Best Car Insurance for Doctors in 2026 (Top 10 Companies)

Get the best car insurance for doctors among The Hartford, USAA, and Progressive offering professional discounts of up to 15%. Discover how these industry leaders provide customized insurance options, taking into account factors such as credit scores, mileage, coverage levels, and driving histories.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Tracey L. Wells

Updated May 2024

Company Facts

Full Coverage for Doctors

A.M. Best Rating

Complaint Level

Company Facts

Full Coverage for Doctors

A.M. Best Rating

Complaint Level

Company Facts

Full Coverage for Doctors

A.M. Best Rating

Complaint Level

The last thing on a busy doctor’s or dentist’s mind is trying to find a great deal on car insurance.

Our Top 10 Company Picks: Best Car Insurance for Doctors

| Company | Rank | Professional Discount | Multi-Policy Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 12% | 20% | Tailored Coverage | The Hartford |

| #2 | 15% | 25% | Customer Service | USAA | |

| #3 | 10% | 15% | Comprehensive Coverage | Progressive | |

| #4 | 10% | 17% | Local Agents | State Farm | |

| #5 | 12% | 25% | Bundle Discounts | Allstate | |

| #6 | 15% | 20% | Vanishing Deductible | Nationwide |

| #7 | 10% | 15% | Specialized Coverage | Farmers | |

| #8 | 8% | 12% | 24/7 Support | Liberty Mutual |

| #9 | 10% | 15% | Multi-Policy Discounts | Travelers | |

| #10 | 10% | 15% | Safe-Driving Discounts | AAA |

How much is car insurance for a medical doctor or dentist? The average monthly cost for dentists and doctors car insurance is $106 across the best car insurance companies.

Read on to review pros and cons of getting car insurance as a doctor or dentist and find out what doctors and dentist should look for in a policy.

If you’re looking to compare car insurance rates for a doctor or dentist, just enter your ZIP code in the free box above and get great car insurance quotes from multiple insurers.

- The Hartford, USAA, and Progressive, are top companies for doctor and dentist

- Comparison of rates, coverage levels, and factors such as credit scores

- Malpractice insurance, coverage for medical equipment, and liability coverage

#1 – The Hartford: Top Overall Pick

Pros

- Tailored Coverage: The Hartford Offers customized plans specifically designed for doctors and dentists.

- Professional Discount: Up to 12% discount for medical professionals. Learn more about their discounts in our article called “The Hartford Car Insurance Discounts“.

- Balanced Rates: Provides a balanced monthly rate of $107 for full coverage.

Cons

- Higher Minimum Coverage: Minimum coverage is comparatively higher at $40 per month.

- Limited Accessibility: Not available to everyone; eligibility criteria may apply.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Customer Service

Pros

- Unmatched Rates: Stands out with unmatched rates at $56 for full coverage.

- Customer Service: Recognized for exceptional customer service.

- Exclusive Discounts: Up to 15% discount for professionals and up to 25% for multi-policy.

Cons

- Limited Eligibility: As mentioned in our USAA car insurance review, they are available only to military members, veterans, and their families.

- Membership Requirement: Requires USAA membership for insurance services.

#3 – Progressive: Best for Comprehensive Coverage

Pros

- Affordability: Competitive choice with a monthly rate of $100 for full coverage.

- Comprehensive Coverage: Offers comprehensive coverage options, learn more about what they offer in our Progressive car insurance review.

- Discounts: Up to 10% professional discount and up to 15% multi-policy discount.

Cons

- Moderate Full Coverage Rate: While competitive, the full coverage rate is higher than some.

- Customer Complaints: Reports of customer service-related complaints.

#4 – State Farm: Best for Local Agents

Pros

- Local Agents: Offers personalized service through a network of local agents as mentioned in our State Farm car insurance review.

- Multi-Policy Discount: Up to 17% discount for combining multiple policies.

- Strong Reputation: A well-established company with a positive reputation.

Cons

- Average Full Coverage Rate: Monthly full coverage rate of $82 is in the mid-range.

- Limited Specialization: May not offer specialized coverage for certain professions.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Allstate: Best for Bundle Discounts

Pros

- Bundle Discounts: Offers up to 25% discount for bundling multiple policies.

- Wide Range of Coverage: As outlined in our Allstate car insurance review, comprehensive coverage options available.

- Professional Discount: Up to 12% discount for professionals..

Cons

- Higher Full Coverage Rate: Monthly full coverage rate of $152 is relatively higher.

- Customer Complaints: Some reports of customer service-related complaints.

#6 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Offers up to 20% discount through vanishing deductible.

- Specialized Coverage: Provides specialized coverage options.

- Multi-Policy Discount: Up to 15% discount for combining multiple policies. More information is available in our Nationwide car insurance discounts.

Cons

- Moderate Minimum Coverage Rate: Minimum coverage rate is higher at $41 per month.

- Coverage Limitations: Some policies may have limitations on coverage.

#7 – Farmers: Best for Specialized Coverage

Pros

- Specialized Coverage: Offers specialized coverage for specific needs.

- Multi-Policy Discount: Up to 15% discount for combining multiple policies.

- Variety of Discounts: Provides various discounts for policyholders. Learn more in our Farmers car insurance review.

Cons

- Higher Minimum Coverage Rate: Minimum coverage rate is relatively higher at $50 per month.

- Coverage Restrictions: Some policies may have restrictions on coverage.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for 24/7 Support

Pros

- 24/7 support: Offers round-the-clock customer support.

- Multi-policy discount: Up to 12% discount for combining multiple policies.

- Variety of discounts: Provides various discounts for policyholders.

Cons

- Higher full coverage rate: Monthly full coverage rate of $165 is on the higher side.

- Customer complaints: As mentioned in our Liberty Mutual car insurance review, some reports of customer service-related complaints.

#9 – Travelers: Best for Multi-Policy Discounts

Pros

- Multi-Policy Discounts: Offers up to 15% discount for combining multiple policies.

- Financial Stability: Holds an A++ rating from A.M. best.

- Safe-Driving Discounts: Provides discounts for safe driving habits. Learn more about their discounts in our Travelers car insurance review.

Cons

- Moderate Full Coverage Rate: Monthly full coverage rate of $94 is in the mid-range.

- Limited Specialization: May not offer specialized coverage for certain professions.

#10 – AAA: Best for Safe-Driving Discounts

Pros

- Safe-Driving Discounts: Offers discounts for safe driving habits.

- Multi-Policy Discounts: Up to 15% discount for combining multiple policies.

- Safe-Driver Rewards: Rewards safe driving with additional discounts.

Cons

- Limited Availability: May not be available in all locations.

- Membership Requirement: AAA car insurance Requires membership for insurance services.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

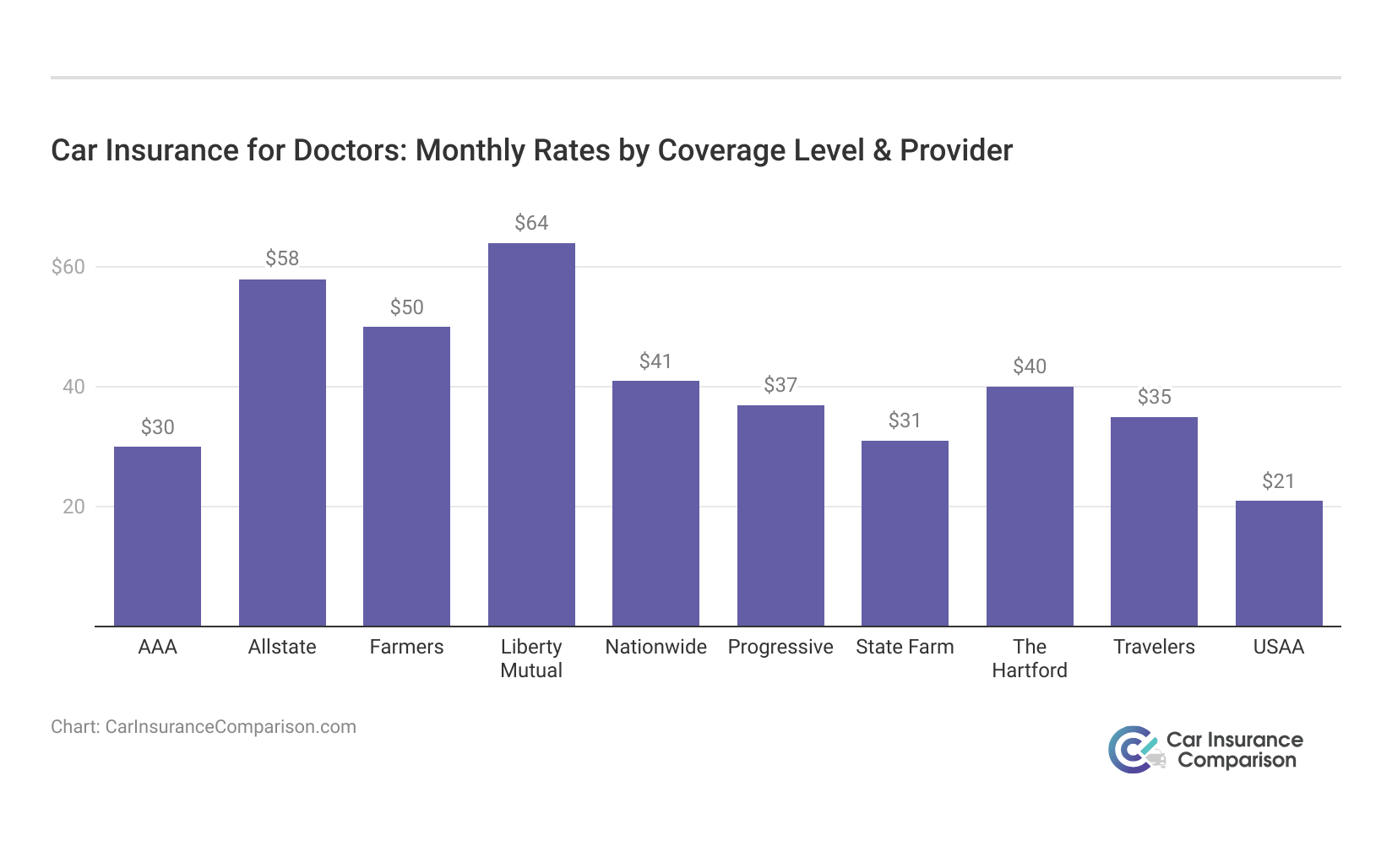

Comparing Average Monthly Rates for Doctors & Dentists With Top 10 Car Insurance Companies

When it comes to securing car insurance for doctors and dentists, finding the right coverage at an affordable rate is crucial. We’ve compiled a detailed comparison of average monthly rates from the best car insurance companies to help you make an informed decision tailored to your profession.

Car Insurance for Doctors: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $30 | $81 |

| Allstate | $58 | $152 |

| Farmers | $50 | $131 |

| The Hartford | $40 | $107 |

| Liberty Mutual | $64 | $165 |

| Nationwide | $41 | $109 |

| Progressive | $37 | $100 |

| State Farm | $31 | $82 |

| Travelers | $35 | $94 |

| USAA | $21 | $56 |

Standout options include The Hartford, offering a balanced $107 for full coverage and $40 for minimum coverage. USAA follows with unmatched rates at $56 for full and $21 for minimum coverage, known for exceptional service.

Progressive is a competitive choice, providing affordability at $100 for full coverage and $37 for minimum coverage. Consider The Hartford’s balance, USAA’s exclusivity, and Progressive’s affordability to tailor your choice to your preferences and budget as a medical professional.

Medical Doctor and Dentist Car Insurance

If you’re wondering how your job affects car insurance, you’re not alone. The car insurance industry is especially interested in the driving habits of those in a variety of occupations. They use information gathered from conducting independent research to adjust car insurance rates and set occupation based rates.

Do doctors pay more on average for car insurance?

Medical doctors and dentists have an annual average car insurance rate that is slightly higher than those in other types of occupations.

The main reason that medical doctors and dentists have a slightly higher car insurance rate is because of the income bracket they fall into. A higher income bracket often means more expensive cars such as sports cars, or luxury cars.

How much more on average do doctors and dentists pay?

The table below shows sample quotes for car insurance for medical professionals and rates for physician insurance.

Car Insurance Monthly Rates for Health Care Workers by Profession & Coverage Level

| Health Care Occupation | Minimum Coverage | Full Coverage |

|---|---|---|

| Dentist | $70 | $155 |

| Orthodontist | $75 | $160 |

| Psychiatrist | $65 | $140 |

| Surgeon | $80 | $170 |

Even though the rates for dentists and doctors car insurance may be elevated, the percentage of their income that goes toward coverage is much lower. You can see in the table below examples of that with the average physician salary for each state stacked against the average car insurance rates.

Read More: Compare Healthcare Worker Car Insurance Rates

Car Insurance for Doctors: Monthly Rates by State as a Percent of Income

| States | Annual Salary | Monthly Rates | Rate as a Percent of Income |

|---|---|---|---|

| Alabama | $9,456 | $285 | 3.02% |

| Alaska | $10,783 | $297 | 2.76% |

| Arizona | $10,150 | $344 | 3.39% |

| Arkansas | $9,513 | $314 | 3.30% |

| California | $10,613 | $307 | 2.90% |

| Colorado | $10,126 | $323 | 3.19% |

| Connecticut | $10,851 | $385 | 3.55% |

| Delaware | $10,136 | $499 | 4.92% |

| Florida | $9,114 | $390 | 4.28% |

| Georgia | $9,663 | $414 | 4.28% |

| Hawaii | $11,267 | $213 | 1.89% |

| Idaho | $10,783 | $248 | 2.30% |

| Illinois | $9,457 | $248 | 2.63% |

| Indiana | $9,946 | $275 | 2.77% |

| Iowa | $9,762 | $285 | 2.92% |

| Kansas | $9,904 | $273 | 2.76% |

| Kentucky | $10,322 | $433 | 4.19% |

| Louisiana | $9,873 | $476 | 4.82% |

| Maine | $9,864 | $246 | 2.49% |

| Maryland | $10,863 | $382 | 3.52% |

| Massachusetts | $11,718 | $223 | 1.91% |

| Michigan | $9,472 | $875 | 9.24% |

| Minnesota | $10,173 | $367 | 3.61% |

| Mississippi | $9,339 | $277 | 2.97% |

| Missouri | $9,333 | $305 | 3.27% |

| Montana | $10,783 | $268 | 2.49% |

| Nebraska | $10,694 | $283 | 2.64% |

| Nevada | $10,783 | $347 | 3.22% |

| New Hampshire | $11,402 | $274 | 2.40% |

| New Jersey | $10,295 | $263 | 2.55% |

| New Mexico | $9,533 | $460 | 4.82% |

| New York | $11,833 | $289 | 2.44% |

| North Carolina | $8,693 | $405 | 4.66% |

| North Dakota | $10,783 | $358 | 3.32% |

| Ohio | $10,080 | $226 | 2.24% |

| Oklahoma | $9,934 | $345 | 3.47% |

| Oregon | $10,124 | $289 | 2.85% |

| Pennsylvania | $10,229 | $336 | 3.29% |

| Rhode Island | $10,653 | $417 | 3.91% |

| South Carolina | $10,185 | $315 | 3.09% |

| South Dakota | $10,317 | $332 | 3.22% |

| Tennessee | $10,139 | $305 | 3.01% |

| Texas | $9,544 | $337 | 3.53% |

| Utah | $9,998 | $301 | 3.01% |

| Vermont | $10,688 | $197 | 1.84% |

| Virginia | $10,553 | $270 | 2.55% |

| Washington D.C. | $11,640 | $255 | 2.19% |

| West Virginia | $10,300 | $216 | 2.10% |

| Wisconsin | $10,046 | $301 | 2.99% |

| Wyoming | $10,783 | $267 | 2.47% |

The Bureau of Labor Statistics reports that the average physician wage is $203,450 and the average dentist salary is $178,260. But, there’s so much variety within the medical field that you could end up making much less or far greater. Higher salaries generally mean more expensive cars, but if you have an older vehicle that percentage will be much lower.

The Hartford stands out as the top choice for doctors and dentists, offering tailored coverage, a professional discount of up to 12%, and a balanced approach with rates starting at $107 for full coverage and $40 for minimum coverage.

Brad Larson Licensed Insurance Agent

Car insurance is required for all drivers in every state. Some individuals are not interested in searching around for a good deal while others want to save money however they can. Shopping around and comparing rates is one of the best ways to save money on car insurance rates.

Read more: Compare Social Worker Car Insurance Rates

How Your Commute Affects Car Insurance Rates

Whether you work in a hospital or a private practice, the distance you drive will affect your rates. Though it’s by no means the biggest factor in determining your rates, a long commute will add a few percentage points to how much you pay versus if you live close to work.

Car Insurance Monthly Rates by Commute & Provider

| Insurance Company | 10-Mile Commute | 25-Mile Commute |

|---|---|---|

| Allstate | $34 | $34 |

| American Family | $24 | $24 |

| Farmers | $29 | $29 |

| Geico | $22 | $23 |

| Liberty Mutual | $42 | $43 |

| Nationwide | $24 | $24 |

| Progressive | $28 | $28 |

| State Farm | $22 | $23 |

| Travelers | $31 | $31 |

| USAA | $17 | $18 |

Commute length may not be the biggest factor, but it does make a dent. The two biggest factors that determine how much you’ll pay are: credit score and driving record.

Read more: How much does mileage affect car insurance rates?

How Your Credit Score Affects Car Insurance Rates

Dentists and doctors tend to be more responsible and driven than some other occupations. That usually translates to a higher credit score, and that’s also good news for your car insurance rates.

See the table below to see how a poor credit score compares to a good one.

Car Insurance Monthly Rates by Credit Score & Provider

| Insurance Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| Allstate | $322 | $382 | $541 |

| American Family | $224 | $264 | $372 |

| Farmers | $306 | $325 | $405 |

| Geico | $203 | $249 | $355 |

| Liberty Mutual | $366 | $467 | $734 |

| Nationwide | $244 | $271 | $340 |

| Progressive | $302 | $330 | $395 |

| State Farm | $181 | $238 | $413 |

| Travelers | $338 | $362 | $430 |

| USAA | $152 | $185 | $308 |

Experian reports that the average credit score in the U.S. is 703, and most dentists and doctors are higher than that. That can’t be applied to everyone but after years of credit history with student loans, it’s true for a lot of practitioners.

Read more: Good Credit Car Insurance Discounts

How Your Driving Record Affects Car Insurance Rates

This is the biggest one. If you have an at-fault accident, speeding ticket, or DUI, your rates could more than double. Check out the table below for some examples from the major insurers.

Car Insurance Monthly Rates by Driving Record & Provider

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Allstate | $160 | $225 | $270 | $188 |

| American Family | $117 | $176 | $194 | $136 |

| Farmers | $139 | $198 | $193 | $173 |

| Geico | $80 | $132 | $216 | $106 |

| Liberty Mutual | $174 | $234 | $313 | $212 |

| Nationwide | $115 | $161 | $237 | $137 |

| Progressive | $105 | $186 | $140 | $140 |

| State Farm | $86 | $102 | $112 | $96 |

| Travelers | $99 | $139 | $206 | $134 |

| USAA | $59 | $78 | $108 | $67 |

These can raise your rates excessively. Learn more by reading our article titled “Do all car insurance companies check your driving records?“.

A Typical Schedule for a Medical Doctor

Becoming a medical doctor takes years of dedication, hard work, and education. Once someone officially becomes a doctor, he has the ability to have a slightly more regulated schedule, although some irregularity is expected when on call.

Medical doctors have different schedules depending on whether they work at a hospital, have their own practice, or work at a private practice. Most doctors who work at a private practice start their day early with patients who have scheduled appointments. They will diagnose, treat, and run tests for patients throughout the day.

Sometime during the day, they will have to review charts and make treatment plans for ill patients. If they have patients who have been admitted to the hospital, they will have check with the hospital regarding their admitted patients.

Returning phone calls and meeting with pharmaceutical reps is also part of the weekly routine of private practice doctors.

Hospital physicians may work a variety of hours and shifts depending on what department they work in at the hospital. When their shift begins, they have to check on patients which is called doing rounds. They will also check charts, discuss issues with patients, and call for any additional testing or medication that is necessary.

They are also responsible for deciding when patients need to be admitted and discharged.

Read more: How Occupation Affects Car Insurance Rates

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

A Typical Schedule for a Dentist

Becoming a dentist is just as demanding as becoming a medical doctor. Study.com notes that you must earn a bachelor’s degree. Then, you have the option of a Doctor of Dental Surgery (DDS) or Doctor of Medicine in Dentistry/Doctor of Dental Medicine (DMD) degree.

There is undergraduate work, post-graduate work, and doctoral work that needs to be done. There are also internship requirements, practicums, and state licensing requirements that have to be fulfilled.

Read more: Compare Healthcare Worker Car Insurance Rates

A dentist can maintain a pretty regulated schedule once a client base is established. Most dentists work at a private practice, although oral surgeons have a connection to a specific hospital where they can be on call to perform surgery.

Dentists can choose to specialize in pediatrics, geriatrics, or other specifics fields of study.

Routine cleanings are done by a dental hygienist that works for a dentist. However, a dentist has to do all work and recommend treatment plans for those who have dental problems that need to be addressed. When working with older individuals, dentists often have to build bridges, partials, dentures, and other dental apparatus.

Case Studies: Doctor & Dentist – Tailored Car Insurance Solutions for Medical Professionals

Medical professionals, with their demanding schedules and unique needs, require car insurance solutions that provide both comprehensive coverage and tailored benefits. Through three compelling case studies, we delve into how doctors and dentists find the perfect balance between work and personal life with car insurance solutions designed specifically for them.

- Case Study #1 – Tailoring Coverage for a Busy Doctor: Dr. Emily Sanchez, a dedicated medical professional, juggles a hectic schedule attending to patients and making rounds at the hospital. Faced with the challenge of finding a balance between work and personal life, Dr. Sanchez needed a car insurance solution that understood her unique needs.

- Case Study #2 – Unmatched Rates and Service for a Military Dentist: Major James Anderson, a dentist serving in the military, required car insurance that not only provided unmatched rates but also catered to his specific requirements. USAA proved to be the perfect fit, offering Major Anderson a monthly rate of $62.75 for good drivers and additional benefits exclusive to military members.

- Case Study #3 – Affordable Comprehensive Coverage for Dr. Sarah Reynolds: Dr. Sarah Reynolds, a young dentist building her career, sought comprehensive yet affordable car insurance. Progressive stood out as a competitive choice, providing affordability with a monthly rate of $109.17 for good drivers. Dr. Reynolds appreciated the balance of comprehensive coverage options and discounts, including a 10% professional discount and a 15% multi-policy discount. Learn more in our Progressive car insurance review.

Through the experiences of Dr. Emily Sanchez, Major James Anderson, and Dr. Sarah Reynolds, we see how insurers like USAA and Progressive provide unmatched rates, comprehensive coverage, and exclusive benefits designed specifically for doctors and dentists.

Need the cheapest car insurance possible? Enter your ZIP code below into our free comparison tool to find the most affordable rates for your vehicle.

Frequently Asked Questions

Do doctors and dentists qualify for specialized car insurance?

Yes, many insurance companies offer specialized car insurance tailored for doctors and dentists. These policies often come with professional discounts and customized coverage options to address the unique needs of medical professionals.

Read more: Best Car Insurance by Occupation

Do insurance companies provide discounts for medical professionals?

Yes, many insurance companies offer discounts specifically for medical professionals. These discounts can include professional discounts, safe-driving rewards, and multi-policy discounts, providing cost-effective solutions for doctors and dentists.

How can doctors and dentists save on car insurance rates?

Medical professionals can save on car insurance rates by exploring discounts, maintaining a good credit score, and having a clean driving record. Shopping around and comparing rates from different insurers is also an effective way to find the most competitive premiums.

Can insurance rates be affected by the type of practice (private, hospital, etc.)?

Yes, the type of practice can impact insurance rates. Doctors and dentists working in different settings may have varied commuting patterns and vehicle usage, influencing their insurance premiums. It’s essential to discuss these details with insurers for accurate coverage.

Avoid overpaying for your car insurance by entering your ZIP code below in our free comparison tool to find which company has the lowest rates.

Are there specific car insurance options for doctors and dentists with a busy schedule?

Yes, insurance companies like The Hartford recognize the challenges of a busy schedule for medical professionals. They provide customizable plans and discounts, acknowledging the unique needs of doctors and dentists who require flexibility and comprehensive coverage.

Are there specific coverage options tailored for doctors and dentists with busy schedules?

Yes, insurance companies like The Hartford recognize the challenges of a hectic schedule for medical professionals. They offer customizable plans and discounts, acknowledging the unique needs of doctors and dentists who require flexibility and comprehensive coverage. Learn about The Hartford’s discounts in our The Hartford car insurance discounts article.

Can insurance rates be affected by the type of practice (private, hospital, etc.)?

Yes, the type of practice can impact insurance rates. Doctors and dentists working in different settings may have varied commuting patterns and vehicle usage, influencing their insurance premiums. It’s essential to discuss these details with insurers for accurate coverage.

Do doctors and dentists qualify for specialized car insurance?

Yes, many insurance companies offer specialized car insurance tailored for doctors and dentists. These policies often come with professional discounts and customized coverage options to address the unique needs of medical professionals.

Do insurance companies provide discounts for medical professionals?

Yes, many insurance companies offer discounts specifically for medical professionals. These discounts can include professional discounts, safe-driving rewards, and multi-policy discounts, providing cost-effective solutions for doctors and dentists.

Learn more by reading our article titled “Occupation Car Insurance Discounts“.

How can doctors and dentists save on car insurance rates?

Medical professionals can save on car insurance rates by exploring discounts, maintaining a good credit score, and having a clean driving record. Shopping around and comparing rates from different insurers is also an effective way to find the most competitive premiums.

When you’re ready to see how much you can save on your car insurance, enter your ZIP code below into our free comparison tool.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.