Compare Oregon Car Insurance Rates [2025]

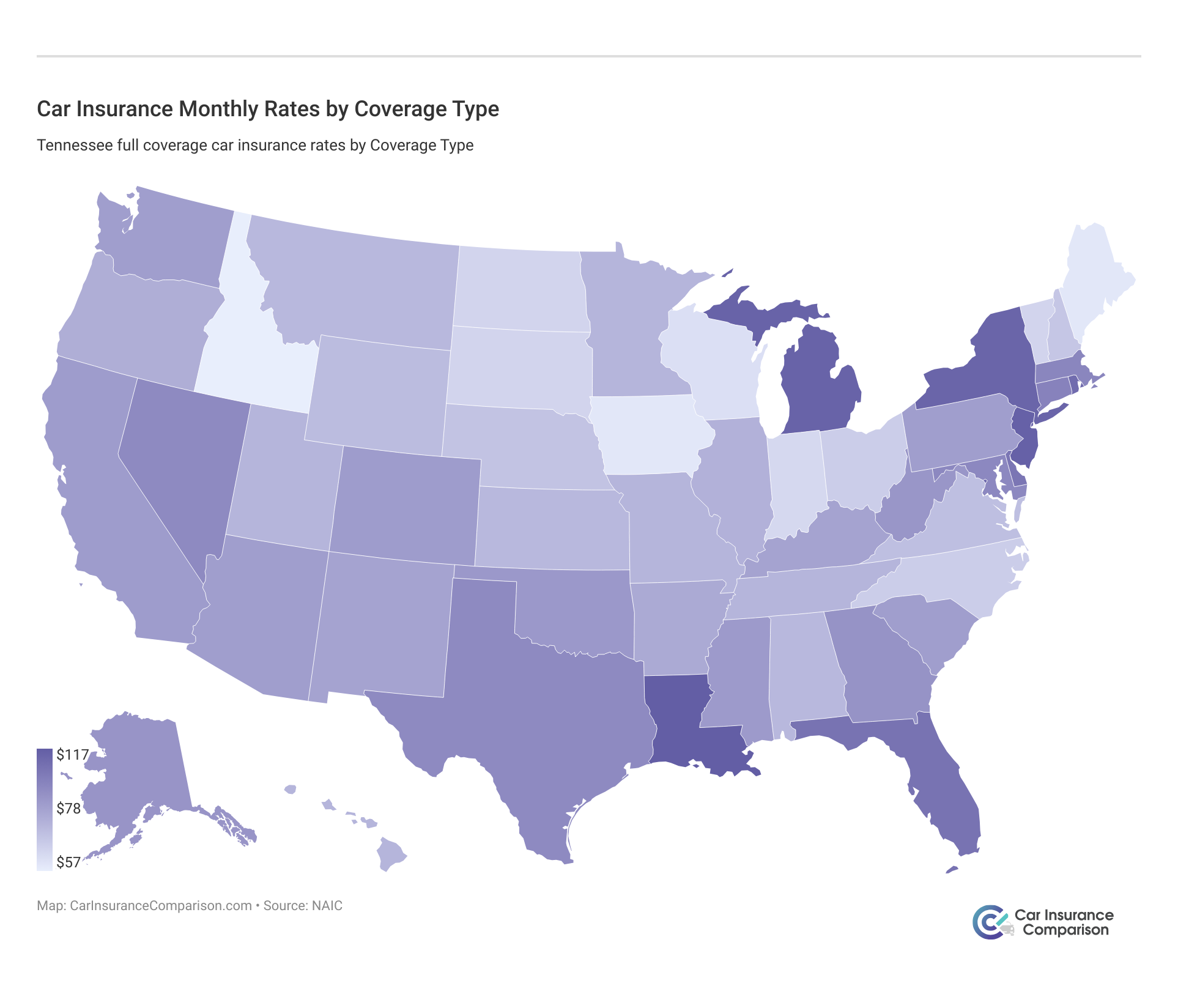

Minimum Oregon car insurance requirements are 25/50/20 of liability coverage, which costs an average of $53 per month. When you compare Oregon car insurance rates, a full coverage policy costs double that of liability insurance policy, as Oregon full coverage insurance averages $116 per month.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Zach Fagiano

Insurance & Finance Analyst

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Insurance & Finance Analyst

UPDATED: May 13, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: May 13, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Oregon Statistics Summary | Details |

|---|---|

| Road Miles | Total in State: 73,544 Vehicle Miles Driven: 35.9 billion |

| Vehicles Registered | 3.5 million |

| State Population | 4,190,713 |

| Most Popular Vehicle | Subaru Outback |

| Motorists Uninsured | 12.7% State Rank: 21st |

| Driving Deaths | 2008-2017 Speeding Total: 1,158 Drunk Driving Total: 1,150 |

| Average Premiums (Annual) | Liability: $584.13 Collision: $226.83 Comprehensive: $93.87 Combined Premium: $904.83 |

| Cheapest Provider | State Farm Mutual Auto |

- Oregon drivers must carry 25/50/20 of liability car insurance to drive

- Full coverage car insurance in Oregon costs an average of $116/mo

- Rates will vary based on a driver’s chosen coverages and driving record

Finding the best car insurance in Oregon starts by taking the time to compare Oregon car insurance rates. In our guide, we compare Oregon car insurance rates and coverage, the best companies, driving laws, and more, so that you can make an informed decision about your car insurance.

Excited to get started comparing to find the best cheap car insurance in Oregon? Use our free online quote tool to start comparing rates in your area.

Oregon Car Insurance Coverage and Rates

What coverage should you be getting? What rates will you have to pay for that coverage? In this section, we’ll go over all of the information you’ll need to know about picking out the optimal coverage and rates for driving safely in Oregon.The bottom line is that we want you to know what it is you’re paying for. It is your money after all! We’ve gone through and explained items such as minimum liability coverage, forms of financial responsibility, average rates in Oregon, and more.Keep reading to learn more!

Oregon Minimum Liability Coverage

Is car insurance mandatory in Oregon? Oregon requires each driver has something known as liability car insurance coverage on their vehicle. What does this mean? The minimum liability coverage is the absolute minimum insurance coverage you can have in order to drive in Oregon. It basically means that if you are in a car accident, you’re able to pay off all of the costs of that accident without having to go into debt.So what is Oregon’s minimum coverage? Oregon follows what’s known as a 25/50/20 liability coverage system. Below we’ve gone through what exactly this means.

- 25 = $25,000 to pay for bodily injuries per person

- 50 = $50,000 to pay for total bodily injuries per accident

- 20 = $20,000 to pay for property damages per accident

Keep in mind as well, Oregon law also requires that drivers also have the following coverage (in addition to the minimum coverage rates above)

- $15,000 for Personal Injury Protection (also known as Medical Payments/MedPay)

- $25,000 per person and $50,000 total per accident for Uninsured Motor Coverage

This additional coverage is different by state, as a lot of states do not require this additional coverage and make it optional to drivers. Oregon, however, wants to ensure the best protection for their drivers and make these two items required. This can make the minimum coverage costs more expensive in Oregon than in other states!

Keep in mind that this is just the MINIMUM coverage you are allowed to have in Oregon. It’s always recommended to get more than this minimum amount. The better protection you have for yourself, the less you have to worry in the future.Forms of Financial Responsibility

As it is required to have car insurance, Oregon auto insurance law also requires that all drivers have at least one form of financial responsibility on them while operating a vehicle. What is a form of financial responsibility? Also known as proof of insurance, they are forms of documentation that serve as proof that you have Oregon’s required minimum liability coverage.There are a few acceptable forms of proof of insurance, which can be at least one of the following:

- Valid (and Current) Insurance ID Card

- Current Liability Insurance Binder or a copy of your Insurance Policy

- Signed letter from an insurance agent or company official (must be on company letterhead)

- DMV certificate of self-insurance that names the vehicle owner

You need to have at least one of the above with you when you are driving. If you are pulled over by law enforcement for whatever reason (traffic violation, traffic stop, accident, etc.), you will need to provide some form of proof. If you do not, you may face penalties such as fines or license/registration suspension.

If you have been driving without insurance, you may also need to file an SR-22 form in order to prove that you do have insurance. It’s another form of financial responsibility that guarantees that you will hold at least the minimum required car insurance for a full three years. There are a few reasons why you would need to file an SR-22:

- You were convicted of driving without insurance

- You own a vehicle that was uninsured at the time of an accident

- You want to reinstate your driving privileges

- You are applying for a hardship or probationary permit

All of these require you to have an SR-22 certificate, and all start on the date you received one of the above. You will be required to carry this with you for a minimum of three years. If you do NOT file an SR-22 when you are ordered to, your license will be immediately suspended.

Premiums as a Percentage of Income

You’ve probably heard of the phrase ‘disposable income per capita’, but what does it mean, and how would it apply to your car insurance rates/coverage? It basically means the amount of money a group of individuals has to spend after taxes have been paid.

So, for example, if you made $75,000 per year and after taxes, you had $60,000, that $60,000 is considered your disposable income. Averaging your disposable income with other individuals, you get a per capita disposable income.

In Oregon, the annual per capita disposable income is $36,445. So after taxes, the average Oregon citizen has a disposable income of $36,445.Let’s break that down even further. With this annual per capita disposable income, you can calculate that to a monthly per capita disposable income of $3,037.08.

Meaning that all of your monthly expenses come from this $3,037.08. Car insurance payments, health insurance, utilities, groceries, and more all from this monthly income.The average annual full coverage premium for car insurance in Oregon is $894.10, meaning that each month the average Oregon citizen is paying an average of $74.51 per month for full coverage car insurance.

Oregon citizens only pay 2.45 percent of their income towards car insurance

Do you know why this is so awesome for Oregon citizens? The average annual rate for car insurance countrywide is $981. That means that Oregon citizens are paying about $87 LESS on average than the rest of the nation! Way to go Beaver State!

Average Car Insurance Rates in OR (Liability, Collision,Comprehensive)

| Coverage Type | Annual Costs (2015) |

|---|---|

| Liability | $584.13 |

| Collision | $226.83 |

| Comprehensive | $93.87 |

| Combined | $904.83 |

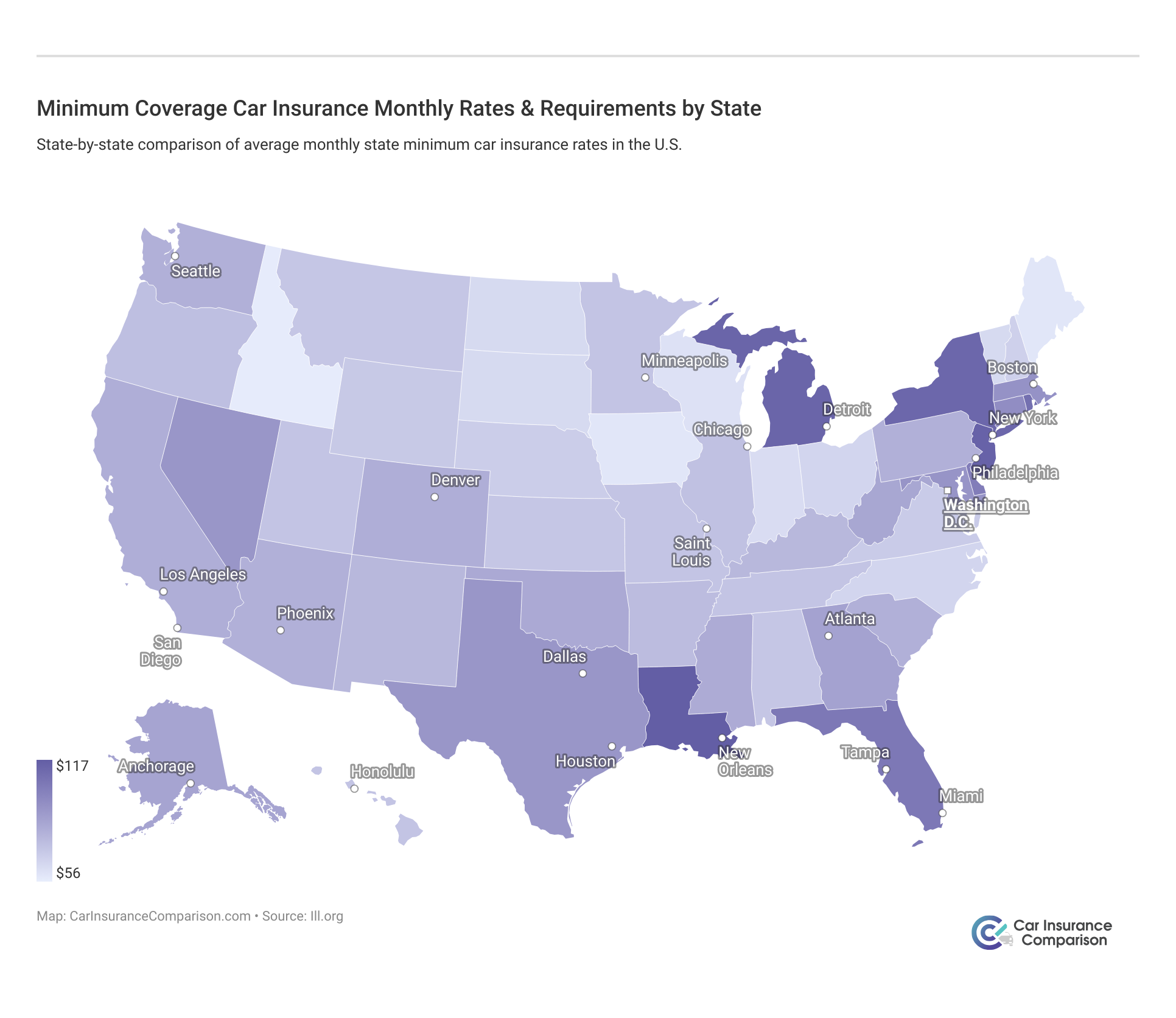

The above information was taken from the National Association of Insurance Commissioners, a leading source on insurance.While having the required insurance is necessary, it is wise to consider additional coverage. What if you get into an accident that costs more than the minimum coverage you have? You’ll have to take that out of your own pockets.You can see how average rates compare across the U.S. with our interactive chart.

Protect yourself in the best way you can, your wallet may thank you later for it! Want to learn more about extra coverage? Keep reading to find out more coverage options you can add!Additional Liability Coverage

As mentioned previously, uninsured/underinsured motorist coverage and MedPay coverage options are required in the state of Oregon.

- MedPay Coverage is the coverage that pays for your medical expenses after you’re in an accident

- Uninsured/Underinsured Coverage protects you if you are in an accident with someone who is uninsured or underinsured. This means if they are the one who caused the accident and are unable to pay for your accident costs, this coverage comes in to cover you.

Below we’ve listed something known as the loss ratios for these coverages.

| Loss Ratio | 2013 | 2014 | 2015 |

|---|---|---|---|

| Medical Payments (MedPay) | 124.89% | 116.36% | 115.50% |

| Uninsured/Underinsured Motorist Coverage | 64.68% | 72.79% | 76.53% |

What does all this mean for you? Loss ratios essentially tell you how companies are paying out claims; are they paying too much (making them at risk for going bankrupt) or are they not paying enough? If a company has a loss ratio over 100 percent, they are paying out too much, but if their loss ratio is far below that, they likely aren’t paying enough for claims. In Oregon, The Underinsured/Uninsured loss ratios are pretty good but are high for MedPay.

Add-Ons, Endorsements, and Riders

In the previous sections, we’ve talked about the minimum coverage and how sometimes it might not give you all of the coverage you may need. But what could you add, you may ask, that will give you more coverage? There is an abundance of additional coverage options that you could add to your policy, so many so that it can feel overwhelming.To help make the ordeal less difficult for you, we’ve found a list of some of the most affordable coverage options to add to your plan. These coverages are cost effective and are useful in both the case of an accident or any other mishap you might encounter.

- Gap Insurance

- Personal Umbrella Policy (PUP)

- Rental Car Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Low-Mileage Car Insurance Discount

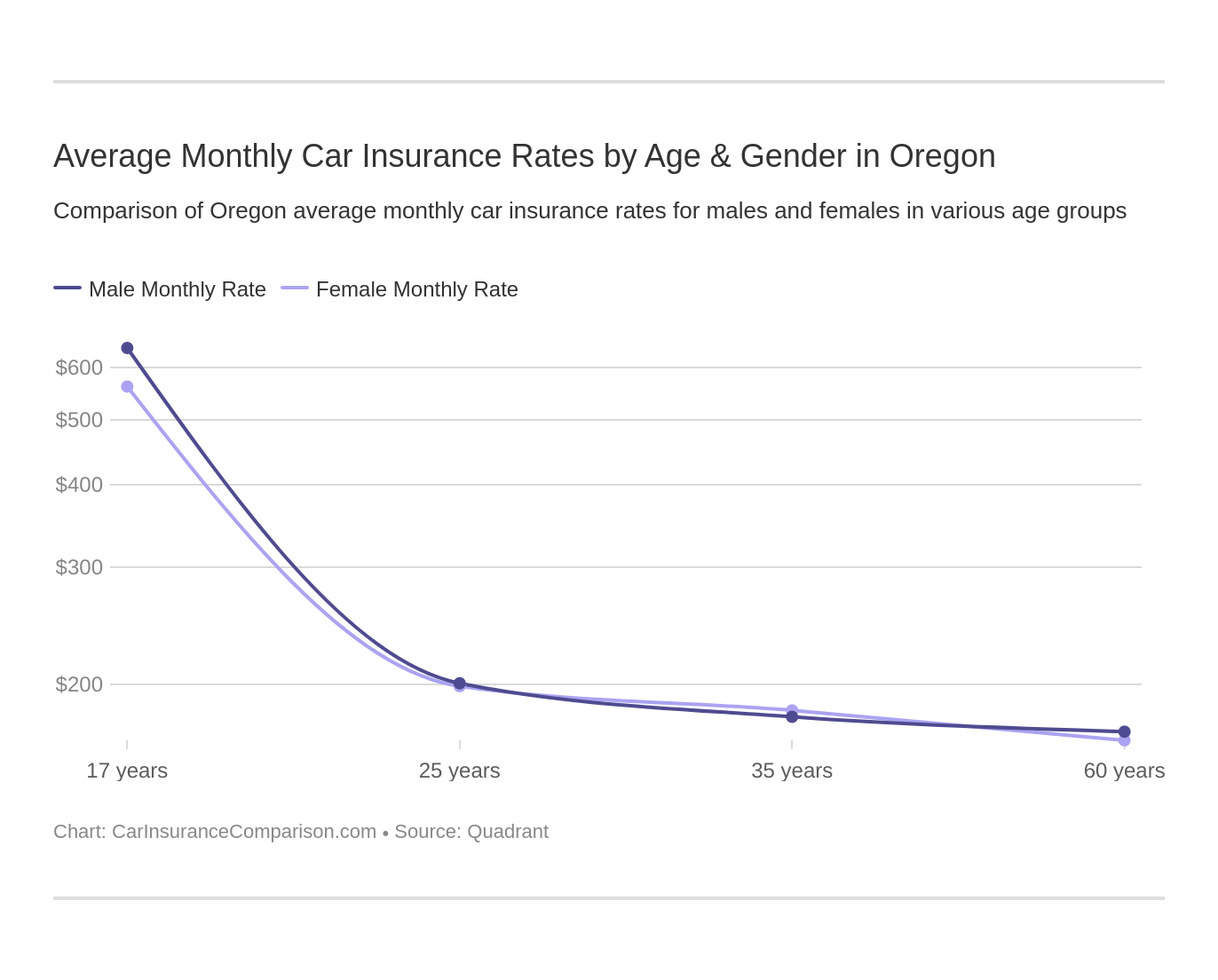

Average Car Insurance Rates by Age & Gender in OR

In case you didn’t have enough factors contributing to what your car insurance rate is, did you know that even your own gender can contribute? Even though there shouldn’t be, there is still a trend in differences between the rates for males and females.

| Company | Married 35-year old female annual rate | Married 35-year old male annual rate | Married 60-year old female annual rate | Married 60-year old male annual rate | Single 17-year old female annual rate | Single 17-year old male annual rate | Single 25-year old female annual rate | Single 25-year old male annual rate |

|---|---|---|---|---|---|---|---|---|

| Blank | $1,914.64 | $1,904.00 | $1,723.47 | $1,794.06 | $5,037.55 | $6,279.58 | $2,206.08 | $2,312.57 |

| Allstate F&C | $3,116.60 | $2,896.79 | $2,841.32 | $2,868.61 | $9,332.73 | $10,401.52 | $3,262.94 | $3,277.55 |

| American Family Mutual | $2,304.32 | $2,304.32 | $2,054.19 | $2,054.19 | $5,697.93 | $8,930.71 | $2,304.32 | $2,413.79 |

| Farmers Ins Co Of OR | $2,069.68 | $2,024.02 | $1,829.43 | $1,945.91 | $8,559.72 | $8,752.78 | $2,317.92 | $2,376.37 |

| Geico Cas | $2,392.62 | $2,311.56 | $2,226.68 | $2,240.44 | $6,189.22 | $5,642.07 | $2,548.10 | $2,200.85 |

| Safeco Ins Co of OR | $2,776.95 | $2,928.21 | $2,411.66 | $2,679.41 | $8,850.63 | $9,545.05 | $2,670.62 | $2,692.84 |

| NICOA | $2,222.89 | $2,212.78 | $1,980.76 | $2,071.14 | $5,087.37 | $6,359.30 | $2,592.14 | $2,729.36 |

| Progressive Universal | $1,926.67 | $1,745.84 | $1,672.83 | $1,722.85 | $8,277.50 | $9,124.21 | $2,301.66 | $2,177.58 |

| State Farm Mutual Auto | $1,618.73 | $1,618.73 | $1,481.05 | $1,481.05 | $5,136.09 | $6,447.93 | $1,836.59 | $2,105.82 |

| Standard Fire Insurance Co | $1,887.50 | $1,902.25 | $1,699.83 | $1,768.58 | $5,296.68 | $6,424.93 | $1,969.94 | $2,002.27 |

| USAA CIC | $1,608.07 | $1,560.55 | $1,590.69 | $1,535.96 | $4,886.29 | $5,247.50 | $2,068.24 | $2,149.86 |

You can see in the data above that there are a few providers that offer similar rates for both married females and married males, such as American Family Mutual and State Farm Mutual Auto.

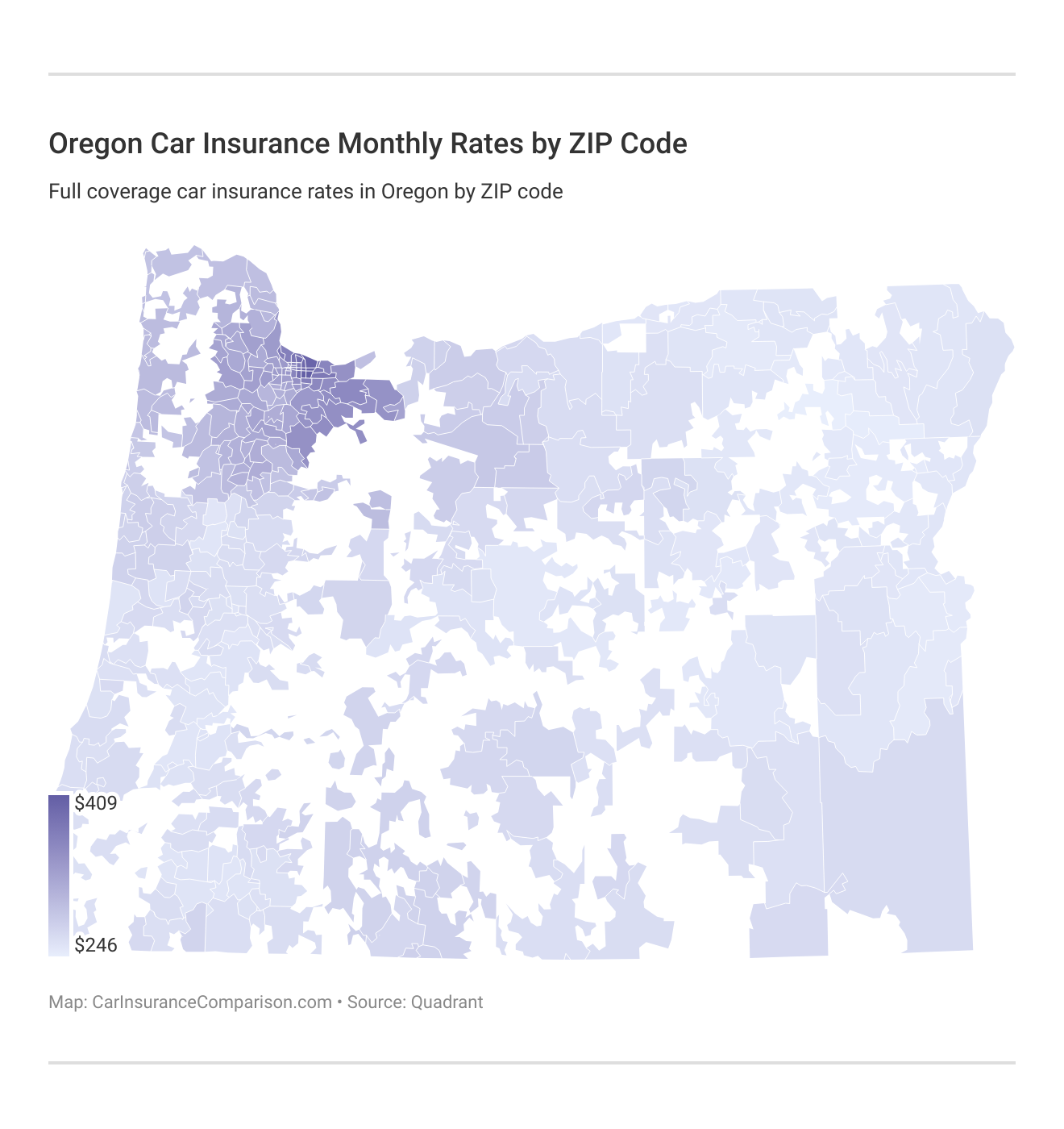

The biggest trend you could probably see from the data above is how rates differ depending on how old you are. Yes, this also contributes. Teenage boys, in particular, can’t seem to catch a break for their insurance rates. They seem to be paying thousands of dollars more for some companies than older drivers. Why is that? Companies tend to charge higher rates for teenagers as they are considered more inexperienced drivers, and therefore more likely to be reckless or get into an accident.Highest and Lowest Insurance Rates by ZIP Code

Below we’ve gone through and listed all of the provider’s costs next to the ZIP code. Hopefully, this will give you a helpful snapshot of what you should ideally be paying for your area!| Most Expensive ZIP Codes in Oregon | City | Average annual rate by ZIP Code | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 97236 | PORTLAND | $4,908.54 | Allstate | $5,782.60 | Liberty Mutual | $5,661.06 | USAA | $2,996.88 | Geico | $4,370.90 |

| 97233 | PORTLAND | $4,879.89 | Liberty Mutual | $5,703.38 | Allstate | $5,474.80 | USAA | $3,363.24 | Geico | $4,394.08 |

| 97266 | PORTLAND | $4,879.16 | Liberty Mutual | $5,712.95 | Allstate | $5,465.51 | USAA | $3,087.87 | Geico | $4,394.08 |

| 97230 | PORTLAND | $4,798.11 | Allstate | $5,857.67 | Liberty Mutual | $5,741.60 | USAA | $3,274.95 | State Farm | $4,023.41 |

| 97216 | PORTLAND | $4,786.62 | Liberty Mutual | $5,710.85 | Allstate | $5,707.26 | USAA | $3,028.60 | Travelers | $4,100.87 |

| 97220 | PORTLAND | $4,750.30 | Liberty Mutual | $5,698.92 | Allstate | $5,578.29 | USAA | $3,028.60 | Travelers | $4,031.94 |

| 97218 | PORTLAND | $4,666.61 | Liberty Mutual | $5,754.02 | Allstate | $5,626.35 | USAA | $3,289.55 | Geico | $3,826.42 |

| 97206 | PORTLAND | $4,660.64 | Liberty Mutual | $5,773.06 | Allstate | $5,669.04 | USAA | $3,216.99 | Geico | $3,832.06 |

| 97211 | PORTLAND | $4,562.34 | Allstate | $5,851.02 | Liberty Mutual | $5,742.16 | USAA | $3,033.79 | Geico | $3,767.19 |

| 97215 | PORTLAND | $4,538.22 | Allstate | $5,841.08 | Liberty Mutual | $5,752.02 | USAA | $3,049.18 | State Farm | $3,765.55 |

| 97030 | GRESHAM | $4,530.67 | Allstate | $5,865.83 | Liberty Mutual | $5,505.50 | USAA | $3,154.31 | State Farm | $3,821.03 |

| 97080 | GRESHAM | $4,516.29 | Allstate | $5,782.60 | Liberty Mutual | $5,483.47 | USAA | $2,962.46 | Geico | $3,944.10 |

| 97213 | PORTLAND | $4,466.19 | Allstate | $5,851.02 | Liberty Mutual | $5,658.97 | USAA | $3,049.18 | Geico | $3,725.49 |

| 97203 | PORTLAND | $4,447.21 | Allstate | $5,800.34 | Liberty Mutual | $5,316.10 | USAA | $3,005.93 | Geico | $3,725.49 |

| 97024 | FAIRVIEW | $4,436.31 | Allstate | $5,857.67 | Liberty Mutual | $5,522.75 | USAA | $3,154.31 | State Farm | $3,782.98 |

| 97086 | HAPPY VALLEY | $4,429.53 | Liberty Mutual | $5,703.12 | Allstate | $5,503.60 | USAA | $2,996.88 | State Farm | $3,712.10 |

| 97217 | PORTLAND | $4,413.23 | Allstate | $5,800.34 | Liberty Mutual | $5,181.26 | USAA | $3,106.33 | Geico | $3,450.53 |

| 97212 | PORTLAND | $4,371.73 | Allstate | $5,851.02 | Liberty Mutual | $5,703.36 | USAA | $3,046.69 | Geico | $3,765.67 |

| 97202 | PORTLAND | $4,353.56 | Allstate | $5,841.08 | Farmers | $5,463.28 | USAA | $3,022.62 | Geico | $3,734.01 |

| 97060 | TROUTDALE | $4,342.93 | Allstate | $5,814.37 | Liberty Mutual | $5,413.34 | USAA | $3,040.93 | State Farm | $3,642.90 |

| 97227 | PORTLAND | $4,322.28 | Allstate | $5,851.02 | Liberty Mutual | $5,496.16 | USAA | $2,972.83 | Geico | $3,430.64 |

| 97089 | DAMASCUS | $4,310.96 | Allstate | $5,503.60 | Farmers | $5,017.98 | USAA | $2,962.46 | Geico | $3,595.29 |

| 97010 | BRIDAL VEIL | $4,298.84 | Allstate | $5,865.83 | Liberty Mutual | $5,248.54 | USAA | $2,860.84 | State Farm | $3,312.38 |

| 97055 | SANDY | $4,281.70 | Allstate | $5,865.83 | Liberty Mutual | $5,008.93 | USAA | $3,025.65 | State Farm | $3,537.30 |

| 97009 | BORING | $4,251.54 | Allstate | $5,548.53 | Farmers | $5,033.00 | USAA | $2,860.84 | State Farm | $3,369.54 |

Most of the expensive ZIP codes can be found in Portland.

| Cheapest ZIP Codes in Oregon | City | Average Annual Rate by ZIP Codes | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 97850 | LA GRANDE | $2,953.60 | Allstate | $4,267.33 | Liberty Mutual | $3,689.90 | State Farm | $2,090.46 | Travelers | $2,170.40 |

| 97883 | UNION | $2,977.42 | Allstate | $4,267.33 | Liberty Mutual | $3,645.90 | State Farm | $2,106.65 | Travelers | $2,233.29 |

| 97814 | BAKER CITY | $3,001.96 | Allstate | $4,267.33 | Liberty Mutual | $3,778.56 | State Farm | $2,168.88 | Travelers | $2,396.87 |

| 97914 | ONTARIO | $3,007.22 | Allstate | $4,267.33 | Liberty Mutual | $3,758.49 | State Farm | $2,238.81 | USAA | $2,307.45 |

| 97918 | VALE | $3,009.25 | Allstate | $4,267.33 | Liberty Mutual | $3,764.81 | State Farm | $2,217.80 | USAA | $2,307.45 |

| 97824 | COVE | $3,010.45 | Allstate | $4,267.33 | Liberty Mutual | $3,647.03 | State Farm | $2,126.04 | Travelers | $2,202.86 |

| 97801 | PENDLETON | $3,011.07 | Allstate | $4,267.33 | Liberty Mutual | $3,563.87 | State Farm | $2,229.13 | Travelers | $2,465.98 |

| 97859 | MEACHAM | $3,015.05 | Allstate | $4,267.33 | Liberty Mutual | $3,585.86 | Travelers | $2,276.14 | State Farm | $2,280.15 |

| 97913 | NYSSA | $3,016.37 | Allstate | $4,267.33 | Liberty Mutual | $3,765.91 | State Farm | $2,224.92 | USAA | $2,307.45 |

| 97867 | NORTH POWDER | $3,018.90 | Allstate | $4,267.33 | Liberty Mutual | $3,748.20 | Travelers | $2,178.01 | State Farm | $2,187.18 |

| 97841 | IMBLER | $3,025.25 | Allstate | $4,267.33 | Liberty Mutual | $3,645.90 | State Farm | $2,115.80 | Travelers | $2,216.69 |

| 97820 | CANYON CITY | $3,025.33 | Allstate | $4,267.33 | Liberty Mutual | $3,639.63 | State Farm | $2,280.15 | USAA | $2,369.88 |

| 97876 | SUMMERVILLE | $3,029.90 | Allstate | $4,267.33 | Liberty Mutual | $3,667.90 | State Farm | $2,146.14 | Travelers | $2,228.17 |

| 97819 | BRIDGEPORT | $3,030.22 | Allstate | $4,267.33 | Liberty Mutual | $3,874.82 | Travelers | $2,278.06 | State Farm | $2,280.15 |

| 97880 | UKIAH | $3,030.50 | Allstate | $4,267.33 | Liberty Mutual | $3,648.13 | Travelers | $2,234.80 | State Farm | $2,280.15 |

| 97870 | RICHLAND | $3,033.13 | Allstate | $4,267.33 | Liberty Mutual | $3,884.16 | State Farm | $2,310.69 | Travelers | $2,318.29 |

| 97833 | HAINES | $3,036.74 | Allstate | $4,267.33 | Liberty Mutual | $3,773.47 | Travelers | $2,206.06 | State Farm | $2,224.38 |

| 97877 | SUMPTER | $3,038.47 | Allstate | $4,267.33 | Liberty Mutual | $3,900.47 | State Farm | $2,280.15 | Travelers | $2,294.11 |

| 97905 | DURKEE | $3,040.56 | Allstate | $4,267.33 | Liberty Mutual | $3,848.77 | Travelers | $2,264.88 | State Farm | $2,280.15 |

| 97754 | PRINEVILLE | $3,041.45 | Liberty Mutual | $3,688.59 | Allstate | $3,589.44 | State Farm | $2,332.45 | USAA | $2,540.44 |

| 97738 | HINES | $3,041.62 | Allstate | $4,727.79 | Liberty Mutual | $3,748.20 | State Farm | $2,191.69 | Travelers | $2,251.62 |

| 97818 | BOARDMAN | $3,043.38 | Allstate | $4,267.33 | Liberty Mutual | $3,848.36 | State Farm | $2,327.10 | Travelers | $2,386.93 |

| 97827 | ELGIN | $3,044.26 | Allstate | $4,267.33 | Liberty Mutual | $3,689.90 | State Farm | $2,146.14 | Travelers | $2,307.56 |

| 97479 | SUTHERLIN | $3,044.45 | Liberty Mutual | $3,946.48 | Allstate | $3,933.63 | State Farm | $2,219.39 | USAA | $2,363.60 |

| 97834 | HALFWAY | $3,046.41 | Allstate | $4,267.33 | Liberty Mutual | $3,890.44 | Travelers | $2,296.88 | State Farm | $2,380.44 |

Highest and Lowest Insurance Rates by City

Do you live in a more populated city, or a more rural town with few neighbors? Where you are in Oregon affects what your insurance rate is going to be.

| Most Expensive Cities in Oregon | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Maywood Park | $4,750.30 | Liberty Mutual | $5,698.92 | Allstate | $5,578.29 | USAA | $3,028.60 | Travelers | $4,031.94 |

| Gresham | $4,726.70 | Allstate | $5,752.70 | Liberty Mutual | $5,619.00 | USAA | $3,150.37 | State Farm | $4,163.67 |

| Fairview | $4,436.31 | Allstate | $5,857.67 | Liberty Mutual | $5,522.75 | USAA | $3,154.31 | State Farm | $3,782.98 |

| Happy Valley | $4,429.53 | Liberty Mutual | $5,703.12 | Allstate | $5,503.60 | USAA | $2,996.88 | State Farm | $3,712.10 |

| Troutdale | $4,342.93 | Allstate | $5,814.37 | Liberty Mutual | $5,413.34 | USAA | $3,040.93 | State Farm | $3,642.90 |

| Portland | $4,315.24 | Allstate | $5,732.23 | Liberty Mutual | $5,322.54 | USAA | $2,932.74 | Geico | $3,669.55 |

| Damascus | $4,310.96 | Allstate | $5,503.60 | Farmers | $5,017.98 | USAA | $2,962.46 | Geico | $3,595.29 |

| Bridal Veil | $4,298.84 | Allstate | $5,865.83 | Liberty Mutual | $5,248.54 | USAA | $2,860.84 | State Farm | $3,312.38 |

| Sandy | $4,281.70 | Allstate | $5,865.83 | Liberty Mutual | $5,008.93 | USAA | $3,025.65 | State Farm | $3,537.30 |

| Boring | $4,251.54 | Allstate | $5,548.53 | Farmers | $5,033.00 | USAA | $2,860.84 | State Farm | $3,369.54 |

| Clackamas | $4,220.48 | Allstate | $5,270.25 | Farmers | $5,164.30 | USAA | $2,962.46 | State Farm | $3,582.78 |

| Eagle Creek | $4,214.68 | Allstate | $5,358.66 | Liberty Mutual | $5,207.17 | USAA | $2,844.93 | State Farm | $3,547.67 |

| Estacada | $4,200.61 | Allstate | $5,673.25 | Liberty Mutual | $5,173.44 | USAA | $2,860.84 | State Farm | $3,570.65 |

| Welches | $4,186.59 | Allstate | $5,865.83 | Farmers | $4,990.88 | USAA | $2,860.84 | State Farm | $3,155.29 |

| Brightwood | $4,182.88 | Allstate | $5,865.83 | Farmers | $4,838.29 | USAA | $2,860.84 | State Farm | $3,312.38 |

| Milwaukie | $4,174.20 | Farmers | $5,177.68 | Allstate | $5,137.74 | USAA | $2,914.03 | Travelers | $3,490.77 |

| Molalla | $4,171.20 | Allstate | $5,410.11 | Farmers | $4,926.99 | USAA | $2,958.61 | Travelers | $3,452.72 |

| Rhododendron | $4,162.53 | Allstate | $5,865.83 | Farmers | $4,920.48 | USAA | $2,860.84 | State Farm | $3,126.15 |

| Mulino | $4,149.58 | Allstate | $5,725.75 | Farmers | $5,080.44 | USAA | $2,958.61 | Travelers | $3,336.50 |

| Beavercreek | $4,119.60 | Allstate | $5,581.98 | Farmers | $4,954.21 | USAA | $2,844.93 | State Farm | $3,401.99 |

| Marylhurst | $4,059.09 | Allstate | $5,503.60 | Liberty Mutual | $4,823.25 | USAA | $2,729.08 | State Farm | $3,312.38 |

| Oak Grove | $4,058.14 | Allstate | $5,137.74 | Farmers | $5,088.29 | USAA | $3,039.25 | Travelers | $3,328.53 |

| Beaverton | $4,023.12 | Allstate | $5,331.96 | Liberty Mutual | $4,980.72 | USAA | $2,767.48 | State Farm | $3,405.82 |

| Gladstone | $4,014.25 | Allstate | $5,137.74 | Liberty Mutual | $4,813.85 | USAA | $3,039.25 | Travelers | $3,362.22 |

| Aloha | $3,989.37 | Allstate | $5,231.84 | Liberty Mutual | $4,810.17 | USAA | $2,777.79 | Travelers | $3,412.14 |

Although Portland has the most expensive ZIP codes, Maywood Park is actually the most expensive city.

| Cheapest Cities in Oregon | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| La Grande | $2,953.60 | Allstate | $4,267.33 | Liberty Mutual | $3,689.90 | State Farm | $2,090.46 | Travelers | $2,170.40 |

| Union | $2,977.42 | Allstate | $4,267.33 | Liberty Mutual | $3,645.90 | State Farm | $2,106.65 | Travelers | $2,233.29 |

| Baker City | $3,001.96 | Allstate | $4,267.33 | Liberty Mutual | $3,778.56 | State Farm | $2,168.88 | Travelers | $2,396.87 |

| Ontario | $3,007.22 | Allstate | $4,267.33 | Liberty Mutual | $3,758.49 | State Farm | $2,238.81 | USAA | $2,307.45 |

| Vale | $3,009.25 | Allstate | $4,267.33 | Liberty Mutual | $3,764.81 | State Farm | $2,217.80 | USAA | $2,307.45 |

| Cove | $3,010.45 | Allstate | $4,267.33 | Liberty Mutual | $3,647.03 | State Farm | $2,126.04 | Travelers | $2,202.86 |

| Mission | $3,011.07 | Allstate | $4,267.33 | Liberty Mutual | $3,563.87 | State Farm | $2,229.13 | Travelers | $2,465.98 |

| Meacham | $3,015.05 | Allstate | $4,267.33 | Liberty Mutual | $3,585.86 | Travelers | $2,276.14 | State Farm | $2,280.15 |

| Nyssa | $3,016.37 | Allstate | $4,267.33 | Liberty Mutual | $3,765.91 | State Farm | $2,224.92 | USAA | $2,307.45 |

| North Powder | $3,018.90 | Allstate | $4,267.33 | Liberty Mutual | $3,748.20 | Travelers | $2,178.01 | State Farm | $2,187.18 |

| Imbler | $3,025.25 | Allstate | $4,267.33 | Liberty Mutual | $3,645.90 | State Farm | $2,115.80 | Travelers | $2,216.69 |

| Canyon City | $3,025.33 | Allstate | $4,267.33 | Liberty Mutual | $3,639.63 | State Farm | $2,280.15 | USAA | $2,369.88 |

| Summerville | $3,029.90 | Allstate | $4,267.33 | Liberty Mutual | $3,667.90 | State Farm | $2,146.14 | Travelers | $2,228.17 |

| Bridgeport | $3,030.22 | Allstate | $4,267.33 | Liberty Mutual | $3,874.82 | Travelers | $2,278.06 | State Farm | $2,280.15 |

| Dale | $3,030.50 | Allstate | $4,267.33 | Liberty Mutual | $3,648.13 | Travelers | $2,234.80 | State Farm | $2,280.15 |

| Richland | $3,033.13 | Allstate | $4,267.33 | Liberty Mutual | $3,884.16 | State Farm | $2,310.69 | Travelers | $2,318.29 |

| Haines | $3,036.74 | Allstate | $4,267.33 | Liberty Mutual | $3,773.47 | Travelers | $2,206.06 | State Farm | $2,224.38 |

| Granite | $3,038.46 | Allstate | $4,267.33 | Liberty Mutual | $3,900.47 | State Farm | $2,280.15 | Travelers | $2,294.11 |

| Durkee | $3,040.55 | Allstate | $4,267.33 | Liberty Mutual | $3,848.77 | Travelers | $2,264.88 | State Farm | $2,280.15 |

| Prineville | $3,041.45 | Liberty Mutual | $3,688.59 | Allstate | $3,589.44 | State Farm | $2,332.45 | USAA | $2,540.44 |

| Hines | $3,041.62 | Allstate | $4,727.79 | Liberty Mutual | $3,748.20 | State Farm | $2,191.69 | Travelers | $2,251.62 |

| Boardman | $3,043.38 | Allstate | $4,267.33 | Liberty Mutual | $3,848.36 | State Farm | $2,327.10 | Travelers | $2,386.93 |

| Elgin | $3,044.26 | Allstate | $4,267.33 | Liberty Mutual | $3,689.90 | State Farm | $2,146.14 | Travelers | $2,307.56 |

| Sutherlin | $3,044.45 | Liberty Mutual | $3,946.48 | Allstate | $3,933.63 | State Farm | $2,219.39 | USAA | $2,363.60 |

| Jamieson | $3,047.01 | Allstate | $4,267.33 | Liberty Mutual | $3,720.33 | State Farm | $2,280.15 | USAA | $2,307.45 |

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Oregon Car Insurance Companies

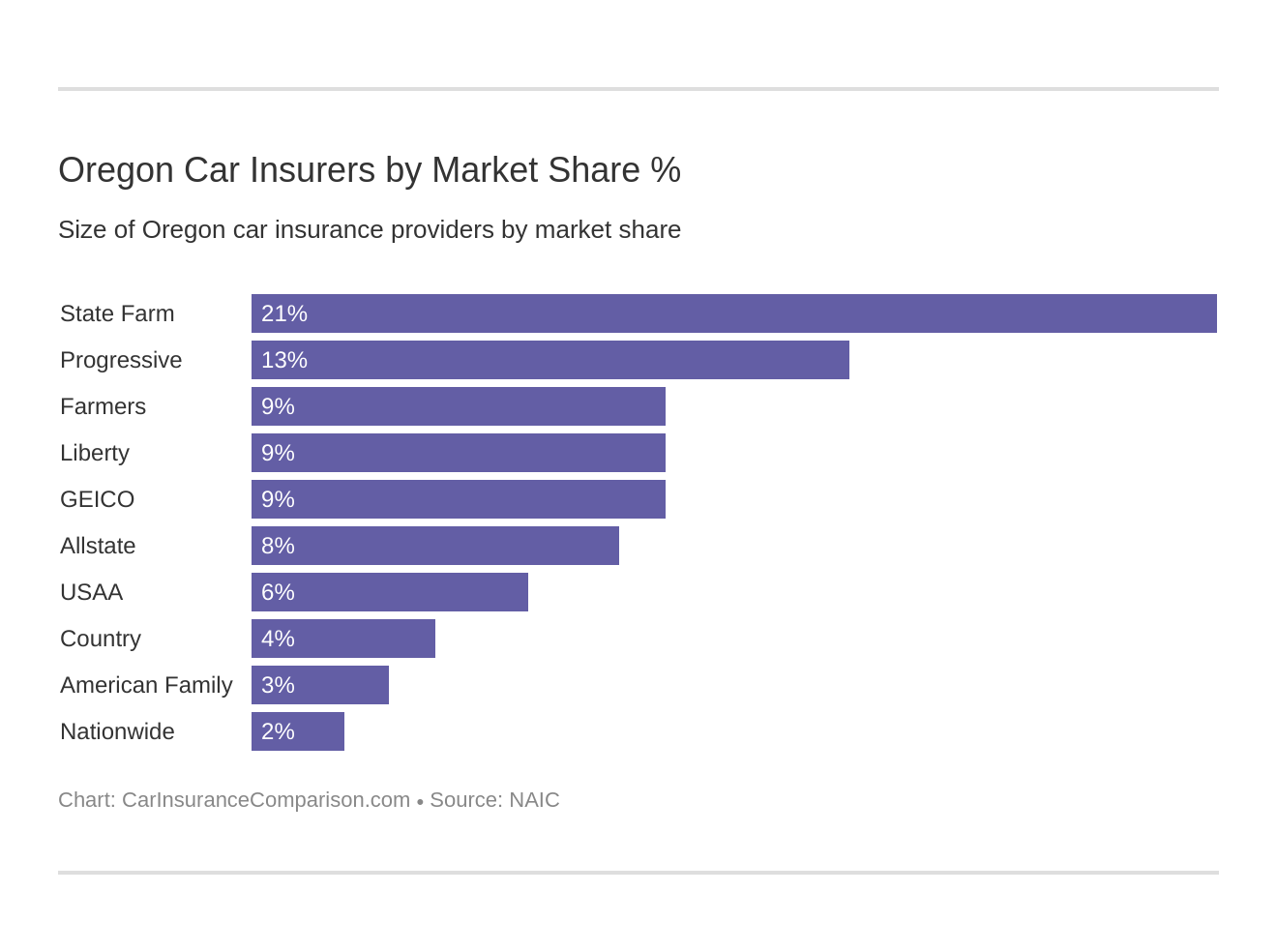

There are so many different car insurance companies out there that are fighting tooth and nail for your business. So many so that trying to find which company is going to give you the best rates AND the best coverage is like finding a needle in a haystack. But rest assured, we are here to help! We want you to know exactly what you’re spending your money on, and that you’re getting exactly what you want. What’s the point of paying for coverage that isn’t going to help you the way you need it to?One way to almost guarantee solid coverage is to go with one of the largest companies in the state. Take a look at the market share percentages of the largest companies in Oregon.

Below we’re going to talk specifically about some of the biggest car insurance companies in Oregon. We’ll provide you with some of the much-needed information you’ll want to know such as company ratings, financial ratings, and more!The Largest Companies Financial Ratings

What’s the best way to tell what insurance providers financial health is like? You check their A.M. Best Rating! What exactly does this mean? An A.M. Best Rating is an insurance provider rating given to them based on their financial, health.From the below table, you can see all of the top insurance providers in Oregon and what their individual A.M. Best Rating is.

| Company Name | AM Best Rating | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|---|

| State Farm Group | A | $620,489 | 59.83% | 21.28% |

| Progressive Group | A+ | $370,678 | 62.08% | 12.71% |

| Farmers Insurance Group | A | $275,252 | 54.10% | 9.44% |

| Liberty Mutual Group | A | $261,291 | 67.77% | 8.96% |

| Geico | A++ | $260,828 | 70.56% | 8.95% |

| Allstate Insurance Group | A+ | $237,418 | 54.12% | 8.14% |

| USAA Group | A++ | $164,064 | 77.08% | 5.63% |

| Country Insurance & Financial Service Group | A | $104,849 | 58.75% | 3.60% |

| American Family Insurance Group | A+ | $91,870 | 66.64% | 3.15% |

| Nationwide Corp Group | A+ | $68,651 | 71.56% | 2.35% |

]

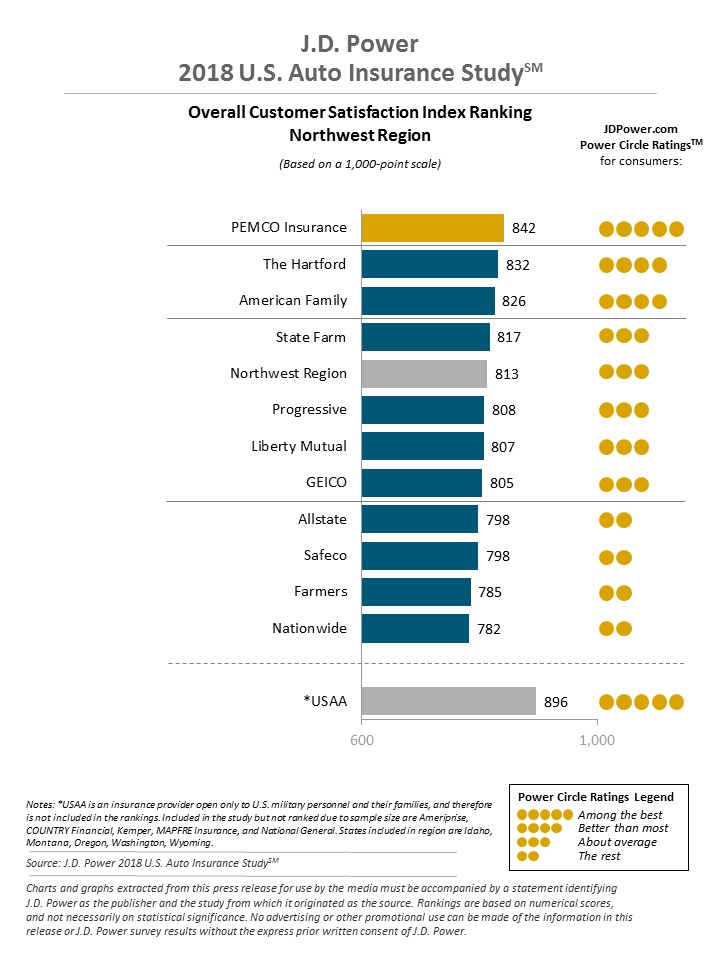

Companies with the Best Ratings

What is another rating you can rely on to tell which companies are higher ranking? Customer satisfaction! How happy do these companies make their customers? Happy customer, happy life!There is a 2018 J.D. Power study that shows the overall customer satisfaction for all of the states in the Northwest region.

Companies with the Most Complaints in Oregon

Now that we’ve talked about the car insurance companies with the highest customer satisfaction, what about the flip side? Which companies have the most complaints?

| Rank | Company | 2013 Premiums | # Confirmed Complaints | Complaint Index |

|---|---|---|---|---|

| 1 | Mutual of Enumclaw | $24,577,981 | 0 | 0.00 |

| 2 | California Casualty | $12,364,357 | 0 | 0.00 |

| 3 | Oregon Automobile Insurance | $2,356,977 | 0 | 0.00 |

| 4 | Nationwide | $27,621,198 | 1 | 0.33 |

| 5 | Oregon Mutual Group | $226,313,718 | 1 | 0.33 |

| 6 | Country Financial Insurance | $76,467,503 | 3 | 0.35 |

| 7 | State Farm | $458,101,249 | 23 | 0.46 |

| 8 | Allstate | $145,845,584 | 11 | 0.69 |

| 9 | Farmers | $257,482,967 | 25 | 0.89 |

| 10 | Progressive | $233,583,428 | 23 | 0.90 |

| 11 | Geico | $105,245,810 | 12 | 1.05 |

| 12 | Safeco | $161,089,253 | 28 | 1.60 |

| 13 | American Family | $67,474,556 | 12 | 1.63 |

| 14 | USAA | $70,876,072 | 13 | 1.68 |

| 15 | Sublimity | $9,324,662 | 2 | 1.97 |

| 16 | Liberty Mutual | $41,884,111 | 11 | 2.41 |

| 17 | Unitrin | $13,016,683 | 4 | 2.82 |

Keep in mind as you look at the information above doesn’t necessarily mean a company is bad. What it does tell you is how these companies handle complaints and customer satisfaction. You don’t make it into the top companies in a region unless you are doing something right.

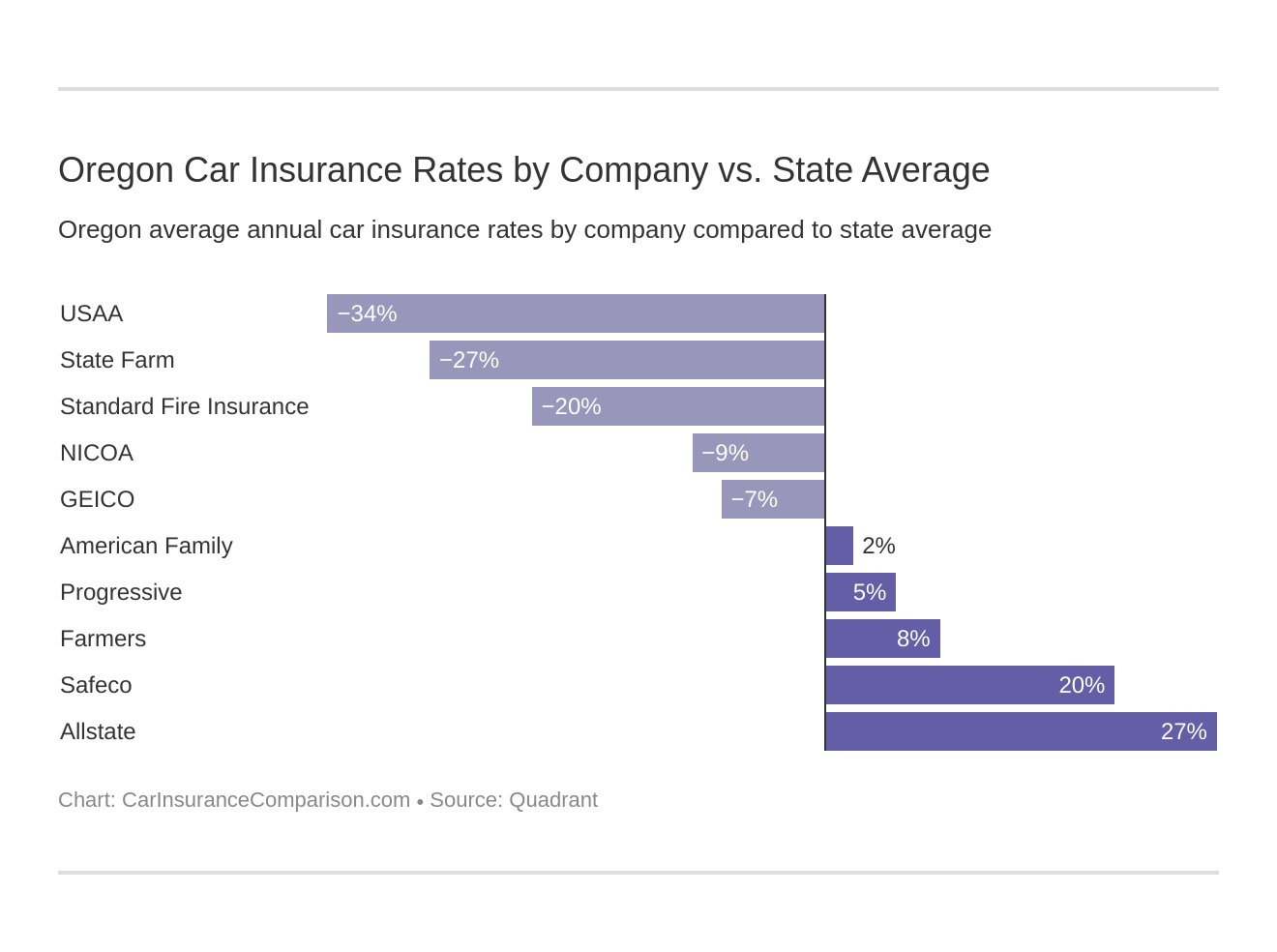

Oregon Car Insurance Rates by Company

Shopping around can help save you hundreds of dollars when looking for the right insurance coverage. While particular companies will offer one rate, another company may offer you a completely different (and lower) rate. Check out the data below for the rates some of the most popular insurance providers in Oregon.

| Company | Average Annual Rate | Compared to State Average Annual Rate | Percent Compared to State Average Annual Rate |

|---|---|---|---|

| Allstate F&C | $4,749.76 | $1,352.64 | 28.48% |

| American Family Mutual | $3,507.97 | $110.85 | 3.16% |

| Farmers Ins Co Of OR | $3,734.48 | $337.36 | 9.03% |

| Geico Cas | $3,218.94 | -$178.18 | -5.54% |

| Safeco Ins Co of OR | $4,319.42 | $922.30 | 21.35% |

| NICOA | $3,156.97 | -$240.15 | -7.61% |

| Progressive Universal | $3,618.64 | $221.52 | 6.12% |

| State Farm Mutual Auto | $2,715.75 | -$681.37 | -25.09% |

| Standard Fire Insurance Co | $2,869.00 | -$528.12 | -18.41% |

| USAA CIC | $2,580.90 | -$816.22 | -31.63% |

The total average of car insurance rates in Oregon is $3,397.12 per year.

So by shopping around you could be saving hundreds of dollars! If you were to choose, for example, State Farm Mutual Auto you could be paying almost $700 less than the state average!

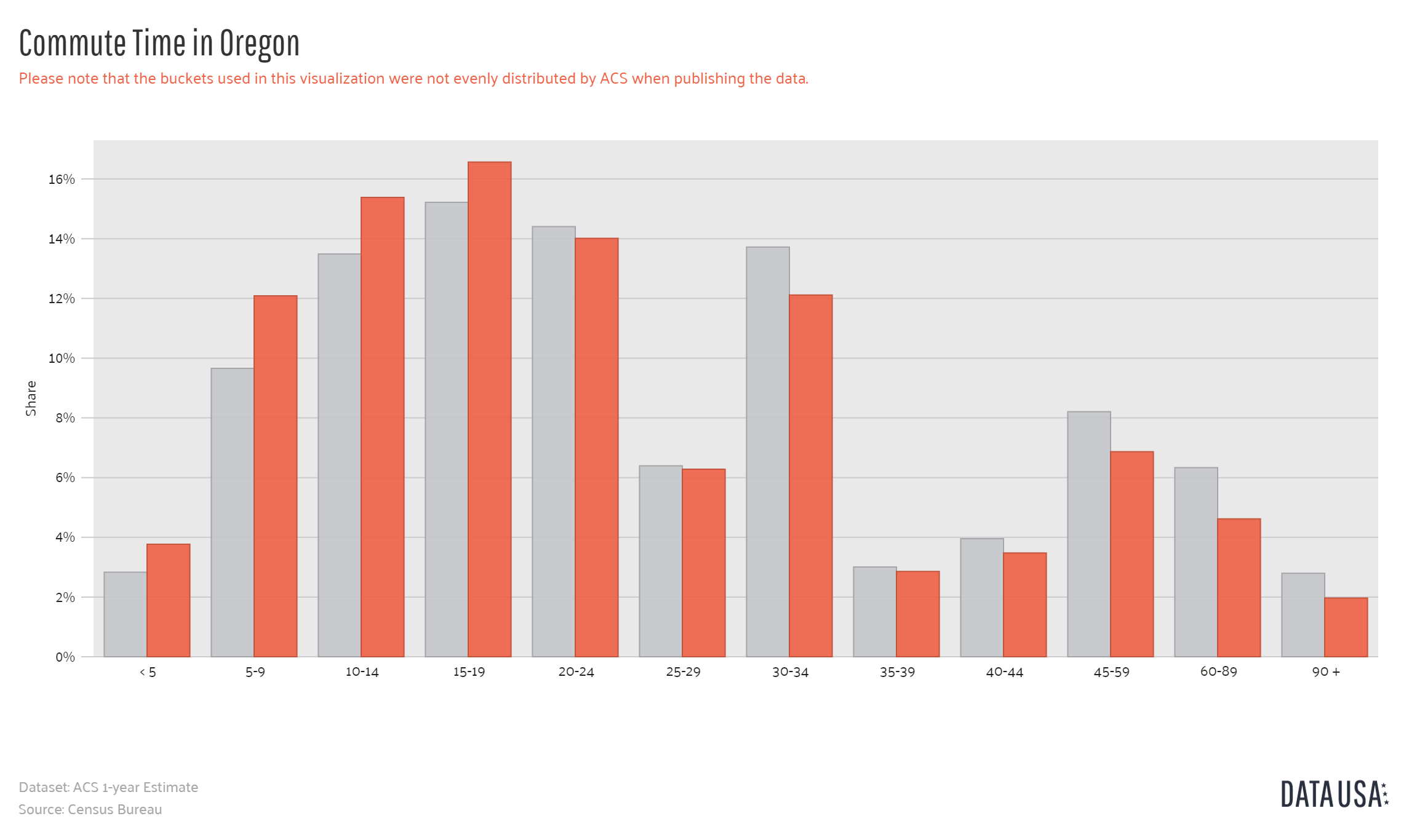

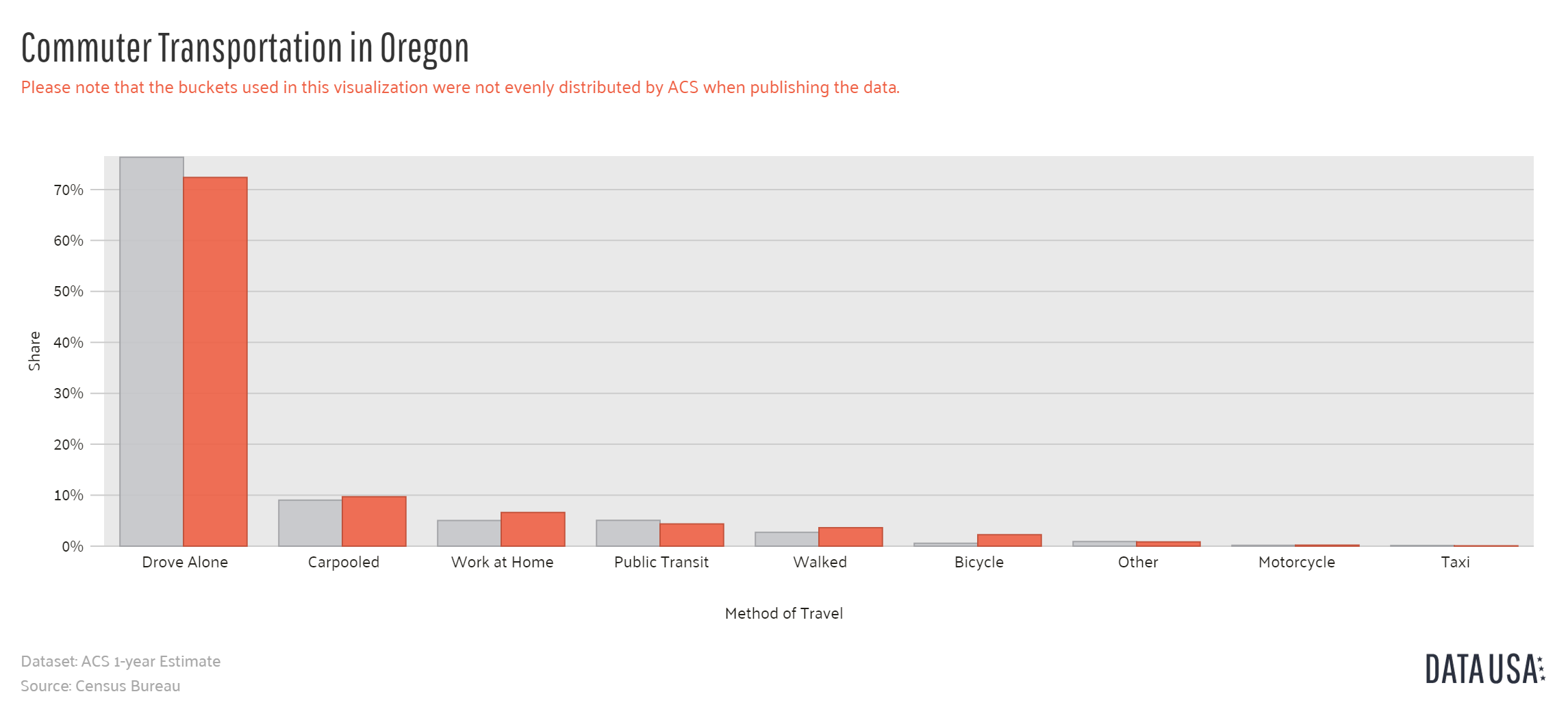

Cost of Commutes by Carrier

How far you commute to and from your destinations actually can factor into what rate you are offered. Pleasure driving cars is sometimes cheaper.

Learn more: Car Insurance Pleasure Driving

The trend is for those with longer commutes to be charged more, likely due to the fact that those drivers are on the road for longer periods of time and therefore have a higher chance of getting into an accident.

| Group | Commute And Annual Mileage | Annual Average |

|---|---|---|

| Allstate | 10 miles commute. 6000 annual mileage. | $4,749.76 |

| Allstate | 25 miles commute. 12000 annual mileage. | $4,749.76 |

| American Family | 25 miles commute. 12000 annual mileage. | $3,562.34 |

| American Family | 10 miles commute. 6000 annual mileage. | $3,453.60 |

| Farmers | 10 miles commute. 6000 annual mileage. | $3,734.48 |

| Farmers | 25 miles commute. 12000 annual mileage. | $3,734.48 |

| Geico | 25 miles commute. 12000 annual mileage. | $3,272.06 |

| Geico | 10 miles commute. 6000 annual mileage. | $3,165.82 |

| Liberty Mutual | 10 miles commute. 6000 annual mileage. | $4,319.42 |

| Liberty Mutual | 25 miles commute. 12000 annual mileage. | $4,319.42 |

| Nationwide | 10 miles commute. 6000 annual mileage. | $3,156.97 |

| Nationwide | 25 miles commute. 12000 annual mileage. | $3,156.97 |

| Progressive | 10 miles commute. 6000 annual mileage. | $3,618.64 |

| Progressive | 25 miles commute. 12000 annual mileage. | $3,618.64 |

| State Farm | 25 miles commute. 12000 annual mileage. | $2,785.80 |

| State Farm | 10 miles commute. 6000 annual mileage. | $2,645.69 |

| Travelers | 25 miles commute. 12000 annual mileage. | $2,983.68 |

| Travelers | 10 miles commute. 6000 annual mileage. | $2,754.32 |

| USAA | 25 miles commute. 12000 annual mileage. | $2,654.80 |

| USAA | 10 miles commute. 6000 annual mileage. | $2,506.99 |

Not all companies, however, charge different rates depending on your commute. Allstate, for example, charges the same rate no matter if your commute is 10 miles per commute or 25 miles per commute. Overall, commute times are among the smaller factors that can increase your rates.

Coverage Level Rates in Oregon

Did you know that you could be paying for a lower coverage plan when you could be getting a higher coverage plan for only a little more money? It can certainly be tempting to get the lowest coverage simply because it costs less, but a higher level of coverage helps to protect you so much more.

| Group | Coverage Type | Annual Average |

|---|---|---|

| Allstate | High | $4,940.50 |

| Allstate | Low | $4,569.25 |

| Allstate | Medium | $4,739.52 |

| American Family | High | $3,323.69 |

| American Family | Low | $3,490.82 |

| American Family | Medium | $3,709.39 |

| Farmers | High | $4,017.90 |

| Farmers | Low | $3,499.81 |

| Farmers | Medium | $3,685.73 |

| Geico | High | $3,465.92 |

| Geico | Low | $2,956.17 |

| Geico | Medium | $3,234.73 |

| Liberty Mutual | High | $4,598.16 |

| Liberty Mutual | Low | $4,052.06 |

| Liberty Mutual | Medium | $4,308.05 |

| Nationwide | High | $3,220.33 |

| Nationwide | Low | $3,008.89 |

| Nationwide | Medium | $3,241.68 |

| Progressive | High | $3,763.21 |

| Progressive | Low | $3,491.04 |

| Progressive | Medium | $3,601.67 |

| State Farm | High | $2,863.31 |

| State Farm | Low | $2,564.14 |

| State Farm | Medium | $2,719.79 |

| Travelers | High | $3,063.38 |

| Travelers | Low | $2,690.23 |

| Travelers | Medium | $2,853.40 |

| USAA | High | $2,690.90 |

| USAA | Low | $2,468.39 |

| USAA | Medium | $2,583.40 |

The difference in getting a better protection plan for yourself could mean as little as a few hundred dollars every year. But as we’ve mentioned before, shopping around could also mean that you’re paying less for a better coverage plan!

You can see in the data above that a low coverage plan for Allstate is $4,569.25 while a high coverage plan for USAA is only $2,690.23. That means you’d actually be spending $1,879.02 LESS for a higher coverage plan!Lesson learned? Low cost doesn’t always mean you’re getting the most for your money, and you could actually be paying more for a plan that doesn’t protect you as well as a higher coverage plan at another company could.

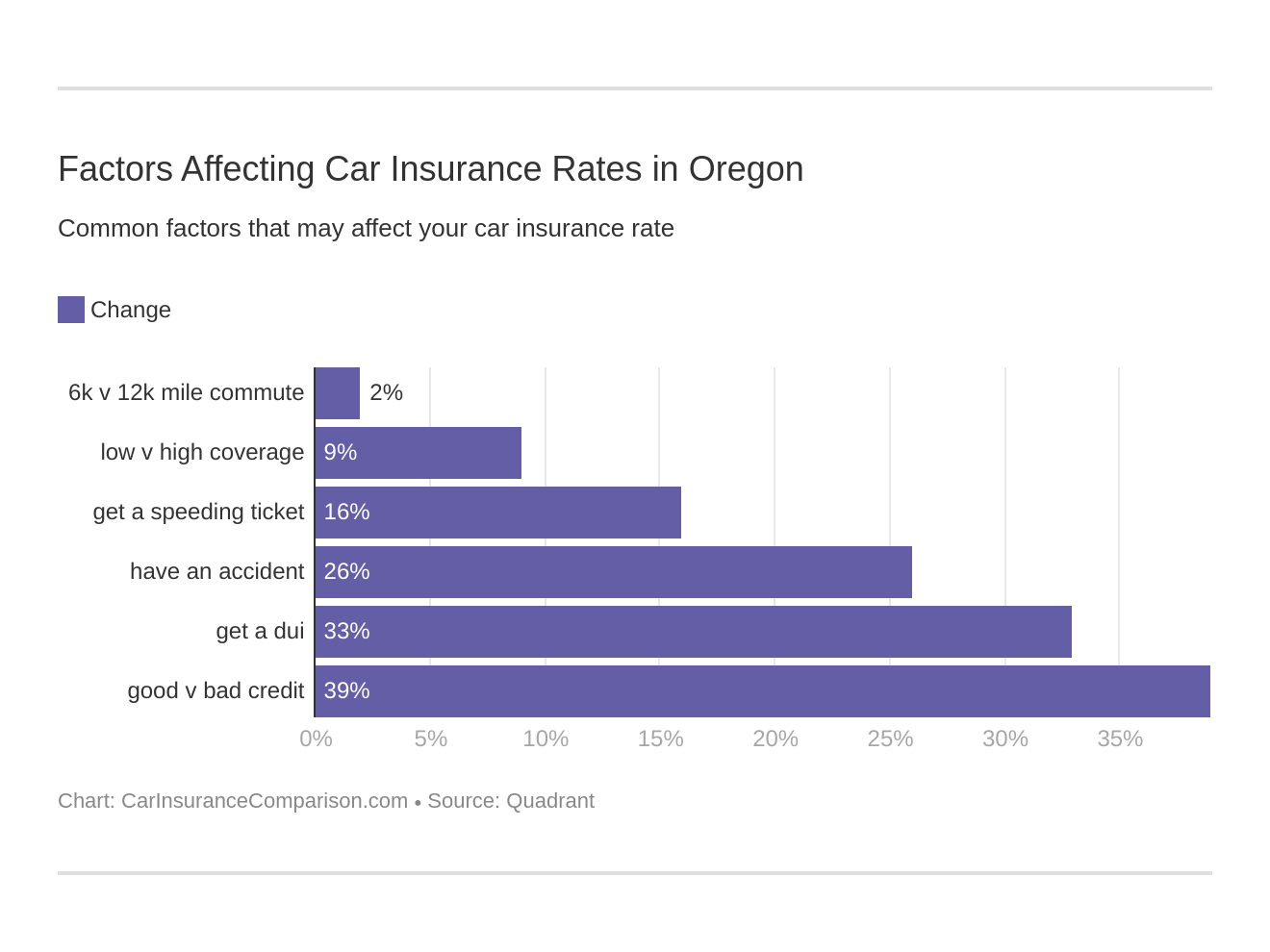

Credit History Rates

Your credit history absolutely will affect your insurance rate, although not all insurance companies use credit scores (learn more: What car insurance companies don’t use credit ratings?). Providers are companies after all and at the end of the day, they want to make sure you can pay for your plan with them. The lower your credit history is, the more likely they think you won’t pay them. Making sure your credit score is the best it can be is going to ensure that you get the lowest insurance rates possible.

| Group | Credit History | Annual Average |

|---|---|---|

| Allstate | Poor | $6,237.94 |

| Allstate | Fair | $4,389.68 |

| Allstate | Good | $3,621.66 |

| American Family | Poor | $4,455.98 |

| American Family | Fair | $3,288.44 |

| American Family | Good | $2,779.49 |

| Farmers | Poor | $4,316.37 |

| Farmers | Fair | $3,535.79 |

| Farmers | Good | $3,351.28 |

| Geico | Poor | $3,883.45 |

| Geico | Fair | $3,218.94 |

| Geico | Good | $2,554.43 |

| Liberty Mutual | Poor | $6,333.87 |

| Liberty Mutual | Fair | $3,737.43 |

| Liberty Mutual | Good | $2,886.97 |

| Nationwide | Poor | $3,817.24 |

| Nationwide | Fair | $3,028.06 |

| Nationwide | Good | $2,625.62 |

| Progressive | Poor | $4,065.88 |

| Progressive | Fair | $3,515.16 |

| Progressive | Good | $3,274.88 |

| State Farm | Poor | $3,793.17 |

| State Farm | Fair | $2,419.05 |

| State Farm | Good | $1,935.03 |

| Travelers | Poor | $3,586.68 |

| Travelers | Fair | $2,810.04 |

| Travelers | Good | $2,210.28 |

| USAA | Poor | $3,865.69 |

| USAA | Fair | $2,157.98 |

| USAA | Good | $1,719.01 |

So you can see from the data above that the differences between poor credit history and good credit history. For example, with Allstate, you could be paying $2,616.28 MORE per year with a poor credit history.

Oregon citizens have an average VantageScore of 688. The national average VantageScore of 675, so Oregon has an average credit score HIGHER than the national average!

Keep up the good work Oregon!

Driving Record Rates

We know everyone likes to think they are the best driver, but does your driving record reflect that? The more traffic violations/accidents you have on your record, the more you’re going to be paying.

| Group | Driving Record | Annual Average |

|---|---|---|

| Allstate | With 1 DUI | $5,337.70 |

| Allstate | With 1 accident | $5,162.22 |

| Allstate | With 1 speeding violation | $4,670.30 |

| Allstate | Clean record | $3,828.80 |

| American Family | With 1 DUI | $4,719.97 |

| American Family | With 1 accident | $3,743.66 |

| American Family | With 1 speeding violation | $3,127.99 |

| American Family | Clean record | $2,440.25 |

| Farmers | With 1 accident | $4,057.67 |

| Farmers | With 1 DUI | $3,968.02 |

| Farmers | With 1 speeding violation | $3,763.01 |

| Farmers | Clean record | $3,149.22 |

| Geico | With 1 DUI | $4,447.98 |

| Geico | With 1 accident | $3,378.95 |

| Geico | With 1 speeding violation | $2,928.42 |

| Geico | Clean record | $2,120.41 |

| Liberty Mutual | With 1 DUI | $4,914.58 |

| Liberty Mutual | With 1 accident | $4,282.10 |

| Liberty Mutual | With 1 speeding violation | $4,254.32 |

| Liberty Mutual | Clean record | $3,826.69 |

| Nationwide | With 1 DUI | $4,056.64 |

| Nationwide | With 1 speeding violation | $3,027.83 |

| Nationwide | With 1 accident | $2,866.59 |

| Nationwide | Clean record | $2,676.81 |

| Progressive | With 1 accident | $4,977.18 |

| Progressive | With 1 DUI | $3,516.70 |

| Progressive | With 1 speeding violation | $3,251.19 |

| Progressive | Clean record | $2,729.50 |

| State Farm | With 1 accident | $3,145.65 |

| State Farm | With 1 DUI | $2,654.33 |

| State Farm | With 1 speeding violation | $2,654.33 |

| State Farm | Clean record | $2,408.68 |

| Travelers | With 1 DUI | $3,341.03 |

| Travelers | With 1 accident | $2,973.80 |

| Travelers | With 1 speeding violation | $2,836.34 |

| Travelers | Clean record | $2,324.83 |

| USAA | With 1 DUI | $3,638.37 |

| USAA | With 1 accident | $2,616.67 |

| USAA | With 1 speeding violation | $2,194.01 |

| USAA | Clean record | $1,874.54 |

Having just one speeding violation could increase your insurance rates by hundreds, if not thousands, of dollars. A clean driving record is probably one of the EASIEST ways to keep your insurance rates low, so drive safe out there!

How Much Auto Insurance Costs in Oregon

Explore auto insurance rates in Oregon cities – Bend, La Grande, Lake Oswego, Tangent. Gain insights into the dynamics shaping car insurance rates for informed decision-making.

| Compare Car Insurance Rates in Your City |

|---|

| Bend, OR |

| La Grande, OR |

| Lake Oswego, OR |

| Tangent, OR |

Number of Insurers in Oregon

Now that we’ve gone over the insurance companies in Oregon, we’ll briefly touch on exactly how that translates to how MANY options there are for those of you in Oregon. There are currently 18 domestic insurance providers and 848 foreign insurance providers. What does this mean?

- Domestic Provider: a provider that is based in that state (think of that local hometown kind of provider)

- Foreign Provider: a provider that is based in another state (think larger companies such as Geico, Allstate, etc.)

Is this something you should worry about? No, because in order for a company to do business in Oregon they will have to abide by the laws of the state and write policies that conform to the state-specific requirements.

Oregon State Laws

We will move onto the specific laws that are unique to Oregon. It can be pretty confusing, as laws vary from state to state. New residents may find it hard to keep track of which state allows what because of this. It can be really frustrating getting a ticket for a law you didn’t even know existed!

We want you to be safe while driving in Oregon, so we went ahead and listed all of the important driving laws you’ll need to know. Read through this section to familiarize yourself with all of these laws before driving.

Car Insurance Laws

We touched on the minimum liability coverage in an earlier section, and how it is required to drive legally in Oregon. So when you are shopping for insurance plans, make sure that they are able to meet these requirements. Need a refresher?

- 25 = $25,000 to pay for bodily injuries per person

- 50 = $50,000 to pay for total bodily injuries per accident

- 20 = $20,000 to pay for property damages per accident

- $15,000 for Personal Injury Protection (also known as Medical Payments/MedPay)

- $25,000 per person and $50,000 total per accident for Uninsured Motor Coverage

Keep reading in order to learn more!

High-Risk Insurance

Have you had a good number of traffic violations stamped onto your record? If you have, you could be considered a “high-risk driver” and therefore could have a harder time finding insurance providers willing to provide you coverage. The more stamps you have on your driving record, the harder it may be.

If you can’t get some of the best car insurance for high-risk drivers, in Oregon, there is a plan known as the Automobile Insurance Plan of Oregon (also known as OR AIP), that can help you get the coverage you need. This organization assigns high-risk drivers to existing Oregon insurers, who will then have to provide you with at least the minimum liability coverage. How do they allocate high-risk drivers?

Well if Allstate, for example, were to make up 20 percent of the auto insurance market in Oregon, they would then be assigned 20 percent of these high-risk drivers.What does all of this mean for you? Well, you are able to get the coverage you need to legally drive, but you may not get the provider you wanted.

Also, this provider is able to charge you whatever they deem appropriate to provide you with that coverage. So if you have no other options, you will have to pay whatever it is they charge you.You’ve exhausted all other options and you need to apply to OR AIP, how do you do that? Well to be eligible for the program, you must meet the following requirements:

- Licensed driver

- Vehicle registered in Oregon

- Certify on your application that you were unable to find voluntary insurance coverage within the last 60 days

There are also a few conditions that may prevent you from even being accepted into this program:

- If you have an unpaid insurance premium

- Failed to present your vehicle for inspection

- If your vehicle is over 25 years old (considered an ‘antique’)

Oregon recommends that citizens should only apply to this program if absolutely necessary. So if you are a high-risk driver and are able to find insurance coverage with a provider, you should take that coverage as opposed to applying to this program.

Low-Cost Insurance

If you are in a low-income household there is, unfortunately, no government-sponsored insurance program currently. California, Hawaii, and New Jersey offer car insurance for welfare recipients, but most of the other states have no options similar to these areas. Don’t let this information discourage you though, as there are plenty of other ways that you can cut down on costs to save money.

As mentioned in the previous sections, having a clean driving record, a good credit history, and having a shorter commute can help you save.Another way to help you save is to ask your insurance provider if they have any discounts that you could qualify for. Ask them about any of the following common discounts:

- Homeowner’s Discount

- Military Discount

- Good Driver / Accident-Free Discount

- Good Student Discount

- Multi-Car Discount

- “Green” Discount (for either having a ‘green’ vehicle or opting for a paperless policy)

- Employee Discount (some companies offer their employees discounts for things such as car insurance)

- Anti-Theft Device Discount

The other best way to save some hard-earned cash? Shop around to all of the providers you can to get the most cost-efficient rate while still providing you with the best coverage you’ll need.

Windshield Coverage

So let’s say that you’re driving down the road and that garbage truck in front of you accidentally hits a bump in the road and kicks a huge rock at your window. The rock slams right through the window, leaving a noticeable rock-shaped hole in your windshield. Alright so that might be a little dramatic, but did you know that some states have extremely specific laws you have to follow in order to repair/replace your windshield?

Luckily Oregon is not one of them, they allow consumers to choose who repairs your windshield. Insurers may also use aftermarket crash parts if is the same quality with respect to fit, finish, function, and is also corrosion resistant.

If you want this coverage though added onto your plan, you can shop around so that you can find coverage for this. Find out what states have full glass coverage so you can look into it.

Automobile Insurance Fraud in Oregon

It should come to no surprise that car insurance fraud is a massive crime. Not only in Oregon but all across the nation. How exactly does one commit insurance fraud?

- Faking an accident on purpose in order to claim for damages or injuries that never actually occurred

- Adding additional (‘extra’) costs onto a claim that is actually legitimate

https://youtu.be/ULIz_QOc9X4If you commit insurance fraud in Oregon, you could be facing some heavy penalties and even jail time! Avoid this by only making legitimate claims with no ‘extra’ costs. It’s simply not worth it otherwise!

Statute of Limitations

So let’s say that you have been in a legitimate accident and need to make a claim, how long do you have? There is something known as the statute of limitations that essentially caps how long you have to make a claim. How long do you have in Oregon?

- Personal Injuries: two years

- Property Damage: six years

Oregon gives a generous amount of time for filing property damage claims, but keep in mind that you only have two years to submit a personal injury claim. This may still seem like a pretty generous amount of time, but if you are dealing with all of the other repercussions of the accident, that time may fly by before you know it. Save yourself the worry and make sure you submit your claims as soon as you are able to. Get the money you need to help you while you can.

Oregon’s Failure to Obey a Traffic Control Device Laws

You are driving down the road and you see the traffic light ahead turn yellow, what do you do? If you’re like most American citizens, you likely will speed up in order to make it through the light before it turns red. Well, if you’re driving in Oregon, you’ll actually be ticketed for doing this.

According to the statute ORS 811.265, you are required to stop at a yellow light just like you would at a red light.

There is an exception to this law, that you only are to proceed through the yellow light if you are unable to stop your vehicle safely. But if you have the ability to stop safely and fail to do so, you could be ticketed! So make sure that when you see a yellow light in Oregon, STOP!

Vehicle Licensing Laws

Oregon requires all drivers to have their insurance on them while operating a vehicle, such as a car insurance certificate. Due to this, they have some specific requirements for vehicle licensing in order to ensure all drivers are safe, and are able to drive legally in the state.Just in case you need a quick reminder, any of the following are acceptable forms of financial responsibility (proof of insurance) in Oregon:

- Valid (and Current) Insurance ID Card

- Current Liability Insurance Binder or a copy of your Insurance Policy

- Signed letter from an insurance agent or company official (must be on company letterhead)

- DMV certificate of self-insurance that names the vehicle owner

Keep reading to find out some of the specific vehicle licensing laws you’ll need to follow while in Oregon.

Penalties for Driving Without Insurance

Even for a first-time offense of driving without your insurance, you’ll be facing the following penalties:

- Registration suspended for three months (unless lapse was for less than 31 days and vehicle not operated during that time)

- $88 restoration fee plus proof of insurance required to get it back

- $500 civil penalty fee is optional in lieu of registration suspension plus $88 restoration fee — can only use this option once within a 12-month period

All just for your first offense! So if you take anything away from this section of this guide, keep your proof of insurance with you at all times while operating a vehicle!

Teen Driver Laws

Teens are allowed to apply for their learner’s license as young as 15 years old! There are a few requirements that they will additionally have to follow in order to then also receive a license or restricted license.

| Teen Driving Requirements | Details |

|---|---|

| Minimum Age (Learner's Permit) | 15 years old |

| Minimum Age (Driver's License) | 16 years old |

| Mandatory Holding Period | 6 months |

| Minimum Supervised Driving Time | 50 hours (100 hours without driver education) |

| Nighttime Restrictions | During Intermediate/Restricted License Stage: Midnight - 5 a.m. Restrictions Lifted: 12 months or age 18 (whichever comes first) |

| Passenger Restrictions | During Intermediate/Restricted License Stage: first 6 months–no passengers younger than 20; second 6 months–no more than 3 passengers younger than 20 Restrictions Lifted: 12 months or age 18 (whichever comes first) |

Keep in mind that in Oregon, driver’s education is required for applicants who are younger than 18 years old. The only exception to this rule is if the applicant has an additional 50 hours of supervised driving.

Older Driver License Renewal Procedures

If you are an older driver, ages 50 and older, you have a few requirements in Oregon you’ll need to follow.

| Older Driver Requirements | Details |

|---|---|

| License Renewal Cycle | 8 years |

| Proof of Adequate Vision (required at renewal) | 50 and older, every renewal |

| Mail or Online Renewal Permitted | No |

This means that you have to go in person to renew your license, as well as scheduling a visit with an eye doctor for EVERY renewal.

New Residents

Thinking of officially taking the plunge and becoming part of the Beaver State? If you are, there are a few requirements that you’ll need to have in order to legally drive in the state. Handling car insurance when moving to a new state can be a little complex, afterall. After you’ve become a resident, you will have 30 days to title and register your vehicle in Oregon.

We recommend stopping by your local Oregon DMV to make sure you don’t forget this one!We’ve mentioned a few times before about having the minimum liability insurance, as well as the required personal injury protection and uninsured/underinsured motorist coverage. Here’s a reminder in case you might have forgotten:

- 25 = $25,000 to pay for bodily injuries per person

- 50 = $50,000 to pay for total bodily injuries per accident

- 20 = $20,000 to pay for property damages per accident

- $15,000 for Personal Injury Protection (also known as Medical Payments/MedPay)

- $25,000 per person and $50,000 total per accident for Uninsured Motor Coverage

License Renewal Procedures

The basic renewal procedures for the general population are as follows:

- Renewal Cycle: eight years

- Proof of Adequate Vision: No

- Online/Mail Renewal: No

The good news for the general population is that you don’t have to provide proof of adequate vision when renewing your license. You do, however, unfortunately, have to go into the DMV for every renewal instead of doing it online or through the mail. Rest assured though, you only have to go in every eight years to do this!

Negligent Drivers

In Oregon, there are two ways in which a driver can drive negligently, “reckless” driving and “careless” driving. Reckless driving is when a driver knowingly (and is proven to have known) does something risky while behind the wheel. It is considered a class A misdemeanor and carries up to a year of jail time as well as a maximum of $6,250 in fines.

In addition to all of this, someone convicted of reckless driving may also face a license suspension period of:

- First Offense: 90 days

- Second Offense (within five years): One year

- Third Offense (within five years): Three years

Careless driving is when a driver does not realize how dangerous their driving was at the time. The penalties for this are generally less severe, but still can be hefty nonetheless.

- Careless Driving: class B traffic violation, fines ranging from $130 to $1,000

- Careless Driving Involving an Accident: class A traffic violation, fines ranging from $220 to $2,000

- Careless Driving Involving Injuries or Fatalities: fines ranging from $200 to $2,000, 200 hours of community service, and must complete a traffic safety course

Keep in mind that violations such as this add to your driving record, which can increase your insurance rates. To avoid having to pay for all of this, as well as the increased rates, avoid driving negligently. Keep yourself and others safe on the road!

Oregon’s Rules of the Road

Knowing Oregon’s rules of the road is going to keep you safe on the road, as well as preventing you from breaking the law. We will cover topics including keep right and move over laws, speed limits, seat belt/car seat laws, and more.Avoid losing the money you worked so hard for by continuing to learn about Oregon’s rules of the road.

Fault Versus No-Fault

Oregon is considered an at-fault state. What does this mean? If you are the driver who caused an accident, you are the at-fault driver. You are then the person who is responsible for paying for the other driver’s medical and property damages as well as your own.

If you don’t have the appropriate car insurance coverage, these costs can really add up and cause you to have to pay out of pocket! This is why it is so crucial to make sure you have the optimal coverage to match what you need. While Oregon does require MedPay and Uninsured/Underinsured coverage, depending on the severity of the accident, it may not be enough. Make sure you purchase the best coverage you can in order to prevent you from having to pay for any accident costs out of your pocket.

Keep Right and Move Over Laws

Keep Right and Move Over laws are fairly simple to understand in Oregon, just like other traffic laws. Keep Right laws in Oregon state that you are to keep right if you are driving slower than the average speed of traffic around you. Not too bad right? Move Over laws are also easy to understand in Oregon.

The law requires that if you are approaching any stationary vehicle that has flashing lights that are traveling in the same direction, that you are to move over to the closest lane. If it is not safe or possible for you to do so, you are to reduce your speed to at least 5 mph under the speed limit posted.What are some examples of vehicles you are to move over for?

- Law Enforcement

- Ambulances

- Fire Trucks

- Utility Service Trucks

- Roadside Assistance

- Tow Vehicles

Speed Limits

Speeding is one of the most common traffic violations that results in a traffic ticket. No one likes getting a speeding ticket, so making sure you know what Oregon’s speed limits are will help prevent you from shelling out speeding fines.

| Oregon Speed Limits | Speed Limit |

|---|---|

| Rural Interstates | cars: 65 mph; 70 mph on specified segments of road trucks: 55 mph; 65 mphon specified segments of road |

| Urban Interstates | 55 mph |

| Other Limited Access Roads | 65 mph |

| Other Roads | 65 mph |

Don’t forget that these are the MAXIMUM speed limits for these types of roads. Speed limits will vary between different roadways, so make sure you pay attention to all traffic signs you see.

Seat Belt and Car Seat Laws

One of Oregon’s top priorities for drivers is that everyone is safe. For that reason, they have very strict rules regarding seat belt use and car seats. Avoid fines and penalties by reading the rules below for both seat belts and car seats.

| Oregon Seat Belt Laws | Details |

|---|---|

| Effective Date | 12/07/1990 |

| Primary Enforcement | Yes ; Effective 12/07/1990 |

| Age/Seats Applicable | 16+ years in all seats |

| 1st Offense Max Fine | $115 |

| Oregon Car Seat Laws | Details |

|---|---|

| Must be in child safety seat | younger than 2 years must be in a rear facing child restraint; 7 or younger: 40 pounds or less must be in a child restraint; more than 40 pounds but 4 feet and 9 inches or less must be in a booster seat |

| Adult belt permissible | taller than 4 feet and 9 inches; 8 through 15 |

| Max Base Fines for 1st Offense | $75 |

| Preference for Rear Seat | Law states no preference for rear seats |

You’re probably wondering what primary enforcement means. Primary enforcement is if law enforcement sees a driver violating any of the above rules, they are able to pull them over and ticket them for the offense.In addition to the above rules, there are also restrictions in Oregon for passengers riding in the cargo areas of trucks:

- Who is not covered:

- people 18 and older

- minors secured with a safety belt or harness

- parades

- minors seated on the floor of the open bed of a motor vehicle in which all available passenger seats are occupied by minors, the tailgate is securely closed and the minor is being transported either in the course and scope of employment or between a hunting camp and hunting site or between hunting sites during hunting season and the minor has a hunting license

Ridesharing

In today’s society, you’re bound to have at least heard of ridesharing services such as Uber and Lyft. If you are thinking of earning some extra cash and hoping to work for one of these companies, you will need to purchase rideshare car insurance. This is insurance coverage IN ADDITION to your already required minimum coverage plan.

The following providers in Oregon offer this type of coverage: State Farm and USAA.

Keep in mind that if your insurance provider does not carry this type of coverage, you may have to purchase an additional policy with the provider that does carry it.

Automation on the Road

Automated vehicles have often been portrayed as the self-driving vehicles seen in the latest sci-fi movies. In reality, however, most of this technology can actually be found in features such as cruise control or parallel parking. There are no specific automated driving laws, but Oregon is one of 19 states that have regulated platooning technology. This allows groups of specific vehicles (trucks or buses namely) to travel within set distances between them at electronically controlled speed together.

Safety Laws

To further keep Oregon drivers safe, there are a few rules regarding safety. Items that are easily avoidable, such as DUI’s, marijuana-impaired driving, and distracted driving are focused on in Oregon.

DUI Laws

In 2017 there were 137 fatalities related to alcohol-impaired driving. It’s a very sad statistic that comes from a very easily avoidable cause. Due to this, however, Oregon has some pretty strict laws regarding DUI‘s, and some even more strict penalties if you are caught drinking and driving.

| Formal Name for Offense | BAC Limit | High BAC Limit | Criminal Status | Look Back Period |

|---|---|---|---|---|

| Driving Under the Influence of Intoxicants | 0.08 | 0.15 | 1st-3rd class A misdemeanors, 4th+ class C felonies | 10 years |

Think you can drink and drive and get away with just a little slap on the hand? Not in Oregon! Check out some of the penalties you’ll be facing if you drink and drive.

| Number of Offense | License Revocation | Jail Time | Fine | Other |

|---|---|---|---|---|

| 1st | 1 year | 2 days - 1 year OR 80 hours community service | Min $1000 for BAC; Min $2000 for HBAC; up $10000 if child in car | Drug and alcohol program, participation in victim impact panel, IID for 1 year after license suspension |

| 2nd | 3 years | Minimum 2 days, but up to 1 year | Min $1500; HBAC Min $2000; up to $10000 if child in car | IID for 2 years after suspenion, treatment program and victim impact panel |

| 3rd | Mandatory lifetime, not elegible for hardship license, may apply for reinstatement after 10 years | 90 day minimum | $2000 min, additional $2000 for HBAC | - |

| 4th | Felony | - | - | - |

Oregon takes this crime extremely seriously. Even your first offense results in your license being suspended for a year, plus fines in the thousands. Your third offense suspends your license indefinitely! That means you’ll never be allowed to legally drive again!

Your fourth offense is considered a felony!

If you decide to go out for some drinks with friends, have a plan to get home! Have a friend be your designated driver, call a taxi, or even call a ridesharing service so that you can safely get home. There are countless options available to you to prevent you from getting behind the wheel in this kind of a state. It’s simply not worth it! You’re putting not only yourself in danger but others around you as well.

Marijuana-Impaired Driving Laws

Oregon is one of the few states in the United States where marijuana is fully legalized. This is a fairly new law, so there are currently no marijuana-specific driving laws. While there are no laws currently specific to this, however, we would highly recommend that you avoid driving while marijuana-impaired.

Driving under anything less than a completely sober state of mind can be dangerous and lead to slower reaction times, which could cause you to get into an accident.

This does NOT necessarily mean that if you drive under the influence of marijuana, you won’t get pulled over. You could still be charged with driving under the influence, especially if your driving is considered dangerous or reckless.

Distracted Driving Laws

Almost everyone these days has some sort of smartphone or cellphone. So it is inevitable that people will try to use their phone while they are driving. This is extremely dangerous for not only yourself but others around you.

Learn more: Texting While Driving Statistics

Not to mention that Oregon has some strict laws in place for the use of these devices while you are driving.

| Hand-held ban | Young driver cell phone ban | Texting ban | Enforcement |

|---|---|---|---|

| All drivers | drivers younger than 18 | All drivers | Primary |

In addition to the information above, according to the IIHS, an addendum to all of this was added as of October 1, 2017. This addendum states that drivers may not hold a personal electronic device in either hand or both hands while operating a motor vehicle on a public highway.

This includes when you are temporarily stationary because of traffic, at a stop sign/light, or other momentary delays. This means that if a law enforcement officer even sees you using your cellphone when in your vehicle, you’ll be given a ticket.

Avoid all of the trouble and simply put your cellphone/smartphone device in a place that you can’t reach it while driving. You could also place your phone on airplane mode so you are unable to receive messages/notifications to keep yourself from looking at the device.

Oregon Can’t-Miss Facts

Now that we’ve covered all of the rules and laws you’ll need to know, what else should you know before getting behind the wheel in Oregon? We’ve discussed why some of the above laws are in place, but how do they translate in real life? In this section, we’ll go over some of the facts for driving in Oregon that you absolutely need to know.

Vehicle Theft in Oregon

Every state has particular vehicles that are more prone to being stolen than others. And before you ask, no they are not the BMW’s and Mercedes. Think more common vehicles than that, like Honda or Toyota for instance.

| Rank | Make/Model | Year of Vehicle | Year | Thefts |

|---|---|---|---|---|

| 1 | Honda Accord | 1994 | 1994 | 1,491 |

| 2 | Honda Civic | 1998 | 1998 | 1,276 |

| 3 | Subaru Legacy | 1998 | 1998 | 377 |

| 4 | Ford Pickup (Full Size) | 2004 | 2004 | 295 |

| 5 | Toyota Camry | 1990 | 1990 | 221 |

| 6 | Chevrolet Pickup (Full Size) | 1999 | 1999 | 217 |

| 7 | Acura Integra | 1994 | 1994 | 209 |

| 8 | Subaru Impreza | 1999 | 1999 | 171 |

| 9 | Honda CR-V | 1999 | 1999 | 158 |

| 10 | Jeep Cherokee/Grand Cherokee | 1994 | 1994 | 141 |

Poor Honda owners, they can’t catch a break!Where you live also plays a factor in the number of these vehicles being stolen. In 2013 the FBI created a report on the number of Oregon’s vehicle thefts by cities. Their findings are listed below, see if your city is on this list!

| City | Population | Motor Vehicle Theft |

|---|---|---|

| Albany | 51,645 | 142 |

| Amity | 1,624 | 0 |

| Ashland | 20,455 | 13 |

| Astoria | 9,543 | 32 |

| Athena | 1,144 | 1 |

| Aumsville | 3,738 | 3 |

| Baker City | 9,660 | 9 |

| Bandon | 3,039 | 5 |

| Banks | 1,862 | 4 |

| Beaverton | 93,551 | 83 |

| Bend | 79,926 | 87 |

| Black Butte | Unknown | 0 |

| Boardman | 3,369 | 4 |

| Brookings | 6,313 | 6 |

| Burns | 2,706 | 4 |

| Canby | 16,031 | 9 |

| Cannon Beach | 1,692 | 2 |

| Carlton | 2,022 | 0 |

| Central Point | 17,485 | 24 |

| Clatskanie | 1,726 | 4 |

| Coburg | 1,043 | 1 |

| Columbia City | 1,938 | 1 |

| Condon | 722 | 0 |

| Coos Bay | 15,816 | 54 |

| Coquille | 3,826 | 4 |

| Cornelius | 12,231 | 14 |

| Corvallis | 55,218 | 38 |

| Cottage Grove | 9,795 | 21 |

| Dallas | 14,803 | 10 |

| Eagle Point | 8,669 | 7 |

| Enterprise | 1,870 | 0 |

| Estacada | 2,919 | 4 |

| Eugene | 158,499 | 608 |

| Fairview | 9,225 | 31 |

| Florence | 8,489 | 10 |

| Forest Grove | 22,239 | 29 |

| Gaston | 665 | 1 |

| Gearhart | 1,485 | 0 |

| Gervais | 2,573 | 15 |

| Gladstone | 11,699 | 34 |

| Gold Beach | 2,239 | 2 |

| Grants Pass | 34,865 | 236 |

| Gresham | 109,965 | 510 |

| Hermiston | 17,214 | 75 |

| Hillsboro | 96,313 | 126 |

| Hines | 1,508 | 0 |

| Hubbard | 3,203 | 1 |

| Independence | 8,661 | 5 |

| Jacksonville | 2,813 | 1 |

| John Day | 1,702 | 2 |

| Junction City | 5,605 | 9 |

| Keizer | 37,018 | 50 |

| King City | 3,389 | 3 |

| Klamath Falls | 21,043 | 78 |

| La Grande | 13,034 | 9 |

| Lake Oswego | 37,428 | 24 |

| Lakeview | 2,252 | 6 |

| Lebanon | 15,810 | 54 |

| Lincoln City | 7,976 | 11 |

| Malin | 791 | 0 |

| Manzanita | 607 | 1 |

| McMinnville | 32,642 | 32 |

| Medford | 76,949 | 163 |

| Milton-Freewater | 7,126 | 21 |

| Milwaukie | 20,480 | 62 |

| Molalla | 8,282 | 9 |

| Monmouth | 9,792 | 5 |

| Mount Angel | 3,405 | 3 |

| Newberg-Dundee | 25,647 | 25 |

| Newport | 10,029 | 15 |

| North Bend | 9,605 | 19 |

| North Plains | 2,033 | 3 |

| Ontario | 11,069 | 22 |

| Oregon City | 33,025 | 55 |

| Pendleton | 16,902 | 44 |

| Philomath | 4,598 | 3 |

| Phoenix | 4,600 | 7 |

| Pilot Rock | 1,518 | 1 |

| Portland | 609,136 | 3,289 |

| Prineville | 9,161 | 1 |

| Rainier | 1,887 | 4 |

| Redmond | 27,153 | 43 |

| Rockaway Beach | 1,313 | 0 |

| Rogue River | 2,173 | 5 |

| Salem | 158,234 | 656 |

| Scappoose | 6,677 | 2 |

| Seaside | 6,475 | 15 |

| Sherwood | 18,932 | 10 |

| Silverton | 9,380 | 6 |

| Springfield | 60,024 | 270 |

| Stanfield | 2,058 | 4 |

| Stayton | 7,733 | 13 |

| St. Helens | 12,917 | 16 |

| Sunriver | Unknown | 4 |

| Sweet Home | 9,035 | 21 |

| Talent | 6,191 | 4 |

| The Dalles | 13,831 | 38 |

| Tigard | 50,311 | 69 |

| Tillamook | 4,932 | 12 |

| Toledo | 3,461 | 5 |

| Troutdale | 16,566 | 49 |

| Tualatin | 26,925 | 37 |

| Turner | 1,896 | 2 |

| Umatilla | 7,040 | 12 |

| Warrenton | 5,146 | 8 |

| West Linn | 25,744 | 9 |

| Wilsonville | 20,819 | 36 |

| Woodburn | 24,263 | 47 |

| Yamhill | 1,040 | 0 |

Oregon Crash Report

As with anything, there are many different factors that contribute to accidents. Below, we’ve broken up some of the most common factors in traffic fatalities in Oregon.

Fatal Crashes by Weather Condition and Light Condition

Yes, the weather is a common factor in traffic fatalities. The harder it is for you to drive safely and see the road in front of you, the more likely you are to get into an accident. Below we’ve given the data for the number of fatalities related to these conditions.

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 180 | 42 | 61 | 12 | 3 | 298 |

| Rain | 17 | 14 | 24 | 1 | 0 | 56 |

| Snow/Sleet | 10 | 0 | 3 | 0 | 0 | 13 |

| Other | 4 | 2 | 5 | 1 | 0 | 12 |

| Unknown | 9 | 0 | 9 | 0 | 3 | 21 |

| TOTAL | 220 | 58 | 102 | 14 | 6 | 400 |

Oregon is quite famous for its rainy weather, so it would make sense for there to be fatalities related to it. Driving in bad weather conditions takes great judgment. Just make sure that while these particular conditions are out, that you take extra precautions to keep yourself safe, such as following our bad weather driving tips.

Road Type Fatalities

What type of road you are driving on is another common factor in traffic fatalities.

| Road Type | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Rural | 300 | 292 | 216 | 217 | 229 | 199 | 237 | 282 | 309 | 284 |

| Urban | 116 | 85 | 101 | 114 | 108 | 114 | 120 | 163 | 189 | 153 |

| Unknown | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 |

There are more fatalities seen on rural roads than on urban roads. Why would that be? Well, typically rural roads have higher speeds that can be reached as there isn’t as much traffic on them in comparison with urban roads.

Person Type Fatalities

Person type is another factor in traffic fatalities, but not in the way you would think. We’re not talking about the demographic information, such as a person’s race or gender. We’re talking more about what type of vehicle they are driving, and whether or not they are a pedestrian or occupant of the vehicle.

| Person Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Passenger Car Occupants | 134 | 128 | 152 | 182 | 155 |

| Light Pickup Truck Occupants | 37 | 56 | 60 | 68 | 60 |

| Light Utility Truck Occupants | 33 | 43 | 56 | 68 | 47 |

| Large Truck Occupants | 5 | 7 | 8 | 9 | 10 |

| Other/Unknown Occupants | 3 | 8 | 5 | 7 | 5 |

| Van Occupants | 11 | 5 | 20 | 24 | 14 |

| Bus Occupants | 0 | 0 | 1 | 0 | 0 |

| Motorcyclists | 34 | 46 | 61 | 55 | 57 |

| Pedestrians | 48 | 57 | 69 | 71 | 69 |

| Bicyclists and Other Cyclists | 3 | 7 | 8 | 10 | 10 |

| Other/Unknown Non-occupants | 4 | 0 | 5 | 3 | 4 |

| State Total | 313 | 357 | 446 | 498 | 437 |

Crash Type Fatalities

The type of crash also factors in. Was it just one single vehicle, or did it involve a large truck?

| Crash Type and Fatality Totals | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Single Vehicle | 190 | 220 | 280 | 266 | 252 |

| Involving a Large Truck | 33 | 32 | 53 | 53 | 54 |

| Involving Speeding | 95 | 105 | 119 | 143 | 119 |

| Involving a Rollover | 67 | 90 | 109 | 95 | 92 |

| Involving a Roadway Departure | 187 | 228 | 278 | 309 | 280 |