Compare Minnesota Car Insurance Rates [2025]

Compare Minnesota car insurance at $73/mo. Minnesota car insurance minimum liability requirements are 30/60/10 for property damage and bodily injury. States mandate minimum vehicle insurance. Car owners can enhance their coverage with extras like rental car, towing, and glass damage packages.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

UPDATED: May 5, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: May 5, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- The best Minnesota car insurance companies are Geico, State Farm, and American West according to J.D. Power.

- Know what you are currently paying and what coverage you already have so you can know if you need to change it

- Check the reviews of car insurance companies from friends and family as well as national rating agencies

Minnesota car insurance comparison shopping does not have to be intimidating or confusing. You can find cheap car insurance in Minnesota today.

People comparison shop for car insurance because they want to be covered in the event of an accident but want to pay as little as possible for this coverage.

Compare car insurance quotes today for FREE with our ZIP code search tool at the top of this page.

Choosing the Best Minnesota Car Insurance Companies

When searching for car insurance, these are several types of coverage to consider.Minnesota requires motorists to have personal injury protection, liability, underinsured and uninsured coverage. Keep in mind the minimum limits in Minnesota:

- Car Insurance Rates in Minnesota

- Compare Wadena, MN Car Insurance Rates [2025]

- Compare Prior Lake, MN Car Insurance Rates [2025]

- Compare Moorhead, MN Car Insurance Rates [2025]

- Compare Mankato, MN Car Insurance Rates [2025]

- Compare Maple Grove, MN Car Insurance Rates [2025]

- Compare Fridley, MN Car Insurance Rates [2025]

- Compare Eagan, MN Car Insurance Rates [2025]

- Compare East Grand Forks, MN Car Insurance Rates [2025]

- Compare Duluth, MN Car Insurance Rates [2025]

- Compare Detroit Lakes, MN Car Insurance Rates [2025]

- Compare Crystal, MN Car Insurance Rates [2025]

- Compare Barnesville, MN Car Insurance Rates [2025]

- Compare St. Paul, MN Car Insurance Rates [2025]

- Compare Minneapolis, MN Car Insurance Rates [2025]

- Personal injury protection – $40,000 per person, per accident

- Underinsured – $25,000 for injuries to one person and $50,000 for injuries to two or more people

- Uninsured – $25,000 for injuries to one person and $50,000 for injuries to two or more people

- Liability – $30,000 for injuries to one person, $60,000 for injuries to two or more people and $10,000 for damage to the other person’s vehicle or property damage

Keep a copy of your current car insurance declaration sheet handy when looking at other insurance quotes and have your vehicle information handy for answering questions. Companies require information including the year, make and model, VIN number of the vehicle, driver’s license number, and any vehicle financing information.

Read up on commonly used terms in the car insurance world such as deductible, comprehensive, liability, and collision coverage.

Shopping for the right car insurance includes comparing one insurance company’s factors that affect premiums versus another’s.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Checking Reviews of MN Car Insurance Companies

Ask friends and family who they use for auto insurance. A good source to utilize is a local car dealership or mechanic. Customers stay loyal to mechanics they trust. Ask your trusted mechanic what insurance companies they recommend. There are two kinds of people, people who like old-fashioned face-to-face interactions with an insurance agent and people who prefer technological contacting an insurance company either through a website or email.

Many insurance companies such as Allstate or State Farm insurance continue to use agents as a middleman while companies like Geico or Esurance work directly with the customer.

Check websites that offer consumer opinions or reputable information such as J.D. Power Associates insurance ratings or Best A.M. Best offers ratings on an insurance company’s financial strength while J. D. Power Associates offers an easy-to-read survey that examines consumer reviews on overall satisfaction, pricing, policy offerings, billing and claims.

Minnesota Car Insurance Requirements

Each state requires a minimum amount of insurance on vehicles. Auto owners have the option to add extra amenities or a more comprehensive package to existing requirements. Optional amenities include:

- Rental car usage

- Towing packages

- Glass damage

Minnesota Car Insurance Discounts

Inquire about what discounts are available when looking at different auto insurances. Discounts are available for safe drivers, full-time students with good grades, anti-lock brakes or anti-theft system, factory air bags, automatic seat belts, and bundled insurance packages.

Driving without insurance in Minnesota is a bad choice for both the driver and others on the road.

Purchasing auto insurance is similar to car buying; it is never wise to choose the product before shopping around and comparing one deal with another. Get insured for less today with our FREE ZIP code search tool at the bottom of the page!

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

What is the penalty for driving without insurance in Minnesota?

Minnesota penalties for driving without insurance for a 1st or 2nd offense include fines up to $1,000 and suspension of your license and vehicle registration for up to 30 days. Find cheap Minnesota car insurance quotes online and save.

- Drivers who own their vehicles outright are required to carry insurance

- You could go to jail if you don’t have car insurance in Minnesota

- It’s cheaper to drive with car insurance than to drive without insurance

Drivers in Minnesota are required to carry car insurance if they want to operate their vehicles within the law. Finding affordable car insurance is crucial to drivers who don’t want to face the law when they are caught driving without insurance. The state minimums are designed to protect both you and the other people on the road, and your finances will be in much better shape with at least the minimum car insurance requirements than with nothing. If you’re not convinced paying for your insurance premium is more affordable than trying to skip paying for insurance, you should know what it might cost you if you’re caught or involved in an accident. Compare car insurance quotes today to find the best rate for the coverage you need. Use our free tool above to get started!

What is The Financial Downfall of Driving Without Insurance in MN?

It’s not uncommon for Minnesota drivers to feel their MN car insurance rates are too high and don’t fit well in the budget. If you feel this way, it’s time to shop around and compare rates with different companies. There might be some companies willing to offer you discounts such as the following:

- retiree discounts

- multiple driver discounts or multiple car discounts

- discounts for driving under a certain number of miles each year

This is much more affordable than driving sans insurance and being involved in an accident. The average cost of any car accident is expensive.

You could find yourself with medical bills, car repair bills, and even lawsuits in the tens of thousands of dollars if you don’t have insurance.

Your insurance company pays your medical bills, your car repair fees, and they pay for any damage you do to other drivers or property if the accident is your fault. Without insurance, you’re paying out of pocket for that. If you are to blame for the car accident, you could be the defendant in a lawsuit. The other driver and/or their insurance company can sue you for damages with the help of a car insurance attorney in addition to the cost of car repairs or replacement and medical bills.If you think paying a few hundred dollars a month for car insurance is too much, you’re certainly going to find this kind of financial situation too much. It’s better to shop around for new insurance now and avoid this kind of financial pitfall in the future.

Penalties for Driving Without Insurance in Minnesota

Minnesota driving laws describe driving without adequate car insurance is a misdemeanor crime. Every driver is required to carry at least the minimum amount of car insurance as required by the state, and anyone who chooses not to follow the law faces serious penalties. Drivers who are caught driving without insurance once or twice face fines up to $1,000, but the fines will not be less than $200. You also lose your license, registration, and the plates on your vehicles for up to 30 days. Each one may be reinstated if you are able to show proof that you’ve purchased car insurance in that time frame. The fee for this is $30. If you cannot afford the fine, you are permitted to offer up your time volunteering in the community. A judge will determine how many hours he or she feels is sufficient in this situation. If you are a third-time offender caught driving without insurance, you face much more serious fines and penalties. The fines are increased to as much as $3,000, and your license, plates, and registration are suspended for up to one year.

If you can prove you have insurance, you can pay the $30 reinstatement fee and still get these back before the one-year suspension is up.

You also face up to three months in jail. You have 10 days to show proof of insurance once you receive a letter from the Department of Public Safety if you’d like to avoid any penalties after being pulled over driving without insurance. If the offense is more serious than just driving without insurance, you might face additional charges. For example, if you are involved in an accident driving without insurance and someone is injured, the charges might be more serious.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

What Are the Minimum Insurance Requirements in Minnesota?

There is a rumor circulating that if you own your car outright and have no loan payment on the vehicle, you can cancel your insurance. This is not true. Minnesota law requires all drivers carry at least a small policy on any vehicle they have.

- $30k per person BIP

- $60k per accident BIP

- $10k property damage

- $25k personal uninsured motorist

- $50k per accident uninsured motorist

These limits may differ for some drivers. If you have a leased vehicle, you must abide by the insurance requirements in your lease agreement. The same goes for cars financed through a bank or car dealership. Since the lender owns these vehicles until you make your final payment or return your lease, they want you to have the best coverage possible. The good news about these types of companies is they are happy to let you choose which company you want to insure your vehicle so you can find the best rates, the lowest premiums, and the most comprehensive coverage. If you’re unable to afford even the minimal car insurance policy, there are many ways you can decrease your at-home budget to make more space for insurance. You can also look around for discounts with different companies. Sometimes your own company is willing to negotiate prices with you if they think you’re willing to move to another insurance agent who is offering a lower premium. It never hurts to see what you can get. Compare car insurance quotes today to find the best rate for the coverage you need. Use our free comparison tool below to begin.

| Minnesota Statistics Summary | Details |

|---|---|

| Road Miles | Miles of Roadway: 138,767 Vehicle Miles Driven: 57,395 million |

| Registered Vehicles | 4,985,782 |

| Population | 5,611,179 |

| Most Popular Vehicle | Ford F-150 |

| Uninsured Motorist Rate | 11.5% |

| Total Driving-Related Deaths in 2017 | 357 |

| Speeding Fatalities in 2017 | 89 |

| DUI Fatalities in 2017 | 85 |

| Average Annual Car Insurance Cost | Liability $456.82 Collision $234.40 Comprehensive $184.27 |

| Cheapest Provider | AMCO |

Minnesota is known for its many lakes, cold winters, and friendly population for whom “Minnesota Nice” is a way of life – something you’ll recognize the moment an entire neighborhood emerges from their homes to help dig your car out of a snowdrift. Home to the Vikings, the Twins, and the Wild, Minnesota’s Twin Cities form a bustling metropolitan hub, while the lake country and miles of farmland beyond city limits are the very image of the pastoral Midwest. And let’s not forget the Minneapolis music scene, which brought us Prince, Bob Dylan, and The Replacements, among others. Whether you’re hitting First Avenue for some live tunes, towing the pontoon out to the lake, or braving the winter highways to get to a hockey tournament, you need car insurance in Minnesota. You’ve got better things to do than to spend hours choosing coverage and comparing rates, so we’ve got you covered. Our comprehensive guide to insurance will help you pick the best policy for your needs at a price you can afford. We’ve gathered all the state laws, statistics, and coverage details right here to get you on the road fast. Ready to roll? Get started right now by entering your ZIP code in our free rate comparison tool above!

Minnesota Car Insurance Coverage and Rates

Minnesota law requires that everyone on the road have car insurance. Required coverage in the Gopher State is a little more complex than in some other states, while the list of optional coverage adds to the confusion. What do you really need to buy? How much will it cost? Look no further! We’ve broken down all of the laws that apply to car insurance in Minnesota and tell you what coverage you have to buy and which options are available. Because rates vary so much, we’ve also gathered rate information by location, demographic, and more to help you figure out what a great quote looks like for your particular situation. Read on for all the details you need to buy car insurance like a pro.

Minnesota Minimum Coverage

Minnesota operates as a no-fault insurance state. That’s a confusing term because it doesn’t really mean no one is at fault — it just means that your insurance will pay out as the first line of defense for injuries to you and your passengers in a car accident — no matter who is at fault. Because of the no-fault system, Minnesota drivers are required to carry Personal Injury Protection (PIP) (read our “Car Insurance PIP Waiver: Explained Simply” for more information). Once the PIP limit is reached, the bodily liability coverage of the at-fault driver will kick in to pay additional costs. If you’re at fault in a serious accident, your insurance will pay the whole cost after PIP — up to your policy limits. After that limit is reached, the at-fault driver is on the hook for the remaining balance, if any.

It’s vital to remember that no-fault doesn’t apply to property damage! If you’re at fault, you’re liable for all damage to vehicles and other property.

Here are a few other things you need to know about no-fault insurance in Minnesota:

- It covers medical expenses, wage loss, other services such as child care, and provides $2,000 for funeral expenses

- A no-fault claim can be made up to six months after the accident

- No-fault benefits on your car insurance don’t apply to accidents on a snowmobile or motorcycle, but you can purchase a separate policy for either of these

- You can increase your PIP limits well beyond the minimum

In addition to PIP, there are also several other coverages you have to carry to meet the state’s insurance mandate. Here’s what the law requires.

| Type of Coverage | Minimum Limits |

|---|---|

| Personal Injury Protection (PIP) | $40,000 per person per accident. ($20,000 for medical expenses and $20,000 for non-medical expenses) |

| Bodily Injury Liability | $30,000 per person $60,000 for two or more people (per incident) |

| Property Damage Liability | $10,000 |

| Uninsured Motorist Bodily Injury | $25,000 per person $50,000 for two or more people (per incident) |

| Underinsured Motorist Bodily Injury | $25,000 per person $50,000 for two or more people (per incident) |

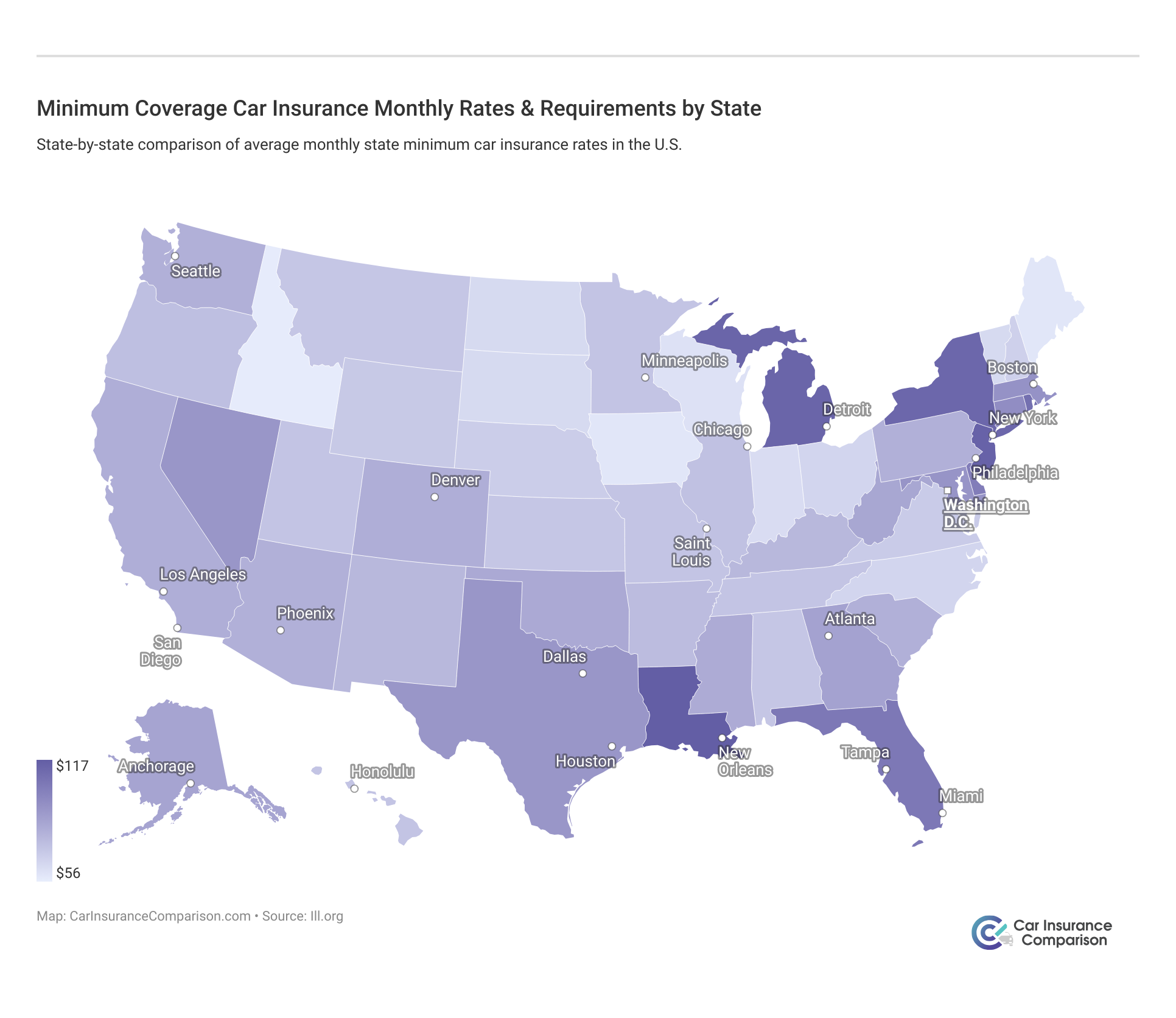

There is one more thing to note about Minnesota car insurance. Every policy must provide $35,000 in property damage liability for rental cars. If you have a Minnesota car insurance policy, you don’t need to take out a collision damage waiver from the rental car company. The company has to tell you this, and they can’t sell you the damage waiver unless you sign indicating you’ve been informed of this law. Another important point of comparison is how much it costs to buy minimum coverage in each state.

Don’t pay for coverage you don’t need!Forms of Financial Responsibility

If you are pulled over or involved in an accident in the state of Minnesota, you have to produce proof of financial responsibility. In other words, you have to show that you have insurance.

In Minnesota, car insurance is the only legal way of proving financial responsibility.

The traditional way of proving you have insurance is to pull out your insurance card and show it to the officer, but insurance has evolved with the times. In 2015, Minnesota became one of many states to allow electronic proof of insurance displayed on a mobile device. That means that if your insurance company has the technology, such as a mobile app or sending out insurance cards by email, you can pull that right up on your phone instead of digging in your wallet or glove box and hoping you have a current insurance card on hand. Don’t worry, Minnesota statute says that the officer doesn’t have permission to look at anything else on your phone, so your Snapchat selfies are safe. If you don’t have the proof of insurance on you, or you’ve borrowed a friend’s car and don’t know where they keep the insurance cards, you have time to produce proof before being convicted of driving without insurance. As long as the proof is provided no later than the court date set for the infraction, you can avoid penalties. Those penalties include fines and revocation of your driver’s license. If your license is revoked for failure to carry insurance, the state can also revoke the registration of your vehicle since insurance is a requirement for registering a car in Minnesota. You can get the registration reinstated by providing proof of insurance, and when you get your license back you’ll have to file proof of insurance with the state as well. It’s a whole lot easier to simply make sure you have proof of insurance with you all the time!

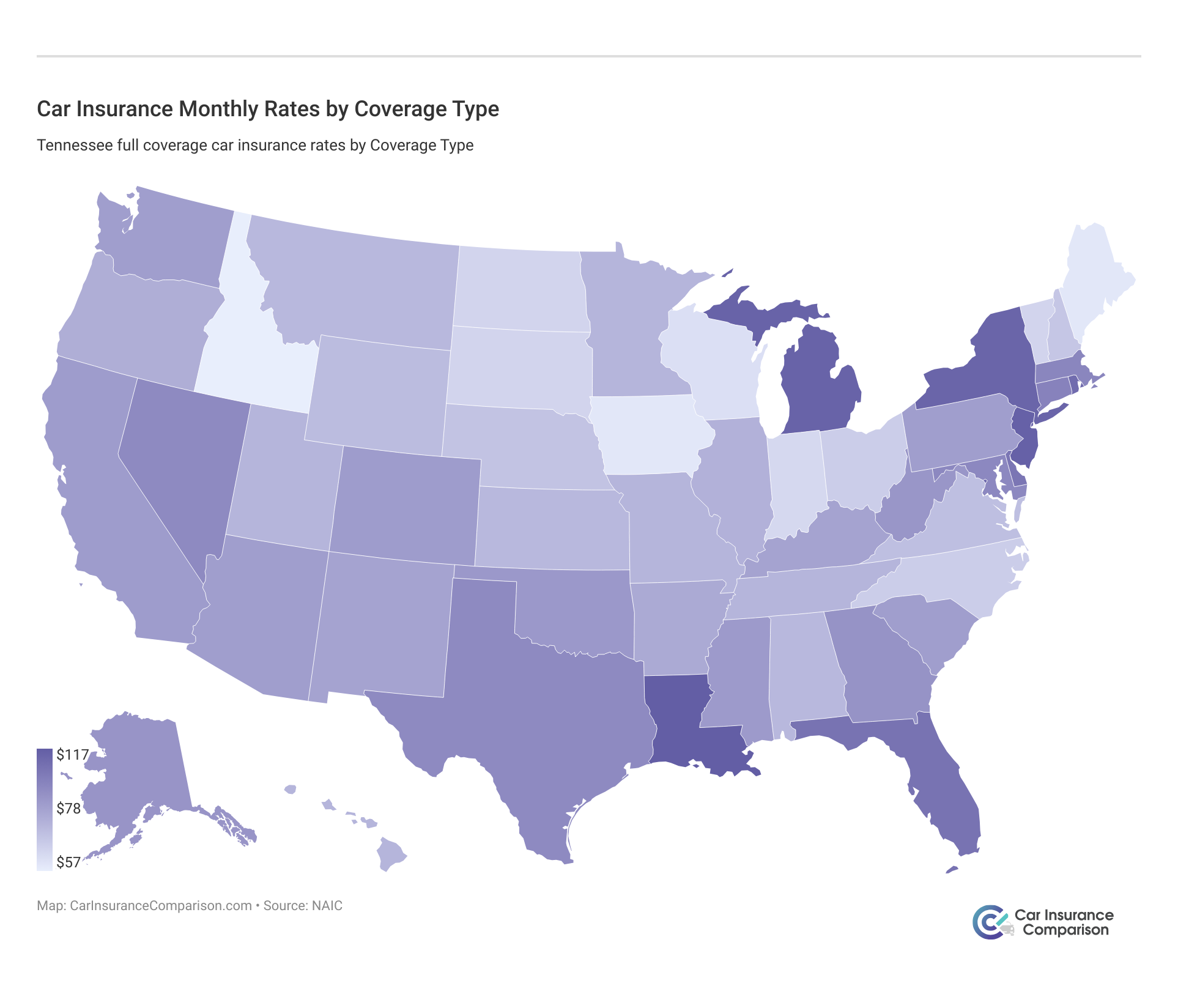

Premiums as a Percentage of Income

How much of their income are Minnesotans spending on car insurance? On average, about 2.01 percent. The average Minnesotan has an annual per capita disposable income of $42,516.00. That’s how much money is available for each person to spend after they’ve handed the IRS their share. Broken down to a monthly amount, that’s $3,543.00 left in the bank.

In Minnesota, the average annual premium for a full coverage auto policy is $856.62.

Minnesotans spend an average of $71.39 a month on their car insurance, which gives us that 2.01% number mentioned above. That brings Minnesota in a little below the national average of $79.30 a month, or 2.37 percent of income. Of course, averages come from a group of rates that fall both above and below that number, which means what you pay will differ based on a variety of factors. Read on, we’ll explain those factors further down the page.

Average Monthly Car Insurance Rates in MN (Liability, Collision, Comprehensive)

Minnesota’s core coverage rates compare favorably with the national average in two out of three categories. Comprehensive coverage is the only area where Minnesota drivers are paying more than the national average. Core coverage refers to the three main parts of a full coverage policy, and these rates are based on a policy that meets the state minimums.

| Coverage Type | Minnesota Annual Average | National Annual Average |

|---|---|---|

| Liability | $456.82 | $538.73 |

| Collision | $234.40 | $322.61 |

| Comprehensive | $184.27 | $148.04 |

| Total | $875.49 | $1009.38 |

As you can see, even with the slightly higher cost of comprehensive coverage, Minnesota drivers are still paying less than the national average overall.

Beyond this core coverage, there are a lot of different coverage options that can be added on to provide extra protection and enhance your policy. We’ll take a look at additional liability coverage as well as other add-ons and endorsements in the next section.Additional Liability Insurance

Unlike fault (or tort) states, Minnesota requires Personal Injury Protection coverage, so it’s not considered an option. What is an option is the limits; you are required to carry at least $40,000 in coverage, but you have the choice to increase that amount. Medical Payments, or Med Pay, is an optional coverage in most states. In Minnesota, it’s part of the PIP coverage. $20,000 of the minimum $40,000 limit is payable for medical expenses. Minnesota also requires uninsured and underinsured motorist coverage for bodily injury liability, and again you have the option to carry that coverage with higher liability limits.

Minnesota ranks at number 27 in the nation for number of uninsured drivers, with 11.5 percent of those on the road lacking coverage.

The required uninsured/underinsured motorist coverage can help protect you if you’re injured in an accident with one of those drivers. Loss ratios are a comparison of the premiums paid for a certain coverage to the claims that are paid out on that coverage. Here’s a look at Minnesota’s loss ratios for PIP, Medical Payments, and Uninsured/Underinsured Motorist coverage.

| Loss Ratio | Minnesota (2014) | Nationwide (2014) | Minnesota (2015) | Nationwide (2015) |

|---|---|---|---|---|

| Personal Injury Protection | 63.53 | 69.50 | 68.34 | 85.68 |

| Medical Payments | 47.73 | 74.07 | 11.11 | 75.72 |

| Uninsured/Underinsured Motorist | 55.81 | 67.33 | 56.97 | 75.11 |

What do loss ratios mean? A high number indicates that an insurance company is paying out a lot of claims compared to the premiums it is taking in. That can be a bad thing for the company’s financial stability. A low number, on the other hand, can mean the company is paying out fewer claims. In general, a company with a lower loss ratio is more profitable, but it means they may not be paying out enough. Across the board, Minnesota’s loss ratios for these liability coverages are lower than the national average. While changes have been minimal in most areas from year to year, the state saw a significant drop in Medical Payments loss ratios between 2014 and 2015.

Add-ons, Endorsements, and Riders

We’ve covered the basics of car insurance, but there are a lot of other options to choose from to help enhance coverage and customize your policy. Let’s look at some of the most common add-ons.

Not every car insurance company offers all of these coverage options. If one or more are important to you, it’s something to be aware of when shopping around.

Here are some of the options you’ll be offered.

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance, such as towing

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Insurance

Most of these add-ons will result in an additional premium, but not always. Some companies include them in the base policy as an extra incentive, so keep an eye out when you’re comparing your options.

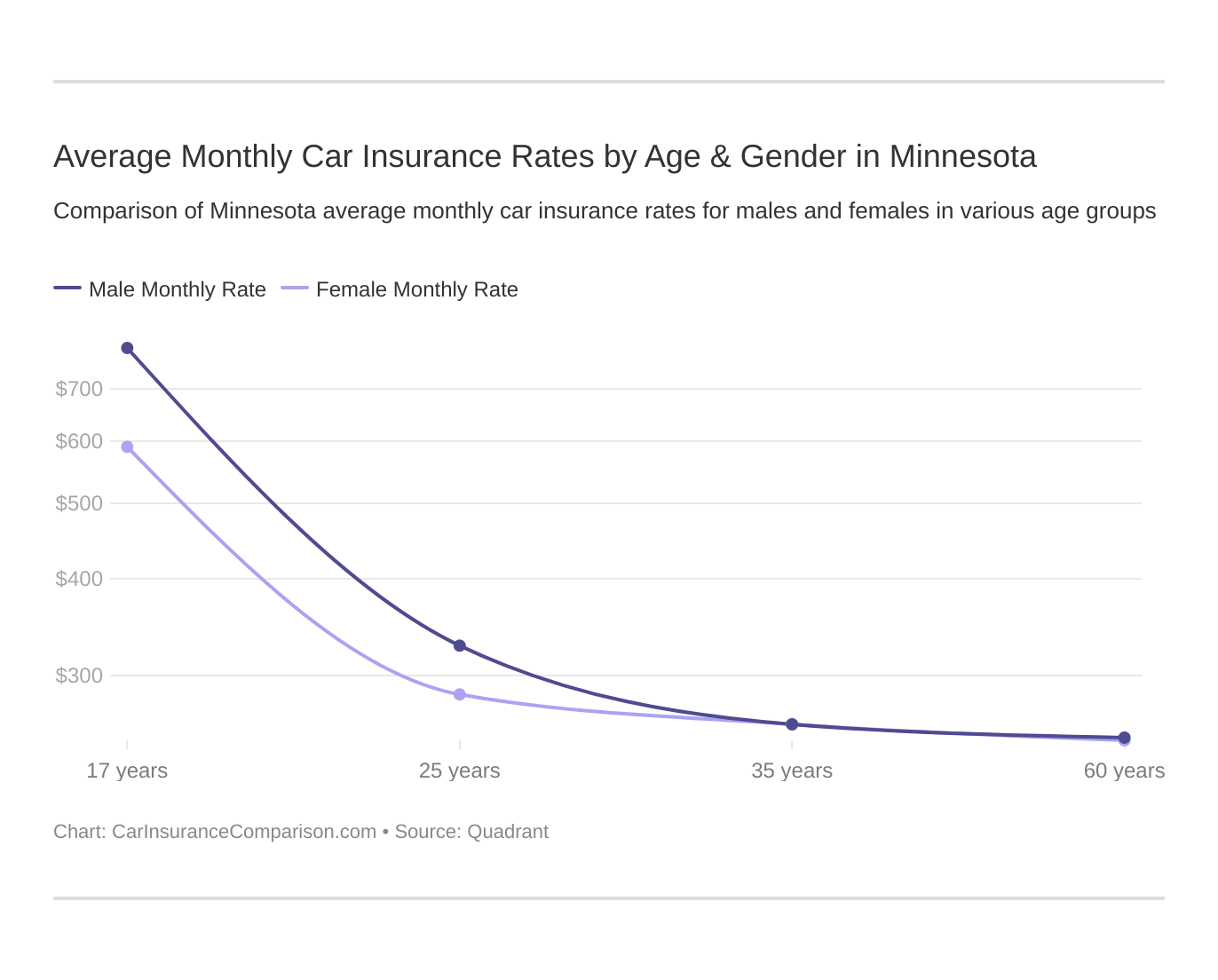

Average Monthly Car Insurance Rates by Age & Gender in MN

Minnesota isn’t one of the few states that have banned the use of gender as a rating factor for car insurance. That means your rates can be affected by gender, but as we see in the data below, that mainly appears for younger, single drivers. Married people in older age groups pay the same rates regardless of gender.

| Company | Married 35-year old female Annual Rate | Married 35-year old male Annual Rate | Married 60-year old female Annual Rate | Married 60-year old male Annual Rate | Single 17-year old female Annual Rate | Single 17-year old male Annual Rate | Single 25-year old female Annual Rate | Single 25-year old male Annual Rate |

|---|---|---|---|---|---|---|---|---|

| Allstate Indemnity | $3,023.30 | $3,023.30 | $2,908.43 | $2,908.43 | $6,885.00 | $9,968.67 | $3,677.99 | $3,860.95 |

| American Family Mutual | $2,233.79 | $2,233.79 | $2,025.26 | $2,025.26 | $6,086.73 | $8,812.61 | $2,233.79 | $2,519.05 |

| Illinois Farmers Ins | $2,041.64 | $2,038.65 | $1,965.24 | $2,076.17 | $5,820.43 | $5,872.48 | $2,672.81 | $2,612.21 |

| Geico General | $2,661.52 | $2,641.10 | $2,544.82 | $2,473.72 | $5,545.67 | $7,047.50 | $2,494.27 | $2,579.67 |

| Liberty Mutual Fire | $9,604.65 | $9,604.65 | $9,510.34 | $9,510.34 | $18,911.44 | $28,385.86 | $9,604.65 | $13,376.94 |

| AMCO Insurance | $2,017.55 | $2,020.31 | $1,797.28 | $1,903.55 | $5,210.96 | $6,308.92 | $2,375.80 | $2,463.90 |

The biggest gap by gender is for the single 17-year-old rate. That’s because, while all teenagers are more expensive to insure due to inexperience, young male drivers are statistically one of the highest-risk groups to insure. The good news is that the gap begins decreasing from age 25.

Relationship status also plays a role in car insurance rates, with married people generally paying less than single drivers. That accounts for some of this data, although by age 35 the gap between male and female closes even for single people. One more important takeaway from this data is that no matter who you are, your rates can be vastly different depending on the company providing the quote. That’s what makes shopping around so important.Cheapest Rates by ZIP Code

People are often surprised when their car insurance rates change after a move, even just a few ZIP codes away. ZIP code is another of the big factors car insurance companies use to calculate rates. You can search for your ZIP code below to see what rates look like in your area.

| Cheapest ZIP Codes in Minnesota | City | Average Annual Rate by ZIP Codes | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 56007 | ALBERT LEA | $3,976.80 | Liberty Mutual | $12,222.48 | Allstate | $4,039.14 | State Farm | $1,827.79 | Nationwide | $2,389.63 |

| 56088 | TRUMAN | $3,983.87 | Liberty Mutual | $12,222.48 | Allstate | $4,013.12 | State Farm | $1,668.01 | Farmers | $2,453.16 |

| 56120 | BUTTERFIELD | $4,009.53 | Liberty Mutual | $12,222.48 | Allstate | $4,110.95 | State Farm | $1,690.81 | USAA | $2,438.90 |

| 55912 | AUSTIN | $4,009.81 | Liberty Mutual | $11,792.33 | Allstate | $4,094.03 | State Farm | $1,858.67 | USAA | $2,502.58 |

| 56159 | MOUNTAIN LAKE | $4,014.86 | Liberty Mutual | $12,222.48 | Allstate | $4,206.30 | State Farm | $1,741.80 | USAA | $2,438.90 |

| 55987 | WINONA | $4,017.60 | Liberty Mutual | $11,372.14 | Allstate | $4,391.76 | State Farm | $1,909.06 | Nationwide | $2,489.07 |

| 56039 | GRANADA | $4,018.94 | Liberty Mutual | $12,222.48 | Allstate | $4,013.12 | State Farm | $1,641.11 | Nationwide | $2,530.75 |

| 56027 | ELMORE | $4,022.41 | Liberty Mutual | $12,222.48 | Allstate | $4,216.61 | State Farm | $1,636.38 | Farmers | $2,391.86 |

| 56073 | NEW ULM | $4,027.34 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,673.65 | USAA | $2,438.90 |

| 56181 | WELCOME | $4,027.96 | Liberty Mutual | $12,222.48 | Allstate | $4,144.34 | State Farm | $1,678.68 | Nationwide | $2,530.75 |

| 56062 | MADELIA | $4,029.17 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,698.53 | USAA | $2,438.90 |

| 56031 | FAIRMONT | $4,029.28 | Liberty Mutual | $12,222.48 | Allstate | $4,013.12 | State Farm | $1,647.15 | Nationwide | $2,530.75 |

| 56127 | DUNNELL | $4,029.53 | Liberty Mutual | $12,222.48 | Allstate | $4,206.30 | State Farm | $1,763.52 | Farmers | $2,448.45 |

| 56087 | SPRINGFIELD | $4,029.60 | Liberty Mutual | $12,222.48 | Allstate | $4,143.10 | State Farm | $1,706.84 | USAA | $2,438.90 |

| 56054 | LAFAYETTE | $4,032.56 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,774.45 | Farmers | $2,585.62 |

| 56081 | SAINT JAMES | $4,032.94 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,698.42 | USAA | $2,438.90 |

| 56075 | NORTHROP | $4,036.97 | Liberty Mutual | $12,222.48 | Allstate | $4,013.12 | State Farm | $1,881.71 | Nationwide | $2,530.75 |

| 56098 | WINNEBAGO | $4,037.01 | Liberty Mutual | $12,222.48 | Allstate | $4,216.61 | State Farm | $1,718.76 | Farmers | $2,436.29 |

| 56019 | COMFREY | $4,041.92 | Liberty Mutual | $12,222.48 | Allstate | $4,013.12 | State Farm | $1,670.30 | USAA | $2,438.90 |

| 56041 | HANSKA | $4,042.96 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,677.99 | USAA | $2,438.90 |

| 56001 | MANKATO | $4,043.78 | Liberty Mutual | $11,927.85 | Allstate | $4,376.76 | State Farm | $2,014.61 | Nationwide | $2,615.86 |

| 56085 | SLEEPY EYE | $4,044.59 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,633.33 | USAA | $2,438.90 |

| 56036 | GLENVILLE | $4,046.92 | Liberty Mutual | $12,222.48 | Allstate | $4,216.61 | State Farm | $1,837.88 | Farmers | $2,408.30 |

| 56171 | SHERBURN | $4,047.15 | Liberty Mutual | $12,222.48 | Allstate | $4,206.30 | State Farm | $1,713.97 | Nationwide | $2,530.75 |

| 56162 | ORMSBY | $4,048.38 | Liberty Mutual | $12,222.48 | Allstate | $4,144.34 | State Farm | $1,881.71 | Nationwide | $2,530.75 |

| Most Expensive ZIP Codes in Minnesota | City | Average Annual Rate by ZIP Code | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 55411 | MINNEAPOLIS | $6,620.56 | Liberty Mutual | $20,934.87 | Allstate | $6,404.25 | State Farm | $3,337.51 | USAA | $3,688.43 |

| 55106 | SAINT PAUL | $6,563.33 | Liberty Mutual | $20,971.66 | Allstate | $6,567.98 | State Farm | $3,568.79 | USAA | $3,711.58 |

| 55101 | SAINT PAUL | $6,547.31 | Liberty Mutual | $20,971.66 | Allstate | $6,523.85 | State Farm | $3,460.84 | USAA | $3,504.15 |

| 55103 | SAINT PAUL | $6,520.89 | Liberty Mutual | $20,971.66 | Allstate | $6,523.85 | State Farm | $3,315.39 | USAA | $3,504.15 |

| 55404 | MINNEAPOLIS | $6,491.18 | Liberty Mutual | $20,934.87 | Allstate | $6,588.35 | State Farm | $2,895.66 | USAA | $3,328.08 |

| 55412 | MINNEAPOLIS | $6,434.63 | Liberty Mutual | $20,934.87 | Allstate | $6,465.92 | State Farm | $3,297.21 | USAA | $3,688.43 |

| 55107 | SAINT PAUL | $6,404.50 | Liberty Mutual | $20,971.66 | Allstate | $6,136.19 | State Farm | $3,003.66 | USAA | $3,261.85 |

| 55454 | MINNEAPOLIS | $6,394.17 | Liberty Mutual | $20,934.87 | Allstate | $6,568.73 | State Farm | $2,770.93 | USAA | $3,328.08 |

| 55415 | MINNEAPOLIS | $6,385.64 | Liberty Mutual | $20,934.87 | Allstate | $6,568.73 | State Farm | $2,861.81 | USAA | $3,328.08 |

| 55407 | MINNEAPOLIS | $6,382.20 | Liberty Mutual | $20,346.17 | Allstate | $6,595.26 | State Farm | $2,988.98 | USAA | $3,582.41 |

| 55408 | MINNEAPOLIS | $6,370.83 | Liberty Mutual | $20,934.87 | Allstate | $6,588.35 | State Farm | $2,894.22 | USAA | $3,183.53 |

| 55402 | MINNEAPOLIS | $6,353.00 | Liberty Mutual | $20,934.87 | Allstate | $6,568.73 | State Farm | $2,824.38 | USAA | $3,328.08 |

| 55455 | MINNEAPOLIS | $6,349.43 | Liberty Mutual | $20,934.87 | Allstate | $6,531.88 | State Farm | $2,935.21 | USAA | $3,328.08 |

| 55104 | SAINT PAUL | $6,339.29 | Liberty Mutual | $20,346.17 | Allstate | $6,523.85 | State Farm | $3,032.21 | USAA | $3,328.08 |

| 55405 | MINNEAPOLIS | $6,320.72 | Liberty Mutual | $20,934.87 | Allstate | $6,601.34 | State Farm | $2,824.38 | USAA | $3,688.43 |

| 55406 | MINNEAPOLIS | $6,257.62 | Liberty Mutual | $20,346.17 | Allstate | $6,568.73 | State Farm | $2,777.97 | USAA | $3,222.20 |

| 55414 | MINNEAPOLIS | $6,254.15 | Liberty Mutual | $20,346.17 | Allstate | $6,531.88 | State Farm | $2,681.89 | USAA | $3,328.08 |

| 55403 | MINNEAPOLIS | $6,252.05 | Liberty Mutual | $20,934.87 | Allstate | $6,568.73 | State Farm | $2,800.79 | USAA | $3,328.08 |

| 55413 | MINNEAPOLIS | $6,248.33 | Liberty Mutual | $20,934.87 | Allstate | $6,370.10 | State Farm | $2,907.36 | USAA | $3,271.06 |

| 55401 | MINNEAPOLIS | $6,221.83 | Liberty Mutual | $20,934.87 | Allstate | $6,370.10 | State Farm | $2,859.24 | USAA | $3,328.08 |

| 55114 | SAINT PAUL | $6,200.17 | Liberty Mutual | $20,346.17 | Allstate | $6,523.85 | State Farm | $2,503.54 | USAA | $3,328.08 |

| 55102 | SAINT PAUL | $6,187.71 | Liberty Mutual | $20,346.17 | Allstate | $5,927.14 | State Farm | $2,977.73 | USAA | $3,261.85 |

| 55409 | MINNEAPOLIS | $6,109.20 | Liberty Mutual | $20,346.17 | Allstate | $6,509.73 | State Farm | $2,954.03 | USAA | $3,183.53 |

| 55130 | SAINT PAUL | $5,798.28 | Liberty Mutual | $14,314.34 | Allstate | $6,462.88 | State Farm | $3,582.91 | USAA | $3,711.58 |

| 55450 | MINNEAPOLIS | $5,758.23 | Liberty Mutual | $20,934.87 | Allstate | $5,069.73 | USAA | $2,531.82 | State Farm | $2,935.21 |

Cheapest Rates by City

Prefer to check out average rates by city? You can search by city name in the tables below:

| Cheapest Cities in Minnesota | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Albert Lea | $3,976.80 | Liberty Mutual | $12,222.48 | Allstate | $4,039.14 | State Farm | $1,827.79 | Nationwide | $2,389.63 |

| Truman | $3,983.87 | Liberty Mutual | $12,222.48 | Allstate | $4,013.12 | State Farm | $1,668.01 | Farmers | $2,453.16 |

| Butterfield | $4,009.53 | Liberty Mutual | $12,222.48 | Allstate | $4,110.95 | State Farm | $1,690.81 | USAA | $2,438.90 |

| Austin | $4,009.81 | Liberty Mutual | $11,792.33 | Allstate | $4,094.03 | State Farm | $1,858.67 | USAA | $2,502.58 |

| Mountain Lake | $4,014.86 | Liberty Mutual | $12,222.48 | Allstate | $4,206.30 | State Farm | $1,741.80 | USAA | $2,438.90 |

| Goodview | $4,017.60 | Liberty Mutual | $11,372.14 | Allstate | $4,391.76 | State Farm | $1,909.06 | Nationwide | $2,489.07 |

| Granada | $4,018.95 | Liberty Mutual | $12,222.48 | Allstate | $4,013.12 | State Farm | $1,641.11 | Nationwide | $2,530.75 |

| Elmore | $4,022.41 | Liberty Mutual | $12,222.48 | Allstate | $4,216.61 | State Farm | $1,636.38 | Farmers | $2,391.86 |

| New Ulm | $4,027.34 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,673.65 | USAA | $2,438.90 |

| Welcome | $4,027.96 | Liberty Mutual | $12,222.48 | Allstate | $4,144.34 | State Farm | $1,678.68 | Nationwide | $2,530.75 |

| Madelia | $4,029.17 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,698.53 | USAA | $2,438.90 |

| Fairmont | $4,029.28 | Liberty Mutual | $12,222.48 | Allstate | $4,013.12 | State Farm | $1,647.15 | Nationwide | $2,530.75 |

| Dunnell | $4,029.53 | Liberty Mutual | $12,222.48 | Allstate | $4,206.30 | State Farm | $1,763.52 | Farmers | $2,448.45 |

| Springfield | $4,029.60 | Liberty Mutual | $12,222.48 | Allstate | $4,143.10 | State Farm | $1,706.84 | USAA | $2,438.90 |

| Lafayette | $4,032.56 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,774.45 | Farmers | $2,585.62 |

| St. James | $4,032.94 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,698.42 | USAA | $2,438.90 |

| Northrop | $4,036.97 | Liberty Mutual | $12,222.48 | Allstate | $4,013.12 | State Farm | $1,881.71 | Nationwide | $2,530.75 |

| Winnebago | $4,037.01 | Liberty Mutual | $12,222.48 | Allstate | $4,216.61 | State Farm | $1,718.76 | Farmers | $2,436.29 |

| Comfrey | $4,041.92 | Liberty Mutual | $12,222.48 | Allstate | $4,013.12 | State Farm | $1,670.30 | USAA | $2,438.90 |

| Hanska | $4,042.96 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,677.99 | USAA | $2,438.90 |

| Sleepy Eye | $4,044.59 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,633.33 | USAA | $2,438.90 |

| Glenville | $4,046.92 | Liberty Mutual | $12,222.48 | Allstate | $4,216.61 | State Farm | $1,837.88 | Farmers | $2,408.30 |

| Sherburn | $4,047.15 | Liberty Mutual | $12,222.48 | Allstate | $4,206.30 | State Farm | $1,713.97 | Nationwide | $2,530.75 |

| Ormsby | $4,048.38 | Liberty Mutual | $12,222.48 | Allstate | $4,144.34 | State Farm | $1,881.71 | Nationwide | $2,530.75 |

| Lewisville | $4,051.00 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,712.06 | USAA | $2,438.90 |

Smaller cities on the southern end of the state, like Austin and Albert Lea, have some of the lowest rates.

| Most Expensive Cities in Minnesota | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Minneapolis | $6,106.69 | Liberty Mutual | $19,767.41 | Allstate | $6,275.74 | State Farm | $2,860.94 | USAA | $3,270.39 |

| St. Paul | $5,972.08 | Liberty Mutual | $18,511.98 | Allstate | $6,141.30 | State Farm | $3,006.99 | USAA | $3,309.17 |

| Little Canada | $5,397.29 | Liberty Mutual | $14,314.34 | Allstate | $5,939.60 | USAA | $3,246.25 | State Farm | $3,375.84 |

| Brooklyn Center | $5,250.46 | Liberty Mutual | $13,733.42 | Allstate | $5,517.75 | State Farm | $2,657.84 | USAA | $3,027.14 |

| Falcon Heights | $5,110.86 | Liberty Mutual | $14,384.20 | Allstate | $5,605.47 | State Farm | $2,445.02 | USAA | $3,000.34 |

| Columbia Heights | $5,103.52 | Liberty Mutual | $13,733.42 | Allstate | $5,453.46 | State Farm | $2,631.03 | USAA | $2,963.85 |

| Maplewood | $5,061.15 | Liberty Mutual | $14,314.34 | Allstate | $5,382.25 | State Farm | $2,720.57 | USAA | $2,960.39 |

| Waskish | $5,023.66 | Liberty Mutual | $15,228.53 | Farmers | $4,564.50 | State Farm | $2,148.12 | Nationwide | $2,950.86 |

| St. Francis | $5,003.38 | Liberty Mutual | $15,094.54 | Allstate | $4,711.37 | State Farm | $2,460.88 | USAA | $3,193.94 |

| Martin Lake | $5,003.33 | Liberty Mutual | $15,094.54 | Allstate | $4,712.34 | State Farm | $2,459.40 | USAA | $3,193.94 |

| Richfield | $5,002.58 | Liberty Mutual | $14,343.36 | Allstate | $5,308.16 | State Farm | $2,566.97 | USAA | $2,790.97 |

| Lake George | $4,999.75 | Liberty Mutual | $15,228.53 | Farmers | $4,491.44 | State Farm | $2,185.55 | USAA | $3,008.87 |

| South St. Paul | $4,994.42 | Liberty Mutual | $14,314.34 | Allstate | $5,331.35 | State Farm | $2,667.84 | USAA | $2,987.88 |

| Columbus | $4,992.05 | Liberty Mutual | $15,094.54 | Allstate | $4,758.69 | State Farm | $2,382.94 | Nationwide | $3,130.44 |

| Bethel | $4,984.06 | Liberty Mutual | $15,094.54 | Allstate | $4,711.37 | State Farm | $2,424.09 | USAA | $3,193.94 |

| East Bethel | $4,978.05 | Liberty Mutual | $15,094.54 | Allstate | $4,712.66 | State Farm | $2,477.33 | USAA | $3,193.94 |

| Fridley | $4,971.65 | Liberty Mutual | $13,733.42 | Allstate | $5,492.04 | State Farm | $2,618.39 | USAA | $2,807.34 |

| Almelund | $4,966.16 | Liberty Mutual | $15,094.54 | Allstate | $5,026.47 | State Farm | $2,406.80 | USAA | $2,915.46 |

| Isanti | $4,955.17 | Liberty Mutual | $15,094.54 | Allstate | $4,790.79 | State Farm | $2,422.96 | Nationwide | $3,215.12 |

| Garrison | $4,948.90 | Liberty Mutual | $15,228.53 | Allstate | $4,537.69 | State Farm | $2,148.12 | USAA | $2,902.05 |

| Andover | $4,946.23 | Liberty Mutual | $15,094.54 | Allstate | $5,081.81 | State Farm | $2,396.83 | USAA | $2,982.27 |

| Grandy | $4,945.76 | Liberty Mutual | $15,094.54 | Allstate | $4,770.32 | State Farm | $2,406.80 | Nationwide | $3,215.12 |

| Swatara | $4,945.15 | Liberty Mutual | $15,228.53 | Allstate | $4,489.01 | State Farm | $2,148.12 | Nationwide | $2,993.69 |

| Taylors Falls | $4,943.22 | Liberty Mutual | $15,094.54 | Allstate | $5,026.47 | State Farm | $2,406.80 | USAA | $2,915.46 |

| Centerville | $4,940.45 | Liberty Mutual | $15,094.54 | Allstate | $4,928.00 | State Farm | $2,248.59 | USAA | $2,780.77 |

Matching up to what the ZIP code charts show, Minneapolis and Saint Paul land in the two top spots for highest rates. They’re not truly twin cities though; Minneapolis has average rates about a hundred dollars higher than those seen in Saint Paul.

How Much Auto Insurance Costs in Minnesota

Discovering the cost of auto insurance in Minnesota can vary significantly based on several factors, including your location within the state. By comparing rates across different cities like Barnesville, East Grand Forks, and Moorhead, among others, you can gain valuable insights into the regional differences in insurance premiums.

Minnesota Car Insurance Companies

Choosing a car insurance company can be stressful. Is that cheap rate quote too good to be true? Can you trust the company to be on your side when there’s a claim? Worse, will you only find out you can’t trust them after the claim is already filed? What should you look for in a car insurance company? There are a lot of questions when it comes to selecting a car insurance company, but we can help you find the answers. We have done all the research for you to make selecting the company that will protect you on the road easier. We’ve gathered information on the best Minnesota car insurance companies that goes past the slick car insurance commercials to find out which companies live up to their promises. Keep reading to find out how the biggest insurance companies rank for financial ratings, customer satisfaction, complaints volume, and more.

The Largest Companies’ Financial Ratings

| Company Name | AM Best Rating | Loss Ratio |

|---|---|---|

| State Farm Group | A++ | 65.52% |

| Progressive Group | A+ | 62.53% |

| American Family Insurance Group | A | 62.97% |

| Farmers Insurance Group | A | 56.43% |

| Allstate Insurance Group | A+ | 60.51% |

| Geico | A++ | 74.00% |

| USAA Group | A++ | 73.57% |

| Liberty Mutual Group | A | 60.04% |

| Travelers Group | A++ | 65.96% |

| Auto-Owners Group | A++ | 61.26% |

AM Best provides financial strength ratings for insurance companies based on a letter-grade scale. All of the top ten car insurance companies in Minnesota have ratings that rank them as either Excellent or Superior. That means they all have the financial stability to pay out claims on their existing policies. We touched on loss ratios above, and here is where they come into play.

An insurance company with a loss ratio that is too high is paying out too much on claims, while a company with a very low loss ratio may not be paying out enough claims.

You’ll note that the companies with the highest financial strength ratings from AM Best tend to have loss ratios in the range of 65-75%, while companies with slightly lower grades have lower loss ratios as well. Of course, all of these top companies have a solid rating, so we don’t see a whole lot of variation in the ratio numbers. It appears that all of these companies are on solid financial footing. So are customers happy with them? Let’s see how they do when it comes to customer satisfaction.

Companies With the Best Ratings

Happy customers keep renewing their policies, which keeps an insurance company’s place in the market secure. So we expect to see some correlation between the most popular companies out there and the best ratings. J.D. Power is the go-to company when it comes to consumer research on insurance companies. Several of Minnesota’s top insurance companies got high marks from J.D. Power in customer satisfaction, while others could be performing better.

Companies With the Most Complaints in Minnesota

Which companies in Minnesota have the most complaints? Before we look at that, let’s talk about what those complaints mean.

Complaint ratio is more important than the actual number of complaints, because it takes into account how much business a company has per complaint.

This chart compares the insurance companies that have the best complaint ratios for the state of Minnesota:

| Company | Complaint Ratio | Total Number of Complaints |

|---|---|---|

| Farmers | 0.028 | 7 |

| USAA | 0.065 | 5 |

| Progressive | 0.083 | 34 |

| State Farm | 0.151 | 106 |

| Geico | 0.158 | 13 |

| Liberty Mutual | 0.178 | 20 |

| American Family | 0.256 | 86 |

| Auto-Owners | 0.270 | 23 |

| Allstate | 0.286 | 46 |

| Auto Club Insurance Association | 0.416 | 32 |

Farmers Insurance has the lowest complaint ratio of the companies in Minnesota, but it doesn’t have the lowest number of complaints. That honor belongs to USAA. Because Farmers has a larger market share than USAA the overall ratio of complaints is lower. Similarly, State Farm has the largest number of complaints in the state but ranks at number four overall. Take a look a little further down the page where we’ve listed the biggest insurance companies in Minnesota, and you’ll see State Farm has the largest market share and the highest dollar amount for premiums by a pretty wide margin. That adds up to a lower complaint ratio. Read our State Farm car insurance review for more information.

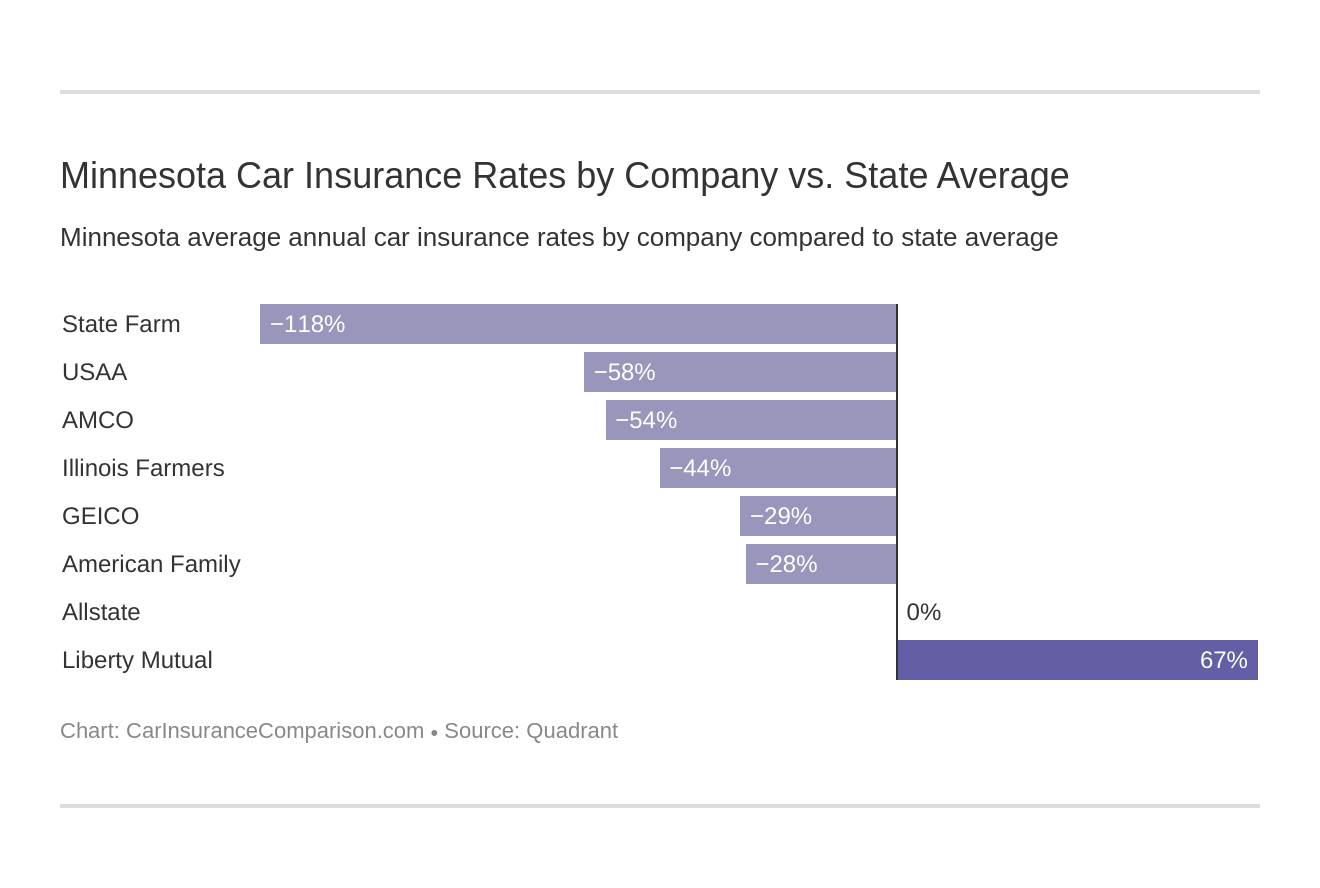

Minnesota Car Insurance Rates By Company

We’ve looked at which companies have the best ratings and the lowest complaint ratios. The next question is, what are these companies charging on average for Minnesota car insurance?The state average in Minnesota is $4,513.50. Here’s how the big companies compare.

Clearly, there is a huge disparity in what various car insurance companies are charging compared to the state average.Rates By Commute Distance in Minnesota

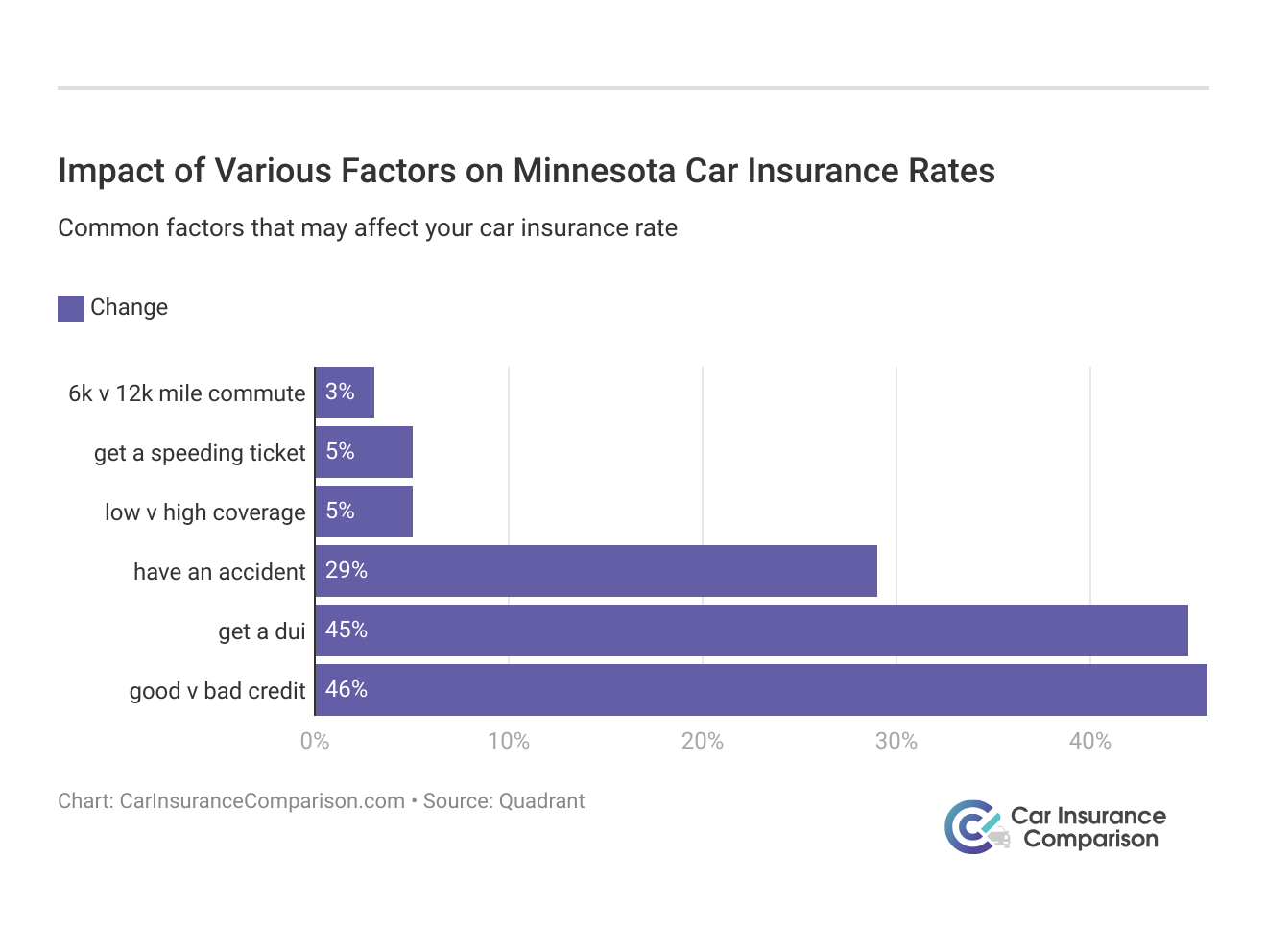

Commute distance is one of the many factors insurance companies consider when calculating rates.

Although it may not affect your rates as much as some other factors, the fact remains that the higher the number of miles you drive each day, the more the risk of an accident increases.Aveage Annual Minnesota Car Insurance Rates by Commute| Companies | Average Annual Rates for 10 Miles Commute 6,000 Annual Mileage | Aveaage Annual Rates for 25 Miles Commute 12,000 Annual Mileage |

|---|---|---|

| State Farm | $2,011.15 | $2,122.82 |

| USAA | $2,824.14 | $2,899.06 |

| Nationwide | $2,926.49 | $2,926.49 |

| Farmers | $3,137.45 | $3,137.45 |

| Geico | $3,452.20 | $3,544.87 |

| American Family | $3,480.06 | $3,562.51 |

| Allstate | $4,532.01 | $4,532.01 |

| Liberty Mutual | $13,165.37 | $13,961.85 |

These rates show that not all companies are increasing rates along with commute time. Several companies show no difference in the rate between a 10-mile daily commute and a 25-mile daily commute.

Coverage Level Rates

No matter which company you choose, you will pay more for a higher level of coverage, but the differences are not as big as you might think.Aveage Annual Minnesota Car Insurance Rates by Coverage Level

| Companies | Annual Average Rates with High Coverage | Annual Average Rates with Medium Coverage | Annual Average Rates with Low Coverage |

|---|---|---|---|

| State Farm | $2,141.38 | $2,074.23 | $1,985.35 |

| USAA | $2,945.57 | $2,859.57 | $2,779.67 |

| Nationwide | $3,064.92 | $2,947.12 | $2,767.43 |

| Farmers | $3,239.56 | $3,150.22 | $3,022.58 |

| American Family | $3,432.86 | $3,618.33 | $3,512.68 |

| Geico | $3,603.48 | $3,497.28 | $3,394.84 |

| Allstate | $4,600.41 | $4,528.59 | $4,467.02 |

| Liberty Mutual | $13,874.92 | $13,574.70 | $13,241.20 |

Take a look at the rates above for high, medium, and low levels of coverage from each of the big name companies. People frequently choose a lower level of coverage because they think better coverage is unaffordable, but these numbers show that’s not necessarily so.

Credit History Rates

Credit history is another factor car insurance companies use to determine rates in Minnesota. While a few states have passed laws prohibiting the use of a credit score for insurance rating, most states do still allow it. So how much does your credit score impact rates?Average Annual Minnesota Car Insurance Rates by Credit History

| Companies | Annual Average Rates with Good Credit | Annual Average Rates with Fair Credit | Annual Average Rates with Poor Credit |

|---|---|---|---|

| State Farm | $1,344.22 | $1,842.99 | $3,013.76 |

| USAA | $1,905.46 | $2,192.66 | $4,486.70 |

| Nationwide | $2,490.14 | $2,807.41 | $3,481.91 |

| American Family | $2,564.44 | $3,190.11 | $4,809.31 |

| Farmers | $2,654.85 | $2,840.59 | $3,916.92 |

| Geico | $2,861.19 | $3,433.78 | $4,200.64 |

| Allstate | $3,344.12 | $3,603.11 | $6,648.80 |

| Liberty Mutual | $9,555.18 | $12,227.54 | $18,908.11 |

This table shows three rates for each insurance company based on different credit levels. It’s pretty clear that credit is a big part of what you pay for your car insurance. As a general rule, you can expect to pay about double with poor credit versus good credit. The good news is that Experian’s 2017 report on credit places Minnesota in the number one spot for high Vantage scores nationwide. The average score in Minnesota is 709, while the national average is 675.Recently paid off some debt? It might be a good time to shop for car insurance, but make sure your credit score reflects the change first.

Driving Record Rates

Good drivers get the best rates, that comes as no surprise to anyone who has ever shopped for car insurance. But how much do violations actually affect rates? Let’s take a look at rates for several companies with a few common violations.

| Group | Driving Record | Annual Average |

|---|---|---|

| Liberty Mutual | With 1 DUI | $19,913.12 |

| Liberty Mutual | With 1 accident | $13,646.49 |

| Liberty Mutual | With 1 speeding violation | $10,738.20 |

| Liberty Mutual | Clean record | $9,956.63 |

| Allstate | With 1 DUI | $5,738.97 |

| Allstate | With 1 accident | $4,780.23 |

| Allstate | With 1 speeding violation | $4,316.11 |

| Allstate | Clean record | $3,292.72 |

| Geico | With 1 DUI | $5,500.20 |

| Geico | With 1 accident | $3,691.11 |

| Geico | With 1 speeding violation | $2,484.09 |

| Geico | Clean record | $2,318.73 |

| American Family | With 1 DUI | $4,775.76 |

| American Family | With 1 accident | $4,259.41 |

| American Family | With 1 speeding violation | $2,682.98 |

| American Family | Clean record | $2,367.00 |

| USAA | With 1 DUI | $4,082.21 |

| USAA | With 1 accident | $2,706.41 |

| USAA | With 1 speeding violation | $2,531.74 |

| USAA | Clean record | $2,126.06 |

| Nationwide | With 1 DUI | $3,547.09 |

| Nationwide | With 1 accident | $3,083.13 |

| Nationwide | With 1 speeding violation | $2,753.24 |

| Nationwide | Clean record | $2,322.48 |

| Farmers | With 1 DUI | $3,427.73 |

| Farmers | With 1 accident | $3,381.83 |

| Farmers | With 1 speeding violation | $3,053.56 |

| Farmers | Clean record | $2,686.69 |

| State Farm | With 1 DUI | $2,066.98 |

| State Farm | With 1 accident | $2,233.53 |

| State Farm | With 1 speeding violation | $2,066.98 |

| State Farm | Clean record | $1,900.45 |

Speeding is one of the most common traffic tickets, and most companies don’t hit your rates too hard for a single violation. It does vary by company, but you can expect to see an increase of a few hundred dollars. Most companies hit you harder for an accident, but a DUI is far and away the worst violation for your bank account. Expect a rate increase of at least a thousand dollars.

Read more: What are the DUI insurance laws in Minnesota?

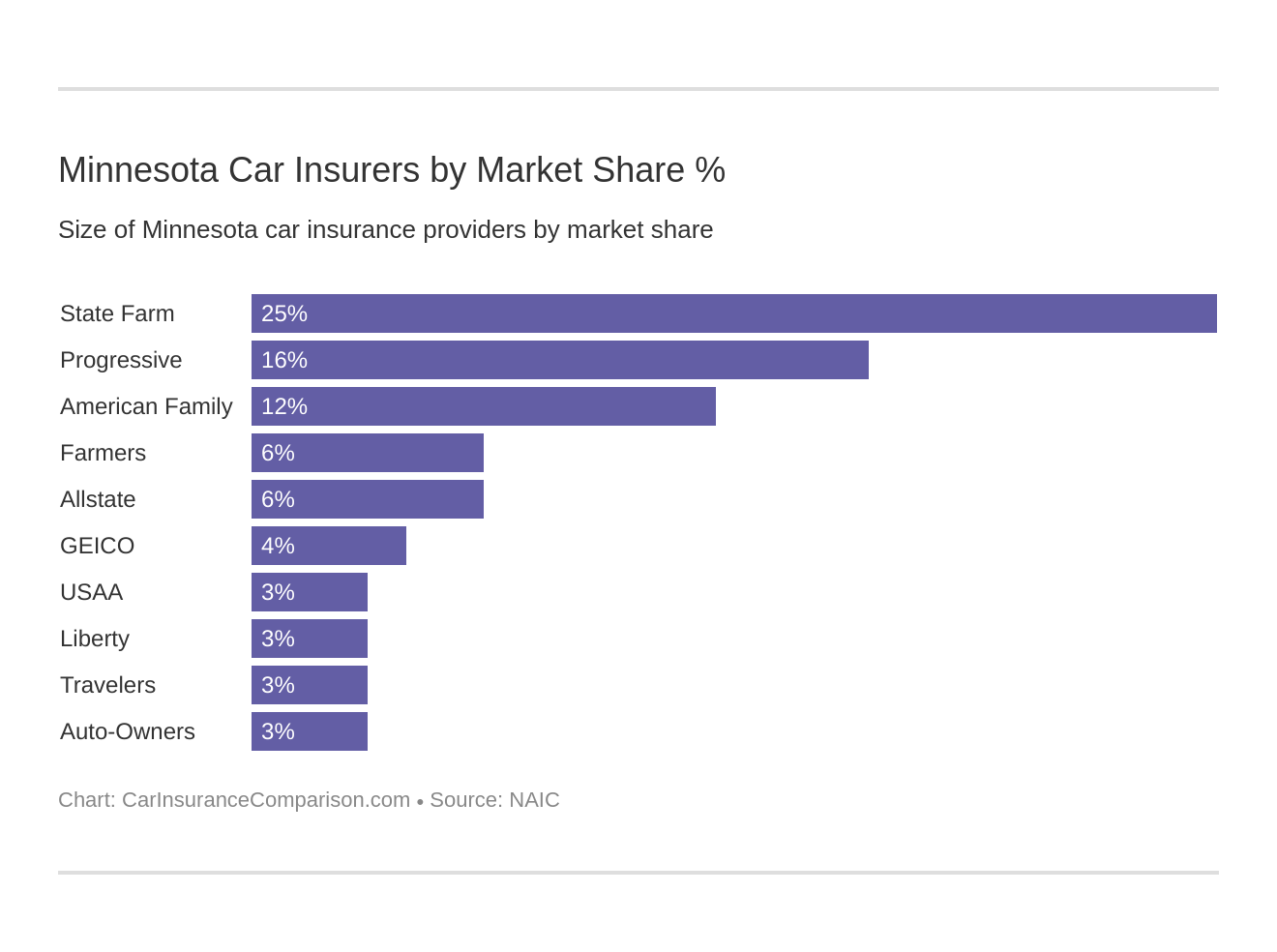

The Largest Car Insurance Companies in Minnesota

| Company Name | Direct Premiums Written | Market Share | |

|---|---|---|---|

| State Farm Group | $891,085 | 24.73% | |

| Progressive Group | $586,357 | 16.27% | |

| American Family Insurance Group | $418,487 | 11.62% | |

| Farmers Insurance Group | $212,804 | 5.91% | |

| Allstate Insurance Group | $200,235 | 5.56% | |

| Geico | $129,987 | 3.61% | |

| USAA Group | $110,895 | 3.08% | |

| Liberty Mutual Group | $110,671 | 3.07% | |

| Travelers Group | $106,222 | 2.95% | |

| Auto-Owners Group | $103,671 | 2.88% |

Number of Car Insurance Companies in Minnesota

| Property & Casualty Insurers | Number |

|---|---|

| Domestic | 39 |

| Foreign | 816 |

| Total | 855 |

There are a lot of insurance companies to choose from in Minnesota. Thirty-nine of those are domestic compared to a total of 816 foreign insurers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Minnesota Laws

Like most states, Minnesota has laws on the books governing drivers on the road.

Minnesota’s State Laws

All of the legal language and nuances of laws can be confusing, but it’s important to know the rules so that you can be sure to follow them. A simple breakdown of the laws in straightforward language would make it a lot easier. So that’s exactly what we’ve put together for you in the next section. We’ll go over the laws every driver needs to know – from insurance to when and how you can use your mobile phone – to avoid expensive tickets and other penalties.

Car Insurance Laws

The Minnesota Legislature determines the laws that govern car insurance for the state. Car insurance laws in Minnesota are laid out in section 65B of the state statutes. Don’t worry about trying to read that, we’ll give you the lowdown on what you really need to know.

High-Risk Insurance

Minnesota is one of the few states that don’t require the filing of an SR-22 for drivers that have been convicted of certain violations such as a DUI. The state does require that anyone who has had their license revoked file proof of an insurance policy that’s good for at least 12 months with the state before the license can be reinstated.High-risk drivers in Minnesota are likely to have some difficulty getting coverage. The state operates the Minnesota Automobile Insurance Plan (MAIP) to provide a solution for those drivers. The plan places drivers who have been turned down on the open market with an insurance company.

Low-Cost Insurance

Minnesota doesn’t operate a low-cost car insurance program. MAIP will help those drivers who have not been able to get a rate below the plan’s pre-determined limits, but since it’s still high-risk auto insurance, low-income drivers with a clean record will likely get a better deal on the standard market.

Windshield Coverage

Under Minnesota law, car insurance companies have to offer Full Glass Replacement as a coverage option on every policy. If you elect to carry this coverage, your insurance company will repair or replace your windshield with no deductible and at no cost to you.The use of aftermarket parts for windshield replacement is allowed under Minnesota law, and they can also use OEM parts that are used.You can choose your own repair shop for the work, rather than the one your insurance company selects, but you might have to pay the difference in cost.

Automobile Insurance Fraud in Minnesota

Minnesota has tough laws when it comes to defrauding an insurance company. Laws prohibiting insurance fraud are outlined in Minnesota statute 609.611. The penalties for breaking the state’s insurance fraud laws can include fines and jail time that increases with the amount of money involved.

If you’re convicted of insurance fraud, you may face a sentence ranging from a $1,000 fine and 90 days in jail up to a fine of $100,000 and 20 years in jail.

The Minnesota Department of Commerce operates a fraud bureau that handles fraud complaints. The state requires insurance companies to have a fraud identification and prevention program in place and provides immunity for insurers when reporting fraud to law enforcement.

Statute of Limitations

The statute of limitations for filing a claim or lawsuit after a car accident in Minnesota differs depending on the type of liability involved. For injury suits, claims and lawsuits can be filed up to 2 years after the accident. Property damage claims and lawsuits can be filed up to 6 years after the accident.

Vehicle Licensing Laws

Insurance is obviously not the only thing you need to drive in Minnesota. You also have to be licensed, and like most states, Minnesota has laws that govern the who, where, and when of vehicle and driver licensing.

Penalties for Driving Without Insurance

Driving without insurance is illegal in Minnesota. The penalties for doing so include:

- Fines of $200-$1,000

- Community Services

- Jail time of up to 90 days

- Revoking of your license and vehicle registration for up to 12 months.

A conviction for driving without insurance means you’ll be required to provide proof of an insurance policy with a term length of no less than 12 months in order to have your driving privileges restored.

Teen Driver Laws

Minnesota uses a graduated licensing system for teen drivers. Every teen driver has to go through several steps before they can obtain a full, unrestricted license.

| License Type | Age of Eligibility | Requirements to Obtain | Restrictions |

|---|---|---|---|

| Learners Permit | 15 | Enroll in Driver Ed if under 18 and complete classroom portion Pass written exam | May drive only with parent, guardian, instructor, or licensed driver over 21 |

| Restricted License | 16 | 6 month holding period with permit Complete 50 hours (40 if parent class is completed) of in-car instruction, 15 of these at night Pass road test | No driving between midnight-5 a.m. Only one passenger under 20 for the first six months, three under 20 for the second six months |

| Full License | 17 | Complete 12 months with restricted license | None |

Older Driver License Renewal Procedures

Minnesota’s driver license renewal procedures are the same regardless of age.

| License Renewal | Vision Test | Renewal by Mail |

|---|---|---|

| Every 4 years | At every renewal | No |

New Residents

If you’re new to Minnesota you will need to obtain a Minnesota driver’s license and register your vehicles with the state. You have 60 days to get your Minnesota license, with the exception of active duty military.New residents that already hold a valid (or expired for less than one year) U.S. or Canadian license will need to head down to the nearest Driver and Vehicle Services Exam Station to take the written knowledge test and complete a vision check.New residents from any other country, or whose license has been expired for more than a year, will need to take a road skills test in addition to the written and vision check tests.With all the testing complete, all that’s left to do is fill out the license application, pay the fees, and smile for the camera.

License Renewal Procedures

Minnesota law requires that all drivers renew their license every four years. This can’t be done by mail (with one exception) or online; you will need to go in and have a new photo taken.A vision test is required at every renewal no matter what your age.

Minnesota’s Negligent Driver System

Minnesota assigns points to drivers for certain violations of the law. Too many points mean your insurance company can choose to non-renew your insurance policy, but it doesn’t affect your driver’s license.That doesn’t mean you can’t have your license suspended or revoked for negligent driving. There are many acts that can result in the state revoking your driving privileges, including DUI convictions and driving without insurance.

Rules of the Road

Minnesota has a lot of rules that tell drivers how to navigate the roads. You don’t need to know all the statutes, but you should know these important laws.

Fault vs No-Fault

As we mentioned back at the beginning of this article, Minnesota is a no-fault car insurance state. When you’re involved in a car accident and are injured, this is the order in which insurance companies will pay out benefits:

- PIP coverage on your policy, up to the limits

- Liability of the at-fault driver’s insurance policy, up to the policy limits

- Underinsured motorist liability on your policy, up to the policy limits

If it turns out the driver at fault doesn’t have insurance, your uninsured motorist coverage will kick into foot the bill after your PIP is exhausted.We’ve already pointed this out, but it bears repeating that property damage doesn’t fall under the no-fault law. If you’re at least 50% at fault, your insurance company pays for repairs – as long as you carry collision coverage. If the other driver is the one at fault, their property damage liability will pay out, with your uninsured or underinsured coverage kicking in as needed.

Keep Right and Move Over Laws

Minnesota drivers are required to stay in the right lane when traveling on a multi-lane road, unless:

- The right lane is closed for construction

- You’re passing a driver moving at a slower rate of speed

- There are three or more lanes

- You’re passing a stopped emergency or construction vehicle that is on the right shoulder

You’re also required to move over to the right and allow a vehicle to pass you if you’re traveling at a speed that’s below the average rate on that road.

Speed Limits

Minnesota’s speed limits are 70 mph on rural interstates, 65 mph on urban interstates, 65 mph on other limited access roads, and 60 on other roads. You can also go too slow on the road! Minnesota also has a minimum speed limit of 40 mph on interstates.

Seat Belt and Car Seat Laws

Make sure you buckle up on Minnesota roads! It’s illegal for anyone over the age of 8 to be in any seat without a seat belt fastened. For kids under 8, the proper car seat for age and weight ratings must be in use. It’s against the law for any child under the age of 7 or 57 lbs in weight to be fastened with only an adult safety belt. Currently, Minnesota law doesn’t put any restrictions on whether that car seat can be in the front seat of the car, although the rear seat is recommended. There is no law that says you can’t ride in the cargo area of a pickup truck in Minnesota.

Ridesharing

If you’re driving for a rideshare service such as Uber or Lyft, you should check to make sure that your insurance covers you for the extra liability. Several insurance companies offer ridesharing endorsements on their personal auto policies for Minnesota drivers. Read the fine print carefully, though, as what is covered depends on the company.

Automation on the Road

Minnesota doesn’t have any laws on the books at the moment in regards to automation on the road. A task force was created and released a report on the subject, but there’s no legislation in place just yet.

Safety Laws

We’re almost at the end of the laws you need to know to drive in Minnesota! Keep reading, because this is important. In this section, we’ll take a look at safe driving laws.

DUI Laws

In Minnesota, the legal blood alcohol limit for drivers is 0.08.A DUI conviction in Minnesota can be a misdemeanor of varying levels or a felony, depending on the aggravating factors. These factors include prior offenses, blood alcohol level over .19, and driving with a passenger under the age of 16 (if that passenger is 36 months or more younger than the driver.Here are the penalties you can expect if you’re convicted.

| Type of Penalty | First Offense | Second Offense | Third Offense | Fourth Offense | Fifth and Subsequent Offenses |

|---|---|---|---|---|---|

| License Revocation | 90 days (180 days if under 21 year old) | One year | Third offense on record - Revoked one year Third offense in 10 years - Cancelled and denied for three years | Fourth offense on record - Cancelled and revoked for three years Fourth offense in 10 years - Cancelled and revoked for four years | Fifth offense on record - Cancelled and revoked for six years Fifth in 10 years - Cancelled and revoked for six years |

| Imprisonment | No minimum up to 90 days | Mandatory 30 days incarceration (48 hours must be served in jail/workhouse) up to one year | 90 days incarceration (at least 30 days served consecutively in jail/workhouse) | 90 days up to seven years (at least 30 days served consecutively in local jail/workhouse) | One year incarceration (at least 60 days served consecutively in local jail/workhouse) |

| Fine | $1000 | $3,000 | $3,000 minimum | $14000 | N/A |

| Other Penalties | N/A | N/A | Unless the maximum bail is imposed, the offender may receive pretrial release from detention if they agree to no alcohol consumption and submit to electronic alcohol monitoring (REAM) with at least daily breath-alcohol testing | Impoundment of registration and plates, weekly meeting with probation officer and random substance testing. Must pay the court for these services | N/A |

Marijuana Impaired Driving Laws

Minnesota doesn’t have any laws specific to driving while impaired by marijuana.

Distracted Driving Laws

In 2019, Minnesota joined the other states that have banned hand-held cell phone use while driving, passing the law through the state legislature.It’s also illegal to text while driving, or to use your phone for other purposes including emailing or web browsing. You can use your phone while driving in an emergency situation but bear in mind that getting the perfect Instagram shot is not considered an emergency!Drivers with a learners permit and during the first 12 months as a provisional licensed driver are banned from using a cell phone in any way, including hands-free.

Must-Read Facts About Minnesota

How safe are you on the road in Minnesota? How safe is your car? There are a lot of statistics out there, and it can be hard to make sense of them.We’ve got all the facts for you right here. Read on for a breakdown of everything you need to know about the risks on Minnesota roads.

Vehicle Theft in Minnesota

Here is a look at the most commonly stolen cars in Minnesota.

| Make/Model | Year of Vehicle | Thefts |

|---|---|---|

| Honda Civic | 1998 | 676 |

| Honda Accord | 1997 | 524 |

| Chevrolet Pickup (Full Size) | 1999 | 329 |

| Ford Pickup (Full Size) | 2005 | 246 |

| Toyota Camry | 1999 | 214 |

| Honda CR-V | 1999 | 190 |

| Chevrolet Impala | 2004 | 171 |

| Dodge Caravan | 2003 | 143 |

| Toyota Corolla | 2010 | 109 |

| Acura Integra | 1996 | 95 |

Curious as to how many cars are stolen in your hometown? Search for your city to view 2017 data gathered from the FBI.

| State | Motor vehicle theft |

|---|---|

| Aitkin | 4 |

| Akeley | 1 |

| Albany | 7 |

| Albert Lea3 | 20 |

| Alexandria | 28 |

| Annandale | 3 |

| Anoka | 20 |

| Appleton | 0 |

| Apple Valley | 31 |

| Arlington | 0 |

| Atwater | 0 |

| Austin | 26 |

| Avon | 4 |

| Babbitt | 2 |

| Barnesville | 0 |

| Baxter | 8 |

| Bayport | 1 |

| Becker | 2 |

| Belgrade/Brooten | 2 |

| Belle Plaine | 0 |

| Bemidji | 59 |

| Benson | 0 |

| Big Lake | 8 |

| Blackduck | 1 |

| Blaine | 78 |

| Blooming Prairie | 1 |

| Bloomington | 133 |

| Blue Earth | 3 |

| Bovey | 0 |

| Braham | 0 |

| Brainerd | 14 |

| Breckenridge | 6 |

| Breezy Point | 2 |

| Breitung Township | 1 |

| Brooklyn Center | 111 |

| Brooklyn Park | 158 |

| Brownton | 0 |

| Buffalo | 11 |

| Buffalo Lake | 1 |

| Burnsville | 104 |

| Caledonia | 0 |

| Cambridge | 17 |

| Canby | 0 |

| Cannon Falls3 | 3 |

| Centennial Lakes | 11 |

| Champlin | 8 |

| Chaska | 8 |

| Chisholm | 2 |

| Clara City | 0 |

| Clearbrook3 | 0 |

| Cleveland | 0 |

| Cloquet | 24 |

| Cold Spring/Richmond | 2 |

| Coleraine | 0 |

| Columbia Heights | 44 |

| Coon Rapids | 52 |

| Corcoran | 1 |

| Cosmos | 2 |

| Cottage Grove | 40 |

| Crookston | 2 |

| Crosby | 0 |

| Crosslake | 0 |

| Crystal | 22 |

| Danube | 2 |

| Dawson/Boyd | 1 |

| Dayton | 8 |

| Deephaven | 0 |

| Deer River | 1 |

| Detroit Lakes3 | 24 |

| Dilworth | 8 |

| Duluth | 222 |

| Dundas | 0 |

| Eagan | 42 |

| Eagle Lake | 2 |

| East Grand Forks | 6 |

| East Range | 1 |

| Eden Prairie | 29 |

| Eden Valley | 0 |

| Edina | 30 |

| Elko New Market | 0 |

| Elk River | 17 |

| Elmore | 0 |

| Ely | 2 |

| Eveleth | 7 |

| Fairfax | 1 |

| Fairmont | 2 |

| Falcon Heights | 7 |

| Faribault | 32 |

| Farmington | 11 |

| Fergus Falls3 | 16 |

| Floodwood | 1 |

| Foley | 0 |

| Forest Lake | 49 |

| Fridley | 76 |

| Fulda | 0 |

| Gaylord | 0 |

| Gilbert | 3 |

| Glencoe | 3 |

| Glenwood | 0 |

| Golden Valley | 21 |

| Goodhue3 | 0 |

| Goodview | 2 |

| Grand Rapids | 5 |

| Granite Falls | 3 |

| Hallock | 0 |

| Hancock | 0 |

| Hastings | 25 |

| Hawley | 0 |

| Hector | 1 |

| Henning3 | 0 |

| Hermantown | 12 |

| Hibbing | 10 |

| Hill City | 6 |

| Hilltop | 9 |

| Hokah | 0 |

| Hopkins | 31 |

| Houston | 0 |

| Howard Lake | 0 |

| Hutchinson | 2 |

| International Falls | 6 |

| Inver Grove Heights | 78 |

| Isanti | 4 |

| Isle | 0 |

| Janesville | 1 |

| Jordan | 0 |

| Kasson | 4 |

| Keewatin | 1 |

| Kimball | 0 |

| La Crescent | 2 |

| Lake City | 2 |

| Lake Crystal | 4 |

| Lakefield | 0 |

| Lakes Area | 11 |

| Lake Shore | 0 |

| Lakeville | 20 |

| Lamberton | 0 |

| Lauderdale | 3 |

| Le Center | 0 |

| Lester Prairie | 2 |

| Le Sueur | 1 |

| Lewiston | 1 |

| Lino Lakes | 8 |

| Litchfield | 7 |

| Little Falls | 11 |

| Long Prairie | 3 |

| Lonsdale | 0 |

| Madelia | 0 |

| Madison Lake | 0 |

| Mankato | 51 |

| Maple Grove | 35 |

| Mapleton | 0 |

| Maplewood | 169 |

| Marshall | 7 |

| McGregor | 0 |

| Medina | 2 |

| Melrose | 0 |

| Menahga | 0 |

| Mendota Heights | 13 |

| Milaca | 2 |

| Minneapolis | 2,388 |

| Minneota | 0 |

| Minnesota Lake | 0 |

| Minnetonka | 34 |

| Minnetrista | 3 |

| Montevideo | 6 |

| Montgomery | 8 |

| Moorhead | 104 |

| Moose Lake | 1 |

| Morris | 3 |

| Motley | 0 |

| Mounds View | 29 |

| Mountain Lake | 2 |

| Nashwauk | 0 |

| New Brighton | 47 |

| New Hope | 22 |

| New Prague | 3 |

| New Richland | 0 |

| New Ulm | 10 |

| North Branch | 7 |

| Northfield | 6 |

| North Mankato | 11 |

| North St. Paul | 26 |

| Oakdale | 65 |

| Oak Park Heights | 9 |

| Olivia | 7 |

| Onamia | 0 |

| Orono | 5 |

| Ortonville | 0 |

| Osakis | 2 |

| Osseo | 0 |

| Owatonna | 27 |

| Park Rapids | 8 |

| Paynesville | 5 |

| Pequot Lakes | 3 |

| Pierz | 0 |

| Pike Bay | 0 |

| Pillager | 0 |

| Pine River | 1 |

| Plainview | 1 |

| Plymouth | 28 |

| Preston | 2 |

| Princeton | 9 |

| Prior Lake | 45 |

| Proctor | 4 |

| Ramsey | 17 |

| Randall | 0 |

| Red Wing3 | 24 |

| Redwood Falls | 13 |

| Renville | 3 |

| Rice | 0 |

| Richfield | 67 |

| Robbinsdale | 28 |

| Rochester | 98 |

| Rogers | 14 |

| Roseau | 2 |

| Rosemount | 3 |

| Roseville | 100 |

| Rushford | 0 |

| Sartell | 6 |

| Sauk Centre | 4 |

| Sauk Rapids | 7 |

| Savage | 30 |

| Sebeka | 0 |

| Shakopee | 51 |

| Sherburn | 0 |

| Silver Bay | 0 |

| Silver Lake | 0 |

| Slayton | 0 |

| Sleepy Eye | 1 |

| South Lake Minnetonka | 7 |

| South St. Paul | 72 |

| Springfield | 0 |

| Spring Grove | 1 |

| Spring Lake Park | 27 |

| St. Anthony | 10 |

| Staples | 4 |

| Starbuck | 1 |

| St. Charles | 2 |

| St. Cloud | 181 |

| St. Francis | 6 |

| Stillwater | 21 |

| St. James | 1 |

| St. Joseph | 7 |

| St. Louis Park | 55 |

| St. Paul | 2,084 |

| St. Paul Park | 10 |

| St. Peter | 9 |

| Thief River Falls | 9 |

| Tracy | 3 |

| Tri-City | 1 |

| Trimont | 0 |

| Truman | 0 |

| Twin Valley | 0 |

| Two Harbors | 0 |

| Virginia | 19 |

| Wabasha | 4 |

| Wadena | 7 |

| Waite Park | 12 |

| Walker | 1 |

| Warroad | 0 |

| Waseca | 9 |

| Waterville | 0 |

| Wayzata | 5 |

| Wells | 0 |

| West Concord | 0 |

| West Hennepin | 3 |

| West St. Paul | 57 |

| Wheaton | 1 |

| White Bear Lake | 57 |

| Willmar | 40 |

| Windom | 1 |

| Winnebago | 1 |

| Winona | 16 |

| Winsted | 0 |

| Woodbury | 65 |

| Worthington3 | 13 |

| Wyoming | 11 |

| Zumbrota3 | 2 |

Risky and Harmful Behavior

Unfortunately, many accidents happen every year because drivers just aren’t using the caution they should. Let’s take a look at some of the most common bad driving behaviors and the damage they cause.

357 traffic fatalities happened in Minnesota in 2017.

Fatality Rates by City

The Twin Cities are the two cities with the most traffic fatalities in Minnesota, which isn’t surprising given the fact that they are the largest by a wide margin.In 2016, 22 traffic fatalities occurred in Minneapolis, double the 11 fatalities that happened in St. Paul.

Fatality Rates Rural Vs. Urban

In 2017, 209 traffic fatalities happened in Minnesota’s rural areas, while 147 happened in urban areas. One is listed as unknown.

Fatalities by Person Type

| Person Type | Number of Fatalities |

|---|---|

| Vehicle Occupants (all seats) | 254 |

| Pedestrians | 38 |

| Bicyclist/other Cyclist | 6 |

Fatalities by Crash Type

| Crash Type | Fatalities |

|---|---|

| Total Fatalities (All Crashes)* | 357 |

| Single Vehicle | 179 |

| Involving a Large Truck | 61 |

| Involving Speeding | 89 |

| Involving a Rollover | 89 |

| Involving a Roadway Departure | 181 |

| Involving an Intersection (or Intersection Related) | 126 |

Five-Year Trend for The Top Counties

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Hennepin County | 42 | 34 | 33 | 45 | 45 |