Compare Rhode Island Car Insurance Rates [2025]

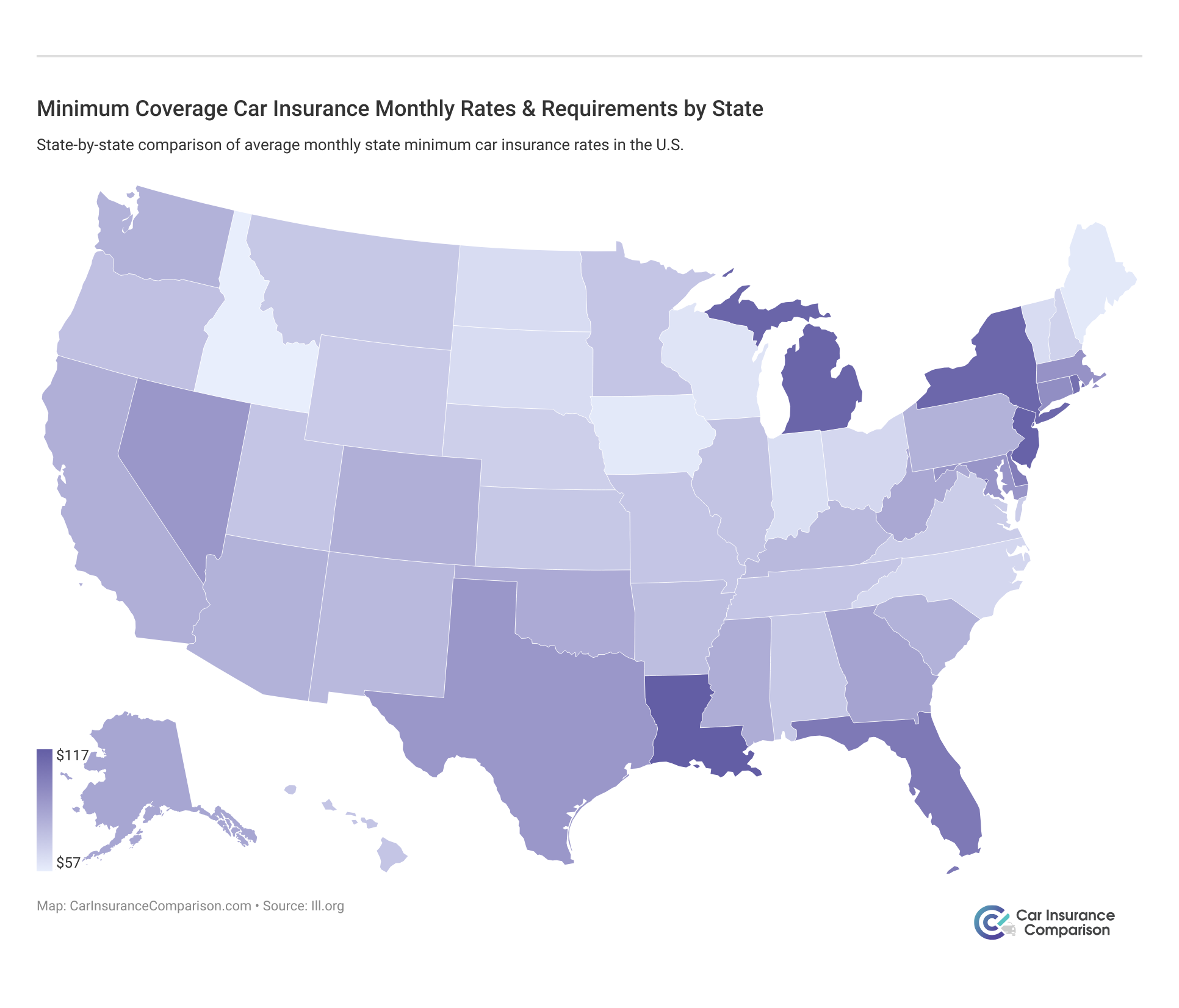

At $198 per month, average Rhode Island car insurance quotes are higher than the national average. Many factors increase Rhode Island car insurance rates, including traffic density and uninsured drivers. Compare Rhode Island car insurance rates with multiple companies to find the lowest prices.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

UPDATED: May 5, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: May 5, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Rhode Island Statistics Summary

| Rhode Island Statistics Summary | Details |

|---|---|

| Annual Road Miles | Total in State: 6,106 Vehicle Miles Driven: 7.7 billion |

| Vehicles | Registered in State: 853,152 Total Stolen: 2,233 |

| State Population | 1,054,480 |

| Most Popular Vehicle | Toyota Camry |

| Uninsured Motorists | 15.20% State Rank: 14th |

| Total Driving Fatalities | Speeding Total: 41 Drunk Driving Total: 34 |

| Annual Premiums | Liability: $759.8 Collision: $411.51 Comprehensive: $132.19 Full Coverage: $1303.50 |

| Cheapest Provider | State Farm |

- Average Rhode Island car insurance rates are $198 for full coverage and $100 for minimum insurance

- Many factors affect coverage prices, but the cost of car insurance in Rhode Island tends to be high because of traffic density, uninsured drivers, and rising health care costs

- To find the cheapest car insurance in Rhode Island, look for discounts, compare quotes, and choose the right coverage

Despite its small size, Rhode Island car insurance quotes tend to be some of the highest in the nation. With an average price of $198 per month, finding affordable Rhode Island car insurance takes a little more work than in many other states.

However, finding the best car insurance in Rhode Island for a good price isn’t impossible. Read on to learn where to find the cheapest car insurance in Rhode Island. Then, compare Rhode Island car insurance rates to find the best policy for your car.

Compare Rhode Island Car Insurance Rates

If you’re a resident of the State of Rhode Island and Providence Plantations – and yes, that’s the state’s full name for those of you who didn’t know – you’re required by law, if driving a car, to have car insurance. Choosing the best coverage for your situation, though, is tough, especially with so many car insurance options and types available to you.

As this news story below highlights, even a single factor like where you live can change your rates. More on that if you keep reading.

- Car Insurance Rates in Rhode Island

It’s much easier to make tough decisions like this one when you have all the facts in front of you. When you do, you can compare and contrast rates and coverage until you find the provider that has your best interests at heart.

We want your car insurance adventure to be a little easier to handle. That’s why this comprehensive guide to Rhode Island car insurance puts all of the state’s car insurance provider data on display as well as compares what people are paying on average for car insurance both in Rhode Island and in other states.

Keep reading to learn more about Rhode Island car insurance.

Car Insurance Requirements in Rhode Island

Rhode Island, like every other state in the union, requires drivers to be covered by a state minimum amount of coverage in order to legally operate on the road. Rhode Island’s minimum coverage includes a 25/50/25 minimum liability policy.

What does that mean for you? Let’s break things down.

- 25 = $25,000 of bodily injury coverage per person

- 50 = $50,000 that can pay for the total injuries per accident

- 25 = $25,000 to cover any property damage per accident

You should also note that the state requires you to have $25,000 worth of coverage to use in case you get in an accident with someone who is under or uninsured.

Note again that this is the minimum coverage required of you if you’re a resident of the state of Rhode Island. Because medical costs have risen dramatically in the past decade, it’s unlikely that this minimum will be able to provide for all your needs should you end up severely injured. However, it is a good foundation to lay in terms of coverage.

Compare Rhode Island Car Insurance Rates by ZIP Code

The place you live in as a resident of Rhode Island can, as well. As you can see below, we’ve divided the state of Rhode Island up by its zip codes so you can see where your own ranks in comparison to the rest of the state.

Rhode Island Average Car Insurance Rates by ZIP Code

| ZIP Code | Average | Allstate F&C | Geico General | Liberty Mutual Fire Ins Co | Nationwide Mutual | Progressive Direct | State Farm Mutual Auto | Travelers Home & Marine Ins Co | USAA CIC |

|---|---|---|---|---|---|---|---|---|---|

| 02907 | $7,262.39 | $6,578.00 | $9,245.62 | $8,976.30 | $6,383.07 | $7,071.89 | $2,897.12 | $11,565.67 | $5,381.45 |

| 02909 | $7,237.08 | $6,597.67 | $9,245.62 | $8,976.30 | $6,945.09 | $7,071.89 | $2,897.12 | $11,060.59 | $5,102.32 |

| 02908 | $7,060.09 | $6,729.85 | $9,245.62 | $8,976.30 | $6,383.07 | $7,071.89 | $2,897.12 | $10,074.55 | $5,102.32 |

| 02905 | $6,922.54 | $6,829.59 | $7,509.80 | $8,976.30 | $6,383.07 | $6,041.92 | $2,897.12 | $10,947.57 | $5,794.91 |

| 02904 | $6,466.51 | $5,761.71 | $8,022.00 | $8,976.30 | $5,736.03 | $6,818.86 | $2,897.12 | $8,417.74 | $5,102.32 |

| 02903 | $6,360.08 | $6,815.41 | $5,363.01 | $8,976.30 | $6,383.07 | $6,041.92 | $2,897.12 | $9,470.14 | $4,933.68 |

| 02911 | $6,341.33 | $5,770.56 | $7,510.66 | $7,555.06 | $5,736.03 | $6,818.86 | $2,733.99 | $9,171.84 | $5,433.62 |

| 02860 | $6,225.51 | $5,704.11 | $7,660.12 | $6,431.29 | $5,451.32 | $6,633.86 | $2,733.99 | $9,930.84 | $5,258.56 |

| 02912 | $6,185.30 | $5,770.56 | $5,363.01 | $8,976.30 | $5,736.03 | $6,633.86 | $2,897.12 | $9,171.84 | $4,933.68 |

| 02918 | $6,115.57 | $5,142.24 | $9,245.62 | $8,976.30 | $4,399.53 | $7,071.89 | $2,897.12 | $6,891.40 | $4,300.44 |

| 02910 | $6,107.90 | $5,608.49 | $7,509.80 | $7,555.06 | $5,623.06 | $6,041.92 | $2,733.99 | $8,603.12 | $5,187.73 |

| 02919 | $6,101.39 | $5,836.91 | $7,510.66 | $7,555.06 | $5,485.56 | $5,271.32 | $2,733.99 | $8,723.05 | $5,694.62 |

| 02921 | $6,041.61 | $5,939.87 | $7,510.66 | $7,064.98 | $5,623.06 | $6,041.92 | $2,733.99 | $8,400.58 | $5,017.82 |

| 02920 | $5,975.60 | $5,961.89 | $7,510.66 | $7,064.98 | $5,623.06 | $6,041.92 | $2,733.99 | $7,850.49 | $5,017.82 |

| 02863 | $5,975.22 | $5,711.10 | $7,660.12 | $6,431.29 | $5,352.61 | $6,633.86 | $2,733.99 | $8,213.51 | $5,065.26 |

| 02906 | $5,881.57 | $5,843.77 | $5,363.01 | $8,976.30 | $5,764.46 | $5,064.86 | $2,897.12 | $8,209.34 | $4,933.68 |

| 02914 | $5,580.28 | $5,306.99 | $6,040.54 | $6,431.29 | $4,824.04 | $7,082.60 | $2,733.99 | $7,548.79 | $4,674.02 |

| 02916 | $5,580.24 | $5,479.07 | $7,660.12 | $6,431.29 | $4,342.35 | $5,064.86 | $2,733.99 | $8,216.34 | $4,713.94 |

| 02861 | $5,423.20 | $5,371.52 | $6,096.63 | $6,431.29 | $5,352.61 | $5,064.86 | $2,733.99 | $7,348.61 | $4,986.07 |

| 02888 | $5,348.42 | $5,282.37 | $5,570.22 | $6,431.29 | $4,686.28 | $6,041.92 | $2,733.99 | $7,608.61 | $4,432.68 |

| 02915 | $5,324.98 | $5,129.32 | $6,040.54 | $6,431.29 | $4,342.35 | $5,064.86 | $2,733.99 | $8,183.44 | $4,674.02 |

| 02889 | $5,281.80 | $5,218.92 | $5,570.22 | $6,431.29 | $4,686.28 | $6,041.92 | $2,733.99 | $7,165.04 | $4,406.74 |

| 02917 | $5,252.06 | $5,142.24 | $5,716.58 | $5,749.70 | $4,399.53 | $7,082.60 | $2,733.99 | $6,891.40 | $4,300.44 |

| 02823 | $5,243.45 | $5,143.93 | $7,510.66 | $5,749.70 | $4,268.78 | $5,271.32 | $2,897.12 | $6,773.15 | $4,332.97 |

| 02865 | $5,230.17 | $5,287.41 | $5,956.68 | $6,051.59 | $4,324.01 | $5,271.32 | $2,733.99 | $7,524.78 | $4,691.55 |

| 02886 | $5,176.46 | $5,074.63 | $5,570.22 | $6,431.29 | $4,686.28 | $5,271.32 | $2,733.99 | $7,119.81 | $4,524.14 |

| 02815 | $5,166.90 | $5,170.00 | $6,145.50 | $5,749.70 | $4,501.52 | $5,271.32 | $2,897.12 | $7,174.48 | $4,425.54 |

| 02893 | $5,161.34 | $5,307.13 | $6,118.54 | $6,431.29 | $4,483.28 | $5,127.81 | $2,733.99 | $6,996.78 | $4,091.92 |

| 02831 | $5,158.80 | $5,357.04 | $6,145.50 | $5,749.70 | $4,501.52 | $5,271.32 | $2,084.74 | $7,142.77 | $5,017.82 |

| 02828 | $5,141.78 | $5,723.52 | $5,716.58 | $5,749.70 | $4,399.53 | $5,271.32 | $2,733.99 | $7,239.18 | $4,300.44 |

| 02829 | $5,141.41 | $5,459.15 | $5,705.40 | $5,749.70 | $4,399.53 | $5,380.78 | $2,897.12 | $7,239.18 | $4,300.44 |

| 02857 | $5,035.12 | $5,459.02 | $6,145.50 | $5,749.70 | $4,501.52 | $5,271.32 | $2,084.74 | $6,736.18 | $4,332.97 |

| 02818 | $5,002.54 | $5,007.06 | $5,187.83 | $5,992.38 | $4,714.15 | $5,127.81 | $2,733.99 | $7,078.97 | $4,178.12 |

| 02883 | $4,976.25 | $4,079.57 | $4,953.55 | $5,512.74 | $3,712.07 | $9,855.70 | $2,034.57 | $5,704.68 | $3,957.14 |

| 02825 | $4,966.72 | $4,998.16 | $6,145.50 | $5,749.70 | $4,268.78 | $5,380.78 | $2,084.74 | $6,773.15 | $4,332.97 |

| 02802 | $4,926.01 | $4,809.11 | $5,956.68 | $5,249.77 | $4,209.52 | $5,271.32 | $2,897.12 | $6,681.58 | $4,332.97 |

| 02814 | $4,884.10 | $4,877.21 | $5,705.40 | $5,749.70 | $4,209.52 | $5,380.78 | $2,084.74 | $6,681.58 | $4,383.88 |

| 02838 | $4,880.00 | $4,866.72 | $5,110.94 | $5,607.51 | $4,324.01 | $5,271.32 | $2,733.99 | $6,433.97 | $4,691.55 |

| 02816 | $4,843.62 | $4,908.81 | $5,614.71 | $5,512.74 | $4,469.49 | $5,271.32 | $2,084.74 | $6,709.03 | $4,178.12 |

| 02864 | $4,833.39 | $5,133.09 | $5,616.85 | $5,988.57 | $4,065.11 | $4,695.54 | $2,733.99 | $5,742.42 | $4,691.55 |

| 02827 | $4,821.18 | $5,108.62 | $5,614.71 | $5,512.74 | $4,469.49 | $5,271.32 | $2,084.74 | $6,211.98 | $4,295.81 |

| 02817 | $4,789.81 | $4,867.09 | $5,614.71 | $5,512.74 | $4,358.70 | $5,271.32 | $2,084.74 | $6,431.08 | $4,178.12 |

| 02895 | $4,773.58 | $4,717.34 | $5,431.54 | $5,988.57 | $3,995.44 | $4,695.54 | $2,733.99 | $6,539.08 | $4,087.14 |

| 02824 | $4,768.57 | $4,820.28 | $5,110.94 | $5,249.77 | $4,268.78 | $4,695.54 | $2,897.12 | $6,773.15 | $4,332.97 |

| 02806 | $4,767.50 | $5,087.95 | $5,198.05 | $5,749.70 | $4,470.47 | $5,064.86 | $2,034.57 | $6,356.31 | $4,178.12 |

| 02801 | $4,739.53 | $4,227.79 | $3,886.67 | $5,236.06 | $3,469.58 | $9,855.70 | $2,034.57 | $5,844.74 | $3,361.12 |

| 02876 | $4,733.23 | $4,871.68 | $5,110.94 | $5,607.51 | $3,979.08 | $4,695.54 | $2,897.12 | $6,403.54 | $4,300.44 |

| 02877 | $4,723.62 | $4,852.61 | $4,953.55 | $5,512.74 | $4,296.51 | $5,127.81 | $2,084.74 | $6,765.38 | $4,195.60 |

| 02858 | $4,721.36 | $4,716.04 | $5,110.94 | $5,749.70 | $3,841.35 | $4,695.54 | $2,897.12 | $6,413.98 | $4,346.21 |

| 02885 | $4,717.07 | $4,496.59 | $5,530.72 | $6,431.29 | $3,971.82 | $5,064.86 | $2,034.57 | $6,028.57 | $4,178.12 |

| 02896 | $4,712.58 | $4,788.03 | $5,110.94 | $5,607.51 | $3,979.08 | $4,695.54 | $2,733.99 | $6,698.38 | $4,087.14 |

| 02826 | $4,688.32 | $4,918.18 | $5,110.94 | $5,749.70 | $3,841.35 | $4,695.54 | $2,084.74 | $6,773.15 | $4,332.97 |

| 02839 | $4,673.94 | $4,818.91 | $5,110.94 | $5,749.70 | $3,841.35 | $4,695.54 | $2,084.74 | $6,744.13 | $4,346.21 |

| 02830 | $4,658.66 | $4,846.04 | $5,110.94 | $5,749.70 | $3,841.35 | $4,695.54 | $2,084.74 | $6,594.73 | $4,346.21 |

| 02859 | $4,636.04 | $4,680.85 | $5,705.40 | $5,749.70 | $3,841.35 | $4,695.54 | $2,084.74 | $5,984.53 | $4,346.21 |

| 02852 | $4,625.78 | $4,704.29 | $4,564.15 | $5,512.74 | $4,296.51 | $5,127.81 | $2,034.57 | $6,719.02 | $4,047.14 |

| 02822 | $4,601.32 | $4,793.90 | $4,534.73 | $5,749.70 | $4,406.24 | $5,271.32 | $2,084.74 | $5,893.61 | $4,076.35 |

| 02809 | $4,576.63 | $4,713.12 | $5,530.72 | $5,236.06 | $4,140.36 | $5,064.86 | $2,034.57 | $5,715.24 | $4,178.12 |

| 02874 | $4,467.61 | $4,774.47 | $4,953.55 | $5,512.74 | $4,296.51 | $3,999.24 | $2,034.57 | $6,334.94 | $3,834.82 |

| 02812 | $4,458.91 | $4,269.21 | $4,534.73 | $5,749.70 | $3,629.83 | $5,271.32 | $2,084.74 | $6,084.64 | $4,047.14 |

| 02873 | $4,448.23 | $4,381.89 | $4,534.73 | $5,749.70 | $4,296.51 | $3,999.24 | $2,084.74 | $6,334.94 | $4,204.12 |

| 02892 | $4,362.34 | $4,407.99 | $4,953.55 | $5,512.74 | $3,712.07 | $3,999.24 | $2,084.74 | $6,393.60 | $3,834.82 |

| 02833 | $4,354.65 | $4,346.62 | $4,534.73 | $5,749.70 | $3,760.68 | $3,999.24 | $2,084.74 | $6,321.10 | $4,040.43 |

| 02881 | $4,339.38 | $4,161.70 | $4,953.55 | $5,512.74 | $3,712.07 | $5,271.32 | $2,034.57 | $5,234.28 | $3,834.82 |

| 02875 | $4,324.21 | $4,442.16 | $4,534.73 | $5,749.70 | $3,629.83 | $3,999.24 | $2,084.74 | $6,318.46 | $3,834.82 |

| 02804 | $4,292.12 | $4,349.95 | $4,534.73 | $5,749.70 | $3,760.68 | $3,999.24 | $2,084.74 | $5,817.48 | $4,040.43 |

| 02832 | $4,288.65 | $4,322.23 | $4,534.73 | $5,749.70 | $3,760.68 | $3,999.24 | $2,084.74 | $5,817.48 | $4,040.43 |

| 02879 | $4,280.44 | $4,349.37 | $4,953.55 | $5,512.74 | $3,712.07 | $3,999.24 | $2,034.57 | $5,724.80 | $3,957.14 |

| 02813 | $4,269.11 | $4,613.02 | $4,953.55 | $5,749.70 | $3,629.83 | $3,999.24 | $2,084.74 | $5,144.17 | $3,978.65 |

| 02808 | $4,265.93 | $4,476.34 | $4,534.73 | $5,749.70 | $3,629.83 | $3,999.24 | $2,084.74 | $5,831.01 | $3,821.84 |

| 02882 | $4,265.28 | $4,248.23 | $4,953.55 | $5,512.74 | $3,712.07 | $3,999.24 | $2,034.57 | $5,704.68 | $3,957.14 |

| 02898 | $4,264.65 | $4,408.38 | $4,534.73 | $5,749.70 | $3,813.30 | $3,999.24 | $2,084.74 | $5,479.95 | $4,047.14 |

| 02836 | $4,256.34 | $3,895.91 | $4,534.73 | $5,749.70 | $3,813.30 | $3,999.24 | $2,084.74 | $5,925.99 | $4,047.14 |

| 02894 | $4,240.73 | $4,280.51 | $4,534.73 | $5,749.70 | $3,813.30 | $3,999.24 | $2,084.74 | $5,416.44 | $4,047.14 |

| 02872 | $4,222.09 | $4,142.01 | $3,886.67 | $5,236.06 | $4,036.99 | $5,064.86 | $2,034.57 | $5,886.01 | $3,489.60 |

| 02878 | $4,181.30 | $4,070.49 | $4,077.21 | $5,249.77 | $3,853.86 | $4,480.85 | $2,034.57 | $6,004.65 | $3,678.96 |

| 02807 | $4,125.16 | $4,204.43 | $4,129.79 | $5,749.70 | $3,417.05 | $3,999.24 | $2,084.74 | $5,831.01 | $3,585.36 |

| 02871 | $4,112.71 | $4,142.01 | $4,077.21 | $5,236.06 | $4,036.99 | $3,999.24 | $2,034.57 | $5,886.01 | $3,489.60 |

| 02891 | $4,057.50 | $4,249.38 | $4,129.79 | $5,749.70 | $3,694.86 | $3,999.24 | $2,084.74 | $4,819.39 | $3,732.92 |

| 02837 | $4,027.83 | $4,018.83 | $3,886.67 | $5,236.06 | $3,731.00 | $4,480.85 | $2,034.57 | $5,473.51 | $3,361.12 |

| 02841 | $3,999.62 | $4,071.70 | $3,886.67 | $5,249.77 | $3,514.01 | $3,999.24 | $2,034.57 | $5,660.98 | $3,580.01 |

| 02835 | $3,967.95 | $3,911.64 | $3,886.67 | $5,236.06 | $3,469.58 | $3,999.24 | $2,034.57 | $5,844.74 | $3,361.12 |

| 02840 | $3,953.70 | $3,923.26 | $3,886.67 | $5,249.77 | $3,514.01 | $3,999.24 | $2,034.57 | $5,660.98 | $3,361.12 |

| 02842 | $3,908.01 | $3,909.18 | $3,886.67 | $5,249.77 | $3,469.02 | $3,999.24 | $2,034.57 | $5,135.64 | $3,580.01 |

If you want to know how much your city, overall, impacts your premium, you can explore the differences below.

Rhode Island Cheapest Rates by City

| City | Average Car Insurance Rates by City in RI |

|---|---|

| MIDDLETOWN | $3,908.01 |

| JAMESTOWN | $3,967.95 |

| NEWPORT | $3,976.66 |

| LITTLE COMPTON | $4,027.83 |

| WESTERLY | $4,057.50 |

| PORTSMOUTH | $4,112.71 |

| BLOCK ISLAND | $4,125.16 |

| TIVERTON | $4,181.29 |

| PRUDENCE ISLAND | $4,222.10 |

| WOOD RIVER JUNCTION | $4,240.72 |

| KENYON | $4,256.34 |

| WYOMING | $4,264.65 |

| NARRAGANSETT | $4,265.28 |

| BRADFORD | $4,265.93 |

| CHARLESTOWN | $4,269.11 |

| WAKEFIELD | $4,280.43 |

| HOPE VALLEY | $4,288.65 |

| ASHAWAY | $4,292.12 |

| SHANNOCK | $4,324.21 |

| KINGSTON | $4,339.38 |

| HOPKINTON | $4,354.65 |

| WEST KINGSTON | $4,362.34 |

| ROCKVILLE | $4,448.23 |

| CAROLINA | $4,458.91 |

| SAUNDERSTOWN | $4,467.60 |

| BRISTOL | $4,576.63 |

| EXETER | $4,601.32 |

| NORTH KINGSTOWN | $4,625.78 |

| PASCOAG | $4,636.04 |

| HARRISVILLE | $4,658.66 |

| MAPLEVILLE | $4,673.94 |

| GLENDALE | $4,688.32 |

| NORTH SMITHFIELD | $4,712.58 |

| WARREN | $4,717.07 |

| OAKLAND | $4,721.36 |

| SLOCUM | $4,723.62 |

| SLATERSVILLE | $4,733.23 |

| ADAMSVILLE | $4,739.53 |

| BARRINGTON | $4,767.50 |

| FORESTDALE | $4,768.57 |

| WOONSOCKET | $4,773.58 |

| WEST GREENWICH | $4,789.81 |

| GREENE | $4,821.18 |

| CUMBERLAND | $4,833.39 |

| COVENTRY | $4,843.62 |

| MANVILLE | $4,880.00 |

| CHEPACHET | $4,884.10 |

| ALBION | $4,926.01 |

| FOSTER | $4,966.72 |

| PEACE DALE | $4,976.25 |

| EAST GREENWICH | $5,002.54 |

| NORTH SCITUATE | $5,035.12 |

| HARMONY | $5,141.41 |

| GREENVILLE | $5,141.78 |

| HOPE | $5,158.80 |

| WEST WARWICK | $5,161.34 |

| CLAYVILLE | $5,166.90 |

| LINCOLN | $5,230.17 |

| FISKEVILLE | $5,243.45 |

| SMITHFIELD | $5,252.06 |

| WARWICK | $5,268.89 |

| RIVERSIDE | $5,324.98 |

| RUMFORD | $5,580.25 |

| EAST PROVIDENCE | $5,580.28 |

| PAWTUCKET | $5,824.36 |

| CENTRAL FALLS | $5,975.22 |

| CRANSTON | $6,041.70 |

| JOHNSTON | $6,101.40 |

| NORTH PROVIDENCE | $6,341.33 |

| PROVIDENCE | $6,610.12 |

Compare Rhode Island Car Insurance Rates by Gender and Age

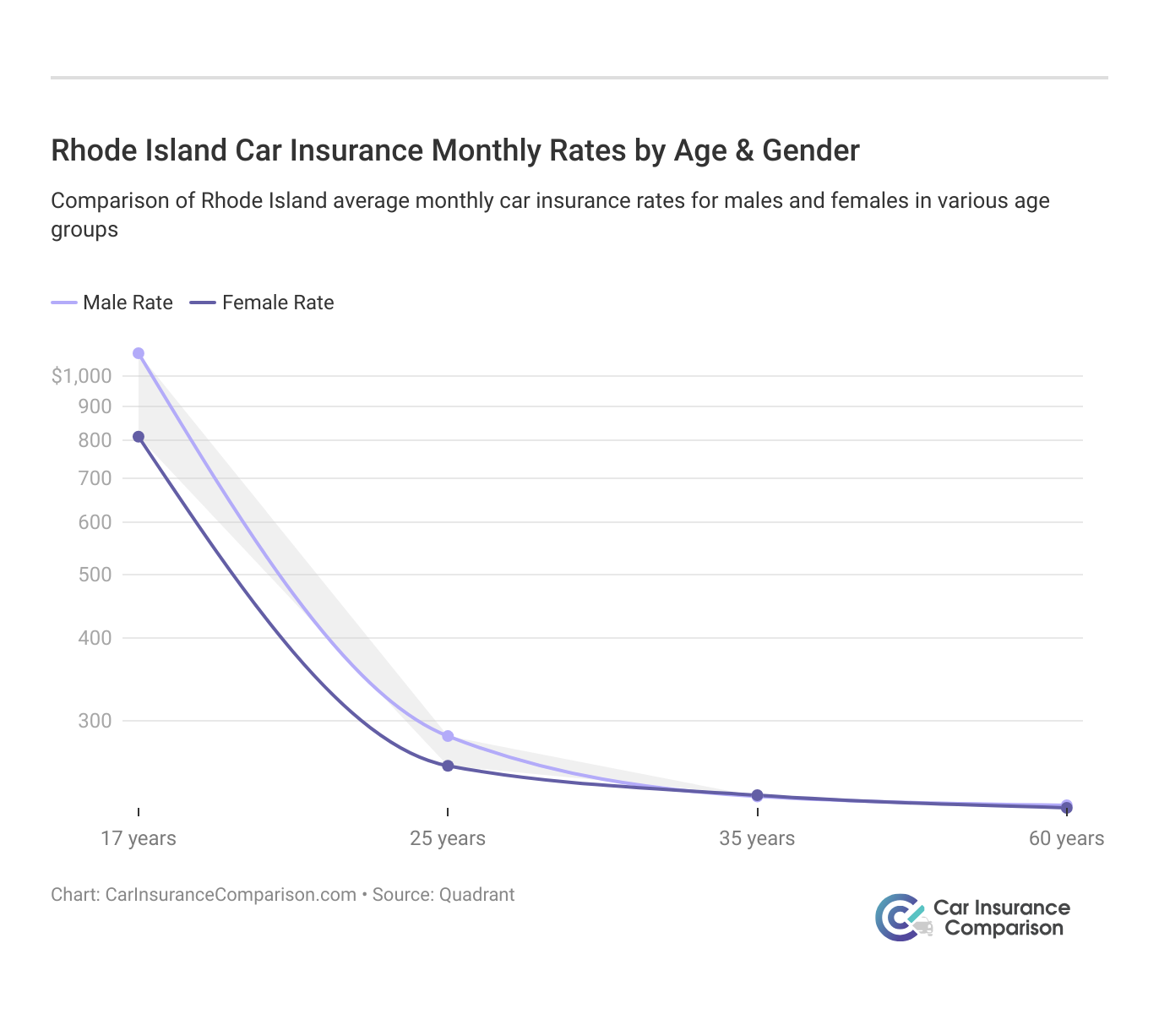

Did you know that your gender can impact your insurance rates? You’ve probably heard the old myth that male drivers are a little more reckless than women drivers and are, as such, charged more for their coverage. Is that old myth really true, though?

Age contributes to the car insurance rates a driver has to pay. 17-year-old boys have to pay a significantly higher premium than their female counterparts — complying with the gender myth — but once both genders reach 35, the rates even out.

Rhode Island Coverage by Demographic

| Company | Married 35-year old female | Married 35-year old male | Married 60-year old female | Married 60-year old male | Single 17-year old female | Single 17-year old male | Single 25-year old female | Single 25-year old male |

|---|---|---|---|---|---|---|---|---|

| Allstate F&C | $3,991.81 | $3,919.97 | $3,965.46 | $4,138.80 | $6,951.89 | $8,211.70 | $4,181.73 | $4,314.24 |

| Geico General | $3,352.25 | $3,435.27 | $3,435.27 | $3,358.93 | $10,460.06 | $13,683.07 | $3,471.31 | $3,624.88 |

| Liberty Mutual Fire Ins Co | $3,967.26 | $3,967.26 | $3,781.20 | $3,781.20 | $9,610.11 | $15,000.77 | $3,967.26 | $5,397.88 |

| Nationwide Mutual | $2,870.60 | $2,916.99 | $2,522.14 | $2,676.05 | $7,505.22 | $9,664.73 | $3,412.17 | $3,709.14 |

| Progressive Direct | $2,657.85 | $2,523.06 | $2,442.97 | $2,428.75 | $11,882.34 | $13,361.63 | $3,245.10 | $3,307.02 |

| State Farm Mutual Auto | $1,529.96 | $1,529.96 | $1,349.64 | $1,349.64 | $4,204.16 | $5,604.41 | $1,680.96 | $2,003.27 |

| Travelers Home & Marine Ins Co | $1,681.61 | $1,701.83 | $1,712.33 | $1,702.69 | $17,367.38 | $27,457.38 | $1,729.94 | $1,922.42 |

| USAA CIC | $2,081.24 | $2,057.69 | $1,994.32 | $1,954.09 | $9,649.96 | $11,028.79 | $2,842.49 | $2,983.23 |

Compare Rhode Island Car Insurance Rates by Coverage Level

Rhode Island’s listed core coverage comes from the National Association of Insurance Commissioners, one of the most trusted sources in insurance today. It should be noted, though, that the cost of insurance coverage here is from 2015, and these rates may be much higher from 2019 on.

Rhode Island Coverage Types

| Coverage Type | Annual Costs (2015) |

|---|---|

| Liability | $759.80 |

| Collision | $411.51 |

| Comprehensive | $132.19 |

| Combined | $1,303.50 |

Rhode Island requires its drivers to have bodily injury liability as well as property damage liability, as we noted a little bit ago. If you’re interested in taking on additional types of coverage, we’re about to discuss variations on the state minimum that can provide you more protection in the long run.

Rhode Island Forms of Financial Responsibility

You are also required by the state of Rhode Island to carry proof of insurance with you at all times while driving your car. You may be asked to provide evidence of your insurance coverage if you are:

- Registering your vehicle’s license and registration

- Stopped by a law enforcement officer

- After an accident

Proof of insurance in Rhode Island consists of any paperwork that has been legally notarized and which bears your assigned vehicle identification number on it. You can obtain proof of insurance from the Rhode Island DMV or through your insurance provider upon your purchase of a policy.

If you read Rhode Island General Law section 31-47-9, you’ll find the various offenses and fines for driving in the state without proof of insurance.

- For your first offense, you risk license/registration suspension for three months as well as a fine between $100 and $500.

- For your second offense, you risk losing your license/registration for six months and paying a fine of a flat $500.

- From your third suspension onward, you risk losing your license/registration for a full year and paying a fine of $1,000.

Want to avoid that trouble? Don’t drive without car insurance. No matter what your lifestyle, you can find the kind of coverage that’s best for you.

Read more: What happens if I forget to get insurance for my car?

Compare Rhode Island Car Insurance Rates by Percentage of Income

You may or may not be familiar with the term ‘per capita income.’ If you’re not, the term describes the amount of income you’re able to take home with you after you’ve had the appropriate amount taken out for taxes.

For example, someone who makes $80,000 would likely be able to take home $65,000 after paying their taxes. As such, the $65,000 would be considered your per capita income.

How does this factor into your car insurance? Read on.

In Rhode Island, the average per capita income per household is $33,315, according to the Rhode Island Department of Labor and Training. Per month, then, Rhode Island residents are able to spend about $2776.25 on rent, utilities, groceries, health insurance, and so on.

The average annual cost of full coverage car insurance in Rhode Island is $1,688. That means Rhode Island residents need to commit an average of $141 to their car insurance payments a month.

As you can see, a Rhode Island resident with a per capita disposable income would have to pay $1,688 a year in order to maintain full car insurance coverage. Rhode Island’s average annual car insurance premium is notably higher than the national average of $981, though.

In fact, Rhode Island is home to the 5th most expensive car insurance premiums in the United States.

Does this mean you should move to Connecticut or Massachusetts instead? That’s kind of up to you. Massachusetts car insurance varies by company. We can still help you find car insurance deals in Rhode Island, though, that’ll make your budgeting a little bit easier.

Additional Liability in Rhode Island

Rhode Island Core Coverage/Loss Ratios

| Loss Ratio | 2013 | 2014 | 2015 |

|---|---|---|---|

| Medical Payments | 99.07% | 100.17% | 97.52% |

| Uninsured/Underinsured Motorist Coverage | 152.80% | 128.43% | 103.30% |

Personal Injury Protection (PIP) and uninsured motorist coverage are not required by the state. That doesn’t mean, though, that the coverage they offer isn’t important.PIP and UUM both work to protect you, specifically in case of an accident.

They’ll do double duty if you happen to get in an accident with a driver who doesn’t have insurance, and they come in particularly handy if, by some misfortune, you’re injured in an accident with a driver who doesn’t have insurance.

An uninsured driver who causes an accident in Rhode Island is an “at-fault” driver – a concept that we’ll touch on later. That driver will have to pay for all of your medical bills out of pocket and could go bankrupt before they’re able to pay for all of the injuries or property damage their accident caused.

17 percent of drivers in Rhode Island drive on the interstates uninsured.

With the national average of uninsured drivers coming in at a comparably low 12.6 percent, it seems especially important for you to have the coverage you need in order to keep yourself safe after an accident in the Ocean State.

Popular Car Insurance Add-ons in Rhode Island

With the need to add on to your minimum coverage in mind, where should you start? There are a number of add-on coverage options available for you to choose from, but depending on your lifestyle and needs as a driver, you’ll need to determine for yourself which ones are worth the additional cost.

We’ve included a list of the more affordable add-on coverage options that you can attach to your baseline coverage.

Additional Coverage Options (click on each to learn more about that specific type):

- Guaranteed Auto Protection (Gap)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Insurance

Like PIP and UUM, none of these add-ons are required by the state of Rhode Island. However, you’ll definitely want to consider including them in your coverage, as you can add as few or as many as you want. Additional car insurance coverages aren’t needed by everyone.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

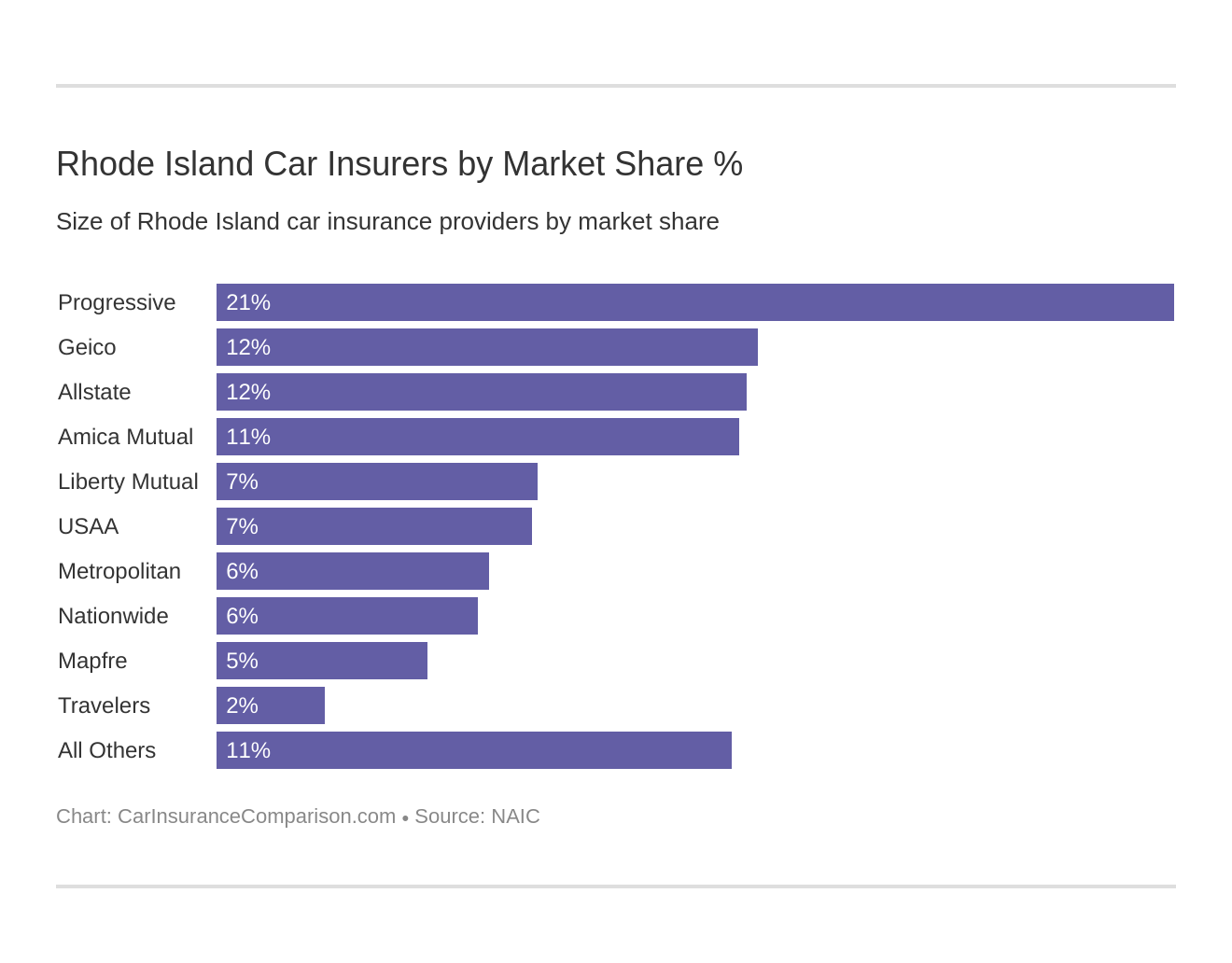

Best Rhode Island Car Insurance Companies

Rhode Island is home to dozens of car insurance providers, and all of them want your business. When you’re bombarded with car insurance commercials insisting that this provider, that provider, every provider is the best one for you, it can be easy to get overwhelmed.

You don’t want to invest in the wrong provider, though, and we don’t want you to end up paying a premium that’s too expensive for your taste.

That’s why we’ve laid out the details of Rhode Island’s biggest and best car insurance providers. Want to see ratings, complaint statistics, and all the juicy details? Then read on!

Rhode Island’s Largest Companies’ Financial Ratings

One of the easiest ways to start exploring the value of an insurance provider is to assess their AM Best Rating. A company’s AM Best Rating tells you how strong a provider is financially. The better the rating, the more likely it is that the company in question is financially secure and, in turn, able to support you if you need coverage paid out.

As you’ll see in the table below, AM Best Ratings can range from the lower end of the alphabetic scale to A+++. National insurers are more likely to have additional plus signs simply because they have more surface area over which to spread and stabilize their loss ratios, so to speak.

Let’s take a look at the AM Ratings of Rhode Island’s most prominent insurance providers.

Rhode Island Largest Companies

| Companies | AM Best Rating | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|---|

| Progressive Group | A+ | $193,720.00 | 65.71% | 21.01% |

| Geico | A++ | $109,611.00 | 79.71% | 11.89% |

| Allstate Insurance Group | A+ | $107,256.00 | 62.08% | 11.63% |

| Amica Mutual Group | A+ | $105,708.00 | 63.36% | 11.47% |

| Liberty Mutual Group | A | $65,124.00 | 65.17% | 7.06% |

| USAA Group | A++ | $63,851.00 | 78.38% | 6.93% |

| Metropolitan Group | A | $55,075.00 | 57.15% | 5.97% |

| Nationwide Corp Group | A+ | $52,881.00 | 63.34% | 5.74% |

| Mapfre Insurance Group | A | $42,523.00 | 63.64% | 4.61% |

| Travelers Group | A++ | $21,853.00 | 54.69% | 2.37% |

Read more: MAPFRE Car Insurance Review

A quick note on loss ratios: As you can see in the above table, some companies have loss ratios that exceed 100 percent, while others have ones in more reasonable ranges. What do these numbers mean?

Generally speaking, a high loss ratio means that the company in question is able to pay out on all of its claims. They also happen to risk their financial security to do so, though.

Comparatively, companies with lower loss ratios are more financially secure, but they’re also less likely to provide you with the full coverage you may need. Comparing car insurance companies may help you find out which ones have a lower loss ratio.

Companies with the Best Ratings in Rhode Island

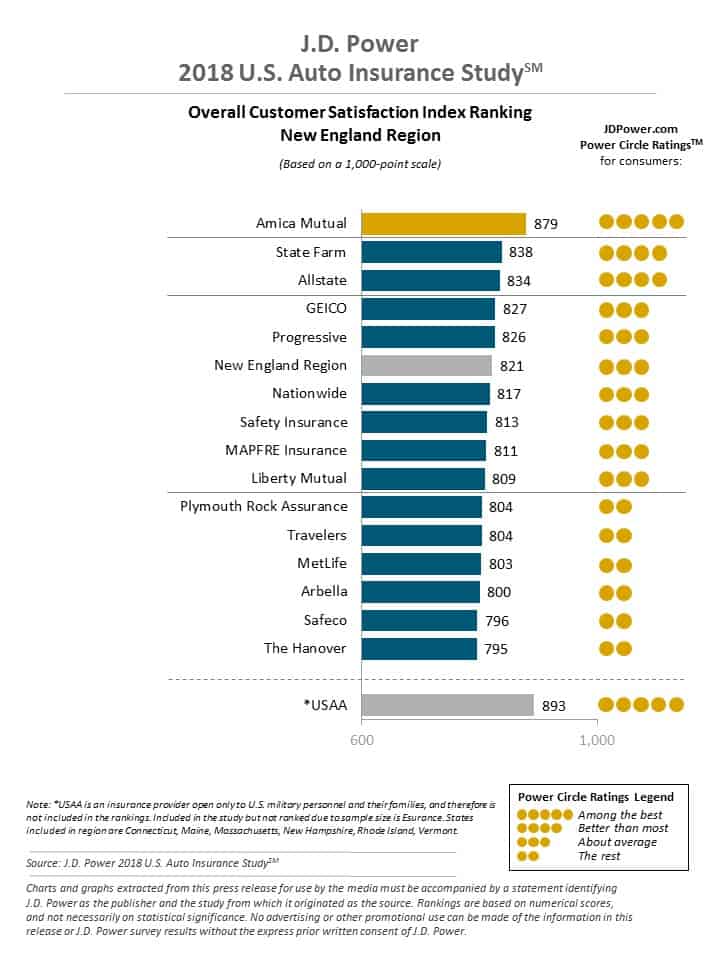

Let’s leave money behind for a moment and take customer satisfaction into account. Rhode Island is in the New England Region and, thus, works with the statistics below.

Companies with the Most Complaints in Rhode Island

On the other end of the spectrum are customer complaints. While complaints aren’t always the best way to measure a provider’s ability to meet your needs, the statistics in the table below will give you a good idea of how the providers in Rhode Island may respond to your needs.Rhode Island Car Insurance Complaints

| Companies | Number of Complaints | Complaint Index |

|---|---|---|

| Allstate | 163 | 0.5 |

| Amica | 52 | 0.46 |

| Geico | 333 | 0.68 |

| Liberty Mutual | 222 | 5.95 |

| MAPFRE Insurance | 27 | 6.25 |

| Metropolitan Group | 70 | 1.3 |

| Nationwide | 25 | 0.28 |

| Progressive | 120 | 0.75 |

| Travelers | 2 | 0.09 |

| USAA | 296 | 0.74 |

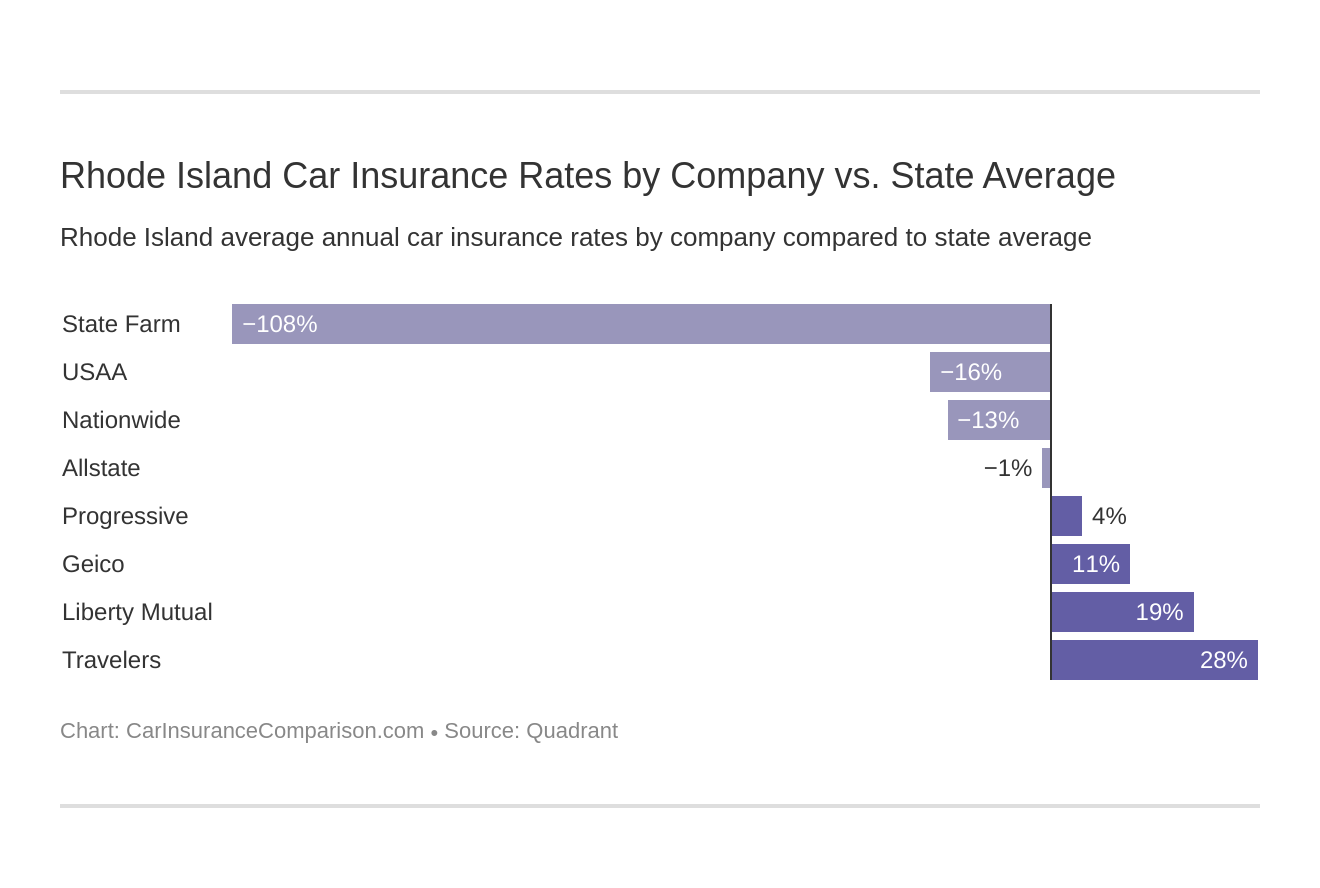

Rhode Island Car Insurance Rates by Company

If we look at things from another perspective, we can explore the cost of different car insurance rates compared to the state average.

Rhode Island Rates by Company

| Companies | Average | Compared to State Average | |

|---|---|---|---|

| Allstate F&C | $4,959.45 | -$43.91 | -0.89% |

| Geico General | $5,602.63 | $599.27 | 10.70% |

| Liberty Mutual Fire Ins Co | $6,184.12 | $1,180.76 | 19.09% |

| Nationwide Mutual | $4,409.63 | -$593.73 | -13.46% |

| Progressive Direct | $5,231.09 | $227.73 | 4.35% |

| State Farm Mutual Auto | $2,406.50 | -$2,596.85 | -107.91% |

| Travelers Home & Marine Ins Co | $6,909.45 | $1,906.09 | 27.59% |

| USAA CIC | $4,323.98 | -$679.38 | -15.71% |

As you can see, there’s a lot of variation in rates throughout Rhode Island. Where Travelers’ and State Farm’s rates both vastly exceed the state average, they do so in different ways — Travelers is more expensive than the state average, whereas State Farm’s is less so.

Read our State Farm car insurance review for more information.

Commute Rates by Company in Rhode Island

You wouldn’t think that a commute would impact insurance rates all that much in a state as small as Rhode Island. That isn’t the case, though, as you can see in the table below.

Commute Rates by Carrier

| Companies | Commute And Annual Mileage | Annual Average |

|---|---|---|

| Travelers | 10 miles commute. 6000 annual mileage. | $6,909.45 |

| Travelers | 25 miles commute. 12000 annual mileage. | $6,909.45 |

| Liberty Mutual | 25 miles commute. 12000 annual mileage. | $6,384.99 |

| Liberty Mutual | 10 miles commute. 6000 annual mileage. | $5,983.25 |

| Geico | 25 miles commute. 12000 annual mileage. | $5,716.30 |

| Geico | 10 miles commute. 6000 annual mileage. | $5,488.96 |

| Progressive | 10 miles commute. 6000 annual mileage. | $5,231.09 |

| Progressive | 25 miles commute. 12000 annual mileage. | $5,231.09 |

| Allstate | 25 miles commute. 12000 annual mileage. | $4,994.34 |

| Allstate | 10 miles commute. 6000 annual mileage. | $4,924.56 |

| Nationwide | 10 miles commute. 6000 annual mileage. | $4,409.63 |

| Nationwide | 25 miles commute. 12000 annual mileage. | $4,409.63 |

| USAA | 25 miles commute. 12000 annual mileage. | $4,365.30 |

| USAA | 10 miles commute. 6000 annual mileage. | $4,282.66 |

| State Farm | 25 miles commute. 12000 annual mileage. | $2,479.54 |

| State Farm | 10 miles commute. 6000 annual mileage. | $2,333.47 |

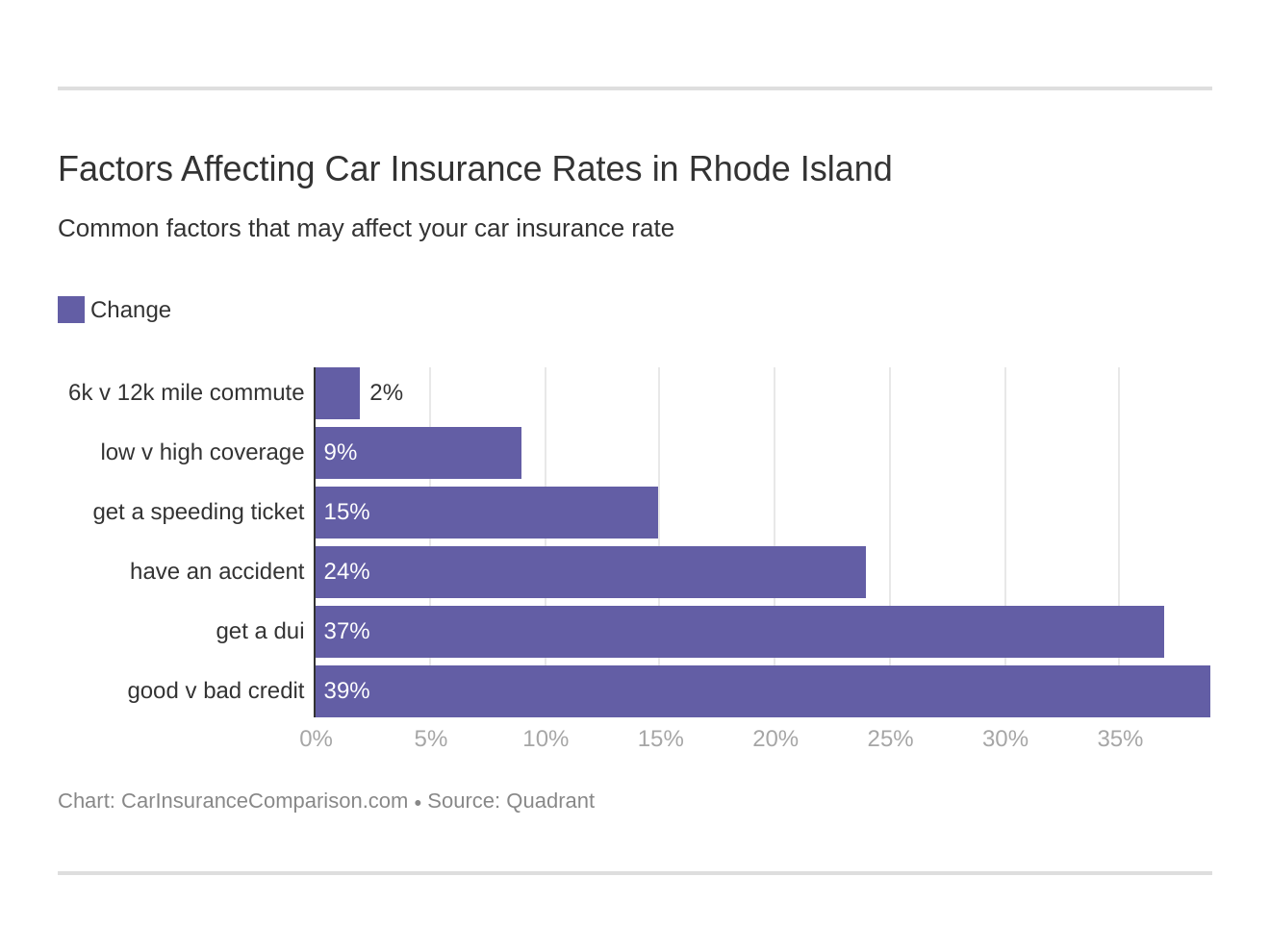

Longer commutes naturally result in higher car insurance premiums than shorter ones, as longer commutes expose drivers not only to an increased number of natural dangers but also to exhaustion.

Compare Rhode Island Car Insurance Rates by Coverage Type

If you’re the type of person who loves to find a deal, you may be tempted to purchase only the minimum state-required auto insurance coverage or, alternatively, the least amount of coverage you can. While your wallet may thank you at the moment, it won’t so much in the case of an accident.

Higher levels of coverage, though more expensive, keep you safe when you need financial back-up. Check out Rhode Island’s varying coverage rates and annual costs below.

Rhode Island Coverage Types by Company

| Companies | Coverage Type | Annual Average |

|---|---|---|

| Travelers | Medium | $7,036.02 |

| Travelers | Low | $7,019.75 |

| Travelers | High | $6,672.57 |

| Liberty Mutual | High | $6,597.08 |

| Liberty Mutual | Medium | $6,145.16 |

| Geico | High | $5,889.27 |

| Liberty Mutual | Low | $5,810.12 |

| Geico | Medium | $5,589.68 |

| Progressive | High | $5,584.04 |

| Geico | Low | $5,328.94 |

| Allstate | High | $5,236.55 |

| Progressive | Medium | $5,196.08 |

| Allstate | Medium | $4,945.81 |

| Progressive | Low | $4,913.15 |

| Allstate | Low | $4,695.99 |

| Nationwide | Low | $4,545.71 |

| USAA | High | $4,520.27 |

| Nationwide | Medium | $4,438.92 |

| USAA | Medium | $4,327.44 |

| Nationwide | High | $4,244.26 |

| USAA | Low | $4,124.23 |

| State Farm | High | $2,539.55 |

| State Farm | Medium | $2,402.31 |

| State Farm | Low | $2,277.64 |

Keeping with the theme of variation, you can see that the provider’s rates in Rhode Island extend over a significant range. However, the costs of insurance by the company tend to remain within the same range. Geico, for example, has medium and high insurance within $300 of each other.

Read our Geico car insurance review for more information.

Compare Rhode Island Car Insurance Rates by Credit Score

It won’t surprise you to learn that your credit history will impact your car insurance rate. The better your credit history, the lower your car insurance costs will be.

Rhode Island Credit History by Carrier

| Companies | Credit History | Annual Average |

|---|---|---|

| Liberty Mutual | Poor | $8,135.91 |

| Travelers | Poor | $7,249.34 |

| Travelers | Fair | $6,752.96 |

| Travelers | Good | $6,726.05 |

| USAA | Poor | $6,414.26 |

| Geico | Poor | $6,278.27 |

| Allstate | Poor | $6,222.18 |

| Progressive | Poor | $5,858.59 |

| Geico | Fair | $5,446.57 |

| Liberty Mutual | Fair | $5,399.61 |

| Nationwide | Poor | $5,115.80 |

| Progressive | Fair | $5,095.01 |

| Geico | Good | $5,083.04 |

| Liberty Mutual | Good | $5,016.84 |

| Allstate | Fair | $4,774.97 |

| Progressive | Good | $4,739.68 |

| Nationwide | Fair | $4,212.78 |

| Nationwide | Good | $3,900.31 |

| Allstate | Good | $3,881.20 |

| USAA | Fair | $3,646.05 |

| State Farm | Poor | $3,232.92 |

| USAA | Good | $2,911.61 |

| State Farm | Fair | $2,184.74 |

| State Farm | Good | $1,801.84 |

Take State Farm, for example. The difference between a “fair” and “good” ranking’s influence on your credit card rate is roughly $334 — not a big leap for a less-than-perfect credit rate, but not an insignificant difference, either.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Compare Rhode Island Car Insurance Rates by Driving Record

In the same way you’d expect your credit to impact your rate, a better driving history can net you a lower car insurance rate than a poor one.

Rhode Island Driving Record by Carrier

| Companies | Driving Record | Annual Average |

|---|---|---|

| Geico | With 1 DUI | $9,473.52 |

| Travelers | With 1 DUI | $7,989.23 |

| Travelers | With 1 speeding violation | $7,053.75 |

| Progressive | With 1 accident | $6,772.26 |

| Liberty Mutual | With 1 DUI | $6,658.34 |

| Liberty Mutual | With 1 accident | $6,618.39 |

| USAA | With 1 DUI | $6,559.16 |

| Travelers | With 1 accident | $6,403.21 |

| Travelers | Clean record | $6,191.60 |

| Allstate | With 1 DUI | $5,752.11 |

| Liberty Mutual | Clean record | $5,729.87 |

| Liberty Mutual | With 1 speeding violation | $5,729.87 |

| Progressive | With 1 speeding violation | $5,089.68 |

| Allstate | With 1 accident | $5,049.86 |

| Nationwide | With 1 DUI | $4,855.18 |

| Progressive | With 1 DUI | $4,794.93 |

| Allstate | With 1 speeding violation | $4,782.41 |

| Geico | With 1 accident | $4,766.89 |

| Geico | With 1 speeding violation | $4,548.61 |

| Nationwide | With 1 accident | $4,480.98 |

| Progressive | Clean record | $4,267.49 |

| USAA | With 1 accident | $4,263.97 |

| Allstate | Clean record | $4,253.42 |

| Nationwide | With 1 speeding violation | $4,225.48 |

| Nationwide | Clean record | $4,076.88 |

| Geico | Clean record | $3,621.50 |

| USAA | With 1 speeding violation | $3,333.54 |

| USAA | Clean record | $3,139.23 |

| State Farm | With 1 accident | $2,930.32 |

| State Farm | Clean record | $2,231.90 |

| State Farm | With 1 DUI | $2,231.90 |

| State Farm | With 1 speeding violation | $2,231.90 |

Take Travelers’ insurance rates into account. Driving with a clean record leaves you with a rate of $6,191.60. Comparatively, one accident raises that number by $211.51. Similarly, a single DUI brings the cost of Travelers’ insurance up to $7,989.23, a stunning $1,797.53 difference in rate.

It only goes to show that if you want to protect your wallet, you need to invest in driving more safely. Read our Travelers car insurance review for more information.

How Much Auto Insurance Costs in Rhode Island

| Compare Car Insurance Rates in Your City |

|---|

| Newport, RI |

| Providence, RI |

Number of Insurers in Rhode Island

In light of the statistics in the table above, you might be wondering: What’s the difference between domestic and foreign insurers when you’re in the United States, which consists of states and not foreign entities?

Rhode Island Domestic and Foreign Insurers

| Type of Insurance | Number of Providers |

|---|---|

| Domestic | 22 |

| Foreign | 727 |

| Total Number of Insurers | 749 |

Effectively, domestic insurance refers to insurance formed under Rhode Island law. Foreign insurance refers to a policy formed under the law of any other state in the union.

Rhode Island Driving Laws

With a baseline understanding of car insurance in Rhode Island under your belt, we can take a look at the laws that are specific to the state. Rhode Island’s laws can be confusing because the legalities in the state aren’t always the same as those in Rhode Island’s neighbors.

You’ll want to make sure that you know precisely what you’re allowed to do on the road so you can stay out of trouble in Rhode Island. It’s a real hassle to realize that you may have broken a law that you didn’t know about.

In order to help you avoid that unfortunate situation, we’ve collected some of the most important driving laws in Rhode Island and put them on display for you. Keep on reading to find out more!

Car Insurance Laws in Rhode Island

As we’ve mentioned, Rhode Island requires every driver registered in the state to be covered by minimum liability insurance coverage.

Rhode Island operates on a 25/50/25 minimum liability insurance coverage ratio.

So, if you’ve just moved to the state or need to update your registration, make sure that your car insurance coverage at the least meets the state minimum.

High-Risk Insurance in RI

You may have a difficult time securing car insurance coverage if Rhode Island’s providers consider you a high-risk driver. What factors contribute to this label?

Well, you’ll be considered a high-risk driver if you’ve got a troubled driving history. This means that any tickets, DUI/DWI convictions, or owning a high-risk car like a sports car could raise your insurance rates or make it impossible for you to find coverage at all.

This plan has been available to Rhode Island residents since 1968. Through this plan, high-risk drivers whom providers would rather not cover can have access to the state minimum car insurance.

In 2014, 16,000 drivers in Rhode Island were insured courtesy of the RI AIP. That means 21 percent of all of the drivers registered in Rhode Island were able to rely on the state to ensure that they drove the roads safely.

In order to qualify for coverage through the RI AIP, you’ll have to offer the state proof that you sought out car insurance coverage within the 60 days preceding your appeal and were denied.

So long, then, as your car is registered with the state of Rhode Island and you’re in possession of a valid driver’s license, you should qualify for insurance coverage through the RI AIP.

By providing this service, the state of Rhode Island has attempted to ensure that no driver on its road will drive without insurance, thereby making the roads of the state much safer.

Low-Cost Insurance in Rhode Island

Unfortunately, Rhode Island does not have any car insurance programs that are available to low-income homes. The RI AIP is only available to high-risk drivers. However, there are various insurance discounts that you can pursue through your preferred insurance provider in order to save some money.

These discounts include but are not limited to:

- Affiliation Discount (this would be any discounts through your employer, school, team, etc.)

- Anti-Theft Discounts (i.e. if you have alarms, tracking systems, etc. on your vehicle, these items may give you a vehicle recovery discount on your insurance)

- Homeowner’s Discount

- Multi-car Discount

The best way to save money on car insurance is to shop around and find the provider who offers you exactly the amount of coverage you need. This way, you can be certain that you’re not paying more or less than you should in order to stay safe on the road.

Windshield Coverage in Rhode Island

Note that you shouldn’t drive on the road if your windshield has been cracked or damaged. Instead, your insurance provider and coverage may have the funds to provide you with a new windshield.

Rhode Island Windshield Repair

| Replacement | Repair | Zero Deductible with Comprehensive Coverage |

|---|---|---|

| Aftermarket parts at least equal in kind and quality may be used unless car is 30 months old or less; then consumer must be notified in writing and gives consent | No specifications in law found. | Not a law - Individual insurance companies may offer with comprehensive coverage. |

As you can see, providers in Rhode Island aren’t required by law to provide you with windshield coverage. However, the individual insurance companies in the state may offer you replacement funds via comprehensive coverage.

The parts that your provider offers you need to be at least equal in quality to that which is being replaced. However, if you’re driving an older car that is 30 months old or older, then the value of the provided windshield is legally allowed to be less than that which is being replaced.

Automobile Insurance Fraud in Rhode Island

Auto insurance fraud is illegal in every state in the union. That said, it’s pretty difficult to commit auto insurance fraud by accident.

According to the IIHS, auto insurance fraud can be committed in one of two ways:

- Intentionally staging an accident or making a false claim

- “Padding” or adding intentionally false things to a legitimate claim

If you get caught committing insurance fraud in Rhode Island, your consequences could range from severe fines to community service or, in some cases, jail time. Again, though, it’s difficult to unintentionally commit insurance fraud. Just don’t place a false claim or add anything extra onto a claim that you’ve already filed.

Statute of Limitations in Rhode Island

You have a limited amount of time to file an insurance claim after a car accident. This amount of time is known as your “statute of limitations.”In Rhode Island, you have three years to submit a claim detailing information about any personal injuries you sustained in an accident in which you were not at fault, with that three-year countdown starting on the day the accident took place.

You’ll have 10 years to submit a claim noting any property damage that arose out of an accident.

Rhode Island as an At-Fault State

As was noted above, Rhode Island is an at-fault driver state. What does it mean to be “at-fault” in an accident?

You are “at-fault” in an accident if the state determines you to be responsible for the injury of another person or persons and/or for any property damage.

The at-fault driver in an accident has to cover all of the other parties’ medical bills and ensure that any property that is damaged is adequately replaced.

Because Rhode Island is an at-fault state, all Rhode Island drivers should have at least minimum state coverage in order to ensure that a) they can provide for anyone who they injured in a car accident, and b) they don’t break the bank paying for another person’s medical bills or property damage.

If you want to know about the opposite of at-fault insurance, no-fault insurance, read here.

Vehicle Licensing Laws in Rhode Island

So, it’s clear that Rhode Island requires every driver registered with the state to have minimum liability coverage in order to drive. What happens, though, if you get caught driving through Rhode Island without proof of insurance or without any insurance at all?

You may find that the consequences of driving without insurance in Rhode Island are fairly severe.

Penalties for Driving Without Insurance in Rhode Island

The following table outlines the consequences of driving through Rhode Island without insurance and getting caught.

Rhode Island Penalties for Driving Without Insurance

| Offense | Fine | License Suspension | Reinstatement Fee |

|---|---|---|---|

| 1 | $100-$500 | Suspension up to three months | $30-$50 |

| 2 | $500 | Suspension up to six months | $30-$50 |

As you can see, one offense alone can result in a charge of up to $500. That’s the kind of fine that you’ll want to make an effort to avoid. Not only that but with your license suspended, your mobility in Rhode Island will be severely limited.

Just as a reminder, proof of insurance in Rhode Island consists of a copy of your car insurance policy, a valid insurance card, or any form of notarized paperwork that has your vehicle identification number on it.

In order to avoid Rhode Island’s fines and license suspension, make sure you have proof of insurance with you in your car whenever you’re driving through the state. If you don’t, you could find yourself in a world of trouble.

Teen Driver Laws in Rhode Island

There’s nothing like getting into the driver’s seat of a car for the first time as a teenager. Teen drivers in Rhode Island can get their driver’s permits at any point between the ages of 16 and 18, so long as the teen in question has completed 33 hours of driver’s education as taught by the Community College of Rhode Island.

Any driver who completes driver’s education at another institution can bring their class completion certificate to Rhode Island’s DMV headquarters in order to take a computerized knowledge exam and receive their driver’s permit.

https://youtu.be/DmIhjMwZs5AA

A driver’s permit in Rhode Island will be valid for one year or until the driver in question turns 18. After six months of driving with a permit, a driver may take a road test in order to receive their full license. You can also get driver’s education car insurance discounts.

Older Driver License Renewal Procedures in RI

As you grow older in Rhode Island, your ability to renew your license may vary. For anyone under 72, the process of renewing your license will require you to visit the Rhode Island DMV every five years in order to ensure that your license is updated.

For drivers over 72, your license expiration date will be extended to your 75th birthday, at which point you’ll need to have your license renewed every two years.

Luckily, the Rhode Island DMV allows you to renew your license in person, by mail, or over the Internet so long as you’re younger than 72 years old. After you turn 72, you’ll need to go to the DMV or local AAA branch in person for your license renewal in order to have your eyes tested.

New Residents

If you’ve recently become a resident of Rhode Island, you’ll need to get in touch with your current car insurance provider in order to update your policy’s information and to ensure that your coverage meets the state’s minimum liability insurance requirements.

Remember, in Rhode Island, the minimum liability insurance breaks down as follows:

- 25 = $25,000 of bodily injury coverage per person

- 50 = $50,000 that can pay for the total injuries per accident

- 25 = $25,000 to cover any property damage per accident

It’s recommended that you update your car insurance policy within 30 days of moving to your new home, so be sure to do so quickly!- License Renewal ProceduresAs a Rhode Island resident, you’ll need to get your license renewed every few years, but what does the process look like exactly?

- Renewal Cycle: once every five years

- Online/Mail Renewal: You can easily renew your license online or through the mail without any breaks in this availability.

You can also visit your local AAA branch in order to have your license renewed so long as you’re an AAA member. Read our AAA car insurance review for more information.

Rules of the Road in Rhode Island

Now that we’ve gone over basic license management in the state of Rhode Island, what rules do you need to know about while driving down the road on an average day?

Fault vs. No-Fault in Rhode Island

We’ve mentioned already that Rhode Island is an at-fault state. Just for a refresher, though: The at-fault driver in an accident has to cover all of the other parties’ medical bills and ensure that any property that is damaged is adequately replaced.

Because Rhode Island is an at-fault state, all Rhode Island drivers should have at least minimum state coverage in order to ensure that a) they can provide for anyone who they injured in a car accident, and b) they don’t break the bank paying for another person’s medical bills or property damage.

Seat Belt and Car Seat Laws in Rhode Island

Wearing a seat belt could save your life in a car accident, which is why Rhode Island has instituted a primary seat belt law that applies to both adults and children. This law, according to the Rhode Island State government, states that:

- Anyone driving a car needs to be properly wearing a seat belt or shoulder harness when the car is in motion.

- Any passenger 8 years old or older needs to be wearing a seat belt or safety harness while the car is in motion.

- Any passenger younger than eight needs to be in an appropriate car seat unless they are over 57 inches in height or weigh more than 80 pounds.

- Infants and toddlers need to be kept in a rear-facing car seat unless they are older than 2 years of age or weigh more than 30 pounds.

- Any children who are over 2 years old or weigh more than 30 pounds need to be in a forward-facing car seat with a harness.

Rhode Island does not specify whether or not passengers riding in the cargo area of a truck need to be secured, but as a general rule, keep the passengers in your car as secure as you can, given their age and build. Find out whether seat belt laws impact your car insurance to make sure you don’t see your policy rates increase.

Keep Right and Move Over Laws in Rhode Island

When you’re on the road in Rhode Island, you do have the opportunity to pass other drivers on the right side of the road, though only under certain circumstances.

Typically, if you’re driving at a speed that’s slower than the posted speed limit, you need to stay on the right side of the road. If a driver on the left side of the road is moving slowly, though, you can pass on the right-hand side.

Move Over Laws in Rhode Island are equally straightforward.

A Move Over law requires you to move out of the way of an oncoming vehicle that is driving on the same side of the road as you.

These vehicles include:

- Firefighters

- Ambulances

- Utility Workers

- Law Enforcement

- Utility Trucks

- Drivers with Hazard Lights on

In general, flashing lights in your rearview mirror mean that you need to move over. That way, EMS authorities can do their jobs more effectively, and drivers on the road can stay safer.

Speed Limits in Rhode Island

Each state has its own average speed limits. A number of different variables contribute to these designated speed limits, ranging from the curviness of a particular road to the environment surrounding it, be that urban or rural.

Rhode Island Posted Speed Limits

| Rhode Island Speed Limits | MPH |

|---|---|

| Rural Interstate | 65 |

| Urban Interstate | 55 |

| Other Limited Access Roads | 55 |

| Other Roads | 55 |

As you can see, Rhode Island keeps its speed limits between a 55-65 mph range. These are the state’s maximum speed limits, though posted limits may vary on specific roads throughout the state.

Ridesharing in Rhode Island

With the rise of Lyft, Uber, and other ridesharing services in the past few years, car insurers have had to instate new policies designed to protect drivers who use their cars professionally. This coverage is known as ridesharing insurance.

At this point in time, only Geico and Liberty Mutual offer ridesharing insurance in Rhode Island.

If you want to make a little extra money on the side, then you’ll have to see if your provider of choice offers ridesharing insurance. If not, you can talk to your company representatives to see if you can get on a company plan or seek out another provider who can cover you appropriately.

Safety Laws in Rhode Island

What laws does Rhode Island have in place that direct your behavior as a driver? Keep reading to find out more.

Impaired Driving Laws

Drinking and driving is never a good idea. Not only do you put yourself at risk, but you put any passengers you have with you in your car and the other drivers on the road at risk for severe injury.

The laws that Rhode Island has in place to curb driving while under the influence are strict and unrelenting. Pair these consequences with the possibility of having your license revoked, and you’ll find that you can wait to get buzzed until you’re safely at home.

Rhode Island First DUI Offense

| First Offense | Consequences |

|---|---|

| Imprisonment | No minimum, but up to 1 year or 10-60 hours community service |

| Fine | $100-$500 +$500 to hwy assessment fund |

| Other | Possible attendance to treatment program; SR-22 insurance |

Rhode Island 2nd DUI Offense

| Second Offense | Consequences |

|---|---|

| Driver’s License Revocation | 1 year |

| Imprisonment | 5 days - 6 months |

| Fine | $300-$2500 |

| Other | 1 year IID Alcohol HWY safety school Treatment when ordered |

Rhode Island 3rd DUI

| Third Offense | Consequences |

|---|---|

| Driver’s License Revocation | 2-3 years |

| Imprisonment | 1-5 years |

| Fine | $400-$5000 +$500 to hwy assessment fund |

| Other | Vehicle may be seized or forfeited. Mandatory treatment program. IID for 2 years |

As you can see, it’s not worth it to drink and drive. When you do, you’re putting more than just yourself at risk, and the consequences for doing so will be severe.

Distracted Driving Laws in Rhode Island

In a similar vein, distracted driving or texting while driving is strictly monitored in Rhode Island. The state has an all-encompassing ban on cellphone use and texting while driving.

It does not matter how old you are; if a police officer catches you on your phone at any point while driving in Rhode Island, you will be ticketed and potentially have your license revoked for a short time. Whatever text you have coming in can wait.

Rhode Island’s Can’t-Miss Facts

With Rhode Island’s laws out of the way, we can move on to explore some of the state’s lesser-known driving facts. The care and keeping of your vehicle isn’t always easy, so we want to do what we can to help you stay on top of your car management without having to worry about any additional stress.

Keep on reading in order to learn a little bit more about some important facts about Rhode Island.

Vehicle Theft in Rhode Island

It turns out that sports cars aren’t the only cars at risk of being stolen. In Rhode Island, Honda Accords and Civics are some of the most commonly stolen vehicles across the whole of the state.

Rhode Island Vehicle Theft

| Rank | Make/Model | Year of Vehicle | Thefts |

|---|---|---|---|

| 1 | Honda Accord | 1997 | 101 |

| 2 | Honda Civic | 1998 | 95 |

| 3 | Toyota Camry | 2014 | 69 |

| 4 | Nissan Maxima | 2000 | 45 |

| 5 | Toyota Corolla | 2014 | 40 |

| 6 | Nissan Altima | 2013 | 38 |

| 7 | Ford Pickup (Full Size) | 2003 | 36 |

| 8 | Jeep Cherokee/Grand Cherokee | 1999 | 32 |

| 9 | Honda CR-V | 1999 | 27 |

| 10 | Toyota Avalon | 2000 | 18 |

Compared to the national average rate of car theft, which is 2.94 per 1,000 registered cars, Rhode Island comes in at a whopping 3.2 cars stolen out of every 1,000 registered.

No need to fret straight off the bat, though. Where you live also contributes to the likelihood that your car may be stolen. The FBI has compiled a list of Rhode Island’s major cities and ranked them in terms of car theft, as you can see below.[

table id=1597 datatables_scrolly=500px responsive=scroll /]

It’s worth noting that Providence and Pawtucket don’t have thefts affiliated with their residential bodies. This is because the FBI noted that both cities had under-reported their vehicle theft and found it best to leave the false data off of their listings.

Road Dangers in Rhode Island

There are more dangers to car owners in Rhode Island than theft. Read on to find out what risks you might be up against as a Rhode Island resident.

Fatal Crashes by Weather Condition and Light Condition

While the weather in Rhode Island isn’t particularly severe, it can still impact the safety of drivers making their way to and from work on a daily basis. As you can see, the weather has had a hand in causing a fair share of Rhode Island’s fatalities.

Rhode Island Weather

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 29 | 24 | 13 | 2 | 1 | 69 |

| Rain | 2 | 1 | 1 | 1 | 0 | 5 |

| Snow/Sleet | 0 | 1 | 0 | 0 | 0 | 1 |

| Other | 1 | 0 | 0 | 0 | 0 | 1 |

| Unknown | 0 | 0 | 0 | 0 | 0 | 0 |

| TOTAL | 32 | 26 | 14 | 3 | 1 | 76 |

Likewise, the type of road you’re driving on can impact your safety while in a car.

Rhode Island Fatalities by Road

| Traffic Fatalities by Road Type | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Rural | 14 | 19 | 15 | 7 | 10 | 5 | 6 | 7 | 10 | 18 |

| Urban | 51 | 64 | 52 | 59 | 54 | 60 | 45 | 38 | 41 | 65 |

| Total | 65 | 83 | 67 | 66 | 64 | 65 | 51 | 45 | 51 | 83 |

In Rhode Island, urban roads see more fatalities over the course of a year than rural roads, suggesting that Rhode Island’s cities may be a little more dangerous to drive in than its rural highways.

Person type also plays a role in traffic fatalities, with “person type’ describing pedestrians, passengers, and other people adjacent to a potential accident.

Rhode Island Fatalities by Person Type

| Person Type | 2013 | 2014 | 2015 | 2016 | 2017 | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| -- | Number | Percent | Number | Percent | Number | Percent | Number | Percent | Number | Percent |

| Passenger Car | 29 | 45 | 17 | 33 | 18 | 40 | 19 | 37 | 35 | 42 |

| Light Truck - Pickup | 4 | 6 | 3 | 6 | 3 | 7 | 4 | 8 | 3 | 4 |

| Light Truck - Utility | 3 | 5 | 3 | 6 | 5 | 11 | 6 | 12 | 6 | 7 |

| Light Truck - Van | 1 | 2 | 1 | 2 | 1 | 2 | 0 | 0 | 4 | 5 |

| Total Occupants | 37 | 57 | 26 | 51 | 28 | 62 | 31 | 61 | 49 | 59 |

| Large Truck | 0 | 0 | 1 | 2 | 1 | 2 | 1 | 2 | 1 | 1 |

| Other/Unknown Occupants | 0 | 0 | 1 | 2 | 0 | 0 | 0 | 0 | 0 | 0 |

| Light Truck - Other | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 2 | 0 | 0 |

| Total Motorcyclists | 11 | 17 | 10 | 20 | 9 | 20 | 4 | 8 | 11 | 13 |

| Pedestrian | 14 | 22 | 14 | 27 | 8 | 18 | 14 | 27 | 21 | 25 |

| Bicyclist and Other Cyclist | 3 | 5 | 0 | 0 | 0 | 0 | 2 | 4 | 2 | 2 |

| Total Nonoccupants | 17 | 26 | 15 | 29 | 8 | 18 | 16 | 31 | 23 | 28 |

| Other/Unknown Nonoccupants | 0 | 0 | 1 | 2 | 0 | 0 | 0 | 0 | 0 | 0 |

| Total | 65 | 100 | 51 | 100 | 45 | 100 | 51 | 100 | 83 | 100 |

Likewise, the type of crash most commonly seen in Rhode Island impacts the state’s fatality statistics and lets you know, as a driver, which areas on the road may be more dangerous than others. Over the past few years, lone vehicles have been in more accidents than vehicles with trucks, intersections, or rollovers throughout Rhode Island.

Rhode Island Fatalities by Crash Type

| Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Single Vehicle | 44 | 39 | 27 | 36 | 57 |

| Involving a Large Truck | 5 | 2 | 1 | 2 | 8 |

| Involving Speeding | 17 | 13 | 20 | 23 | 41 |

| Involving a Rollover | 8 | 7 | 12 | 11 | 11 |

| Involving a Roadway Departure | 36 | 24 | 23 | 23 | 47 |

| Involving an Intersection (or Intersection Related) | 18 | 10 | 7 | 8 | 12 |

| Total | 65 | 51 | 45 | 51 | 83 |

With all of that data in mind, what have the past five years looked like, in terms of fatalities, for Rhode Island’s counties? Take a look at the five-year trend for Rhode Island’s five biggest counties and see for yourself.

Rhode Island 5 Year Trends

| Rank | County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|

| 1 | Providence County | 39 | 29 | 26 | 28 | 48 |

| 2 | Kent County | 9 | 9 | 7 | 9 | 17 |

| 3 | Washington County | 9 | 6 | 10 | 11 | 14 |

| 4 | Newport County | 8 | 5 | 1 | 2 | 3 |

| 5 | Bristol County | 0 | 2 | 1 | 1 | 1 |

| All Counties in Total | - | 65 | 51 | 45 | 51 | 83 |

The good news is that none of these numbers, save for Providence’s, are especially high. However, Providence itself seems to be one of the most dangerous areas to drive in the state of Rhode Island.

The good news is that there haven’t been any jumps in the data and that it seems Providence County’s accident rate is on the decline! It’s important to compare Providence car insurance rates so you’re protected in case of an accident.

How do things change when we bring speeding into the mix? Take a look at the speeding-related data we’ve gathered outlining the fatality rate of speeders in Rhode Island.

Rhode Island Speeding Fatalities

| County Name | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Bristol County | 0 | 1 | 0 | 0 | 1 |

| Kent County | 3 | 2 | 4 | 5 | 6 |

| Newport County | 3 | 0 | 1 | 1 | 2 |

| Providence County | 9 | 7 | 10 | 12 | 21 |

| Washington County | 2 | 3 | 5 | 5 | 11 |

While we’ve already touched on the consequences of drunk driving, what do the fatality statistics for the practice look like in Rhode Island? Below you’ll find a compilation of drunk-driving (BAC of .08 or higher) related fatalities as organized by county.

Rhode Island Alcohol Fatalities

| County Name | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Bristol County | 0 | 0 | 0 | 0 | 1 |

| Kent County | 3 | 4 | 2 | 5 | 6 |

| Newport County | 5 | 1 | 0 | 0 | 0 |

| Providence County | 10 | 7 | 11 | 11 | 18 |

| Washington County | 4 | 4 | 5 | 4 | 10 |

Again, Providence County, being one of the most urban areas in the state of Rhode Island, lays claim to the largest county of drunk driving-related fatalities.

What’s especially unfortunate is that these listed numbers include the number of teenagers who’ve fallen victim to accidents as a result of drunk driving.

2.4 percent of drivers in Rhode Island have reported to the CDC that they get into a car after drinking. The national average, in comparison, for drivers who’ve driven drunk is 1.9 percent.

Remember that when you get on the road after drinking, you’re putting not only yourself but dozens of other people at risk. The practice simply isn’t worth the consequences.

EMS Response Time

If you’ve been in an accident, you want to know that emergency medical services will be at your side soon enough to get you the care you need. No matter your location, EMS will get to you as quickly as they can. Response time will vary, though, depending on whether you’re in a rural or urban area.

Rhode Island EMS Response Time

| Location of Incident | Time of Crash to EMS Notification | EMS Notification to EMS Arrival | EMS Arrival at Scene to Hospital Arrival | Time of Crash to Hospital Arrival |

|---|---|---|---|---|

| Urban | 4.5 min | 8.3 min | 36.5 min | 46.88 min |

| Rural | 4.5 min | 8.3 min | 36.5 min | 46.88 min |

It’s here that Rhode Island’s smaller size comes in handy. There’s no difference in EMS response time in the state’s rural and urban areas. Instead, you can always rely on EMS to get to your location quickly and to, in turn, deliver you to a nearby hospital within the same hour you’ve had your accident.

Transportation

With all of the fatalities and other information behind us, we can see how driving legislation, general behavior on the road, and other factors impact how you might drive through Rhode Island.

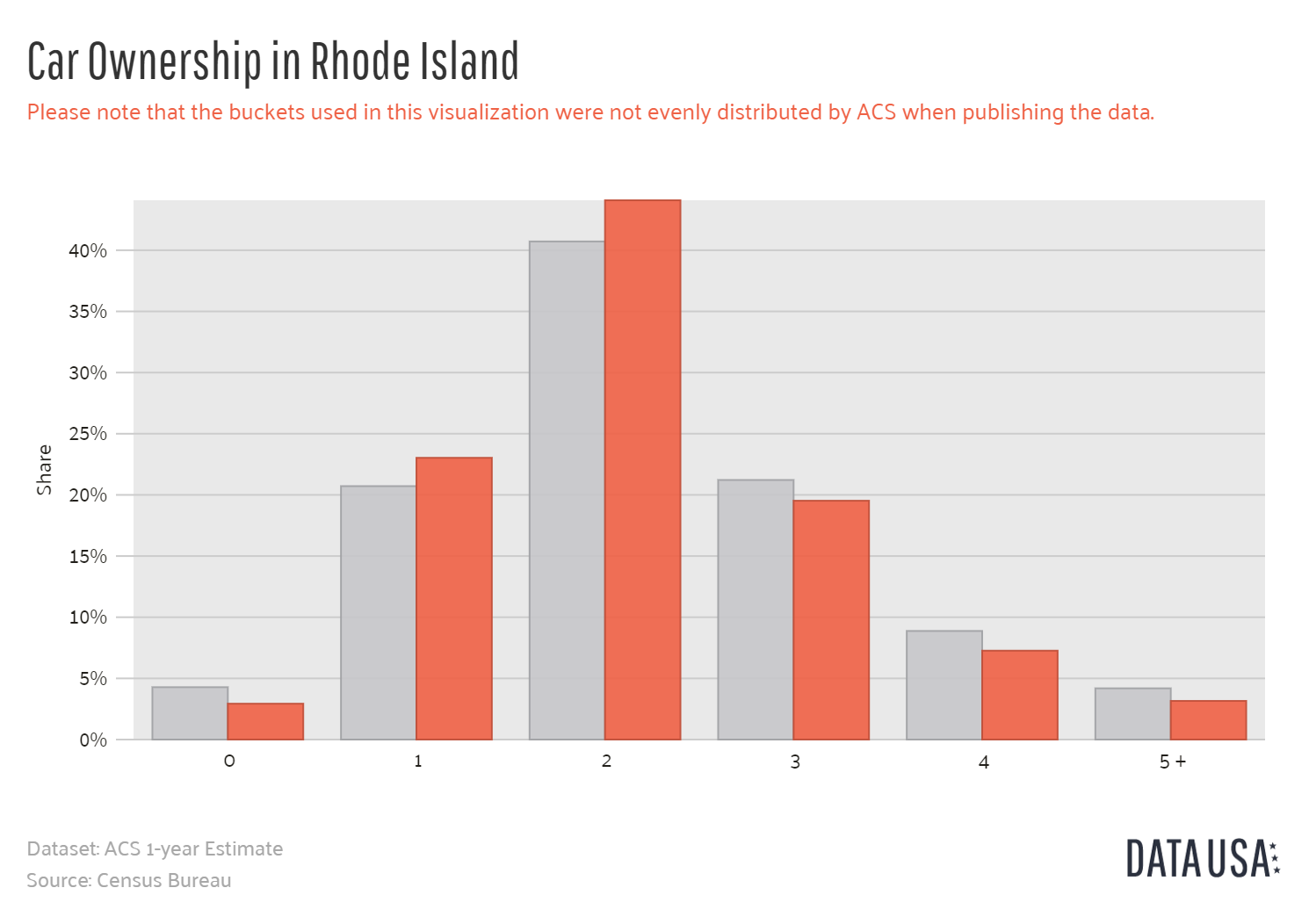

Car Ownership in Rhode Island

Rhode Island residents tend to own two cars instead of just one. Nearly 50 percent of the state’s residents, in fact, have reported owning two cars instead of one or three.

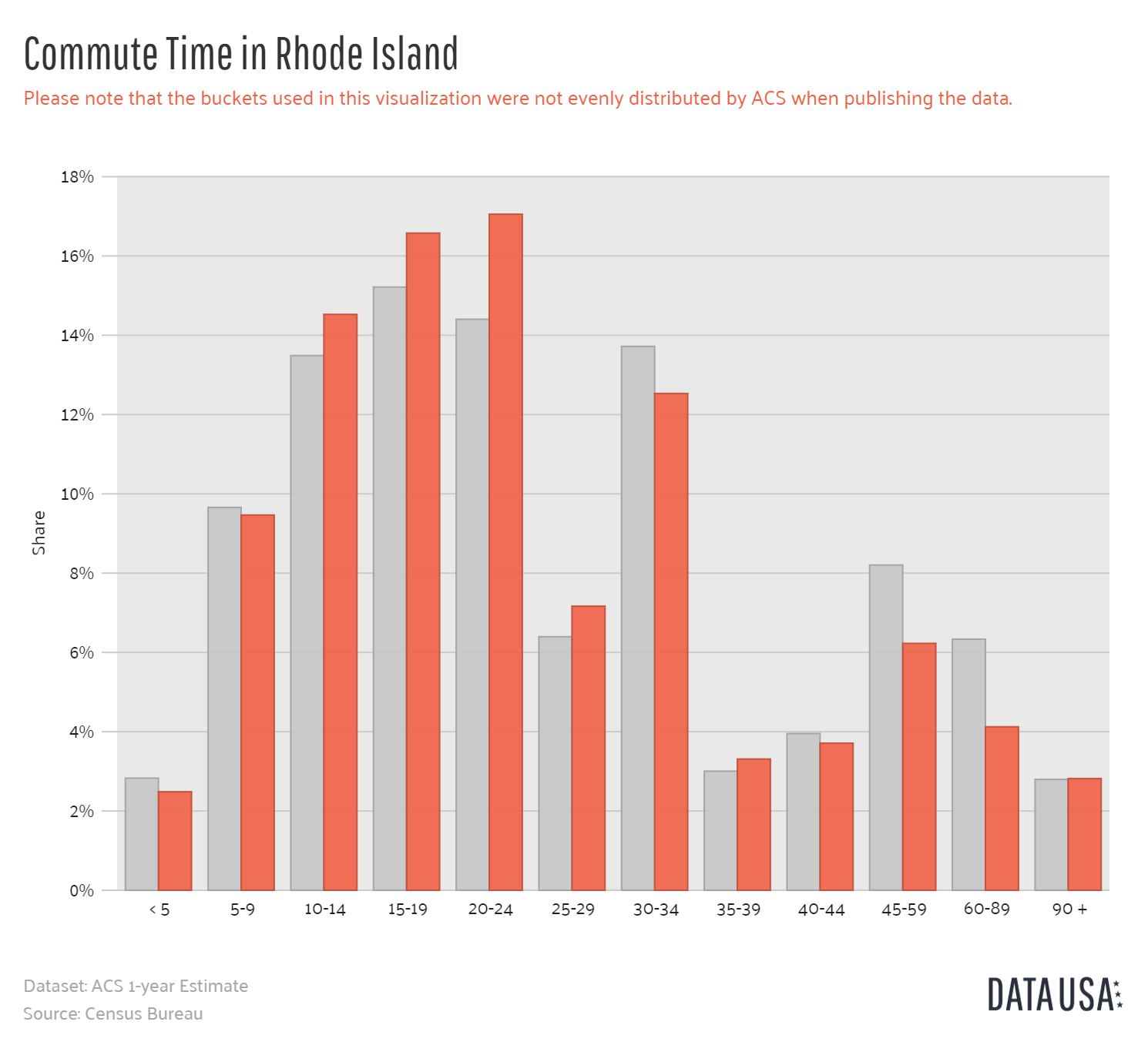

Commute Time in Rhode Island

Commute times in Rhode Island tend to last between 5 and 24 minutes, with a fair range existing between the two. Because Rhode Island is a smaller state, drivers can worry a little less about falling victim to super commutes or commutes that last longer than 90 minutes.

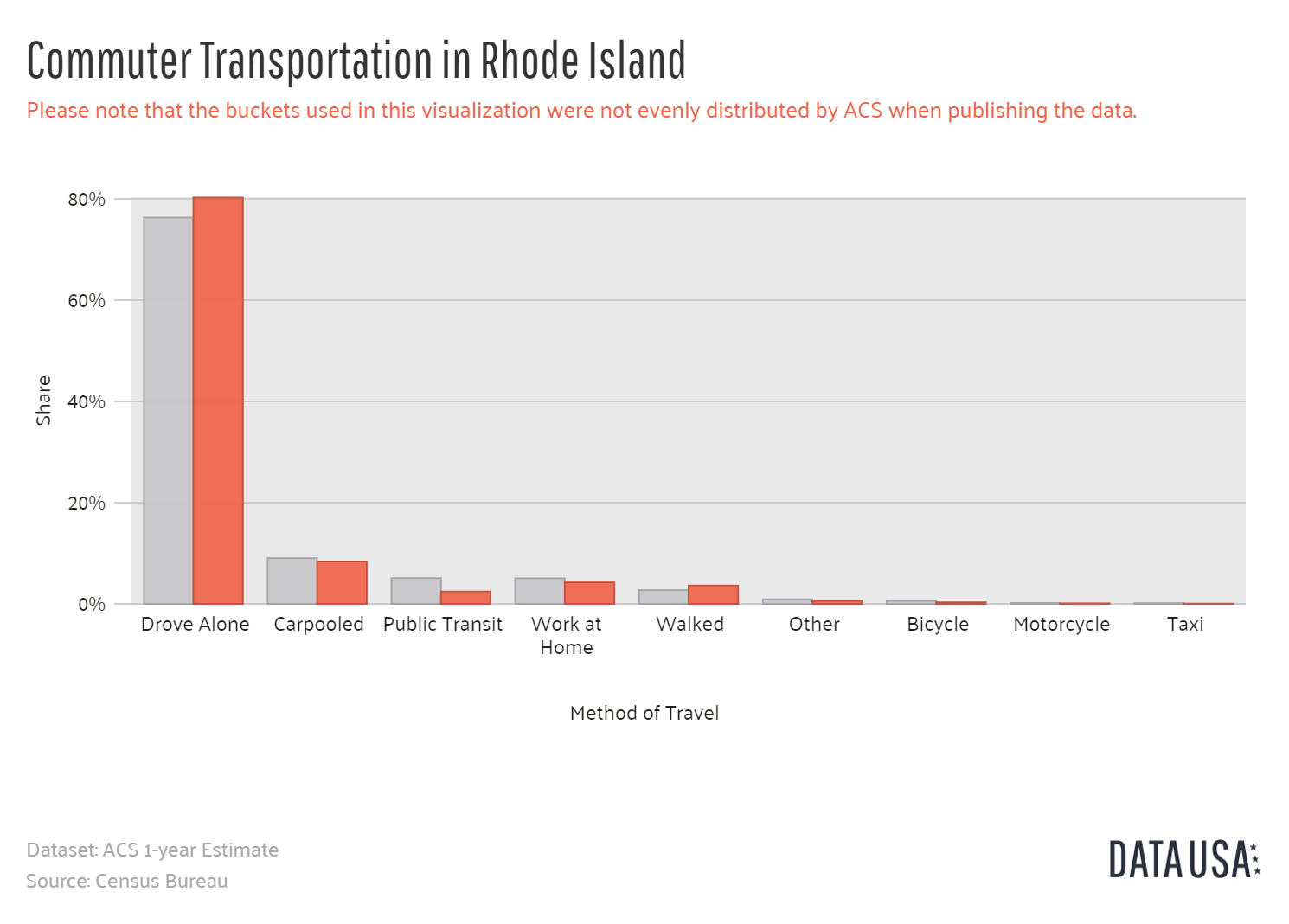

Commuter Transport in Rhode Island

As you might expect in a state where 50 percent of the population owns two cars, the vast majority of Rhode Island residents commute to work by driving alone. While carpooling has made a minimal impact on the population, it seems that most Rhode Island residents prefer to wake up and head home on their own time.

If people do decide to carpool, they should find out if they’re legally covered with car insurance when carpooling.

Traffic Congestion in Rhode Island

Do you need to worry about dealing with Rhode Island traffic congestion if you wake up after your morning alarm, though? Not at all. None of Rhode Island’s cities are listed on the INRIX’s scorecard for global traffic. That’s not terribly surprising, but it’s still nice to know that even if you wake up late one morning, you should still be able to make it to work on time in the Ocean State.

With that, you’ve learned just about all there is to know about car insurance and driving laws in the state of Rhode Island. Hopefully, you’ll be able to utilize this data in order to find the perfect coverage for you and your needs. So enjoy the smell of the ocean and the compact beauty of the smallest state in the country. The roads of Rhode Island are out there waiting for you.

Don’t forget, you can also take advantage of our online car insurance comparison tool! It’s free to use, and all you need to do is enter your zip code in order to start comparing car insurance rates today.

Frequently Asked Questions

Are there any specific laws for high-risk insurance in Rhode Island?

Rhode Island has options for high-risk drivers to obtain insurance through the Rhode Island Automobile Insurance Plan (RIAIP). This plan helps provide coverage for drivers who have difficulty obtaining insurance in the voluntary market.

What are the car insurance laws in Rhode Island?

Car insurance laws in Rhode Island require drivers to have a minimum amount of liability coverage, and it is illegal to drive without insurance. Rhode Island follows an at-fault system for determining liability in car accidents.

What are the penalties for driving without insurance in Rhode Island?

Driving without insurance in Rhode Island can result in penalties such as fines, license suspension, and the requirement to file an SR-22 form.

What are some add-ons, endorsements, and riders available for car insurance in Rhode Island?

Car insurance companies in Rhode Island may offer various add-ons, endorsements, or riders to enhance your coverage. These can include options like roadside assistance, rental car reimbursement, and gap insurance.

Are there any additional liability options in Rhode Island?

Yes, Rhode Island allows you to add additional liability coverage to your car insurance policy. This can provide extra protection in case you cause an accident with damages that exceed the minimum requirements.

Does the place where I live in Rhode Island affect my car insurance rates?

Yes, the place you live can impact your car insurance rates. Different ZIP codes in Rhode Island may have different average rates based on factors like population density, crime rates, and accident statistics.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.