How do you get a mercury car insurance quote online?

Follow these 11 steps to get a Mercury car insurance quote from their website, or enter your ZIP code into our free tool below to get multiple car insurance quotes for free. Mercury car insurance quotes can include a variety of discounts and most will automatically be applied to your quote.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Certified Financial Planner

Joel Ohman is the CEO of a private equity backed digital media company. He is a CERTIFIED FINANCIAL PLANNER™, author, angel investor, and serial entrepreneur who loves creating new things, whether books or businesses. He has also previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He has an MBA from the University of South Florida. Joel...

Joel Ohman

Updated February 2024

- Mercury Insurance offers auto insurance in select states

- There are a variety of discounts at Mercury that can help you save, and most will be automatically applied to your quote

- If your state isn’t covered, Mercury will redirect you to EverQuote to match you with local agents and insurance providers near you

Mercury Insurance is one of the many car insurance companies out there drivers can choose from. There are a lot of things to consider besides just price when you’re looking for a new policy.

Read more: Compare Mercury Car Insurance Rates

The company counts as much as its insurance coverages. You want to feel valued as a client and be able to trust the people behind your policy.

Reading reviews online, checking out customer reviews and testimonials, and looking for ratings through agencies like the Better Business Bureau and A.M. Best are all great ways to gauge whether or not a company is trustworthy.

Getting a Mercury Car Insurance Quote Online

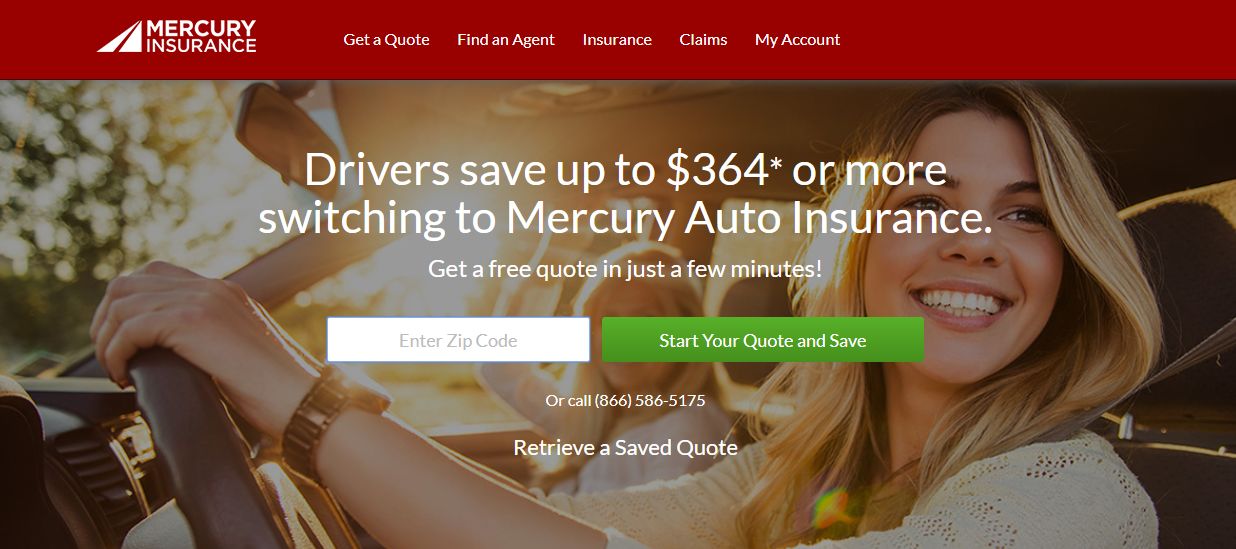

Mercury Insurance offers free auto insurance policy quotes online on their site, which you can complete in under 10 minutes. If you want to save time shopping and get more rates in one place, enter your zip code below to compare free quotes using our secure, fast system!

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Step #1 – Check if Your State is Covered

Mercury offers auto insurance, home, condo, renters, umbrella coverage, and more, but availability varies by state.

Step #2 – Enter Your Zip Code to Get Started

You’ll be redirected to EverQuote, a Mercury partner, and be able to get quotes from agencies that offer insurance in your area.

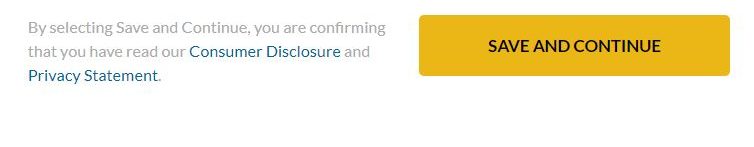

Step #3 – Read the Privacy Statement

Understand how the company will use your information, what third parties may access that information and how it will be used.

You should never provide your personal information to any company online that does not have a privacy policy and ensures your identity will be protected.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

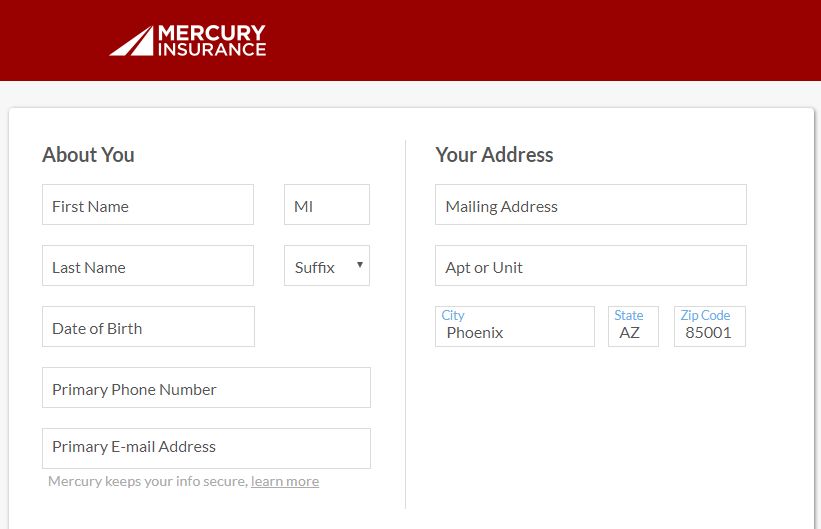

Step #4 –Enter Your Information

If you agree to let Mercury access your information and use it to get an insurance rate with a personalized quote, start by providing your name, date of birth, contact details, and residential address.

Read More: What information do you need for a car insurance quote?

Step #5 – Save Your Quote (And Get Help if Needed)

If you have any questions, you can use the number on the right side of the screen to call Mercury directly. You should also take note of your unique quote ID, which can be used to resume the quote request process if you need to step away at any point.

Your progress is automatically saved every time you advance to a new step.

Step #6 – Choose Existing Car

Mercury will present you with vehicles it’s able to find registered to your address. If any of them are correct, hit “Add to Quote”. If you want to add additional cars or none of the suggestions match yours, then simply click “Add a Vehicle” to begin adding details.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

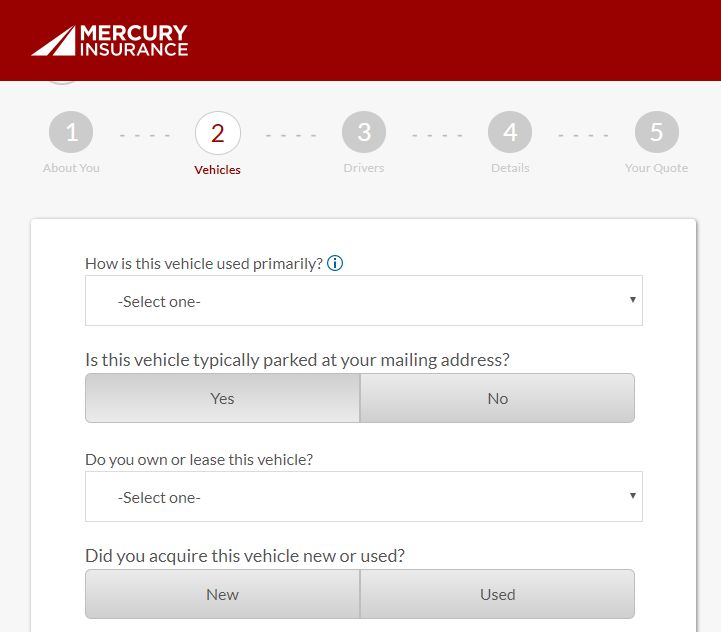

Step #7 – Add Cars On Your Own

You can add your car’s information manually or have it automatically inputted by providing its VIN.

The drop-down menus make it easy to fill out the information manually, so you won’t have to remember your car’s body type off the top of your head.

Step #7 – Add Drivers

You’ll need to provide details on your license status, marital status, living situation, and gender. These small details are all calculated into Mercury’s algorithm to customize your premium estimate.

You will be asked questions related to SR-22 insurance and your driving record.

You can add additional drivers to your policy here, but you will need to know the answers to the same questions you were asked, so make sure you have all of their information on-hand.

Step #8 – Qualify for Discounts

Some of their auto insurance discounts include:

- having Anti-theft devices

- a Multi-car discount

- a good driver discount

There are also discounts for those who have homeowners insurance with the insurance company. Discounts can be applied for bundling both car and home insurance; as well as discounts for your home if you qualify. Making sure you qualify for these discounts can really reduce your insurance premiums.

You may qualify for additional car insurance discounts depending on your job. You can use the menus provided on the “Drivers” portion of the application to find your title or the position that most closely matches it.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

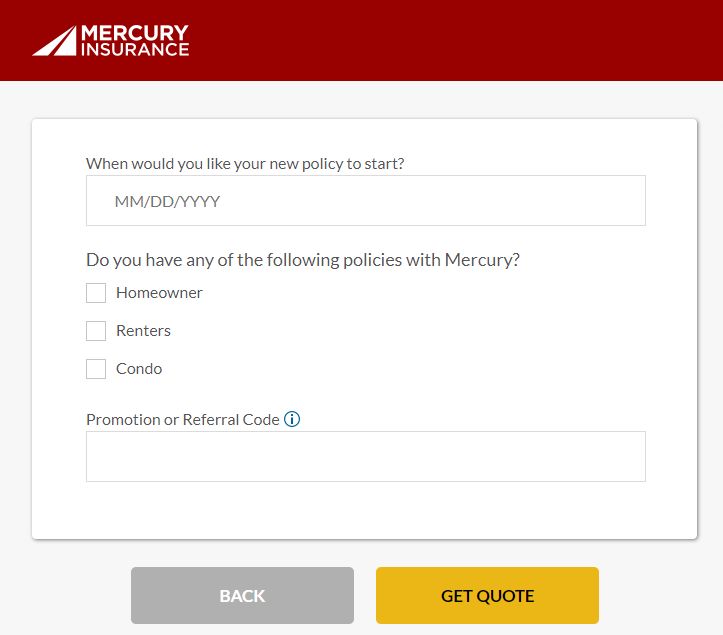

Step #9 – Add Final Details

If you received a promotion or referral code, you will be able to enter it at this stage of the application.

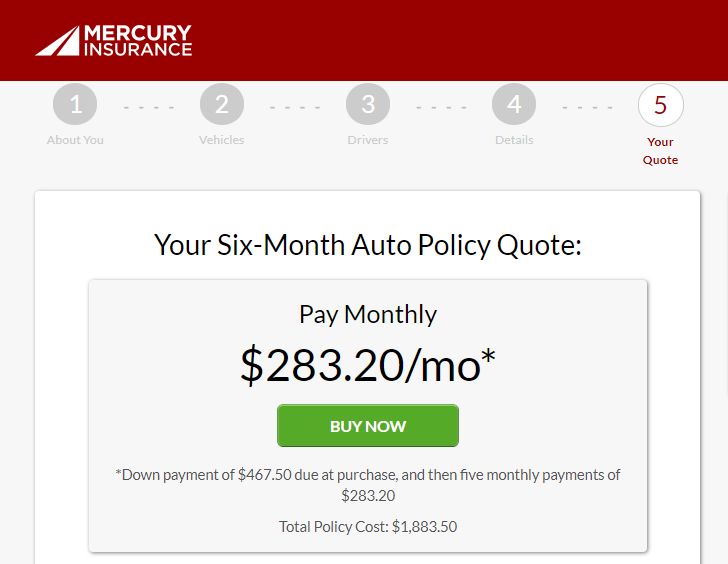

Step #10 – Review Your Quote

Step #11 – Choose a Plan

Scroll down to review the coverage limits and car insurance products included in your estimate.

You can adjust the limits to change the price of your quote.

Any additional details will have to be made by speaking to an agent. We recommend saving your quote from Mercury and comparing it to others before making a final choice.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Save Before You Buy a Car Insurance Policy

Many people feel like they don’t have any choices when it comes to car insurance. While it is required by law, there is freedom to search and discover the right company for you and your needs.

A tight budget might mean less coverage, but limited funds don’t have to equal poor coverage.

Enter your zip code below and provide us with some details about who you are and what you’re looking for. We’ll match you with free auto insurance quotes from multiple providers that you can compare and use to find the perfect match.

Case Studies: Getting Mercury Car Insurance Quotes Online

Case Study 1: Saving With Bundled Coverage

Sarah, a homeowner in California, wanted to find the best car insurance coverage at an affordable price. She decided to get a car insurance quote from Mercury Insurance online. By bundling her home insurance policy with her car insurance policy, she qualified for a discount and was able to save significantly on her premiums.

Case Study 2: Customizing Coverage Options

John, a young driver in Florida, was looking for car insurance that suited his specific needs. He used Mercury Insurance’s online quote tool to customize his coverage options and limits. By selecting the coverage types he needed and adjusting the limits to his desired level of protection, he was able to find a policy that provided adequate coverage at a competitive price.

Case Study 3: Exploring Discount Opportunities

Emily, a married driver in Texas, wanted to explore discount opportunities to lower her car insurance premiums. She obtained a car insurance quote from Mercury Insurance online and discovered various driver discounts available. By qualifying for discounts based on her occupation and bundling her car and home insurance, she significantly reduced her insurance costs.

Case Study 4: Convenience and Ease of Use

Mark, a busy professional in New York, valued convenience and efficiency when it came to getting a car insurance quote. He chose to use Mercury Insurance’s online quote tool, which allowed him to complete the process in under 10 minutes. Using Mercury’s secure he obtained multiple quotes from top companies, his comparison and selection process.

Frequently Asked Questions

How can I obtain a car insurance quote from Mercury Insurance online?

To get a car insurance quote from Mercury Insurance online, follow these steps:

- Visit the official Mercury Insurance website.

- Look for the “Get a Quote” or “Request a Quote” option on the homepage or the insurance section.

- Click on the option to begin the quote process.

- Fill out the necessary information, such as your personal details, vehicle information, and coverage preferences.

- Review the information you provided for accuracy.

- Submit your quote request.

- Wait for the quote to be generated. This process may take a few moments.

What information do I need to provide when requesting a Mercury car insurance quote online?

When requesting a Mercury car insurance quote online, you will typically be asked to provide the following information:

- Personal details: Full name, date of birth, address, and contact information.

- Vehicle information: Year, make, model, and Vehicle Identification Number (VIN) of the car you want to insure.

- Driver’s license details: Your driver’s license number, state of issuance, and the date you received your license.

- Driving history: Information about any accidents, violations, or claims you have had in the past few years.

- Coverage preferences: The type and level of coverage you are looking for, such as liability, collision, comprehensive, etc.

Can I get a Mercury car insurance quote online without providing my social security number?

Yes, it is possible to get a Mercury car insurance quote online without providing your social security number. However, keep in mind that providing your social security number may help in obtaining a more accurate and personalized quote. Insurance companies may use this information, along with other factors, to assess risk and determine pricing. If you prefer not to provide your social security number during the quote process, you can still receive a preliminary estimate, but the final quote may be subject to change after further verification.

Is it necessary to create an account on the Mercury Insurance website to get a car insurance quote?

In most cases, creating an account on the Mercury Insurance website is not necessary to obtain a car insurance quote. You can usually request a quote without logging in or creating an account. However, if you plan to proceed with purchasing a policy from Mercury, you may need to create an account to complete the application and manage your policy online. Creating an account can provide you with convenient access to your policy information, claims, and other services offered by Mercury Insurance.

What factors can affect the accuracy of the online car insurance quote from Mercury?

Several factors can influence the accuracy of an online car insurance quote from Mercury Insurance. These factors include:

- The accuracy and completeness of the information provided during the quote process.

- The specific details of your driving history, including accidents, violations, or claims.

- The accuracy of the vehicle information provided, such as the year, make, model, and VIN.

- Any additional factors considered by Mercury Insurance, such as your credit history or insurance score. Keep in mind that an online quote is typically an estimate based on the information provided. The final premium may be subject to change after additional verification and underwriting by Mercury Insurance.

Can I customize the coverage options and limits when getting a Mercury car insurance quote online?

Yes, when obtaining a Mercury car insurance quote online, you can typically customize the coverage options and limits to meet your specific needs. During the quote process, you will have the opportunity to select the types of coverage you want, such as liability, collision, comprehensive, uninsured/underinsured motorist, and more. Additionally, you can choose the coverage limits for each type of coverage based on your desired level of protection. Make sure to review the available options and select the ones that align with your insurance requirements.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.