Compare Young Driver Car Insurance Rates in 2026 (Top 10 Companies)

Learn why State Farm, Progressive, and Allstate stand out as the top companies when you compare young driver car insurance rates. Explore their competitive rates and tailored discounts designed for young drivers, ensuring reliable and affordable coverage options.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Insurance & Finance Analyst

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Updated May 2024

18,155 reviews

18,155 reviewsCompany Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 13,283 reviews

13,283 reviewsCompany Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

13,283 reviews

13,283 reviews 11,638 reviews

11,638 reviewsCompany Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsCompare young driver car insurance rates with the top companies like State Farm, Progressive, and Allstate. State Farm leading for its competitive rates, innovative discounts, and customer service excellence. Make informed and secure insurance decisions with these standout options.

- Discover competitive young driver car insurance rates with a focus on State Farm, Progressive, and Allstate.

- Learn about the necessity of car insurance for young drivers, their higher risk factors, and tips for affordable coverage.

- Explore insurance success stories in brief case studies, offering insights into notable benefits in savings, safety, and satisfaction.

Our Top 10 Best Companies: Compare Young Driver Car Insurance Rates

| Company | Rank | See Pros/Cons | Usage-Based Discount | Multi-Car Discount | Best For |

|---|---|---|---|---|---|

| #1 | State Farm | Up to 25% | Up to 25% | Customer Service | |

| #2 | Progressive | Up to 30% | Up to 10% | Innovative Discounts | |

| #3 | Allstate | Up to 25% | Up to 25% | Driving Insights | |

| #4 | Nationwide | Up to 25% | Up to 20% | Family Savings |

| #5 | Liberty Mutual | Up to 20% | Up to 25% | Enhanced Coverage |

| #6 | Travelers | Up to 20% | Up to 8% | Smart Driving | |

| #7 | American Family | Up to 10% | Up to 20% | Driver Safety | |

| #8 | Esurance | Up to 25% | Up to 10% | Online Convenience | |

| #9 | Farmers | Up to 15% | Up to 15% | Telematics Innovation | |

| #10 | AAA | Up to 15% | Up to 20% | Roadside Assistance |

#1 – State Farm: Customer Service Excellence

State Farm emerges as the top choice for young drivers, offering customer service excellence, competitive rates, and tailored discounts for a secure and affordable coverage experience.

Brad Larson Licensed Insurance Agent

Pros

- Significant savings: Up to 25% discounts on both usage-based and multi-car policies.

- Customer service: Known for exceptional client support and satisfaction.

- Broad coverage: Offers a comprehensive range of coverage options.

Cons

- Higher rates: May have higher average monthly rates than some competitors.

- Limited customization: Some policy areas lack extensive customization options.

Read more: State Farm Car Insurance Review

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Leader in Innovative Discounts

Pros

- Maximum discounts: Progressive leads with up to 30% in usage-based discounts.

- Variety in savings: Offers a diverse range of innovative discount options.

- Flexible policies: Known for adaptable insurance policies catering to various needs.

Cons

- Lower multi-car discounts: Offers up to 10% on multi-car discounts, less than some competitors.

- Mixed customer reviews: Some customers report varied experiences with service quality.

Read more: Progressive Car Insurance Review

#3 – Allstate: Driving Insights Specialist

Pros

- High discounts: Up to 25% discounts for both usage-based and multi-car insurance.

- Driving analytics: Provides valuable driving insights to help improve habits and safety.

- Strong financial stability: Well-rated for its financial health and claims-paying ability.

Cons

- Potentially high premiums: Can be more expensive for certain driver categories.

- Limited global reach: Predominantly focused on the U.S. market, less presence internationally.

Read more: Allstate Car Insurance Review

#4 – Nationwide: Family Savings Focus

Pros

- Family-oriented discounts: Up to 25% usage-based and up to 20% multi-car discounts.

- Comprehensive plans: Offers a wide range of plans suitable for families.

- Nationwide coverage: Extensive network and availability across various regions.

Cons

- Coverage limitations: Some geographic areas might have limited coverage options.

- Policy complexity: Some customers find their policy options complex to navigate.

Read more: Nationwide Car Insurance Discounts

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Enhanced Coverage Expert

Pros

- Coverage options: Up to 20% usage-based and 25% multi-car discounts, with enhanced coverage.

- Customization: Highly customizable policies tailored to individual needs.

- Global Presence: Strong international presence, offering services in multiple countries.

Cons

- Higher price point: Can be more expensive than competitors for certain coverages.

- Variable customer service: Customer service quality can vary by location and department.

Read more: Liberty Mutual Car Insurance Review

#6 – Travelers: Smart Driving Innovator

Pros

- Smart technology use: Emphasizes smart driving technology in its policies.

- Competitive discounts: Up to 20% usage-based and 8% multi-car discounts.

- Strong financial standing: Known for its financial stability and reliability.

Cons

- Limited global reach: More focused on the U.S., with less international presence.

- Conservative discounting: Relatively lower discounts compared to some other insurers.

Read more: Travelers Car Insurance Review

#7 – American Family: Driver Safety Champion

Pros

- Focus on safety: Tailors policies with a strong emphasis on driver safety.

- Balanced discounts: Offers up to 10% usage-based and 20% multi-car discounts.

- Customer-centric approach: Known for a strong focus on customer service and satisfaction.

Cons

- Limited availability: Not as widely available across all states.

- Standard coverage options: Coverage options may be more standard without many unique offerings.

Read more: American Family Car Insurance Review

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Esurance: Online Convenience Leader

Pros

- Easy online management: Streamlines insurance management with online tools.

- Competitive discounts: Up to 25% usage-based and 10% multi-car discounts.

- Innovative technology: Leverages technology for efficient claim processing and support.

Cons

- Less personal interaction: Online-focused approach may limit direct customer service.

- Coverage variation: Coverage options and availability may vary significantly by region.

#9- Farmers: Telematics Innovation Pioneer

Pros

- Innovative telematics: Leaders in using telematics technology for insurance discounts.

- Balanced discount offers: Up to 15% discounts on both usage-based and multi-car policies.

- Comprehensive coverage: Wide range of coverage options catering to diverse needs.

Cons

- Higher premiums: Can have higher premiums compared to some competitors.

- Mixed reviews on claims: Some customers report varied experiences with the claims process.

Read more: Farmers Car Insurance Review

#10 – AAA: Roadside Assistance Specialist

Pros

- Excellent roadside assistance: Renowned for its superior roadside support services.

- Good discount range: Offers up to 15% usage-based and 20% multi-car discounts.

- Additional member benefits: Provides various benefits and services to AAA members.

Cons

- Membership requirement: Requires AAA membership for insurance services.

- Variable coverage options: Coverage and services may differ significantly by region.

Read more: AAA Car Insurance Review

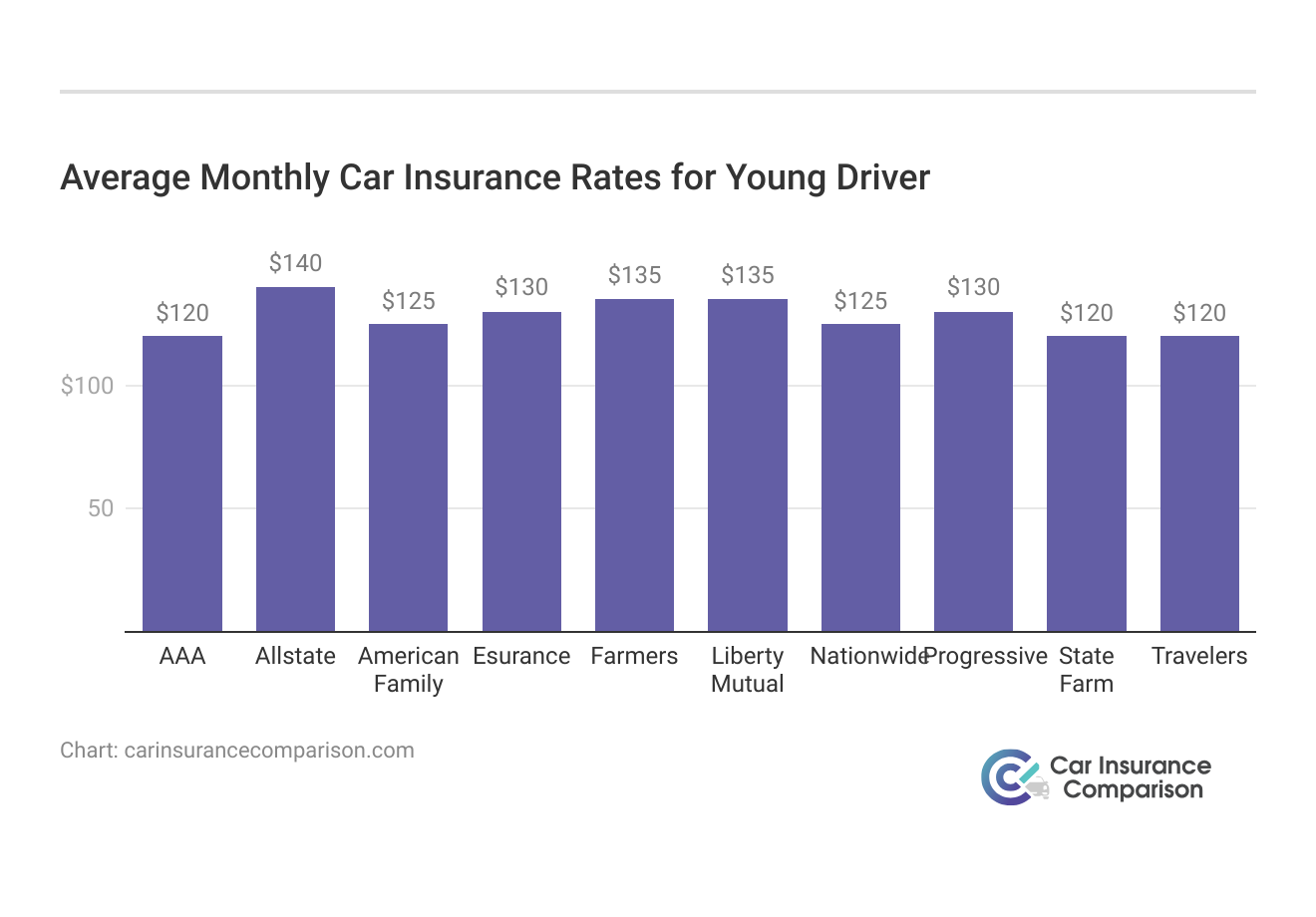

Looking at the table provided, it’s clear that there’s a range of rates offered by different insurance companies for both minimum and full coverage options.

Average Monthly Car Insurance Rates for Young Driver

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $120 | $250 |

| Allstate | $140 | $300 |

| American Family | $125 | $270 |

| Esurance | $130 | $280 |

| Farmers | $135 | $300 |

| Liberty Mutual | $135 | $290 |

| Nationwide | $125 | $270 |

| Progressive | $130 | $280 |

| State Farm | $120 | $250 |

| Travelers | $120 | $250 |

For young drivers, finding the right car insurance means balancing coverage and cost. Rates vary among insurance companies, with minimum coverage ranging from $120 to $140 per month and full coverage from $250 to $300 per month.

Why is it mandatory for young drivers to own car insurance?

Driving a car is a necessity and allows children to go wherever they want without much hassle. Just as they are educated on the rules of driving and respecting other drivers, young drivers should be educated about what it means to have car insurance. Unfortunately, most automobile accidents involve young drivers from ages 15 to 20.

Reasoning, mental judgment, tolerance, and emotional faculties don’t often mature until kids are in their late teens or past, and lack of these mature functions often paves the way for disastrous results.

With the advent of sophisticated insurance websites, you can search the internet for different kinds of car insurance policies. Finding the cheapest young drivers car insurance rates is as simple as just entering your zip code into the free car insurance comparison tool above!

How can I go about getting my teen car insurance?

Young drivers often end up with more tickets and fines than adult drivers. If the teen has a car of his own, it’s better to get a policy for him alone.

If there are two cars in the household and there are three regular drivers in the family, most insurance companies will ask for expensive premiums if the teen has to be included.

It’s quite understandable that parents will want to buy their child’s dream car. However, it would be a good idea to let children handle the oldest car in the house until they become experienced drivers. A young driver’s car insurance is based on the risk factor, the age, gender and marital status. Young drivers are known for driving fast so the risk factor is understandably high.

Read more:

- Compare Car Insurance Rates for First-time Drivers

- Compare Car Insurance Rates for Inexperienced Drivers

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Real-World Insurance Success Stories: A Case Study Approach

Explore through these case studies how real individuals and families successfully navigated the complex landscape of car insurance. Each case study highlights unique needs and solutions, providing insights into how the right coverage and company can lead to significant benefits in terms of savings, safety, and satisfaction.

Case Study 1: Emma’s Experience With State Farm

Emma, a 23-year-old recent college graduate living in Austin, Texas, needed affordable yet comprehensive car insurance. She drives a 2017 Honda Civic and has a clean driving record. Emma uses her car primarily for commuting to her new job and occasional road trips.

After researching various options, Emma chose State Farm due to its reputation for excellent customer service and its competitive rates for young drivers. She was particularly attracted to the discounts available for good driving and the multi-car discount, as her roommate also considered switching to State Farm.

Emma benefited from a 25% good driver discount and an additional multi-car discount, significantly lowering her monthly premium. She appreciated State Farm’s customer service, which helped her understand her policy and made her feel secure in her choice. Emma’s positive experience led her to recommend State Farm to friends.

Case Study 2: Progressive’s Innovative Approach for Ryan

Ryan, a 27-year-old freelance graphic designer from Denver, Colorado, sought car insurance that could offer flexibility and innovative discounts. He drives a 2019 Subaru Outback and has a minor traffic violation on his record.

Ryan found Progressive’s usage-based insurance program appealing. The potential 30% discount for safe driving habits aligned with his occasional car use. Progressive’s Snapshot program allowed Ryan to demonstrate his responsible driving behavior and save money.

Ryan’s monthly premium was reduced by 28% after six months of using Snapshot. He appreciated the transparency and the innovative approach to insurance. Ryan’s experience with Progressive’s flexible policies and the savings he gained encouraged him to continue his policy.

Case Study 3: Allstate and the Family Plan for the Johnsons

The Johnson family, residing in Orlando, Florida, includes two teenage drivers. They needed a comprehensive insurance plan that could cover multiple vehicles and offer insights into their children’s driving habits.

Allstate’s combination of up to 25% discounts for both usage-based and multi-car insurance made it an attractive choice. The driving insights feature was particularly appealing as it allowed the Johnsons to monitor their teenagers’ driving behaviors and encourage safer driving practices.

The Johnson family benefited from substantial savings through the multi-car discount, while the driving insights helped their teenagers become more aware and responsible drivers. The family appreciated the added peace of mind and financial benefits, making Allstate their preferred choice for car insurance.

Finding Cheap Young Drivers Car Insurance

Here are some other tips for finding cheap car insurance for young drivers. First, get a hold of insurance companies that specialize in giving a fair deal to young drivers.Once you identify these companies, get quotes, compare them, and choose the best out of them.The budget of the family is greatly affected by insurance premiums, so it’s a good idea to shop around a bit before finalizing on one.Most insurance companies offer teen discounts. Ask teenagers to do a bit of shopping around; it will make them more responsible for their vehicles. Teach them how to browse free quotes and compare benefits as well as costs to make the most informed decision for their security and budget.You and your teen can compare free car insurance quotes online right here by entering your zip code below!

Frequently Asked Questions

Why is car insurance mandatory for young drivers?

Car insurance is mandatory for young drivers because they have a higher risk of accidents due to their lack of driving experience and maturity.

How can I get car insurance for my teen?

It’s recommended to get a separate policy for your teen if they have their own car. Including them in a policy with multiple drivers can increase premiums.

Any tips for finding cheap car insurance for young drivers?

Look for insurance companies specializing in coverage for young drivers, compare quotes from different providers, and take advantage of any available discounts.

What factors affect young drivers’ car insurance rates?

Factors such as age, gender, marital status, and driving history can influence young drivers’ car insurance rates. They are often considered higher risk due to their age and driving habits.

How can young drivers reduce their insurance costs?

Young drivers can reduce insurance costs by maintaining a clean driving record, completing driver training courses, and considering higher deductibles. Additionally, comparing quotes from multiple providers can help find more affordable options.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.