto insurance provider.

Regardless of age, it doesn’t necessarily equate to dissatisfaction. Most dissatisfaction has to do with the quality of service. According to a resident from Metairie, Louisiana, this resident was less than satisfied with his or her insurance:

“I had an accident in April, here it is August and they still haven’t paid my claim. UN-BE-FREAKIN-LIEVABLE. I saved 55 dollars a month” for this?”

| Company | Amount of Complaints (2017) |

|---|---|

| State Farm Group | 1,482 |

| Progressive Group | 120 |

| Allstate Insurance Group | 163 |

| Geico | 0 |

| Liberty Mutual Group | 222 |

| USAA Group | 296 |

| Southern Farm Bureau Casualty Group | $231,086 |

| Goauto Insurance Co | 25 |

| Amtrust NGH Group | 2 |

| Safeway Insurance Group | 30 |

Bear in mind, some complaints are based on general customer satisfaction, so factor that into your final decision.

If you happen to have a complaint, go to the Louisiana Department of Insurance and fill out their online forms.

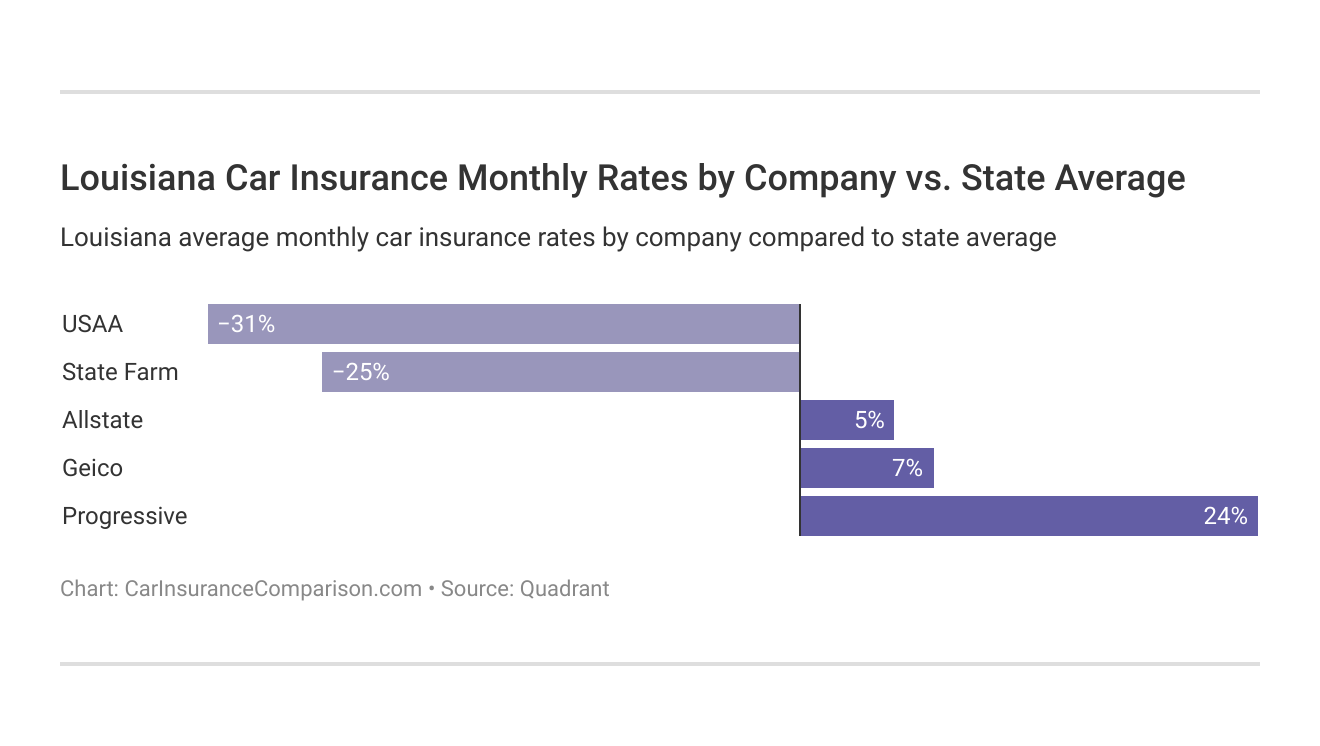

Best Car Insurance Rates by Company

| Company | Annual Average |

|---|---|

| Allstate P&C | $5,998.79 |

| Geico Cas | $6,154.60 |

| Progressive Security Ins. | $7,471.10 |

| State Farm Mutual Auto | $4,579.12 |

| USAA | $4,353.12 |

USAA is the least expensive in Louisiana when it comes to annual rates for car insurance. The most expensive company, annually, is Allstate. Read our Allstate car insurance review for more information.

Best Commute Rates in Louisiana

| Group | Commute (in miles) | Annual Mileage | Annual Average |

|---|---|---|---|

| Progressive | 10 | 6000 | $7,471.10 |

| Progressive | 25 | 12,000 | $7,471.10 |

| Geico | 25 | 12,000 | $6,274.40 |

| Geico | 10 | 6000 | $6,034.79 |

| Allstate | 10 | 6000 | $5,998.79 |

| Allstate | 25 | 12,000 | $5,998.79 |

| State Farm | 25 | 12,000 | $4,697.11 |

| USAA | 25 | 12,000 | $4,487.91 |

| State Farm | 10 | 6000 | $4,461.13 |

| USAA | 10 | 6000 | $4,218.32 |

It is interesting and of note that Progressive and Allstate offer the same annual rates, no matter the commute.

Commute times are not the only factors considered when increasing or decreasing rates.

Best Coverage Rates in Louisiana

| Group | Coverage Type | Annual Average |

|---|---|---|

| Progressive | High | $8,813.16 |

| Progressive | Medium | $7,406.27 |

| Geico | High | $7,200.21 |

| Allstate | High | $6,702.00 |

| Progressive | Low | $6,193.86 |

| Geico | Medium | $6,176.92 |

| Allstate | Medium | $6,109.21 |

| State Farm | High | $5,206.86 |

| Allstate | Low | $5,185.16 |

| Geico | Low | $5,086.66 |

| USAA | High | $4,862.64 |

| State Farm | Medium | $4,568.03 |

| USAA | Medium | $4,420.47 |

| State Farm | Low | $3,962.47 |

| USAA | Low | $3,776.25 |

Progressive is the most expensive when it comes to high coverage, and USAA is the least expensive when it comes to high coverage.

Best Credit History Rates in Louisiana

| Group | Credit History | Annual Average |

|---|---|---|

| Progressive | Poor | $8,444.80 |

| Allstate | Poor | $7,859.57 |

| Geico | Poor | $7,322.08 |

| Progressive | Fair | $7,236.85 |

| Progressive | Good | $6,731.64 |

| Geico | Fair | $6,353.32 |

| State Farm | Poor | $6,350.34 |

| USAA | Poor | $6,010.39 |

| Allstate | Fair | $5,410.52 |

| Geico | Good | $4,788.40 |

| Allstate | Good | $4,726.27 |

| State Farm | Fair | $4,086.69 |

| USAA | Fair | $3,841.14 |

| State Farm | Good | $3,300.33 |

| USAA | Good | $3,207.81 |

Having good credit pays off if you are a USAA or a State Farm customer, as they offer the best rates. Those with poor credit can still find good rates at USAA, though it is almost doubled from if you have good credit.

Best Driving Record Rates in Louisiana

| Group | Driving Record | Annual Average |

|---|---|---|

| Progressive | With 1 accident | $8,352.66 |

| Geico | With 1 DUI | $8,315.63 |

| Progressive | With 1 DUI | $8,027.23 |

| Progressive | With 1 speeding violation | $7,281.29 |

| Allstate | With 1 accident | $7,221.89 |

| Geico | With 1 accident | $6,755.09 |

| Allstate | With 1 DUI | $6,443.95 |

| Progressive | Clean record | $6,223.20 |

| Allstate | With 1 speeding violation | $5,575.49 |

| USAA | With 1 DUI | $5,514.32 |

| Geico | With 1 speeding violation | $5,367.48 |

| State Farm | With 1 accident | $4,961.27 |

| Allstate | Clean record | $4,753.81 |

| USAA | With 1 accident | $4,611.20 |

| State Farm | With 1 DUI | $4,579.12 |

| State Farm | With 1 speeding violation | $4,579.12 |

| State Farm | Clean record | $4,196.97 |

| Geico | Clean record | $4,180.19 |

| USAA | With 1 speeding violation | $3,965.32 |

| USAA | Clean record | $3,321.63 |

USAA has the best rates if you have a perfect and clean driving record.

Read more: What are the DUI insurance laws in Louisiana?

The 10 Largest Car Insurance Companies in Louisiana

| Company | Market Share |

|---|---|

| State Farm Group | 33.57% |

| Progressive Group | 13.37% |

| Allstate Insurance Group | 11.15% |

| Geico | 9.59% |

| Liberty Mutual Group | 5.63% |

| USAA Group | 5.52% |

| Southern Farm Bureau Casualty Group | 5.13% |

| Goauto Insurance Co | 3.21% |

| Amtrust NGH Group | 2.32% |

| Safeway Insurance Group | 1.62% |

Number of Car Insurance Providers in Louisiana

| Property and Casualty Insurance | Total Providers |

|---|---|

| Domestic | 14 |

| Foreign | 822 |

| Total | 836 |

And when it comes to domestic versus foreign insurers in Louisiana, there are 34 domestic insurers compared to 819 foreign insurers.

Laws in Louisiana

In order to keep your car insurance rates low, you have to know the laws in your state so you’re not blindsided by a fine.

Don’t worry! We’re here to help.

Keep reading to learn about the laws specific to the state of Louisiana.

Louisiana’s State Laws

Car insurance laws vary from state to state, and Louisiana is no different.

State laws for insurance are determined under Title 22, otherwise known as the Louisiana Insurance Code.

High-Risk Insurance

Drivers with a history of accidents or traffic violations may find themselves unable to purchase coverage from an auto insurance carrier. This is where a type of insurance known as high-risk insurance comes into play.

But, don’t fret.

The Louisiana Automobile Insurance Plan was created to provide automobile insurance coverage to eligible risks who seek coverage and are unable to obtain such coverage through the voluntary market.

Low-Cost Insurance

Louisiana does not have any special low-cost programs for people who don’t have insurance. It is up to you, as the consumer, to shop around for the lowest rate. You can’t afford to NOT have insurance!

Windshield Coverage

In terms of windshield coverage, Louisiana does not have any laws specific to this. Insurers may use non-OEM aftermarket parts if mentioned on the estimate. Also, it’s important to note that the maximum comprehensive deductible (what you can claim on this) is $250.

Automobile Insurance Fraud in Louisiana

The Louisiana Automobile Theft and Insurance Fraud Prevention Authority (LATIFPA) “combats motor theft, insurance fraud, and other criminal acts.”

Insurance fraud is a felony in the state of Louisiana.

In 2008, the Coalition Against Insurance Fraud estimated that insurance fraud costs Americans at least $80 billion annually, nearly $950 a year per family.

According to the Louisiana Department of Insurance, the penalty for insurance fraud, whether it’s hard (deliberate criminal acts) or soft (little white lies), is severe:

“A person convicted of insurance fraud can be sent to jail for up to five years, with or without hard labor, and/or fined up to five thousand dollars for each count of insurance fraud.”

Long story short: don’t do it.

Statute of Limitations

A statute of limitations is the limit on the amount of time you have to bring a lawsuit to court. Different states have different statutes of limitations for personal injury and property damage matters.

If you are ever in an auto accident involving extensive injuries and damages, you need to know your rights in the matter.

Louisiana CC 3492 states you have up to one year following an accident to file charges in court.

Louisiana’s Vehicle Licensing Laws

Now, we all know that you can’t drive a car without a license. Let’s find out what Louisiana’s mandatory vehicle licensing laws are.

Penalties for Driving Without Insurance

Louisiana has strict rules for driving without insurance. If you knowingly drive without insurance, you are subject to fines of $500 to $1,000. You’re also subject to having your driving privileges suspended and revoked for up to 180 days.

If you falsely claim to have insurance, your license can be revoked anywhere from 12-18 months.

With a law known as “No Pay, No Play”, you are prohibited from collecting the first $25,000 in property damages and the first $15,000 in personal injuries (regardless of who causes the accident) if you are uninsured.

Teen Driver Laws

Teens are at a higher risk of being involved in an auto accident and are up to 50 percent MORE likely to be in an accident in the first month of driving alone.

With teen drivers and licensing teen drivers, Louisiana takes the following precautions:

| Teen Driving Laws in Louisiana | Requirements #1 | Requirements #2 | Requirements #3 |

|---|---|---|---|

| To get a learners license you must: | Have a minimum age of 15 | - | - |

| Before getting a license or restricted license you must: | Have a mandatory holding period of 6 months | Have a minimum supervised driving time of 50 hours, 15 of which must be at night | Have a minimum age of 16 |

| Nighttime restrictions midnight-5 a.m. secondary enforcement | 11 p.m. - 5 a.m. | no more than one passenger younger than 21 between the hours of 6 pm-5 am | - |

Older Driver License Renewal Procedure

| License Renewal | Proof of vision required | Mail or online renewal permitted |

|---|---|---|

| Every 6 years | 70 years and older | No for 70 years and older |

New Residents

If you are about to make the move to Louisiana, here’s what you need to know:

- You need to register your out-of-state car with the OMV.

- You need to obtain a Louisiana driver’s license.

- You need to register to vote in your new county.

If you’re active duty military stationed in Louisiana, you may be exempt from these requirements.

Vehicle Negligent Injury

When it comes to Louisiana and their negligence laws:

Under R.S. 14:30.1 of Louisiana driving law, vehicle negligent injury is inflicting any injury by an operator of any motor vehicle, aircraft, water-craft, or other means of conveyance when the offender is under the influence of alcohol or drugs and/or the offender’s blood alcohol concentration is 0.10 percent or more. Penalties for violations of these Louisiana traffic laws include fines of not more than $1,000 or imprisonment for not more than six months, or both.

Louisiana’s Rules of the Road

Now, before you get out on the open road in the Pelican State, you need to know the rules so you can stay safe and keep your car insurance rates down.

Fault vs. No-Fault

The first thing to know is that Louisiana follows a traditional fault-based system when it comes to financial responsibility for losses stemming from a crash: that includes car accident injuries, lost income, vehicle damage, and so on.

Keep Right and Move Over Laws

Louisiana is one of the few states that does have Keep Right laws. According to RS 32:71, you must keep right except to pass. You also must move right if blocking overtaking traffic.

Maximum posted speed limits are 75 mph on rural interstates, 70 mph on urban interstates, 70 mph on limited access roads, and 65 mph on all other roads.

Car Seat and Cargo Area Laws

All children five years and younger or less than 60 pounds must be restrained in a child safety seat.

Violation of Louisiana’s child seat law may not only put the child in danger, but could result in a fine of $100.

Children 6 years old and up who weigh 60 pounds or more are allowed to sit in all seats with no preference for the rear seat.

Louisiana imposes restrictions on who can ride in pickup truck cargo areas. There are gaps in coverage if you are 12 years of age on a non-interstate highway; if you are in a parade moving less than 15 mph, or if there is an emergency that requires you to be in the cargo area.

Ridesharing

Rideshare services like Uber and Lyft mandate that all their drivers carry personal car insurance policies that align or exceed the minimum coverages dictated by state law. Drivers rarely carry their own commercial insurance coverage. There are a few options for drivers in Louisiana if they wish to carry rideshare insurance.

Automation on the Road

According to the Insurance Institute for Highway Safety (IIHS),

“Automation is the use of a machine or technology to perform a task or function that was previously carried out by a human. In driving, automation involves using radar, camera and other sensors to gather information about a vehicle’s surroundings, which is then used by computer programs to perform parts or all of the driving task on a sustained basis.”

Currently, Louisiana has no restrictions on autonomous vehicles.

Louisiana’s Safety Laws

But wait, there’s more! Let’s dig deeper into Louisiana’s safety laws to protect you on the open road.

DWI Laws

Louisaina’s laws for driving while intoxicated are just as strict in adjacent states.

| Type of Penalty | First Offense | Second Offense | Third Offense | Fourth and Subsequent Offenses |

|---|---|---|---|---|

| License suspension | One year Two years for high BAC | Two years Four years for high BAC | Three years | Vehicle seized |

| Fine | $300 - $1000 + $100 reinstatement fee | $750 - $1000 +$200 reinstatement fee | $2000 + $300 reinstatement fee | $5000 + $300 reinstatement fee |

| Jail time | 48 hours in jail + up to six months in jail OR fine; up to two years probation | At least 48 hours | One to five years with or without hard labor | 10-30 years, two years served w/o suspension or parole + home incarceration for at least one year |

| Other | 30 hours reeducation, 32+ hours community service, half must be street garbage pickup | possible 30 days community service +reeducation requirements of 1st DUI | 30 days community service, evaluation for addictive disorder, IID, probabation and home incarceration for any part of suspended sentence | 40 days community service |

Marijuana-Impaired Driving Laws

There are no marijuana-specific impaired driving laws in the state of Louisiana.

Distracted Driving Laws

In Louisiana, “192 people were killed from 2011 – 2015 because of some distraction either inside or outside the vehicle, and another 26,977 people were injured,” according to the Louisiana Highway Safety Commission. In an image from the LHSC, it says there are three types of distracted driving:

Louisiana has enacted legislation that bans texting for all drivers (which is a primary offense), hands-free usage in school zones, and no cell phone usage (including hands-free) for drivers under the age of 16.

Louisiana: Fascinating Facts You Need to Know

Do you want to know how safe it really is for drivers in Louisiana?

Well, the data our researchers found might surprise you.

Let’s take a look-see…

Vehicle Theft in Louisiana

Here are the top ten types of stolen cars in Louisiana:

| Vehicle | Year | Number of Thefts (2016) |

|---|---|---|

| Chevrolet Pickup (Full Size) | 2006 | 671 |

| Ford Pickup (Full Size) | 2006 | 584 |

| GMC Pickup (Full Size) | 2006 | 253 |

| Toyota Camry | 2007 | 224 |

| Dodge Pickup (Full Size) | 2003 | 222 |

| Nissan Altima | 2014 | 215 |

| Honda Accord | 2008 | 209 |

| Chevrolet Impala | 2008 | 177 |

| GMC Yukon | 2003 | 125 |

| Chevrolet Tahoe | 2007 | 114 |

Risky/Harmful Driving Behavior

The best way to stay safe while driving is to always keep your eyes on the road and stay aware of common risky driving issues in your state.

Let’s delve into this a bit further.

Traffic Fatalities

Only three cities in Louisiana topped the list for most traffic fatalities: New Orleans, Shreveport, and Baton Rouge. It makes sense, as they are the three biggest cities in Louisiana.

Traffic Fatalities by Person Type

| Person Type | Number of Fatalities |

|---|---|

| Traffic Fatalities | 760 |

| Passenger Vehicle Occupant Fatalities (All Seat Positions) | 488 |

| Motorcyclist Fatalities | 96 |

| Pedestrian Fatalities | 111 |

| Bicyclist and Other Cyclist Fatalities | 22 |

In rural areas, the number of traffic fatalities was lower than in urban areas (though not by much): 369 in rural areas versus 390 in urban areas.

Fatalities by Crash Type

| Crash Type | Number |

|---|---|

| Single Vehicle | 440 |

| Involving a Large Truck | 102 |

| Involving Speeding | 177 |

| Involving a Rollover | 204 |

| Involving a Roadway Departure | 421 |

| Involving an Intersection (or Intersection Related) | 141 |

Five-Year Trend for the Top 10 Counties

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| East Baton Rouge Parish | 41 | 50 | 43 | 52 | 65 |

| Orleans Parish | 53 | 50 | 50 | 55 | 44 |

| Calcasieu Parish | 24 | 24 | 36 | 47 | 38 |

| Caddo Parish | 29 | 40 | 36 | 27 | 36 |

| Tangipahoa Parish | 26 | 22 | 36 | 40 | 31 |

| St. Tammany Parish | 20 | 22 | 26 | 23 | 30 |

| Terrebonne Parish | 22 | 19 | 16 | 20 | 29 |

| Ascension Parish | 23 | 23 | 19 | 21 | 28 |

| Jefferson Parish | 22 | 24 | 26 | 34 | 28 |

| Ouachita Parish | 22 | 23 | 21 | 20 | 28 |

Fatalities Involving Speeding by County

| County | Fatalities |

|---|---|

| Acadia Parish | 2 |

| Allen Parish | 0 |

| Ascension Parish | 7 |

| Assumption Parish | 1 |

| Avoyelles Parish | 0 |

| Beauregard Parish | 0 |

| Bienville Parish | 0 |

| Bossier Parish | 4 |

| Caddo Parish | 9 |

| Calcasieu Parish | 6 |

| Caldwell Parish | 2 |

| Cameron Parish | 0 |

| Catahoula Parish | 0 |

| Claiborne Parish | 0 |

| Concordia Parish | 0 |

| De Soto Parish | 2 |

| East Baton Rouge Parish | 5 |

| East Carroll Parish | 0 |

| East Feliciana Parish | 4 |

| Evangeline Parish | 2 |

| Franklin Parish | 1 |

| Grant Parish | 1 |

| Iberia Parish | 2 |

| Iberville Parish | 1 |

| Jackson Parish | 0 |

| Jefferson Davis Parish | 1 |

| Jefferson Parish | 3 |

| La Salle Parish | 0 |

| Lafayette Parish | 5 |

| Lafourche Parish | 11 |

| Lincoln Parish | 2 |

| Livingston Parish | 8 |

| Madison Parish | 1 |

| Morehouse Parish | 0 |

| Natchitoches Parish | 0 |

| Orleans Parish | 7 |

| Ouachita Parish | 6 |

| Plaquemines Parish | 1 |

| Pointe Coupe Parish | 2 |

| Rapides Parish | 4 |

| Red River Parish | 2 |

| Richland Parish | 1 |

| Sabine Parish | 1 |

| St. Bernard Parish | 1 |

| St. Charles Parish | 4 |

| St. Helena Parish | 1 |

| St. James Parish | 0 |

| St. John the Baptist Parish | 1 |

| St. Landry Parish | 2 |

| St. Martin Parish | 7 |

| St. Mary Parish | 1 |

| St. Tammany Parish | 10 |

| Tangipahoa Parish | 14 |

| Tensas Parish | 0 |

| Terrebonne Parish | 11 |

| Union Parish | 0 |

| Vermilion Parish | 0 |

| Vernon Parish | 6 |

| Washington Parish | 4 |

| Webster Parish | 1 |

| West Baton Rouge Parish | 4 |

| West Carroll Parish | 1 |

| West Feliciana Parish | 0 |

| Winn Parish | 2 |

Fatalities in Crashes Involving an Alcohol-Impaired Driver by County

| County | Fatalities |

|---|---|

| Acadia Parish | 4 |

| Allen Parish | 0 |

| Ascension Parish | 7 |

| Assumption Parish | 0 |

| Avoyelles Parish | 3 |

| Beauregard Parish | 1 |

| Bienville Parish | 0 |

| Bossier Parish | 3 |

| Caddo Parish | 14 |

| Calcasieu Parish | 12 |

| Caldwell Parish | 1 |

| Cameron Parish | 1 |

| Catahoula Parish | 0 |

| Claiborne Parish | 0 |

| Concordia Parish | 0 |

| De Soto Parish | 1 |

| East Baton Rouge Parish | 19 |

| East Carroll Parish | 0 |

| East Feliciana Parish | 2 |

| Evangeline Parish | 3 |

| Franklin Parish | 2 |

| Grant Parish | 2 |

| Iberia Parish | 2 |

| Iberville Parish | 2 |

| Jackson Parish | 1 |

| Jefferson Davis Parish | 2 |

| Jefferson Parish | 6 |

| La Salle Parish | 1 |

| Lafayette Parish | 5 |

| Lafourche Parish | 5 |

| Lincoln Parish | 2 |

| Livingston Parish | 4 |

| Madison Parish | 1 |

| Morehouse Parish | 1 |

| Natchitoches Parish | 0 |

| Orleans Parish | 16 |

| Ouachita Parish | 8 |

| Plaquemines Parish | 1 |

| Pointe Parish | 3 |

| Rapides Parish | 2 |

| Red River Parish | 2 |

| Richland Parish | 1 |

| Sabine Parish | 2 |

| St. Bernard Parish | 0 |

| St. Charles Parish | 2 |

| St. Helena Parish | 6 |

| St. James Parish | 1 |

| St. John the Baptist Parish | 0 |

| St. Landry Parish | 7 |

| St. Martin Parish | 6 |

| St. Mary Parish | 3 |

| St. Tammany Parish | 6 |

| Tangipahoa Parish | 7 |

| Tensas Parish | 0 |

| Terrebonne Parish | 13 |

| Union Parish | 0 |

| Vermilion Parish | 2 |

| Vernon Parish | 3 |

| Washington Parish | 2 |

| Webster Parish | 3 |

| West Baton Rouge Parish | 5 |

| West Carroll Parish | 0 |

| West Feliciana Parish | 1 |

| Winn Parish | 0 |

Teen Drinking and Driving

| Teens and Drunk Driving | Info |

|---|---|

| Alcohol-Impaired Driving Fatalities Per one million people | 1.3 |

| Higher/Lower Than National Average (1.2) | Higher |

| DUI Arrests (Under 18 years old) | 32 |

| DUI Arrests (Under 18 years old) Total Per Million People | 28.73 |

EMS Response Time

| Time of Crash to Notification | Arrival | Arrival at Scene to Hospital | Time of Crash to Hospital | |

|---|---|---|---|---|

| Rural | 5 minutes | 14 minutes | 45 minutes | 1 hour, 3 minutes |

| Urban | 4 minutes | 8 minutes | 33 minutes | 35 minutes |

Both rural and urban areas in Louisiana have fast EMS Notification times. It is in all the other categories where they greatly differ.

Transportation

If you live in Louisiana, chances are you live in a two-car, or more, household, drive alone to work, and spend a hefty amount of your day commuting!

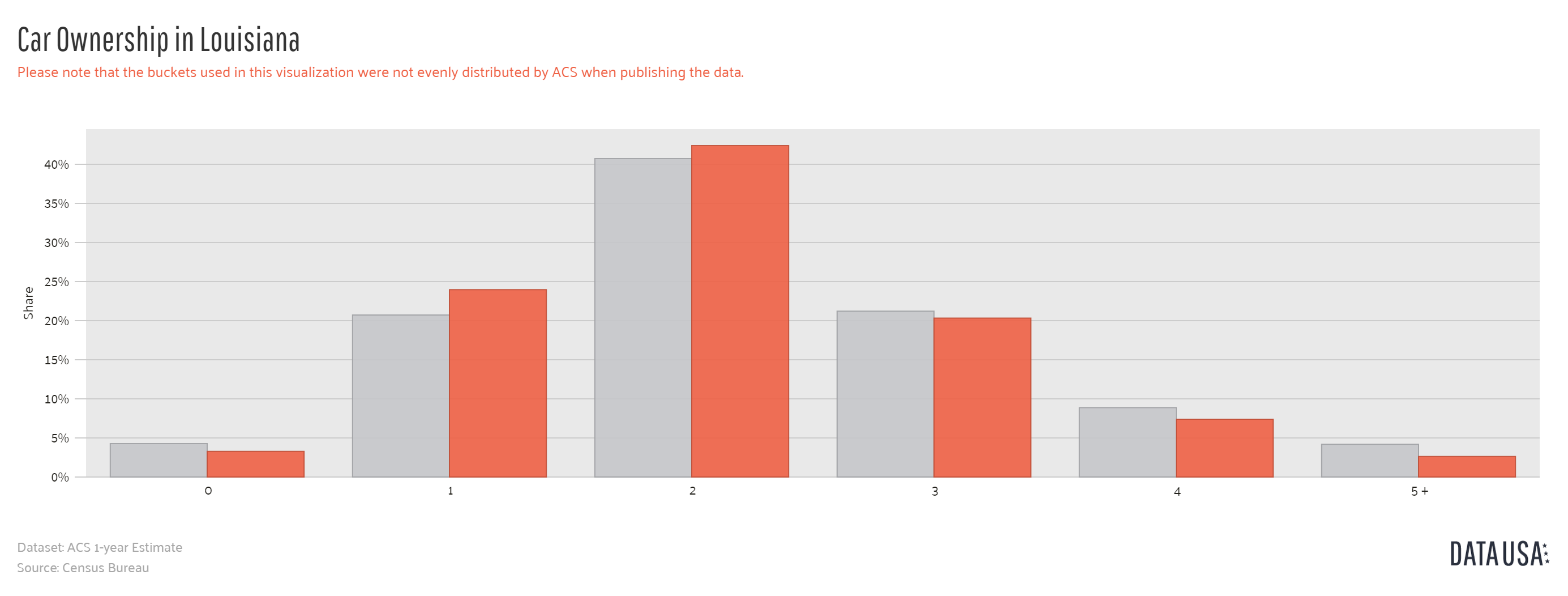

Car Ownership

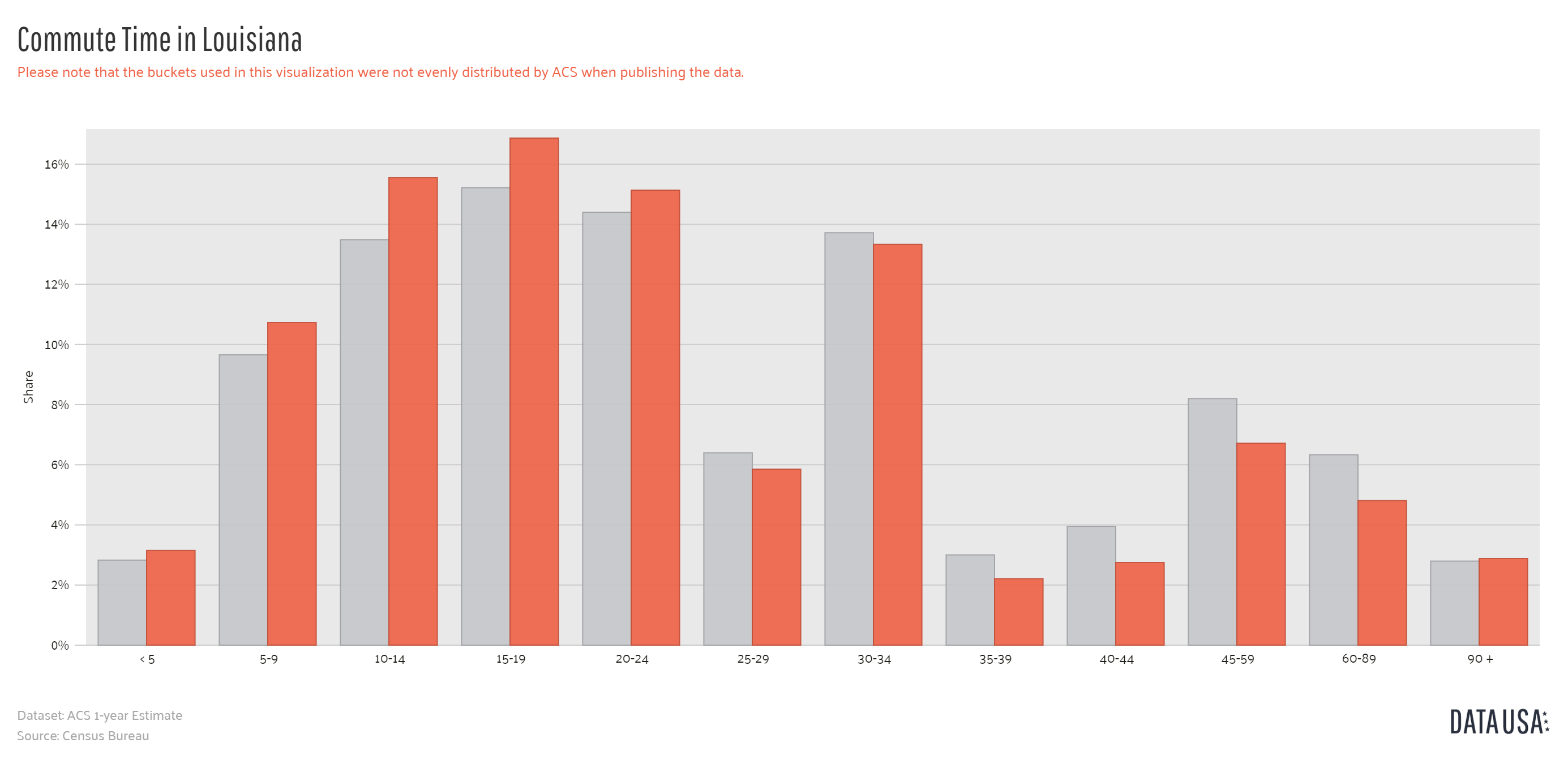

Commute Time

With an average commute time of 24.2 minutes, Louisiana ranks below the national average of 25.3 minutes, but not by much.

Some Louisiana residents–2.88 percent, to be exact–suffer through a “super commute” — spending in excess of 90 minutes in the car!

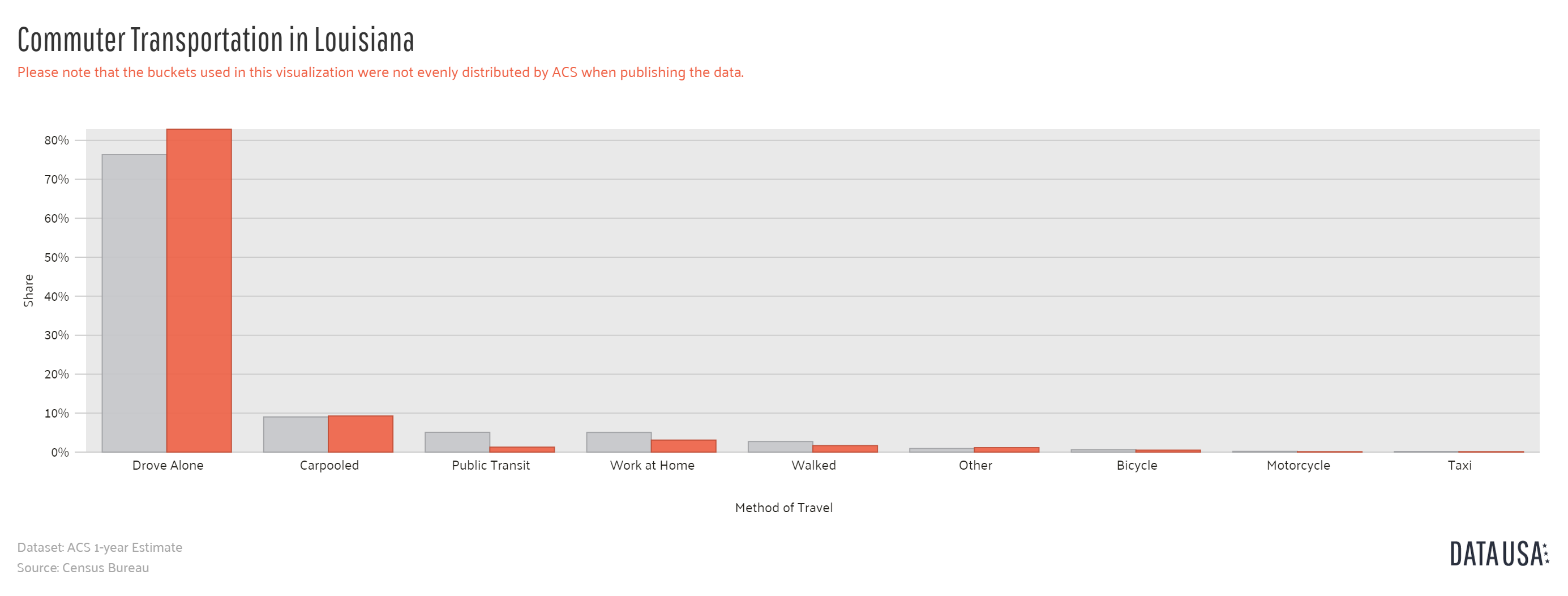

Commuter Transportation

Most people in Louisiana like to drive in to work alone, with carpooling the second most popular option.

Traffic Congestion

Is traffic a major problem in Louisiana?

According to the INRIX Scorecard, a traffic study that ranks cities globally in terms of worst traffic congestion, the only city to make it to the list is New Orleans, ranked at 137 in the world for worst traffic, and 73 hours lost in congestion. That is fewer hours lost in congestion than in 2017, where 156 hours were lost in congestion. However, the ranking for worst traffic went up five spots: 142 in 2017 versus 137 in 2018.

Au revoir. We hope this guide for Louisiana car insurance has helped you.

Don’t waste another minute while you wait. Start comparison shopping car insurance rates today.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What are the minimum car insurance requirements in Louisiana?

In Louisiana, the minimum car insurance requirements are as follows:

- $15,000 bodily injury liability per person

- $30,000 bodily injury liability per accident

- $25,000 property damage liability per accident

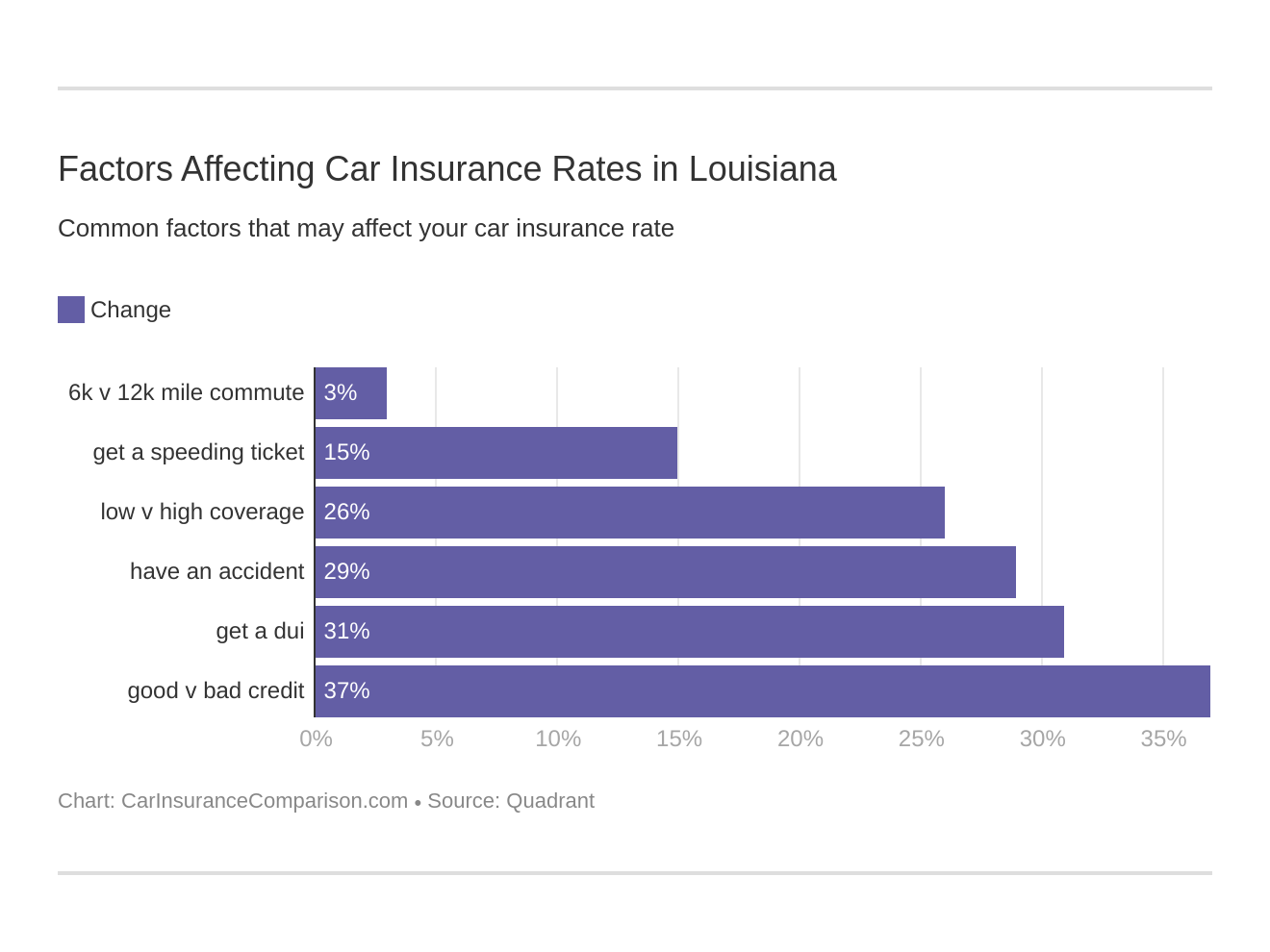

What factors can affect car insurance rates in Louisiana?

Several factors can impact car insurance rates in Louisiana, including:

- Driving Record: Your driving history and any past accidents or violations can affect your insurance premiums.

- Age and Gender: Younger drivers, particularly teenagers, tend to have higher insurance rates. Gender may also be a factor, as statistically, some groups may have a higher risk of accidents.

- Vehicle Type: The make, model, and year of your vehicle can influence insurance rates. Luxury cars or high-performance vehicles may have higher premiums.

- Location: Where you live in Louisiana can impact insurance rates. Areas with higher population density, crime rates, or traffic congestion may result in higher premiums.

- Credit History: Insurance companies in Louisiana may consider your credit history when determining rates, as there is a correlation between credit and the likelihood of filing claims.

- Coverage Options: The type and amount of coverage you choose will affect your premiums. Additional coverage options, such as comprehensive and collision coverage, will increase the cost.

What additional coverage options should I consider in Louisiana?

While the minimum required coverage provides basic protection, it’s recommended to consider additional coverage options for better financial security. Some recommended coverage options in Louisiana include:

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who has insufficient or no insurance.

- Comprehensive Coverage: This coverage helps cover damage to your vehicle caused by non-collision incidents, such as theft, vandalism, or severe weather.

- Collision Coverage: Collision coverage pays for damage to your vehicle in case of an accident, regardless of fault.

- Medical Payments Coverage: Medical payments coverage helps cover medical expenses for you and your passengers in the event of an accident, regardless of fault.

- Personal Injury Protection (PIP): PIP coverage provides broader medical coverage, including lost wages and other related expenses.

How can I find affordable car insurance in Louisiana?

To find affordable car insurance in Louisiana, consider the following:

- Shop Around: Obtain quotes from multiple insurance companies to compare rates and coverage options.

- Bundle Policies: Consider bundling your car insurance with other policies, such as homeowners or renters insurance, as it can lead to discounts.

- Maintain a Good Driving Record: Avoid accidents and traffic violations, as a clean driving record can help lower insurance premiums.

- Increase Deductibles: Opting for a higher deductible can lower your insurance premium, but remember to choose an amount you can comfortably afford to pay out of pocket.

- Ask About Discounts: Inquire about available discounts, such as multi-policy, safe driver, or good student discounts, that you may qualify for.

- Consider Usage-Based Insurance: Some insurance companies offer usage-based insurance programs where your premium is based on your driving habits. If you’re a safe driver, this could result in lower premiums.

What steps should I take after a car accident in Louisiana?

After a car accident in Louisiana, follow these steps:

- Check for Injuries: Ensure everyone involved in the accident is safe and call for medical assistance if needed.

- Report the Accident: Notify the police about the accident and file an accident report.

- Exchange Information: Exchange contact and insurance information with the other driver(s) involved in the accident.

- Document the Scene: Take photos of the accident scene, including damages to vehicles and any other relevant details.

- Notify Your Insurance Company: Report the accident to your insurance company as soon as possible and provide them with the necessary details.

- Seek Legal Advice if Necessary: If you’re unsure about your rights or if there are disputes, consider consulting an attorney who specializes in car accident cases.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.