Compare Ohio Car Insurance Rates [2025]

Car insurance rates in Ohio are less than the national average rates when you compare Ohio car insurance rates. For example, full coverage insurance policies in Ohio are only an average of $90/mo, making them more affordable than the national average rate of $132/mo for full coverage policies.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

UPDATED: May 5, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: May 5, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Ohio Statistics Summary

| Ohio Statistics Summary | Details |

|---|---|

| Roadway Miles | Road Miles in State: 122,926 Vehicle Miles Driven: 113.7 billion |

| Vehicles | Registered: 10,152,367 Vehicle Thefts: 18,015 |

| Population | 11,689,442 |

| Most Popular Vehicle | Honda Civic |

| Uninsured Motorists | 12.40% State Rank: 22nd |

| Traffic Fatalities | Total: 1,179 Speeding: 252 DUI: 333 |

| Average Insurance Premiums | Liability $397.11 Collision $269.84 Comprehensive $121.61 Total $788.56 |

| Cheapest Provider | USAA and American Family |

Ohio rates are already cheaper than the national average, but drivers who compare Ohio car insurance rates may be able to save even more. Drivers should first familiarize themselves with Ohio car insurance laws, however, so they can decide how much coverage they want after purchasing the required coverage.

Our guide goes over everything drivers need to know about car insurance requirements and rates in Ohio. Ohio drivers can then compare cheap car insurance rates and switch insurance companies to find the best car insurance in Ohio. If you want, you can get started on comparing car insurance quotes in Ohio right away with our free quote comparison tool.

Ohio Car Insurance Coverage and Rates

Ohio law mandates that you have to carry a minimum amount of car insurance to be on the road legally.

- Car Insurance Rates in Ohio

- Compare West Lafayette, OH Car Insurance Rates [2025]

- Compare Waverly, OH Car Insurance Rates [2025]

- Compare Struthers, OH Car Insurance Rates [2025]

- Compare Sidney, OH Car Insurance Rates [2025]

- Compare Navarre, OH Car Insurance Rates [2025]

- Compare Moraine, OH Car Insurance Rates [2025]

- Compare Mechanicsburg, OH Car Insurance Rates [2025]

- Compare Mason, OH Car Insurance Rates [2025]

- Compare Marion, OH Car Insurance Rates [2025]

- Compare Logan, OH Car Insurance Rates [2025]

- Compare Lancaster, OH Car Insurance Rates [2025]

- Compare Defiance, OH Car Insurance Rates [2025]

- Compare Cleveland, OH Car Insurance Rates [2025]

- Compare Cincinnati, OH Car Insurance Rates [2025]

- Compare Bridgeport, OH Car Insurance Rates [2025]

- Compare Bowling Green, OH Car Insurance Rates [2025]

- Compare Blanchester, OH Car Insurance Rates [2025]

- Compare Athens, OH Car Insurance Rates [2025]

The good news for Ohioans is that rates fall below the national average, but that doesn’t make shopping for car insurance any more enjoyable.

Learn more: Should you shop around for car insurance?

You want to make sure you’re adequately covered, but you don’t want to overpay or buy coverage you don’t need. A clear, concise understanding of your options would make it easier!

Everything you need to know is right here in a straightforward and uncomplicated format.

We have gathered the details on mandatory coverage and options and provided rate comparisons between states and companies to give you an idea of what to expect.

This complete guide to Ohio auto insurance will get you ready for the road.

What is the minimum car insurance required in Ohio?

Insurance in Ohio is required to make sure that everyone can handle the financial responsibility of a car accident. Liability car insurance coverage exists to do just that, and it’s what you need to buy to form the legally required basis of your policy. Minimum coverage costs vary from state to state.

Here are Ohio’s state minimum car insurance requirements, according to Ohio State Law.

Ohio Minimum Coverage

| Coverage Type | Legal Minimum |

|---|---|

| Bodily Injury Liability | $25,000 per person $50,000 per incident |

| Property Damage Liability | $25,000 |

Do you need car insurance in Ohio? The answer is yes. You can choose to carry a lot more coverage than the minimums, and it’s a good idea to do so. These limits will keep you on the right side of the law.

Forms of Financial Responsibility in Ohio

Liability insurance is a form of financial responsibility and the most popular choice for Ohio drivers.

There are a few other options. One of them is to be self-insured, but that only applies if you own 25 or more vehicles, and most people don’t.

Alternatively, you can be issued a certificate of financial responsibility in one of three ways:

- Deposit cash or government bonds with the Treasurer of the State of Ohio.

- Sign a certificate of bond asserting that you own real estate with equity for at least $60,000 (two people are required to sign together).

- Provide evidence of a bond issued by an authorized surety or insurance company.

You are always required to carry proof of financial responsibility with you when driving, so whether you choose insurance or an alternative, make sure that’s with the car. Having your car insurance certificate with you when driving is one of the ways you can show proof of financial responsibility.

Ohio Car Insurance Rates as a Percentage of Income

Ohioans spend less of their hard-earned cash on car insurance than the national average by about forty percent.

Based on the average disposable income in the state, drivers in Ohio spent about 1.98 percent of their money on car insurance in 2014. That’s down from the previous two years.

Although premiums have gone up, so has the average disposable income.

Ohio Premiums as Percentage of Income

| Premiums As a Percentage of Income | 2012 Disposable Income | 2012 Average Premium | 2012 Percentage | 2013 Disposable Income | 2013 Average Premium | 2013 Percentage | 2014 Disposable Income | 2014 Average Premium | 2014 Percentage |

|---|---|---|---|---|---|---|---|---|---|

| Ohio | $36,035.00 | $714.05 | 1.98% | $36,168.00 | $738.68 | 2.04% | $37,490.00 | $766.66 | 2.04% |

| National Average | $39,473.00 | $924.45 | 2.34% | $39,192.00 | $950.92 | 2.43% | $40,859.00 | $981.77 | 2.40% |

Indiana fares about the same, with an average of two percent of income spent on car insurance.

To the east, Pennsylvanians spent more, averaging 2.24 percent in 2014.

Average Car Insurance Costs in Ohio (Liability, Collision, Comprehensive)

What is considered full coverage insurance in Ohio? A full-coverage policy consists of three essential components: liability, collision, and comprehensive car insurance.

Ohio Core Coverage

| Coverage Type | Ohio Average (2015) | National Average (2015) |

|---|---|---|

| Liability | $397.11 | $538.73 |

| Collision | $269.84 | $322.61 |

| Comprehensive | $121.61 | $148.04 |

| Total | $788.56 | $1,009.38 |

In Ohio, average rates for core coverage compare favorably with the national average. Ohio’s rates are lower in every category.

Ohio Additional Liability

In addition to the liability you are required by law to carry, you can add some additional options to your insurance policy.

Uninsured/Underinsured Motorist coverage is the most common of these. It’s designed to protect you from both people who don’t carry insurance at all. You’re also protected from those who aren’t able to cover the cost of an accident when they’re at fault.

Approximately 12 percent of motorists on Ohio’s roads are uninsured, ranking 22nd in the nation.

That number doesn’t even account for those that may be underinsured. It can be challenging to quantify since it depends on the accident.

The legal minimum might be fine to cover a fender bender, but someone with that coverage will quickly become underinsured in a severe accident involving injuries.

The second type of additional liability you will be offered in Ohio is Medical Payments (Med Pay). This coverage pays medical bills for you and your passengers regardless of fault in the accident.

Loss ratios gathered by the National Association of Insurance Commissioners (NAIC) can tell us how much Ohio car insurance companies are paying out on these two coverage options compared to the premiums they collect.

Ohio Loss Ratios Additional Liability

| Type of Coverage | Ohio Loss Ratio (2015) | National Average Loss Ratio (2015) |

|---|---|---|

| Uninsured/Underinsured Motorist | 60.65 | 75.11 |

| Medical Payments | 77.37 | 75.72 |

Ohio’s medical payments (MedPay) loss ratio is close to the national average, while UM/UIM’s loss ratio is less. The lower ratio shows car insurance companies paying less in filed claims.

Add-Ons, Endorsements, and Riders

- GAP insurance

- Personal Umbrella Policy (PUP)

- Rental Car Reimbursement

- Emergency Roadside Assistance, such as towing

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Usage-Based Auto Insurance Programs

Most usage-based insurance plans offer a discount in return for allowing the company to monitor your driving habits. Pay-per-mile, on the other hand, actually determines your monthly cost based on the number of miles you drive.

Although several companies offer usage-based insurance in Ohio, the few companies writing pay-per-mile insurance only offer that plan in a handful of states. You won’t get these automobile insurance plans in Ohio.

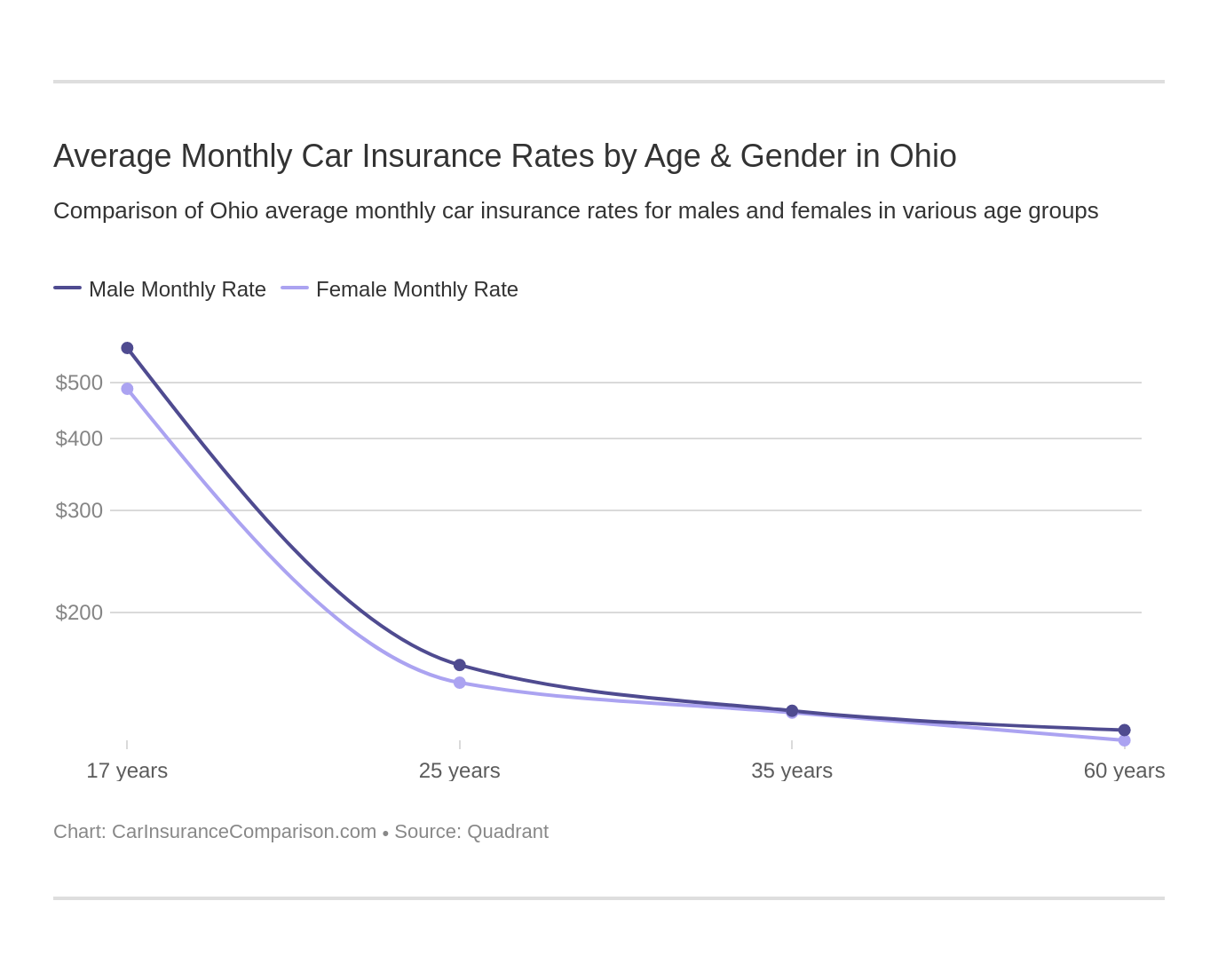

Ohio’s Average Monthly Car Insurance Rates by Age & Gender

Age and gender are two of the factors that have an impact on rates in Ohio. Teen drivers pay the highest rates. Males are a little more expensive than females to insure at age 17.

Rates drop quickly from age 25 and up, and the gender cost gap closes.

Ohio Demographic Rates Male/Female/Age

| Company | Married 35-year old female Annual Rate | Married 35-year old male Annual Rate | Married 60-year old female Annual Rate | Married 60-year old male Annual Rate | Single 17-year old female Annual Rate | Single 17-year old male Annual Rate | Single 25-year old female Annual Rate | Single 25-year old male Annual Rate |

|---|---|---|---|---|---|---|---|---|

| Allstate F&C | $2,138.70 | $2,132.00 | $1,926.78 | $2,060.78 | $5,908.09 | $6,758.78 | $2,248.98 | $2,403.62 |

| American Family Mutual | $943.84 | $980.06 | $862.73 | $866.82 | $2,911.29 | $3,161.47 | $1,166.31 | $1,228.84 |

| Farmers Ins of Columbus | $1,814.67 | $1,810.78 | $1,598.65 | $1,686.60 | $8,004.71 | $8,312.21 | $2,032.84 | $2,123.65 |

| Geico Cas | $1,348.45 | $1,310.04 | $1,264.91 | $1,276.23 | $3,611.17 | $3,359.64 | $1,497.90 | $1,269.11 |

| Safeco Ins Co of IL | $2,067.94 | $2,258.05 | $1,589.89 | $1,934.44 | $10,791.30 | $12,192.16 | $2,199.81 | $2,404.29 |

| Nationwide Mutual | $2,202.69 | $2,214.18 | $1,987.35 | $2,002.19 | $5,629.14 | $7,261.11 | $2,361.32 | $2,749.18 |

| Progressive Specialty | $1,774.30 | $1,672.93 | $1,477.06 | $1,525.00 | $7,866.04 | $8,860.06 | $2,124.39 | $2,195.89 |

| State Farm Mutual Auto | $1,505.94 | $1,505.94 | $1,347.85 | $1,347.85 | $4,698.43 | $5,902.29 | $1,749.20 | $2,005.47 |

| Discover Prop & Cas Ins Co | $1,444.26 | $1,466.30 | $1,434.68 | $1,427.12 | $6,234.90 | $9,849.32 | $1,505.60 | $1,719.12 |

| USAA | $895.00 | $902.46 | $851.69 | $850.63 | $2,763.43 | $3,076.83 | $1,196.59 | $1,291.02 |

Cheapest Ohio Car Insurance Rates By ZIP Code

Did you know that the ZIP code you live in can affect your rates?

Below you can search ZIP codes to see what the average rates look like in various parts of Ohio. You’ll notice that although the most expensive ZIP codes tend to be in the same areas. Not every ZIP code, even within the same city, has the same rates.

Ohio 25 MOST Expensive ZIP Codes

| 25 Most Expensive Zip Codes in Ohio | City | Average Annual Rate by Zip Code | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 43224 | COLUMBUS | $3,667.48 | Progressive | $5,629.87 | Liberty Mutual | $5,580.27 | USAA | $1,677.82 | American Family | $1,735.02 |

| 43608 | TOLEDO | $3,629.84 | Liberty Mutual | $5,604.95 | Farmers | $4,702.48 | USAA | $1,752.21 | American Family | $1,917.02 |

| 43211 | COLUMBUS | $3,608.65 | Liberty Mutual | $5,580.27 | Progressive | $5,260.21 | USAA | $1,602.45 | American Family | $1,820.61 |

| 43610 | TOLEDO | $3,603.68 | Liberty Mutual | $5,604.95 | Farmers | $4,702.66 | USAA | $1,752.21 | American Family | $1,916.61 |

| 43620 | TOLEDO | $3,562.98 | Liberty Mutual | $5,604.95 | Farmers | $4,675.36 | USAA | $1,752.21 | American Family | $1,894.20 |

| 45225 | CINCINNATI | $3,553.80 | Liberty Mutual | $5,279.24 | Progressive | $5,142.08 | USAA | $1,615.82 | American Family | $1,879.15 |

| 45214 | CINCINNATI | $3,546.86 | Liberty Mutual | $5,279.24 | Progressive | $4,932.49 | USAA | $1,773.59 | American Family | $1,914.64 |

| 44510 | YOUNGSTOWN | $3,534.06 | Liberty Mutual | $5,196.76 | Farmers | $4,590.33 | American Family | $1,776.30 | USAA | $1,871.55 |

| 44104 | CLEVELAND | $3,529.50 | Liberty Mutual | $5,411.26 | Progressive | $4,557.19 | USAA | $1,623.13 | American Family | $1,841.35 |

| 44502 | YOUNGSTOWN | $3,525.99 | Liberty Mutual | $5,196.76 | Farmers | $4,548.25 | American Family | $1,769.59 | USAA | $1,871.55 |

| 43604 | TOLEDO | $3,517.76 | Liberty Mutual | $5,604.95 | Farmers | $4,431.29 | USAA | $1,752.21 | American Family | $1,854.68 |

| 44503 | YOUNGSTOWN | $3,516.11 | Liberty Mutual | $5,196.76 | Farmers | $4,541.42 | American Family | $1,769.59 | USAA | $1,871.55 |

| 44504 | YOUNGSTOWN | $3,514.38 | Liberty Mutual | $5,196.76 | Farmers | $4,585.91 | American Family | $1,623.63 | USAA | $1,871.55 |

| 45205 | CINCINNATI | $3,513.17 | Liberty Mutual | $5,279.24 | Progressive | $4,572.49 | USAA | $1,773.59 | American Family | $1,896.43 |

| 43203 | COLUMBUS | $3,511.66 | Liberty Mutual | $5,580.27 | Progressive | $4,524.21 | USAA | $1,602.45 | American Family | $1,832.09 |

| 43609 | TOLEDO | $3,508.26 | Liberty Mutual | $5,604.95 | Farmers | $4,427.34 | USAA | $1,632.21 | American Family | $1,854.68 |

| 43219 | COLUMBUS | $3,507.34 | Liberty Mutual | $5,580.27 | Progressive | $4,346.93 | USAA | $1,485.99 | American Family | $1,788.00 |

| 44506 | YOUNGSTOWN | $3,500.25 | Liberty Mutual | $5,196.76 | Farmers | $4,531.75 | American Family | $1,764.69 | USAA | $1,871.55 |

| 44507 | YOUNGSTOWN | $3,497.59 | Liberty Mutual | $5,196.76 | Farmers | $4,608.03 | American Family | $1,779.08 | USAA | $1,871.55 |

| 43612 | TOLEDO | $3,496.23 | Liberty Mutual | $5,604.95 | Farmers | $4,371.09 | USAA | $1,690.58 | American Family | $1,827.44 |

| 43605 | TOLEDO | $3,483.76 | Liberty Mutual | $5,604.95 | Farmers | $4,343.36 | American Family | $1,663.32 | USAA | $1,690.58 |

| 45219 | CINCINNATI | $3,477.52 | Liberty Mutual | $5,279.24 | Farmers | $4,641.51 | USAA | $1,713.89 | American Family | $1,879.84 |

| 44127 | CLEVELAND | $3,472.34 | Liberty Mutual | $5,411.26 | Farmers | $4,386.64 | USAA | $1,623.13 | American Family | $1,821.20 |

| 44103 | CLEVELAND | $3,469.12 | Liberty Mutual | $5,411.26 | Farmers | $4,241.90 | USAA | $1,623.13 | American Family | $1,841.35 |

| 43205 | COLUMBUS | $3,462.57 | Liberty Mutual | $5,580.27 | Progressive | $4,216.52 | USAA | $1,547.76 | American Family | $1,781.09 |

The highest ZIP code rates tend to be in parts of Ohio’s bigger cities, such as Columbus, Toledo, and Cincinnati. You can compare Cleveland, OH car insurance rates to find out about the prices in Ohio’s second biggest city.

Ohio 25 CHEAPEST ZIP Codes

| 25 Cheapest ZIP Codes in Ohio | City | Average Annual Rate by Zip Codes | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 44883 | TIFFIN | $2,325.38 | Liberty Mutual | $3,357.16 | Nationwide | $2,831.42 | USAA | $1,301.36 | American Family | $1,360.24 |

| 45840 | FINDLAY | $2,340.63 | Liberty Mutual | $3,357.16 | Nationwide | $2,970.73 | USAA | $1,357.45 | American Family | $1,374.49 |

| 44861 | OLD FORT | $2,355.45 | Liberty Mutual | $3,357.16 | Farmers | $3,101.73 | USAA | $1,301.36 | American Family | $1,362.16 |

| 45816 | BENTON RIDGE | $2,360.76 | Liberty Mutual | $3,357.16 | Nationwide | $2,970.73 | American Family | $1,272.61 | USAA | $1,357.45 |

| 44820 | BUCYRUS | $2,362.24 | Liberty Mutual | $3,357.16 | Progressive | $2,961.66 | American Family | $1,346.67 | USAA | $1,380.40 |

| 44830 | FOSTORIA | $2,366.68 | Liberty Mutual | $3,357.16 | Progressive | $2,942.53 | USAA | $1,301.36 | American Family | $1,332.01 |

| 43351 | UPPER SANDUSKY | $2,367.88 | Liberty Mutual | $3,357.16 | Farmers | $2,847.94 | American Family | $1,329.32 | USAA | $1,380.40 |

| 44809 | BASCOM | $2,376.36 | Liberty Mutual | $3,357.16 | Farmers | $3,205.79 | USAA | $1,301.36 | American Family | $1,317.91 |

| 43330 | KIRBY | $2,377.02 | Liberty Mutual | $3,357.16 | Farmers | $3,022.97 | American Family | $1,353.85 | USAA | $1,380.40 |

| 44845 | MELMORE | $2,377.03 | Liberty Mutual | $3,357.16 | Progressive | $3,100.88 | USAA | $1,301.36 | American Family | $1,329.07 |

| 45875 | OTTAWA | $2,380.80 | Liberty Mutual | $3,357.16 | Nationwide | $2,970.73 | American Family | $1,363.80 | USAA | $1,380.40 |

| 44828 | FLAT ROCK | $2,385.20 | Liberty Mutual | $3,357.16 | Farmers | $3,134.66 | USAA | $1,301.36 | American Family | $1,362.08 |

| 44802 | ALVADA | $2,385.94 | Liberty Mutual | $3,357.16 | Nationwide | $2,970.73 | American Family | $1,317.91 | USAA | $1,357.45 |

| 44817 | BLOOMDALE | $2,386.88 | Liberty Mutual | $3,357.16 | Nationwide | $3,032.81 | American Family | $1,291.40 | USAA | $1,357.45 |

| 44827 | CRESTLINE | $2,389.32 | Liberty Mutual | $3,357.16 | Allstate | $2,935.13 | American Family | $1,315.21 | USAA | $1,380.40 |

| 45891 | VAN WERT | $2,391.83 | Liberty Mutual | $3,639.93 | Nationwide | $2,910.25 | USAA | $1,380.40 | American Family | $1,434.97 |

| 43316 | CAREY | $2,393.94 | Liberty Mutual | $3,357.16 | Farmers | $2,996.09 | American Family | $1,353.85 | USAA | $1,380.40 |

| 45815 | BELMORE | $2,396.47 | Liberty Mutual | $3,357.16 | Nationwide | $2,970.73 | American Family | $1,276.62 | USAA | $1,380.40 |

| 44853 | NEW RIEGEL | $2,396.49 | Liberty Mutual | $3,357.16 | Farmers | $3,084.43 | USAA | $1,301.36 | American Family | $1,385.92 |

| 45877 | PANDORA | $2,397.00 | Liberty Mutual | $3,357.16 | Nationwide | $2,970.73 | American Family | $1,317.31 | USAA | $1,380.40 |

| 44844 | MC CUTCHENVILLE | $2,404.82 | Liberty Mutual | $3,357.16 | Progressive | $3,045.60 | American Family | $1,329.07 | USAA | $1,380.40 |

| 45889 | VAN BUREN | $2,406.02 | Liberty Mutual | $3,357.16 | Nationwide | $2,970.73 | American Family | $1,272.61 | USAA | $1,357.45 |

| 44836 | GREEN SPRINGS | $2,408.82 | Liberty Mutual | $3,357.16 | Farmers | $3,170.31 | USAA | $1,301.36 | American Family | $1,362.16 |

| 43323 | HARPSTER | $2,409.21 | Liberty Mutual | $3,357.16 | Farmers | $3,026.73 | American Family | $1,329.32 | USAA | $1,380.40 |

| 44854 | NEW WASHINGTON | $2,409.32 | Liberty Mutual | $3,357.16 | Farmers | $3,064.02 | American Family | $1,373.19 | USAA | $1,380.40 |

The cheapest ZIP codes happen to be rural areas. Rural areas are much less expensive because the risk of an accident is much lower. A low accident rate means lower chances of filing a claim.

Cheapest Ohio Car Insurance Rates by City

Let’s compare car insurance rates from different cities. Review the rates below to compare which are the most expensive and the cheapest.

Ohio 10 MOST Expensive Cities

| 10 Most Expensive Cities in Ohio | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Youngstown | $3,471.04 | Liberty Mutual | $5,116.26 | Farmers | $4,491.06 | American Family | $1,720.93 | USAA | $1,834.62 |

| Toledo | $3,462.84 | Liberty Mutual | $5,528.64 | Farmers | $4,373.06 | USAA | $1,682.66 | American Family | $1,747.29 |

| Blacklick Estates | $3,449.06 | Liberty Mutual | $5,580.27 | Progressive | $4,254.54 | American Family | $1,696.72 | USAA | $1,699.83 |

| Bexley | $3,433.05 | Liberty Mutual | $5,580.27 | Travelers | $4,212.62 | USAA | $1,705.29 | American Family | $1,776.08 |

| Beachwood | $3,397.39 | Liberty Mutual | $5,411.26 | Farmers | $4,311.60 | USAA | $1,623.13 | American Family | $1,633.38 |

| Ottawa Hills | $3,396.30 | Liberty Mutual | $5,604.95 | Nationwide | $4,141.77 | USAA | $1,632.21 | American Family | $1,664.03 |

| Cleveland | $3,395.66 | Liberty Mutual | $5,411.26 | Farmers | $4,164.61 | USAA | $1,622.29 | American Family | $1,765.02 |

| Columbus | $3,340.94 | Liberty Mutual | $5,580.27 | Travelers | $4,153.84 | USAA | $1,551.12 | American Family | $1,683.71 |

| Bridgetown | $3,314.15 | Liberty Mutual | $5,279.24 | Progressive | $4,179.06 | USAA | $1,710.83 | American Family | $1,823.10 |

| Cincinnati | $3,303.69 | Liberty Mutual | $5,126.55 | Progressive | $4,086.64 | USAA | $1,617.73 | American Family | $1,784.34 |

Youngstown has the most expensive rate in Ohio. However, Youngstown’s rate is not that much higher than the rates for the cheapest cities.

Ohio Top 10 Cheapest Cities

| 10 Least Expensive Cities in Ohio | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Bettsville | $2,325.38 | Liberty Mutual | $3,357.16 | Nationwide | $2,831.42 | USAA | $1,301.36 | American Family | $1,360.24 |

| Findlay | $2,340.63 | Liberty Mutual | $3,357.16 | Nationwide | $2,970.73 | USAA | $1,357.45 | American Family | $1,374.49 |

| Old Fort | $2,355.45 | Liberty Mutual | $3,357.16 | Farmers | $3,101.73 | USAA | $1,301.36 | American Family | $1,362.16 |

| Benton Ridge | $2,360.75 | Liberty Mutual | $3,357.16 | Nationwide | $2,970.73 | American Family | $1,272.61 | USAA | $1,357.45 |

| Bucyrus | $2,362.24 | Liberty Mutual | $3,357.16 | Progressive | $2,961.66 | American Family | $1,346.67 | USAA | $1,380.40 |

| Fostoria | $2,366.68 | Liberty Mutual | $3,357.16 | Progressive | $2,942.53 | USAA | $1,301.36 | American Family | $1,332.01 |

| Upper Sandusky | $2,367.88 | Liberty Mutual | $3,357.16 | Farmers | $2,847.94 | American Family | $1,329.32 | USAA | $1,380.40 |

| Bascom | $2,376.36 | Liberty Mutual | $3,357.16 | Farmers | $3,205.79 | USAA | $1,301.36 | American Family | $1,317.91 |

| Kirby | $2,377.02 | Liberty Mutual | $3,357.16 | Farmers | $3,022.97 | American Family | $1,353.85 | USAA | $1,380.40 |

| Melmore | $2,377.03 | Liberty Mutual | $3,357.16 | Progressive | $3,100.88 | USAA | $1,301.36 | American Family | $1,329.07 |

USAA car insurance company is the cheapest company in most parts of Ohio. Only U.S. military members and their immediate families are eligible for USAA. Be sure to carry military ID proof for USAA company policies.

American Family car insurance in Perrysburg and Upper Sandusky, Ohio, is cheaper than USAA car insurance. You can read our USAA car insurance review for more information on the company.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

The Best Ohio Car Insurance Companies

Choosing a car insurance company feels a little like throwing a dart at a list of company names and hoping for the best.

Everyone promises excellent rates, great coverage, and the best customer service, but how can you be sure they’re keeping those promises? There has to be a better way to choose the company that’s protecting you on the road.

We can help you make that decision with the information you need to feel confident in your choice.

We’ve gathered all the ratings and complaint data for the biggest insurance companies in Ohio right here, and broken down all the information.

You can also compare those companies based on their average premiums for several big rating factors, so you know you’re picking both the company with the best reputation and the company that delivers the best rates for your needs.

The Largest Companies’ Financial Ratings

Financial ratings for insurance companies may not seem like they are all that relevant to the average consumer, but they can tell you whether you can count on your insurer to pay out their claims.

Consider what happens when there is a major natural disaster. Insurance companies have to pay out a lot of claims in a short time.

Most car insurance companies also write home insurance, which means all those hurricane home claims are draining the same company’s resources that insure homes and cars in other parts of the country.

A company that doesn’t have the financial resources to ride out the storm claims could go under, and what if that’s the moment you’re in a major car accident?

A.M. Best provides us with ratings that help determine a company’s stability.

Ohio Top Companies A.M. Best Rating

| Company | AM Best Rating |

|---|---|

| State Farm Group | A++ |

| Progressive Group | A+ |

| Allstate Insurance Group | A+ |

| Nationwide Corp Group | A+ |

| Geico | A++ |

| Grange Mutual Casualty Group | A |

| Liberty Mutual Group | A |

| Erie Insurance Group | A+ |

| USAA Group | A++ |

| American Family Insurance Group | A |

As you can see, all of the top companies rate well for financial stability. They have all earned a rating of either Excellent (A, A-) or Superior (A+, A++). All of these companies are in a stable position to pay out claims on the policies they have written.

Companies With The Best Ratings

From financial ratings, we move on to what the customers have to say. First, let’s look at the ratings provided by J.D. Power, the most trusted name in consumer survey ratings.

So what are the best Ohio car insurance companies?

J.D. Power ranks companies on a 1000-point scale

USAA ranks the best on the scale for 2020, but since they are open only to military members and their families, J.D. Power doesn’t list them.

The other top insurance companies on the latest survey are Geico, Farm Bureau, and Erie Insurance Erie Insurance is among the largest companies in Ohio. Erie Insurance is located in Kenton, Ohio, as well as, Vandalia, Belpre, Wadsworth, and Poland, Ohio.

State Farm car insurance fell below average on the latest ratings. You can read our State Farm car insurance review for more information.

The takeaway? The biggest car insurance companies aren’t always the best-rated. It’s still a good idea to look at options beyond the insurers that own the biggest market share.

Companies With The Most Complaints in Ohio

The Ohio Department of Insurance collects complaints data for car insurance companies operating in the state.

Ohio Companies Customer Complaints

| Company | Number of Complaints (2015) | Complaint Ratio (to market share) |

|---|---|---|

| State Farm Group | 132 | 0.54 |

| Progressive Group | 72 | 0.87 |

| Allstate Insurance Group | 66 | 0.79 |

| Nationwide Corp Group | 28 | 0.55 |

| Geico | 53 | 1.27 |

| Grange Mutual Casualty Group | 46 | 1.12 |

| Liberty Mutual Group | 6 | 0.71 |

| Erie Insurance Group | 21 | 0.51 |

| USAA Group | 11 | 1.14 |

| American Family Insurance Group | 24 | 1.07 |

Geico, USAA, and Grange car insurance had the highest complaint ratio.

Complaint ratios are the big number to look at here – you will note that although State Farm has the highest number of complaints, it also has the lowest ratio. That’s because they have the largest part of the market share in Ohio. Their number of complaints comes from a much larger pool of customers than other companies.

Several complaints can cause something of a knee-jerk reaction, but it’s important to remember that it depends on the size of the company.

You may not be able to get a direct Grange car insurance quote here, but you can compare car insurance quotes from different companies in your local area by entering your ZIP code below!

Read more: The Grange Car Insurance Review

Cheapest Car Insurance Companies in Ohio

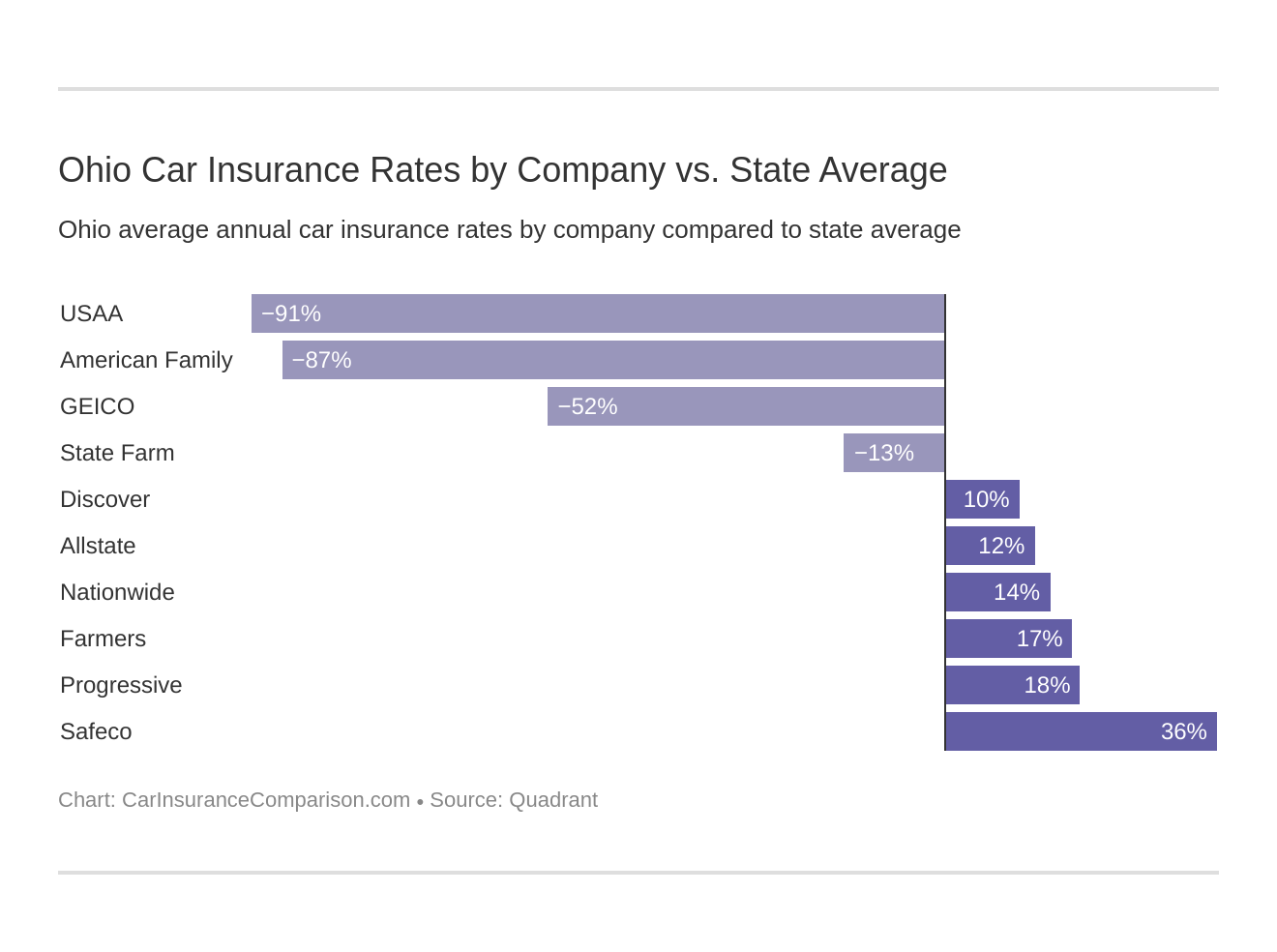

You can see below how the top ten companies’ rates compare to the state average.

Of the top companies, USAA is the cheapest option in Ohio, with rates coming in at almost half of the average. They’re only open to those with a qualifying military connection, but for those without that qualification, rates from American Family are not far behind. Read our American Family car insurance review for more information.

Ohio Cheapest Companies

| Company | Average Annual Rate | Compared to State Average ($) | Compared to State Average (%) |

|---|---|---|---|

| Allstate F&C | $3,197.22 | $368.05 | 11.51% |

| American Family Mutual | $1,515.17 | -$1,314.00 | -86.72% |

| Farmers Ins of Columbus | $3,423.01 | $593.85 | 17.35% |

| Geico Cas | $1,867.18 | -$961.98 | -51.52% |

| Safeco Ins Co of IL | $4,429.74 | $1,600.57 | 36.13% |

| Nationwide Mutual | $3,300.89 | $471.73 | 14.29% |

| Progressive Specialty | $3,436.96 | $607.79 | 17.68% |

| State Farm Mutual Auto | $2,507.87 | -$321.30 | -12.81% |

| Discover Prop & Cas Ins Co | $3,135.16 | $306.00 | 9.76% |

| USAA | $1,478.46 | -$1,350.71 | -91.36% |

Compared to the national average, American Family and USAA are the cheapest car insurance companies in Ohio.

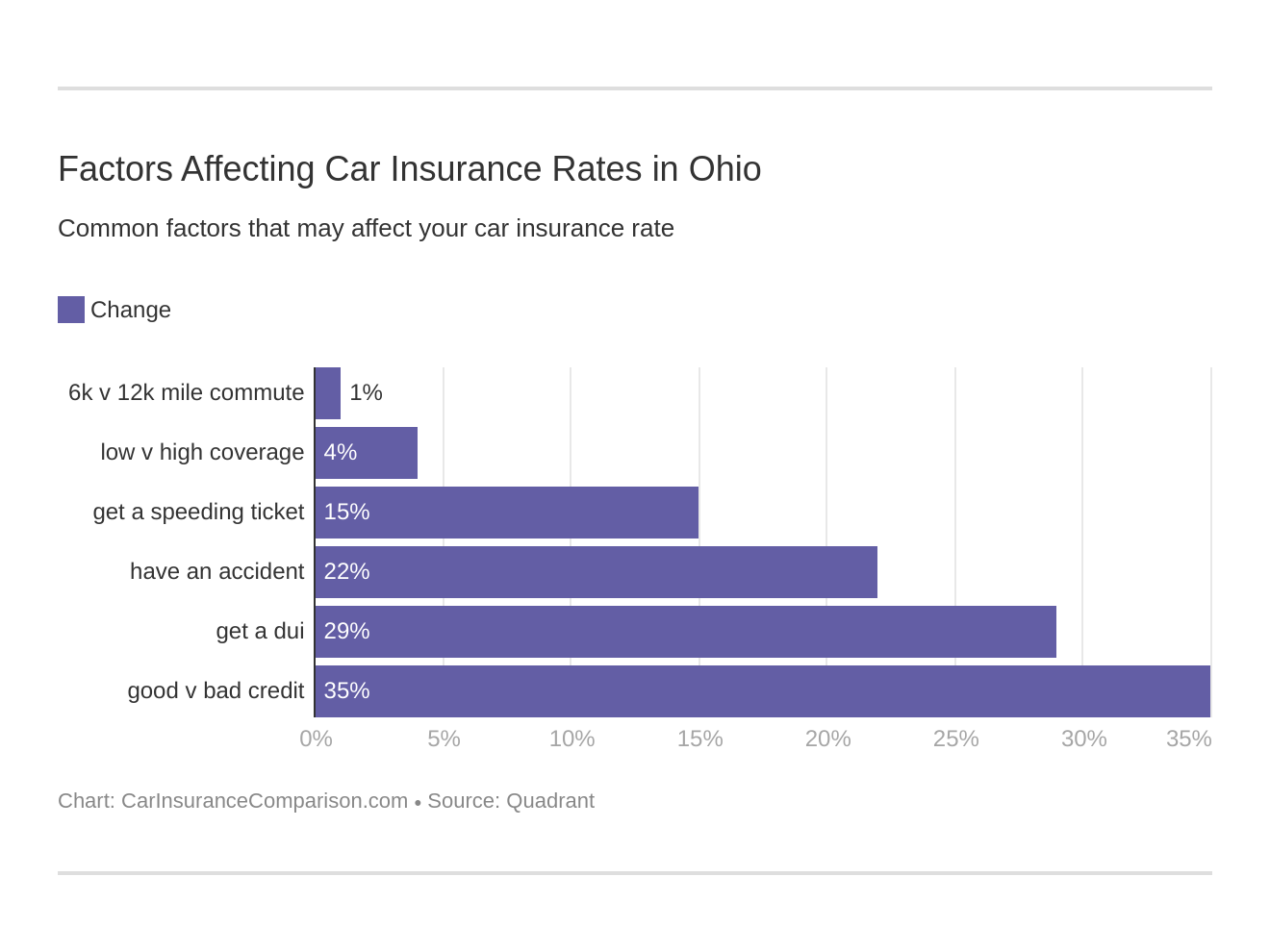

Commute Rates By Company

Out of the top companies, only four show an increase in rates with a longer commute. For those that do show a change, it’s minimal, with the biggest difference seen at State Farm. Even there, it’s less than $125 a year difference.

Your commute doesn’t have a significant impact on what you pay for car insurance in Ohio. People who only drive for pleasure can look into what is pleasure driving for car insurance purposes.

Ohio Commute Rates By Company

| Company | 10 Mile commute, 6000 miles annually | 25-mile commute, 12,000 miles annualy |

|---|---|---|

| Allstate | $3,197.22 | $3,197.22 |

| American Family | $1,496.84 | $1,533.50 |

| Farmers | $3,423.01 | $3,423.01 |

| Geico | $1,834.42 | $1,899.95 |

| Liberty Mutual | $4,429.74 | $4,429.74 |

| Nationwide | $3,300.89 | $3,300.89 |

| Progressive | $3,436.96 | $3,436.96 |

| State Farm | $2,445.81 | $2,569.94 |

| Travelers | $3,135.16 | $3,135.16 |

| USAA | $1,422.09 | $1,534.83 |

American Family and USAA remain the cheapest companies even by commute mileage.

Coverage Level Rates By Company

The biggest reason drivers skip out on higher coverage levels is that they think it’s not affordable. Take a look at the average rates below by coverage level.

Ohio Rates By Coverage Level and Company

| Company | Annual Rate with Low Coverage | Annual Rate with Medium Coverage | Annual Rate with High Coverage |

|---|---|---|---|

| Allstate | $3,092.59 | $3,190.74 | $3,308.32 |

| American Family | $1,488.65 | $1,526.68 | $1,530.18 |

| Farmers | $3,243.37 | $3,370.12 | $3,655.55 |

| Geico | $1,807.66 | $1,858.73 | $1,935.16 |

| Liberty Mutual | $4,264.14 | $4,451.75 | $4,573.32 |

| Nationwide | $3,647.54 | $3,199.58 | $3,055.56 |

| Progressive | $3,305.47 | $3,408.32 | $3,597.09 |

| State Farm | $2,384.79 | $2,515.42 | $2,623.40 |

| Travelers | $3,050.20 | $3,176.78 | $3,178.51 |

| USAA | $1,413.38 | $1,477.00 | $1,544.99 |

At several companies, you can jump from low to high coverage for less than $200 a year, and at almost all the difference is less than $300 a year. Broken down monthly, that’s a pretty nominal difference, and well worth the extra cost.

Credit History Rates By Company

Your credit score does affect car insurance rates, particularly if you have poor credit. According to Experian, the average 2019 credit score in Ohio was 705. That’s a few points above the national average of 703.

Ohio Rates By Credit Rating and Company

| Company | Annual Rate with Poor Credit | Annual Rate with Fair Credit | Annual Rate with Good Credit |

|---|---|---|---|

| Allstate | $4,109.54 | $2,987.92 | $2,494.19 |

| American Family | $2,010.87 | $1,372.30 | $1,162.34 |

| Farmers | $3,877.82 | $3,273.78 | $3,117.43 |

| Geico | $2,239.10 | $1,867.18 | $1,495.27 |

| Liberty Mutual | $6,349.68 | $3,890.18 | $3,049.35 |

| Nationwide | $3,983.93 | $3,209.33 | $2,709.43 |

| Progressive | $3,860.18 | $3,335.09 | $3,115.60 |

| State Farm | $3,573.32 | $2,208.94 | $1,741.35 |

| Travelers | $3,505.29 | $3,050.60 | $2,849.59 |

| USAA | $1,919.04 | $1,358.48 | $1,157.84 |

Fair credit and above don’t have much impact on your car insurance rates. Some drivers with poor credit will pay double or close to it for poor credit.

On the bright side, not all companies hit rates so hard based on credit. While you work on improving that credit score, shopping around will be your best friend. Some insurance companies give a good credit discount.

Driving Record Rates By Company

A clean record will always earn you the best rates from any insurance company. But what does it look like in terms of increase for common violations and accidents?

The numbers below will give you an idea of what you can expect to pay annually for a speeding ticket, DUI, or an accident on your record.

Ohio Rates By Driving Record and Company

| Company | Clean Record | With 1 Accident | With 1 Speeding Ticket | With 1 DUI |

|---|---|---|---|---|

| Allstate | $2,689.12 | $3,250.76 | $3,040.34 | $3,808.65 |

| American Family | $1,451.77 | $1,536.30 | $1,536.30 | $1,536.30 |

| Farmers | $2,823.36 | $3,634.83 | $3,688.92 | $3,544.94 |

| Geico | $1,269.11 | $1,828.67 | $1,725.85 | $2,645.09 |

| Liberty Mutual | $3,722.47 | $4,775.12 | $4,341.01 | $4,880.34 |

| Nationwide | $2,644.52 | $3,364.88 | $2,924.39 | $4,269.79 |

| Progressive | $2,963.60 | $4,028.09 | $3,599.93 | $3,156.21 |

| State Farm | $2,285.04 | $2,730.70 | $2,507.87 | $2,507.87 |

| Travelers | $2,308.77 | $3,009.00 | $2,683.62 | $4,539.26 |

| USAA | $1,135.07 | $1,521.70 | $1,257.56 | $1,999.49 |

As you can see, how each company rates for these three situations differs quite a bit. Some charge their highest rate on an accident, others the DUI, while still others will hit you hardest for a speeding ticket.

Once again, shopping around makes a big difference no matter what is on your record!

How Much Auto Insurance Costs in Ohio

Explore auto insurance rates in various Ohio cities – Athens, Cincinnati, Cleveland, and more. Gain insights into the dynamics shaping car insurance rates for informed decision-making.

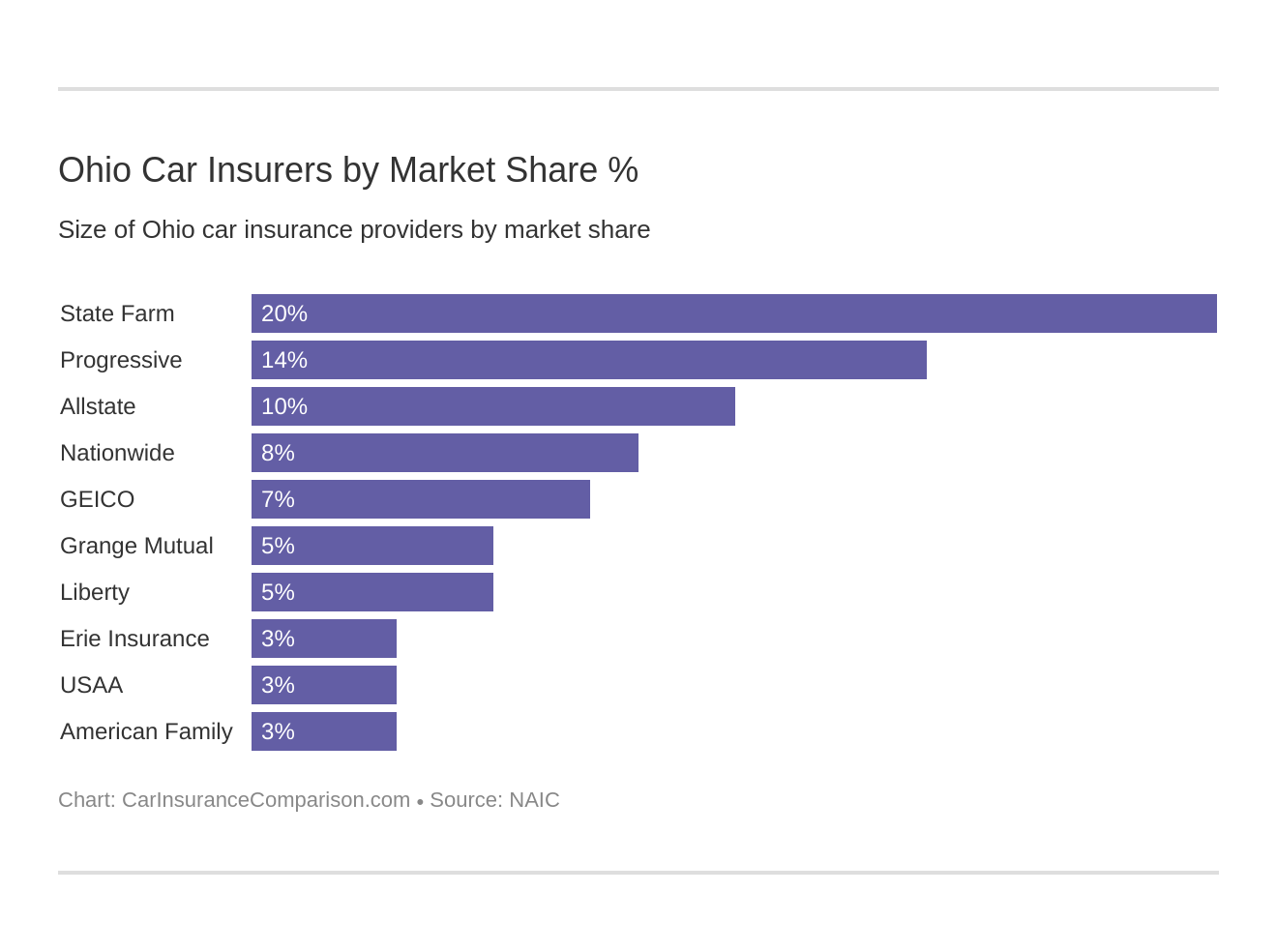

Largest Car Insurance Companies in Ohio

State Farm holds nearly 20 percent of the market share for car insurance in Ohio. That’s in keeping with their position as the most prominent car insurance company in the nation.

Much of the list consists of national companies, but there are a few smaller, regional car insurance companies in there as well, such as Grange. They’re a homegrown company with headquarters located in Columbus.

Largest Car Insurance Companies in Ohio

| Company | Direct Premiums Written | Market Share |

|---|---|---|

| State Farm Group | $1,316,297 | 19.69% |

| Progressive Group | $903,179 | 13.51% |

| Allstate Insurance Group | $687,527 | 10.29% |

| Nationwide Corp Group | $536,768 | 8.03% |

| Geico | $466,535 | 6.98% |

| Grange Mutual Casualty Group | $344,399 | 5.15% |

| Liberty Mutual Group | $315,308 | 4.72% |

| Erie Insurance Group | $222,863 | 3.33% |

| USAA Group | $198,016 | 2.96% |

| American Family Insurance Group | $176,153 | 2.64% |

Although J.D. Power reported that Erie Insurance is the largest in Ohio, State Farm has the largest national market share.

Number of Insurers in Ohio

There are 138 domestic property and casualty insurance companies operating in Ohio.

Foreign insurers, on the other hand, are incorporated in another state. Ohio has 851 property and casualty companies that are licensed in Ohio.

That adds up to 989 insurance companies you could potentially choose from for your car insurance.

Ohio State Laws

Ohio laws are in place to protect everyone in the state, and apply both to insurance companies and residents.

The laws regarding vehicles, insurance, and roadways can be overwhelming and confusing, and since they change occasionally, it can also be hard to stay on top of things.

It would be great just to have the important ones broken down into a simple to read format, minus all the legal language and excess details, right?

We have pulled out all the state laws you need to know and presented them for you right here, clear and without complex language.

We’ll cover laws about insurance, driver, and vehicle licensing, and what happens when a driver breaks the law, so keep reading for the details!

Ohio Car Insurance Laws

Car insurance is regulated by Ohio laws, including how rates are determined and other details that apply to companies and you as drivers.

How Ohio Laws For Car Insurance Are Determined

The Ohio Department of Insurance is in charge of regulating insurance rates for some products, including auto insurance. They accept form filings from insurance companies but aren’t involved in rate-setting unless a company violates it.

The Ohio State Legislature handles the creating, changing, and repealing of laws. All of the laws on the books regarding insurance and motor vehicles are found in the Ohio Codes.

Don’t worry about digging through the statutes, though! We’ve pulled out the relevant laws for you. If you ever get into an accident and still don’t understand the laws for car insurance, sometimes you can use a car insurance attorney.

Learn more: How do you find a car insurance attorney?

Windshield Coverage

One area of coverage where there has been some debate is windshield coverage and replacement with aftermarket versus OEM parts. (For more information, read our “Compare Best Car Insurance Companies That Offer OEM Parts Coverage”).

Laws differ from state to state, but in Ohio, insurance companies are permitted to use aftermarket parts for windshield replacement.

You have the right to refuse aftermarket windshield replacement, but may have to pay the difference in cost out of pocket.

Insurance companies in Ohio may have individual coverage available for glass repair and replacement that reduces or removes the deductible, but they’re not required by law.

If it’s not possible (or you don’t select it), glass is covered under comprehensive and is subject to that deductible.

High-Risk Insurance

High-risk drivers are those that are seen by insurance companies to represent a much higher than average risk of a claim. Drivers usually get this classification for a problematic driving record – multiple tickets and accidents, DUIs, and other major violations. Credit history and other issues can also earn a high-risk driver label.

Being considered a high-risk driver can make it very expensive and very difficult to get car insurance. Some drivers will find they aren’t able to get insurance from standard companies and look to non-standard car insurance companies.

Non-standard insurance companies take on drivers that other companies have turned down and often specialize in poor driving records.

There are situations where even the non-standard companies either turn down a driver or quote rates so high they’re unaffordable. In that case, the Ohio Automobile Insurance Plan (OIAP) can step in.

OIAP is an assigned risk plan that takes high-risk drivers and divides them up among the various insurance companies. The company is required to provide a policy at a rate in line with the plan’s limits.

That doesn’t make it a cheap option for high-risk drivers. It’s still going to be pricey, but you can’t be turned down, and they do have to play by specific rate rules.

Drivers convicted of certain violations will be required by the state to provide an SR-22. That’s a financial responsibility document the insurance company filed with the state proving the driver has the required minimum insurance.

If you’re looking for cheap SR22 car insurance in Akron, Ohio, start with our FREE comparison tool!

Low-Cost Insurance

Ohio already has lower insurance costs than many other states, so it doesn’t provide a specific program for low-income families.

Fortunately, there are a lot of companies to choose from, and many offer below-average rates. Shopping your car insurance around is the best way to get low-cost coverage in Ohio.

Automobile Insurance Fraud in Ohio

Insurance fraud is against the law, and Ohio operates a Fraud Unit through the Department of Insurance, where fraud can be reported and investigated. Having your car insurance claim investigated can be stressful, so it’s important to avoid fraud.

Every insurance company in the state is required to have procedures in place for reporting suspected fraud.

Many people see insurance fraud, mainly what is known as “soft fraud” (like misrepresentation on an insurance application or padding a claim) as a victimless crime.

Unfortunately, fraud can cost insurance companies millions, and that cost will be passed on to the consumers as rate increases.

Fraud Penalties in Ohio

| Amount of Fraud | Classification | Fine | Jail Time |

|---|---|---|---|

| >$1,000 | Misdemeanor | Up to $1,000 | Up to 180 days |

| $1001-$7,499 | Fifth-degree felony | Up to $2,500 | 6-12 months |

| $7,500-$149,999 | Fourth-degree felony | Up to $5,000 | 6-18 months |

| $150,000-$749,999 | Third-degree felony | Up to $10,000 | 9-36 months |

| $750,000-$1.499 million | Second-degree felony | Up to $15,000 | 2-8 years |

| $1.5 million or more | First-degree felony | Up to $20,000 | 3-11 years |

Insurance fraud can be classified as a misdemeanor or a felony, depending on the amount of money involved.

Statute of Limitations

Under Ohio law, you have two years to file either an injury or property damage claim. After this period, the statute of limitations has run out on both.

Vehicle Licensing Laws in Ohio

This next section will outline the laws you need to know to get a license in Ohio (and keep it).

Penalties for Driving Without Insurance

Driving without car insurance in Ohio is illegal, and the penalties get steeper every time you are caught.

Ohio Driving Without Insurance Penalties

| Driving Without Insurance | License Suspension | Reinstatement Fee | Other | Violation of Suspension Penalties |

|---|---|---|---|---|

| First Offense | Until all requirements are met | $100 | Loss of license plates/registration SR-22 requirement 3-5 years | Vehicle immobilized/license plates forfeit for 30 days |

| Second Offense | 1 year | $300 | Loss of license plates/registration SR-22 requirement 3-5 years | Vehicle immobilized/license plates forfeit for 60 days |

| Third Offense + Subsequent Offenses | 2 years | $600 | Loss of license plates/registration SR-22 requirement 3-5 years | Vehicle forfeit and sold, may not register another vehicle for five years |

The law says you have to show proof of insurance to an officer at any traffic stop or vehicle inspection stop. You’ll also be required to produce it if you’ve been in an accident. An at-fault accident where you are uninsured will lead to additional penalties on top of those outlined above.

Ohio no longer performs random selection. As of July 3, 2019, the Ohio state law will no longer send out letters requesting that you provide proof of insurance.

However, if you’re pulled over, an Ohio law enforcement officer will accept both paper and electronic proof of insurance. It’s a good idea to keep the paper even if you can access it on your phone.

Teen Driver Laws in Ohio

Ohio’s Probationary Driver Licensing program for teen drivers has several steps and a lot of requirements. This is designed to get new drivers on the road safely.

Here’s an overview of the stages of graduated licensing.

Ohio Teen Driver Licensing Stages

| License Type | Minimum Age | Requirements | Restrictions |

|---|---|---|---|

| Temporary Instruction Permit | 15 years, 6 months | Pass knowledge test Pass vision screening | Under 15: must have parent, guardian, or instructor in passenger seat Over 16: Must have a licensed driver 21 or over in passenger seat May not drive between midnight-6 a.m. unless parent or guardian in vehicle |

| Probationary License | 16 years | Hold permit for 6 months Complete driver ed with 24 hours of classroom time and 8 hours of in vehicle instruction Complete 50 hours of practice, 10 of which are at night | First 12 months: -no driving between midnight-6 a.m. unless accompanied by a parent or guardian, or for pre-approved reasons -no more than one non-family passenger After 12 months: -night driving restrictions change to 1-5 a.m. |

| Full License | 18 years | No violations during probationary period | None |

No driver in the probationary license period can use a cell phone while driving.

Older Driver License Renewal Procedures

All drivers in Ohio follow the same renewal procedures regardless of age.

The renewal cycle is every four years, and no matter how old you are, you will need to go into the BMV office to pass a vision test and complete the renewal process.

New Residents

If you’re new to Ohio, you have 30 days to get an Ohio license and register your vehicles in Ohio.

If you are not yet licensed, or your out-of-state license expires, you will need to pass a test to get an Ohio license, but if you have a valid license from another state, you can simply exchange it.

That can be done at any deputy registrar licensing location.

Don’t forget to bring your current license or other ID, proof of legal presence in the United States, and proof of Ohio residency. Handling car insurance when moving takes a few extra steps, but it doesn’t have to be stressful!

License Renewal Procedures

Ohio requires all drivers to renew their licenses every four years. There is no option for renewing either online or by mail; all renewals must be done in person.

At the BMV, you will need to take a vision test and pay the renewal fee to complete it.

If you are under 21, your license will expire on your 21st birthday. You won’t be able to renew more than 30 days in advance, so plan to visit the BMV during that window to process your renewal.

Negligent Operator Treatment System

Ohio uses a points system to track driver violations. Points in varying amounts will be placed on your license for every offense, with increasing points for serious violations.

When you reach a total of six points in two years, a warning letter will be sent out. Twelve points in two years will result in penalties. You will need to:

- Serve a six-month suspension.

- Complete a remedial driving course

- File a certificate of insurance (SR-22/bond)

- Pay a reinstatement fee.

- Retake the complete driver license exam

On top of all that, you can expect your car insurance rates to climb quite a bit and likely require high-risk coverage. If you’re wondering how long do points stay on your license, it really depends on the offense you committed.

Ohio Rules of the Road

Ohio’s rules of the road make sure everyone is safe and responsible when driving.

Fault Vs. No-Fault

Ohio’s insurance system uses fault to determine which insurance company pays out for damages. This means that your liability coverage will pay for the other driver’s damages and any injuries if you’re at fault.

When your liability limits are met and exceeded, you will be responsible for the remaining damages.

In a fault state, carrying liability limits that are too low is a hazardous move. You can be sued, and your assets put at risk if you don’t have enough coverage.

Ohio is a comparative negligence state that affects how much can be collected in a claim or lawsuit. If you’re more than 50 percent at fault, you can’t recover any damages.

If you are less than 50 percent at fault, you can recover damages minus the percentage of your fault. Here’s how that works: if you’re 20 percent at fault, you can recover 80 percent of your costs, so in a $100,000 claim, you’d get $80,000.

If you’re at “no-fault,” you can recover all of your damages from the at-fault party.

Seat Belt and Car Seat Laws

Ohio’s seat belt law requires that everyone is buckled in a seat belt when driving or riding in the front passenger seat.

For passengers under the age of 16, car seat laws apply:

- Children ages four and under or under 40 lbs must be restrained in an appropriate car seat that meets federal standards.

- Children over four must be in a car seat or booster seat until they turn eight years old or reach 4’9”³ in height.

- Children ages eight to 15 must be buckled in a safety seat or with a seat belt.

There is no rule about whether children should be in the back seat. However, the American Academy of Pediatrics recommends it.

Ohio law also prohibits people 15 and under from riding in the back of a pickup truck’s uncovered cargo area. It’s only allowed when there is an OEM seat with a belt, or if it moves at less than 25 miles per hour.

Keep Right and Move Over Laws

It’s illegal in Ohio to travel in the left lane of a multi-lane road if you are traveling under the speed limit. Passing on the right is only allowed in specific circumstances.

You’re also required to change lanes if safe to do so and slow down when passing a stationary emergency vehicle with its lights on; this includes tow trucks and waste management vehicles.

Speed Limits

Below are the speed limits in Ohio.

Ohio Speed Limits

| Type of Road | Speed Limit |

|---|---|

| Rural Interstate | 70 |

| Urban Interstate | 65 |

| Other Limited Access Roads | 70 |

| Other Roads | 55 |

Bear in mind that they can change in various locations, including construction zones – always follow the posted limit.

Ridesharing

Since 2015, Ohio has had laws mandating insurance coverage for rideshare drivers working for companies like Uber or Lyft. The law considers three separate periods in which a driver is considered to be engaged in commercial activities, and therefore not covered by a personal auto policy.

Period One: the app is on, and the driver is seeking a customer. During this time, the driver must carry a minimum of $50,000 per person and $100,000 per incident in bodily injury coverage and $25,000 in property damage coverage.

Period Two and Three: the driver has accepted a passenger but not yet picked them up, and when a passenger is in the vehicle. During this time, $1,000,000 in liability provided by the rideshare company must be in place.

During all of these periods, the rideshare company’s coverage is considered primary.

While you can continue to use a personal insurance policy when you aren’t driving for a company, it’s vital to know that the company is within its rights to drop you as a customer if they find out you’re a rideshare driver.

That’s why it’s best to have your insurance with a company that provides a rideshare endorsement or specific policy.

Currently, these companies provide that coverage in Ohio:

- Erie Insurance

- Geico

- Allstate

- State Farm

- Farmers

- USAA

Automation on the Road

Automated cars may well be the future, but in Ohio, they are only allowed on the road for testing purposes.

Operators must be licensed, and liability insurance is required at all times.

Ohio Safety Laws

These laws penalize drivers who risk the lives of others with dangerous driving habits.

Ohio Driving Under the Influence Laws

In Ohio, driving under the influence is legally known as Operating a Vehicle Under the Influence (OVI), and depending on the offense, it may be a misdemeanor or a felony.

Read more: What are the DUI insurance laws in Ohio?

Ohio DUI (OVI) Laws

| Offense | Classification | License Suspension | Imprisonment | Fine | Other Penalties |

|---|---|---|---|---|---|

| 1st Offense | 1st degree misdemeanor | 6 months to 3 years and 15 days | 3 days to 6 months, suspended if court grants driving privilege with IID | $250-$1,075 plus $475 license reinstatement fee | 6 points on record Optional treatment program Optional restricted plates Up to 5 years probation |

| 2nd Offense | 1st degree misdemeanor | 1-7 years, no driving for 45 days | 10 days jail or 5 days jail plus 18 days house arrest, up to 6 months in jail | $350-$1625 plus $475 license reinstatement | Up to 5 years probation Restricted plates Mandatory treatment IID required 90-day vehicle immobilization 6 points on license |

| 3rd Offense | Misdemeanor | 1-12 years, no driving for 120 days | 30 days in jail or 15 days in jail and 55 days house arrest, up to 1 year in jail | $350-$2750 plus $475 license reinstatement fee | Up to 5 years probation Mandatory addiction program Restricted plates required IID required Possible forfeiture of vehicle registered to offender 6 points on license |

| 4th Offense in 6 years | Fourth degree felony | 3 years to life | 60 days to 30 months | Up to $10,000 | Mandatory IID Restricted plates Mandatory treatment program |

| 5th or more in any time period | Third degree felony | 3 years to life | 120 days to five years | Up to $10,000 | Forfeiture of vehicle Mandatory IID Restricted plates Mandatory treatment |

Any OVI charge for an accident in which someone was injured or killed can be prosecuted as a first-degree felony and may result in a minimum sentence of 10 years.

Ohio Marijuana Driving Laws

The use of medical marijuana is legal in Ohio, while in neighboring Michigan, it’s legal for recreational use. But driving while impaired by marijuana can result in an OVI charge.

The legal limit for THC in Ohio is two nanograms per milliliter in the blood and ten nanograms per milliliter in the urine.

Police can also administer a field sobriety test to determine whether a driver is intoxicated. You will have to have a doctor’s letter showing that you have legal access to medical marijuana if you have it in your system.

If you have higher than allowed amounts in your blood or urine or fail the sobriety test, you can be charged and face the same penalties as an alcohol-impaired driver.

Ohio Distracted Driving Laws

In Ohio, there is no ban on cell phone use while driving, except for these circumstances:

- Any driver under 18 cannot use a cell phone in any capacity.

- Texting is illegal for any driver of any age.

That said, law enforcement can use the general distracted driving law, which carries a fine of $100 for any driver whose distraction contributes to another violation.

For example, if you run a stop sign while on the phone, it could be determined that your phone call contributed to your missing the sign and compounding the violation. Texting while driving statistics are very startling around Ohio and the rest of the United States.

Any activity that distracts from driving the vehicle can result in a fine. So keep your eyes on the road, Ohio!

Ohio Need-To-Know Facts

Ohio laws are meant to keep people safe on the road, but unfortunately, there are always those that don’t obey them.

The risks out there are real, but it can be hard to get a feel for how everyday things like stolen cars are, or what the statistics are on serious crashes in Ohio. A straightforward look at the numbers would make it a lot easier to understand.

We’ll bring you everything you need to know about the risks to your property and your safety.

Below you’ll find precise numbers for vehicle theft, fatal crashes and what causes them, and even how Ohio’s traffic compares to other states.

Vehicle Theft in Ohio

Which vehicles attract thieves in Ohio? Take a look at the top ten most stolen cars in the state. Fortunately, Ohio isn’t one of the 15 states with the highest vehicle theft rates.

Ohio Most Stolen Vehicles

| Make and Model | Most Commonly Stolen Model Year | Total Thefts (All Model Years) |

|---|---|---|

| Dodge Caravan | 2003 | 679 |

| Chevrolet Pickup (Full Size) | 1999 | 579 |

| Ford Pickup (Full Size) | 2004 | 540 |

| Jeep Cherokee/Grand Cherokee | 2000 | 467 |

| Chevrolet Impala | 2007 | 441 |

| Honda Accord | 1997 | 437 |

| Chevrolet Malibu | 2015 | 343 |

| Honda Civic | 2000 | 325 |

| Toyota Camry | 2014 | 308 |

| Dodge Pickup (Full Size) | 2005 | 297 |

The FBI’s crime statistics provide us with a breakdown of car theft by the city. You can search the table for your hometown below.

Ohio Vehicle Theft By City

| City | Motor Vehicle Theft (2017) |

|---|---|

| Ada | 1 |

| Addyston | 1 |

| Akron | 755 |

| Albany | 0 |

| Alliance | 41 |

| Amberley Village | 0 |

| Amelia | 3 |

| American Township | 11 |

| Amherst | 3 |

| Archbold | 1 |

| Ashland | 5 |

| Ashville | 4 |

| Athens | 19 |

| Aurora | 2 |

| Austintown | 21 |

| Avon Lake | 6 |

| Bainbridge Township | 0 |

| Baltimore | 1 |

| Barberton | 41 |

| Barnesville | 1 |

| Batavia | 4 |

| Bath Township, Summit County | 2 |

| Bazetta Township | 0 |

| Beavercreek | 49 |

| Beaver Township | 5 |

| Bedford | 32 |

| Bedford Heights3 | 50 |

| Bellaire | 0 |

| Bellbrook | 0 |

| Bellefontaine | 5 |

| Bellville | 1 |

| Belpre | 5 |

| Berea | 8 |

| Bethel | 2 |

| Bexley | 15 |

| Blanchester | 5 |

| Blue Ash | 7 |

| Bluffton | 1 |

| Bowling Green | 15 |

| Brecksville | 1 |

| Bridgeport | 5 |

| Brimfield Township | 9 |

| Broadview Heights | 5 |

| Brooklyn3 | 34 |

| Brookville3 | 5 |

| Brunswick | 11 |

| Brunswick Hills Township | 2 |

| Bucyrus | 6 |

| Butler Township | 24 |

| Byesville | 3 |

| Cambridge3 | 6 |

| Campbell | 6 |

| Canal Fulton | 2 |

| Canfield | 0 |

| Canton | 246 |

| Cardington | 0 |

| Carey | 0 |

| Carlisle | 0 |

| Carroll Township | 0 |

| Centerville | 16 |

| Chagrin Falls | 0 |

| Chardon3 | 1 |

| Chester Township | 0 |

| Cheviot | 21 |

| Chillicothe | 52 |

| Cincinnati | 1,485 |

| Circleville | 28 |

| Clayton | 9 |

| Clay Township, Montgomery County | 1 |

| Clearcreek Township | 3 |

| Cleveland | 3,395 |

| Cleveland Heights | 99 |

| Clyde | 3 |

| Coitsville Township | 4 |

| Coldwater | 0 |

| Colerain Township | 85 |

| Columbiana | 0 |

| Columbus | 4,176 |

| Commercial Point | 1 |

| Copley Township | 6 |

| Cortland | 1 |

| Covington | 0 |

| Crestline | 5 |

| Creston | 2 |

| Cuyahoga Falls | 39 |

| Dayton | 616 |

| Deer Park | 3 |

| Defiance | 20 |

| Delaware | 22 |

| Delhi Township | 26 |

| Delphos3 | 1 |

| Dennison | 1 |

| Dover | 5 |

| Dublin | 20 |

| East Cleveland | 150 |

| Eastlake | 10 |

| East Palestine | 2 |

| Elyria | 56 |

| Englewood | 12 |

| Euclid | 131 |

| Evendale | 7 |

| Fairborn | 53 |

| Fairfax | 2 |

| Fairfield | 51 |

| Fairfield Township | 8 |

| Fairview Park | 7 |

| Felicity | 1 |

| Findlay | 38 |

| Forest Park | 20 |

| Frazeysburg | 0 |

| Fredericktown | 0 |

| Fremont3 | 16 |

| Gahanna | 27 |

| Galion | 5 |

| Gallipolis | 9 |

| Gates Mills | 2 |

| Georgetown | 3 |

| Germantown | 4 |

| German Township, Montgomery County | 2 |

| Glouster | 1 |

| Goshen Township, Clermont County | 15 |

| Goshen Township, Mahoning County | 5 |

| Grafton4 | 0 |

| Granville | 2 |

| Greenfield | 21 |

| Greenhills | 1 |

| Green Township | 56 |

| Greenville | 21 |

| Grove City | 56 |

| Groveport | 12 |

| Hamilton | 2 |

| Harrison | 9 |

| Hartville | 0 |

| Heath | 28 |

| Highland Heights3 | 4 |

| Hilliard | 36 |

| Hillsboro | 11 |

| Hinckley Township | 1 |

| Holland | 4 |

| Howland Township | 20 |

| Hubbard | 1 |

| Hubbard Township | 7 |

| Huber Heights | 52 |

| Hudson | 2 |

| Huron | 0 |

| Independence | 2 |

| Indian Hill | 3 |

| Ironton | 15 |

| Jackson | 3 |

| Jackson Township, Mahoning County | 0 |

| Jackson Township, Stark County | 18 |

| Jamestown | 4 |

| Johnstown | 3 |

| Kent | 17 |

| Kenton | 13 |

| Kettering | 52 |

| Kirtland | 0 |

| Kirtland Hills3 | 0 |

| Lakewood | 78 |

| Lancaster | 88 |

| Lawrence Township | 6 |

| Lexington | 0 |

| Liberty Township | 14 |

| Lima | 79 |

| Lisbon | 1 |

| Lithopolis | 0 |

| Lockland | 19 |

| Logan | 14 |

| London | 13 |

| Lorain | 94 |

| Lordstown | 3 |

| Loudonville | 1 |

| Louisville | 3 |

| Loveland | 7 |

| Lyndhurst | 11 |

| Macedonia | 3 |

| Madison Township, Franklin County | 7 |

| Madison Township, Lake County | 2 |

| Magnolia | 1 |

| Mansfield | 78 |

| Mariemont3 | 2 |

| Marietta | 16 |

| Marion | 30 |

| Martins Ferry | 6 |

| Mason | 5 |

| Maumee | 9 |

| Mayfield Heights | 6 |

| McArthur | 3 |

| McConnelsville | 2 |

| Mechanicsburg | 1 |

| Medina | 0 |

| Medina Township | 5 |

| Mentor | 23 |

| Mentor-on-the-Lake | 6 |

| Miamisburg | 7 |

| Miami Township, Clermont County | 19 |

| Miami Township, Montgomery County | 43 |

| Middlefield3 | 0 |

| Middleport | 1 |

| Middletown | 180 |

| Milford | 11 |

| Millersburg | 1 |

| Milton Township | 2 |

| Minerva | 3 |

| Mogadore3 | 1 |

| Monroe | 7 |

| Montgomery | 5 |

| Montpelier | 6 |

| Montville Township | 0 |

| Moreland Hills | 0 |

| Mount Healthy | 23 |

| Mount Orab | 8 |

| Mount Vernon | 7 |

| Munroe Falls | 0 |

| Napoleon | 3 |

| Navarre | 1 |

| Nelsonville | 6 |

| New Albany | 4 |

| New Boston | 11 |

| Newcomerstown3 | 6 |

| New Concord | 0 |

| New Franklin | 4 |

| New Lebanon | 3 |

| New Lexington | 8 |

| New Middletown | 2 |

| New Philadelphia | 4 |

| New Richmond | 3 |

| Newton Falls | 6 |

| Newtown | 0 |

| New Vienna | 3 |

| North Baltimore | 1 |

| North Canton | 8 |

| North College Hill | 26 |

| Northfield | 3 |

| North Olmsted | 32 |

| North Ridgeville | 4 |

| Norton | 11 |

| Norwood | 56 |

| Oak Harbor | 0 |

| Oak Hill | 0 |

| Oberlin | 2 |

| Olmsted Falls | 3 |

| Olmsted Township | 2 |

| Ontario | 1 |

| Oregon | 22 |

| Orrville | 6 |

| Ottawa | 1 |

| Ottawa Hills | 4 |

| Owensville | 1 |

| Oxford4 | 6 |

| Oxford Township | 5 |

| Parma | 74 |

| Peninsula | 1 |

| Pepper Pike | 0 |

| Perrysburg | 1 |

| Perrysburg Township | 7 |

| Perry Township, Columbiana County | 0 |

| Perry Township, Franklin County | 2 |

| Pickerington | 16 |

| Pierce Township | 5 |

| Pioneer | 2 |

| Piqua | 18 |

| Poland Township | 0 |

| Poland Village | 2 |

| Port Clinton | 13 |

| Portsmouth | 69 |

| Powell | 1 |

| Reading | 7 |

| Reminderville | 1 |

| Reynoldsburg | 35 |

| Richmond Heights | 23 |

| Ripley | 3 |

| Rittman | 8 |

| Roseville | 4 |

| Ross Township | 3 |

| Russells Point | 0 |

| Russell Township | 0 |

| Sabina | 0 |

| Sagamore Hills | 1 |

| Salem | 4 |

| Salineville | 0 |

| Sandusky | 39 |

| Sebring | 5 |

| Seven Hills | 3 |

| Sharon Township | 1 |

| Shawnee Township | 3 |

| Sheffield Lake | 8 |

| Shelby | 3 |

| Sidney | 19 |

| Solon | 11 |

| South Bloomfield | 3 |

| South Charleston | 4 |

| South Euclid | 35 |

| South Point3 | 3 |

| South Russell | 0 |

| South Zanesville | 1 |

| Springboro | 2 |

| Springfield | 293 |

| Springfield Township, Hamilton County | 48 |

| Springfield Township, Mahoning County | 4 |

| Springfield Township, Summit County | 28 |

| St. Clairsville | 0 |

| St. Clair Township | 0 |

| Steubenville | 22 |

| St. Marys | 6 |

| Stow | 4 |

| Strasburg | 0 |

| Streetsboro | 10 |

| Strongsville | 25 |

| Struthers | 10 |

| Sugarcreek Township | 5 |

| Swanton | 4 |

| Sylvania | 7 |

| Sylvania Township | 38 |

| Tallmadge3 | 12 |

| Tiffin3 | 4 |

| Tipp City | 10 |

| Toledo4, 5, 6 | 745 |

| Toronto | 1 |

| Trotwood | 145 |

| Troy | 8 |

| Twinsburg | 3 |

| Uhrichsville | 11 |

| Uniontown | 6 |

| Union Township, Clermont County | 16 |

| University Heights | 15 |

| Upper Arlington | 7 |

| Upper Sandusky | 3 |

| Urbana | 13 |

| Utica | 1 |

| Valley View, Cuyahoga County3 | 6 |

| Vandalia | 25 |

| Van Wert | 6 |

| Vermilion | 1 |

| Village of Leesburg | 2 |

| Wadsworth | 4 |

| Waite Hill | 0 |

| Walton Hills3 | 1 |

| Wapakoneta | 2 |

| Warren | 106 |

| Warren Township | 14 |

| Washington Court House | 10 |

| Waterville | 0 |

| Wauseon | 4 |

| Waverly | 1 |

| Wellston | 5 |

| West Carrollton | 21 |

| West Chester Township | 44 |

| Westerville | 17 |

| West Jefferson | 2 |

| West Lafayette | 0 |

| Westlake | 15 |

| West Union | 5 |

| Whitehall | 81 |

| Wickliffe | 8 |

| Willard | 11 |

| Williamsburg | 2 |

| Willoughby | 18 |

| Wilmington | 11 |

| Windham | 2 |

| Wintersville | 2 |

| Woodlawn | 5 |

| Woodmere Village | 5 |

| Wooster | 37 |

| Worthington | 13 |

| Wyoming | 2 |

| Xenia | 34 |

| Yellow Springs | 5 |

| Youngstown | 232 |

| Zanesville | 57 |

Road Dangers in Ohio

A total of 1,179 lives were lost in Ohio car crashes in 2017. What dangers on the road contributed to those crashes?

There are several factors, both within and out of the driver’s control, in a fatal crash. We’ve gathered statistics from the National Highway Traffic Safety Administration (NHTSA) to break it down.

Fatal Crashes By Weather and Light Conditions

The majority of crashes happened in average weather conditions, and of those, more than half were in daylight.

Ohio Fatal Crashes By Light and Weather Conditions

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 507 | 172 | 237 | 42 | 1 | 959 |

| Rain | 36 | 21 | 28 | 4 | 1 | 90 |

| Snow/Sleet | 12 | 4 | 12 | 1 | 0 | 29 |

| Other | 1 | 1 | 7 | 2 | 0 | 11 |

| Unknown | 0 | 0 | 3 | 0 | 2 | 5 |

Fatal Crashes By County

The numbers below break down the number of fatal crashes in each county.

Ohio Fatal Crashes By County

| County | Fatal Crashes (2017) |

|---|---|

| Adams County | 0 |

| Allen County | 2 |

| Ashland County | 2 |

| Ashtabula County | 6 |

| Athens County | 1 |

| Auglaize County | 0 |

| Belmont County | 2 |

| Brown County | 0 |

| Butler County | 5 |

| Carroll County | 0 |

| Champaign County | 1 |

| Clark County | 1 |

| Clermont County | 1 |

| Clinton County | 1 |

| Columbiana County | 0 |

| Coshocton County | 1 |

| Crawford County | 1 |

| Cuyahoga County | 34 |

| Darke County | 0 |

| Defiance County | 2 |

| Delaware County | 0 |

| Erie County | 2 |

| Fairfield County | 0 |

| Fayette County | 3 |

| Franklin County | 8 |

| Fulton County | 0 |

| Gallia County | 2 |

| Geauga County | 1 |

| Greene County | 2 |

| Guernsey County | 4 |

| Hamilton County | 17 |

| Hancock County | 2 |

| Hardin County | 1 |

| Harrison County | 1 |

| Henry County | 1 |

| Highland County | 1 |

| Hocking County | 1 |

| Holmes County | 1 |

| Huron County | 1 |

| Jackson County | 2 |

| Jefferson County | 3 |

| Knox County | 2 |

| Lake County | 2 |

| Lawrence County | 2 |

| Licking County | 9 |

| Logan County | 1 |

| Lorain County | 8 |

| Lucas County | 7 |

| Madison County | 3 |

| Mahoning County | 5 |

| Marion County | 0 |

| Medina County | 5 |

| Meigs County | 1 |

| Mercer County | 1 |

| Miami County | 3 |

| Monroe County | 1 |

| Montgomery County | 13 |

| Morgan County | 2 |

| Morrow County | 2 |

| Muskingum County | 4 |

| Noble County | 0 |

| Ottawa County | 0 |

| Paulding County | 0 |

| Perry County | 1 |

| Pickaway County | 2 |

| Pike County | 3 |

| Portage County | 2 |

| Preble County | 5 |

| Putnam County | 2 |

| Richland County | 3 |

| Ross County | 0 |

| Sandusky County | 1 |

| Scioto County | 0 |

| Seneca County | 0 |

| Shelby County | 3 |

| Stark County | 10 |

| Summit County | 10 |

| Trumbull County | 2 |

| Tuscarawas County | 10 |

| Union County | 0 |

| Van Wert County | 0 |

| Vinton County | 1 |

| Warren County | 2 |

| Washington County | 5 |

| Wayne County | 3 |

| Williams County | 1 |

| Wood County | 2 |

| Wyandot County | 0 |

Read more: Mercer Insurance Group Car Insurance Review

Traffic Fatalities Rural Vs. Urban

Fatal crashes were split relatively evenly between rural and urban locations in 2017.

Five hundred fifty-two fatalities were in rural areas, while 620 were in urban areas.

Fatalities By Person Type

The largest number of fatalities involved occupants of passenger cars are listed in the data below.

Ohio Fatal Crashes By Person Type

| Type | 2017 Fatalities |

|---|---|

| Passenger Car | 545 |

| Light Truck | 145 |

| Motorcyclist | 157 |

| Bicyclist/other cyclist | 19 |

| Pedestrian | 142 |

Fatalities By Crash Type

A majority of fatal crashes in 2017 involved a single vehicle, and a large number also included a roadway departure.

Ohio Fatalities By Crash Type

| Crash Type | 2017 |

|---|---|

| Single Vehicle | 641 |

| Involving a Large Truck | 164 |

| Involving Speeding | 252 |

| Involving a Rollover | 254 |

| Involving a Roadway Departure | 670 |

| Involving an Intersection (or Intersection Related) | 327 |

Five-Year Trend For The Top Ten Counties

While the general trend has been an increase in fatal crashes over the past five years, a few counties saw a decrease from 2016 to 2017.

Ohio 5-year Trend Traffic Fatalities, Top Ten Counties

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Cuyahoga County | 56 | 46 | 75 | 82 | 95 |

| Franklin County | 76 | 74 | 85 | 94 | 88 |

| Hamilton County | 38 | 49 | 54 | 62 | 58 |

| Lucas County | 34 | 41 | 34 | 35 | 49 |

| Montgomery County | 55 | 42 | 56 | 60 | 49 |

| Summit County | 29 | 32 | 25 | 41 | 47 |

| Lorain County | 14 | 10 | 34 | 38 | 33 |

| Stark County | 26 | 44 | 19 | 32 | 33 |

| Butler County | 19 | 29 | 29 | 23 | 31 |

| Licking County | 14 | 19 | 23 | 20 | 30 |

Fatalities Involving Speeding By County

Speeding is risky behavior, and there were 252 speeding-related fatalities in 2017. Here’s how that number breaks down by county.

Ohio Speeding Fatalities By County

| County | 2017 Speeding Fatalities |

|---|---|

| Adams County | 0 |

| Allen County | 2 |

| Ashland County | 2 |

| Ashtabula County | 6 |

| Athens County | 1 |

| Auglaize County | 0 |

| Belmont County | 2 |

| Brown County | 0 |

| Butler County | 5 |

| Carroll County | 0 |

| Champaign County | 1 |

| Clark County | 1 |

| Clermont County | 1 |

| Clinton County | 1 |

| Columbiana County | 0 |

| Coshocton County | 1 |

| Crawford County | 1 |

| Cuyahoga County | 34 |

| Darke County | 0 |

| Defiance County | 2 |

| Delaware County | 0 |

| Erie County | 2 |

| Fairfield County | 0 |

| Fayette County | 3 |

| Franklin County | 8 |

| Fulton County | 0 |

| Gallia County | 2 |

| Geauga County | 1 |

| Greene County | 2 |

| Guernsey County | 4 |

| Hamilton County | 17 |

| Hancock County | 2 |

| Hardin County | 1 |

| Harrison County | 1 |

| Henry County | 1 |

| Highland County | 1 |

| Hocking County | 1 |

| Holmes County | 1 |

| Huron County | 1 |

| Jackson County | 2 |

| Jefferson County | 3 |

| Knox County | 2 |

| Lake County | 2 |

| Lawrence County | 2 |

| Licking County | 9 |

| Logan County | 1 |

| Lorain County | 8 |

| Lucas County | 7 |

| Madison County | 3 |

| Mahoning County | 5 |

| Marion County | 0 |

| Medina County | 5 |

| Meigs County | 1 |

| Mercer County | 1 |

| Miami County | 3 |

| Monroe County | 1 |

| Montgomery County | 13 |

| Morgan County | 2 |

| Morrow County | 2 |

| Muskingum County | 4 |

| Noble County | 0 |

| Ottawa County | 0 |

| Paulding County | 0 |

| Perry County | 1 |

| Pickaway County | 2 |

| Pike County | 3 |

| Portage County | 2 |

| Preble County | 5 |

| Putnam County | 2 |

| Richland County | 3 |

| Ross County | 0 |

| Sandusky County | 1 |

| Scioto County | 0 |

| Seneca County | 0 |

| Shelby County | 3 |

| Stark County | 10 |

| Summit County | 10 |

| Trumbull County | 2 |

| Tuscarawas County | 10 |

| Union County | 0 |

| Van Wert County | 0 |

| Vinton County | 1 |

| Warren County | 2 |

| Washington County | 5 |

| Wayne County | 3 |